Market Overview

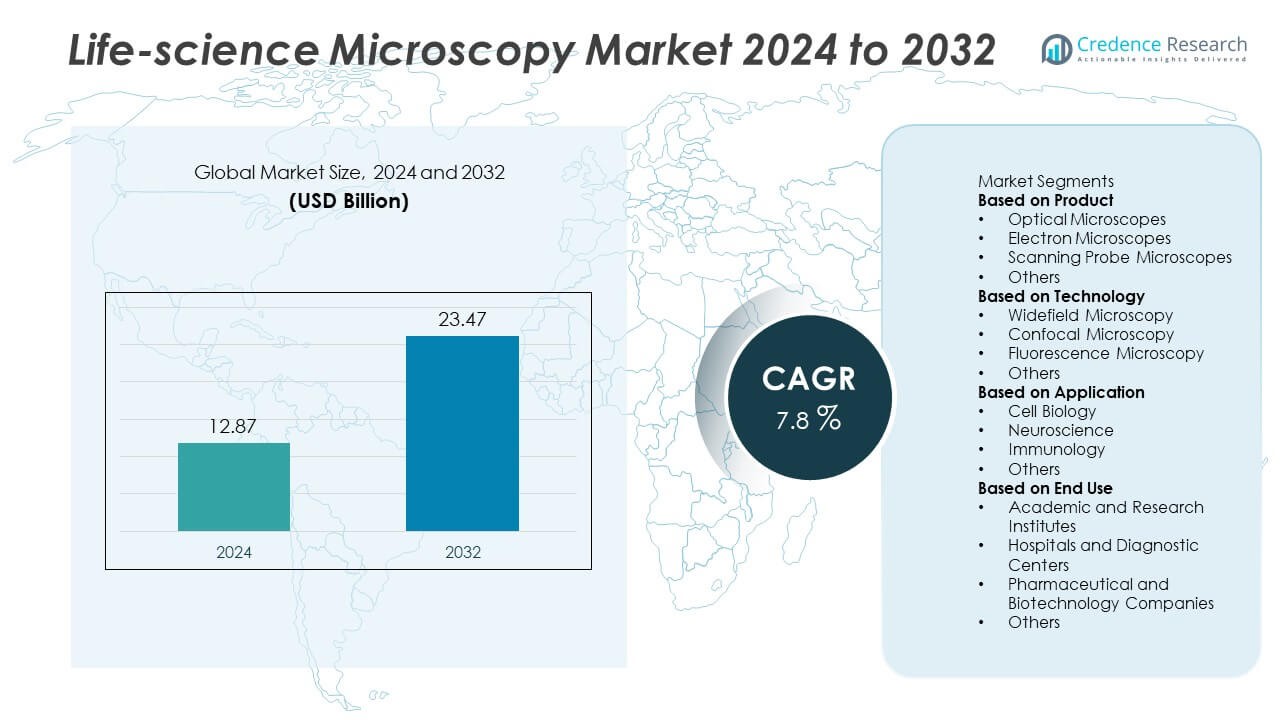

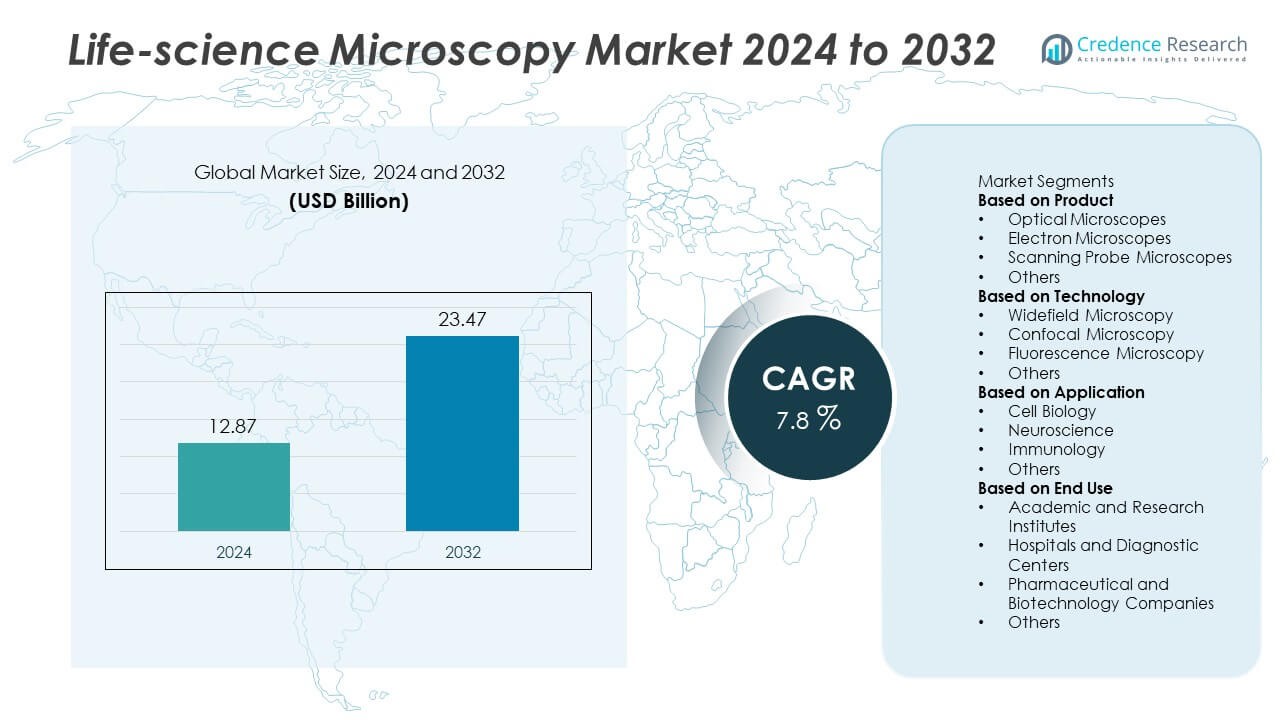

Life-science Microscopy market size reached USD 12.87 billion in 2024 and is expected to rise to USD 23.47 billion by 2032. The market is set to grow at a CAGR of 7.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Life-science Microscopy market Size 2024 |

USD 12.87 Billion |

| Life-science Microscopy market , CAGR |

7.8% |

| Life-science Microscopy market Size 2032 |

USD 23.47 Billion |

Top players in the Life-science Microscopy market include Olympus Corporation, Leica Microsystems, Nikon Corporation, ZEISS Group, Thermo Fisher Scientific, Bruker Corporation, Hitachi High-Tech Corporation, Jeol Ltd., Keyence Corporation, and Oxford Instruments. These companies lead through advanced optical systems, high-resolution imaging platforms, and strong integration of digital and AI-based analysis tools. North America stands as the leading region with a 38% share, driven by strong research funding and rapid adoption of next-generation microscopy. Europe follows with a 29% share supported by advanced biomedical programs, while Asia Pacific holds a 24% share due to rising investments in research, diagnostics, and biotechnology.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Life-science Microscopy market reached USD 12.87 billion in 2024 and will rise to USD 23.47 billion by 2032, growing at a CAGR of 7.8% during the forecast period.

- Strong demand comes from cell biology, immunology, and neuroscience research, supported by expanding use of high-resolution optical systems, which hold a 42% share as the dominant product segment.

- Key trends include rapid adoption of AI-powered imaging, digital platforms, and 3D live-cell visualization, with rising upgrades in fluorescence and confocal technologies.

- Leading companies such as Olympus, Leica Microsystems, Nikon, ZEISS, and Thermo Fisher compete through innovation in advanced optics, automated workflows, and integrated analysis tools, strengthening global market presence.

- Regional growth is led by North America with 38% share, followed by Europe at 29% and Asia Pacific at 24%, driven by strong investments in biomedical research; meanwhile, high equipment costs and limited technical expertise remain major restraints to broader adoption.

Market Segmentation Analysis:

By Product

Optical microscopes lead the product segment with a 42% share due to strong use in academic labs, clinical testing, and routine biological imaging. These systems support brightfield, phase-contrast, and fluorescence workflows used in cell studies and disease research. Electron microscopes follow because researchers need high-resolution views of cellular structures and complex biomolecules. Scanning probe microscopes gain traction in nanobiology and material-level analysis. The “Others” category includes digital and hybrid systems used in fast imaging tasks. Growth in the segment comes from demand for advanced optics, improved detection modules, and higher adoption in drug discovery programs.

- For instance, Nikon introduced the AX R confocal platform with a 2048 × 2048-pixel resolution that increases data capture per frame by 4× compared to older models.

By Technology

Widefield microscopy holds the dominant position with a 39% share, driven by broad use in cell culture, tissue imaging, and high-throughput screening. Researchers prefer this method for simple setup, short imaging time, and strong compatibility with live-cell studies. Confocal microscopy grows due to rising need for 3D visualization, optical sectioning, and precise fluorescence imaging in advanced research labs. Fluorescence systems expand as biologists use labeled proteins, probes, and tracking assays. The “Others” category includes multiphoton and super-resolution tools. Improvements in laser modules, detectors, and imaging software push adoption across research and clinical fields.

- For instance, Leica Microsystems enhanced widefield imaging with the THUNDER platform, which removes out-of-focus blur using GPU-based processing at up to 50 fps.

By Application

Cell biology dominates the application segment with a 44% share, supported by heavy imaging use in cell growth, division, protein expression, and structural studies. Laboratories rely on advanced microscopes for disease modeling, regenerative research, and drug mechanism analysis. Neuroscience applications grow due to deeper demand for neuron mapping, synaptic imaging, and brain-tissue visualization. Immunology advances as teams study immune responses, host-pathogen interactions, and biomarker behavior. The “Others” category includes pathology, genetics, and applied diagnostics. Demand rises as researchers adopt high-resolution tools for complex biological questions and precision-driven therapeutic development.

Key Growth Drivers

Advancement in High-Resolution and Super-Resolution Imaging

Demand for advanced imaging systems rises as researchers require clearer visualization of cellular and molecular structures. High-resolution and super-resolution microscopes enable detailed mapping of proteins, organelles, and complex biological pathways. These systems support live-cell imaging, fast acquisition, and deeper tissue penetration, which accelerates disease modeling and drug discovery. Research labs, biotech companies, and clinical facilities invest in new imaging platforms to improve accuracy and reproducibility. Continuous upgrades in detectors, optics, and illumination systems further strengthen adoption across genomics, oncology, and regenerative medicine.

- For instance, ZEISS’s Lattice SIM² platform achieves 60 nm resolution through structured illumination upgrades with high-speed cameras operating at 120 fps.

Rising Investment in Biomedical Research and Drug Development

Growth accelerates as global spending on cell biology, immunology, and neuroscience research continues to increase. Academic institutes and pharmaceutical companies rely on microscopy tools to study disease progression, evaluate drug responses, and validate therapeutic targets. Microscopy also supports screening workflows and helps teams generate high-quality biological evidence. Funding for precision medicine, genetic engineering, and translational research boosts instrument demand. Expanding collaborations between research centers and industry players increase procurement of modern imaging systems to handle complex experiments.

- For instance, Thermo Fisher’s CellInsight CX7 platform conducts high-content screening using standard microplates, including 6-well through 1,536-well formats. When paired with an automated plate handler, the system can process up to 80 plates to achieve high-throughput screening.

Growing Use of Microscopy in Clinical Diagnostics

Clinical laboratories adopt advanced imaging systems to support diagnosis of cancer, infectious diseases, and genetic disorders. Fluorescence, confocal, and digital microscopy help clinicians detect biomarkers, analyze tissue samples, and improve decision accuracy. Automated systems reduce human error and allow high-volume examination in hospital settings. Pathology departments rely on image-based tools to enhance workflow speed and consistency. Integration with AI-enabled analysis platforms further boosts diagnostic value. Demand rises as healthcare providers seek faster, more reliable methods to support precision-based treatments.

Key Trends & Opportunities

Shift Toward AI-Enabled and Automated Imaging Platforms

AI-powered tools reshape the microscopy ecosystem by speeding up analysis, improving image clarity, and reducing manual workload. Automated systems handle segmentation, pattern detection, and anomaly identification with strong accuracy. Research labs gain faster insights from complex datasets, while diagnostic centers benefit from consistent interpretation. Integration of machine learning models with digital microscopes supports real-time analysis and decision assistance. This trend opens opportunities for software companies, imaging system manufacturers, and data-driven research workflows seeking higher productivity and reduced turnaround times.

- For instance, the Olympus scanR high-content screening station uses GPU acceleration and artificial intelligence (AI) for image processing and analysis, which generally increases throughput for high-content profiling tasks.

Expansion of Live-Cell and 3D Imaging Applications

Demand for live-cell imaging grows as researchers track cellular behavior, signaling pathways, and treatment responses over time. Advancements in confocal, multiphoton, and super-resolution technologies support clearer 3D visualization of tissues and organoids. These capabilities help scientists explore cell interactions, disease progression, and regenerative processes. Growth in organ-on-chip systems and advanced cell models expands opportunities across drug testing and tissue engineering. Improved sample preparation, environmental chambers, and imaging software enhance real-time observation and encourage adoption across academia and biotech.

- For instance, the Bruker Ultima 2Pplus multiphoton microscope supports high-speed 2D imaging at rates up to 30 Hz and can be configured with dual-beam excitation for simultaneous imaging and photostimulation.

Key Challenges

High Equipment Cost and Complex Installation Needs

Advanced microscopes require high upfront investment, limiting adoption in small labs and emerging research centers. Installation involves specialized calibration, controlled environments, and stable infrastructure, which increases operational costs. Many institutions face budget constraints that delay upgrades or restrict access to high-end systems. Maintenance and training add further expenses, making procurement difficult for resource-limited organizations. These factors slow market penetration despite growing demand for precision imaging tools.

Limited Technical Expertise and Data Handling Complexity

Modern imaging systems generate large datasets that require skilled users and advanced computational tools. Many research teams struggle to manage image processing, analysis pipelines, and software integration. Limited expertise reduces imaging accuracy and slows research output. Handling high-resolution files also strains storage and data-management systems. Institutions with inadequate training programs face challenges in adopting new technologies. This gap creates barriers to effective use of advanced microscopes across clinical and research environments.

Regional Analysis

North America

North America holds the leading position in the market with a 38% share, supported by strong research funding, advanced laboratory infrastructure, and early adoption of super-resolution and digital microscopy. Universities, biotech firms, and pharmaceutical companies drive high demand for imaging tools used in cell biology, oncology, and molecular diagnostics. The region benefits from strong industry presence, including major manufacturers and technology innovators. Growth also comes from rising use of AI-enabled analysis systems in clinical and research settings. Expanding investments in precision medicine and neuroscience research further reinforce the region’s dominant role.

Europe

Europe accounts for a 29% share due to robust biomedical research programs, specialized imaging centers, and strong collaboration between academia and industry. Countries such as Germany, the UK, and France lead adoption of confocal, fluorescence, and electron microscopy systems used in genetics, pathology, and drug development. Supportive government initiatives and funding for life-science innovation strengthen market expansion. Hospitals and diagnostic laboratories also increase deployment of digital imaging systems to improve workflow accuracy. Growth is reinforced by rising demand for tools that support regenerative medicine, immunology studies, and advanced material characterization.

Asia Pacific

Asia Pacific holds a 24% share and represents the fastest-growing regional market due to rising investments in biotechnology, clinical diagnostics, and biomedical research. China, Japan, South Korea, and India increase adoption of high-resolution and automated imaging systems across research institutes and pharmaceutical manufacturing units. Growing focus on cancer diagnostics, infectious disease studies, and advanced cell-based research boosts demand. Expansion of academic infrastructure and improving availability of skilled professionals strengthen uptake. Local production of cost-efficient instruments and rapid digitalization in laboratories further support strong regional growth.

Latin America

Latin America captures a 5% share, driven by steady growth in diagnostic imaging, academic research, and disease-focused studies. Brazil, Mexico, and Argentina expand use of optical and fluorescence microscopy in clinical and research environments. Limited budgets slow high-end system adoption, but increasing investment in public health programs improves access to modern imaging tools. Rising cases of infectious and chronic diseases create demand for reliable diagnostic microscopy. Regional universities focus on cell biology and immunology research, which boosts procurement of advanced imaging technologies and supports market expansion.

Middle East & Africa

Middle East & Africa holds a 4% share, driven by growing investments in healthcare modernization, research facilities, and diagnostic laboratories. Countries such as Saudi Arabia, the UAE, and South Africa adopt advanced microscopy systems to support cancer diagnostics, pathology workflows, and molecular studies. Research initiatives in genomics and infectious disease surveillance increase demand for digital and fluorescence imaging platforms. Despite budget limitations in several regions, rising awareness of precision diagnostics supports gradual adoption. Expanding medical training programs and international collaborations help strengthen the regional microscopy landscape.

Market Segmentations:

By Product

- Optical Microscopes

- Electron Microscopes

- Scanning Probe Microscopes

- Others

By Technology

- Widefield Microscopy

- Confocal Microscopy

- Fluorescence Microscopy

- Others

By Application

- Cell Biology

- Neuroscience

- Immunology

- Others

By End Use

- Academic and Research Institutes

- Hospitals and Diagnostic Centers

- Pharmaceutical and Biotechnology Companies

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The competitive landscape of the Life-science Microscopy market features major players such as Olympus Corporation, Leica Microsystems, Nikon Corporation, ZEISS Group, Thermo Fisher Scientific, Bruker Corporation, Hitachi High-Tech Corporation, Jeol Ltd., Keyence Corporation, and Oxford Instruments. These companies strengthen their positions through continuous innovation in high-resolution, super-resolution, and automated imaging systems. Many players invest in advanced optics, AI-driven software, and integrated digital platforms to improve accuracy and workflow efficiency for research and clinical use. Strategic partnerships with universities, biotech firms, and pharmaceutical companies support technology expansion and product validation. Several manufacturers focus on expanding 3D imaging, live-cell monitoring, and automated analysis to meet rising demand for precision research. The market also sees strong competition in pricing, system versatility, and after-sales service. Growing interest in personalized medicine, advanced disease research, and next-generation therapeutics encourages companies to accelerate product upgrades and strengthen global distribution networks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, ZEISS also collaborated with Concept Life Sciences to advance automated high-throughput imaging workflows and AI-powered image analysis in spatial biology.

- In May 2025, Leica Microsystems (a subsidiary of Danaher Corporation) introduced the Visoria series of upright microscopes designed for life science and clinical labs.

- In May 2025, ZEISS Group announced a partnership with Alpenglow Biosciences to co-develop an inverted light-sheet microscopy platform tailored for 3D pathology.

Report Coverage

The research report offers an in-depth analysis based on Product, Technology, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for super-resolution and high-speed imaging will rise across research labs.

- AI-enabled analysis tools will support faster interpretation of complex biological images.

- Live-cell and 3D imaging platforms will gain wider adoption in drug discovery.

- Automated microscopy systems will expand as labs seek higher workflow efficiency.

- Digital microscopy and remote analysis will grow with increasing cloud integration.

- Clinical diagnostics will adopt advanced imaging to support precision treatment decisions.

- Compact and hybrid microscopes will gain traction in space-limited laboratories.

- Emerging markets will increase investments in modern research infrastructure.

- Integration of microscopy with multi-omics tools will strengthen advanced disease research.

- Industry partnerships with academic institutes will accelerate innovation in next-generation imaging.