| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Industrial Catalyst Market Size 2024 |

USD 862.97 Million |

| Italy Industrial Catalyst Market, CAGR |

4.91% |

| Italy Industrial Catalyst Market Size 2032 |

USD 1,265.89 Million |

Market Overview:

The Italy Industrial Catalyst Market is projected to grow from USD 862.97 million in 2024 to an estimated USD 1,265.89 million by 2032, with a compound annual growth rate (CAGR) of 4.91% from 2024 to 2032.

Several factors are driving the demand for industrial catalysts in Italy. The nation’s strong chemical manufacturing base necessitates catalysts for various processes, including petrochemical production and specialty chemicals. With Italy being a key player in the European chemical sector, the demand for efficient and high-performance catalysts is expected to rise. Moreover, Italy’s emphasis on environmental sustainability aligns with the global shift towards cleaner production methods, further boosting the adoption of catalysts that reduce emissions and enhance process efficiency. The push towards decarbonization and stricter regulatory frameworks for emissions is further stimulating this trend. Additionally, Italy’s automotive industry, renowned for its high-performance vehicles, relies on catalysts to meet stringent emission standards, thereby supporting market growth. The continued development of electric vehicles and hybrid systems will also require advanced catalytic solutions, driving innovation in this segment.

Regionally, Italy’s industrial catalyst market benefits from the country’s well-developed infrastructure and strategic location within Europe. Northern regions, with their dense industrial clusters, are significant consumers of catalysts, especially in chemical manufacturing and automotive sectors. The presence of major industrial hubs in cities like Milan and Turin enhances market accessibility and facilitates the distribution of catalysts across industries. Southern regions, while less industrialized, are experiencing growth in manufacturing activities, gradually increasing their share in the catalyst market. Local governments have been investing in industrial development in these regions, which will likely contribute to a surge in demand for catalysts. This balanced regional development contributes to the overall expansion of Italy’s industrial catalyst market, as both established industrial areas and emerging regions continue to fuel the demand for advanced catalytic solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Italy Industrial Catalyst Market is projected to grow from USD 862.97 million in 2024 to an estimated USD 1,265.89 million by 2032, with a compound annual growth rate (CAGR) of 4.91% from 2024 to 2032, driven by increasing demand from sectors like chemical manufacturing and automotive.

- The global industrial catalyst market is projected to grow from USD 31.56 billion in 2024 to USD 51.15 billion by 2032, with a CAGR of 6.22% from 2024 to 2032.

- The chemical manufacturing sector in Italy remains a major driver, particularly in petrochemical production and specialty chemicals, where catalysts are essential for process efficiency.

- Italy’s commitment to environmental sustainability and stricter emission regulations is pushing industries to adopt advanced catalysts that reduce emissions and enhance efficiency.

- The automotive sector plays a pivotal role in catalyst demand, particularly as Italy shifts towards hybrid and electric vehicle technologies requiring advanced catalytic solutions.

- Northern Italy, with its industrial hubs like Milan and Turin, will continue to lead in catalyst consumption, while southern regions show promising growth due to expanding manufacturing activities.

- Technological innovations, including the development of nanocatalysts and biocatalysts, are driving improvements in catalyst performance and efficiency across various industrial applications.

- Despite high costs of catalyst development and the complexities of evolving regulatory landscapes, Italy’s industrial catalyst market remains poised for long-term growth, particularly in sustainable and efficient catalytic solutions.

Market Drivers:

Demand from Chemical Manufacturing Sector

The chemical manufacturing sector in Italy plays a pivotal role in driving the demand for industrial catalysts. As one of Europe’s leading producers of chemicals, Italy relies heavily on catalysts to facilitate a wide range of chemical processes. Industrial catalysts are essential for improving the efficiency of chemical reactions, optimizing energy consumption, and enhancing product yields. The need for catalysts is particularly strong in the production of petrochemicals, polymers, and specialty chemicals, where their role in ensuring the desired reaction rates and selectivity is crucial. With Italy’s chemical industry being a major contributor to the economy, the demand for industrial catalysts is expected to remain high, supporting the growth of the market.

Shift Towards Environmental Sustainability

Italy has placed significant emphasis on environmental sustainability, which acts as a key driver for the industrial catalyst market. With stricter environmental regulations and global pressure for cleaner production processes, industries are increasingly adopting catalysts that minimize harmful emissions and reduce waste. For instance, Italy has co-funded nearly 190 projects through its Sustainable Mobility Fund at a total cost of €195 million to reduce black carbon emissions in transportation. Catalysts not only play a crucial role in reducing the carbon footprint but also help businesses comply with stringent environmental standards, such as the European Union’s directives on air quality and industrial emissions. Italy’s commitment to sustainability, reflected in its green energy initiatives and carbon reduction goals, will continue to fuel the demand for catalysts that enhance the efficiency and environmental friendliness of industrial processes.

Automotive Industry’s Contribution

The Italian automotive industry is another major driver of the industrial catalyst market. Known for its high-performance vehicles, Italy requires advanced catalysts to meet rigorous emission standards. These catalysts are primarily used in the automotive sector for exhaust after-treatment systems, which help in reducing harmful emissions such as nitrogen oxides (NOx), carbon monoxide (CO), and particulate matter. As Italy continues to prioritize cleaner transportation, particularly with the rise of hybrid and electric vehicle technologies, the demand for automotive catalysts is expected to grow. Additionally, as emissions regulations become stricter, the need for more efficient and durable catalytic converters in vehicles will further drive the market for industrial catalysts.

Technological Advancements in Catalysis

Technological innovation in the field of catalysis is playing an increasingly important role in shaping the industrial catalyst market in Italy. Ongoing research and development are leading to the creation of more efficient, durable, and cost-effective catalysts that can handle the demands of diverse industrial applications. For example, BASF SE introduced X3D technology for industrial catalysts that enhance reactor output while lowering energy requirements through innovative designs. Advances in catalyst formulations, including the development of nanocatalysts and heterogeneous catalysts, are improving the performance of industrial processes, reducing energy consumption, and lowering operational costs. As Italy continues to invest in technological advancements, these innovations will further drive market growth by offering more sustainable and efficient solutions to industrial challenges.

Market Trends:

Growth in Demand for Renewable Energy Catalysts

The growing demand for renewable energy catalysts in Italy is closely tied to the country’s commitment to achieving carbon neutrality by 2050. Catalysts play a critical role in renewable energy applications, particularly in biofuel production and hydrogen technologies. For instance, catalysts are essential for converting biomass and waste materials into bioethanol and biodiesel, processes that align with Italy’s focus on sustainable energy solutions. Additionally, the increasing interest in green hydrogen as an alternative energy source has led to innovations in catalysts that enhance hydrogen production, storage, and utilization. This trend is supported by government incentives and EU climate targets, which are driving advancements in renewable energy technologies across Italy

Focus on Catalyst Recycling and Reusability

The growing emphasis on sustainability has led to a notable trend toward the recycling and reusability of industrial catalysts. Italy, like other European nations, is increasingly prioritizing circular economy principles, including the recycling of catalytic materials to reduce waste and improve resource efficiency. Catalyst recovery and regeneration processes are becoming more advanced, allowing for catalysts to be reused multiple times, thus reducing both environmental impact and operational costs for industries. This trend is particularly prominent in the chemical and petrochemical sectors, where catalysts are integral to large-scale production processes. As Italy continues to push for sustainable industrial practices, the trend of catalyst recycling will become an increasingly important factor in the market’s evolution.

Adoption of Advanced Catalytic Technologies

Another key trend in the Italy Industrial Catalyst Market is the widespread adoption of advanced catalytic technologies. Industrial sectors in Italy are increasingly turning to next-generation catalysts, such as nanocatalysts and biocatalysts, to enhance process efficiency and product yield while reducing energy consumption. Nanocatalysts, in particular, offer unique advantages, including improved surface area, higher catalytic activity, and greater resistance to deactivation, making them ideal for a variety of applications, from petrochemicals to pharmaceuticals. Furthermore, the use of biocatalysts in green chemistry processes is on the rise, offering a more environmentally friendly alternative to traditional catalytic methods. These technological advancements are transforming industrial catalysis in Italy, enabling manufacturers to achieve better performance and align with sustainability goals.

Emergence of Customized Catalysts for Specific Applications

The demand for customized catalysts is rising as Italian industries seek tailored solutions for specific processes. For example, pharmaceutical companies are increasingly using custom catalysts to synthesize complex molecules with high precision, while the automotive sector relies on specialized catalysts for emission control. This trend is driven by advancements in catalyst design technologies, including the use of artificial intelligence and machine learning to optimize performance. By collaborating with catalyst providers, Italian manufacturers are developing bespoke solutions that enhance product quality and process efficiency across sectors such as specialty chemicals and automotive manufacturing

Market Challenges Analysis:

High Cost of Catalyst Development

One of the key restraints in the Italy Industrial Catalyst Market is the high cost associated with the development and production of advanced catalysts. The research and development (R&D) processes involved in creating new catalyst formulations, particularly those based on innovative technologies like nanocatalysts and biocatalysts, can be capital intensive. The costs of raw materials, such as precious metals and rare earth elements, further add to the expense. For instance, platinum-based catalysts used in hydrogenation processes are expensive due to the high cost of raw materials like platinum and the complex manufacturing processes involved. This high cost can limit the adoption of advanced catalysts, particularly for small and medium-sized enterprises (SMEs) in Italy’s industrial sectors, which may struggle to justify the investment. As a result, cost remains a significant barrier to the widespread deployment of cutting-edge catalytic technologies.

Environmental and Regulatory Challenges

Another significant challenge for the industrial catalyst market in Italy lies in navigating the complex and ever-evolving environmental and regulatory landscape. While catalysts are often adopted to comply with environmental regulations, industries face ongoing challenges related to meeting stricter emission standards and sustainability targets. Italy’s environmental regulations, aligned with European Union directives, are continuously becoming more stringent, requiring manufacturers to invest in advanced catalysts to ensure compliance. These regulatory pressures can pose a challenge, as companies may face difficulty in keeping up with the increasing demand for more efficient catalysts while ensuring they meet evolving regulations.

Catalyst Deactivation and Lifespan Issues

Catalyst deactivation remains a critical challenge for the industrial catalyst market in Italy. Over time, catalysts can lose their effectiveness due to factors such as poisoning, fouling, or sintering, reducing their performance and necessitating costly replacements or regeneration processes. This issue affects several industries, including petrochemicals and automotive, where catalyst performance is essential for maintaining operational efficiency. The need to replace or regenerate deactivated catalysts increases operational costs, thus creating a significant hurdle for businesses in maintaining profitability while ensuring effective catalyst performance throughout their lifecycle.

Market Opportunities:

The growing focus on renewable energy presents a significant opportunity for the Italy Industrial Catalyst Market. With Italy’s ambitious goals to transition to a more sustainable energy mix, the demand for catalysts in renewable energy applications is on the rise. Catalysts are essential in processes such as biofuel production, hydrogen production, and energy storage solutions, all of which align with Italy’s long-term commitment to reducing carbon emissions and promoting green energy. The increased adoption of biofuels as an alternative to fossil fuels, along with the advancements in hydrogen energy systems, offers a unique opportunity for catalyst manufacturers to develop and supply specialized catalysts that optimize these renewable energy processes. As Italy continues to invest in renewable energy infrastructure, the market for industrial catalysts in this sector is expected to experience substantial growth.

Technological innovation in catalyst design is another key opportunity for the industrial catalyst market in Italy. Advancements such as the development of nanocatalysts, more efficient heterogeneous catalysts, and the emergence of biocatalysts are paving the way for more efficient and sustainable industrial processes. These innovations enable better performance, lower energy consumption, and enhanced process yields, which are highly sought after by industries across the chemical, automotive, and manufacturing sectors. The demand for high-performance, cost-effective, and environmentally friendly catalysts is expected to rise, driving new market opportunities for suppliers who can meet the specific needs of Italy’s industrial sectors. By capitalizing on these technological advancements, companies in the catalyst market can gain a competitive edge and tap into emerging demand across various industries.

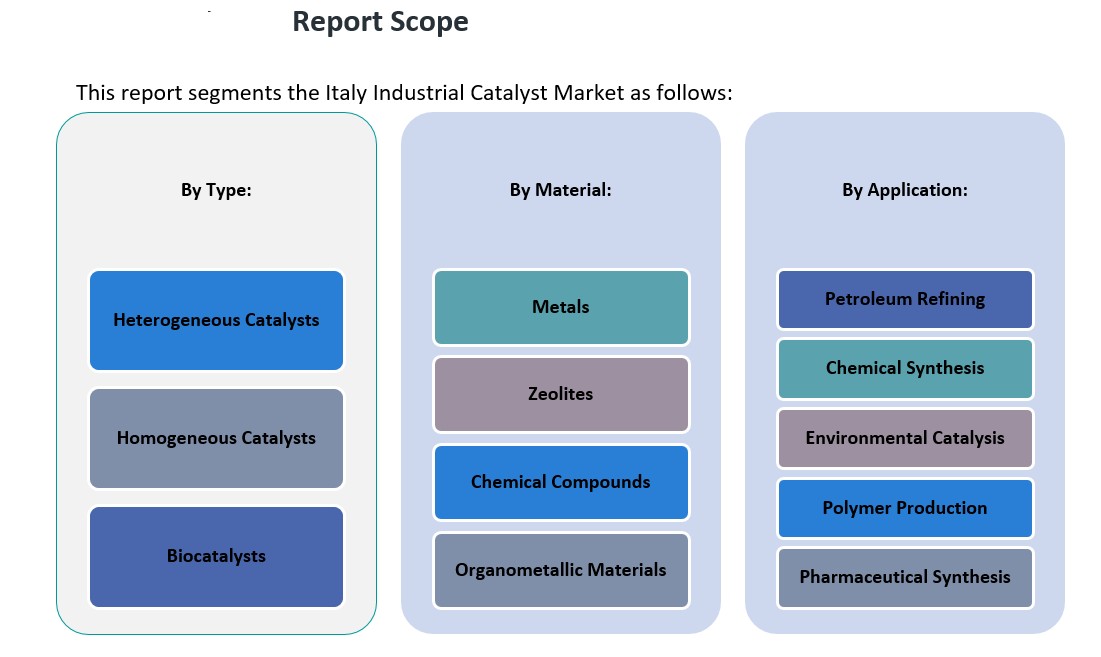

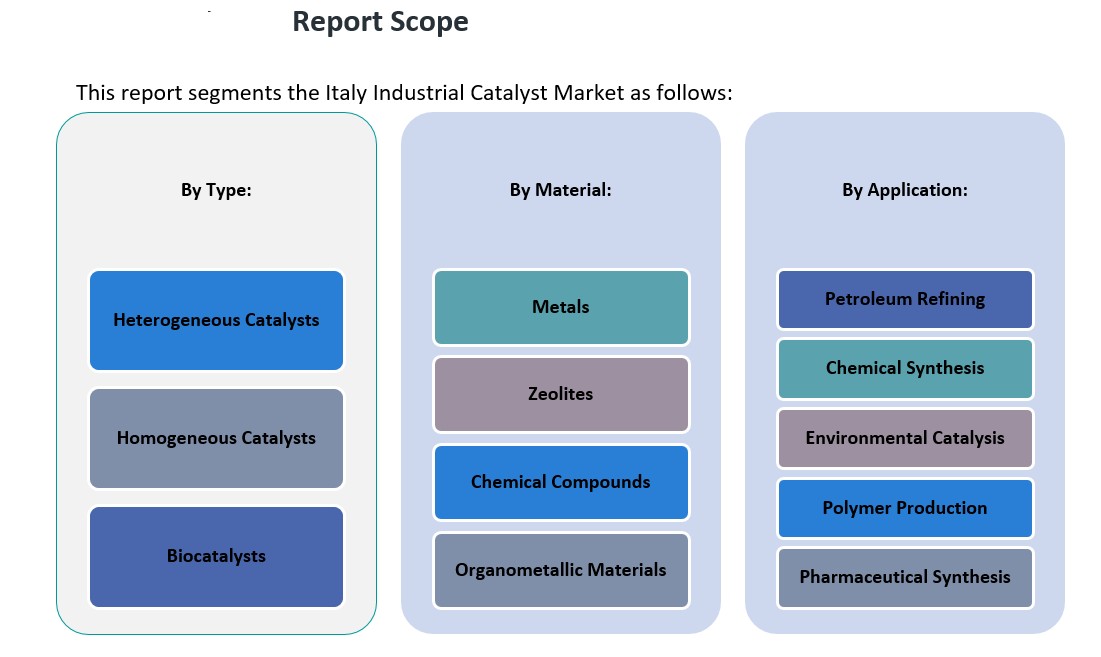

Market Segmentation Analysis:

By Type Segment

The Italy Industrial Catalyst Market can be segmented by catalyst type into heterogeneous, homogeneous, and biocatalysts. Heterogeneous catalysts dominate the market, particularly in large-scale industrial applications such as petroleum refining and chemical synthesis. These catalysts are used in fixed-bed reactors and other solid-phase processes, offering high efficiency and easy separation from products. Homogeneous catalysts, though less common, are important in specific applications requiring precise control over reaction conditions, such as pharmaceutical synthesis. Biocatalysts, which utilize natural catalysts such as enzymes, are gaining traction due to their environmental benefits and are increasingly being used in sustainable chemical processes and biofuel production.

By Application Segment

The industrial catalyst market in Italy is also segmented by application, with key sectors including petroleum refining, chemical synthesis, environmental catalysis, polymer production, and pharmaceutical synthesis. Petroleum refining is the largest application segment, driven by the need for efficient conversion of crude oil into valuable products like gasoline and diesel. Chemical synthesis follows closely, as catalysts are essential in the production of chemicals and materials used across various industries. Environmental catalysis is growing in importance due to stricter emissions regulations, with catalysts being used in emissions reduction processes. The polymer production and pharmaceutical synthesis segments also drive market demand, as catalysts play critical roles in the production of specialty polymers and active pharmaceutical ingredients.

By Material Segment

The material segment of the Italy Industrial Catalyst Market includes metals, zeolites, chemical compounds, and organometallic materials. Metals, such as platinum and palladium, are widely used in both petroleum refining and automotive catalytic converters due to their high catalytic activity. Zeolites are essential in petrochemical and chemical synthesis processes due to their unique pore structure. Chemical compounds and organometallic materials are used in more specialized applications, including pharmaceutical synthesis and fine chemicals production, offering tailored properties for specific catalytic functions.

Segmentation:

By Type Segment

- Heterogeneous Catalysts

- Homogeneous Catalysts

- Biocatalysts

By Application Segment

- Petroleum Refining

- Chemical Synthesis

- Environmental Catalysis

- Polymer Production

- Pharmaceutical Synthesis

By Material Segment

- Metals

- Zeolites

- Chemical Compounds

- Organometallic Materials

Regional Analysis:

The Italy Industrial Catalyst Market is experiencing varied growth across its regions, with significant demand emerging from both the northern and southern parts of the country. Each region presents unique dynamics, driven by industrial activity, infrastructure, and environmental initiatives.

Northern Italy

Northern Italy is the dominant region in the industrial catalyst market, accounting for a substantial share of the market due to its well-established industrial base. Key industrial hubs like Lombardy, Piedmont, and Veneto are home to a wide range of manufacturing sectors, including chemical production, petroleum refining, automotive, and pharmaceuticals, all of which are key users of industrial catalysts. The region’s robust infrastructure, technological advancements, and proximity to major European markets contribute to its leading position in the catalyst market. Northern Italy is also at the forefront of sustainability initiatives, with many industries adopting advanced catalysts for cleaner and more efficient production processes. The region’s market share is estimated to be around 60%, driven by the concentration of large-scale industrial operations and a focus on innovation.

Central Italy

Central Italy, including regions such as Tuscany and Lazio, contributes a smaller but significant portion to the industrial catalyst market. The area is known for its chemical synthesis and pharmaceutical industries, with key players in the production of fine chemicals and specialty products. While central Italy’s industrial base is smaller compared to the north, its pharmaceutical and environmental catalysis sectors are growing steadily. The adoption of industrial catalysts in green energy and sustainability-focused projects is also increasing in this region. Central Italy’s market share is estimated to be around 20%, with growth driven by the ongoing modernization of manufacturing facilities and increased demand for efficient catalysts in specialized applications.

Southern Italy

Southern Italy, comprising regions like Campania, Calabria, and Sicily, accounts for the remaining 20% of the market share. Although less industrialized compared to the northern regions, Southern Italy is gradually increasing its industrial footprint. The demand for industrial catalysts in this region is rising as manufacturing activities expand, particularly in areas such as petrochemical production and renewable energy projects. Local governments have been investing in infrastructure and industrial development, further driving the need for industrial catalysts. As Southern Italy continues to industrialize, its market share in the catalyst sector is expected to grow in the coming years.

Key Player Analysis:

- BASF SE

- Johnson Matthey PLC

- Clariant AG

- Evonik Industries AG

- Haldor Topsoe A/S

- Arkema Group

- Akzo Nobel N.V.

- INEOS Group

- Umicore

- SABIC Italy

Competitive Analysis:

The Italy Industrial Catalyst Market is highly competitive, with both global and regional players vying for market share. Key international companies such as BASF, Johnson Matthey, and Clariant dominate the market, offering a wide range of catalyst solutions across various sectors including petroleum refining, chemical synthesis, and environmental applications. These industry leaders leverage their advanced technologies, extensive R&D capabilities, and global supply chains to maintain a strong presence in the Italian market. Local companies also play a significant role, particularly in the pharmaceutical and specialty chemicals sectors, where customized catalysts are in demand. These players often focus on providing tailored solutions to meet the specific needs of Italian industries, ensuring a competitive edge in niche markets. As Italy continues to focus on sustainability and energy efficiency, competition among companies will intensify, driving innovation in catalyst technologies and increasing demand for eco-friendlier and cost-effective solutions.

Recent Developments:

- In February 2024, BASF Environmental Catalyst and Metal Solutions (ECMS) completed the acquisition of Arc Metal AB in Hofors, Sweden. This strategic move added smelting capabilities for processing spent automotive catalysts in Europe, the Middle East, and Africa (EMEA), complementing ECMS’s global recycling operations. The acquisition bolstered ECMS’s ability to deliver its Verdium™ offering, a 100% recycled metal solution that significantly reduces carbon emissions.

- In December 2024, BASF inaugurated its new Catalyst Development and Solids Processing Center in Ludwigshafen, Germany. This state-of-the-art facility aims to accelerate the development of innovative catalyst and process technologies, serving as a hub for pilot-scale synthesis of chemical catalysts. The center is equipped with cutting-edge process equipment, enabling faster and more focused R&D activities essential for the green transformation.

- In Feb, 2025, Johnson Matthey PLC announced a partnership with Bosch to develop catalyst-coated membranes (CCMs) for fuel cell stacks. These CCMs will be integrated into Bosch’s fuel cell power modules for commercial vehicles, promoting zero-emission hydrogen technology. The collaboration focuses on advancing cleaner mobility solutions and energy generation.

Market Concentration & Characteristics:

The Italy Industrial Catalyst Market is characterized by moderate concentration, with several major players driving market dynamics. Prominent international companies such as BASF SE, Albemarle Corporation, Johnson Matthey PLC, and Clariant AG maintain significant influence by offering a diverse range of catalyst solutions. These companies serve key sectors like petroleum refining, chemical manufacturing, and environmental catalysis, leveraging advanced technologies and extensive research and development capabilities to stay competitive. Zeolite-based catalysts currently dominate the material segment, and their adoption remains strong, especially in petroleum refining applications. The chemical compounds segment is expected to grow rapidly as demand for sustainable and efficient catalytic solutions rises, driven by innovations in catalyst formulations and environmental regulations. This market presents substantial opportunities for both established and emerging companies to expand their footprint in Italy by focusing on developing advanced and sustainable catalyst solutions. With ongoing investments in R&D, market players can tap into emerging trends and meet the evolving needs of industries, particularly in the areas of energy efficiency and environmental compliance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type Segment, Application Segment and Material Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Italian industrial catalyst market is expected to grow steadily in the coming years, driven by an increasing demand across various sectors.

- Zeolite-based catalysts will continue to dominate the material segment, especially in petroleum refining applications.

- Chemical compounds are predicted to experience rapid growth due to advancements in catalyst formulations and the shift towards sustainable practices.

- Northern regions of Italy will maintain their leadership in catalyst demand, supported by dense industrial clusters and chemical manufacturing activities.

- Southern regions are expected to see increased catalyst adoption as local manufacturing activities expand and modernize.

- Government initiatives focused on environmental sustainability will drive the demand for catalysts that support cleaner production methods and emissions reductions.

- The growing renewable energy sector, including biofuels and hydrogen production, will present new opportunities for catalyst applications.

- Technological innovations in nanocatalysts and biocatalysts will enhance catalyst performance and efficiency across industrial processes.

- The automotive, defense, and aerospace sectors will continue to contribute to the demand for specialized catalysts in high-performance applications.

- Ongoing investments in infrastructure and industrial innovation will support continued growth in Italy’s industrial catalyst market.