| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Retail Pharmacy Market Size 2024 |

USD 4,74,884.81 Million |

| U.S. Retail Pharmacy Market, CAGR |

4.01% |

| U.S. Retail Pharmacy Market Size 2032 |

USD 6,50,442.92 Million |

Market Overview

The U.S. Retail Pharmacy Market is projected to grow from USD 4,74,884.81 million in 2024 to an estimated USD 6,50,442.92 million by 2032, with a compound annual growth rate (CAGR) of 4.01% from 2025 to 2032. This growth reflects a steady increase in consumer demand for both prescription medications and over-the-counter (OTC) health products.

Market growth is primarily driven by rising healthcare expenditures, an aging population, and the increasing prevalence of chronic diseases such as diabetes, hypertension, and cardiovascular disorders. Additionally, consumer preference for convenient healthcare access is boosting the adoption of pharmacy services such as immunizations, diagnostic testing, and medication therapy management. Digital health integration, including mobile prescription apps and telepharmacy services, is also gaining traction, enhancing patient engagement and operational efficiency across retail pharmacy chains.

Geographically, the U.S. retail pharmacy market is dominated by key metropolitan regions with dense populations and high healthcare demand. Urban areas in states like California, Texas, New York, and Florida contribute significantly to market revenue. Leading players in the market include CVS Health, Walgreens Boots Alliance, Walmart Inc., Rite Aid Corporation, and Kroger Co., each leveraging extensive pharmacy networks, digital platforms, and diversified service offerings to maintain a competitive edge.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.S. retail pharmacy market is projected to grow from USD 4,74,884.81 million in 2024 to USD 6,50,442.92 million by 2032, at a CAGR of 4.01%. The market is driven by rising demand for prescription and over-the-counter medications.

- The Global Retail Pharmacy Market is expected to grow from USD 14,45,920.00 million in 2024 to USD 19,65,958.05 million by 2032, at a CAGR of 3.92% from 2025 to 2032.

- An aging population in the U.S. is significantly driving demand for chronic disease management and medication, contributing to the growing need for retail pharmacy services.

- Rising healthcare expenditures are pushing consumers to seek more accessible, cost-effective healthcare solutions, further fueling the demand for pharmacy services.

- Consumers increasingly prefer convenient healthcare access, including prescription refills, vaccinations, and diagnostic testing, all of which are offered by retail pharmacies.

- The rise of e-commerce and online pharmacies poses challenges to traditional brick-and-mortar retail pharmacies, leading to price pressures and the need for more digital integration.

- Retail pharmacies face complex regulations and evolving drug pricing pressures, which can affect profitability and operational strategies, especially for smaller players.

- The U.S. retail pharmacy market is led by urban regions in states like California, Texas, New York, and Florida, where dense populations and high healthcare demand contribute to substantial market share.

Report Scope

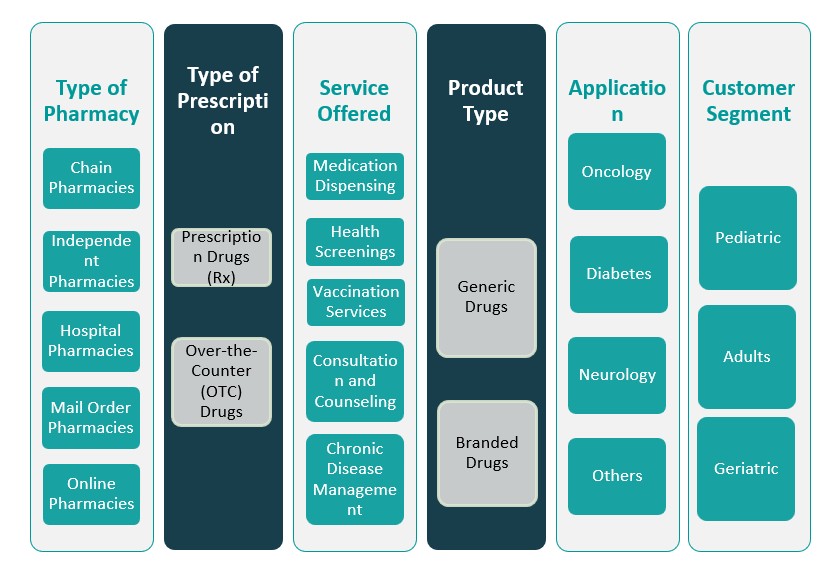

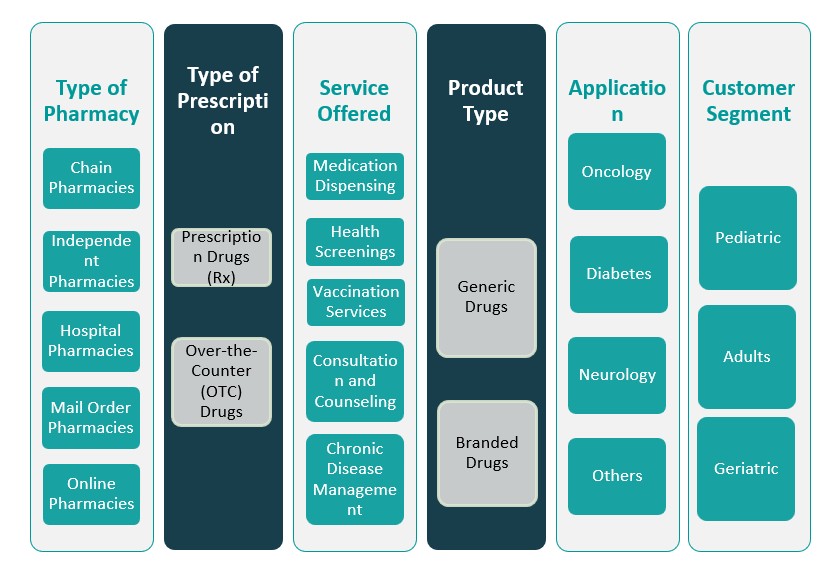

This report segments the U.S. Retail Pharmacy Market as follows:

Market Drivers

Increasing Prevalence of Chronic Diseases and Aging Population

The rising prevalence of chronic diseases such as diabetes, hypertension, cardiovascular conditions, and respiratory ailments remains a primary growth driver for the U.S. retail pharmacy market. According to the Centers for Disease Control and Prevention (CDC), six in ten Americans live with at least one chronic disease, and four in ten live with two or more. As chronic conditions require long-term treatment plans involving continuous medication, monitoring, and therapeutic intervention, retail pharmacies play a critical role in ensuring consistent drug availability and support services. This burden of chronic illness is further intensified by the rapidly aging population. For instance, the U.S. Census Bureau estimates that individuals aged 65 and older will account for nearly 21% of the total population by 2030. Older adults typically have higher medication needs due to age-related degenerative conditions and comorbidities. Retail pharmacies cater to this demographic through prescription refills, adherence programs, and consultations. In addition, many pharmacies now offer geriatric-specific healthcare services, including screenings and medication therapy management, positioning themselves as accessible, patient-friendly health support centers for elderly customers. As the population ages and chronic conditions increase, retail pharmacies are becoming indispensable in the continuum of care.

Expansion of Clinical Services in Pharmacy Settings

Retail pharmacies are evolving beyond traditional dispensing models to incorporate a wide range of clinical and preventive healthcare services, significantly contributing to market expansion. During the COVID-19 pandemic, retail pharmacies played a pivotal role in administering vaccines and providing testing services, reinforcing their trust and value among consumers. Today’s retail pharmacies offer immunizations, health screenings, chronic disease management, smoking cessation programs, and even basic diagnostic services. These in-store healthcare solutions increase patient engagement and alleviate pressure on overcrowded hospitals and clinics. For instance, government policy support, such as provider status recognition and reimbursement for pharmacy-based services in certain states, has accelerated this shift. By becoming convenient, one-stop healthcare destinations, retail pharmacies are driving a new era of decentralized, consumer-focused care.

Digital Health Transformation and E-commerce Integration

The digital transformation of the healthcare sector has significantly reshaped the U.S. retail pharmacy landscape. Consumers now expect seamless digital interactions for managing their medications and accessing pharmacy services. E-commerce integration has enabled retail pharmacies to provide online prescription refills, home delivery services, virtual consultations, and app-based medication tracking, enhancing the customer experience and increasing medication adherence. These digital touchpoints are especially critical for working professionals, elderly patients with mobility issues, and individuals in remote locations. In addition to convenience, technology also improves operational efficiency through digital inventory management, automated refill alerts, and telepharmacy services that enable remote consultations. Major retail pharmacy chains like CVS and Walgreens have invested heavily in proprietary digital platforms and mobile health apps that streamline workflows, reduce wait times, and provide health reminders. Artificial intelligence (AI) and data analytics are being used to personalize medication plans, flag potential drug interactions, and monitor patient outcomes. This shift toward digitization aligns with broader consumer behavior trends and strengthens retail pharmacies’ role in modern healthcare delivery systems.

Growing Consumer Preference for Affordable and Accessible Healthcare

Affordability and accessibility have become essential considerations in the American healthcare landscape, driving more consumers to choose retail pharmacies for their primary care needs. Compared to traditional clinics and hospitals, retail pharmacies offer lower out-of-pocket costs, shorter wait times, and extended hours of operation. These attributes make them highly attractive for working individuals, families without insurance, and low-income populations seeking basic healthcare services. Moreover, retail pharmacies actively promote the use of generic drugs, which are substantially cheaper than brand-name counterparts but therapeutically equivalent. By facilitating access to affordable medication, they contribute to greater medication adherence and better health outcomes. Many chains also operate customer loyalty programs and discount schemes that further reduce costs for consumers. Additionally, partnerships with insurance providers and pharmacy benefit managers (PBMs) help retail pharmacies offer competitive pricing and simplified reimbursement processes. In an environment where consumers are increasingly value-conscious, the cost-effective and patient-centric model of retail pharmacies supports their sustained growth and relevance.

Market Trends

Integration of Telepharmacy and Virtual Care Services

Telepharmacy is transforming the U.S. retail pharmacy market by expanding access to pharmaceutical care through digital platforms. For instance, during the COVID-19 pandemic, telepharmacy services saw a 77% preference rate among patients for remote consultations over in-person visits, showcasing the growing reliance on digital healthcare solutions. This model allows licensed pharmacists to serve patients across multiple locations without being physically present, which is particularly beneficial in rural and underserved regions where healthcare access is limited. Reports indicate that telepharmacy services have reduced hospital admissions by improving medication adherence and patient monitoring. These services enhance medication adherence, improve patient monitoring, and support chronic disease management through regular digital check-ins. Additionally, telepharmacy aligns with evolving regulatory frameworks that increasingly support pharmacist-led care models and remote dispensing practices. As digital health technologies mature, telepharmacy is poised to remain a central element of retail pharmacy operations, supporting personalized care and extending the reach of clinical pharmacy services beyond brick-and-mortar locations.

Expansion of In-Store Health Clinics and Preventive Care Offerings

Retail pharmacies are increasingly positioning themselves as accessible healthcare hubs by expanding in-store clinics and preventive care services. For example, vaccination services provided by retail clinics have increased significantly, with over 50 million flu shots administered annually in the U.S. through pharmacy-based clinics. These clinics provide a wide range of healthcare offerings, including vaccinations, routine checkups, screenings, wellness exams, and minor illness treatments, all at a lower cost and with minimal waiting time compared to traditional healthcare facilities. Additionally, some locations are beginning to offer mental health services, with reports indicating a 20% rise in demand for these services at retail clinics. This shift aligns with healthcare policy changes encouraging value-based care and preventive interventions. By increasing access to basic and preventive care within local communities, retail pharmacies are playing a critical role in reducing hospital visits and improving public health outcomes. This evolution reinforces their position in the primary care ecosystem.

Personalized Medicine and Data-Driven Patient Engagement

The adoption of personalized medicine and data analytics is reshaping the retail pharmacy market by enabling more targeted, efficient, and proactive care. Retail pharmacies now leverage consumer health data, prescription histories, and wearable device inputs to customize care plans, predict health risks, and enhance medication adherence. With the help of AI and machine learning algorithms, pharmacies can analyze customer profiles to recommend specific products, identify potential drug interactions, and deliver timely refill alerts. This trend reflects a broader movement in healthcare toward precision medicine, where treatment strategies are tailored to individual patient needs rather than generalized protocols. Pharmacies are integrating loyalty programs, mobile apps, and digital health platforms to gather real-time data and engage customers through personalized messages, discounts, and wellness reminders. For instance, Walgreens’ myWalgreens app and CVS’s CarePass program provide users with personalized insights, savings, and proactive health nudges based on their medical and behavioral data. The ability to combine pharmacy services with personalized engagement not only enhances the patient experience but also improves health outcomes and builds brand loyalty. As consumers become more health-conscious and technology-savvy, personalized pharmacy services will play a key role in differentiating market leaders from competitors.

Growing Emphasis on Omnichannel Retail and E-Commerce Expansion

The shift toward omnichannel retailing is becoming a dominant trend in the U.S. retail pharmacy market, driven by the evolving expectations of digital-first consumers. Pharmacies are enhancing their online presence by offering seamless e-commerce platforms for prescription refills, health product purchases, and virtual consultations. Integration between physical stores and digital services allows customers to choose between home delivery, curbside pickup, or in-store collection, thus offering greater flexibility and improving customer satisfaction. Leading pharmacy chains have significantly expanded their digital ecosystems. For example, CVS has developed a robust digital infrastructure that integrates mobile apps, personalized alerts, and loyalty rewards, while Walgreens has partnered with tech firms like Microsoft to optimize its e-commerce and supply chain operations. These initiatives aim to create a unified and consistent customer experience across all touchpoints, from digital interactions to in-store visits. Additionally, real-time inventory tracking, automated prescription processing, and subscription models for recurring medications are being increasingly adopted. The expansion of digital channels also opens new opportunities for consumer engagement through health-related content, virtual wellness programs, and personalized promotions. As consumer preferences continue to evolve, retail pharmacies that successfully implement omnichannel strategies will strengthen their competitive positioning and boost long-term customer retention.

Market Challenges

Intensifying Competition and Margin Pressures

The U.S. retail pharmacy market faces significant challenges due to intensifying competition and shrinking profit margins. Traditional retail pharmacies are competing not only among themselves but also against large-scale online retailers, mass merchandisers, and emerging digital health platforms. Companies like Amazon have entered the pharmacy space with offerings such as Amazon Pharmacy, introducing price transparency, home delivery services, and subscription-based medication programs that appeal to a digitally-savvy consumer base. Additionally, big-box retailers like Walmart and Target continue to expand their healthcare services, offering low-cost prescriptions and health consultations that directly impact the foot traffic and sales volume of traditional pharmacy chains. This competitive landscape leads to aggressive pricing strategies, often eroding profit margins for retail pharmacies. For instance, insurance reimbursement rates for prescription drugs have declined by approximately 10% over the past five years, adding further financial strain on pharmacies. Pharmacies increasingly depend on high-volume sales, diversified services, and front-of-store product revenue to sustain profitability. However, achieving this balance requires significant investment in technology, marketing, and supply chain management, which smaller and independent pharmacies may find difficult to sustain.

Complex Regulatory and Reimbursement Environment

Navigating the complex regulatory and reimbursement environment presents another major challenge for the U.S. retail pharmacy market. Pharmacies must comply with a myriad of federal and state-level regulations concerning drug dispensing, controlled substances, insurance billing, data privacy (such as HIPAA compliance), and pharmacy practice standards. Regulatory requirements frequently change, and staying compliant demands substantial administrative effort, specialized staffing, and technological upgrades, all of which increase operational costs. In addition to regulatory complexities, pharmacies face uncertainty surrounding reimbursement structures from Pharmacy Benefit Managers (PBMs) and insurance companies. PBMs often implement unpredictable reimbursement rates and retroactive fees, such as Direct and Indirect Remuneration (DIR) fees, which affect the financial stability of retail pharmacies. These fees are sometimes applied months after a transaction, making revenue forecasting difficult. Furthermore, legislative scrutiny and ongoing policy debates around drug pricing transparency, rebate reforms, and PBM practices add another layer of uncertainty. Managing compliance while maintaining profitability in this dynamic environment requires strategic agility, robust legal expertise, and constant operational vigilance.

Market Opportunities

Expansion into Preventive and Primary Healthcare Services

A major market opportunity lies in the expansion of preventive and primary healthcare services within retail pharmacy settings. As consumers increasingly seek convenient, affordable, and immediate access to healthcare, retail pharmacies are well-positioned to meet this demand by offering services such as immunizations, health screenings, chronic disease management programs, and minor ailment consultations. With the shortage of primary care physicians and growing patient volumes across the healthcare system, retail pharmacies can bridge critical gaps by functioning as accessible community healthcare hubs. Investments in in-store clinics, partnerships with healthcare providers, and the deployment of telehealth platforms further enhance pharmacies’ ability to deliver integrated care solutions. By expanding their clinical service offerings, retail pharmacies can diversify revenue streams, improve patient outcomes, and solidify their role in the broader healthcare ecosystem.

Leveraging Digital Health Innovations and E-commerce Platforms

The growing adoption of digital health technologies and e-commerce platforms presents another significant opportunity for the U.S. retail pharmacy market. Consumers now expect a seamless digital experience for managing prescriptions, consulting pharmacists, and purchasing health-related products. Retail pharmacies can capitalize on this shift by enhancing their online presence, offering mobile applications, subscription services for medication delivery, and personalized health management tools. Integrating artificial intelligence (AI), predictive analytics, and wearable health data can further enable pharmacies to provide customized care solutions and proactive health engagement. By building robust omnichannel ecosystems that blend in-store and digital experiences, retail pharmacies can boost customer loyalty, expand their market reach, and create new competitive advantages in a rapidly evolving healthcare landscape.

Market Segmentation Analysis

By Type of Pharmacy

The U.S. retail pharmacy market is segmented into chain pharmacies, independent pharmacies, hospital pharmacies, mail order pharmacies, and online pharmacies. Chain pharmacies dominate the market due to their extensive network, brand recognition, and access to greater operational efficiencies. Independent pharmacies continue to serve vital roles in local communities, offering personalized care despite facing challenges from larger competitors. Hospital pharmacies are crucial in dispensing medications to inpatients and managing outpatient prescription needs. Mail order pharmacies are gaining traction by offering convenient, cost-effective solutions for chronic disease medication adherence. Online pharmacies represent a rapidly expanding segment, fueled by consumer demand for home delivery and digital convenience, further accelerated by advancements in telehealth services.

By Type of Prescription

The market divides between prescription (Rx) drugs and over-the-counter (OTC) drugs. Prescription drugs account for a significant portion of revenue due to the growing burden of chronic diseases and the need for specialty medications. However, OTC drugs are witnessing strong growth, driven by increasing consumer inclination toward self-medication and preventive health measures, especially for common ailments like colds, allergies, and digestive issues.

Segments

Based on Type of Pharmacy

- Chain Pharmacies

- Independent Pharmacies

- Hospital Pharmacies

- Mail Order Pharmacies

- Online Pharmacies

Based on Type of prescription

- Prescription Drugs (Rx)

- Over-the-Counter (OTC) Drugs

Based on Service offered

- Medication Dispensing

- Health Screenings

- Vaccination Services

- Consultation and Counseling

- Chronic Disease Management

Based on Product Type

- Generic Drugs

- Branded Drugs

Based on Application

- Oncology

- Diabetes

- Neurology

- Others

Based on Customer

- Paediatric

- Adults

- Geriatric

Based on Region

- California

- Texas

- New York

- Florida

Regional Analysis

South region (36.5%)

The South region holds the largest share of the market, accounting for 36.5% of the total revenue in 2024. States such as Texas, Florida, and Georgia are key contributors, driven by large populations, a higher proportion of elderly residents, and rising rates of chronic diseases. The South’s retail pharmacies are expanding their clinical services and telehealth integrations to cater to growing healthcare demands, particularly in suburban and rural communities where access to traditional healthcare facilities can be limited.

West region (26.8%)

The West region follows, representing 26.8% of the U.S. retail pharmacy market. California leads this region with a strong emphasis on digital health adoption, innovative pharmacy services, and integration of e-commerce solutions. Urban centers like Los Angeles, San Francisco, and San Diego show high consumer engagement with online prescription services and preventive healthcare programs. Pharmacies in the West are increasingly leveraging technology to streamline operations and enhance patient engagement, making the region a hub for pharmacy innovation and personalized medicine initiatives.

Key players

- CVS Health

- Walgreens Boots Alliance

- Walmart

- Kroger

- Rite Aid Corp.

Competitive Analysis

The U.S. retail pharmacy market is highly competitive, dominated by established players such as CVS Health, Walgreens Boots Alliance, Walmart, Kroger, and Rite Aid Corp. CVS Health leads the market with its expansive retail footprint, integration of healthcare services through MinuteClinic, and robust digital platform. Walgreens Boots Alliance focuses on expanding healthcare partnerships and enhancing its omnichannel capabilities to remain competitive. Walmart leverages its extensive store network and competitive pricing to attract a broad consumer base, while Kroger strengthens its market presence through its pharmacy divisions and health-focused retail strategy. Rite Aid Corp. continues to reposition itself by enhancing its service offerings and targeting regional markets. Overall, the competition centers on expanding clinical services, improving digital engagement, and optimizing supply chain efficiency. Companies that effectively combine healthcare delivery with retail innovation are best positioned to capture future growth and enhance customer loyalty in an evolving healthcare landscape.

Recent Developments

- As of March 31, 2024, Apollo Pharmacy operated 6,030 stores across approximately 1,200 cities and towns in 22 states and 5 union territories. The company continues to expand its digital healthcare platform, offering services like online medicine delivery and virtual doctor consultations.

- In October 2024, Caring Pharmacy Retail Management Sdn Bhd, a 75%-owned unit of 7-Eleven Malaysia Holdings Bhd, announced acquisitions of equity interest and business assets in several pharmaceutical outlets for a combined cash consideration of RM48.86 million.

- In June 2024, the Australian Competition and Consumer Commission (ACCC) expressed concerns that the proposed acquisition of Chemist Warehouse by Sigma Healthcare could substantially lessen competition in pharmacy retailing, potentially leading to higher prices and reduced service quality.

- In January 2025, Watsons Philippines ended 2024 with 1,166 stores, expanding its community pharmacy format. The company opened more than 50 stores outside of Metro Manila.

Market Concentration and Characteristics

The U.S. retail pharmacy market is moderately to highly concentrated, with a few dominant players such as CVS Health, Walgreens Boots Alliance, Walmart, Kroger, and Rite Aid Corp. capturing a significant share of total market revenue. These companies leverage expansive store networks, integrated healthcare services, and advanced digital platforms to maintain competitive advantages. The market is characterized by a strong focus on convenience, affordability, and service diversification, with pharmacies increasingly expanding into preventive care, chronic disease management, and telehealth services. Consumer expectations for digital engagement, personalized care, and seamless omnichannel experiences are reshaping traditional pharmacy operations. Additionally, competitive pricing pressures, regulatory complexities, and evolving healthcare models influence market dynamics, compelling players to invest in technology, partnerships, and service innovation to sustain growth. Despite consolidation trends, regional and independent pharmacies continue to serve vital community roles, particularly in rural and underserved areas, maintaining a diverse and dynamic market landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type of Pharmacy, Type of prescription, Service offered, Product Type, Application, Customer and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Retail pharmacies will play an expanding role in primary healthcare by offering more services, including chronic disease management and preventative care, to reduce pressure on hospitals and clinics.

- As consumers demand convenience, retail pharmacies will continue to integrate digital health services like telepharmacy, online prescription refills, and virtual consultations to enhance patient engagement.

- With growing consumer preference for self-care, the demand for OTC products will continue to rise, driving pharmacies to expand their range of non-prescription offerings.

- The increasing use of data analytics and AI will enable pharmacies to offer personalized medication regimens and tailored health management solutions, improving patient outcomes.

- Pharmacies will expand in-store clinics to provide essential healthcare services, including vaccinations, health screenings, and wellness checks, responding to consumer demand for accessible healthcare.

- The market will see a shift toward preventive healthcare offerings, with pharmacies providing services that help detect health risks early, reducing long-term healthcare costs and improving public health.

- Retail pharmacies will seek stronger partnerships with health insurance providers, allowing them to offer integrated care solutions and expanded services to covered patients at affordable rates.

- Pharmacies will increasingly adopt automation and AI-driven solutions to streamline operations, improve accuracy in medication dispensing, and enhance customer experience.

- Ongoing changes in healthcare regulations and drug pricing reforms will influence pharmacy business models, requiring them to adapt to new reimbursement structures and pricing transparency mandates.

- The retail pharmacy market will continue to consolidate as larger players acquire regional chains to expand their footprint, improve economies of scale, and strengthen competitive positioning.