Market Overview

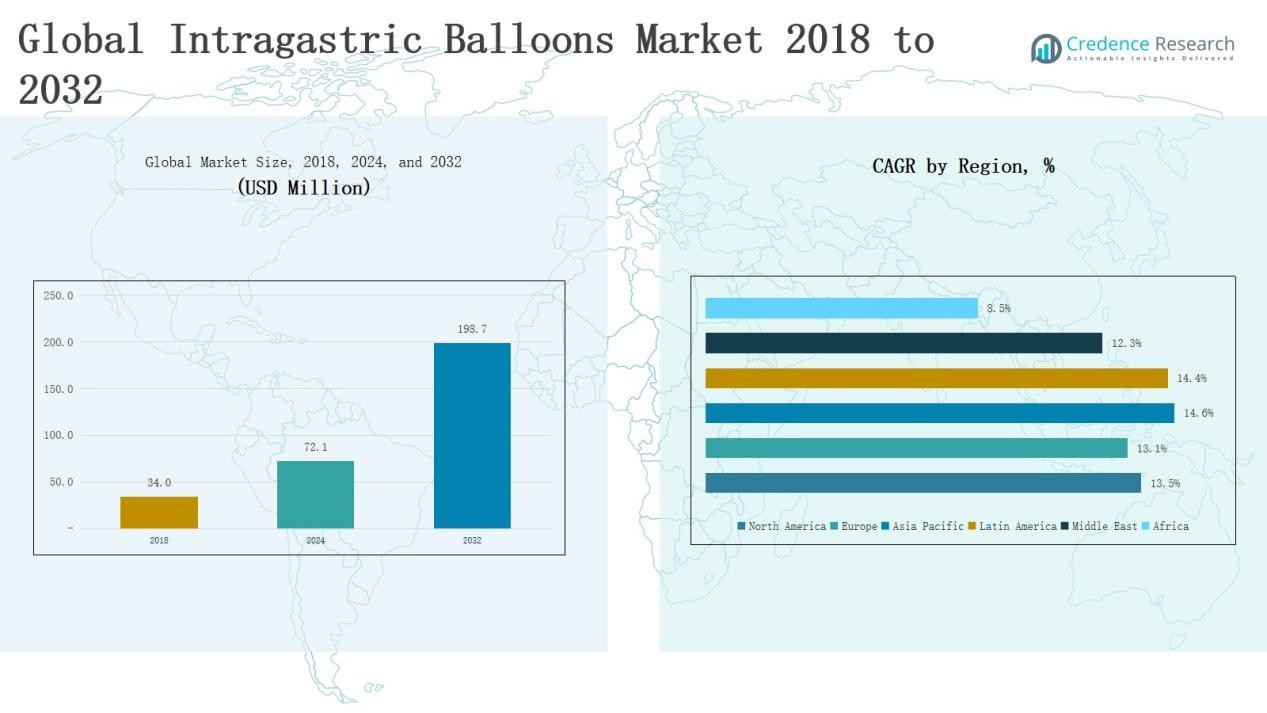

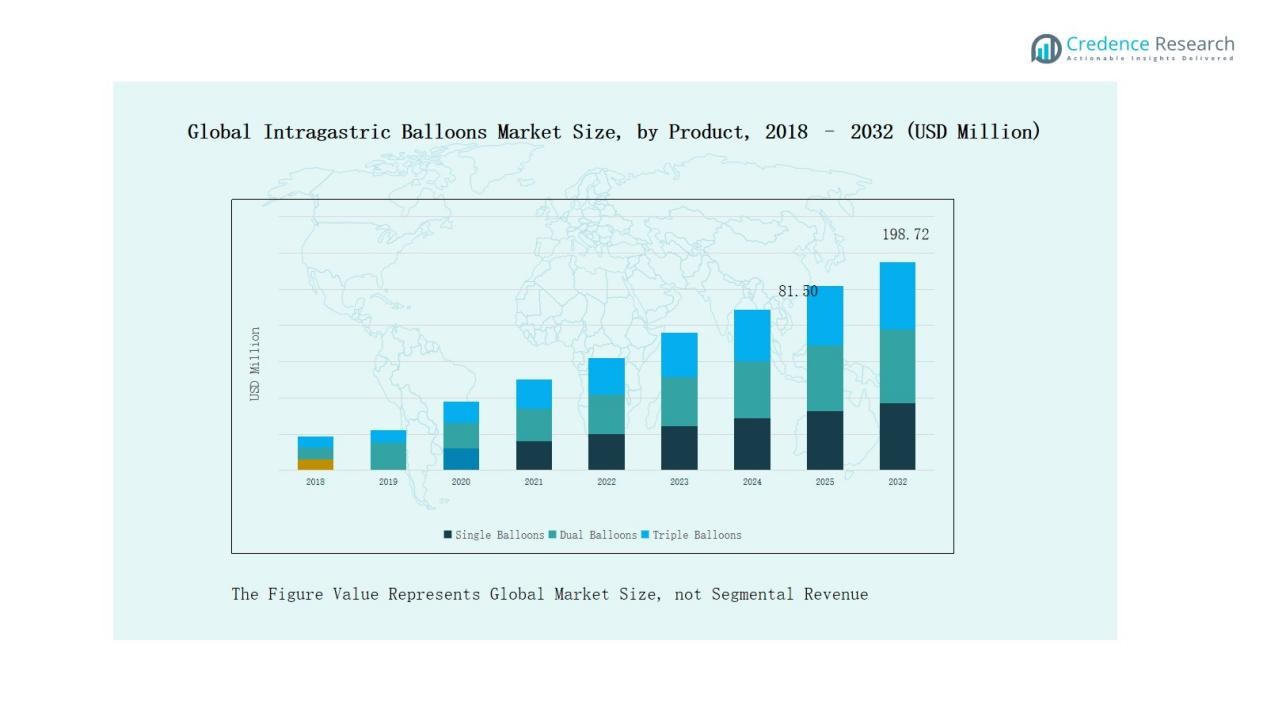

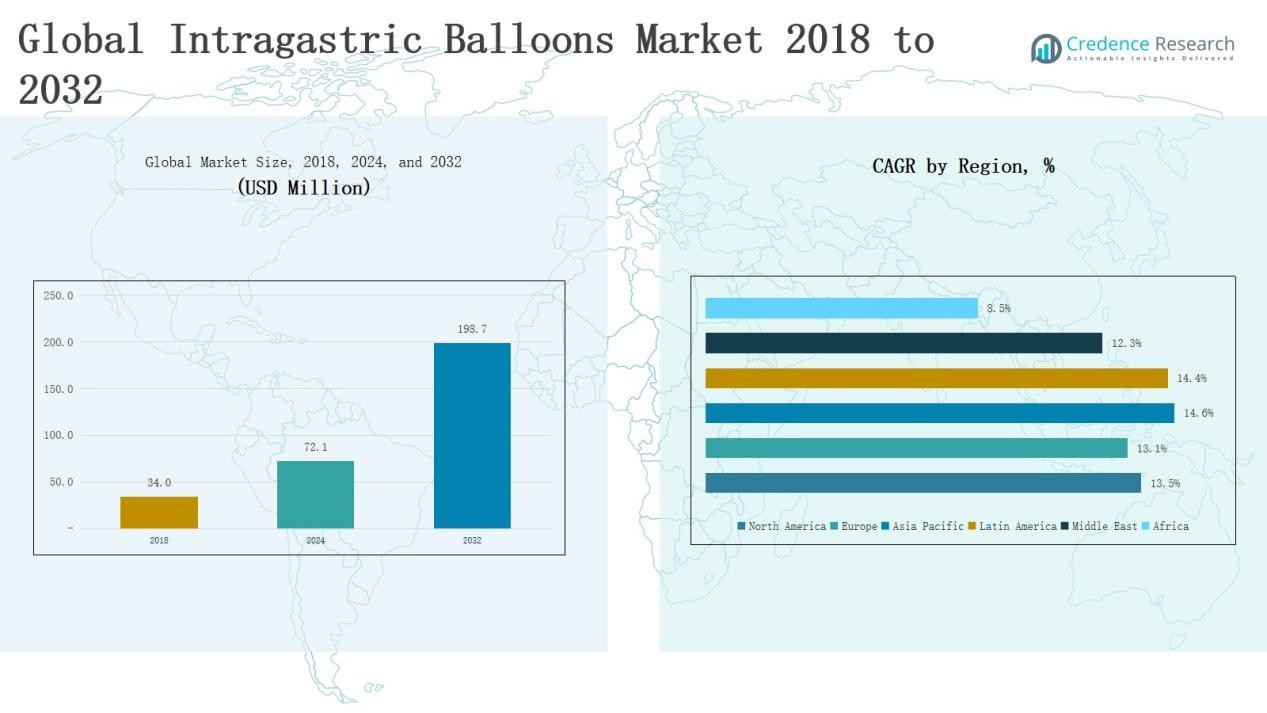

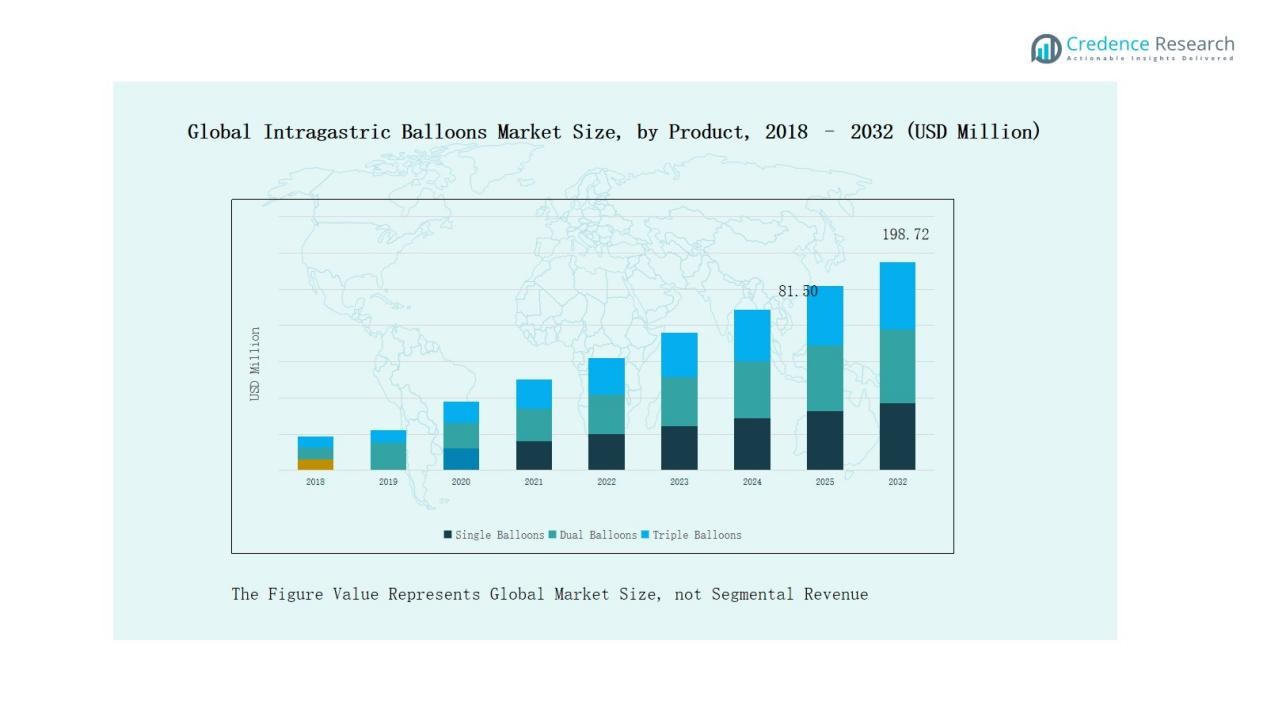

Global Intragastric Balloons Market size was valued at USD 34.0 million in 2018 to USD 72.1 million in 2024 and is anticipated to reach USD 198.7 million by 2032, at a CAGR of 13.58% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Intragastric Balloons Market Size 2024 |

USD 72.1 Million |

| Intragastric Balloons Market, CAGR |

13.58% |

| Intragastric Balloons Market Size 2032 |

USD 198.7 Million |

The Global Intragastric Balloons Market is shaped by leading players such as Allurion, Boston Scientific Corporation, Medicone, ReShape Lifesciences, Helioscopie, MEDSIL, and Lexel Medical, alongside several regional participants. These companies compete through innovation in capsule-based technologies, product safety enhancements, and strategic collaborations with healthcare providers to expand adoption. Allurion and ReShape Lifesciences emphasize swallowable balloon systems to strengthen patient compliance, while Boston Scientific leverages its diversified portfolio and global network. European players like Helioscopie and MEDSIL focus on region-specific innovation, while emerging firms improve local supply chains. Regionally, North America dominated the market in 2024 with a 36.3% share, supported by high obesity prevalence, advanced healthcare infrastructure, and strong procedural adoption across hospitals and clinics.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Intragastric Balloons Market grew from USD 34.0 million in 2018 to USD 72.1 million in 2024 and is projected to reach USD 198.7 million by 2032.

- Saline-filled balloons led the filled material segment with 68% share in 2024, while gas-filled options gained traction due to lighter weight and improved patient comfort.

- Single-balloon systems dominated the product segment with 57% share in 2024, whereas dual and triple-balloon systems advanced through higher efficacy and reduced migration risk.

- Endoscopy-based procedures held 72% market share in 2024, while pill-form capsules accounted for 28% and are expanding rapidly due to non-invasive benefits.

- North America led the regional market with 36.3% share in 2024, followed by Europe at 33% and Asia Pacific at 23.5%, reflecting strong global adoption patterns.

Market Segment Insights

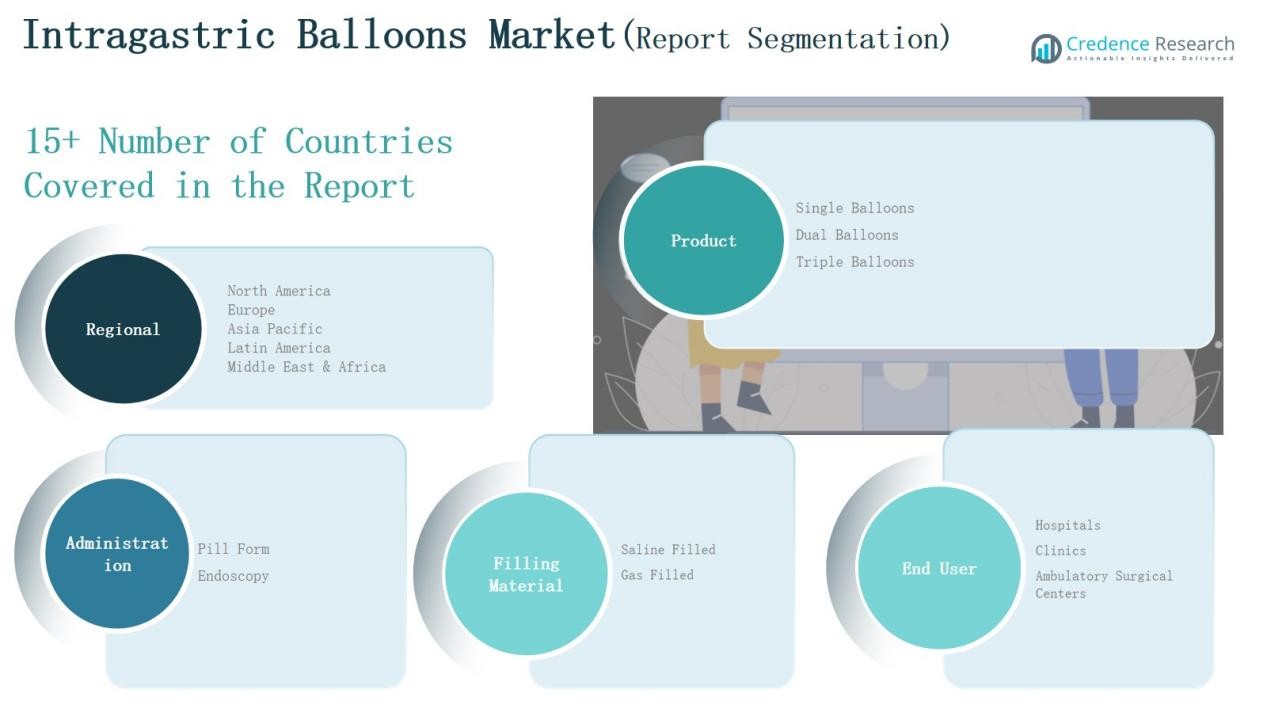

By Filled Material

Saline-filled intragastric balloons dominate the market with nearly 68% share in 2024. Their leadership is supported by established safety profiles, wide clinical acceptance, and relatively lower costs compared to gas-filled options. Gas-filled balloons, while lighter and offering greater patient comfort, account for the remaining share and are gaining traction due to improved tolerance rates and reduced post-procedure discomfort.

- For instance, Allurion Technologies reported that more than 150,000 patients worldwide had been treated with its swallowable, gas-filled intragastric balloon system, highlighting growing preference for non-invasive options.

By Product

Single-balloon systems lead the segment with around 57% market share in 2024, driven by ease of insertion, lower procedure complexity, and broad physician adoption. Dual and triple-balloon systems, together holding about 43%, are increasingly utilized in cases requiring higher volume restriction and better weight loss outcomes. Their adoption is growing as clinical studies highlight enhanced efficacy and reduced balloon migration risk.

- For instance, Spatz Medical received expanded CE Mark approval for its Spatz3 Adjustable Balloon System, allowing longer implantation duration and improved patient-adjustability for enhanced weight loss performance.

By Administration

Endoscopy-based administration holds a strong 72% share in 2024, reflecting its long-standing use, reliability, and physician preference for controlled placement and removal. Pill form administration, accounting for about 28%, is witnessing rapid adoption due to its non-invasive approach, reduced procedural costs, and higher patient convenience. Its growth is expected to accelerate as capsule-based technologies continue to gain regulatory approvals and wider clinical trust.

Key Growth Drivers

Rising Obesity Prevalence

The increasing global prevalence of obesity and overweight conditions is a primary driver for the intragastric balloons market. Rising sedentary lifestyles, poor dietary habits, and urbanization have amplified obesity-related health issues, such as diabetes and cardiovascular diseases. Intragastric balloons are gaining preference as a minimally invasive weight-loss intervention compared to bariatric surgery. Healthcare providers are recommending these devices for patients not eligible for invasive procedures, further fueling adoption. This rising demand is directly translating into higher procedure volumes worldwide.

- For instance, Orbera intragastric balloon showed an average weight loss of 12.9 kg within the first three months of therapy, highlighting early effectiveness.

Minimally Invasive Preference

Growing patient preference for minimally invasive treatments is propelling the adoption of intragastric balloons. Compared to surgical interventions, these balloons offer reduced risk, quicker recovery, and improved patient compliance. The increasing burden of healthcare costs has also encouraged payers and hospitals to promote less invasive solutions. The shorter procedure time and outpatient nature of balloon placement add further value for both patients and providers. As awareness spreads, this trend is accelerating adoption in both developed and emerging markets.

- For instance, Allurion Technologies announced that over 100,000 of its swallowable intragastric balloons had been placed worldwide, highlighting increasing global adoption of non-surgical weight-loss solutions.

Expanding Clinical Evidence

Clinical studies supporting the safety and efficacy of intragastric balloons are strengthening market acceptance. Evidence showing significant short-term weight reduction and improved metabolic parameters has influenced physician recommendations. The availability of published data highlighting reduced comorbidities, such as hypertension and type 2 diabetes, is enhancing trust among patients and healthcare systems. These outcomes are also driving greater regulatory support, reimbursement consideration, and expansion of product approvals across multiple regions, creating a strong foundation for future market growth.

Key Trends & Opportunities

Capsule-Based Balloons

The emergence of swallowable, pill-form balloons is a key trend transforming the market. These capsules allow non-endoscopic placement, reducing procedure costs and patient discomfort. Their non-invasive nature is appealing to patients hesitant about traditional endoscopy-based solutions. With regulatory approvals expanding in multiple regions, capsule-based systems are creating strong growth opportunities. Manufacturers focusing on enhancing safety and retrievability of such devices are likely to capture significant market share in the coming years.

- For instance, Allurion Technologies announced that more than 100,000 of its swallowable intragastric balloons had been placed globally, highlighting increasing adoption as a non-invasive weight-loss alternative.

Expanding Emerging Markets

Developing economies represent untapped opportunities due to rising obesity rates and growing healthcare spending. Countries across Asia Pacific, Latin America, and the Middle East are witnessing increasing demand for affordable and less invasive weight management solutions. Healthcare reforms, expanding insurance coverage, and the entry of global players are accelerating accessibility. Local distribution partnerships and awareness programs are helping penetrate these regions, positioning them as lucrative markets. This trend is expected to drive future revenue diversification for key players.

- For instance, Novo Nordisk launched its weight-loss drug Wegovy in June 2025. The company priced it between ₹17,345 and ₹26,015 depending on dose, aiming for affordability.

Key Challenges

Limited Long-Term Efficacy

One of the major challenges is the limited long-term efficacy of intragastric balloons. While effective for short-term weight loss, many patients experience weight regain after balloon removal. This limitation reduces confidence among both patients and healthcare providers. Sustained lifestyle modifications are required to maintain outcomes, which can be difficult to achieve. Addressing this challenge demands greater integration of behavioral therapy and follow-up programs to improve long-term patient success rates.

Adverse Effects and Tolerability Issues

Complications such as nausea, vomiting, abdominal pain, and balloon intolerance remain barriers to widespread adoption. Although generally safe, these side effects often lead to premature balloon removal, impacting patient satisfaction and overall market credibility. Efforts to improve balloon design, use lighter materials, and enhance placement techniques are ongoing. However, unless tolerability issues are significantly reduced, adoption rates may face limitations in both new and existing patient groups.

Reimbursement Limitations

Reimbursement challenges continue to hinder broader market penetration. In many countries, intragastric balloon procedures are classified as elective or cosmetic, restricting insurance coverage. Out-of-pocket expenses limit accessibility for patients, particularly in price-sensitive markets. The lack of uniform reimbursement policies also discourages hospitals and clinics from investing heavily in these procedures. Market growth depends on securing stronger payer support and generating cost-effectiveness data to justify insurance inclusion across key healthcare systems.

Regional Analysis

North America

North America generated USD 11.61 million in 2018, rising to USD 24.53 million in 2024, with an expected USD 67.37 million by 2032. The region held 36.3% share in 2024 and is projected to sustain leadership with a CAGR of 13.5%. Growth is driven by high obesity rates, advanced healthcare facilities, and strong adoption of minimally invasive weight-loss procedures. The U.S. dominates regional demand, while Canada and Mexico contribute with growing awareness programs and accessibility to innovative balloon technologies.

Europe

Europe recorded USD 10.81 million in 2018, increasing to USD 22.36 million in 2024, and is forecasted at USD 59.62 million by 2032. With 33.0% share in 2024, Europe ranks as the second-largest market, growing at a CAGR of 13.1%. Key contributors include Germany, the UK, France, and Italy, where bariatric programs and clinical adoption are well-established. Supportive reimbursement policies and ongoing product approvals for balloon systems enhance regional acceptance, further consolidating Europe’s strong position.

Asia Pacific

Asia Pacific was valued at USD 7.11 million in 2018, expanding to USD 15.92 million in 2024, and projected to reach USD 47.04 million by 2032. The region captured 23.5% share in 2024, advancing at the fastest CAGR of 14.6%. Rising obesity prevalence, rapid lifestyle changes, and improved healthcare access are fueling adoption. China, Japan, and India lead market growth, while Southeast Asia is witnessing increased penetration through cost-effective solutions and expanding distributor networks.

Latin America

Latin America generated USD 2.54 million in 2018, growing to USD 5.61 million in 2024, and forecasted at USD 16.31 million by 2032. Holding 8.3% share in 2024, the region is expanding at a CAGR of 14.4%. Brazil is the largest contributor, with Argentina and other nations gradually adopting minimally invasive treatments. Market expansion is supported by obesity prevalence, affordability programs, and partnerships between global players and local distributors.

Middle East

The Middle East accounted for USD 1.10 million in 2018, rising to USD 2.19 million in 2024, and expected to reach USD 5.52 million by 2032. It held 3.3% share in 2024 with a CAGR of 12.3%. Demand is primarily concentrated in GCC countries, driven by high obesity prevalence, supportive healthcare investments, and premium treatment adoption. Israel and Turkey also contribute significantly due to advanced medical infrastructure and increasing uptake of minimally invasive solutions.

Africa

Africa registered USD 0.86 million in 2018, increasing to USD 1.49 million in 2024, and projected at USD 2.86 million by 2032. With the smallest 2.2% share in 2024, the region grows at the lowest CAGR of 8.5%. Limited healthcare infrastructure, low awareness, and affordability barriers constrain adoption. However, South Africa and Egypt are emerging hubs due to obesity growth trends and gradual infrastructure improvements, while international players are eyeing Africa as a long-term expansion opportunity.

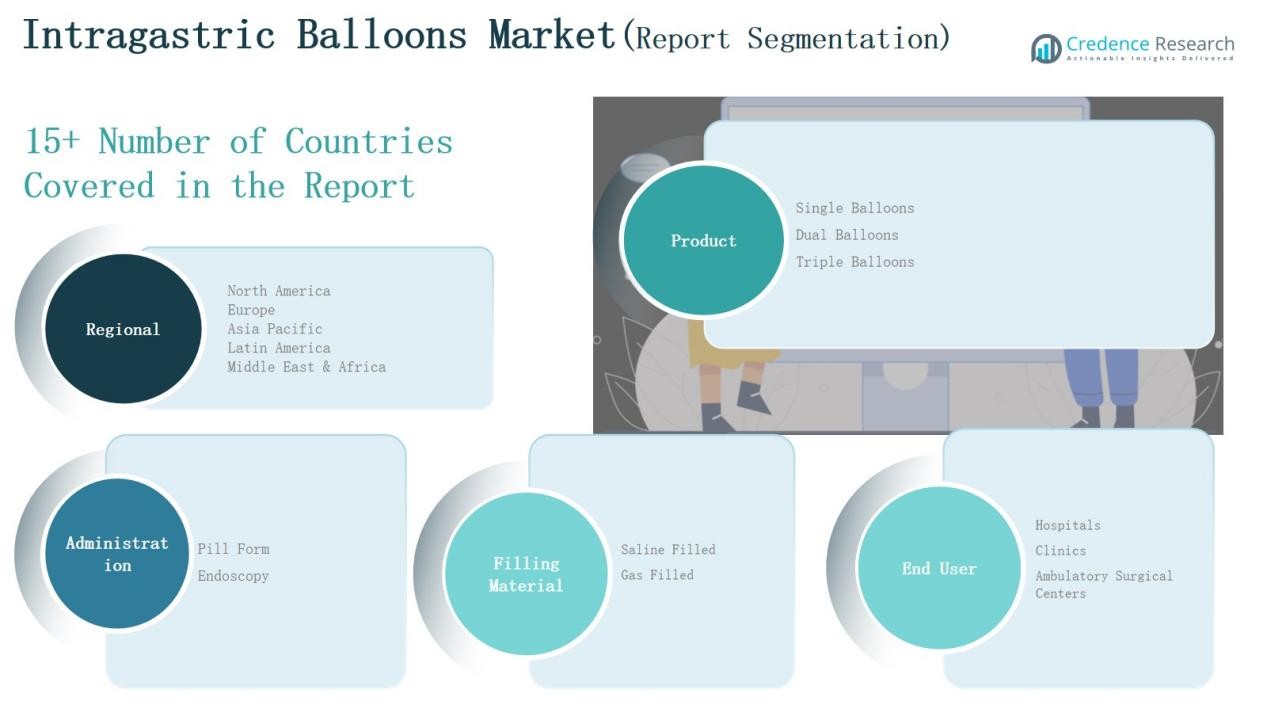

Market Segmentations:

By Filled Material

By Product

- Single Balloons

- Dual Balloons

- Triple Balloons

By Administration

By End User

- Hospitals

- Clinics

- Ambulatory Surgical Centers

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Global Intragastric Balloons Market is characterized by moderate concentration, with a mix of established multinational corporations and specialized medical device manufacturers. Key players include Allurion, Boston Scientific Corporation, Medicone, ReShape Lifesciences, Helioscopie, MEDSIL, and Lexel Medical, alongside several regional participants. These companies compete on product innovation, safety profiles, pricing strategies, and distribution networks. Allurion and ReShape Lifesciences emphasize capsule-based and advanced balloon designs to enhance patient tolerability and expand adoption. Boston Scientific leverages its strong global presence and diversified product portfolio to maintain market reach. European players like Helioscopie and MEDSIL focus on innovation tailored to regional regulatory requirements, while emerging firms strengthen local supply chains. Strategic collaborations, clinical trial investments, and geographic expansion remain central to sustaining competitiveness. The market is also witnessing increased product launches, regulatory approvals, and partnerships with healthcare providers, positioning leading firms to capture growing demand for minimally invasive weight-loss solutions worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In April 2025, RadNet, Inc. began the acquisition process of iCAD, Inc., a global leader in AI-powered breast health solutions, aiming to accelerate AI-driven early detection and diagnosis of breast cancer, with integration expected by Q3 2025.

- In March 2025, iCAD partnered with RamSoft to integrate the ProFound AI® Breast Health Suite into RamSoft’s RIS/PACS platforms across North America.

- In January 2025, Dolbey and Ikonopedia formed a strategic partnership to offer a hands-free mammography reporting solution with speech recognition and structured reporting.

- In April 2025, SimonMed Imaging collaborated with Lunit and Volpara Analytics to deploy Lunit INSIGHT DBT and Volpara tools for AI-powered breast cancer detection.

Report Coverage

The research report offers an in-depth analysis based on Filled Material, Product, Administration, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of capsule-based intragastric balloons will expand due to non-invasive placement.

- Rising obesity prevalence worldwide will continue to drive demand for weight-loss interventions.

- Hospitals and clinics will strengthen adoption with supportive patient management programs.

- Technological advancements will improve balloon durability, comfort, and safety.

- Strategic collaborations between manufacturers and healthcare providers will widen market reach.

- Emerging markets in Asia Pacific and Latin America will witness faster adoption.

- Growing clinical evidence will enhance physician trust and patient acceptance.

- Companies will focus on affordability to penetrate price-sensitive regions.

- Regulatory approvals for innovative products will accelerate global commercialization.

- Integration of digital health monitoring with balloon therapies will improve patient outcomes.