Market Overview

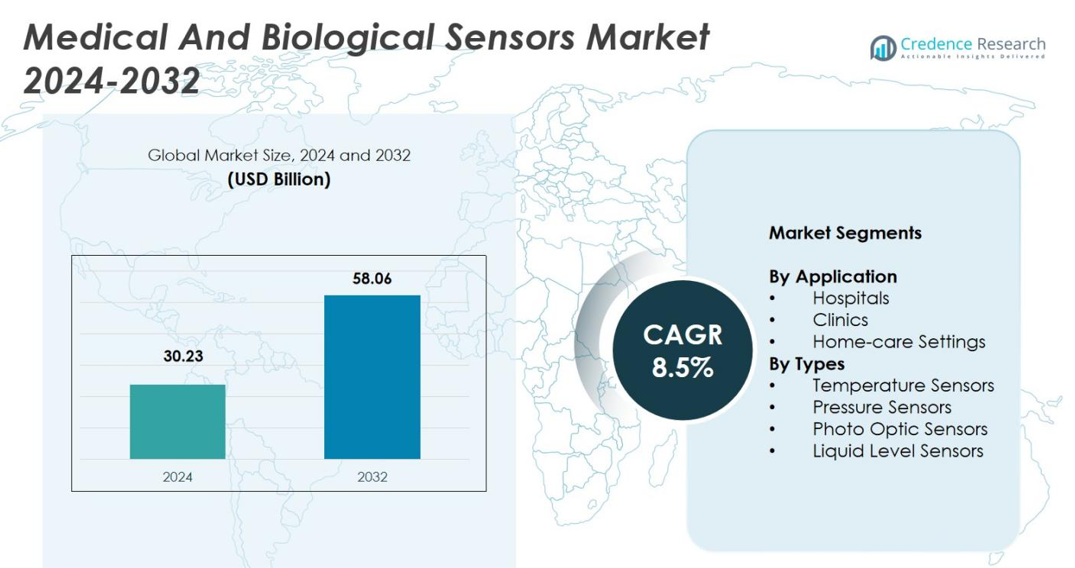

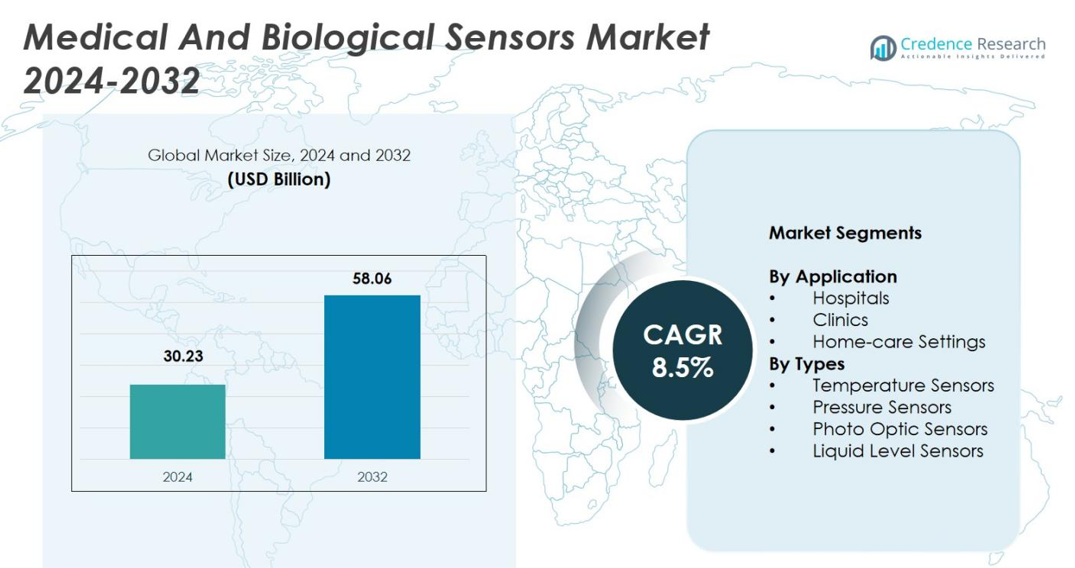

The Medical and Biological Sensors Market size was valued at USD 30.23 Billion in 2024 and is anticipated to reach USD 58.06 Billion by 2032, at a CAGR of 8.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medical and Biological Sensors Market Size 2024 |

USD 30.23 Billion |

| Medical and Biological Sensors Market, CAGR |

8.5% |

| Medical and Biological Sensors Market Size 2032 |

USD 58.06 Billion |

The Medical and Biological Sensors Market is dominated by key players such as Medtronic, Honeywell, GE, TE Connectivity, Analog Devices, and STMicroelectronics. These companies lead through extensive product portfolios, continuous innovation, and strategic partnerships. Medtronic is a major player in the field, particularly in the development of advanced implantable and wearable sensors. Honeywell and GE are prominent in integrating sensor technologies into healthcare systems, driving advancements in diagnostic and monitoring solutions. North America holds the largest market share at 34.6% in 2024, driven by robust healthcare infrastructure and high adoption of advanced medical technologies. Europe follows with 28.3% of the market share, while Asia Pacific, with its rapidly expanding healthcare infrastructure, is the fastest-growing region, accounting for 22.1% of the market in 2024. These regions remain central to the growth trajectory of the medical and biological sensors market.

Market Insights

- The Medical and Biological Sensors Market reached USD 30.23 Billion in 2024 and is forecast to grow at a CAGR of 8.5% through 2032.

- Rapid growth stems from rising prevalence of chronic diseases and increasing demand for continuous monitoring in hospitals, clinics, and home‑care settings.

- Wearable and non‑invasive sensor devices are gaining momentum, enabling real‑time monitoring outside traditional clinical settings and driving higher adoption rates globally.

- Leading application segment Hospitals held 64.0% share in 2024 while temperature sensors accounted for 35.7% of type‑based share, highlighting strong demand for vital‑sign monitoring solutions.

- Regionally, North America remains dominant with 34.6% share in 2024, followed by Europe with 28.3% and Asia Pacific with 22.1%, reflecting robust infrastructure and growing healthcare investments across these geographies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

The Hospitals application segment dominates the medical and biological sensors market, accounting for 64.0% of the market share in 2024. This dominance is driven by the increasing patient load, rising cases of chronic diseases, and the need for real-time monitoring of patient vitals in intensive care units (ICUs) and during surgeries. Hospitals continue to invest in advanced sensor technologies to enhance patient outcomes and improve the efficiency of medical workflows. The demand for sensors is particularly strong in critical care environments, where they are essential for monitoring heart rate, blood pressure, oxygen levels, and other vital parameters.

- For instance, GE Healthcare’s CARESCAPE Monitor B650 integrates multiple sensors to provide comprehensive ICU patient monitoring, improving response times.

By Type

Temperature sensors lead the market within the “By Type” category, holding the largest share due to their widespread use in medical diagnostics and patient monitoring systems. These sensors are vital in tracking body temperature, a key indicator in detecting infections and other medical conditions. They are used extensively in hospitals, clinics, and home-care settings, with a market share of 35.7% in 2024. The growth of wearable temperature sensors and the integration of these devices into telemedicine platforms are further driving market expansion. Temperature sensors are favored for their accuracy, low cost, and ability to provide continuous monitoring of patients in diverse care settings.

- For instance, Texas Instruments’ TMP117 sensor offers an accuracy of ±0.1°C and is used in clinical thermometers and wearable health devices.

Key Growth Drivers

Rising Prevalence of Chronic Diseases and Aging Population

The global increase in chronic diseases such as diabetes, cardiovascular disorders, and respiratory conditions is fueling demand for continuous monitoring solutions using medical sensors. Simultaneously, the growing elderly population drives demand for long‑term care and remote monitoring — a key factor that expands adoption of medical and biological sensors in both clinical and home‑care environments. This demographic shift underpins strong growth for sensors used in chronic‑disease management and elderly care monitoring.

- For instance, Dexcom’s continuous glucose monitoring system has improved real-time diabetes management for millions worldwide.

Advancements in Sensor Miniaturization and IoMT / Connectivity

Progress in micro‑ and nano‑fabrication techniques and the integration of sensors into connected medical devices (IoMT) significantly boost the market. These advances enable compact, non‑invasive, wearable, and implantable sensors with high precision — expanding usability across hospitals, clinics, and home‑care settings. The resulting ease of deployment and improved patient comfort drive accelerated adoption of sensor‑based solutions worldwide.

- For instance, Abbott’s FreeStyle Libre system uses a small, wearable sensor that provides painless glucose monitoring without finger pricks, improving diabetes management.

Growing Shift Toward Home‑Healthcare & Remote Patient Monitoring

Increasing acceptance of home‑based care, coupled with rising healthcare costs and limited hospital capacity in many regions, pushes demand for remote patient monitoring systems. Sensors embedded in wearable or portable devices allow continuous health tracking outside hospitals. This trend gains strength from both patient preference and the need for efficient chronic‑disease management, particularly in regions with aging demographics and growing burden of chronic illness.

Key Trends & Opportunities

Expansion of Wearable and Non‑Invasive Sensor Devices

Wearable and non‑invasive sensor devices including patches, wristbands, and other portable monitors are emerging as a dominant format in medical sensing. Their growth is propelled by demand for comfortable, continuous, real‑time vitals monitoring, preventive care, and fitness–health convergence. This shift opens opportunities for manufacturers to develop user‑friendly, regulatory‑compliant wearables targeting both clinical and consumer segments.

- For instance, Apple’s Apple Watch Series 8 features advanced sensors that monitor blood oxygen levels and ECG, enabling users to track heart health continuously.

Integration of AI, Data Analytics and IoT Platforms

Increasing adoption of IoT‑enabled sensors, combined with AI-driven analytics and healthcare data platforms, is transforming traditional medical sensing into integrated health‑management solutions. This convergence enables predictive diagnostics, early disease detection, remote monitoring, and personalized care offering major growth opportunities in telehealth, chronic‑care management, and value-based healthcare models globally.

- For instance, Medtronic’s connected insulin pumps leverage data analytics and IoT to personalize diabetes management in real time, improving patient outcomes and reducing hospital visits.

Key Challenges

High Cost of Advanced, High‑Precision Sensors

While advanced wearable and implantable sensors offer rich functionality, their high manufacturing cost driven by precise microfabrication, regulatory compliance, and integration efforts remains a major barrier. This restricts adoption in cost‑sensitive geographies and limits scalability in emerging markets. As a result, the high unit cost of cutting‑edge sensors can hamper broader market penetration.

Regulatory Complexity and Market Fragmentation

The medical sensors market faces challenges stemming from stringent regulatory standards across regions, divergent reimbursement policies, and fragmented healthcare systems. These factors can delay product approval, complicate market entry, and increase compliance costs. Such regulatory and systemic barriers can hinder rapid adoption, especially for innovative sensor technologies and cross‑border deployments.

Regional Analysis

North America

North America leads the global medical and biological sensors market, commanding a market share of 34.6% in 2024. The region’s dominance reflects its advanced, well‑established healthcare infrastructure, robust reimbursement mechanisms, and high adoption of cutting‑edge medical technologies. The presence of major device manufacturers and continuous investment in R&D further strengthen the region’s leadership. Demand is particularly strong in the United States, where chronic disease prevalence, rising health‑consciousness, and widespread use of sensor‑enabled devices in hospitals and home‑care settings drive growth.

Europe

Europe represents the second‑largest regional market for medical and biological sensors, accounting for 28.3% of the global market share in 2024. The region benefits from a large geriatric population, increasing chronic disease incidence, and strong public healthcare expenditure. Well‑defined regulatory frameworks and supportive reimbursement policies facilitate faster adoption of sensor‑based diagnostics and monitoring devices. Continued investments in portable and wearable medical technologies, along with rising demand for non‑invasive diagnostics and preventive care, sustain steady growth in Europe.

Asia Pacific

Asia Pacific stands out as the fastest‑growing regional market, accounting for 22.1% of the global market share in 2024. The region is propelled by rapid urbanization, rising healthcare awareness, and expanding medical infrastructure in countries such as China, India, and Japan. The region sees increasing demand for cost‑effective sensor‑enabled devices in hospitals, clinics, and home‑care settings, fueled by a growing elderly population and rising incidence of chronic diseases. Entry of local manufacturers and rising affordability further drives market penetration, creating significant growth opportunities over the forecast period.

Latin America

Latin America’s medical and biological sensors market is gradually expanding, holding 9.8% of the global market share in 2024. The region is supported by improving healthcare infrastructure, growing public and private investments, and rising adoption of modern medical technologies. As governments and private players upgrade diagnostic and monitoring capabilities, demand for sensor‑based devices in hospitals and clinics increases. The growing prevalence of chronic diseases and rising patient awareness further support uptake. However, the pace of growth remains moderate compared to more mature regions, leaving room for gradual scaling over the forecast period.

Middle East & Africa

The Middle East & Africa region shows emerging potential for medical and biological sensors, representing 5.2% of the global market share in 2024. The region is driven by growing healthcare investment, expanding hospital networks, and increasing demand for modern diagnostics. Rising prevalence of chronic and communicable diseases, together with improving access to healthcare services, propels adoption of sensor‑based monitoring and diagnostic tools. While current market share remains limited compared to developed regions, improving economic conditions and public health initiatives indicate rising growth prospects over the coming years.

Market Segmentations:

By Application

- Hospitals

- Clinics

- Home-care Settings

By Types

- Temperature Sensors

- Pressure Sensors

- Photo Optic Sensors

- Liquid Level Sensors

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive analysis in the medical and biological sensors market reveals a dynamic landscape with key players such as Medtronic, Honeywell, GE, TE Connectivity, Analog Devices, and STMicroelectronics leading the charge. These companies are focusing on expanding their product portfolios, incorporating advanced sensor technologies, and investing in strategic partnerships and acquisitions to maintain market dominance. The competitive environment is marked by a strong emphasis on innovation, with major players integrating cutting-edge technologies like IoT, AI, and miniaturized sensor designs into their offerings. Market growth is fueled by the increasing adoption of wearable, non-invasive, and implantable sensors, with companies targeting both clinical and home-care applications. Additionally, regulatory compliance and robust distribution networks are pivotal for capturing market share, particularly in North America and Europe. To differentiate themselves, leading players are also emphasizing cost-effective solutions and improved patient outcomes, positioning themselves to cater to the growing demand for preventive healthcare and chronic disease management worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2024, STMicroelectronics introduced a new bio‑sensing chip designed for next‑generation healthcare wearables including smartwatches, sports bands, connected rings, and smart glasses.

- In June 2025, Sensirion partnered with Sintropy.ai and Repcom and acquired Kuva Systems to accelerate AI‑driven sensor technologies and expand its IoT sensor portfolio.

- In October 2025, a new flexible, antenna‑integrated capacitive sensing platform MAiCaS demonstrated wireless, passive cardiovascular monitoring capabilities, offering a promising route for long‑term patient monitoring without bulky hardware.

Report Coverage

The research report offers an in-depth analysis based on Application, Types and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to experience strong growth due to the increasing demand for wearable and non-invasive sensors.

- Advancements in IoT and AI technologies will enhance the capabilities and efficiency of medical sensors.

- The aging global population will drive significant demand for sensors in chronic disease management and elderly care.

- The rise in home healthcare and remote patient monitoring will open new opportunities for sensor adoption.

- There will be an increasing focus on the development of personalized healthcare solutions powered by medical sensors.

- Rising healthcare costs will accelerate the need for cost-effective, preventative, and home-based monitoring solutions.

- Miniaturization of sensors will enable more compact, portable, and user-friendly devices, improving patient compliance.

- The integration of medical sensors with telemedicine platforms will boost the growth of remote diagnostics and treatment.

- Regulatory advancements and new reimbursement models will facilitate faster adoption of innovative medical sensor technologies.

- Competition will intensify as new entrants and existing players innovate to meet the diverse needs of both clinical and home-care settings.