Market Overview:

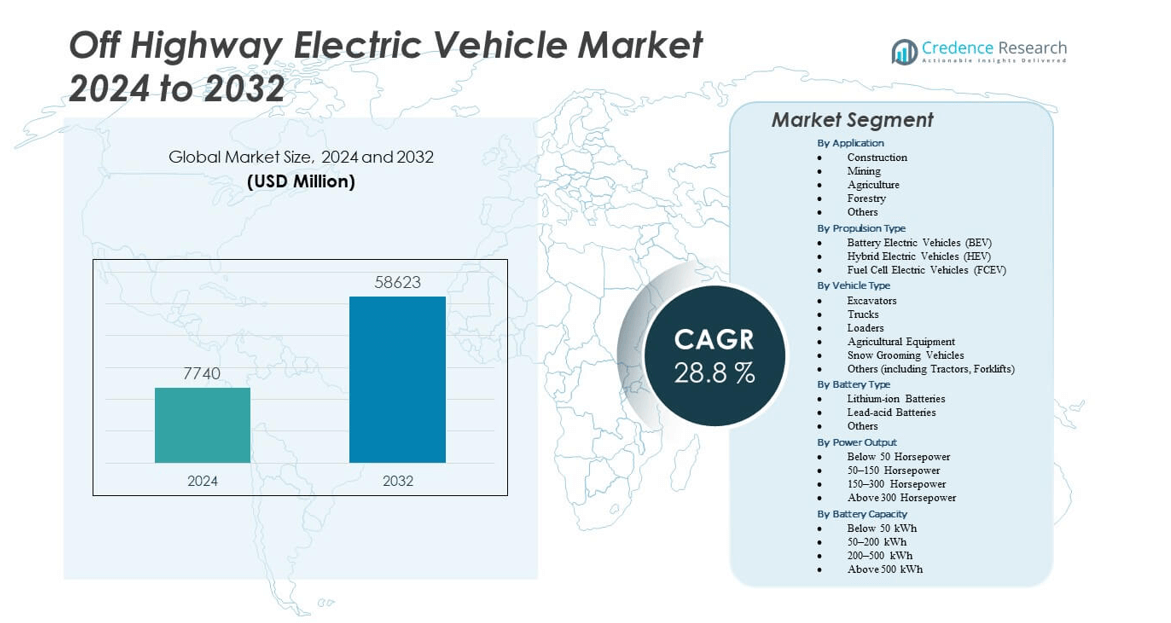

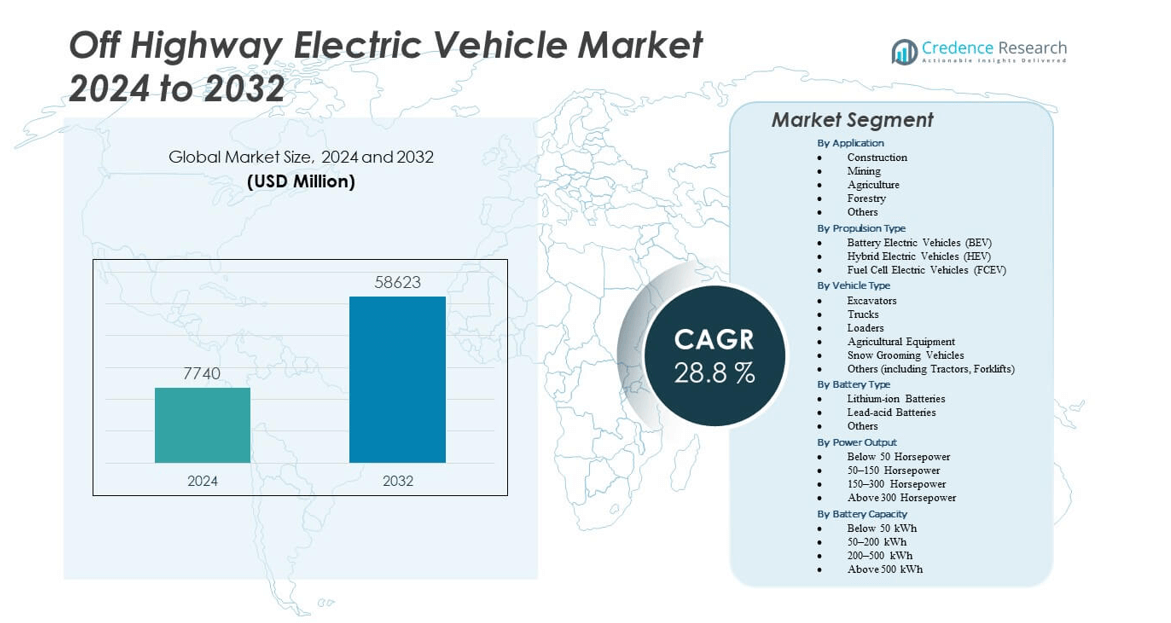

The Off Highway Electric Vehicle Market is projected to grow from USD 7,740 million in 2024 to an estimated USD 58,623 million by 2032, with a compound annual growth rate (CAGR) of 28.8% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Off-Highway Electric Vehicles Market Size 2024 |

USD 7,740 million |

| Off-Highway Electric Vehicles Market, CAGR |

28.8% |

| Off-Highway Electric Vehicles Market Size 2032 |

USD 58,623 million |

The market growth is driven by a strong push toward sustainability, rising fuel costs, and stricter emission regulations that are encouraging industries to adopt electric alternatives for off-highway operations. Mining, agriculture, and construction sectors are leading the transition as companies aim to cut operational costs while meeting environmental targets. Advances in battery technology, improved charging infrastructure, and government incentives are further accelerating adoption. Major manufacturers are investing heavily in research and development to produce high-performance electric vehicles with longer operating hours and reduced downtime, supporting the market’s expansion.

Regionally, North America and Europe are emerging as leading markets due to strong regulatory frameworks, established infrastructure, and high awareness of environmental impacts. The Asia Pacific region is rapidly catching up, fueled by increasing industrialization, government-backed electrification programs, and the presence of key manufacturing hubs such as China and India. Latin America and the Middle East are still in the early stages but hold significant potential with rising construction and mining activities. This geographic diversification highlights how different regions are shaping the trajectory of the Off Highway Electric Vehicle Market through policy, investment, and industrial demand.

Market Insights:

- The Off Highway Electric Vehicle Market is projected to grow from USD 7,740 million in 2024 to USD 58,623 million by 2032, at a CAGR of 28.8%.

- Stricter emission regulations are pushing industries to replace diesel-based machinery with electric alternatives.

- Rising fuel prices and maintenance savings are increasing demand for electric equipment across heavy industries.

- High upfront costs and limited awareness among smaller operators remain key restraints for the market.

- North America holds 32% share, Europe accounts for 28%, and Asia Pacific leads with 34% due to rapid industrialization.

- Infrastructure gaps in remote construction and mining zones continue to slow widespread adoption.

- Growing government incentives and investment commitments are strengthening the long-term growth of the Off Highway Electric Vehicle Market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Environmental Regulations and Demand for Sustainable Alternatives

Governments across major economies are enforcing stricter emission norms, compelling industries to adopt cleaner power solutions. Companies in mining, agriculture, and construction face regulatory pressure to reduce carbon footprints. Electric vehicles provide a viable pathway to meet compliance standards while maintaining operational efficiency. It helps reduce reliance on fossil fuels, which directly supports corporate sustainability goals. Strong commitments to net-zero targets are encouraging early adoption of electric machinery. Infrastructure policies focused on green transition reinforce the shift. The Off Highway Electric Vehicle Market benefits from this alignment between regulation and corporate sustainability.

Advancements in Battery Technology and Extended Operational Range

Improved lithium-ion and solid-state batteries are driving confidence in electric alternatives for demanding industries. Enhanced energy density supports longer operational cycles, making electric machinery practical for remote worksites. Fast-charging technologies reduce downtime, ensuring productivity levels remain stable. It delivers performance comparable to conventional diesel engines, strengthening adoption across sectors. Declining battery costs are lowering entry barriers for manufacturers and end-users. Strong R&D initiatives from global players ensure continuous improvements in energy storage. The Off Highway Electric Vehicle Market gains momentum through reliable and efficient battery-driven systems.

- For instance, Caterpillar successfully demonstrated its 793 battery-electric mining truck equipped with a 2,650 kWh battery pack, completing a full production cycle while hauling a 265-ton payload.

Increasing Fuel Prices and Operational Cost Efficiency

Rising fuel costs create an urgent need for more economical alternatives in off-highway operations. Electric equipment reduces dependency on diesel, offering significant cost savings over lifecycle usage. Maintenance expenses also decline due to fewer moving parts in electric systems. It enables operators to achieve higher profit margins without compromising productivity. Industry leaders are adopting electric vehicles to stabilize long-term costs. Contractors and fleet managers are prioritizing predictable expense structures over volatile fuel expenditures. The Off Highway Electric Vehicle Market accelerates its growth as operational efficiency becomes a central business requirement.

- For instance, JCB unveiled its 19C-1E mini electric excavator, its first fully electric model designed to deliver zero exhaust emissions, reduced noise, and lower operating costs compared to conventional diesel-powered machines.

Strong Government Incentives and Industry Investment Commitments

Financial incentives, subsidies, and tax rebates from governments encourage large-scale adoption of electric off-highway machinery. Public-private partnerships support infrastructure development for charging facilities in industrial regions. It stimulates demand among small and medium enterprises that rely on external support for technology adoption. Multinational corporations are committing significant investments to expand their electric portfolios. Long-term contracts and fleet replacement programs create predictable demand. Pilot projects across industrial hubs demonstrate performance success and boost confidence. The Off Highway Electric Vehicle Market expands through combined efforts of supportive policy frameworks and industry investments.

Market Trends

Integration of Digital Platforms with Off-Highway Electric Systems

The adoption of digital monitoring platforms is redefining how electric vehicles operate in off-highway industries. Telematics systems enhance real-time tracking of battery performance and operational metrics. Predictive analytics supports maintenance planning and reduces equipment downtime. It helps companies improve resource allocation and decision-making efficiency. Cloud-based platforms connect multiple fleets for centralized control. Integration of AI-driven tools improves productivity by automating monitoring processes. The Off Highway Electric Vehicle Market evolves through the fusion of digital technologies and electrification strategies.

Growing Adoption of Hybrid Electric Models in Transitional Industries

Hybrid electric vehicles are becoming increasingly common where full electrification faces infrastructure challenges. These models allow companies to reduce emissions while ensuring operational continuity. It provides flexibility for industries working in remote or fuel-dependent environments. Hybrid systems extend range and allow gradual transition toward full electric adoption. Manufacturers are introducing modular powertrains to support customization. Customers in construction and agriculture value the balance between efficiency and dependability. The Off Highway Electric Vehicle Market strengthens its position with hybrid adoption bridging gaps in energy transition.

- For instance, Caterpillar introduced its D7E electric-drive dozer, designed with a diesel-electric hybrid system that delivers higher efficiency, reduced fuel consumption, and full performance in demanding construction environments.

Customization of Electric Vehicles for Industry-Specific Requirements

Manufacturers are developing specialized electric vehicles tailored for industries such as mining, forestry, and large-scale agriculture. Design innovation focuses on heavy-duty performance, rugged durability, and adaptability to harsh terrains. It ensures electric machinery can match or surpass traditional models in specialized environments. Companies invest in modular designs that allow operators to upgrade or adapt vehicles easily. Customization increases operational efficiency and user satisfaction. Industrial buyers seek machines that align with sector-specific workflows. The Off Highway Electric Vehicle Market gains strength from bespoke solutions designed to meet complex industry needs.

Expansion of Charging Infrastructure Across Industrial Zones

The installation of fast-charging stations in mining sites, ports, and agricultural hubs is accelerating adoption. Industrial operators demand reliable charging solutions that minimize downtime and increase vehicle availability. It supports large-scale deployment by removing key infrastructure barriers. Public authorities collaborate with private firms to expand grid connectivity in remote areas. Innovations such as mobile charging stations add flexibility in off-highway operations. Construction and mining companies are piloting dedicated charging hubs to streamline usage. The Off Highway Electric Vehicle Market advances as infrastructure scales to meet heavy-duty demands.

- For instance, ABB deployed its eMine™ FastCharge system at Boliden’s Aitik mine in Sweden, a high-power solution delivering up to 600 kW per charger to support rapid charging of heavy-duty electric haul trucks.

Market Challenges Analysis

High Upfront Costs and Limited Awareness Among End Users

High capital requirements pose a barrier to adoption for smaller contractors and regional operators. Many end-users remain hesitant due to limited awareness of long-term savings and performance reliability. It creates an adoption gap despite supportive policies and cost benefits. Lack of financing solutions for heavy machinery purchases further delays transitions. Customers often compare initial purchase costs with diesel-powered alternatives and delay investment. Training requirements for operators add to short-term expenses. The Off Highway Electric Vehicle Market faces difficulty in penetrating price-sensitive regions where awareness is still low.

Infrastructure Gaps and Technical Limitations in Remote Areas

Charging infrastructure remains unevenly distributed, particularly in mining and agricultural regions. Remote operations lack reliable grid connectivity, making large-scale electrification complex. It restricts adoption even where demand is strong. Technical limitations such as reduced performance in extreme conditions create further hesitation. Battery degradation under heavy workloads raises concerns about lifespan and replacement costs. Industry stakeholders are addressing these challenges, but progress is uneven. The Off Highway Electric Vehicle Market must overcome infrastructure and technical hurdles to achieve consistent global penetration.

Market Opportunities

Expansion in Emerging Economies with Industrial Growth

Emerging markets are experiencing rapid industrialization, creating opportunities for electric adoption in construction and mining. Governments in these regions promote electrification through incentives and environmental commitments. It supports a strong demand base for modern, efficient machinery. Urbanization and infrastructure projects generate long-term demand for electric fleets. International manufacturers see these regions as growth engines for future expansion. Domestic players are entering partnerships with global firms to accelerate technology transfer. The Off Highway Electric Vehicle Market can leverage this demand surge in developing economies.

Innovation in Autonomous and AI-Enabled Off-Highway Vehicles

Integration of AI and automation is opening opportunities for next-generation electric equipment. Autonomous systems improve safety and reduce dependence on human labor in hazardous environments. It enhances productivity by ensuring precise operations in mining and agriculture. AI-powered sensors and data analytics optimize energy usage and extend battery life. Manufacturers are investing in research to combine automation with electrification. Customers show strong interest in vehicles capable of operating independently in remote zones. The Off Highway Electric Vehicle Market advances by integrating smart and autonomous features into electric platforms.

Market Segmentation Analysis:

By applications, the Off Highway Electric Vehicle Market demonstrates strong diversification across multiple applications including construction, mining, agriculture, and forestry. Construction and mining lead adoption due to high demand for heavy-duty vehicles capable of operating in emission-regulated environments. Agriculture follows with growing use of electric tractors and equipment to improve efficiency and reduce operational costs. Forestry and other specialized applications expand adoption gradually with niche requirements. Each sector benefits from government-backed sustainability programs and the rising need to reduce dependence on diesel-based machinery.

- For instance, John Deere showcased its 310 X-Tier E-Power backhoe loader prototype, designed to deliver diesel-like performance with zero tailpipe emissions, while Epiroc’s battery-electric underground mining truck MT42 has been deployed in operations in Sweden and Canada with a 42-tonne hauling capacity.

By propulsion type, Battery Electric Vehicles dominate owing to rapid advancements in lithium-ion technology, cost efficiency, and wide deployment across industries. Hybrid Electric Vehicles hold relevance in regions with limited charging infrastructure, providing flexibility for operators managing long work shifts. Fuel Cell Electric Vehicles remain in early adoption stages but show promise for long-range operations in mining and construction where heavy loads demand extended power supply. It reflects the industry’s phased transition toward complete electrification.

By vehicle type, excavators, trucks, and loaders form the largest demand base due to their heavy use in construction and mining operations. Agricultural equipment also emerges as a fast-growing segment with increasing investment in precision farming. Snow grooming vehicles and other categories, including tractors and forklifts, address specialized applications.

By battery type, lithium-ion holds dominance given its higher energy density and longer lifespan, while lead-acid and others serve cost-sensitive uses.

By power output segmentation highlights significant traction in the 50–300 horsepower range, covering the majority of industrial requirements. Higher output above 300 horsepower addresses large-scale mining and infrastructure projects.

By battery capacity, the 50–200 kWh and 200–500 kWh ranges attract attention for their balance of performance and cost. It positions the market toward scalable adoption across small, medium, and large industrial operations.

- For instance, Volvo CE’s L25 Electric compact loader is equipped with a 48 kWh battery that supports up to 6 hours of work per charge, while Hitachi’s ZE85 battery-electric excavator integrates a high-capacity lithium-ion battery system to extend runtime for medium-scale projects. On a larger scale, Caterpillar’s 793 battery-electric mining truck prototype carries a modular lithium-ion battery pack with a total capacity of 2.65 MWh, designed for continuous heavy-load operations.

Segmentation:

By Application

- Construction

- Mining

- Agriculture

- Forestry

- Others

By Propulsion Type

- Battery Electric Vehicles (BEV)

- Hybrid Electric Vehicles (HEV)

- Fuel Cell Electric Vehicles (FCEV)

By Vehicle Type

- Excavators

- Trucks

- Loaders

- Agricultural Equipment

- Snow Grooming Vehicles

- Others (including Tractors, Forklifts)

By Battery Type

- Lithium-ion Batteries

- Lead-acid Batteries

- Others

By Power Output

- Below 50 Horsepower

- 50–150 Horsepower

- 150–300 Horsepower

- Above 300 Horsepower

By Battery Capacity

- Below 50 kWh

- 50–200 kWh

- 200–500 kWh

- Above 500 kWh

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America holds a market share of 32% in the Off Highway Electric Vehicle Market, driven by strong regulatory frameworks, advanced infrastructure, and early adoption of sustainable technologies. The United States leads the region with high investments in construction and mining projects that prioritize electric machinery for lower emissions and cost efficiency. Canada follows with government incentives promoting electric adoption in agriculture and forestry. Mexico contributes with expanding industrial projects that demand cost-effective and eco-friendly solutions. It benefits from strong presence of global manufacturers and supportive financing mechanisms for electric fleets.

Europe accounts for 28% market share, supported by stringent emission regulations and strong commitments toward carbon neutrality. Germany, the United Kingdom, and France are the leading contributors with advanced infrastructure and high levels of industrial electrification. Demand in construction and agricultural sectors is expanding as governments fund green technology adoption. It focuses on integrating advanced battery systems and hybrid models for operational efficiency in diverse industrial environments. The region benefits from strong collaboration between policymakers and manufacturers, enabling faster deployment of specialized electric machinery.

Asia Pacific leads with 34% market share, emerging as the fastest-growing region supported by rapid industrialization and strong government-backed electrification programs. China dominates with large-scale manufacturing hubs and widespread adoption of electric trucks and loaders. India shows accelerating adoption in agriculture and construction with policy-driven incentives. Japan, South Korea, and Australia strengthen the region’s position with advanced R&D and deployment of high-performance equipment. It expands further with rising demand in infrastructure development and precision farming. Latin America holds 4% share led by Brazil, while the Middle East & Africa represent 2% share, with growth supported by mining and construction in South Africa, UAE, and Saudi Arabia.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Caterpillar Inc.

- Komatsu Ltd.

- Volvo Group (AB Volvo)

- Deere & Company (John Deere)

- CNH Industrial N.V.

- J C Bamford Excavators Ltd. (JCB)

- Hitachi Construction Machinery Co., Ltd.

- Liebherr Group

- Sandvik AB

- SANY Group

- Epiroc AB

- XCMG (Xuzhou Construction Machinery Group)

- Zoomlion Heavy Industry

- Hyundai Construction Equipment Co., Ltd.

- Doosan Corporation/Bobcat Company

- Prinoth AG

Competitive Analysis:

The Off Highway Electric Vehicle Market is characterized by intense competition among global leaders such as Caterpillar, Komatsu, Volvo Group, Deere & Company, and Hitachi Construction Machinery. These companies invest heavily in research and development to expand portfolios of battery-electric and hybrid equipment for construction, mining, and agriculture. European players including Liebherr, Sandvik, and Epiroc emphasize advanced battery systems and underground mining solutions, while Asian manufacturers like SANY, XCMG, and Zoomlion strengthen their presence through cost-effective electric machinery. It benefits from partnerships, acquisitions, and joint ventures aimed at scaling production and advancing technology. North American firms, led by John Deere and Bobcat, focus on compact and agricultural machinery, reflecting diverse applications. Strategic priorities include extending operational range, reducing lifecycle costs, and meeting emission standards. The market remains highly dynamic, with new product launches and infrastructure collaborations shaping competitive positioning across regions.

Recent Developments:

- In July 2024, Fortescue Metals formed a partnership with Liebherr Mining to deploy and validate a fully integrated autonomous haulage solution at the Christmas Creek mine site, featuring a fleet management system and onboard autonomy kit for the Liebherr T 264 truck—this system coordinates diverse autonomous vehicles and supports Fortescue’s goal for zero Scope 1 and 2 emissions by 2030.

- In July 2024, Eleo, a subsidiary of Yanmar, launched a new line of modular battery packs engineered for off-highway electric vehicles, offering scalable voltage ranges between 50V and 720V and delivering up to 90 kW of continuous power with flexible integration for low-volume, high-diversity off-road applications.

- In January 2024, Caterpillar partnered with CRH plc to accelerate the deployment of battery electric off-highway trucks, specifically focusing on introducing electric 70–100 ton-class vehicles and intelligent charging infrastructure at CRH’s site in North America.

Report Coverage:

The research report offers an in-depth analysis based on Application, Propulsion Type, Vehicle Type, Battery Type, Power Output and Battery Capacity. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Off Highway Electric Vehicle Market will expand with increasing adoption in construction, mining, and agriculture supported by sustainability targets.

- Advances in battery technology will enhance operational efficiency and extend equipment lifespan for diverse applications.

- Charging infrastructure development in industrial and remote zones will accelerate large-scale deployment of electric machinery.

- Hybrid and fuel cell vehicles will gain traction in operations requiring extended range and heavy-duty performance.

- Manufacturers will prioritize cost optimization and lifecycle efficiency to address barriers for smaller contractors and emerging markets.

- Integration of AI, telematics, and automation will strengthen fleet management and improve productivity in off-highway operations.

- Governments will continue to support adoption through incentives, emission regulations, and funding for electrification initiatives.

- Emerging economies will become major growth drivers due to rapid industrialization and infrastructure development.

- Strategic collaborations between OEMs and battery suppliers will shape innovation and competitive advantages.

- Increasing customer preference for low-emission, high-performance machinery will define long-term demand in the Off Highway Electric Vehicle Market.