Market Overviews

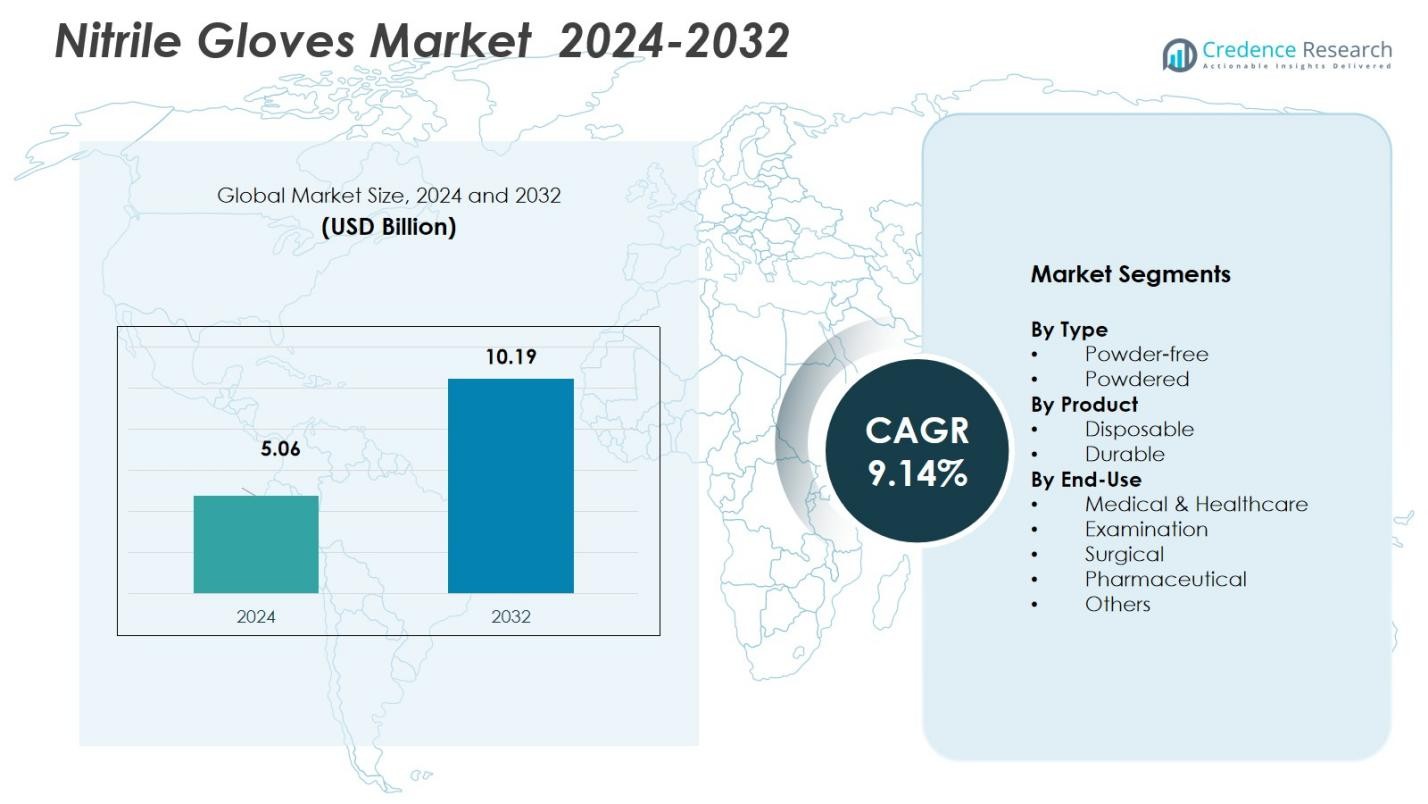

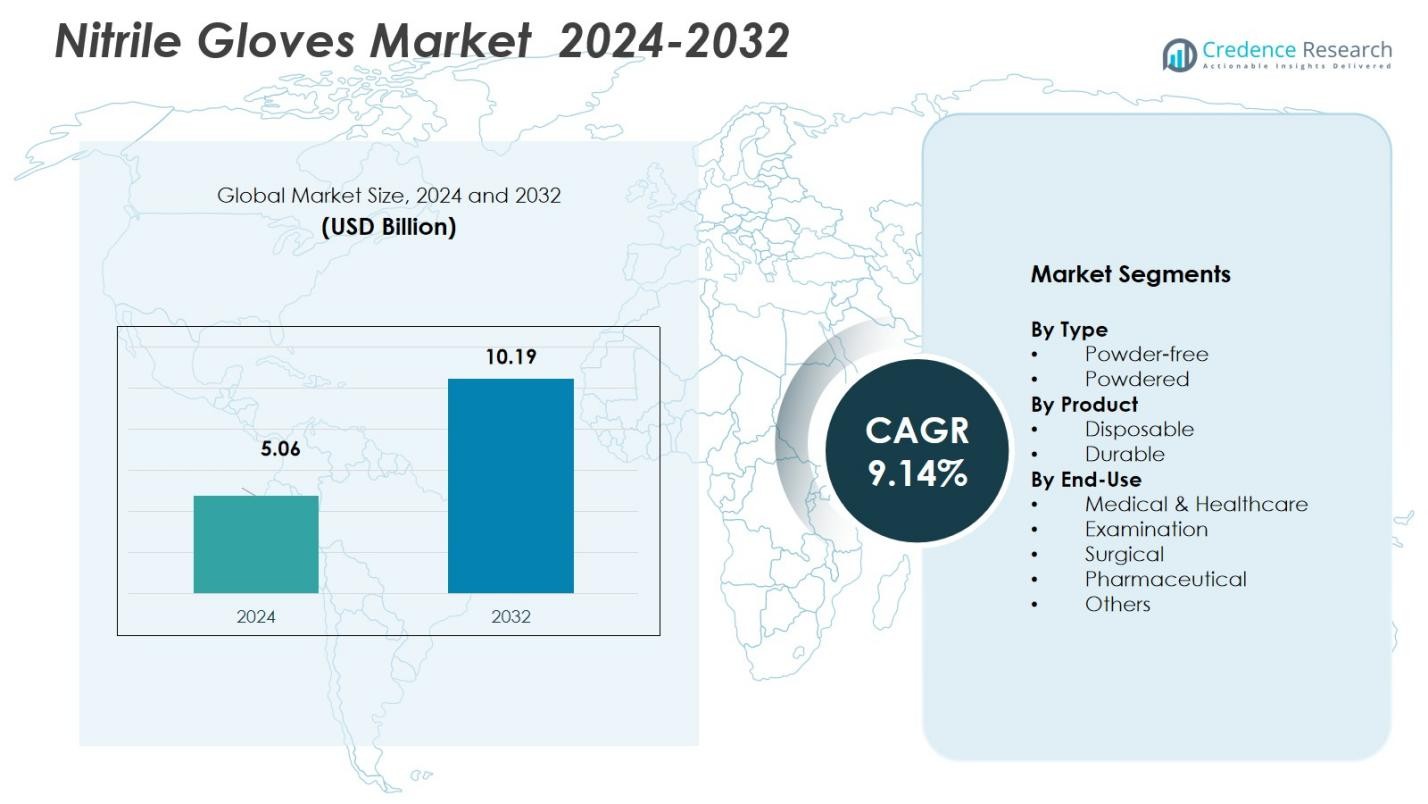

The Nitrile Gloves Market size was valued at USD 5.06 Billion in 2024 and is anticipated to reach USD 10.19 Billion by 2032, at a CAGR of 9.14% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Nitrile Gloves Market Size 2024 |

USD 5.06 Billion |

| Nitrile Gloves Market, CAGR |

9.14% |

| Nitrile Gloves Market Size 2032 |

USD 10.19 Billion |

The Nitrile Gloves Market is led by key players such as Ansell, Kimberly-Clark Professional, Hartalega, Kossan, and Cardinal Health. These companies dominate the market through extensive product offerings, technological innovations, and robust distribution networks. Ansell and Kimberly-Clark Professional, known for their strong foothold in medical and industrial segments, continue to drive the market with their advanced nitrile glove solutions. Hartalega and Kossan, both major manufacturers in Malaysia, lead in production capacity and global supply. North America holds the largest market share of 38.4% in 2024, primarily due to strong healthcare and industrial demand. Europe follows with 29.7% share, driven by stringent safety regulations. Asia Pacific, with 31.1%, continues to grow, supported by rising healthcare investments and manufacturing capacities in countries like Malaysia and Thailand. These regions are critical in shaping global demand, positioning them as essential players in the nitrile gloves market’s ongoing expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Nitrile Gloves Market was valued at USD 5.06 Billion in 2024 and is expected to reach USD 10.19 Billion by 2032, growing at a CAGR of 9.14%.

- Rising demand for gloves in healthcare, pharmaceuticals, and food processing sectors, along with strict hygiene and safety regulations, are key drivers of market growth.

- Key trends include the shift toward powder-free and eco-friendly nitrile gloves, along with the increasing adoption of disposable gloves due to their convenience and safety.

- Major players such as Ansell, Kimberly-Clark Professional, Hartalega, Kossan, and Cardinal Health continue to lead the market through innovation, capacity expansion, and strong distribution networks.

- North America dominates the market with a 38.4% share in 2024, followed by Asia Pacific at 31.1% and Europe at 29.7%, driven by growing healthcare investments, regulatory standards, and industrial applications across regions.

Market Segmentation Analysis

By Type

The “Powder-free” sub-segment dominates the nitrile gloves market by type, capturing a market share of 73.9% in 2024. Powder-free gloves have gained preference due to their allergy-free, contaminant-free profile, eliminating risks associated with glove powder. Strict regulatory guidelines in healthcare, cleanroom, and food-processing environments accelerate adoption of powder-free variants. Their superior safety, reduced contamination risk, and compliance with hygiene standards drive widespread replacement of powdered gloves globally.

- For instance, Cardinal Health reported that its Esteem™ Powder-Free Nitrile Exam Gloves meet rigorous international safety standards, including the American standard ASTM D6319 and European standard EN 455, making them suitable for adoption in U.S. hospitals and healthcare systems under safety-compliance programs.

By Product

Within product categories, the “Disposable” sub-segment leads the nitrile gloves market, accounting for 78.4% of global revenue in 2024. Disposable nitrile gloves offer unmatched convenience for single-use settings, eliminating the need for sterilization or maintenance associated with durable gloves. Their high puncture resistance, chemical resistance, and ease of donning/doffing make them ideal for medical, laboratory, and food-industry applications. The growing emphasis on hygiene and infection control further reinforces demand for disposable gloves over durable alternatives.

- For Instance, Ansell reported that Microflex disposable nitrile gloves withstand up to 3× higher puncture resistance than standard latex exam gloves, making them widely adopted in laboratory and industrial safety programs.

By End-Use

The “Medical & Healthcare” end-use segment constitutes the dominant share in the nitrile gloves market globally, holding 63.5% of the market in 2024. Rising awareness of infection control, increasing volume of medical procedures, expanding healthcare infrastructure, and stringent hygiene protocols across hospitals and clinics drive this dominance. Nitrile gloves’ latex-free composition, chemical resistance, and suitability for handling bodily fluids make them preferred over alternatives prompting widespread adoption in surgeries, diagnostics, and general patient care.

Key Growth Drivers

Strong Healthcare and Hygiene Demand

Growing emphasis on hygiene, infection control, and worker safety in the global healthcare sector drives demand for nitrile gloves. As hospitals, clinics, diagnostic centers, and laboratories expand, the need for gloves to prevent cross-contamination, handle bodily fluids, and comply with stringent safety protocols grows. This increased demand from the “Medical & Healthcare” end-use segment results in widespread adoption of nitrile gloves. Additionally, the rapid expansion of healthcare facilities in emerging markets is further fueling the global requirement for personal protective equipment, particularly in the wake of global health crises like the COVID-19 pandemic.

· For instance, Kossan Rubber Industries Bhd, one of the largest producers of disposable nitrile gloves globally, claims an annual production capacity of up to 32 billion gloves, enabling it to meet heightened global demand from hospitals, clinics, and diagnostic labs; during the pandemic, its stock value reportedly doubled.

Regulatory Pressure and Safety Standards

Strict occupational safety laws, hygiene regulations, and PPE guidelines across medical, pharmaceutical, food processing, and industrial sectors compel organizations to adopt reliable protective gloves. The regulatory push for latex-free, chemical-resistant, and durable gloves boosts nitrile glove purchases over traditional alternatives. This regulatory compliance requirement sustains a steady baseline demand for nitrile gloves globally. Furthermore, as governments around the world implement stricter workplace safety laws, companies are increasingly adopting nitrile gloves to meet these evolving compliance requirements, which helps sustain long-term market growth.

- For Instance, The ASTM D6319 standard is widely accepted for nitrile examination gloves requiring rigorous tests for barrier integrity, strength, and leak-resistance.

Superior Technical Performance and Versatility

Nitrile gloves offer superior resistance to punctures, chemicals, oils, and pathogens compared to latex or vinyl gloves, making them ideal across demanding applications from healthcare to food-processing and industrial use. Their hypoallergenic properties address allergy concerns, and their durability and reliability make them a preferred choice for diverse end-uses. Such technical advantages reinforce adoption and drive market growth. Additionally, nitrile gloves’ ability to provide a tactile feel and flexibility while ensuring protection contributes to their expanding use in industries that require precision and safety, such as pharmaceuticals and research.

Key Trends & Opportunities

Shift Toward Powder-Free and Sustainable Gloves

There is a clear shift toward powder-free nitrile gloves, largely driven by allergy reduction, contamination control, and regulatory mandates. Simultaneously, rising environmental awareness and sustainability concerns create opportunities for biodegradable or eco-friendly nitrile glove variants. Manufacturers investing in “green” glove materials can capture demand from environmentally conscious buyers and regulated industries. As sustainable practices become increasingly important to corporate social responsibility, glove manufacturers who embrace eco-friendly production processes and materials are well-positioned to attract customers who value both product quality and environmental impact.

- For Instance, Ansell introduced manufacturing improvements that reduced CO₂ emissions by nearly 30% at select facilities through renewable-energy integration and water-efficient dipping processes, supporting demand for lower-impact PPE options.

Expansion beyond Healthcare into Food, Pharmaceutical & Industrial Sectors

While medical and healthcare remains the dominant end-use, growing demand from food processing, pharmaceutical manufacturing, chemical handling, and industrial sectors opens new growth avenues. As hygiene and safety standards rise globally in these industries, nitrile gloves’ versatility and chemical resistance make them attractive, broadening the market beyond traditional healthcare boundaries. This expanding application is especially driven by the increasing need for protective gloves in food handling, where nitrile gloves are preferred for their non-reactivity and resistance to oils, fats, and certain chemicals commonly found in food processing environments.

- For Instance, a 2025 market review observed that the global disposable gloves market is trending strongly toward nitrile (away from latex and vinyl), with non-medical sectors including industrial, food processing, and general manufacturing accounting for a sizable portion of demand.

Key Challenges

Raw Material Price Volatility and Supply-Chain Constraints

Fluctuations in raw material costs and supply-chain disruptions pose a significant challenge to glove manufacturers, affecting production costs and pricing. Such volatility can squeeze margins and lead to supply shortages or cost-pass-throughs, which may hamper market growth or push customers toward alternatives. Moreover, geopolitical issues and trade restrictions in key glove-producing countries have intensified supply-chain bottlenecks, adding complexity to the production process. Manufacturers must find strategies to mitigate these challenges, such as sourcing from multiple suppliers and investing in more resilient supply chains to maintain market stability.

Competitive Pressure and Market Fragmentation

The global nitrile gloves industry is crowded with many players, including low-cost producers. This competition, combined with fragmented supply chains across regions, challenges profitability. Manufacturers must continuously optimize operations, maintain quality standards, and differentiate their products to avoid margin erosion and commoditization. Furthermore, the rise of new market entrants in emerging economies, offering competitive pricing and local manufacturing advantages, increases pressure on established companies to innovate and streamline their processes, pushing them to continually improve in product differentiation, customer service, and operational efficiency.

Regional Analysis

North America

North America dominates the nitrile gloves market, holding a significant market share of 38.4% in 2024. The increasing demand for gloves in healthcare, pharmaceuticals, and industrial applications is the primary driver. Stringent regulations regarding worker safety, along with growing awareness of infection control, continue to boost market growth. The COVID-19 pandemic further emphasized the importance of PPE, leading to sustained demand. The U.S. is the key contributor to this regional growth, with major manufacturers and a strong healthcare infrastructure supporting the demand for nitrile gloves in both disposable and durable categories.

Europe

Europe accounts for 29.7% of the global nitrile gloves market in 2024, driven by high adoption rates in healthcare and industrial sectors. The region is characterized by stringent regulations regarding workplace safety, leading to increased demand for protective gloves. The growing healthcare infrastructure in countries like Germany, France, and the UK continues to fuel the market. Moreover, the rise in hygiene awareness across sectors such as food processing and pharmaceuticals further contributes to nitrile gloves’ popularity. Sustainability trends in the region also encourage manufacturers to develop eco-friendly, powder-free nitrile gloves to meet consumer demand.

Asia Pacific

Asia Pacific holds the largest share of the nitrile gloves market, with 31.1% in 2024. The region is expected to experience rapid growth, driven by the expanding healthcare industry, particularly in China, India, and Southeast Asia. The increasing healthcare spending and adoption of safety protocols across various industries are major contributors. Additionally, the rise of manufacturing and industrial sectors in countries like Malaysia and Thailand, which are key producers of nitrile gloves, ensures a steady supply of these products globally. Demand for nitrile gloves is further boosted by growing awareness of safety and hygiene.

Latin America

Latin America represents 6.5% of the global nitrile gloves market in 2024. The region’s growth is supported by expanding healthcare and pharmaceutical sectors, particularly in Brazil and Mexico. Increasing healthcare infrastructure, alongside rising awareness of workplace safety and hygiene, has spurred nitrile glove adoption. However, the region faces challenges in terms of economic instability and fluctuating demand from industries like food processing and pharmaceuticals. Despite these challenges, the growing focus on worker safety regulations and the healthcare sector’s expansion provides a solid foundation for nitrile glove market growth in Latin America.

Middle East & Africa

The Middle East and Africa hold a market share of 4.3% in 2024 for nitrile gloves. The market is driven by increasing healthcare investments and rising awareness of infection control across the region. Demand for nitrile gloves is particularly high in the medical and healthcare sectors, as well as industrial applications, including construction and chemical industries. Key countries like Saudi Arabia and the UAE are focusing on expanding healthcare services, leading to heightened demand for PPE. However, limited local manufacturing capacity in the region means that importation remains a key factor in meeting market needs.

Market Segmentations:

By Type

By Product

By End-Use

- Medical & Healthcare

- Examination

- Surgical

- Pharmaceutical

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The nitrile gloves market is highly competitive, with key players such as Ansell, Kimberly-Clark Professional, Hartalega, Kossan, and Cardinal Health leading the industry. These companies dominate the market through strategic partnerships, product innovation, and extensive distribution networks. Major manufacturers focus on enhancing their product portfolios with powder-free, sustainable, and biodegradable gloves to cater to the increasing demand for eco-friendly and high-quality solutions. Companies are investing heavily in production capacities and expanding their operations to meet global demand, especially in emerging markets. For instance, Hartalega and Kossan have significantly increased their production capacities in Malaysia, which is a global hub for nitrile glove manufacturing. Additionally, firms are concentrating on advancing their research and development activities to introduce high-performance gloves for specialized applications such as pharmaceuticals, food processing, and industrial uses. The market also sees the rise of local players in emerging markets, which intensifies competition and price pressures.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Global Gloves S.R.L.

- Kemei

- Ansell

- Kossan

- Cardinal Health

- Kimberly‑Clark Professional

- American Nitrile

- Mercator Medical Ltd.

- Hartalega

- Kim Gloves Co. Ltd.

Recent Developments

- In July 2025, Top Glove Corporation Berhad introduced a new chemotherapy‑grade nitrile glove offering enhanced protection for handling hazardous drugs.

- In October 2024, Ansell’s chemical‑resistant glove “AlphaTec 53‑002” was honored as the “2024 Best New Product of the Year” in the Hand Protection: Chemical/Liquid category by a leading safety magazine.

- In February 2024, Ansell launched a new nitrile disposable glove model “MICROFLEX Mega Texture 93‑256,” designed for industrial workers to provide enhanced chemical, oil, and grime resistance.

Report Coverage

The research report offers an in-depth analysis based on Type, Product, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The global demand for nitrile gloves will continue to rise as healthcare infrastructure expands worldwide, driven by growing medical procedures, higher patient throughput, and increased emphasis on infection control.

- Industries beyond healthcare such as food processing, pharmaceuticals, chemicals, and manufacturing will increasingly adopt nitrile gloves due to stricter hygiene and safety regulations, broadening the user base.

- Manufacturers will invest in advanced glove designs, including powder-free, micro-textured, and eco-friendly/biodegradable variants, to meet rising demand for comfort, safety, and sustainability.

- Growth in emerging economies particularly in Asia Pacific, Latin America, and parts of Africa will contribute significantly to overall market expansion as healthcare spending, industrialization, and regulatory standards improve.

- Demand for disposable gloves will remain strong, given preferences for single-use products in sterile, medical, industrial, and food-handling contexts.

- Regulatory emphasis on workplace safety, infection control, and hygiene standards will continue to mandate glove usage in hospitals, labs, food industries, and chemical/manufacturing plants sustaining long-term demand.

- Supply-chain and production innovations including automation, vertical integration of raw-material sourcing, and improved manufacturing efficiencies will help reduce costs and increase availability globally.

- Rising global awareness about latex allergies and glove-related skin sensitization will drive continued migration from latex to nitrile gloves, boosting nitrile adoption.

- Expansion of outsourced healthcare, home-care services, and diagnostic testing labs will elevate demand for gloves outside traditional hospital settings.

- Growing emphasis on sustainability and environmental impact will encourage development and adoption of recyclable or biodegradable nitrile gloves, opening new market opportunities.