CHAPTER NO. 1: GENESIS OF THE MARKET

1.1 Market Prelude – Introduction & Scope

1.2 The Big Picture – Objectives & Vision

1.3 Strategic Edge – Unique Value Proposition

1.4 Stakeholder Compass – Key Beneficiaries

CHAPTER NO. 2: EXECUTIVE LENS

2.1 Pulse of the Industry – Market Snapshot

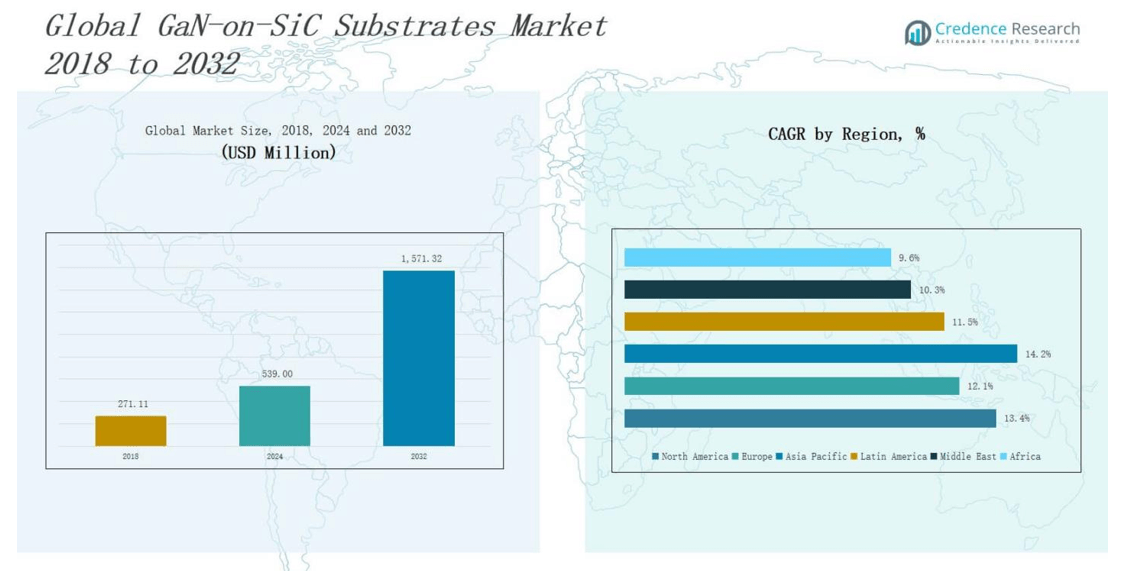

2.2 Growth Arc – Revenue Projections (USD Million)

2.3. Premium Insights – Based on Primary Interviews

CHAPTER NO. 3: GAN-ON-SIC SUBSTRATES MARKET FORCES & INDUSTRY PULSE

3.1 Foundations of Change – Market Overview

3.2 Catalysts of Expansion – Key Market Drivers

3.2.1 Momentum Boosters – Growth Triggers

3.2.2 Innovation Fuel – Disruptive Technologies

3.3 Headwinds & Crosswinds – Market Restraints

3.3.1 Regulatory Tides – Compliance Challenges

3.3.2 Economic Frictions – Inflationary Pressures

3.4 Untapped Horizons – Growth Potential & Opportunities

3.5 Strategic Navigation – Industry Frameworks

3.5.1 Market Equilibrium – Porter’s Five Forces

3.5.2 Ecosystem Dynamics – Value Chain Analysis

3.5.3 Macro Forces – PESTEL Breakdown

3.6 Price Trend Analysis

3.6.1 Regional Price Trend

3.6.2 Price Trend by Product

CHAPTER NO. 4: KEY INVESTMENT EPICENTER

4.1 Regional Goldmines – High-Growth Geographies

4.2 Product Frontiers – Lucrative Product Categories

4.3 Application Sweet Spots – Emerging Demand Segments

CHAPTER NO. 5: REVENUE TRAJECTORY & WEALTH MAPPING

5.1 Momentum Metrics – Forecast & Growth Curves

5.2 Regional Revenue Footprint – Market Share Insights

5.3 Segmental Wealth Flow – Wafer Size & Application Revenue

CHAPTER NO. 6: TRADE & COMMERCE ANALYSIS

6.1. Import Analysis by Region

6.1.1. Global GaN-on-SiC Substrates Market Import Revenue By Region

6.2. Export Analysis by Region

6.2.1. Global GaN-on-SiC Substrates Market Export Revenue By Region

CHAPTER NO. 7: COMPETITION ANALYSIS

7.1. Company Market Share Analysis

7.1.1. Global GaN-on-SiC Substrates Market: Company Market Share

7.2. Global GaN-on-SiC Substrates Market Company Revenue Market Share

7.3. Strategic Developments

7.3.1. Acquisitions & Mergers

7.3.2. New Product Launch

7.3.3. Regional Expansion

7.4. Competitive Dashboard

7.5. Company Assessment Metrics, 2024

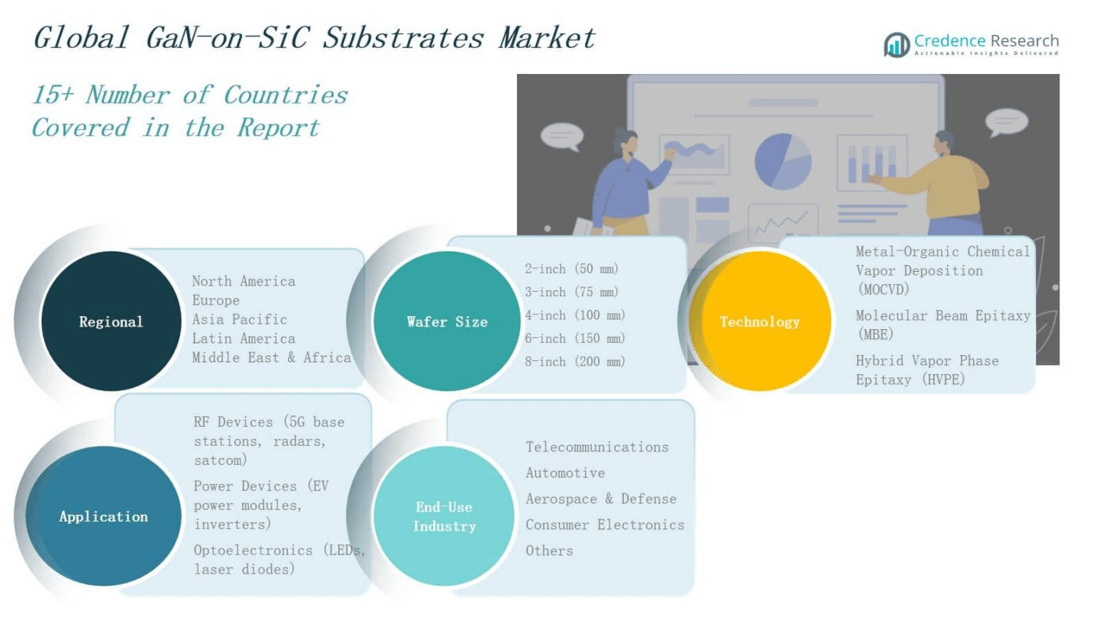

CHAPTER NO. 8: GAN-ON-SIC SUBSTRATES MARKET – BY WAFER SIZE SEGMENT ANALYSIS

8.1. GaN-on-SiC Substrates Market Overview by Wafer Size Segment

8.1.1. GaN-on-SiC Substrates Market Revenue Share By Wafer Size

8.2. 2-inch (50 mm)

8.3. 3-inch (75 mm)

8.4. 4-inch (100 mm)

8.5. 6-inch (150 mm)

8.6. 8-inch (200 mm)

CHAPTER NO. 9: GAN-ON-SIC SUBSTRATES MARKET – BY TECHNOLOGY SEGMENT ANALYSIS

9.1. GaN-on-SiC Substrates Market Overview by Technology Segment

9.1.1. GaN-on-SiC Substrates Market Revenue Share By Technology

9.2. Metal-Organic Chemical Vapor Deposition (MOCVD)

9.3. Molecular Beam Epitaxy (MBE)

9.4. Hybrid Vapor Phase Epitaxy (HVPE)

CHAPTER NO. 10: GAN-ON-SIC SUBSTRATES MARKET – BY APPLICATION SEGMENT ANALYSIS

10.1. GaN-on-SiC Substrates Market Overview by Application Segment

10.1.1. GaN-on-SiC Substrates Market Revenue Share By Application

10.2. RF Devices (5G base stations, radars, satcom)

10.3. Power Devices (EV power modules, inverters)

10.4. Optoelectronics (LEDs, laser diodes)

CHAPTER NO. 11: GAN-ON-SIC SUBSTRATES MARKET – BY END-USE INDUSTRY SEGMENT ANALYSIS

11.1. GaN-on-SiC Substrates Market Overview by End-Use Industry Segment

11.1.1. GaN-on-SiC Substrates Market Revenue Share By End-Use Industry

11.2. Telecommunications

11.3. Automotive

11.4. Aerospace & Defense

11.5. Consumer Electronics

11.6. Others

CHAPTER NO. 12: GAN-ON-SIC SUBSTRATES MARKET – REGIONAL ANALYSIS

12.1. GaN-on-SiC Substrates Market Overview by Region Segment

12.1.1. Global GaN-on-SiC Substrates Market Revenue Share By Region

12.1.2. Regions

12.1.3. Global GaN-on-SiC Substrates Market Revenue By Region

12.1.4. Wafer Size

12.1.5. Global GaN-on-SiC Substrates Market Revenue By Wafer Size

12.1.6. Technology

12.1.7. Global GaN-on-SiC Substrates Market Revenue By Technology

12.1.8. Application

12.1.9. Global GaN-on-SiC Substrates Market Revenue By Application

12.1.10. End-Use Industry

12.1.11. Global GaN-on-SiC Substrates Market Revenue By End-Use Industry

CHAPTER NO. 13: NORTH AMERICA GAN-ON-SIC SUBSTRATES MARKET – COUNTRY ANALYSIS

13.1. North America GaN-on-SiC Substrates Market Overview by Country Segment

13.1.1. North America GaN-on-SiC Substrates Market Revenue Share By Region

13.2. North America

13.2.1. North America GaN-on-SiC Substrates Market Revenue By Country

13.2.2. Wafer Size

13.2.3. North America GaN-on-SiC Substrates Market Revenue By Wafer Size

13.2.4. Technology

13.2.5. North America GaN-on-SiC Substrates Market Revenue By Technology

13.2.6. Application

13.2.7. North America GaN-on-SiC Substrates Market Revenue By Application

13.2.8. End-Use Industry

13.2.9. North America GaN-on-SiC Substrates Market Revenue By End-Use Industry

13.3. U.S.

13.4. Canada

13.5. Mexico

CHAPTER NO. 14: EUROPE GAN-ON-SIC SUBSTRATES MARKET – COUNTRY ANALYSIS

14.1. Europe GaN-on-SiC Substrates Market Overview by Country Segment

14.1.1. Europe GaN-on-SiC Substrates Market Revenue Share By Region

14.2. Europe

14.2.1. Europe GaN-on-SiC Substrates Market Revenue By Country

14.2.2. Wafer Size

14.2.3. Europe GaN-on-SiC Substrates Market Revenue By Wafer Size

14.2.4. Technology

14.2.5. Europe GaN-on-SiC Substrates Market Revenue By Technology

14.2.6. Application

14.2.7. Europe GaN-on-SiC Substrates Market Revenue By Application

14.2.8. End-Use Industry

14.2.9. Europe GaN-on-SiC Substrates Market Revenue By End-Use Industry

14.3. UK

14.4. France

14.5. Germany

14.6. Italy

14.7. Spain

14.8. Russia

14.9. Rest of Europe

CHAPTER NO. 15: ASIA PACIFIC GAN-ON-SIC SUBSTRATES MARKET – COUNTRY ANALYSIS

15.1. Asia Pacific GaN-on-SiC Substrates Market Overview by Country Segment

15.1.1. Asia Pacific GaN-on-SiC Substrates Market Revenue Share By Region

15.2. Asia Pacific

15.2.1. Asia Pacific GaN-on-SiC Substrates Market Revenue By Country

15.2.2. Wafer Size

15.2.3. Asia Pacific GaN-on-SiC Substrates Market Revenue By Wafer Size

15.2.4. Technology

15.2.5. Asia Pacific GaN-on-SiC Substrates Market Revenue By Technology

15.2.6. Application

15.2.7. Asia Pacific GaN-on-SiC Substrates Market Revenue By Application

15.2.8. End-Use Industry

15.2.9. Asia Pacific GaN-on-SiC Substrates Market Revenue By End-Use Industry

15.3. China

15.4. Japan

15.5. South Korea

15.6. India

15.7. Australia

15.8. Southeast Asia

15.9. Rest of Asia Pacific

CHAPTER NO. 16: LATIN AMERICA GAN-ON-SIC SUBSTRATES MARKET – COUNTRY ANALYSIS

16.1. Latin America GaN-on-SiC Substrates Market Overview by Country Segment

16.1.1. Latin America GaN-on-SiC Substrates Market Revenue Share By Region

16.2. Latin America

16.2.1. Latin America GaN-on-SiC Substrates Market Revenue By Country

16.2.2. Wafer Size

16.2.3. Latin America GaN-on-SiC Substrates Market Revenue By Wafer Size

16.2.4. Technology

16.2.5. Latin America GaN-on-SiC Substrates Market Revenue By Technology

16.2.6. Application

16.2.7. Latin America GaN-on-SiC Substrates Market Revenue By Application

16.2.8. End-Use Industry

16.2.9. Latin America GaN-on-SiC Substrates Market Revenue By End-Use Industry

16.3. Brazil

16.4. Argentina

16.5. Rest of Latin America

CHAPTER NO. 17: MIDDLE EAST GAN-ON-SIC SUBSTRATES MARKET – COUNTRY ANALYSIS

17.1. Middle East GaN-on-SiC Substrates Market Overview by Country Segment

17.1.1. Middle East GaN-on-SiC Substrates Market Revenue Share By Region

17.2. Middle East

17.2.1. Middle East GaN-on-SiC Substrates Market Revenue By Country

17.2.2. Wafer Size

17.2.3. Middle East GaN-on-SiC Substrates Market Revenue By Wafer Size

17.2.4. Technology

17.2.5. Middle East GaN-on-SiC Substrates Market Revenue By Technology

17.2.6. Application

17.2.7. Middle East GaN-on-SiC Substrates Market Revenue By Application

17.2.8. End-Use Industry

17.2.9. Middle East GaN-on-SiC Substrates Market Revenue By End-Use Industry

17.3. GCC Countries

17.4. Israel

17.5. Turkey

17.6. Rest of Middle East

CHAPTER NO. 18: AFRICA GAN-ON-SIC SUBSTRATES MARKET – COUNTRY ANALYSIS

18.1. Africa GaN-on-SiC Substrates Market Overview by Country Segment

18.1.1. Africa GaN-on-SiC Substrates Market Revenue Share By Region

18.2. Africa

18.2.1. Africa GaN-on-SiC Substrates Market Revenue By Country

18.2.2. Wafer Size

18.2.3. Africa GaN-on-SiC Substrates Market Revenue By Wafer Size

18.2.4. Technology

18.2.5. Africa GaN-on-SiC Substrates Market Revenue By Technology

18.2.6. Application

18.2.7. Africa GaN-on-SiC Substrates Market Revenue By Application

18.2.8. End-Use Industry

18.2.9. Africa GaN-on-SiC Substrates Market Revenue By End-Use Industry

18.3. South Africa

18.4. Egypt

18.5. Rest of Africa

CHAPTER NO. 19: COMPANY PROFILES

19.1. Cree, Inc. (Wolfspeed)

19.1.1. Company Overview

19.1.2. Product Portfolio

19.1.3. Financial Overview

19.1.4. Recent Developments

19.1.5. Growth Strategy

19.1.6. SWOT Analysis

19.2. Sumitomo Electric Industries

19.3. II-VI Incorporated (Coherent Corp.)

19.4. Qorvo

19.5. MACOM

19.6. NTT Advanced Technology

19.7. NGK Insulators

19.8. Saint-Gobain

19.9. Sino Nitride Semiconductor

19.10. Freiberger Compound Materials