Market Overviews

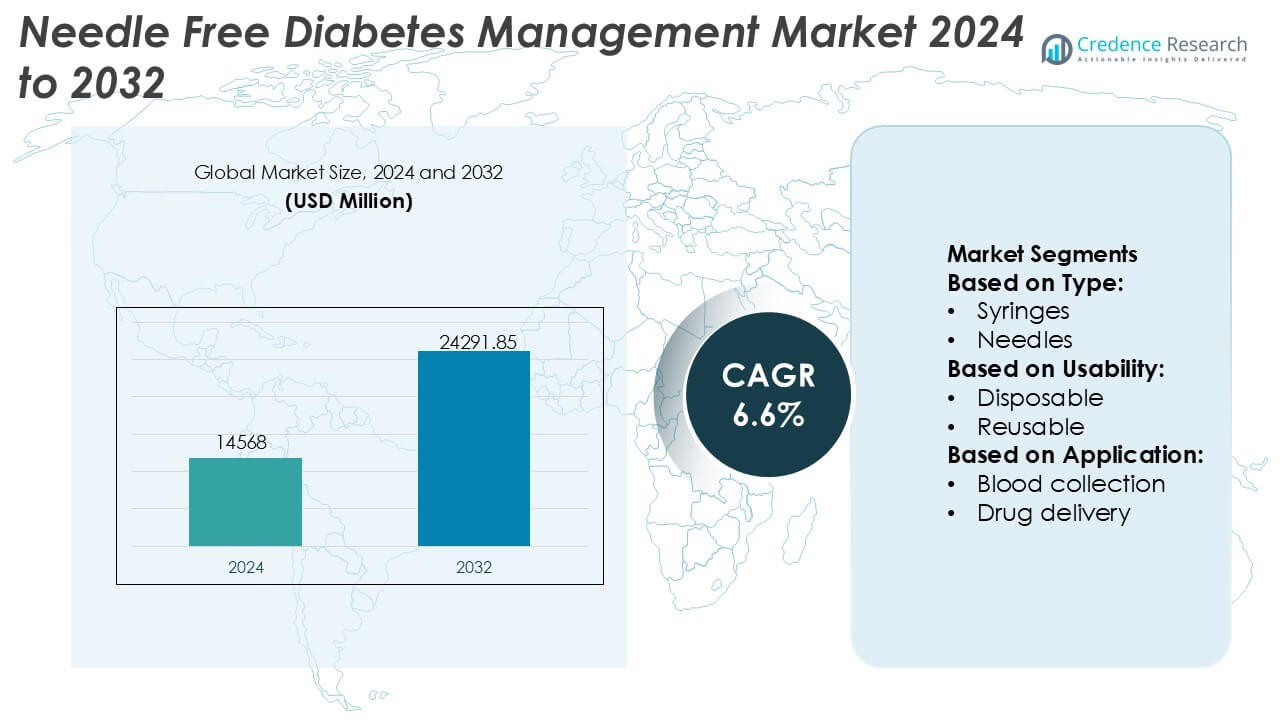

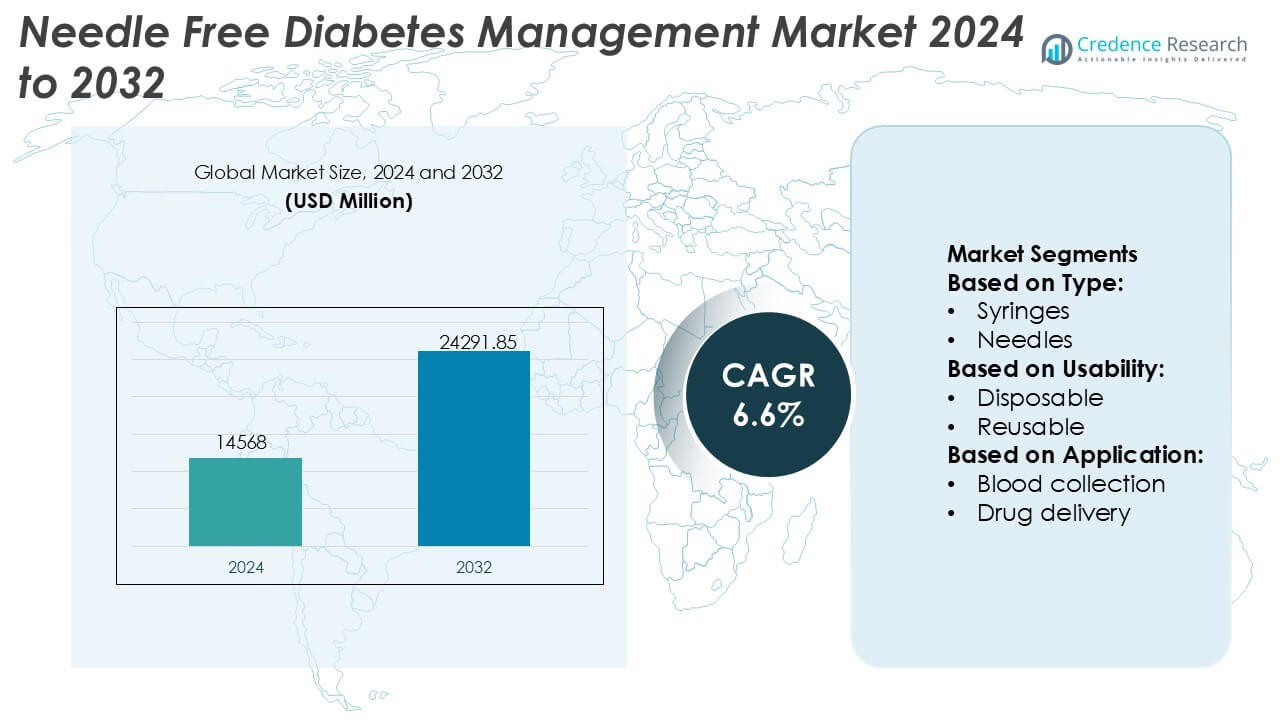

Needle Free Diabetes Management Market size was valued USD 14568 million in 2024 and is anticipated to reach USD 24291.85 million by 2032, at a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Needle Free Diabetes Management Market Size 2024 |

USD 14568 Million |

| Needle Free Diabetes Management Market, CAGR |

6.6% |

| Needle Free Diabetes Management Market Size 2032 |

USD 24291.85 Million |

The Needle Free Diabetes Management Market is led by established medical technology providers and specialized device manufacturers that compete through innovation, clinical reliability, and patient-focused design. Top players emphasize advanced needle-free drug delivery systems, non-invasive glucose monitoring, and integration with digital health platforms to improve therapy adherence and outcomes. Strong investment in research, regulatory compliance, and global distribution supports competitive positioning. Regionally, North America leads the market with an exact 38% share, driven by high diabetes prevalence, advanced healthcare infrastructure, strong reimbursement frameworks, and early adoption of patient-centric technologies. Widespread acceptance of homecare solutions and connected diabetes management systems further reinforces regional leadership, while ongoing product innovation sustains competitive intensity across global markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Needle Free Diabetes Management Market was valued at USD 14,568 million in 2024 and is projected to reach USD 24,291.85 million by 2032, expanding at a CAGR of 6.6% during the forecast period.

- Rising diabetes prevalence and demand for pain-free, long-term therapy solutions act as key market drivers, with needle-free drug delivery and non-invasive glucose monitoring emerging as dominant segments holding the majority share.

- Market trends highlight growing integration of digital health platforms, connected monitoring systems, and homecare-compatible devices that support personalized care and improve patient adherence.

- The competitive landscape remains strong, led by established medical technology providers focusing on innovation, clinical validation, regulatory compliance, and global distribution strategies.

- Regionally, North America leads with an exact 38% market share, supported by advanced healthcare infrastructure, favorable reimbursement, and early adoption of patient-centric diabetes management technologies.

Market Segmentation Analysis:

By Type

Within the Needle Free Diabetes Management Market, the needles segment remains the dominant sub-segment, accounting for an estimated 58% market share. This dominance reflects the widespread installed base of conventional insulin delivery systems and blood sampling devices, particularly in hospital and home-care settings. Needles continue to benefit from established clinical familiarity, low unit costs, and broad compatibility with existing insulin pens and syringes. However, syringe-free and needle-free alternatives are gaining attention due to pain reduction and improved patient comfort, yet penetration remains limited by higher device costs and regulatory validation requirements.

- For instance, B. Braun (or embecta), through its medical device portfolio, manufactures insulin delivery needles engineered in ultra-fine gauges such as 31G with lengths down to 4 mm, designed to reduce insertion force while maintaining dose accuracy.

By Usability

By usability, disposable systems lead the market with an approximate 63% share, driven by strong demand for infection control, convenience, and regulatory compliance. Disposable needle-free components and accessories reduce cross-contamination risks and eliminate sterilization needs, making them preferred in hospitals, clinics, and home-based diabetes care. Rising awareness of hygiene, especially among immunocompromised diabetic patients, further supports adoption. Reusable systems attract interest for long-term cost efficiency, but concerns around cleaning protocols, durability, and compliance limit broader uptake compared to single-use solutions.

- For instance, Medtronic has advanced the usability of its disposable diabetes care consumables with its MiniMed™ 780G system and compatible Simplera Sync™ disposable CGM sensor, which integrates a single-use sensor that can be applied in under 10 seconds and interfaces with automated insulin delivery algorithms that adjust insulin delivery every 5 minutes based on real-time glucose readings a frequency derived directly from device specifications and clinical product descriptions.

By Application

In terms of application, insulin administration represents the dominant sub-segment, holding nearly 47% market share. This leadership stems from the large global diabetic population requiring frequent insulin dosing and growing demand for less painful, anxiety-free delivery methods. Needle-free insulin devices support improved adherence, particularly among pediatric and geriatric patients. Blood collection and drug delivery follow as secondary segments, while vaccination and other applications show steady expansion as needle-free platforms gain validation for broader therapeutic use beyond routine glucose and insulin management.

Key Growth Drivers

Rising Prevalence of Diabetes and Need for Long-Term Therapy

The global increase in diabetes prevalence continues to expand the patient pool requiring lifelong insulin and glucose management. Needle-free solutions address pain, anxiety, and adherence challenges associated with frequent injections and finger-prick testing. These systems improve patient comfort and reduce injection-related complications, supporting consistent therapy compliance. Healthcare providers increasingly favor alternatives that enhance quality of life while maintaining clinical efficacy. This sustained demand for patient-centric diabetes care solutions directly accelerates adoption of needle-free diabetes management technologies.

- For instance, Hilgenberg manufactures glass capillaries and micro-tubes with inner diameters down to 0.1 mm, length tolerances below ±0.02 mm, and volumetric accuracy suitable for microliter-scale dosing and sampling. Its components comply with ISO 11040 and ISO 3585 standards and withstand thermal loads above 500 °C during forming and sterilization, enabling reliable integration into high-frequency diabetes management systems documented in company technical datasheets.

Growing Focus on Patient Comfort, Safety, and Adherence

Patient preference is shifting toward non-invasive and minimally invasive diabetes management methods. Needle-free devices reduce needle-stick injuries, cross-contamination risks, and biohazard waste, aligning with safety priorities in both homecare and clinical settings. Improved comfort encourages regular insulin administration and glucose monitoring, leading to better glycemic control. Manufacturers emphasize ergonomic design, ease of use, and portability, which further strengthens acceptance among elderly patients and pediatric populations, driving sustained market growth.

- For instance, Novo Nordisk A/S has embedded smart technology into its NovoPen® 6 and NovoPen Echo® Plus reusable insulin pens, which automatically record and store up to 800 past insulin doses including time, date, and units injected to help patients and clinicians analyze dosing history and refine therapy plans a capability documented in the devices’ specifications on the company’s product pages.

Technological Advancements in Drug Delivery and Monitoring Systems

Continuous innovation in jet injectors, transdermal delivery, microneedle patches, and sensor-based glucose monitoring enhances the performance of needle-free solutions. Improved dose accuracy, faster drug absorption, and integrated digital connectivity strengthen clinical outcomes and patient engagement. Advances in wearable technology and smart monitoring platforms enable real-time data tracking and personalized therapy adjustments. These technological improvements increase physician confidence and broaden clinical applications, accelerating commercialization and adoption across diabetes care settings.

Key Trends & Opportunities

Integration of Digital Health and Connected Care Platforms

Needle-free diabetes management systems increasingly integrate with mobile applications, cloud platforms, and remote monitoring tools. Connected devices enable real-time glucose tracking, automated insulin delivery insights, and data sharing with healthcare professionals. This trend supports personalized treatment plans and proactive disease management. The convergence of needle-free delivery with digital therapeutics creates opportunities for value-added services, subscription models, and long-term patient engagement solutions.

- For instance, Boston Scientific Corporation has demonstrated large-scale connected-care capability through its LATITUDE™ NXT Patient Management System, a cloud-based remote monitoring platform documented by the company to support more than 2 million implanted devices worldwide and process billions of data points annually.

Expansion in Homecare and Self-Management Applications

The shift toward home-based diabetes management creates strong opportunities for needle-free devices designed for self-administration. Compact, user-friendly systems support independent disease management while reducing dependence on clinical visits. This trend aligns with broader healthcare decentralization and cost-containment strategies. Growing awareness programs and patient education initiatives further encourage adoption, particularly among newly diagnosed patients seeking convenient and less intimidating treatment options.

- For instance, ICU Medical, Inc. (Smiths Medical, Inc.) has advanced homecare-ready safety and needle-free infusion technologies through products such as the MicroClave™ and NanoClave™ needle-free connectors, which are validated for up to 7 days of continuous use, support flow rates exceeding 300 mL/min, and withstand hundreds of access cycles without leakage or reflux.

Emerging Opportunities in Pediatric and Geriatric Care

Needle anxiety remains high among children and elderly patients with diabetes, creating targeted opportunities for needle-free solutions. Devices tailored for sensitive skin, reduced handling complexity, and simplified dosing protocols address unmet needs in these demographics. Healthcare providers increasingly recommend needle-free options to improve adherence and reduce treatment resistance, positioning these segments as high-potential growth areas.

Key Challenges

High Device Costs and Reimbursement Limitations

Needle-free diabetes management devices often involve higher upfront costs compared to conventional needles and syringes. Limited reimbursement coverage in several healthcare systems restricts affordability, particularly in price-sensitive markets. Cost concerns may slow adoption among individual patients and smaller healthcare providers. Manufacturers face pressure to balance innovation with cost optimization while demonstrating long-term economic benefits to payers and policymakers.

Clinical Acceptance and Standardization Barriers

Despite technological progress, variability in drug delivery efficiency and limited long-term clinical data for certain needle-free technologies create hesitation among clinicians. Standardization of dosing accuracy, regulatory pathways, and clinical guidelines remains inconsistent across regions. Overcoming these barriers requires robust clinical validation, physician education, and regulatory alignment. Without clear standards, adoption may remain uneven across healthcare systems and clinical practices.

Regional Analysis

North America

North America leads the Needle Free Diabetes Management Market with an estimated 38% market share, driven by high diabetes prevalence, advanced healthcare infrastructure, and early adoption of patient-centric technologies. Strong awareness of needle-free alternatives, combined with favorable regulatory support for innovative drug delivery and glucose monitoring systems, accelerates market penetration. The region benefits from robust reimbursement frameworks, widespread use of homecare devices, and strong presence of technology-driven manufacturers. High adoption of digital health platforms and connected diabetes management solutions further strengthens North America’s leadership position.

Europe

Europe accounts for approximately 27% of the global market share, supported by well-established healthcare systems and a strong emphasis on patient safety and comfort. Increasing adoption of non-invasive diabetes management solutions aligns with regional efforts to reduce needle-stick injuries and medical waste. Government-backed chronic disease management programs and growing acceptance of home-based care contribute to steady demand. Countries with high diabetes awareness and strong regulatory oversight promote clinical validation and standardization, supporting consistent adoption of needle-free technologies across hospitals and outpatient settings.

Asia-Pacific

Asia-Pacific holds an estimated 25% market share and represents the fastest-growing regional market due to a rapidly expanding diabetic population and improving healthcare access. Rising urbanization, lifestyle changes, and increased screening programs drive demand for convenient and less painful diabetes management solutions. Governments and private healthcare providers increasingly invest in advanced medical technologies to address chronic disease burdens. Growing middle-class populations, expanding homecare adoption, and rising awareness of patient-friendly devices create strong long-term opportunities for needle-free diabetes management solutions.

Latin America

Latin America captures around 6% of the global market share, supported by gradual improvements in healthcare infrastructure and increasing diabetes awareness. Public health initiatives focused on chronic disease management encourage adoption of innovative treatment approaches, including needle-free options. However, market growth remains moderated by cost sensitivity and limited reimbursement coverage in several countries. Expanding private healthcare networks and growing demand for home-based diabetes management support steady uptake, particularly in urban centers with better access to advanced medical devices.

Middle East & Africa

The Middle East & Africa region accounts for approximately 4% of the market share, with growth driven by rising diabetes prevalence and expanding healthcare investments. Gulf countries lead regional adoption due to higher healthcare spending, strong government initiatives, and growing awareness of advanced diabetes care technologies. In contrast, adoption across parts of Africa remains limited by affordability and infrastructure constraints. Increasing focus on preventive care, gradual expansion of homecare services, and improving access to medical technologies support moderate but steady market development.

Market Segmentations:

By Type:

By Usability:

By Application:

- Blood collection

- Drug delivery

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Needle Free Diabetes Management Market players such as Fresenius SE & Co. KGaA, Medtronic, Hilgenberg GmbH, Novo Nordisk A/S, Boston Scientific Corporation, ICU Medical, Inc. (Smiths Medical, Inc.), Thermo Fisher Scientific Inc., Ethicon (Johnson & Johnson Services, Inc.), BD, and Stryker. The Needle Free Diabetes Management Market exhibits a competitive landscape defined by rapid technological innovation, product differentiation, and a strong focus on patient-centric care. Market participants compete on device accuracy, safety, ease of use, and integration with digital health platforms that support personalized diabetes management. Continuous advancements in needle-free drug delivery and non-invasive glucose monitoring drive competition, while regulatory compliance and clinical validation remain critical success factors. Companies prioritize expanding homecare-compatible solutions, improving patient adherence, and reducing total cost of ownership. Strategic initiatives such as research collaborations, product pipeline expansion, and entry into emerging markets further intensify competition. The landscape favors players that can deliver reliable performance, scalable production, and seamless connectivity within evolving diabetes care ecosystems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fresenius SE & Co. KGaA

- Medtronic

- Hilgenberg GmbH

- Novo Nordisk A/S

- Boston Scientific Corporation

- ICU Medical, Inc. (Smiths Medical, Inc.)

- Thermo Fisher Scientific Inc.

- Ethicon (Johnson & Johnson Services, Inc.)

- BD

- Stryker

Recent Developments

- In June 2025, FedEx and IIT Bombay inaugurated the IITB-FedEx Centre for Advanced Logistics and Focused Analytics (FedEx ALFA) to foster student entrepreneurship, develop innovative supply chain solutions using data, and promote real-world problem-solving for future talent, aligning with goals for a more intelligent and sustainable logistics future in India.

- In May 2025, ThingsRecon, a specialist in Digital Asset Discovery & Supply Chain Attack Surface Management (EASM), announced a significant launch including their new Supply Chain Discovery product and an expanded strategic partnership program to enhance visibility into hidden digital exposures within extended enterprise networks and third-party risks, aiming to connect technical vulnerabilities to real business risks.

- In November 2024, Medtronic plc announced the FDA clearance for its InPen app, which now includes a missed meal dose detection feature. This advancement sets the stage for the upcoming launch of its Smart MDI system, which will be integrated with the Simplera continuous glucose monitor (CGM).

- In January 2024, Abbott and Tandem Diabetes Care, Inc. announced that the t:slim X2 insulin pump with Control-IQ technology is now integrated with Abbott’s FreeStyle Libre 2 Plus sensor, offering users in the U.S. the benefits of a hybrid closed-loop system that helps manage and prevent high and low blood sugar levels.

Report Coverage

The research report offers an in-depth analysis based on Type, Usability, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Needle-free technologies will gain wider acceptance as healthcare systems prioritize patient comfort and long-term therapy adherence.

- Continuous innovation will improve dose accuracy, reliability, and consistency of needle-free drug delivery systems.

- Integration with digital health platforms will strengthen personalized diabetes management and remote monitoring capabilities.

- Homecare adoption will increase as compact and user-friendly needle-free devices support self-management.

- Pediatric and geriatric patient segments will drive demand due to reduced needle anxiety and improved usability.

- Regulatory clarity and clinical validation will support broader physician acceptance and standardization.

- Emerging economies will present strong growth opportunities with rising diabetes awareness and healthcare access.

- Manufacturers will focus on cost optimization to improve affordability and expand market reach.

- Strategic partnerships will accelerate product development and geographic expansion.

- Sustainability considerations will encourage adoption of solutions that reduce sharps waste and biohazard risks.