Market Overview

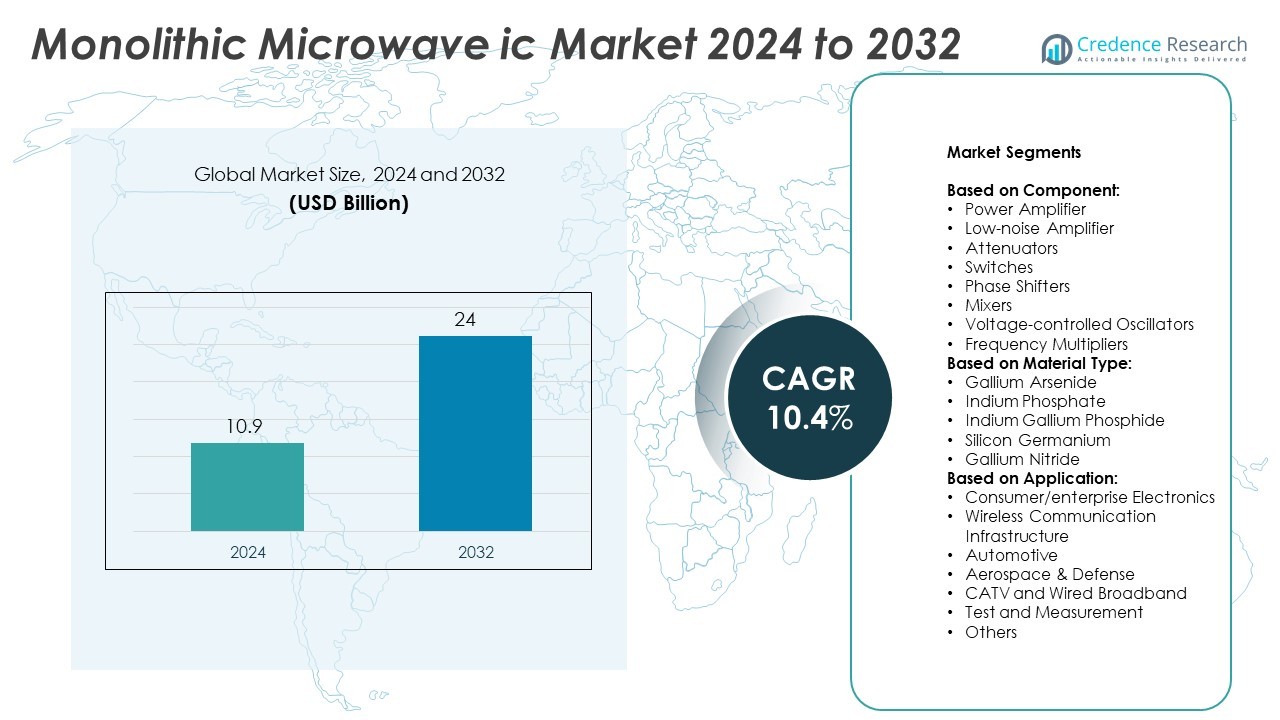

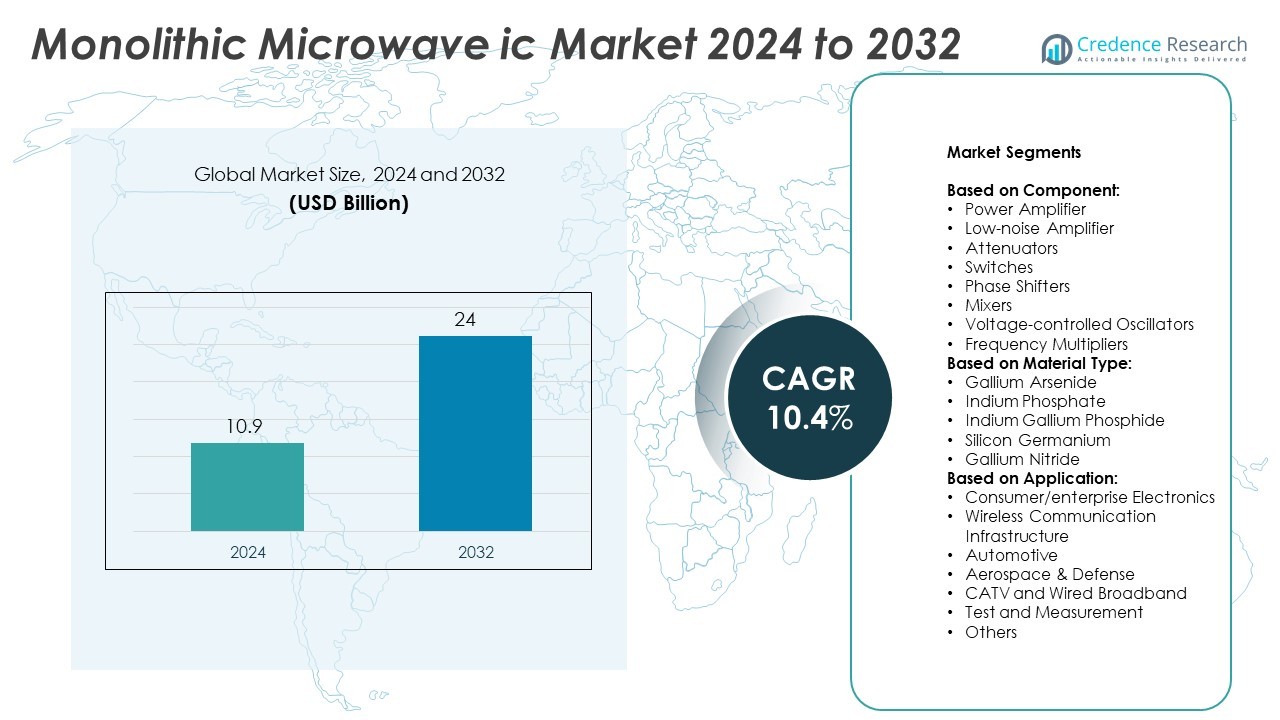

The Monolithic Microwave IC market size was valued at USD 10.9 billion in 2024 and is projected to reach USD 24 billion by 2032, growing at a CAGR of 10.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Monolithic Microwave IC (MMIC) Market Size 2024 |

USD 10.9 Billion |

| Monolithic Microwave IC (MMIC) Market, CAGR |

10.4% |

| Monolithic Microwave IC (MMIC) Market Size 2032 |

USD 24 Billion |

The Monolithic Microwave IC market grows due to rising demand for compact, high-frequency components in 5G, satellite, and defense applications. MMICs offer improved signal performance, low power loss, and high integration, making them ideal for next-generation communication and radar systems. Trends include increasing use of GaN and InP materials, expansion of automotive radar, and integration into consumer electronics. Manufacturers focus on multi-functional designs to reduce system size and support evolving application requirements across global industries.

The Monolithic Microwave IC market sees strong growth in North America, Europe, and Asia-Pacific, supported by booming telecom and defense projects. Regional production hubs leverage advanced semiconductor fabrication capabilities and skilled engineering talent. Key players such as Infineon Technologies, Qorvo, Skyworks Solutions, and MACOM compete on innovation and application-specific solutions. These leaders invest in GaN and GaAs technologies to address high-frequency needs. They also steer multi-functional component trends tailored to automotive, satellite, and telecom deployments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Monolithic Microwave IC market was valued at USD 10.9 billion in 2024 and will reach USD 24 billion by 2032, growing at a CAGR of 10.4%.

- Rising demand for high-frequency, compact components in 5G, satellite, and defense applications drives market expansion.

- Trends show increased use of GaN and InP materials to support thermal efficiency, bandwidth, and power performance.

- Key companies focus on multi-functional MMICs to reduce size, improve performance, and enable integration in complex systems.

- High production cost and limited skilled workforce act as restraints in scaling MMIC development.

- North America leads in adoption due to advanced defense, aerospace, and telecom investments; Asia-Pacific grows through manufacturing strength.

- Competitive landscape includes Infineon Technologies, Qorvo, Skyworks Solutions, MACOM, and Analog Devices leading on innovation, design, and material capabilities.

Market Drivers

Rising Demand for Compact and High-Performance Electronic Components

The Monolithic Microwave IC market benefits from rising demand for smaller, integrated devices. Consumer electronics and military equipment require components that combine performance and size. MMICs enable this by integrating multiple microwave functions into a single chip. It supports faster signal transmission and reduces losses in communication systems. Manufacturers prefer MMICs over traditional discrete components due to reduced assembly time and higher reliability. The trend toward miniaturization across industries continues to accelerate adoption. The Monolithic Microwave IC market gains strength from these compact design benefits.

- For instance, Analog Devices’ HMC7149 GaN MMIC power amplifier delivers a +40 dBm saturated output power, provides 20 dB small-signal gain, and operates from 6 to 18 GHz, drawing 680 mA at 28 V

Expansion of Wireless Communication Infrastructure Worldwide

Telecommunication networks invest heavily in 5G and satellite communication technologies. These systems require high-frequency components with precise performance. The Monolithic Microwave IC market supports this need by offering low-noise amplifiers, phase shifters, and mixers with minimal interference. It plays a central role in enabling efficient spectrum use and enhancing signal quality. Rising mobile data traffic and IoT connectivity fuel further investment in MMIC-based hardware. The push for dense network coverage and speed upgrades keeps demand consistent. The market responds to these infrastructure needs with scalable solutions.

- For instance, Intel announced the first successful large-scale integration of silicon and gallium nitride (GaN) transistors on the same 300 mm wafer. The technology is codenamed “DrGaN,” which refers to an integrated CMOS (silicon) driver and GaN power switch

Growth in Defense and Aerospace Applications

Military systems increasingly depend on radar, communication, and electronic warfare capabilities. MMICs enhance these systems with wide bandwidth and stable performance under extreme conditions. The Monolithic Microwave IC market benefits from ongoing defense modernization programs. It supports applications in surveillance drones, missile guidance, and satellite tracking. Governments prioritize long-range and high-resolution radar technologies for national security. MMICs’ rugged design and low power consumption make them ideal for mission-critical defense uses. This specialized demand drives innovation and procurement volume.

Technological Advancements in Semiconductor Materials

Advances in gallium nitride (GaN) and indium phosphide (InP) boost MMIC performance. These materials support higher power levels, frequency ranges, and thermal stability. The Monolithic Microwave IC market leverages these capabilities to meet stricter industrial and commercial standards. It enables newer applications in automotive radar, space-based communications, and medical imaging. Industry players invest in fabrication improvements to scale output while maintaining quality. Material innovations continue to reduce signal loss and extend device life. These developments make MMICs more viable across diverse end uses.

Market Trends

Integration of MMICs into 5G and Beyond Communication Systems

The telecom industry is rapidly deploying MMICs to support 5G rollouts and future 6G networks. High data rates and low latency demand advanced components with wide bandwidth capabilities. The Monolithic Microwave IC market addresses these needs with compact, power-efficient amplifiers and mixers. It plays a key role in optimizing antenna arrays and small cell deployments. MMICs offer consistent signal quality across high-frequency ranges needed for millimeter-wave bands. Their integration reduces design complexity and shortens time to market. Telecom vendors prioritize MMIC-based solutions for network scalability.

- For instance, The Qorvo QPF4800 is a dual-band Wi-Fi 6 Front-End Module designed for wireless routers and other IoT applications. It covers the standard Wi-Fi bands of 2.4 GHz (2412–2484 MHz) and 5.0 GHz (5150–5925 MHz). Its actual linear output power is designed to meet the more complex requirements of Wi-Fi 6 and depends on the specific modulation and channel width used

Increasing Use of MMICs in Automotive Radar Systems

Automotive radar systems now adopt MMICs to support advanced driver assistance systems (ADAS). These systems require high-frequency components with precision and stability. The Monolithic Microwave IC market grows through its support of radar modules operating at 24 GHz and 77 GHz. It enhances lane departure warning, adaptive cruise control, and collision avoidance functions. Automakers rely on MMICs for compact design and thermal efficiency in harsh environments. Demand for safety regulations and autonomous driving technologies further supports the trend. MMICs continue to enable faster detection and improved radar resolution.

- For instance, NXP Semiconductors developed the TEF810X radar transceiver MMIC, supporting 77–81 GHz with 4 transmit and 4 receive channels, achieving range resolution <10 cm and enabling long-range radar detection beyond 250 m

Shift Toward Multi-Function, High-Density MMICs

Manufacturers now prefer MMICs that integrate multiple microwave functions into a single package. This trend reduces system size, weight, and cost across end-user applications. The Monolithic Microwave IC market meets this shift by offering power amplifiers, switches, and oscillators on unified chips. It enables more efficient and scalable system designs. Integration helps reduce parasitic losses and enhances overall performance. This multi-functionality supports industries like aerospace, telecom, and medical diagnostics. Compact, all-in-one MMICs reduce component count and speed up system integration.

Emergence of GaN and InP-Based MMIC Technologies

Gallium nitride and indium phosphide MMICs are gaining traction due to superior power and frequency capabilities. These materials support operation in extreme thermal and electrical conditions. The Monolithic Microwave IC market incorporates GaN and InP to address space, military, and 5G infrastructure demands. It delivers higher power efficiency, smaller footprints, and broader bandwidths. Key players invest in advanced fabrication processes to scale these technologies. The shift toward compound semiconductors ensures that MMICs meet evolving performance standards. These materials push the boundaries of high-frequency circuit design.

Market Challenges Analysis

High Design Complexity and Manufacturing Costs Limit Mass Adoption

MMICs require advanced fabrication techniques and cleanroom environments. Designing for high frequencies demands precision layout, accurate modeling, and expert circuit integration. The Monolithic Microwave IC market faces challenges due to high production costs and limited design flexibility. It relies heavily on expensive materials like gallium arsenide and gallium nitride. These factors increase the cost per chip and limit feasibility in price-sensitive applications. Small design errors can lead to poor yields and performance issues. Companies must invest in simulation tools and skilled engineers to reduce development time and ensure quality.

Limited Availability of Skilled Workforce and Specialized Equipment

MMIC development needs specialized knowledge in RF engineering, semiconductor physics, and microwave circuit design. The industry struggles to find qualified engineers and technicians trained in these areas. The Monolithic Microwave IC market slows when companies lack access to skilled labor and modern equipment. It affects production efficiency and delays time-to-market for new products. High entry barriers discourage small players from entering the market. Government and academic support for MMIC-related training programs remains insufficient. These talent and equipment gaps restrict innovation and capacity expansion.

Market Opportunities

Expansion of Satellite Communication and Space-Based Applications

Satellite networks are expanding to support global broadband, remote sensing, and defense operations. These systems require compact, lightweight, and high-frequency components to function efficiently in space. The Monolithic Microwave IC market finds strong opportunities in meeting these technical needs. It enables low-noise amplifiers, power modules, and phase shifters for satellites and ground stations. The rising number of low Earth orbit (LEO) satellite constellations drives long-term demand. Space agencies and private operators seek reliable MMICs to reduce power consumption and enhance system durability. This sector promises consistent procurement and long-term contracts.

Rising Demand from Medical Imaging and Industrial Sensing Sectors

MMICs offer advantages in non-invasive diagnostics and high-frequency imaging systems. Medical equipment like MRI machines and diagnostic sensors benefit from MMICs’ compact size and signal accuracy. The Monolithic Microwave IC market taps into growing healthcare needs for faster and more detailed diagnostics. It supports development of portable imaging devices and wearable monitoring systems. Industrial sensing also gains from MMIC-based radar and inspection tools. Manufacturers seek MMICs to improve resolution and reduce maintenance downtime. These use cases extend MMIC adoption beyond traditional telecom and defense markets.

Market Segmentation Analysis:

By Component:

The power amplifier segment leads due to its widespread use in wireless transmitters and radar systems. It delivers high gain and output power, essential for signal strength. The Monolithic Microwave IC market benefits from increasing demand for low-noise amplifiers in satellite and 5G base stations. Mixers and switches support efficient frequency conversion and signal routing, playing vital roles in RF front-end modules. Voltage-controlled oscillators and frequency multipliers see demand from test equipment and high-frequency synthesizers. Phase shifters and attenuators offer precise control in phased array systems and gain matching. Each component meets specific performance needs across high-frequency applications.

- For instance, the Qorvo QPD1020 is a GaN HEMT discrete power transistor that delivers 31 W (P₃dB) of output power at 3.1 GHz, with 18.4 dB gain and 64% power-added efficiency (PAE), all within a compact 6 x 5 mm package. This highlights its high-performance role in wireless transmitter modules, including for military and civilian radar applications.

By Material Type:

Gallium arsenide dominates due to its balance of performance and cost. It supports high-frequency, low-noise circuits in mass-market communication devices. Gallium nitride grows rapidly because of its power density and thermal stability in aerospace and radar. The Monolithic Microwave IC market adopts indium phosphide for ultra-high-speed data and optical networks. Indium gallium phosphide offers potential for optoelectronics and advanced sensor integration. Silicon germanium remains relevant for mid-range applications due to its compatibility with CMOS processes. Each material choice reflects trade-offs between performance, cost, and fabrication ease.

- For instance, the Infineon XENSIV™ BGT60LTR series (specifically the BGT60LTR11AIP) embeds a Voltage-Controlled Oscillator (VCO) and Phase-Locked Loop (PLL) in its 60 GHz radar MMIC. This enables highly integrated, on-chip signal generation for compact radar modules, which supports autonomous operation for low-power applications.

By Application:

Wireless communication infrastructure remains the top segment, driven by 5G and satellite network investments. The Monolithic Microwave IC market sees rising use in consumer electronics through smart devices and high-speed connectivity features. Automotive radar systems adopt MMICs to support advanced driver assistance and autonomous driving. Aerospace and defense applications require MMICs for mission-critical communication, radar, and electronic warfare. CATV and wired broadband networks benefit from MMICs in amplifiers and up/down converters. Test and measurement tools use MMICs for accurate, high-frequency signal analysis. Other sectors include healthcare and industrial sensing, expanding the application base further.

Segments:

Based on Component:

- Power Amplifier

- Low-noise Amplifier

- Attenuators

- Switches

- Phase Shifters

- Mixers

- Voltage-controlled Oscillators

- Frequency Multipliers

Based on Material Type:

- Gallium Arsenide

- Indium Phosphate

- Indium Gallium Phosphide

- Silicon Germanium

- Gallium Nitride

Based on Application:

- Consumer/enterprise Electronics

- Wireless Communication Infrastructure

- Automotive

- Aerospace & Defense

- CATV and Wired Broadband

- Test and Measurement

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America held the largest share of the Monolithic Microwave IC market in 2024, accounting for 34.2% of the global revenue. The region benefits from strong investments in defense, aerospace, and wireless infrastructure. MMICs are widely used in advanced radar systems, electronic warfare, and satellite communications, supported by funding from agencies such as the U.S. Department of Defense and NASA. Leading companies across the United States develop cutting-edge MMICs for military-grade and commercial applications. The rollout of 5G networks and private LTE systems further accelerates demand for MMICs in the telecom sector. Consumer electronics adoption also supports market strength, with growing integration of MMICs in Wi-Fi 6 routers and smart devices. The established semiconductor ecosystem and continued innovation across microwave technologies drive stable growth in the region.

Europe

Europe represented 24.6% of the global Monolithic Microwave IC market in 2024. The region benefits from rising demand across aerospace, defense, and telecommunications sectors. Countries such as Germany, France, and the United Kingdom lead in MMIC development for radar, satellite, and high-frequency automotive systems. MMICs support European defense initiatives through air surveillance, navigation, and encrypted communications. The region’s focus on electric and connected vehicles also increases demand for automotive radar modules. Telecom operators across Europe invest in 5G infrastructure and fiber networks that require MMIC-based components. Regional R&D programs and collaborations between public institutions and private firms strengthen innovation pipelines and support long-term competitiveness.

Asia-Pacific

Asia-Pacific held 29.1% of the global Monolithic Microwave IC market in 2024, with strong momentum across manufacturing and deployment sectors. China, Japan, South Korea, and Taiwan lead in MMIC production and consumption. Regional companies play a critical role in producing GaN and GaAs-based MMICs for consumer electronics, telecom, and satellite markets. The expansion of 5G base stations, mobile networks, and IoT ecosystems drives demand for high-performance microwave ICs. Asia-Pacific also benefits from its strong position in semiconductor fabrication, with major foundries supporting mass-scale MMIC production. Defense spending in countries such as China and India supports long-range radar systems and space programs. Cost advantages in raw materials and skilled labor continue to make the region a preferred hub for MMIC manufacturing.

Latin America

Latin America contributed 6.3% to the global Monolithic Microwave IC market in 2024. Though smaller in scale, the region shows emerging demand in defense, telecommunications, and test and measurement applications. Brazil and Mexico lead regional adoption, supported by government initiatives to modernize defense systems and expand communication infrastructure. MMICs are used in broadcasting, radar navigation, and satellite ground stations. Private telecom operators also deploy MMIC-based systems to improve rural network coverage and broadband access. The growing electronics manufacturing sector creates an opportunity to localize MMIC-based device production. Supply chain partnerships with North American firms also support knowledge transfer and regional capability building.

Middle East and Africa

The Middle East and Africa region accounted for 5.8% of the Monolithic Microwave IC market in 2024. Countries such as Israel, the UAE, and South Africa are expanding MMIC use in defense and aerospace sectors. MMICs support surveillance, navigation, and missile guidance systems. Telecom investment across the Gulf states fuels deployment of 5G and satellite infrastructure where MMICs play a vital role. Demand also grows in test and measurement equipment used in oil and gas monitoring and industrial automation. Limited local production capacity leads to dependence on imported components from Europe and Asia. Governments aim to increase regional manufacturing capabilities through partnerships and defense offset programs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Monolithic Microwave IC market features strong competition among key players including Infineon Technologies, OMMIC, Qorvo, Skyworks Solutions, United Monolithic Semiconductors, MACOM, Analog Devices, Microarray Technologies, Mini-Circuits, Inc, and NXP Semiconductors. These companies compete on performance, design innovation, material advancement, and customization capabilities. Each firm focuses on expanding its MMIC portfolio to address application needs across defense, telecom, automotive, and satellite systems. They invest heavily in R&D to enhance integration, reduce signal loss, and support wide frequency ranges. Strategic mergers and long-term contracts with OEMs strengthen their market presence and ensure steady revenue streams. Advanced manufacturing capabilities and material expertise, particularly in GaN and GaAs, differentiate leaders in power efficiency and frequency performance. Many players form partnerships with foundries and research institutions to accelerate design cycles and access specialized fabrication processes. The focus on multi-functional MMICs and application-specific custom designs remains critical to maintaining competitive edge. Pricing pressure and compliance with international standards challenge companies to maintain high yield and quality control.

Recent Developments

- In December 2024, Infineon introduced the CTRX8191F radar MMIC, offering enhanced performance and improved signal‑to‑noise ratio.

- In November 2024, MACOM (NASDAQ: MTSI), a leading supplier of semiconductor products, announced today that it has acquired ENGIN-IC, Inc. (ENGIN-IC), a fabless semiconductor.

- In June 2024, Qorvo the company launched three new compact MMIC power amplifiers tailored for Ku‑Band SATCOM terminals

Report Coverage

The research report offers an in-depth analysis based on Component, Material Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rising adoption in 5G infrastructure across urban and rural areas.

- Automotive radar systems will expand MMIC use to support autonomous driving features.

- Demand will grow in satellite communication for broadband, defense, and weather monitoring.

- GaN-based MMICs will gain share due to high efficiency and thermal stability.

- The healthcare sector will adopt MMICs in advanced imaging and diagnostic tools.

- Defense modernization programs will drive new contracts for MMIC suppliers.

- Asia-Pacific will become a leading region for both production and application growth.

- Industrial automation and IoT systems will increase MMIC integration in sensors and controllers.

- MMIC design tools will evolve to reduce development time and improve system performance.

- Collaborations between chipmakers and system integrators will shape product innovation.