Market Overview:

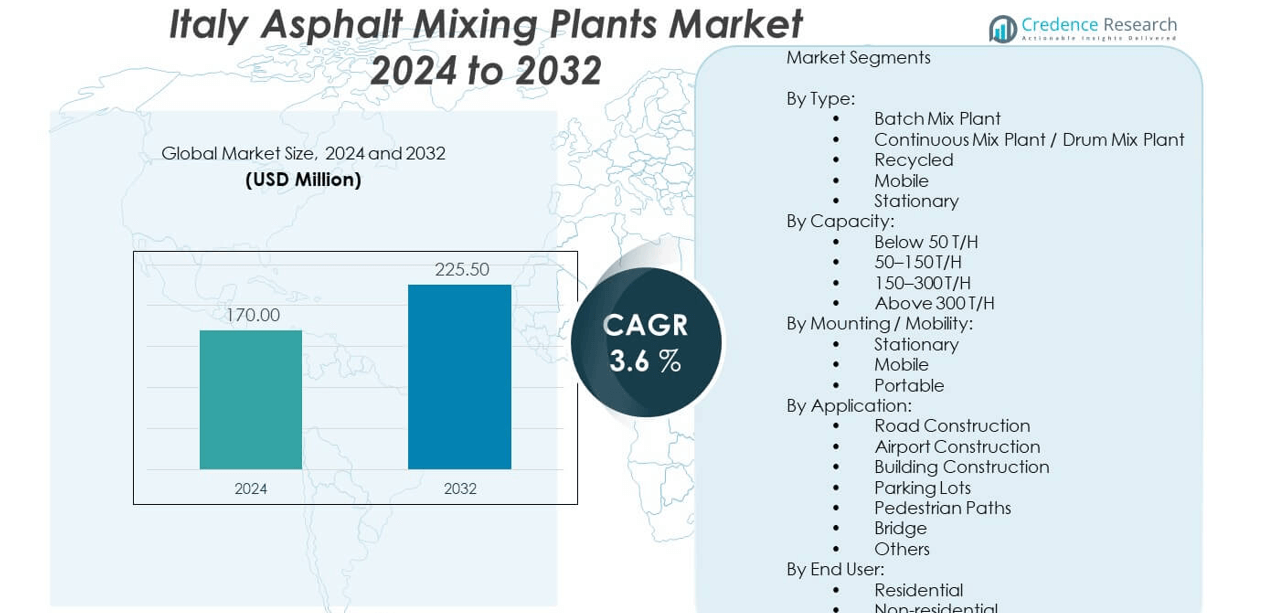

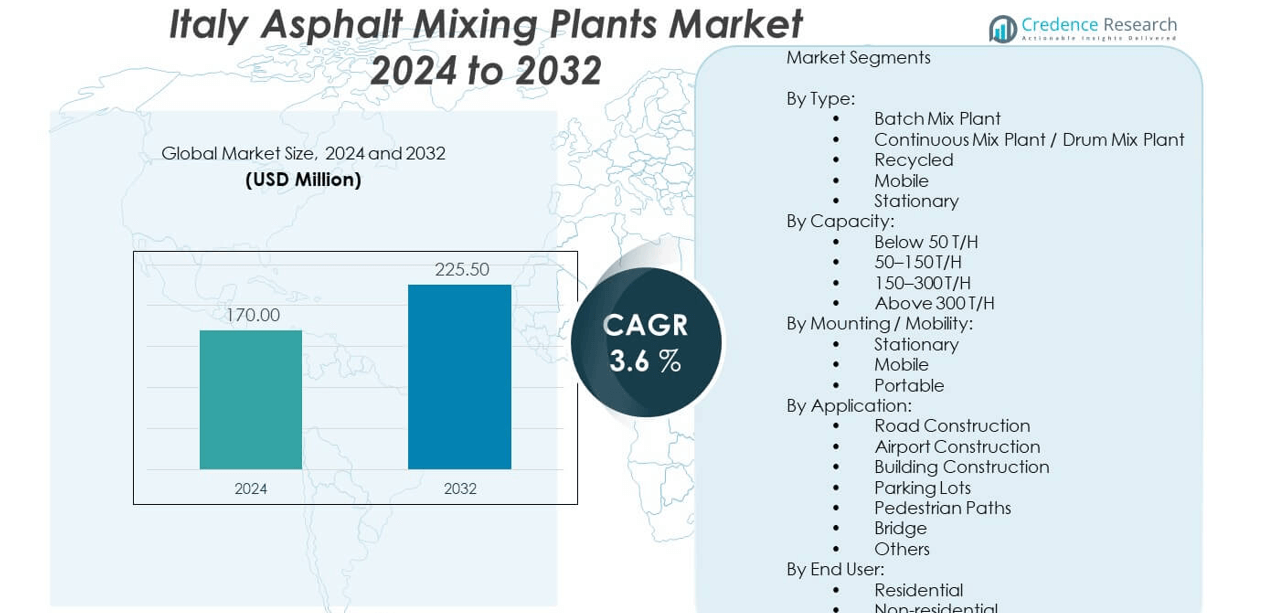

The Italy asphalt mixing plants market is projected to grow from USD 170 million in 2024 to an estimated USD 225.5 million by 2032, with a compound annual growth rate (CAGR) of 3.6% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Asphalt Mixing Plants Market Size 2024 |

USD 170 million |

| Italy Asphalt Mixing Plants Market, CAGR |

3.6% |

| Italy Asphalt Mixing Plants Market Size 2032 |

USD 225.5 million |

The growth of Italy’s asphalt mixing plants market is driven by increasing road infrastructure projects, modernization of aging transportation networks, and government investments targeting urban development. Rising demand for advanced and environmentally compliant equipment fuels adoption of energy-efficient and low-emission asphalt mixing technologies. Public-private partnerships and regional connectivity programs have stimulated the construction sector, creating consistent demand for asphalt production machinery. Moreover, the push for durable, weather-resilient road surfaces encourages adoption of high-performance asphalt mixes, requiring reliable and automated plant systems.

Geographically, northern Italy leads the market due to its industrialized economy, dense transport networks, and high urbanization levels, which necessitate continuous infrastructure upgrades. Central regions such as Lazio are seeing moderate growth with increased investments in smart city and mobility projects. Southern Italy, though slower in development, represents an emerging area for market expansion due to planned infrastructure improvements and European Union funding initiatives. This regional divergence shapes equipment demand, with developed regions preferring technologically advanced plants, while emerging zones focus on cost-effective and scalable solutions.

Market Insights:

- The Italy asphalt mixing plants market is projected to grow from USD 170 million in 2024 to USD 225.5 million by 2032, registering a CAGR of 3.6% during the forecast period.

- Increasing investments in road construction, infrastructure renewal, and urban mobility initiatives are key drivers fueling market demand.

- Growing adoption of eco-friendly, low-emission asphalt plant technologies supports compliance with stringent EU environmental regulations.

- High initial capital expenditure and long equipment payback periods limit adoption among smaller contractors.

- Northern Italy leads the market due to strong industrial presence, dense transport infrastructure, and consistent public works programs.

- Central Italy shows steady growth driven by smart city projects and public transport upgrades, especially in Lazio.

- Southern Italy and islands represent emerging growth zones supported by EU-funded infrastructure and regional connectivity programs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Government Investment in Road Infrastructure Modernization Fuels Demand for Asphalt Mixing Equipment:

Italy continues to prioritize the modernization of its road and highway systems. Public infrastructure budgets target improvements in both urban and inter-city networks. This demand directly supports new installations and upgrades of asphalt mixing plants. National and EU funding programs accelerate road rehabilitation projects. Contractors require reliable equipment to meet regulatory timelines and material specifications. The Italy asphalt mixing plants market benefits from stringent quality standards imposed on pavement construction. It also reflects a shift toward advanced production systems that improve operational control. Long-term infrastructure plans will sustain this investment momentum through 2032.

- For instance, Ammann Italy S.r.l. has supplied batch plants like the ABA UniBatch series, featuring proprietary as1 Control System technology, which enables 100% digital plant management and consistently meets EN 13108 asphalt standards with mix precision tolerances of ±1°C in temperature and ±1.5kg in weight per batch.

Industrial and Commercial Zone Expansions Drive Asphalt Consumption:

The growth of logistics hubs and industrial corridors creates steady demand for access roads and internal roadways. Business parks and warehousing facilities often require custom pavement solutions. Asphalt mixing plants provide flexibility to match mix design with end-use application. Local contractors depend on efficient batch or continuous plants to meet dynamic volume needs. The Italy asphalt mixing plants market aligns with this pattern of industrial development. Urban commercial zones also expand, requiring road upgrades and maintenance. Construction contractors prefer modular and mobile plant configurations for on-site efficiency. These developments create recurring equipment demand across regions.

- For instance, Benninghoven’s TBA 4000 plant, inaugurated in 2021, delivers a continuous output of up to 320 tons per hour, enabling the completion of large industrial paving projects with consistent mix quality—vital for commercial infrastructure timelines

Sustainability Regulations Encourage Adoption of Eco-Friendly Asphalt Plant Technologies:

Italy enforces environmental regulations aimed at reducing emissions in construction operations. These rules cover dust control, noise reduction, and fuel efficiency. Equipment manufacturers have introduced energy-optimized asphalt mixing solutions. Local authorities encourage public procurement to favor low-emission production plants. The Italy asphalt mixing plants market sees increasing uptake of electric and hybrid-powered machinery. It responds to carbon reduction goals and green infrastructure funding conditions. Asphalt recyclability adds pressure to adopt plants capable of integrating reclaimed asphalt pavement (RAP). Equipment suppliers are optimizing systems for both environmental compliance and cost savings.

Urban Infrastructure Renewal and Smart Mobility Projects Create Stable Equipment Demand:

Italian cities actively invest in upgrading transport infrastructure and integrating smart mobility systems. Road surface quality plays a critical role in intelligent transportation networks. Asphalt mixing plants must deliver consistent mix properties to support such systems. The Italy asphalt mixing plants market gains from road repair and resurfacing initiatives linked to urban transformation. City councils specify performance-based mixes that require precision manufacturing. Equipment with real-time monitoring, automation, and digital control meets this demand. These urban infrastructure programs span multiple years, providing stable, long-term demand for modern asphalt plants.

Market Trends:

Rise of Compact and Mobile Asphalt Plants for Flexible Project Deployment:

Contractors face shorter project timelines and stricter environmental access regulations. Mobile asphalt plants offer flexibility in location and ease of setup. These units support smaller road projects, maintenance operations, and rural infrastructure. The Italy asphalt mixing plants market witnesses a steady shift toward compact and mobile configurations. Equipment suppliers innovate on modular designs that reduce setup costs and transport logistics. Plant operators prefer on-site mixing capabilities to minimize material transport delays. Rental demand for these mobile units also increases among smaller contractors. It boosts plant utilization rates and drives leasing activity across regions.

- For instance, Equipment suppliers innovate on modular designs that reduce setup costs and transport logistics. Plant operators prefer on-site mixing capabilities to minimize material transport delays. Rental demand for these mobile units also increases among smaller contractors. It boosts plant utilization rates and drives leasing activity across regions.

Digital Integration and Automation Improve Plant Efficiency and Production Control:

Digitalization transforms plant operations with real-time data monitoring and automated controls. These features enhance quality assurance, reduce manual error, and optimize mix consistency. The Italy asphalt mixing plants market reflects strong interest in intelligent systems that reduce downtime. Software-driven plant operation helps monitor energy usage and predictive maintenance. Users gain from better inventory tracking, batch validation, and compliance reporting. Automation enables centralized control across multiple job sites. Equipment with Industry 4.0 capabilities becomes more prevalent in large-scale tenders. This trend enhances the overall productivity and traceability of asphalt production processes.

- For instance, Lintec & Linnhoff Holdings has implemented the “LEVO” plant control platform across its Eurotec lines, enabling predictive maintenance scheduling and reporting real-time plant performance metrics—a feature that reduces unplanned downtime by up to 30% and increases batch accuracy within ±0.5% aggregate proportion deviation

Preference for Low-Noise and Urban-Friendly Plant Solutions in Densely Populated Areas:

Urban development projects often face strict noise and environmental limitations. Contractors select asphalt plants with enclosed mixing drums and noise-reduction insulation. The Italy asphalt mixing plants market adapts to these requirements through urban-compatible designs. Manufacturers introduce sound-dampened and fume-controlled systems for city operations. Compact urban plants reduce emissions, ensure cleaner operation, and support late-hour activity. Local authorities mandate operational restrictions near residential zones. Noise-abatement technology becomes a standard requirement in new equipment bids. This urban compatibility trend influences both plant configuration and location strategies.

Growing Focus on Recycled Material Integration and Circular Construction Practices:

Construction firms seek to reduce environmental impact and material costs through recycled inputs. Reclaimed asphalt pavement (RAP) use expands across both public and private projects. The Italy asphalt mixing plants market accommodates this trend through RAP-integrated systems. Equipment configurations enable hot and cold recycling with minimal plant modification. Recycled content targets drive innovation in drum design and mixing temperature control. Contractors prefer plants that support high-percentage RAP inclusion without compromising mix quality. Circular economy policies at the EU and regional level push this trend further. Reuse of asphalt material supports cost efficiency and environmental sustainability.

Market Challenges Analysis:

High Capital Costs and Long Payback Periods Deter Smaller Contractors:

Asphalt mixing plants require significant upfront investment in both equipment and site preparation. Smaller construction firms struggle to justify these costs without guaranteed long-term contracts. Financing options remain limited, especially in southern and rural parts of Italy. The Italy asphalt mixing plants market sees adoption concentrated among large infrastructure firms. Leasing options alleviate some pressure, but rental supply does not always meet demand. Operating costs such as energy, maintenance, and compliance management add further complexity. Return on investment depends on steady plant utilization, which fluctuates with project volumes. These financial barriers slow broader market penetration.

Stringent Environmental Compliance Adds Pressure to Equipment Modernization:

New environmental directives introduce stricter controls on emissions, dust, and noise pollution. Many legacy asphalt plants in Italy fall short of meeting current standards. Upgrading or retrofitting old systems involves substantial costs and technical challenges. The Italy asphalt mixing plants market faces rising demand for compliant technology, but transition timelines remain uncertain. Delays in public procurement and regulatory approvals impact adoption. Equipment suppliers must invest in R&D to align with evolving standards. Contractors also require training to operate and maintain new-generation systems. These compliance pressures hinder growth, especially in fragmented construction markets.

Market Opportunities:

Public and EU-Funded Infrastructure Projects Create Sustained Demand Outlook:

The Italian government, backed by EU recovery funds, plans extensive investment in transport and urban infrastructure. This funding supports road modernization, logistics connectivity, and regional accessibility. The Italy asphalt mixing plants market will benefit from increased construction activity across public works. Equipment suppliers can leverage this opportunity by offering scalable, compliant, and energy-efficient plant solutions. Long project cycles and multi-phase tenders enable stable order pipelines. This creates a favorable outlook for both plant manufacturers and service providers.

Technological Differentiation Opens New Growth Avenues in Urban and Export Markets:

Advanced features such as automation, RAP integration, and low-emission operation allow manufacturers to differentiate their products. The Italy asphalt mixing plants market can capitalize on urban infrastructure programs and environmental mandates. Export potential also rises for Italian-manufactured plants with CE and ISO certifications. Suppliers targeting Eastern Europe and North Africa gain traction through customized, modular systems. This opportunity expands the market footprint beyond domestic demand.

Market Segmentation Analysis:

By Type: Diverse Configurations Meet Project-Specific Requirements

The Italy asphalt mixing plants market offers multiple plant types aligned with varying operational demands. Batch mix plants lead in popularity due to their ability to produce consistent and high-quality asphalt, ideal for urban infrastructure. Continuous or drum mix plants support large-scale operations with uninterrupted production. Recycled plants gain importance due to growing environmental regulations. Mobile plants offer flexibility for short-duration or remote site projects, while stationary plants remain essential for long-term, high-output operations across fixed locations.

- For instance, Marini Fayat Group’s MASTER TOWER series enables hot and cold recycling of up to 100% reclaimed asphalt pavement (RAP), permitting the reintroduction of more than 45% recycled material without compromising on end-product quality.

By Capacity: Mid-Range Plants Dominate Infrastructure Projects

The 50–150 T/H capacity segment leads the market, serving the majority of municipal and regional road projects. This range offers a balance between operational efficiency and investment cost. Plants below 50 T/H cater to small-scale or maintenance works, while 150–300 T/H units serve high-traffic roads and industrial zones. Above 300 T/H capacity is reserved for major highways, expressways, and airport construction where high-volume output is required.

- For instance, Astec Industries, Inc. manufactures the Double Barrel series, with models in the 150–300 T/H range; these plants are equipped with energy recovery systems that can reduce fuel consumption by up to 15% relative to conventional units, supporting sustainability and operational economy in Italy’s high-capacity roadworks

By Mounting / Mobility: Stationary Plants Lead, Mobile Solutions Expand

Stationary asphalt plants dominate the Italy asphalt mixing plants market due to their durability, output capacity, and suitability for fixed infrastructure projects. Mobile plants continue to gain traction, especially where frequent relocation or phased construction is necessary. Portable plants remain a niche solution, supporting small contractors or projects with limited access or space constraints.

By Application and End User: Infrastructure Investment Drives Demand

Road construction represents the largest application segment, backed by consistent public and EU-funded projects. Airport and building construction follow with specialized asphalt requirements. Parking lots, pedestrian paths, and bridges reflect growing interest in urban mobility. Among end users, non-residential construction leads the market, driven by commercial, industrial, and public sector developments. Residential use is growing steadily in support of housing-related road access and urban expansion projects.

Segmentation:

By Type:

- Batch Mix Plant

- Continuous Mix Plant / Drum Mix Plant

- Recycled

- Mobile

- Stationary

By Capacity:

- Below 50 T/H

- 50–150 T/H

- 150–300 T/H

- Above 300 T/H

By Mounting / Mobility:

- Stationary

- Mobile

- Portable

By Application:

- Road Construction

- Airport Construction

- Building Construction

- Parking Lots

- Pedestrian Paths

- Bridge

- Others

By End User:

- Residential

- Non-residential

Regional Analysis:

Northern Italy: Leading Region with Strong Infrastructure Base (43% Market Share)

Northern Italy holds the largest share of the Italy asphalt mixing plants market, accounting for approximately 43% of total demand. This dominance stems from its dense transport networks, high urbanization, and robust industrial activity. Regions such as Lombardy, Veneto, and Emilia-Romagna see continuous investment in road expansion, industrial logistics, and cross-border trade infrastructure. Municipalities and regional governments implement multi-year public works programs, creating stable demand for stationary and high-capacity asphalt plants. Contractors in this region prefer automated, environmentally compliant equipment aligned with evolving EU standards. Strong purchasing power and well-established supply chains support frequent equipment upgrades.

Central Italy: Balanced Growth Driven by Urban Projects (27% Market Share)

Central Italy accounts for approximately 27% of the market, driven by steady urban development and public infrastructure initiatives. Lazio, anchored by Rome, sees recurring demand for road repairs, smart city mobility, and public transport improvements. The region emphasizes environmentally friendly construction practices, increasing adoption of recycled asphalt and mobile mixing plants. Public procurement supports plant upgrades that meet emission and energy efficiency targets. The market in Central Italy remains balanced, with contractors seeking flexible capacity ranges and modular systems to suit project diversity. It benefits from integration with national highway and railway expansion strategies.

Southern Italy and Islands: Emerging Region with Strategic Investments (30% Market Share)

Southern Italy, including Sicily and Sardinia, represents an emerging growth area, contributing approximately 30% to the Italy asphalt mixing plants market. Historically underdeveloped compared to the north, the region now receives targeted EU funding for transport infrastructure improvement. Projects include regional highway upgrades, airport renovations, and rural road connectivity. Contractors increasingly adopt mobile and mid-capacity plants to service geographically dispersed sites. Equipment demand is rising due to public-sector road renewal programs and industrial park developments. While challenges remain in logistics and financing, southern Italy’s expanding infrastructure pipeline supports long-term growth potential for plant manufacturers and service providers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Ammann Italy S.r.l.

- BENNINGHOVEN (TBA 4000)

- LINTEC & LINNHOFF HOLDINGS PTE LTD

- MARINI FAYAT GROUP

- Ciber Equipamentos Rodoviários S.A.

- Astec Industries, Inc.

- Parker Plant Limited

- Nikko Co., Ltd.

Competitive Analysis:

The Italy asphalt mixing plants market features a competitive landscape with both domestic and international manufacturers actively operating across the country. Key players include Ammann Italy S.r.l., MARINI FAYAT GROUP, and BENNINGHOVEN, all offering a comprehensive range of asphalt mixing solutions tailored for Italian infrastructure requirements. It exhibits strong brand presence and product differentiation, particularly in automation, mobility, and environmental compliance. Companies compete on technology, plant efficiency, emissions control, and localized support services. Innovation in recycled asphalt integration and compact modular systems strengthens competitiveness. Strategic partnerships with construction contractors and public agencies help secure recurring contracts. The market favors firms with robust after-sales support and product customization capabilities.

Recent Developments:

- In June 2024, Ammann Group completed the acquisition of the ABG Paver Business from Volvo Construction Equipment. This move strengthened Ammann’s portfolio, expanding its offering from asphalt mixing plants to paving and compaction, and marked a strategic step forward in providing end-to-end solutions for infrastructure projects.

- In May 2021, BENNINGHOVEN celebrated the inauguration of the TBA 4000 asphalt mixing plant in Malmedy, Belgium. This plant is the first to be launched from Benninghoven’s new Wittlich factory, reflecting a new product philosophy focused on advanced technology and flexible production to address modern market needs. The TBA 4000 is set to deliver high throughput and quality, becoming a centerpiece for customers requiring large-scale and high-specification asphalt production.

- In July 2024, Lintec & Linnhoff Holdings Pte Ltd. announced the finalization of a new manufacturing partnership in India after terminating its previous agreement with Ardent Maschinenfabrik. The company emphasized this as a new era of strategic investment and commitment to supporting local clients and expanding their market presence across India with customized asphalt and concrete plant solutions.

- In March 2025, the FAYAT Group, owner of Marini Fayat Group, announced the acquisition of MECALAC, a prominent manufacturer of compact construction equipment. This strategic move aims to combine the strengths of both companies to drive innovation, efficiency, and sustainability in construction machinery, with integration expected to be completed by mid-2025.

- In June 2025, Parker Plant Limited’s parent company, Parker Hannifin Corporation, announced plans to acquire Curtis Instruments, Inc. for $1 billion in cash. The deal, expected to close before year-end 2025, reinforces Parker’s growth strategy in electrification and complements its portfolio for electric and hybrid markets—potentially enhancing Parker Plant’s future technology offerings.

Market Concentration & Characteristics:

The Italy asphalt mixing plants market demonstrates moderate concentration, with a few dominant manufacturers accounting for significant market share. It balances between established European brands and global equipment providers entering through partnerships and distribution. The market favors companies offering high-efficiency, low-emission plants compliant with EU regulations. Contractors demand flexible, reliable systems, which supports innovation in modular, mobile, and hybrid designs. It remains project-driven, with public tenders and regional infrastructure budgets shaping purchase cycles and capacity preferences.

Report Coverage:

The research report offers an in-depth analysis based on type, capacity, mobility, application, and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for eco-friendly and energy-efficient plants will increase across public infrastructure projects.

- Mobile asphalt plants will gain market share in regions with dispersed construction sites.

- Mid-capacity plant sales will remain dominant due to steady road rehabilitation work.

- Integration of recycled asphalt technology will shape product innovation and plant upgrades.

- Northern Italy will maintain its lead due to ongoing industrial and urban development.

- Southern regions will see faster growth due to EU-funded infrastructure investments.

- Automation and digital control systems will become standard in new plant installations.

- Equipment leasing and rental models will expand among small and mid-sized contractors.

- Plant manufacturers will focus on modular designs to reduce installation time and costs.

- Government tenders will increasingly mandate environmental compliance and noise reduction.