Market Overview

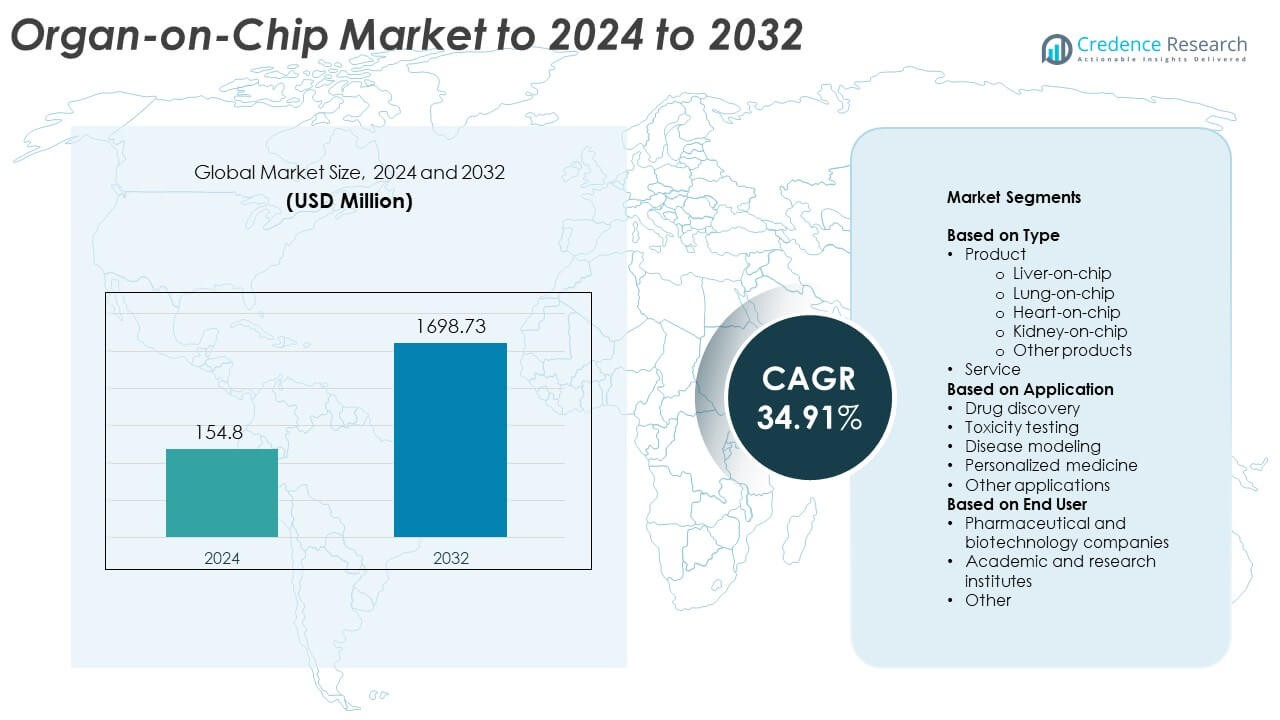

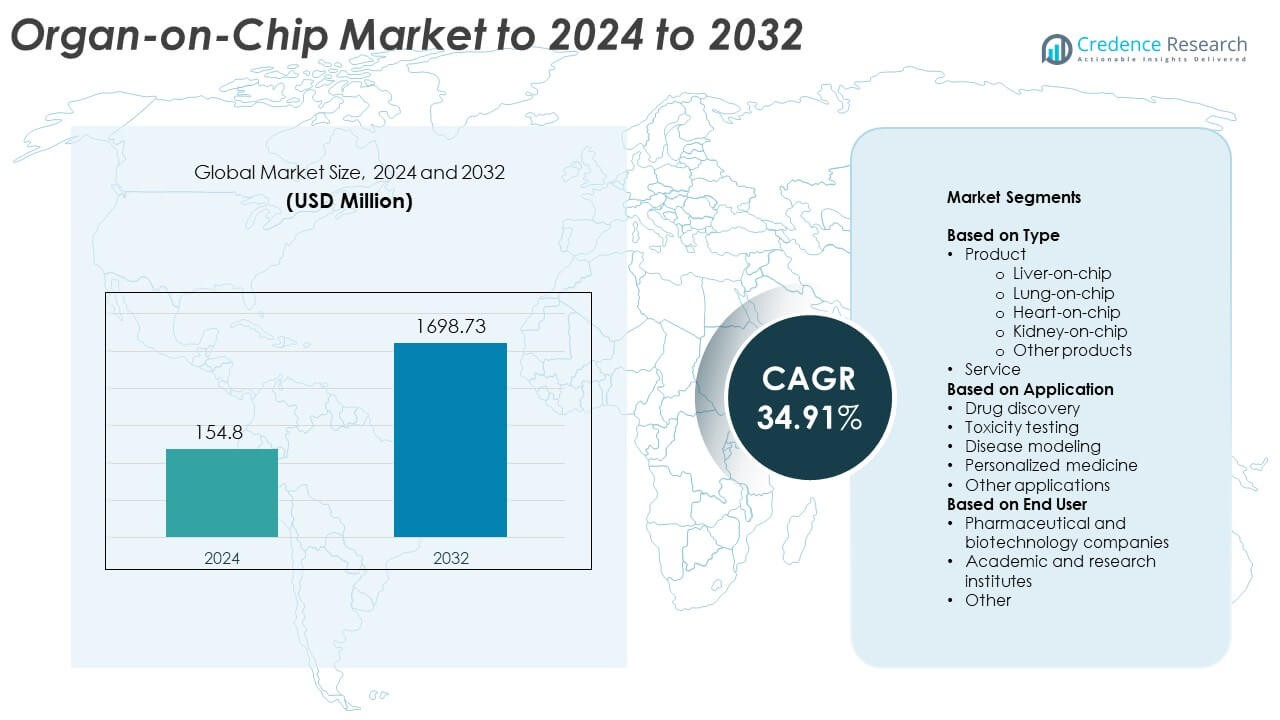

Organ-on-Chip Market size was valued at USD 154.8 Million in 2024 and is anticipated to reach USD 1698.73 Million by 2032, at a CAGR of 34.91% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Organ-on-Chip Market Size 2024 |

USD 154.8 Million |

| Organ-on-Chip Market , CAGR |

34.91% |

| Organ-on-Chip Market Size 2032 |

USD 1698.73 Million |

The Organ-on-Chip Market is shaped by leading global innovators that focus on advanced microphysiological systems, high-fidelity tissue models, and integrated microfluidic platforms used in drug discovery and toxicity testing. These companies strengthen adoption through strong partnerships with pharmaceutical firms, academic research groups, and biotechnology developers. North America emerges as the leading region, holding about 41% share in 2024 due to its mature R&D ecosystem, high investment in next-generation preclinical tools, and strong regulatory engagement. Europe follows with nearly 28% share, supported by active biomedical research programs and rising demand for alternatives to animal testing across major scientific hubs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Organ-on-Chip Market reached USD 154.8 Million in 2024 and is projected to hit USD 1698.73 Million by 2032, growing at a CAGR of 34.91%.

- Strong demand rises as drug discovery and toxicity testing applications lead the market with high adoption, supported by the dominance of the product segment holding about 79% share in 2024.

- Multi-organ chip development and increasing use in personalized medicine shape major trends, with wider use of advanced microfluidic models across research ecosystems.

- Competition intensifies as developers expand partnerships, enhance biological accuracy, and focus on scalable manufacturing to meet high research demand while navigating standardization and cost challenges.

- North America leads with about 41% share, followed by Europe at around 28%, while Asia Pacific grows quickly with nearly 22% share, supported by expanding pharmaceutical activity and rising biomedical investments.

Market Segmentation Analysis:

By Type

The product category leads the Organ-on-Chip Market with about 79% share in 2024, driven by strong adoption of liver-on-chip, lung-on-chip, and heart-on-chip platforms in early-stage drug screening. Liver-on-chip remains the dominant sub-segment due to its critical role in evaluating drug metabolism and predicting hepatotoxicity with higher accuracy than conventional cell cultures. Demand increases as developers shift toward microphysiological systems capable of reducing preclinical failure rates and improving decision-making in drug pipelines. Service-based offerings grow steadily as research groups outsource chip maintenance, validation, and custom model development.

- For instance, the study, published in Nature Communications Medicine in nov 2022, analyzed 870 Liver-Chips using a blinded set of 27 known hepatotoxic and non-toxic drugs and achieved a sensitivity of 87% and a specificity of 100% in the final combined data analysis across multiple donors.

By Application

Drug discovery dominates this segment with nearly 46% share in 2024 because pharmaceutical teams rely on organ-on-chip systems to improve lead optimization and reduce reliance on animal studies. These platforms support better prediction of human responses and help study complex drug-target interactions under controlled microenvironment conditions. Toxicity testing gains traction as regulators encourage high-fidelity preclinical models. Disease modeling and personalized medicine show rising demand as researchers adopt chips to study patient-specific disease pathways and therapeutic responses.

- For instance, AstraZeneca has improved its R&D success rate significantly using a 5R framework (right target, patient, tissue, safety, and commercial potential) that integrates advanced technologies like humanized models, mass spectrometry imaging.

By End User

Pharmaceutical and biotechnology companies lead this segment with around 58% share in 2024, supported by heavy investment in advanced preclinical tools that improve R&D efficiency. These companies use organ-on-chip platforms to accelerate screening, model safety risks, and validate emerging therapies with human-relevant physiology. Academic and research institutes show strong growth as funding increases for microfluidics and 3D tissue engineering studies. Other users, including CROs and diagnostic developers, expand adoption as chips prove effective for custom model creation and targeted testing workflows.

Key Growth Drivers

Rising Need for High-Precision Preclinical Models

Demand grows as drug developers seek tools that predict human responses with higher accuracy than animal models. Organ-on-chip platforms replicate tissue-level functions, which supports safer decision-making in early R&D. Companies adopt these systems to lower failure rates and improve clinical success. Regulatory bodies also encourage advanced microphysiological testing, which strengthens adoption across therapeutic research. This factor stands as the key growth driver.

- For instance, TissUse’s four-organ-chip maintained human intestine, liver, skin and kidney equivalents for 28 days. The organ models operated at a scale about 100000 times smaller than full-size human organs.

Expansion of Drug Discovery and Toxicity Screening Workflows

Pharmaceutical firms integrate organ-on-chip systems to enhance screening efficiency and reduce long testing cycles. The technology helps evaluate toxicity, metabolism, and therapeutic behavior under controlled microfluidic conditions. Growth accelerates as companies invest in next-generation R&D platforms to speed development pipelines. Rising biologics and precision therapies further increase the need for accurate human-relevant models.

- For instance, CN Bio’s PhysioMimix Core system supports long-term liver microtissue cultures under perfusion. Company documentation shows maintained tissue function for up to 4 weeks in these microphysiological assays.

Advancements in Microfluidics and Tissue Engineering

Improved chip fabrication, sensor integration, and 3D tissue engineering techniques boost system accuracy and scalability. These advancements support long-term cell viability and more realistic organ behavior. Developers use upgraded designs to simulate disease states and multi-organ interactions. Greater research funding and industry collaborations accelerate innovation and broaden market adoption.

Key Trends & Opportunities

Shift Toward Multi-Organ and Integrated Systems

Multi-organ chips gain traction because they simulate organ-to-organ interactions and support complex drug pathway studies. This trend opens opportunities for systemic toxicity modeling and metabolic profiling. Developers explore platforms connecting liver, kidney, and heart systems to improve prediction accuracy. The shift supports wider regulatory acceptance and creates commercial opportunities across drug discovery and clinical research. This is a major trend.

- For instance, Creative Biolabs publicly lists a heart–liver–skin three-organs-on-a-chip model and a neuromuscular junction two-organs-on-a-chip model in its 3D biology catalog, explicitly describing both as multi-organ platforms for simultaneous assessment of drug effects across 3 and 2 connected tissues respectively.

Growing Adoption in Personalized Medicine Research

Organ-on-chip systems enable patient-specific disease modeling using individualized cells and tissues. This capability supports targeted therapy development and enhances personalized treatment evaluation. Companies explore chips for oncology, rare diseases, and regenerative medicine studies. Increased integration with AI-based analytics expands opportunities for predictive modeling and precision-driven healthcare.

- For instance, Hesperos used a Human-on-a-Chip neuromuscular model to generate efficacy data. These data supported the rare-disease clinical study NCT04658472, which regulators cleared for patient enrollment.

Expansion in Academic and Collaborative Research Programs

Academic institutes accelerate adoption as funding grows for microphysiological research. Partnerships between universities, biotech companies, and research labs expand development of disease-specific chip models. This trend enables innovation in neurodegenerative, cardiovascular, and metabolic disorder studies. Broader availability of open-access designs also encourages experimental testing and prototype development.

Key Challenges

Complexity in Standardization and Regulatory Acceptance

Lack of unified validation standards limits broad adoption across pharmaceutical development. Regulators require consistent evidence proving reliability, reproducibility, and predictive accuracy of organ-on-chip platforms. Variations in chip design, materials, and cell sources slow industry-wide standardization. This remains a key challenge that delays large-scale integration into regulated workflows.

High Cost and Limited Scalability for Large-Volume Testing

Organ-on-chip systems remain costly due to advanced fabrication, microfluidics, and specialized maintenance. Many labs face barriers in running high-throughput studies because chip production is not fully scalable. Operational complexity increases training needs and limits adoption by smaller organizations. These factors challenge commercial expansion and create hurdles for large R&D teams seeking cost-efficient deployment.

Regional Analysis

North America

North America leads the Organ-on-Chip Market with about 41% share in 2024, driven by strong pharmaceutical R&D activity, early adoption of microphysiological systems, and significant funding for advanced preclinical technologies. The United States supports growth through investment in drug discovery programs and collaborations between biotech companies and research institutes. The region benefits from mature infrastructure, favorable regulatory engagement, and ongoing advancements in tissue engineering and microfluidics. Canada contributes through expanding academic research and innovation programs, which further strengthen regional demand for high-precision organ-on-chip platforms.

Europe

Europe holds around 28% share in 2024, supported by active research funding, strong biomedical innovation, and growing adoption among pharmaceutical developers. Countries such as Germany, the Netherlands, and the United Kingdom lead development of microfluidic and tissue-based models. Regulatory support for reducing animal testing encourages wider use of organ-on-chip systems in drug screening and toxicity studies. Academic institutions collaborate closely with biotech companies to advance multi-organ chip designs. Rising investment in predictive modeling and clinical research enhances Europe’s position as a key contributor to market expansion.

Asia Pacific

Asia Pacific accounts for nearly 22% share in 2024, fueled by rapid growth in pharmaceutical manufacturing, strong government support for biomedical research, and expansion of clinical trial networks. China, Japan, and South Korea invest heavily in organ-on-chip technologies to strengthen drug discovery pipelines and build competitive research capabilities. Academic partnerships and infrastructure development support faster adoption across both biotechnology companies and universities. Growing interest in personalized medicine and disease modeling also boosts demand. Increasing funding for microfluidics and stem cell research helps the region accelerate market uptake.

Latin America

Latin America holds approximately 6% share in 2024, with adoption driven mainly by expanding biomedical research programs in Brazil, Mexico, and Argentina. Academic institutions lead early-stage use of organ-on-chip platforms for disease studies and toxicology research. Limited availability of high-end microfluidic infrastructure slows broader penetration, but interest grows as regional labs seek alternatives to costly animal studies. Government initiatives supporting scientific modernization encourage gradual adoption of advanced research tools. Partnerships with international biotech firms help accelerate knowledge transfer and training, strengthening future market prospects.

Middle East and Africa

Middle East and Africa represent about 3% share in 2024, supported by emerging investments in life sciences and healthcare innovation. Countries such as Saudi Arabia, the United Arab Emirates, and South Africa expand research capabilities and build modern laboratory infrastructure. Adoption remains at an early stage due to high system costs and limited specialized expertise, but interest increases as academic and medical institutions explore microphysiological models for disease studies. Collaborative programs with global research organizations enhance regional exposure to organ-on-chip technologies and support long-term market development.

Market Segmentations:

By Type

- Product

- Liver-on-chip

- Lung-on-chip

- Heart-on-chip

- Kidney-on-chip

- Other products

- Service

By Application

- Drug discovery

- Toxicity testing

- Disease modeling

- Personalized medicine

- Other applications

By End User

- Pharmaceutical and biotechnology companies

- Academic and research institutes

- Other

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Organ-on-Chip Market features leading companies such as Emulate, Inc., Axosim, CN-Bio, Insphero, AlveoliX AG, Altis Biosystems, Bi/ond Solutions B.V, Cherry Biotech, and Hesperos, Inc. The competitive landscape is shaped by rapid innovation in microfluidic engineering, 3D tissue models, and integrated sensing technologies that enhance predictive accuracy in drug development. Vendors focus on developing specialized organ platforms that address toxicity testing, metabolism studies, and complex disease modeling. Many players expand partnerships with pharmaceutical firms to accelerate validation and commercial adoption. Investment in scalable manufacturing, regulatory collaboration, and multi-organ integration strengthens market positioning. Companies also emphasize expanding service portfolios, offering custom assay development and technical support to meet diverse research needs. Rising interest in personalized medicine and patient-derived models pushes developers to enhance biological relevance and improve system reproducibility. Continuous R&D and academic collaborations support ongoing product evolution and competitive differentiation within the global market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Hesperos partnered with Psilera to accelerate preclinical development of a frontotemporal dementia drug candidate using their organ-on-a-chip platform.

- In 2023, AxoSim acquired Vyant Bio’s StemoniX assets enhancing neurological drug discovery, indicating active developments in 2023.

- In 2023, Emulate launched its human Liver-Chip model with key enhancements designed to improve drug toxicity screening, particularly for challenging compounds.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow as drug developers increase adoption of high-precision microphysiological systems.

- Multi-organ and interconnected chip platforms will gain wider acceptance in advanced toxicity and metabolism studies.

- Regulatory agencies will move toward clearer guidelines that support wider use of organ-on-chip systems in preclinical workflows.

- Integration of AI and data analytics will improve prediction accuracy and model reliability.

- Pharmaceutical firms will invest more in customized chip platforms tailored to specific therapeutic areas.

- Academic collaborations will strengthen innovation in disease-specific and patient-derived chip models.

- High-throughput organ-on-chip systems will become more scalable for large drug screening programs.

- Growth in personalized medicine will boost demand for patient-specific chip designs.

- Advances in materials and microfabrication will lower production costs and expand commercial availability.

- Emerging markets will adopt organ-on-chip technologies as research infrastructure and funding improve.