| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Optoelectronics Market Size 2024 |

USD 11,164.21 million |

| Optoelectronics Market, CAGR |

12.36% |

| Optoelectronics Market Size 2032 |

USD 28,298.54 million |

Market Overview

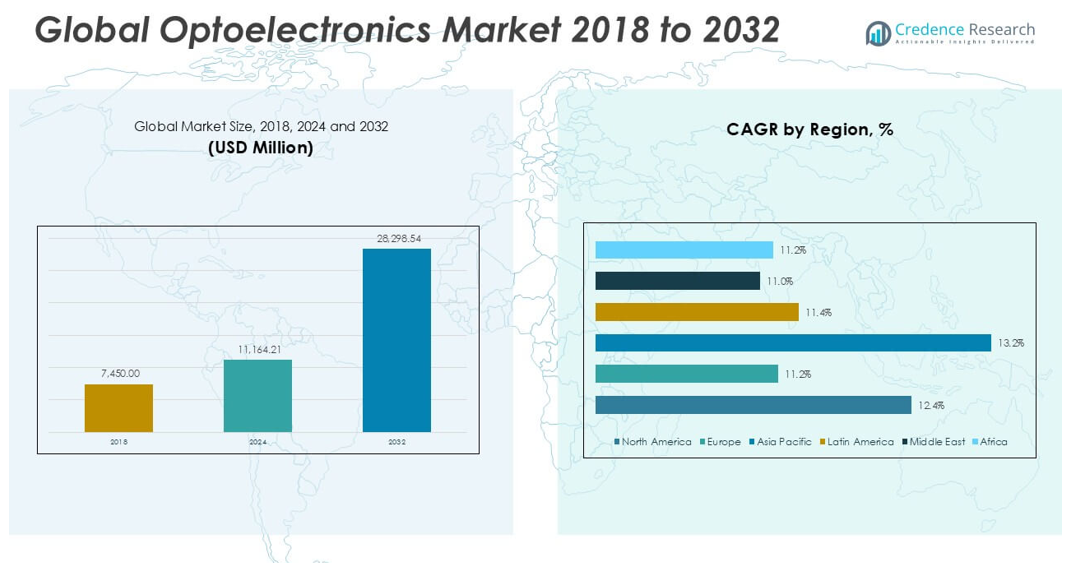

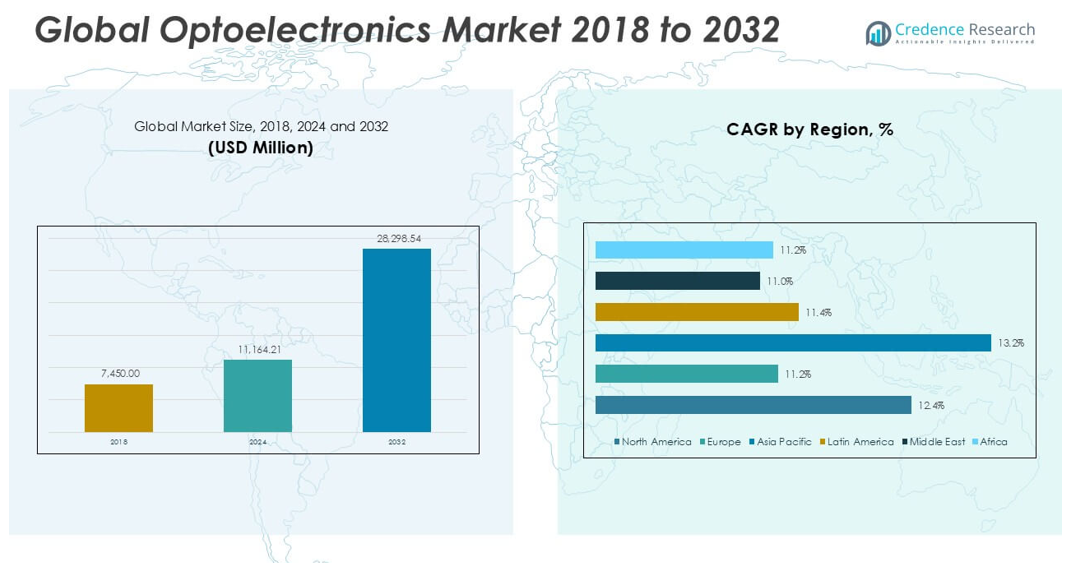

The Global Optoelectronics Market is projected to grow from USD 11,164.21 million in 2024 to an estimated USD 28,298.54 million by 2032, with a compound annual growth rate (CAGR) of 12.36% from 2025 to 2032.

The market growth is fueled by the increasing use of optoelectronic components in high-performance applications, such as LiDAR systems, autonomous vehicles, and medical imaging. The rising consumer preference for high-resolution displays, advanced sensors, and low-power consumption devices is contributing to market momentum. Additionally, rapid advancements in semiconductor technology and the expansion of fiber optic communication networks are key trends shaping the market landscape. The growing focus on renewable energy solutions, particularly the use of photovoltaic cells in solar power generation, is also expected to boost demand in the coming years.

Geographically, the Asia Pacific region holds a dominant position in the Global Optoelectronics Market, supported by strong manufacturing capabilities in countries like China, Japan, and South Korea. North America and Europe are also witnessing steady growth due to increasing adoption of advanced technologies in the automotive and healthcare sectors. Key players operating in the market include Sony Corporation, Samsung Electronics Co., Ltd., Osram Licht AG, ROHM Co., Ltd., Hamamatsu Photonics K.K., and Vishay Intertechnology, Inc.

Market Insights

- The Global Optoelectronics Market is projected to grow significantly, reaching over USD 28 billion by 2032 with a CAGR of 12.36%.

- Rising adoption of energy-efficient optoelectronic components in consumer electronics and automotive sectors drives market expansion.

- Rapid advancements in semiconductor technology and fiber optic communications boost demand for high-performance optoelectronic devices.

- Market growth faces challenges from high manufacturing costs and complex production processes limiting scalability.

- Asia Pacific dominates the market, supported by strong manufacturing capabilities in China, Japan, and South Korea.

- North America and Europe maintain steady growth, fueled by technological innovation in healthcare and automotive applications.

- Increasing investments in renewable energy solutions, especially photovoltaic cells, create new growth opportunities across regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for Energy-Efficient Consumer Electronics Supports Market Expansion

The Global Optoelectronics Market benefits from the increasing demand for energy-efficient consumer electronic devices. Rising consumer awareness regarding energy consumption drives the preference for optoelectronic components in smartphones, televisions, and lighting systems. Consumers seek advanced products that offer superior display quality and lower power usage. The market meets this requirement through technologies like OLEDs and LED lighting. Manufacturers continue to integrate optoelectronics to enhance product performance while reducing energy consumption. It helps companies address both regulatory efficiency standards and consumer expectations for sustainable products.

- For instance, a 2020 study by the Consumer Technology Association estimated that 3.3 billion consumer tech devices in U.S. homes consumed approximately 176 terawatt-hours of electricity, with industry efforts making these devices increasingly energy efficient even as the total number of devices rises

Rapid Adoption of Optoelectronics in Automotive Safety and Lighting Systems

The automotive industry plays a vital role in the growth of the Global Optoelectronics Market. Modern vehicles increasingly feature optoelectronic solutions for advanced driver-assistance systems (ADAS), night vision, and automotive lighting. Automotive manufacturers rely on optoelectronic sensors and lighting to improve vehicle safety and user experience. It enables precise obstacle detection, adaptive lighting, and improved visibility under challenging conditions. Growing consumer focus on vehicle safety encourages further integration of these components. Stringent automotive safety regulations worldwide also support this growing application of optoelectronics.

- For instance, a study by the National Highway Traffic Safety Administration (NHTSA) found that drowsy driving was responsible for over 91,000 crashes in the United States in a single year, highlighting the importance of integrating optical sensors and advanced safety features in vehicles to help prevent such incidents.

Expansion of High-Speed Communication Networks Drives Component Demand

The rapid development of fiber optic communication networks significantly strengthens the Global Optoelectronics Market. Telecom providers invest in optoelectronic components to achieve faster data transmission and lower latency. It enables the deployment of high-speed internet and supports growing data traffic from cloud services and smart devices. Governments worldwide prioritize digital infrastructure, which increases the demand for optical transmitters, receivers, and amplifiers. The market responds by offering high-performance, cost-effective components to meet telecom requirements. Continuous network upgrades contribute to the consistent demand for optoelectronics.

Increasing Use of Optoelectronics in Medical and Industrial Applications

The Global Optoelectronics Market experiences strong growth from expanding medical and industrial applications. Medical imaging devices, surgical systems, and diagnostic tools increasingly incorporate optoelectronic components to improve accuracy and efficiency. It provides healthcare professionals with enhanced visualization and precise diagnostic capabilities. In industrial sectors, optoelectronic sensors support automation, quality inspection, and process monitoring. Manufacturers adopt these technologies to ensure higher productivity and reduced operational errors. The integration of optoelectronics across these sectors solidifies its importance in high-precision environments.

Market Trends

Rising Integration of Optoelectronics in Smart Consumer Devices Enhances Market Growth

The Global Optoelectronics Market sees strong growth through the increasing integration of optoelectronic components in smart consumer devices. Companies continue to introduce advanced smartphones, wearables, and home automation products that rely on these technologies. It supports features like facial recognition, ambient light sensing, and high-definition displays. Manufacturers prioritize optoelectronic components to offer compact, energy-efficient, and multifunctional devices. Consumers show high demand for smart, connected products that deliver enhanced performance and visual clarity. The growing popularity of these devices drives continuous innovation in the optoelectronics sector.

- For instance, a 2024 survey by the Consumer Technology Association found that over 350 million smart consumer devices incorporating optoelectronic components—such as image sensors and OLED displays—were shipped globally in a single year.

Strong Focus on Miniaturization of Optoelectronic Components Shapes Market Direction

The trend toward miniaturization strongly influences the Global Optoelectronics Market. Manufacturers develop smaller, more efficient optoelectronic components to meet the needs of portable and space-constrained applications. It enables integration into compact devices without compromising performance or durability. The focus on lightweight and miniature solutions benefits sectors such as medical, automotive, and telecommunications. Companies invest in advanced manufacturing techniques to achieve size reduction and improve energy efficiency. This trend supports the development of next-generation products with advanced optical and electronic functionalities.

- For instance, more than 120 companies launched over 500 new miniaturized optoelectronic components for use in medical devices, automotive sensors, and next-generation communication equipment.

Increasing Demand for Advanced Display Technologies Accelerates Market Evolution

The Global Optoelectronics Market experiences steady growth with the rising adoption of advanced display technologies. Demand for OLED, micro-LED, and quantum dot displays continues to increase in smartphones, televisions, and wearable devices. It offers improved brightness, contrast, and energy efficiency compared to traditional display technologies. Manufacturers respond to consumer expectations for immersive visual experiences and high-performance displays. The transition to flexible and transparent screens creates further opportunities for opoelectronic innovation. Growing investment in display advancements fuels the development of specialized optoelectronic components.

Strong Deployment of Optoelectronics in Renewable Energy Systems Supports Market Expansion

The Global Optoelectronics Market gains momentum through its expanding role in renewable energy systems, particularly in solar power. Photovoltaic cells, a key application of optoelectronics, contribute to efficient solar energy generation. It helps energy companies address increasing global demand for sustainable power solutions. Governments and private sectors continue to invest in solar infrastructure, creating steady demand for advanced optoelectronic technologies. Manufacturers focus on improving the efficiency and durability of photovoltaic components to enhance energy output. The growing emphasis on clean energy solutions strengthens the relevance of optoelectronics in the energy sector.

Market Challenges

High Manufacturing Costs and Complex Production Processes Restrict Market Scalability

The Global Optoelectronics Market faces significant challenges due to high manufacturing costs and complex production processes. Producing optoelectronic components requires advanced materials, precision equipment, and strict quality control, which increase overall costs. It limits the ability of smaller companies to enter the market and scale their operations efficiently. Complex fabrication processes often lead to production delays and supply chain disruptions. High costs also make it difficult for manufacturers to offer competitive pricing, especially in cost-sensitive applications. The pressure to balance performance, quality, and affordability remains a persistent challenge for industry players.

- For instance, according to SEMI (Semiconductor Equipment and Materials International), the average cost to build a new optoelectronics fabrication facility exceeds 1 billion dollars, and equipment installation alone can require more than 200 specialized machines, illustrating the substantial capital and technical barriers to market entry.

Rapid Technological Changes and Short Product Lifecycles Increase Market Pressure

The Global Optoelectronics Market encounters constant pressure from rapid technological changes and short product lifecycles. Continuous innovation forces companies to invest heavily in research and development to stay competitive. It creates challenges in maintaining product relevance and meeting evolving customer expectations. Fast-paced advancements can lead to inventory obsolescence and financial risks for manufacturers. Companies must quickly adapt to new technologies without compromising product quality or performance. The need for frequent updates and shorter development cycles makes it difficult to achieve long-term market stability.

Market Opportunities

Expanding Applications in Emerging Technologies Create Strong Growth Opportunities

The Global Optoelectronics Market holds significant opportunities through its expanding applications in emerging technologies. It plays a key role in supporting artificial intelligence, autonomous vehicles, and advanced robotics. The growing need for precision sensing, high-speed data transfer, and intelligent imaging creates new demand for optoelectronic components. Companies can develop specialized solutions for these fast-evolving sectors and build long-term growth channels. Strong investment in smart cities and connected infrastructure further strengthens the opportunity landscape. Manufacturers can capitalize on these trends by offering tailored, high-performance optoelectronic systems.

Rising Demand for Healthcare and Medical Imaging Drives New Revenue Potential

The Global Optoelectronics Market benefits from the rising demand for healthcare and advanced medical imaging solutions. It enables the development of high-precision diagnostic devices, surgical imaging systems, and wearable health monitors. Increasing global focus on early disease detection and minimally invasive procedures creates steady demand for optoelectronic innovation. Manufacturers can introduce customized components that improve medical imaging accuracy and patient outcomes. The growing adoption of telemedicine and portable diagnostic equipment offers further avenues for market expansion. Healthcare advancements present long-term opportunities for specialized optoelectronic applications.

Market Segmentation Analysis

By Device

The Global Optoelectronics Market is segmented into LEDs, sensors, infrared components, optocouplers, photovoltaic cells, displays, and others. LEDs hold a significant share due to their energy efficiency, long lifespan, and increasing use in lighting and display applications. Sensors see strong demand from the automotive, healthcare, and consumer electronics industries. Infrared components and optocouplers support critical functions in security, surveillance, and industrial automation. Photovoltaic cells contribute to the rising focus on renewable energy solutions. Displays continue to gain traction in consumer electronics and smart devices. It offers a broad range of devices that address varied technological needs across industries.

- For instance, industry data from Omdia and company shipment reports indicate that global LED production exceeded 120 billion units in 2024, making LEDs the most widely manufactured device in the optoelectronics sector.

By Application

The Global Optoelectronics Market segments by application into communication, security and surveillance, lighting, measurement, displays, and others. Communication holds a leading position due to the growing demand for fiber optic networks and high-speed data transmission. Security and surveillance applications drive strong market growth with increasing investments in public safety and monitoring systems. Lighting remains a key segment driven by the transition to energy-efficient technologies. Measurement applications benefit from the rising use of precision sensors and control systems. Displays find broad use in consumer electronics and automotive dashboards. It provides solutions that support reliable performance across these diverse applications.

- For instance, according to the International Telecommunication Union (ITU), over 600 million kilometers of optical fiber were installed globally in 2024 to support expanding communication networks, underlining the critical role of optoelectronic devices in this application.

By Device Material

The Global Optoelectronics Market classifies device materials into gallium phosphide, gallium arsenide, gallium nitride, silicon carbide, silicon-germanium, and indium phosphide. Gallium nitride holds a major share due to its high efficiency and thermal stability, making it suitable for LEDs and high-frequency applications. Gallium arsenide is widely used in high-speed and optoelectronic devices. Silicon carbide offers benefits in high-power applications and renewable energy systems. Indium phosphide and silicon-germanium serve critical roles in fiber optic communication and advanced sensors. Gallium phosphide supports LED production for specific lighting solutions. It leverages material innovation to meet the growing demand for performance and durability.

By Industry Vertical

The Global Optoelectronics Market segments by industry vertical into consumer electronics, automotive, aerospace and defense, IT and telecommunication, food and beverage, healthcare, energy and utilities, and others. Consumer electronics dominate the market due to strong demand for smartphones, wearables, and smart home devices. Automotive applications see rapid growth with increasing use of ADAS, lighting, and infotainment systems. Aerospace and defense sectors require advanced optoelectronic components for sensing and communication. IT and telecommunication rely on optoelectronics for high-speed data transfer. Healthcare benefits from precise imaging and diagnostic tools. It serves multiple industries with specialized optoelectronic solutions that improve performance and efficiency.

Segments

Based on Device

- LEDs

- Sensors

- Infrared Components

- Optocouplers

- Photovoltaic Cells

- Display

- Others

Based on Application

- Communication

- Security & Surveillance

- Lighting

- Measurement

- Displays

- Others

Based on Device Material

- Gallium Phosphide

- Gallium Arsenide

- Gallium Nitride

- Silicon Carbide

- Silicon-Germanium

- Indium Phosphide

Based on Industry Vertical

- Consumer Electronics

- Automotive

- Aerospace & Defense

- IT & Telecommunication

- Food & Beverage

- Healthcare

- Energy & Utilities

- Others

Based on Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Optoelectronics Market

The North America Optoelectronics Market is projected to grow from USD 3,240.08 million in 2024 to USD 8,264.59 million by 2032, with a CAGR of 12.4% from 2025 to 2032. It holds a regional market share of approximately 29% in 2024. Strong adoption of advanced consumer electronics, high-speed communication networks, and automotive safety systems drives market growth in the United States and Canada. The region benefits from the presence of leading technology companies and robust investment in fiber optic infrastructure. The growing focus on renewable energy also supports demand for photovoltaic components. It continues to attract large investments in next-generation display technologies and smart home devices.

Europe Optoelectronics Market

The Europe Optoelectronics Market is expected to expand from USD 2,274.93 million in 2024 to USD 5,313.62 million by 2032, with a CAGR of 11.2% during the forecast period. Europe holds a regional market share of approximately 20% in 2024. Strong automotive production, particularly in Germany and France, fuels demand for optoelectronic sensors and lighting systems. The region also focuses on enhancing telecommunication infrastructure and renewable energy adoption. It supports technological innovation in energy-efficient lighting, displays, and medical imaging devices. Rising demand for advanced surveillance systems and precision manufacturing continues to push market growth in this region.

Asia Pacific Optoelectronics Market

The Asia Pacific Optoelectronics Market is set to grow from USD 4,251.89 million in 2024 to USD 11,459.78 million by 2032, with a leading CAGR of 13.2% from 2025 to 2032. The region commands the largest market share of approximately 38% in 2024. Strong manufacturing hubs in China, Japan, and South Korea drive the market with large-scale production of consumer electronics and automotive components. Rapid expansion of telecommunication networks and smart city projects further boosts demand for optoelectronic devices. It benefits from cost-effective production and increasing adoption of solar energy technologies. The region shows sustained growth driven by industrial development and rising consumer demand.

Latin America Optoelectronics Market

The Latin America Optoelectronics Market is projected to grow from USD 650.76 million in 2024 to USD 1,535.76 million by 2032, with a CAGR of 11.4% through the forecast period. It holds a regional market share of approximately 6% in 2024. Countries like Brazil and Mexico contribute significantly through growing investments in automotive, communication, and consumer electronics. The region steadily expands its telecommunication infrastructure, which supports the demand for optical components. It also shows increasing interest in renewable energy installations, particularly photovoltaic systems. Latin America strengthens its position with emerging opportunities in industrial automation and smart device adoption.

Middle East Optoelectronics Market

The Middle East Optoelectronics Market is expected to rise from USD 358.26 million in 2024 to USD 823.20 million by 2032, with a CAGR of 11.0% from 2025 to 2032. It holds a regional market share of approximately 3% in 2024. Strong investments in smart city development, particularly in the UAE and Saudi Arabia, drive demand for optoelectronic devices. The region focuses on enhancing security and surveillance systems, which increases the use of infrared and sensor components. It steadily integrates optoelectronics in communication, energy, and healthcare projects. Growing reliance on solar energy solutions supports the use of photovoltaic cells across the Middle East.

Africa Optoelectronics Market

The Africa Optoelectronics Market is projected to expand from USD 388.29 million in 2024 to USD 901.59 million by 2032, at a CAGR of 11.2% during the forecast period. The region holds a regional market share of approximately 3% in 2024. Countries across Africa continue to improve telecommunication networks and introduce smart lighting projects. The demand for energy-efficient consumer electronics and reliable security systems is gradually increasing. It shows potential for photovoltaic adoption due to strong solar energy capacity. The growing healthcare sector also supports the application of optoelectronic components in diagnostic and monitoring equipment. Africa presents steady market development with rising infrastructure investments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key players

- Samsung Electronics

- Panasonic Corporation

- General Electric Company

- Omnivision Technologies Inc

- Sony Corporation

- Koninklijke Philips N.V.

- Osram Licht AG

- Vishay Intertechnology, Inc

- Texas Instruments Inc

- Rohm Co., Ltd (ROHM SEMICONDUCTOR)

- Stanley Electric Co

- Mitsubishi Electric

Competitive Analysis

The Global Optoelectronics Market features strong competition among leading multinational companies focused on technological innovation and product diversification. Key players such as Samsung Electronics, Sony Corporation, and Panasonic Corporation lead the market with advanced product portfolios and strong global presence. It presents growth opportunities that encourage continuous investment in research and development. Companies focus on expanding into emerging sectors like automotive safety, healthcare, and renewable energy to strengthen their market positions. Strategies such as partnerships, mergers, and geographic expansion support competitive advantage. Smaller players target niche applications and cost-effective solutions to capture market share. Competitive pressure drives the industry toward rapid technological upgrades and product differentiation.

Recent Developments

- In January 2025, Samsung Electronics unveiled Samsung Vision AI, integrating AI-powered features into its entire lineup of Neo QLED, OLED, QLED, and The Frame TVs at CES 2025 First Look

- In June 2025, Panasonic Projector & Display Americas (PPNDA) launched MEVIX, a new sub-brand focused on holistic visual solutions, at InfoComm 2025. MEVIX combines Panasonic’s projector and display hardware with software, services, and strategic partnerships to deliver “human-centric” experiences. The sub-brand’s name, MEVIX, stands for Media, Entertainment & Visual Transformation, reflecting a shift towards comprehensive AV ecosystems rather than just hardware.

- In April 2025, OmniVision Technologies launched the OX01N1B, a 1.5MP global shutter image sensor, specifically designed for automotive driver monitoring systems (DMS). It was showcased at the Auto Shanghai event. The sensor features a 2.2-micron pixel and utilizes OmniPixel®4-GS technology for simultaneous image capture. It also incorporates Nyxel® near-infrared (NIR) technology and offers ASIL-B and cybersecurity features.

Market Concentration and Characteristics

The Global Optoelectronics Market shows moderate to high market concentration with a few dominant players controlling significant market shares. It is characterized by rapid technological advancements, high entry barriers, and strong emphasis on research and development. Large companies such as Samsung Electronics, Sony Corporation, and Panasonic Corporation lead the market with advanced manufacturing capabilities and wide product offerings. The market demands continuous innovation, driving companies to focus on miniaturization, energy efficiency, and enhanced performance. It supports both large-scale manufacturers and smaller players targeting specialized applications. The competitive landscape reflects fast product cycles and increasing focus on cost-effective, high-quality solutions.

Report Coverage

The research report offers an in-depth analysis based on Device, Application, Device Material, Industry Vertical and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Global Optoelectronics Market will continue to expand rapidly due to growing demand for energy-efficient and high-performance consumer electronics worldwide.

- Integration of optoelectronic components in automotive safety systems and autonomous vehicles will drive significant market growth.

- Advances in fiber optic communication technology will increase demand for optoelectronic devices, supporting faster and more reliable data transmission.

- Emerging applications in healthcare, including medical imaging and diagnostic equipment, will create new revenue streams for optoelectronic manufacturers.

- The market will see ongoing miniaturization of devices, enabling integration into compact wearables and smart devices with enhanced functionality.

- Renewable energy adoption, especially solar photovoltaics, will expand opportunities for optoelectronics in sustainable power generation.

- Investment in research and development will accelerate innovation in materials such as gallium nitride and silicon carbide, improving device efficiency and durability.

- Growing smart city initiatives will increase the use of optoelectronic sensors in security, surveillance, and infrastructure management applications.

- Expansion in emerging economies will broaden the market base, driven by rising urbanization and demand for consumer electronics and telecommunication infrastructure.

- Strategic partnerships and mergers will intensify, enabling companies to strengthen product portfolios and expand geographic reach to maintain competitive advantage.