| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

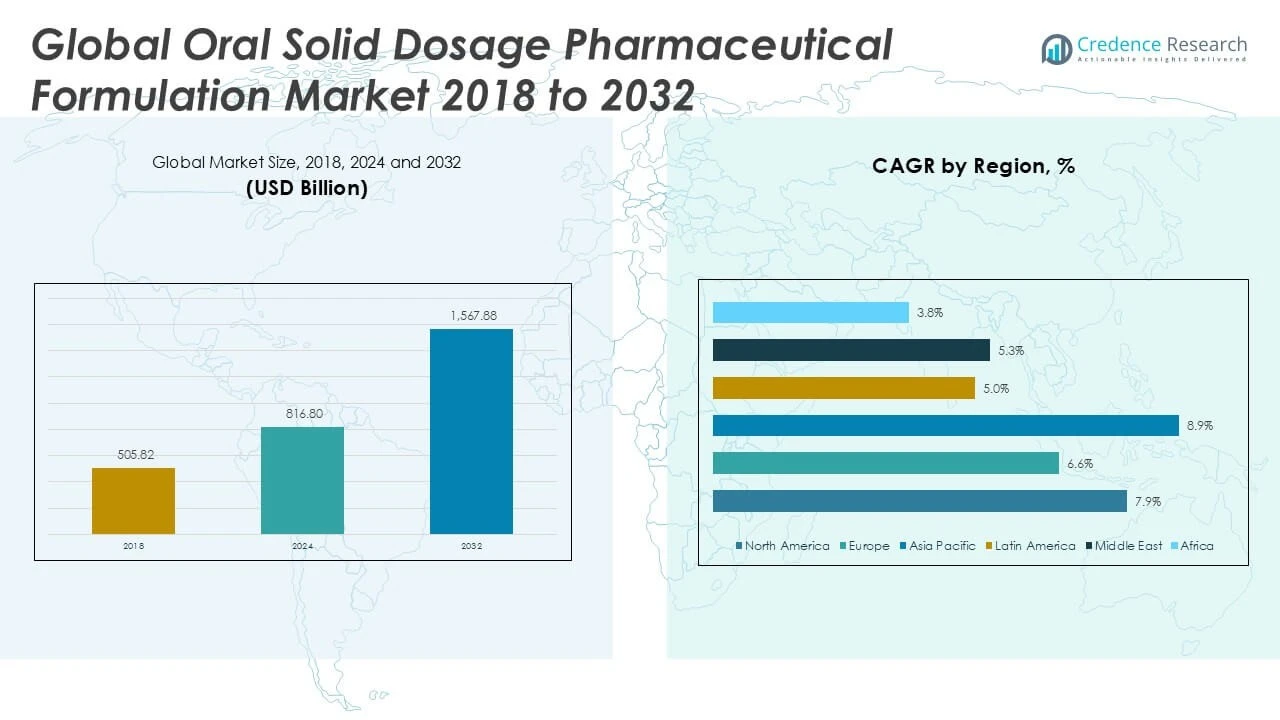

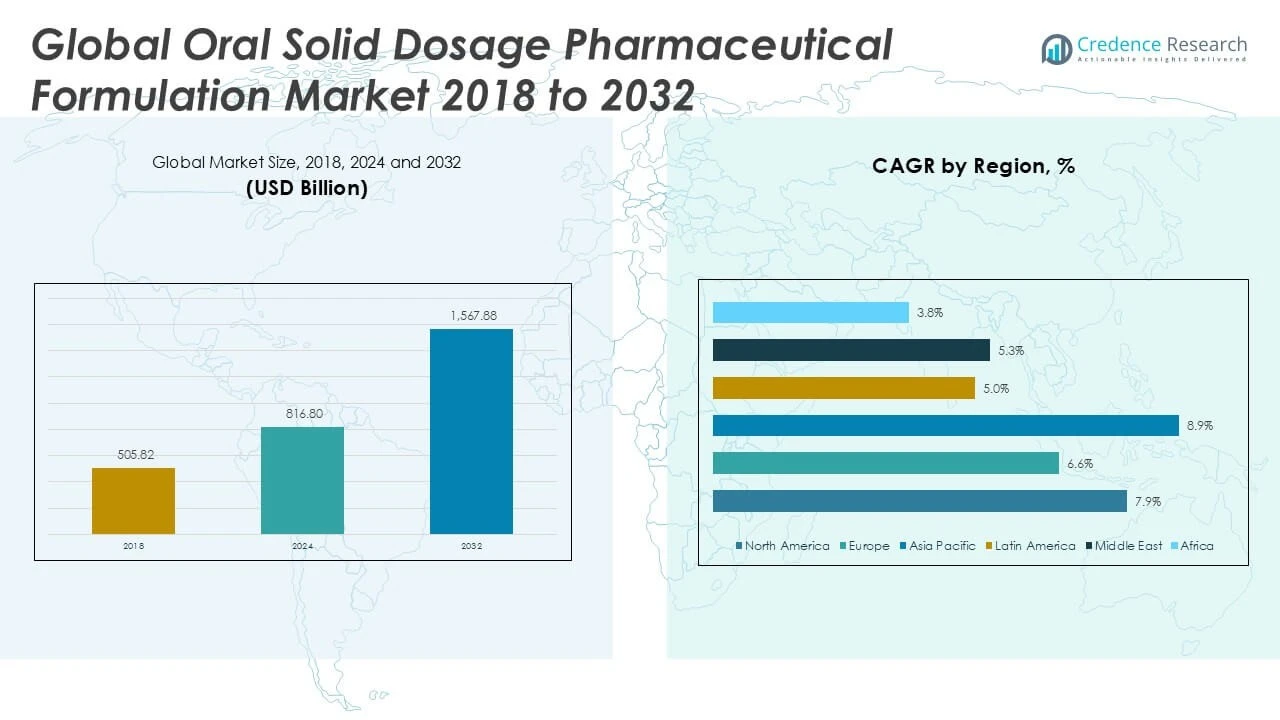

| Oral Solid Dosage Pharmaceutical Formulation Market Size 2024 |

USD 816.80 Million |

| Oral Solid Dosage Pharmaceutical Formulation Market, CAGR |

7.91% |

| Oral Solid Dosage Pharmaceutical Formulation Market Size 2032 |

USD 1,567.88 Million |

Market Overview

The Global Oral Solid Dosage Pharmaceutical Formulation Market is projected to grow from USD 816.80 million in 2024 to an estimated USD 1,567.88 million by 2032, with a compound annual growth rate (CAGR) of 7.91% from 2025 to 2032.

Geographically, North America leads the market, driven by robust healthcare infrastructure, significant pharmaceutical R\&D investments, and a high adoption rate of innovative drug delivery systems. Europe and the Asia Pacific regions are also experiencing substantial growth, with increasing healthcare access and aging populations contributing to the demand for oral solid dosage forms.

Key players in the global oral solid dosage pharmaceutical formulation market include AstraZeneca plc, Bristol-Myers Squibb Company, Eli Lilly and Company, Gilead Sciences, Inc., Merck & Co., Inc., Novartis AG, Pfizer Inc., AbbVie Inc., Boehringer Ingelheim GmbH, F. Hoffmann-La Roche Ltd., Johnson & Johnson, Biogen Inc., Bayer AG, Teva Pharmaceutical Industries Ltd., Amgen Inc., Takeda Pharmaceutical Company, and Otsuka Pharmaceutical Co., Ltd. These companies are actively engaged in drug discovery and development to expand their market presence

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Oral Solid Dosage Pharmaceutical Formulation Market is expected to grow from USD 816.80 million in 2024 to USD 1,567.88 million by 2032, with a CAGR of 7.91%.

- The increasing incidence of chronic diseases such as diabetes and cardiovascular conditions is driving the demand for oral solid dosage forms due to their long-term treatment requirements.

- Advancements like controlled-release and extended-release systems enhance patient adherence and improve therapeutic outcomes, fueling market growth.

- Strict regulatory requirements for drug approvals and manufacturing processes may slow market entry and increase operational costs, limiting growth.

- North America holds the largest market share, driven by advanced healthcare infrastructure, strong pharmaceutical R\&D investments, and high adoption of innovative drug delivery systems.

- The Asia Pacific region is experiencing significant market growth, driven by increased healthcare access, aging populations, and rising chronic disease prevalence.

- The rise of generic drugs and competition from emerging pharmaceutical companies in the Oral Solid Dosage Pharmaceutical Formulation Market offers both challenges and opportunities for market leaders.

Market Drivers

Increasing Prevalence of Chronic Diseases Driving Demand for Oral Solid Dosage Forms

The rising incidence of chronic diseases, such as diabetes, cardiovascular disorders, and respiratory conditions, significantly propels the Global Oral Solid Dosage Pharmaceutical Formulation Market. Patients with chronic illnesses often require long-term medication, which oral solid dosage forms conveniently provide. These formulations offer improved patient compliance due to ease of administration compared to injectable or other delivery methods. It allows healthcare providers to offer cost-effective and efficient treatment options for managing chronic ailments. The growing aging population worldwide further amplifies the demand for such formulations, given the increased susceptibility to chronic diseases in older adults. Rising awareness about health and wellness fuels the need for effective pharmaceutical solutions that can be administered at home. This growing patient base continually supports market expansion.

- For instance, oral solid dosage forms remain the preferred choice for long-term medication, with over 75% of prescribed drugs being in tablet or capsule form.

Technological Advancements Enhancing Efficacy and Patient Compliance

Innovations in drug formulation technologies play a critical role in shaping the market landscape. The Global Oral Solid Dosage Pharmaceutical Formulation Market benefits from improvements in controlled-release, extended-release, and targeted drug delivery systems. These advancements help optimize therapeutic outcomes by maintaining drug concentration within the therapeutic window for longer durations. It increases patient adherence by reducing dosing frequency and minimizing side effects. Formulation techniques such as nanoparticle incorporation and taste masking also enhance drug stability and patient acceptability. The continuous investment in research and development accelerates the introduction of novel oral solid dosage products with improved bioavailability. Such technological progress drives both market competitiveness and growth.

- For instance, 3D printing innovations in oral solid dosage forms enable personalized medicine, allowing precise drug delivery tailored to individual patient needs.

Expanding Healthcare Infrastructure and Pharmaceutical Manufacturing Capabilities

Growth in healthcare infrastructure across emerging economies boosts access to oral solid dosage medications, strengthening market growth. Investments in pharmaceutical manufacturing facilities enhance production capacity and efficiency, enabling manufacturers to meet increasing demand. It supports the development of high-quality, cost-effective formulations tailored for diverse patient populations. Regulatory bodies are streamlining approval processes, encouraging faster market entry for new products. Partnerships between pharmaceutical companies and contract manufacturing organizations further expand production capabilities. Improved distribution networks ensure widespread availability of these formulations, supporting market penetration. This enhanced infrastructure underpins steady growth in global markets.

Increasing Focus on Patient-Centric Drug Delivery Solutions

The pharmaceutical industry prioritizes developing patient-centric drug delivery systems to meet evolving healthcare needs. The Global Oral Solid Dosage Pharmaceutical Formulation Market capitalizes on formulations designed to improve patient convenience and therapeutic outcomes. Innovations include orally disintegrating tablets, chewable tablets, and multiparticulate systems, which enhance ease of use. It facilitates medication adherence, particularly among pediatric, geriatric, and dysphagic patients. Patient feedback and real-world evidence guide formulation improvements, fostering personalized medicine approaches. Growing demand for non-invasive drug delivery options further supports market expansion. The focus on patient-centricity aligns with broader healthcare trends emphasizing quality of life and treatment effectiveness.

Market Trends

Rising Adoption of Novel Drug Delivery Technologies in Oral Solid Dosage Forms

The Global Oral Solid Dosage Pharmaceutical Formulation Market experiences significant transformation due to the integration of advanced drug delivery technologies. Formulation innovations such as controlled-release, extended-release, and gastro-resistant tablets improve drug bioavailability and therapeutic efficiency. It enables precise dosing and better management of chronic conditions by maintaining consistent drug plasma levels. Novel techniques like 3D printing facilitate customized dosage forms tailored to individual patient needs. The trend toward multifunctional tablets combining multiple active ingredients gains traction, offering convenience and enhanced treatment outcomes. Continuous technological upgrades keep the market dynamic and competitive.

- For instance, 3D printing technology has enabled pharmaceutical companies to develop customized dosage forms, improving patient-specific treatment outcomes and reducing variability in drug absorption.

Growing Emphasis on Pediatric and Geriatric-Friendly Formulations

Market trends highlight increasing demand for oral solid dosage forms that cater specifically to pediatric and geriatric populations. The Global Oral Solid Dosage Pharmaceutical Formulation Market focuses on developing chewable tablets, orally disintegrating tablets, and mini-tablets that improve ease of administration and palatability. These formats address swallowing difficulties and compliance challenges common in these age groups. It drives research toward safer excipients and taste-masking technologies to enhance patient acceptance. The demographic shift with rising elderly populations globally intensifies this demand. Tailored formulations support improved therapeutic adherence and patient-centric healthcare delivery.

- For instance, approximately 70% of pediatric patients prefer orally disintegrating tablets over conventional solid dosage forms, improving compliance and therapeutic effectiveness.

Sustainability and Eco-Friendly Practices in Pharmaceutical Manufacturing

Sustainability emerges as a prominent trend influencing the Global Oral Solid Dosage Pharmaceutical Formulation Market. Pharmaceutical companies increasingly adopt eco-friendly manufacturing processes, reducing waste and energy consumption. It promotes the use of biodegradable excipients and sustainable packaging materials that minimize environmental impact. Regulatory agencies encourage adherence to green chemistry principles and sustainability certifications. This trend reflects growing consumer awareness and demand for responsible healthcare products. It also offers cost-saving opportunities through efficient resource management. Commitment to sustainability strengthens corporate reputation and aligns with global environmental goals.

Expansion of Emerging Markets and Increasing Healthcare Accessibility

Emerging economies contribute notably to the growth of the Global Oral Solid Dosage Pharmaceutical Formulation Market. Improvements in healthcare infrastructure and government initiatives expand access to essential medicines in these regions. It stimulates demand for affordable and reliable oral solid dosage forms to address diverse disease burdens. Local pharmaceutical manufacturers increase production capacities and engage in strategic partnerships to meet rising needs. The expanding middle-class population with greater healthcare awareness fuels consumption growth. Market players tailor products to regional preferences and regulatory requirements, fostering market penetration. This trend drives globalization and diversification within the industry.

Market Challenges

Stringent Regulatory Requirements and Complex Approval Processes Impacting Market Growth

The Global Oral Solid Dosage Pharmaceutical Formulation Market faces challenges stemming from stringent regulatory frameworks that govern drug approval and manufacturing standards. Regulatory agencies enforce rigorous quality control, safety, and efficacy criteria, requiring extensive clinical trials and documentation. It leads to prolonged approval timelines and increased development costs, which can delay product launches and affect market entry strategies. Compliance with diverse regional regulations complicates global commercialization efforts. Manufacturers must invest in robust quality management systems to meet evolving regulatory expectations. This regulatory complexity limits the pace at which innovative formulations reach the market and constrains smaller players with limited resources.

- For instance, the oral solid dosage pharmaceutical formulation industry is witnessing increased adoption of continuous manufacturing technologies, which enhance production efficiency and reduce regulatory compliance burdens

Formulation and Manufacturing Challenges Hindering Product Development and Scalability

Developing oral solid dosage formulations that ensure consistent bioavailability and stability remains a significant challenge for the Global Oral Solid Dosage Pharmaceutical Formulation Market. It requires addressing issues related to drug solubility, polymorphism, and excipient compatibility. Scaling up production from laboratory to commercial scale while maintaining product quality poses technical difficulties. Manufacturing processes must accommodate diverse dosage forms and complex release mechanisms, increasing operational complexity. High costs associated with advanced technologies and raw materials further impact profitability. These challenges demand continuous innovation and investment in manufacturing capabilities to sustain competitive advantage and meet market demand effectively.

Market Opportunities

Expanding Personalized Medicine and Customized Oral Solid Dosage Solutions Driving New Growth Prospects

The Global Oral Solid Dosage Pharmaceutical Formulation Market presents significant opportunities through the development of personalized medicine and customized dosage forms. Advances in precision medicine enable tailoring drug formulations to individual patient genetics, lifestyle, and therapeutic needs. It creates scope for technologies like 3D printing to produce patient-specific tablets with optimized dosages and release profiles. Personalized solutions improve treatment efficacy and patient adherence, fostering market differentiation. Growing demand for combination therapies further supports innovation in multifunctional oral solid formulations. Companies investing in these cutting-edge approaches can capitalize on emerging niche markets and strengthen their competitive position.

Rising Penetration in Emerging Economies and Growing Healthcare Infrastructure Expanding Market Reach

Emerging markets offer lucrative opportunities for the Global Oral Solid Dosage Pharmaceutical Formulation Market due to increasing healthcare investments and improving infrastructure. Rising population and growing prevalence of chronic diseases in these regions drive demand for accessible and affordable oral solid dosage forms. It allows manufacturers to expand their footprint through strategic partnerships and localized production facilities. Government initiatives aimed at improving medicine availability and health awareness campaigns also boost market potential. Tailoring products to regional preferences and regulatory environments enhances acceptance and penetration. This expansion supports sustainable growth and diversifies revenue streams across global markets.

Market Segmentation Analysis

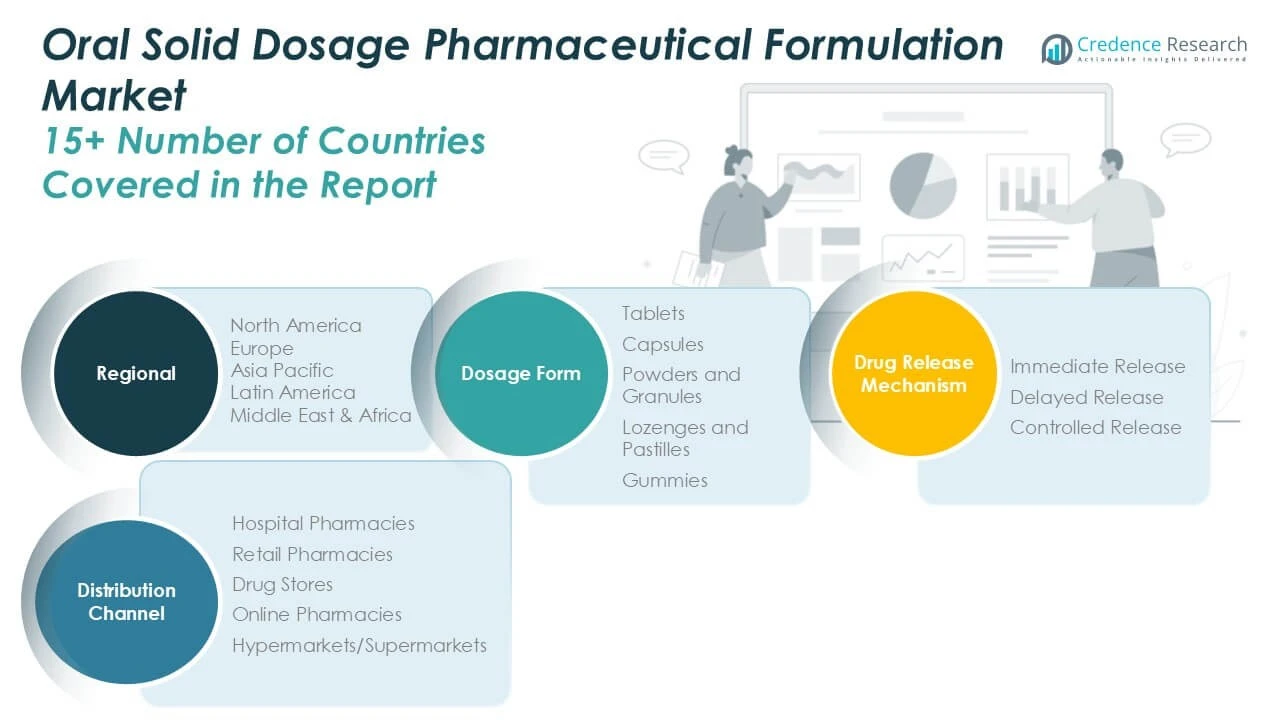

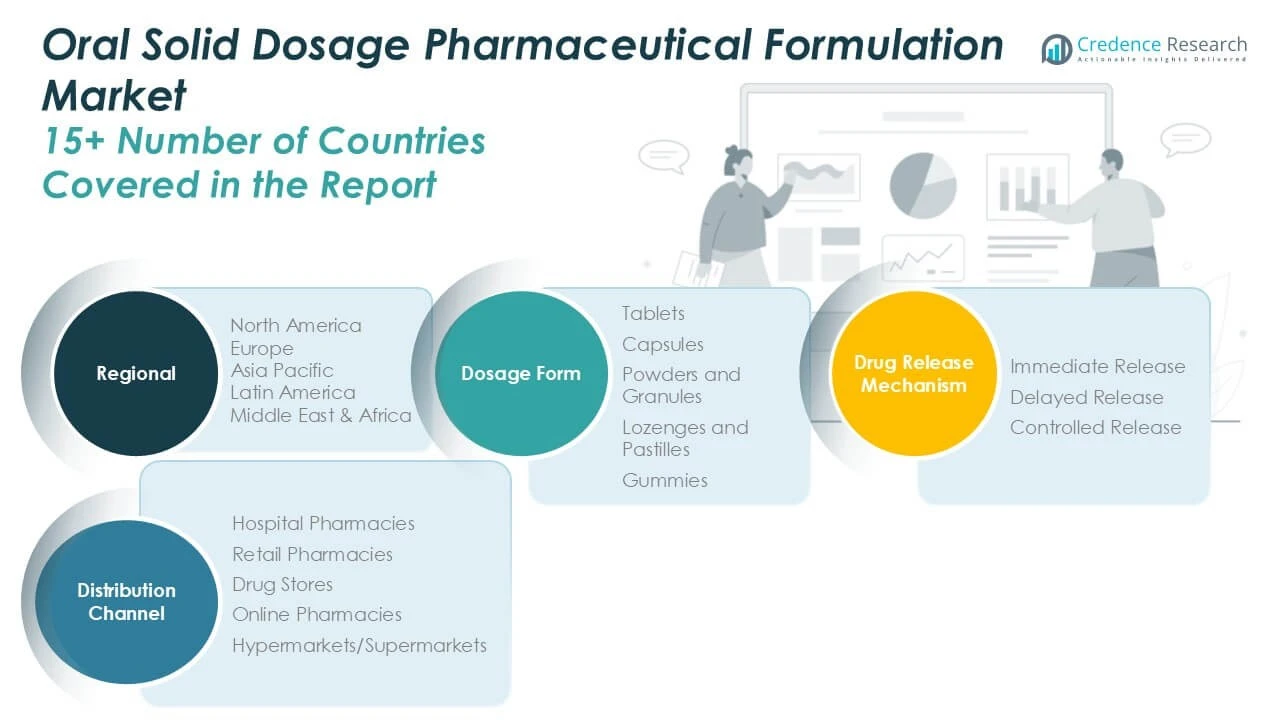

By dosage form

The tablets dominate due to their convenience, cost-effectiveness, and widespread acceptance. Capsules hold significant market share given their ability to mask unpleasant tastes and facilitate controlled release. Powders and granules serve niche applications requiring easy dissolution, while lozenges, pastilles, and gummies cater to pediatric and geriatric populations seeking palatable options. Each dosage form addresses specific patient needs and therapeutic goals, influencing product development strategies.

By Drug Release Mechanism

Regarding drug release mechanisms, immediate release formulations lead the market by providing rapid therapeutic effects and ease of manufacturing. Delayed release segments grow steadily, targeting drug delivery in specific gastrointestinal regions to improve efficacy and reduce side effects. Controlled release formulations show robust expansion, offering sustained drug delivery that enhances patient compliance and optimizes dosing schedules. These mechanisms reflect evolving clinical requirements and technological advancements shaping market offerings.

By Distribution Channel

The distribution channel segment includes hospital pharmacies, retail pharmacies, drug stores, online pharmacies, and hypermarkets/supermarkets. Hospital pharmacies account for substantial revenue due to direct access to institutional patients requiring complex treatments. Retail pharmacies and drug stores provide broad community-level availability. Online pharmacies experience rapid growth, driven by digital transformation and consumer preference for convenient access. Hypermarkets and supermarkets contribute by offering over-the-counter oral solid dosage products, expanding reach in emerging markets. Collectively, these channels ensure widespread product availability and support market penetration globally.

Segments

Based on Dosage Form

- Tablets

- Capsules

- Powders and Granules

- Lozenges and Pastilles

- Gummies

Based on Drug Release Mechanism

- Immediate Release

- Delayed Release

- Controlled Release

Based on Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Drug Stores

- Online Pharmacies

- Hypermarkets/Supermarkets

Based on Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Oral Solid Dosage Pharmaceutical Formulation Market

The North America Oral Solid Dosage Pharmaceutical Formulation Market held a significant market size of USD 336.45 million in 2024 and is projected to reach USD 647.71 million by 2032, registering a CAGR of 7.9%. It accounts for approximately 30.8% of the global market share in 2024. Strong healthcare infrastructure, high pharmaceutical R\&D investment, and a large patient base drive market growth. It benefits from early adoption of innovative drug delivery technologies and favorable regulatory frameworks. The presence of leading pharmaceutical companies and rising chronic disease prevalence sustain steady demand for oral solid dosage forms. This region continues to lead in product approvals and commercialization.

Europe Oral Solid Dosage Pharmaceutical Formulation Market

Europe’s market size stood at USD 146.57 million in 2024 and is expected to grow to USD 256.26 million by 2032, with a CAGR of 6.6%. It represents around 13.4% of the global market in 2024. Mature healthcare systems and stringent regulatory standards influence product development and market entry. It supports the expansion of advanced controlled-release and immediate-release formulations. Growing geriatric populations and increasing healthcare expenditure further enhance market potential. European pharmaceutical companies emphasize innovation and sustainability in production. Collaboration between public and private sectors accelerates access to novel therapies.

Asia Pacific Oral Solid Dosage Pharmaceutical Formulation Market

The Asia Pacific market accounted for USD 281.55 million in 2024, expected to rise to USD 583.78 million by 2032, exhibiting the highest CAGR of 8.9%. It captured approximately 25.7% of the global market share in 2024. Rapid economic growth, expanding healthcare infrastructure, and rising chronic disease incidence fuel demand. Increasing patient awareness and affordability contribute to wider adoption of oral solid dosage forms. It benefits from growing pharmaceutical manufacturing capabilities and government healthcare initiatives. The region attracts substantial foreign investments and partnerships for market expansion. Asia Pacific is poised to become a key growth driver globally.

Latin America Oral Solid Dosage Pharmaceutical Formulation Market

Latin America’s market value reached USD 22.76 million in 2024 and is projected to grow to USD 35.29 million by 2032, at a CAGR of 5.0%. It accounts for roughly 2.1% of the global market in 2024. Expanding healthcare coverage and increasing government support for pharmaceutical access drive growth. It faces challenges related to infrastructure and regulatory harmonization across countries. The growing middle class and urbanization improve access to pharmaceutical products. Manufacturers focus on cost-effective formulations tailored to local needs. Strategic partnerships and investments aim to strengthen market presence in the region.

Middle East Oral Solid Dosage Pharmaceutical Formulation Market

The Middle East market size was USD 18.73 million in 2024, expected to reach USD 29.69 million by 2032, growing at a CAGR of 5.3%. It represents around 1.7% of the global market share in 2024. Healthcare modernization and increased government expenditure on pharmaceutical sectors drive demand. It experiences growing chronic disease prevalence and rising consumer awareness. The region benefits from favorable regulatory reforms and expanding pharmaceutical manufacturing. Local companies collaborate with international players to enhance product availability. Growth opportunities exist in both hospital and retail pharmacy channels.

Africa Oral Solid Dosage Pharmaceutical Formulation Market

Africa’s market size stood at USD 10.74 million in 2024 and is expected to reach USD 15.15 million by 2032, registering a CAGR of 3.8%. It contributes approximately 1.0% to the global market share in 2024. Limited healthcare infrastructure and economic constraints challenge rapid growth. It experiences increasing demand driven by rising disease burden and improving healthcare access. Efforts to strengthen supply chains and regulatory frameworks support market development. It attracts donor funding and international collaborations focused on pharmaceutical access. The market growth remains steady with gradual expansion in urban centers.

Key players

- Pfizer Inc.

- Novartis AG

- AstraZeneca Plc.

- Merck & Co., Inc.

- Johnson & Johnson

- AbbVie Inc.

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- Boehringer Ingelheim GmbH

- Hoffmann-La Roche Ltd.

- Gilead Sciences, Inc.

- Amgen Inc.

- Teva Pharmaceutical Industries Ltd.

Competitive Analysis

The Oral Solid Dosage Pharmaceutical Formulation Market is highly competitive, with leading players such as Pfizer Inc., Novartis AG, and AstraZeneca Plc. driving innovation and market share. These companies leverage strong R\&D capabilities to develop novel drug delivery systems, improving patient compliance and therapeutic efficacy. It faces increasing competition from emerging pharmaceutical companies and generic manufacturers, which offer cost-effective alternatives. Market leaders focus on expanding their product portfolios, forming strategic alliances, and enhancing manufacturing capabilities to sustain growth. Investments in advanced technologies like controlled-release and 3D printing further intensify competition. Regulatory frameworks and pricing pressures continue to challenge companies, especially in emerging markets. Players must balance innovation, cost management, and regulatory compliance to maintain a competitive edge in the evolving market landscape.

Recent Developments

- In January 2025, Eli Lilly reported successful Phase 3 trial results for orforglipron, an oral GLP-1 receptor agonist for Type 2 diabetes and obesity. The drug demonstrated significant weight loss and blood sugar control, with Lilly planning regulatory submissions in 2025.

- In May 2025, AbbVie presented new data at the ASCO meeting, highlighting advancements in oral formulations for oncology treatments.

- In December 2024, Johnson & Johnson licensed novel oral assets from Kaken Pharmaceutical, focusing on STAT6 inhibitors for atopic dermatitis and other autoimmune diseases.

- In January 2025, Merck entered into a global license agreement with Hansoh Pharma for the development of an investigational oral GLP-1 receptor agonist, HS-10535.

Market Concentration and Characteristics

The Oral Solid Dosage Pharmaceutical Formulation Market exhibits moderate concentration, with a few key players holding significant market shares. Large multinational companies, such as Pfizer Inc., AstraZeneca Plc., and Merck & Co., Inc., dominate the market due to their extensive research and development resources, broad product portfolios, and strong distribution networks. Smaller and emerging companies, including generic manufacturers, contribute to the market’s competitiveness by offering affordable alternatives. It is characterized by continuous innovation in drug delivery technologies, such as controlled-release systems and personalized formulations. Regulatory compliance, cost management, and intellectual property protection remain critical factors in maintaining market position. The market sees high investments in R&D and strategic collaborations to improve the efficacy, safety, and patient adherence of oral solid dosage forms. These dynamics ensure steady growth and adaptability in an increasingly competitive pharmaceutical landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Dosage Form, Drug Release Mechanism, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Oral Solid Dosage Pharmaceutical Formulation Market will continue to expand in emerging markets due to improving healthcare infrastructure and increasing access to essential medicines. Growing urbanization and rising disease burden further drive market demand in these regions.

- Advancements in controlled-release, targeted delivery, and 3D printing technologies will lead to more efficient, patient-centric oral solid dosage forms. These innovations will improve therapeutic outcomes and enhance patient compliance.

- The increasing adoption of generic medications, driven by cost-conscious healthcare systems, will boost the market’s growth. Generic drugs offer affordable alternatives to brand-name oral solid dosage forms, ensuring wider accessibility.

- Personalized medicine and customized drug formulations will gain momentum, catering to specific patient needs based on genetic, environmental, and lifestyle factors. This trend will drive innovation in oral solid dosage forms and expand market opportunities.

- As global regulatory bodies enforce stringent standards, pharmaceutical companies will face challenges in market entry and product approvals. However, harmonization efforts across regions will streamline these processes, benefiting the market.

- The rise of online pharmacies will revolutionize the distribution of oral solid dosage forms, providing greater convenience to patients. This shift will lead to increased market penetration, especially in remote areas and emerging economies.

- Pharmaceutical companies will continue to focus on patient-centric oral solid dosage forms that enhance comfort, such as chewable tablets and orally disintegrating formulations. This trend will improve adherence and expand market reach.

- Major players in the Oral Solid Dosage Pharmaceutical Formulation Market will engage in mergers, acquisitions, and partnerships to strengthen their market positions. These strategic moves will enable companies to expand their portfolios and enhance innovation capabilities.

- Sustainability will be a key focus as companies adopt greener manufacturing practices and eco-friendly packaging solutions. Regulatory pressure and consumer preference for sustainable products will drive this shift in the market.

- The increasing global population, particularly in developed countries, will lead to higher demand for chronic disease treatments. This demographic shift will continue to fuel the market for oral solid dosage forms, particularly for age-related conditions.