Market Overview

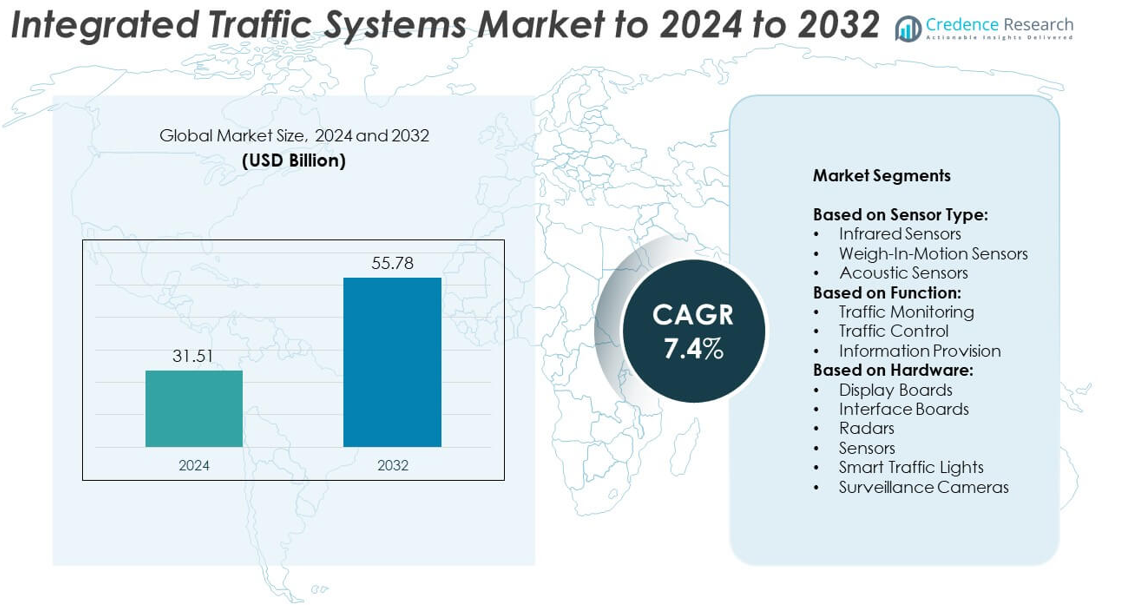

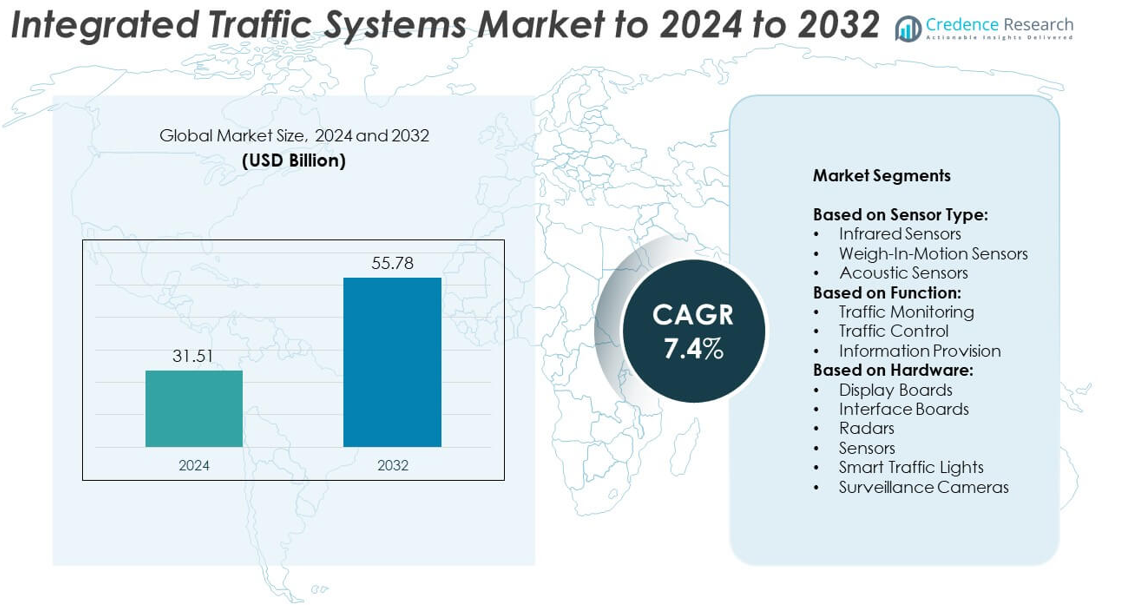

The Integrated Traffic Systems Market size was valued at USD 31.51 billion in 2024 and is anticipated to reach USD 55.78 billion by 2032, at a CAGR of 7.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Integrated Traffic Systems Market Size 2024 |

USD 31.51 billion |

| Integrated Traffic Systems Market, CAGR |

7.4% |

| Integrated Traffic Systems Market Size 2032 |

USD 55.78 billion |

The Integrated Traffic Systems Market is highly competitive, with leading players such as Iteris, Siemens, LG CNS, Swarco, KapschTrafficCom, Cubic, Jenoptik, Cisco, Flir, and Sumitomo driving innovation through advanced IoT, AI, and data analytics integration. These companies focus on expanding smart mobility solutions, adaptive traffic lights, and real-time monitoring platforms to meet growing urban mobility demands. Regional dynamics highlight North America as the dominant market, holding 34% share in 2024, supported by large-scale smart city investments and government funding. Europe follows with strong adoption driven by sustainability goals, while Asia Pacific is set to witness the fastest growth.

Market Insights

- The Integrated Traffic Systems Market was valued at USD 31.51 billion in 2024 and is projected to reach USD 55.78 billion by 2032, growing at a CAGR of 7.4%.

- Rising urbanization, congestion issues, and government-backed smart city projects are fueling strong adoption of intelligent traffic solutions across global markets.

- Key trends include the integration of IoT and AI for real-time traffic monitoring, as well as the emergence of connected vehicle communication systems enhancing safety and efficiency.

- The market is highly competitive, with global leaders focusing on adaptive traffic lights, surveillance systems, and advanced analytics, while regional players target cost-effective solutions for emerging economies.

- North America led with 34% share in 2024, followed by Europe at 28% and Asia Pacific at 25%, with Asia Pacific expected to record the fastest growth; infrared sensors held the largest segment share, supporting system efficiency in adaptive traffic management.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Sensor Type

Infrared sensors held the dominant share in the Integrated Traffic Systems Market in 2024, capturing nearly 38% of the segment. Their wide adoption is driven by reliability in detecting vehicle presence and motion in varying light and weather conditions. These sensors are vital in adaptive signal control and lane management applications. Growing demand for real-time traffic analytics and congestion reduction supports their integration. Meanwhile, weigh-in-motion sensors and acoustic sensors are expanding in freight management and urban noise monitoring, though their adoption trails behind infrared-based solutions.

- For instance, Teledyne FLIR’s FC T2-Series thermal traffic camera is designed to operate in extreme temperatures, with an operating temperature range of (-50) to 75) degrees Celsius

By Function

Traffic monitoring accounted for the largest share of the function segment, representing about 42% of the market in 2024. Continuous vehicle tracking, congestion mapping, and accident detection make monitoring indispensable for urban road networks. Rising smart city initiatives and government-led safety programs further strengthen this sub-segment. Traffic control systems, including adaptive signal management, are also gaining momentum with increasing urbanization. Information provision, such as dynamic signboards and traveler alerts, plays a complementary role but holds a smaller portion compared to the dominance of monitoring solutions.

- For instance, Sensys Networks’ wireless sensor systems for traffic management have been implemented in over 80 countries and 40 U.S. states.

By Hardware

Smart traffic lights emerged as the leading hardware sub-segment, holding around 36% share of the hardware category in 2024. Their dominance stems from the rising demand for adaptive signal control to reduce traffic congestion and emissions. Integration of sensors and AI-based analytics enhances real-time responsiveness, driving adoption across smart city projects worldwide. Surveillance cameras are also expanding rapidly due to their dual role in security enforcement and traffic management. Display boards, interface boards, radars, and stand-alone sensors remain critical, but their uptake is largely tied to supporting infrastructure investments.

Key Growth Drivers

Rising Urbanization and Congestion Management

Rapid urbanization and increasing vehicle ownership are intensifying traffic congestion worldwide, creating strong demand for integrated traffic systems. Governments are prioritizing intelligent traffic solutions to optimize vehicle flow, reduce travel times, and enhance commuter safety. Advanced systems such as adaptive signal control and smart traffic lights are being deployed in metropolitan areas. This driver is key to shaping market expansion, as smart city programs across Asia-Pacific, Europe, and North America continue to invest heavily in traffic optimization infrastructure to address urban mobility challenges.

- For instance, the Orange County Transportation Authority’s Regional Traffic Signal Synchronization Program (RTSSP), which has involved various contractors including Iteris, has optimized signal timing on over 3,500 intersections. As a result, the program has achieved a 13% average travel time savings and reduced fuel consumption by more than 70 million gallons.

Government Smart City Initiatives

Government-backed smart city initiatives are a critical growth driver, accelerating the adoption of integrated traffic management solutions. Countries are deploying advanced monitoring systems, surveillance cameras, and data-driven traffic control technologies to improve public safety and urban mobility. Financial incentives, infrastructure grants, and public-private partnerships are fueling investments in digital mobility platforms. These initiatives not only promote traffic efficiency but also align with global sustainability goals by reducing emissions. As cities expand, government policies remain central to pushing large-scale integration of advanced traffic technologies.

- For instance, Miovision’s Opticom AI software claims it can reduce emergency response times by up to 25% and cut intersection crash risk by up to 70%—which implies handling large volumes of sensitive traffic and location data securely.

Technological Advancements in IoT and AI

The integration of IoT and AI in traffic systems is emerging as a key driver of growth. AI-powered algorithms enable real-time data analysis, predictive modeling, and automated traffic control, improving operational efficiency. IoT sensors provide continuous monitoring across road networks, feeding data into centralized platforms. These advancements support demand for adaptive traffic lights, congestion alerts, and smart surveillance systems. Increasing affordability of connected technologies further accelerates adoption, making IoT and AI crucial for scaling intelligent traffic solutions across both developed and emerging markets.

Key Trends & Opportunities

Adoption of Connected Vehicle Integration

A major trend shaping the market is the integration of connected vehicles with traffic systems. Vehicle-to-infrastructure (V2I) communication allows real-time exchange of data between vehicles and road systems, improving traffic coordination and reducing collision risks. Automakers and traffic authorities are collaborating to deploy these technologies under smart mobility projects. This opportunity is expected to expand as 5G connectivity becomes more widespread, providing seamless data transfer and enabling more efficient and safer urban transport environments.

- For instance, Siemens Mobility has deployed ~525 roadside units (RSUs) across 2,200 km of Austrian highways for cooperative intelligent transport systems.

Expansion of Sustainable Mobility Solutions

Sustainability goals are driving opportunities for integrated traffic systems designed to reduce emissions and energy use. Smart traffic lights and adaptive monitoring systems are being optimized to lower fuel consumption through reduced idling times. Cities across Europe and Asia are investing in eco-friendly traffic solutions to support climate targets. This trend is opening opportunities for vendors to offer energy-efficient hardware and software solutions, aligning with government regulations and corporate sustainability commitments, while meeting public demand for greener urban mobility.

- For instance, Audi’s Traffic Light Information system, which includes the Green Light Optimized Speed Advisory (GLOSA) feature, works with over 22,000 connected intersections in more than 60 U.S. cities and metropolitan areas, as of 2021.

Key Challenges

High Deployment and Maintenance Costs

A key challenge in the integrated traffic systems market is the high cost of deployment and maintenance. Advanced systems require significant upfront investment in infrastructure, hardware, and software integration, which may strain municipal budgets. Regular upgrades and ongoing technical support add to long-term expenses, limiting adoption in developing regions. While public-private partnerships are helping bridge funding gaps, affordability remains a barrier for widespread implementation, especially in smaller cities and low-income economies seeking to modernize traffic infrastructure.

Data Security and Privacy Concerns

The increased reliance on IoT and AI technologies raises significant concerns around data security and privacy. Continuous data collection from vehicles, cameras, and sensors exposes traffic systems to potential cyberattacks and misuse of personal information. Ensuring secure communication protocols and compliance with data protection regulations is critical. Failure to address these issues may hinder public acceptance and slow adoption rates. Vendors are under pressure to invest in robust cybersecurity solutions, making privacy concerns a persistent challenge for the industry’s growth trajectory.

Regional Analysis

North America

North America held the largest share of the Integrated Traffic Systems Market in 2024, accounting for 34%. The region benefits from advanced infrastructure, strong government funding, and widespread adoption of smart city projects. The United States leads with large-scale deployment of smart traffic lights, surveillance systems, and AI-based monitoring solutions. Canada is also investing in digital mobility technologies to enhance safety and reduce emissions. Increasing congestion in metropolitan areas and rising vehicle ownership drive further demand. Public-private partnerships and supportive policies ensure North America maintains its leadership through technological innovation and early adoption of connected solutions.

Europe

Europe captured 28% of the Integrated Traffic Systems Market share in 2024, supported by its strong commitment to sustainability and urban mobility. Countries such as Germany, the United Kingdom, and France are leading in smart traffic management adoption. European Union policies promoting emission reduction and road safety boost market growth. Large investments in adaptive signal control and vehicle-to-infrastructure communication enhance traffic efficiency across major cities. Surveillance cameras and radars are widely deployed for both traffic and security purposes. Continued investments in eco-friendly infrastructure and connected vehicle technologies strengthen Europe’s position as a major market contributor.

Asia Pacific

Asia Pacific accounted for 25% of the Integrated Traffic Systems Market share in 2024, driven by rapid urbanization and large-scale government investments in smart city initiatives. China, Japan, and India are at the forefront of implementing intelligent traffic solutions to address congestion and pollution. Growing vehicle ownership and infrastructure expansion fuel demand for adaptive traffic lights, sensors, and real-time monitoring systems. The region’s focus on digitalization and integration of IoT and AI technologies further accelerates adoption. Asia Pacific is expected to record the fastest growth rate, supported by population density and government-backed transportation modernization programs.

Latin America

Latin America held 7% of the Integrated Traffic Systems Market share in 2024, with growing adoption in countries such as Brazil, Mexico, and Chile. The region is witnessing rising investments in urban mobility projects, driven by increasing congestion in major cities. Smart traffic lights and surveillance cameras are gradually being integrated into public infrastructure to improve safety and efficiency. However, high deployment costs and budgetary constraints limit widespread adoption. Public-private partnerships and international funding are supporting gradual improvements. As urbanization accelerates, Latin America presents opportunities for vendors targeting cost-effective and scalable traffic system solutions.

Middle East and Africa

The Middle East and Africa represented 6% of the Integrated Traffic Systems Market share in 2024, with adoption primarily concentrated in the Gulf Cooperation Council countries. Nations such as the United Arab Emirates and Saudi Arabia are investing heavily in smart city projects as part of long-term development visions. Infrastructure upgrades focus on advanced traffic monitoring, smart lighting, and real-time data systems. In Africa, adoption remains limited to major urban centers due to financial and infrastructural challenges. However, ongoing projects supported by international organizations create opportunities for gradual expansion in traffic system deployment.

Market Segmentations:

By Sensor Type:

- Infrared Sensors

- Weigh-In-Motion Sensors

- Acoustic Sensors

By Function:

- Traffic Monitoring

- Traffic Control

- Information Provision

By Hardware:

- Display Boards

- Interface Boards

- Radars

- Sensors

- Smart Traffic Lights

- Surveillance Cameras

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The Integrated Traffic Systems Market is characterized by strong competition among leading players such as Iteris, Siemens, LG CNS, Swarco, KapschTrafficCom, Cubic, Jenoptik, Cisco, Flir, and Sumitomo. These companies compete through technological innovation, strategic partnerships, and large-scale project deployments across global markets. Vendors are focusing on integrating advanced IoT, AI, and data analytics solutions into traffic systems to enhance efficiency and safety. Expansion into emerging economies is becoming a strategic priority, supported by government-led smart city initiatives and infrastructure modernization programs. The competitive environment is also shaped by sustainability goals, pushing providers to develop energy-efficient hardware and software platforms. Intense rivalry encourages continuous investments in R&D, ensuring product differentiation and improved system reliability. Regional players in developing markets pose competition by offering cost-effective solutions, although global companies maintain an advantage through their broader portfolios and strong global presence. This dynamic landscape ensures steady innovation and market growth opportunities worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Iteris

- Siemens

- LG CNS

- Swarco

- KapschTrafficCom

- Cubic

- Jenoptik

- Cisco

- Flir

- Sumitomo

Recent Developments

- In 2025, Kapsch TrafficCom Continued to refine its business portfolio with the deconsolidation of several smaller companies (e.g., in South Africa and Belarus), streamlining operations to focus on core markets in tolling and traffic management.

- In 2025, SWARCO Acquired a key German traffic management software firm (Heusch/Boesefeldt in August 2025). This move was explicitly aimed at strategically expanding its technological expertise in customized software solutions for traffic and tunnel management systems and strengthening its position in Cooperative, Connected, and Automated Mobility (CCAM).

- In 2023, Iteris, Inc. Unveiled the enhanced VantageCare program, transforming its support into a cloud-enabled managed service (Performance Assist) for its traffic detection systems. Continued to highlight its Vantage Vector and other sensor platforms, emphasizing sensor fusion (combining video and radar data) for reliable detection

Report Coverage

The research report offers an in-depth analysis based on Sensor Type, Function, Hardware and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rapid adoption of smart city initiatives worldwide.

- Increasing vehicle ownership will drive demand for advanced traffic monitoring solutions.

- Integration of AI and IoT will enhance real-time traffic control efficiency.

- Connected vehicle technologies will support safer and more coordinated road networks.

- Governments will invest heavily in adaptive traffic lights and surveillance systems.

- Sustainability goals will promote eco-friendly and energy-efficient traffic solutions.

- Public-private partnerships will fund large-scale deployment of intelligent traffic systems.

- Emerging economies will witness rising adoption despite cost-related challenges.

- Cybersecurity advancements will address growing concerns around data protection.

- The market will see faster growth in Asia Pacific due to urbanization and infrastructure expansion.