Market Overview

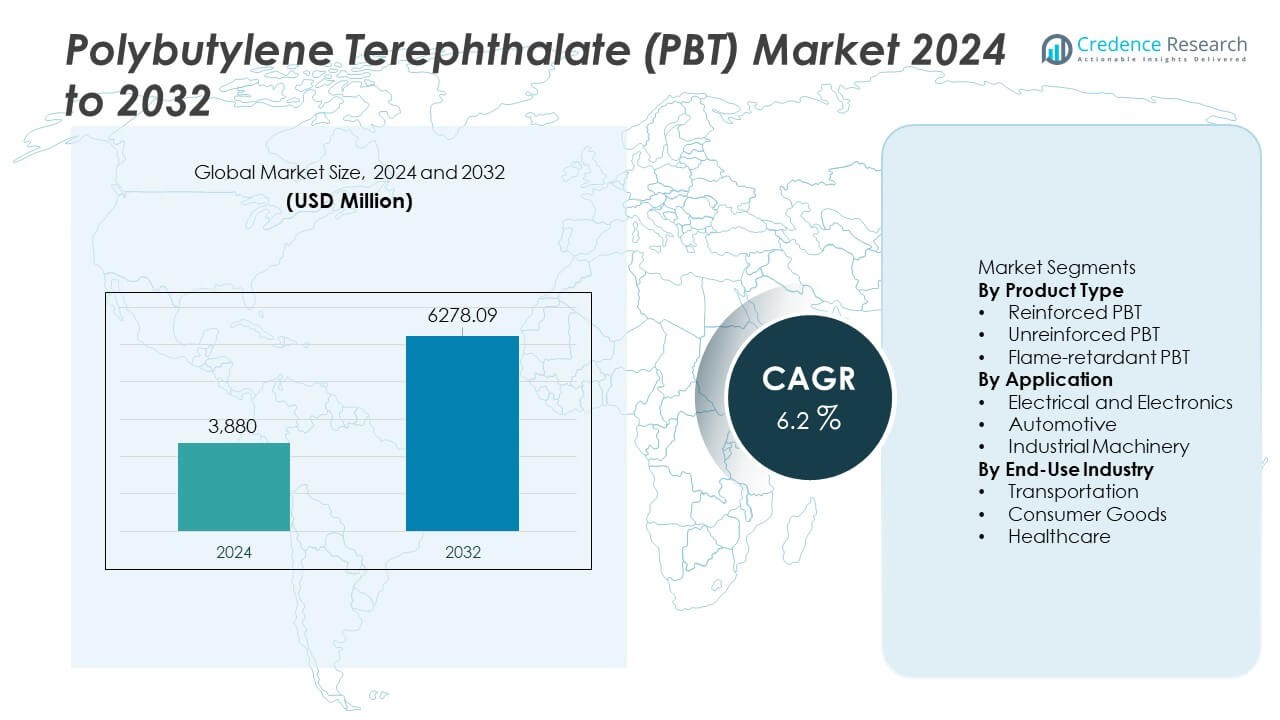

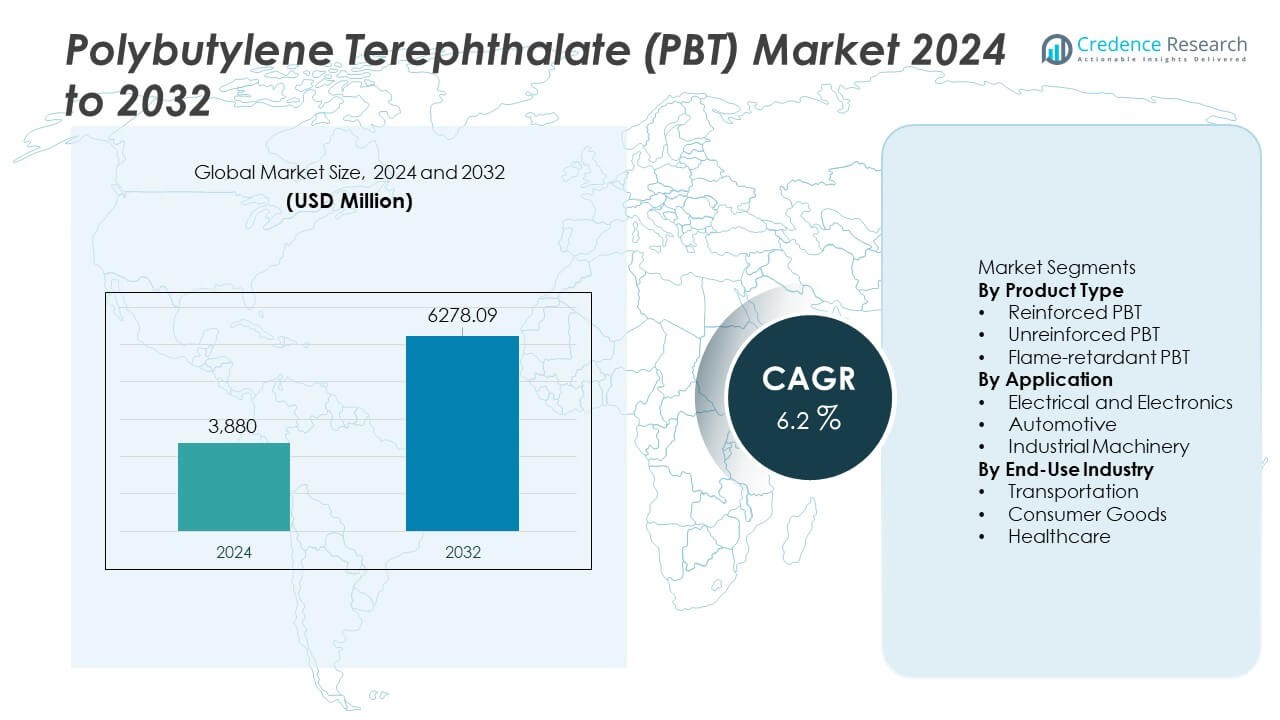

The Polybutylene Terephthalate (PBT) Market was valued at USD 3,880 million in 2024 and is expected to reach USD 6,278.09 million by 2032, growing at a CAGR of 6.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polybutylene Terephthalate (PBT) Market Size 2024 |

USD 3,880 Million |

| Polybutylene Terephthalate (PBT) Market, CAGR |

6.2% |

| Polybutylene Terephthalate (PBT) Market Size 2032 |

USD 6,278.09 Million |

Top players in the Polybutylene Terephthalate (PBT) market include BASF SE, DuPont, SABIC, Celanese Corporation, Mitsubishi Chemical Corporation, Toray Industries, RTP Company, Chang Chun Group, LANXESS AG, and Polyplastics Co., Ltd. These companies lead through strong material portfolios, global supply networks, and steady investment in reinforced and flame-retardant PBT grades. Asia Pacific stands as the leading regional market with a 38% share, driven by large-scale electronics production, expanding automotive manufacturing, and rapid growth in electric vehicles. North America and Europe follow with steady demand from high-performance components used in automotive, electrical, and industrial applications.

Market Insights

Market Insights

- The Polybutylene Terephthalate (PBT) market reached USD 3,880 million in 2024 and will grow at a CAGR of 6.2%, supported by rising demand from major end-use sectors.

- Strong drivers include higher adoption in electrical and electronics, which lead with a 41% segment share, as manufacturers need heat-resistant and precise polymer components.

- Key trends show rising use of reinforced PBT, supported by its 46% product share, along with growing opportunities in EVs and smart devices that require durable, high-performance materials.

- Competitive activity intensifies as leading companies invest in specialty grades and regional expansions to serve Asia Pacific, which holds the highest 38% share, followed by North America at 28%.

- Market restraints include raw-material price volatility and rising competition from alternative engineering plastics, which challenge producers as they work to supply stable, cost-efficient solutions for global industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Reinforced PBT holds the dominant share of 46% in this segment due to its higher strength, dimensional stability, and suitability for high-performance components. Demand rises in connectors, sensor housings, and structural parts that need strong mechanical resistance. Unreinforced PBT follows as a flexible option for lightweight parts where cost and easy processing drive adoption. Flame-retardant PBT secures steady growth in safety-critical applications, aided by strict fire-safety rules in electronics and automotive systems. The shift toward miniaturized devices and thermally stable materials continues to strengthen reinforced PBT’s leadership.

- For instance, Celanese Corporation introduced a glass-fiber-reinforced PBT grade containing 30% glass fiber, raising tensile strength to 135 MPa, which improved connector load performance in automotive assemblies.

By Application

Electrical and Electronics lead this segment with a 41% share, driven by high use in switches, relays, sockets, and precision connectors. The material supports heat resistance and electrical insulation, which improves device safety. Automotive applications follow as OEMs use PBT for sensor housings, lighting modules, and under-the-hood parts. Industrial machinery adopts PBT for gears, housings, and control units where durability matters. Rising demand for compact electronic parts and increased automation strengthens the position of the electrical and electronics segment.

- For instance, BASF SE offers an electronic-grade polybutylene terephthalate (PBT) that achieves a high Comparative Tracking Index, a requirement for safer use in high-voltage EV components. This material is designed to maintain electrical stability, which enhances performance in precision systems.

By End-Use Industry

Transportation holds the highest share at 44%, supported by rising use of PBT in lightweight components, electric-vehicle parts, and thermal-resistant modules. Automakers prefer PBT for its strength, low moisture absorption, and stable performance in demanding environments. Consumer goods follow with strong uptake in home appliances, power tools, and personal-care devices. Healthcare applications expand at a steady pace as medical devices require reliable and sterilizable polymers. Growing EV production and the need for heat-stable materials help transportation maintain its leadership in this segment.

Key Growth Drivers

Rising Demand from Electrical and Electronics Industry

Electrical and electronics manufacturers increase PBT use due to its strong insulation, heat stability, and dimensional accuracy. Growing production of connectors, switches, sensors, and miniature parts strengthens demand as devices become smaller and more complex. The rise of smart devices, 5G infrastructure, and advanced consumer electronics pushes adoption further. PBT supports high-volume processing and reduces defect rates, which improves production efficiency. This shift positions the material as a preferred choice for durable and safe electronic components.

- For instance, DuPont introduced a high-performance PBT grade for precision connectors that reaches CTI 600V, enabling safer use in high-voltage electronics and 5G modules.

Expansion of Automotive Lightweighting Initiatives

Automakers adopt PBT to replace heavier metal components and improve fuel efficiency and EV range. The polymer offers high stiffness, chemical resistance, and stable performance in high-temperature zones under the hood. Electric vehicles rely on PBT for connectors, battery components, and sensor housings that require thermal and electrical reliability. Growth in ADAS systems adds new application areas that support consistent demand. As vehicle electrification accelerates, PBT usage rises across both structural and functional parts.

- For instance, SABIC developed an automotive-grade PBT compound reinforced with glass fiber for use in headlamp housings.

Increasing Use in Industrial Machinery and Automation

Industrial machinery manufacturers use PBT for gears, housings, conveyor parts, and control modules due to its durability and ease of molding. Growth in automation increases the need for precise, long-life engineering plastics. PBT reduces equipment wear and improves stability in environments with heat and mechanical stress. Its ability to support complex geometries also helps machinery makers streamline production. The rise of robotics and smart factories expands opportunities for PBT-based components.

Key Trends & Opportunities

Shift Toward High-Performance and Specialty Grades

Manufacturers develop new reinforced, flame-retardant, and low-hygroscopic PBT grades to meet advanced industry needs. Demand grows for materials that handle higher temperatures, tighter tolerances, and long-term structural loads. Electronics, EVs, and industrial machinery rely on these specialty grades to ensure reliability under stress. Improved formulations with better flow properties also reduce production time and energy use. This shift creates strong opportunities for suppliers offering differentiated, high-performance compounds.

- For instance, LANXESS AG released a specialty PBT grade with 45% glass fiber reinforcement, raising tensile strength to 185 MPa and improving creep resistance under continuous loads.

Growing Opportunities in Electric Vehicles and Renewable Energy Systems

EV platforms create significant demand for heat-resistant and electrically safe polymers like PBT. Battery systems, charging components, and motor parts need materials with stable thermal behavior and flame-retardant properties. Renewable energy equipment, such as solar inverters and wind control modules, also adopts PBT for its durability and insulation strength. As energy systems become more compact and high-powered, the need for reliable engineering plastics expands. This trend opens new revenue streams for PBT suppliers.

- For instance, Mitsubishi Chemical Corporation developed a flame-retardant PBT grade reaching a UL94 V-0 rating at 0.4 mm thickness, used in EV battery module connectors.

Key Challenges

Volatility in Raw Material Prices

Fluctuations in the cost of petrochemical feedstocks affect PBT production margins and pricing stability. Manufacturers struggle to maintain predictable cost structures when raw materials shift due to supply disruptions or geopolitical concerns. Price swings often result in higher operational expenses and reduced profitability for converters. Companies may face difficulties passing increased costs to end users in competitive markets. This challenge prompts firms to explore alternative supply sources and recycling strategies.

Competition from Alternative Engineering Plastics

Materials such as polyamide (PA), polycarbonate (PC), and polypropylene (PP) compete with PBT in several applications. These alternatives sometimes offer cost advantages, higher temperature resistance, or improved mechanical properties depending on the use case. Buyers in cost-sensitive sectors may shift to substitutes when performance differences are minimal. Continuous innovation in competing polymers increases pressure on PBT suppliers to enhance product performance. This challenge reinforces the need for specialty grades and differentiated solutions.

Regional Analysis

North America

North America holds a 28% market share, driven by strong demand from automotive, electronics, and industrial sectors. The region benefits from advanced manufacturing capabilities and steady adoption of engineering plastics for high-performance components. U.S. automakers use PBT in connectors, sensor housings, and EV modules due to its strength and thermal resistance. Growth in consumer electronics and industrial automation further supports steady consumption. Regulatory focus on material safety and performance also encourages wider use of flame-retardant and reinforced PBT grades across key industries.

Europe

Europe accounts for a 26% market share, supported by strict industry standards and a strong base of automotive and electrical manufacturers. Germany, France, and Italy drive demand as OEMs use PBT in lightweight parts, high-precision connectors, and sensor components. The region’s push toward sustainable mobility and electric vehicles expands PBT consumption in battery systems and charging units. Investments in automation and smart manufacturing also boost demand for durable polymer components. European environmental rules promote long-life materials, strengthening adoption of specialty PBT grades.

Asia Pacific

Asia Pacific leads the market with a 38% share, driven by large-scale production of electronics, automotive parts, and consumer goods. China, Japan, South Korea, and India remain key contributors due to strong industrial output and rapid technological growth. Expanding EV manufacturing boosts PBT use in motor components, connectors, and thermal-resistant modules. High electronics production strengthens demand for insulation-grade and flame-retardant PBT. The region benefits from competitive manufacturing costs and large supply-chain networks, which support continuous expansion. Rising automation across factories further fuels adoption of engineering plastics.

Latin America

Latin America holds a 5% market share, supported by growing automotive assembly, consumer appliances, and industrial equipment production. Brazil and Mexico drive regional demand, as manufacturers adopt PBT for connectors, switches, housings, and lightweight modules. Expanding appliance production and rising interest in compact electronics strengthen material usage. Infrastructure upgrades and industrial growth also create steady demand for durable polymer components. Although the region’s market size remains moderate, increasing investments in local manufacturing and higher adoption of engineering plastics support gradual expansion.

Middle East & Africa

The Middle East & Africa region accounts for a 3% market share, with demand supported by industrial machinery, automotive assembly, and consumer electronics imports. Countries such as the UAE, Saudi Arabia, and South Africa adopt PBT for electrical components, appliance parts, and automotive systems. Growth in renewable energy projects drives use of insulation materials for power equipment. Expanding industrial zones and rising manufacturing activity encourage uptake of engineering plastics. Although adoption rates remain lower than other regions, improving industrial capabilities support future market growth.

Market Segmentations:

By Product Type

- Reinforced PBT

- Unreinforced PBT

- Flame-retardant PBT

By Application

- Electrical and Electronics

- Automotive

- Industrial Machinery

By End-Use Industry

- Transportation

- Consumer Goods

- Healthcare

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape features major players such as BASF SE, DuPont, SABIC, Celanese Corporation, Mitsubishi Chemical Corporation, Toray Industries, RTP Company, Chang Chun Group, LANXESS AG, and Polyplastics Co., Ltd. These companies strengthen their positions through advanced material development, expanded production capabilities, and strategic partnerships with automotive and electronics manufacturers. Many focus on high-performance reinforced and flame-retardant PBT grades to meet rising demand from EVs, smart devices, and industrial automation. Innovation centers drive improvements in thermal stability, flow properties, and durability, enabling wider adoption across complex applications. Firms also invest in regional expansions to support fast-growing markets in Asia Pacific and North America. Sustainability efforts, including recyclable formulations and reduced-emission production methods, further shape competition. Collectively, these strategies help players retain market share and address evolving needs in high-precision, high-performance engineering plastics.

Key Player Analysis

- BASF SE

- DuPont

- SABIC

- Celanese Corporation

- Mitsubishi Chemical Corporation

- Toray Industries, Inc.

- RTP Company

- Chang Chun Group

- LANXESS AG

- Polyplastics Co., Ltd.

Recent Developments

- In April 2024, a collaboration was announced between SABIC and a major resin/chemical technology company to jointly develop new PBT solutions aimed at the automotive sector.

- In September 2023, DuPont de Nemours, Inc. (US) unveiled a state-of-the-art adhesives production facility in Zhangjiagang, East China, designed to support the transportation sector and featuring advanced manufacturing execution system (MES) technology.

- In February 2023, BASF SE announced it would expand its global PBT production capacity by 30,000 metric tons per year at its Ludwigshafen, Germany site.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for reinforced PBT will rise as industries need stronger and heat-stable materials.

- Growth in electric vehicles will expand PBT use in connectors, battery parts, and sensor modules.

- Electronics manufacturing will continue to drive higher consumption of flame-retardant PBT grades.

- Automation and smart factories will support wider use of PBT in machinery components.

- New specialty grades will improve thermal stability and boost adoption in high-stress applications.

- Sustainability efforts will push manufacturers to develop recyclable and low-emission PBT compounds.

- Regional growth will remain strong in Asia Pacific as production capacity and end-use demand increase.

- Medical device makers will adopt more PBT for durable and sterilizable components.

- Lightweighting initiatives in automotive will strengthen long-term market opportunities.

- Increased investment in material innovation will improve performance and expand application diversity.

Market Insights

Market Insights