Market Overview

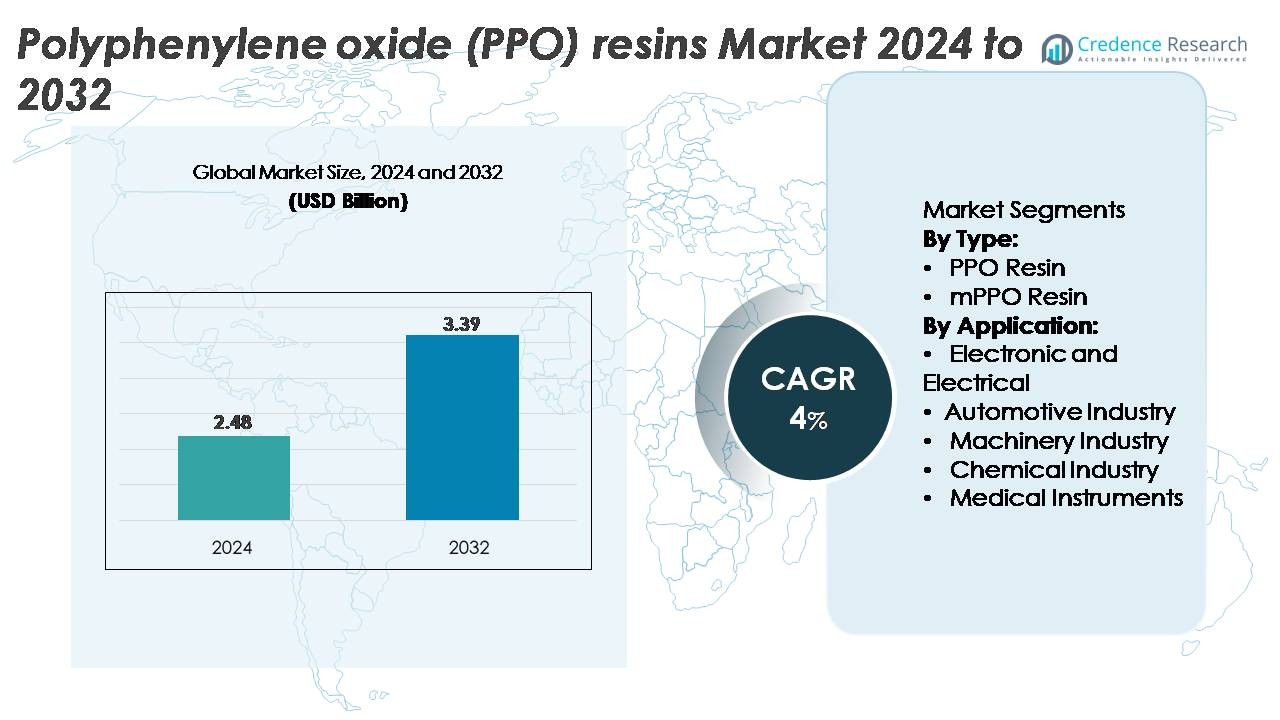

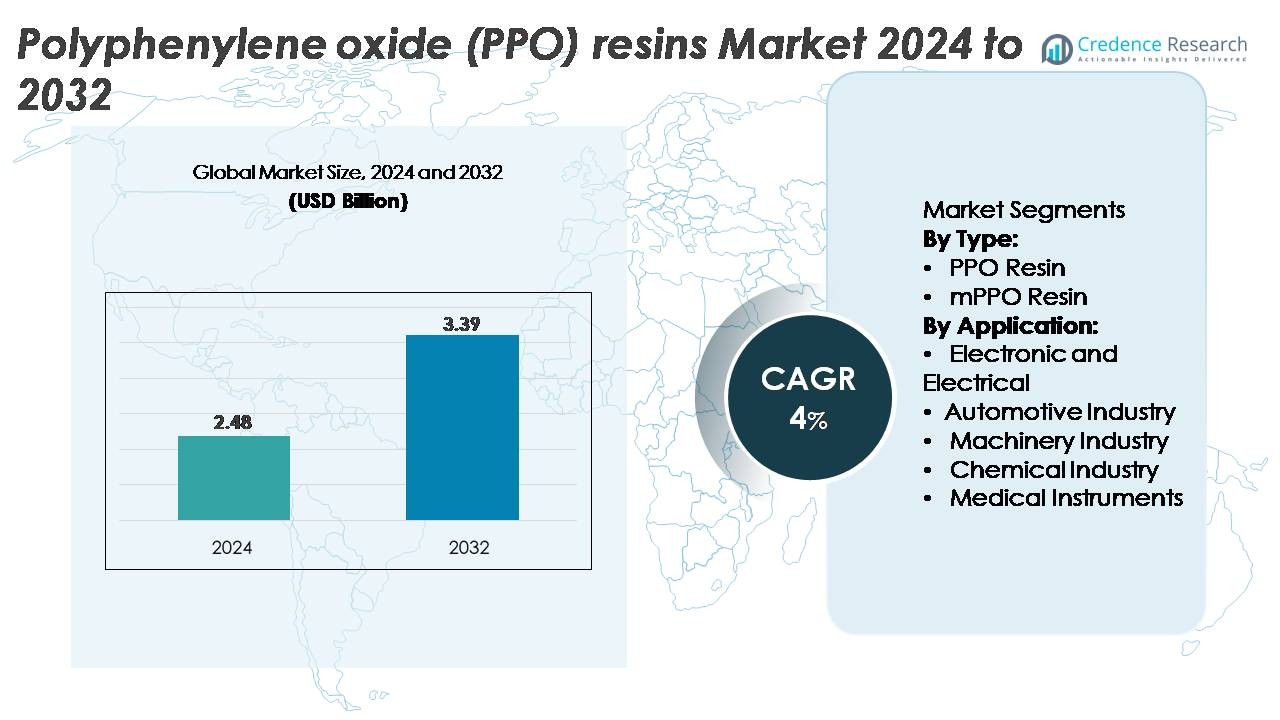

The polyphenylene oxide (PPO) resins market was valued at USD 2.48 billion in 2024 and is projected to reach USD 3.39 billion by 2032, expanding at a CAGR of 4% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polyphenylene Oxide (PPO) Resins Market Size 2024 |

USD 2.48 Billion |

| Polyphenylene Oxide (PPO) Resins Market, CAGR |

4% |

| Polyphenylene Oxide (PPO) Resins Market Size 2032 |

USD 3.39 Billion |

The Polyphenylene Oxide (PPO) resins market is shaped by strong competition among leading material manufacturers such as RTP Company, Kingfa Science and Technology, Sumitomo Chemicals, Romira (BASF), Premier Plastic Resin, Evonik, Bluestar, Mitsubishi Chemicals, Asahi Kasei Chemicals, and Sanic (GE). These companies focus on producing high-performance PPO grades and advanced PPE-based alloys tailored for automotive lightweighting, electrical insulation systems, and precision industrial components. Asia-Pacific leads the global market with a 34% share, driven by large-scale electronics and automotive production, while North America (32%) and Europe (27%) maintain strong demand through technological innovation, established OEM networks, and expanding high-value engineering plastic applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Polyphenylene Oxide (PPO) resins market was valued at USD 2.48 billion in 2024 and is projected to reach USD 3.39 billion by 2032, registering a 4% CAGR during the forecast period.

- Strong demand from the Electronic & Electrical segment, the market’s largest application share, drives adoption due to PPO’s dielectric strength, low moisture absorption, and thermal stability essential for connectors, housings, and high-voltage insulation components.

- Growing use of PPO-based blends, especially PPE/PS and PPE/PA alloys, reflects a clear market trend as industries seek lightweight, high-performance materials for EV power systems, smart appliances, and precision industrial parts.

- Leading players such as RTP Company, Kingfa, Sumitomo Chemicals, Romira (BASF), Evonik, Bluestar, and Asahi Kasei enhance competitiveness through formulation innovation, capacity expansion, and OEM collaborations.

- Asia-Pacific leads with 34% market share, followed by North America at 32% and Europe at 27%, with the Electronic & Electrical segment maintaining the dominant share across all regions due to strong electronics and automotive integration.

Market Segmentation Analysis:

By Type (PPO Resin, mPPO Resin)

PPO Resin holds the dominant position in the type segment, accounting for the largest market share due to its high heat resistance, excellent electrical insulation, and dimensional stability—qualities required in premium electrical housings, relay blocks, and structural automotive components. Manufacturers continue to favor PPO Resin for applications demanding minimal water absorption and sustained performance under thermal stress. mPPO Resin shows steady growth, driven by its improved processability and compatibility with engineering blends, but PPO Resin maintains market leadership as industries prioritize material rigidity and long-term reliability in high-precision environments.

· For instance, SABIC’s NORYL™ N190X PPO/PS grade provides a tensile strength of about 47 MPa and an HDT of roughly 82–85 °C at 1.8 MPa, as listed in the official SABIC product datasheet. These verified properties support its common use in electrical housings and appliance components.

By Application (Electronic & Electrical, Automotive, Machinery, Chemical, Medical Instruments)

The Electronic and Electrical segment represents the largest application share, driven by the surge in compact consumer electronics, industrial controls, and high-voltage insulation systems that require materials with strong dielectric properties and heat resistance. PPO’s low creep, flame retardancy, and hydrolytic stability position it as the preferred resin for connectors, switches, PCB components, and motor housings. The Automotive segment continues to expand with growing demand for lightweight, thermally stable polymers in EV modules and under-the-hood parts, while machinery, chemical processing, and medical instruments adopt PPO for its chemical resistance and structural durability.

- For instance, SABIC lists its NORYL™ N300X PPO/PS resin with a high comparative tracking index of 600 V and strong electrical insulation stability, supporting its use in connectors and power-handling modules. This grade is designed for electrical housings that require low moisture uptake and stable mechanical performance.

Key Growth Drivers

Rising Demand for High-Performance Engineering Plastics

The Polyphenylene Oxide (PPO) resins market expands steadily as industries shift toward engineering plastics that deliver high thermal resistance, electrical insulation, and low moisture absorption. PPO’s superior strength–to–weight ratio and dimensional stability under heat make it indispensable in electronic housings, transformer components, EV insulation modules, and precision automotive parts. Manufacturers increasingly replace metals and conventional plastics with PPO-based blends to reduce weight and enhance energy efficiency in end-use systems. Growing electronics miniaturization further accelerates demand, as PPO enables tight tolerances, flame retardancy, and long service life in compact circuit components. Additionally, industrial machinery and chemical processing equipment rely on PPO for its solvent resistance and mechanical resilience, strengthening long-term adoption. As advanced materials become a priority across automotive, electrical infrastructure, and industrial automation sectors, PPO retains a strong competitive edge.

· For instance, Asahi Kasei’s XYRON™ 5200 PPO/PS resin provides a tensile strength of about 60 MPa and an HDT of roughly 125 °C at 1.8 MPa, according to the official product datasheet, supporting reliable use in electrical connectors and precision molded components.

Expansion of Electric Vehicles and Lightweight Automotive Applications

The rapid growth of electric vehicles (EVs) significantly boosts PPO resin consumption, as OEMs prioritize lightweight, thermally stable polymers for battery insulation, power electronics casings, charging modules, and under-the-hood assemblies. PPO’s high dielectric strength and resistance to thermal degradation support safer and more efficient high-voltage architectures in EV platforms. With global emission norms tightening, manufacturers increasingly incorporate PPO-based composite structures to reduce vehicle mass and improve energy efficiency. The resin’s compatibility with blends such as PPE/PS and PPE/PA enables durable, lightweight alternatives to metal components without compromising mechanical integrity. As automotive electronics become more complex—driven by ADAS, inverters, onboard chargers, and autonomous control systems—PPO serves as a preferred material for structural and electrical protection. This rising reliance on advanced polymers for thermal, mechanical, and dielectric stability makes the automotive sector a long-term driver of PPO demand.

· For instance, Mitsubishi Engineering-Plastics’ MODIC™ E824 PPO resin shows a tensile strength of about 65 MPa and an HDT of roughly 132 °C at 1.8 MPa, as listed in the official datasheet, supporting durable use in EV electrical modules and heat-loaded automotive parts.

Growth in High-Voltage Electrical Infrastructure and Industrial Automation

Increasing investments in electrical infrastructure, renewable energy systems, and industrial automation elevate demand for PPO resins that withstand heat, electrical stress, and environmental exposure. Power distribution units, switchgear housings, circuit breakers, connectors, and motor insulation systems require materials with reliable dielectric behavior and fire resistance—capabilities where PPO excels. As industries implement automation, smart factories, and robotics, OEMs prefer PPO for precision components such as motor housings, sensors, terminal blocks, and control modules. The resin’s durability across variable load conditions and its resistance to hydrolysis and chemical contamination support long operational lifespans in industrial settings. Growth in data centers and telecom infrastructure also contributes, as PPO-based components maintain thermal stability in high-performance electrical environments. The shift toward electrification across manufacturing, energy storage, and utility networks continues to propel PPO demand globally.

Key Trends and Opportunities

Increasing Adoption of PPO-Based Blends and Alloys

A major trend shaping the PPO market is the rapid adoption of PPO-based polymer blends—particularly PPO/PS, PPO/PA, and flame-retardant reinforced formulations—that offer enhanced processability, chemical resistance, and mechanical performance. These blends address limitations of pure PPO, enabling broader use in automotive exteriors, structural housings, electronic enclosures, and industrial components. Innovations in compounding technology allow manufacturers to fine-tune heat distortion temperature, impact strength, and fluid compatibility, unlocking high-value applications in EV power units, smart appliances, and high-temperature electrical modules. With end users demanding materials that combine lightweight properties with durability, PPO blends create strong commercial opportunities for producers. Continued R&D in reinforcing agents, halogen-free retardants, and bio-based additives is expected to open new markets and support sustainability-driven adoption.

· For instance, Techno Polymer’s Xyron™ H Series PPO compounds include grades with heat deflection temperatures reaching about 130 °C at 1.8 MPa and tensile strengths above 65 MPa, as documented in their product literature, enabling reliable use in reinforced electrical enclosures and structural appliance parts.

Growing Opportunities in Medical Devices and Chemical Processing Equipment

The medical and chemical industries present expanding opportunities for PPO resins due to their biocompatibility, sterilization resistance, and chemical inertness. Medical device manufacturers increasingly use PPO-based materials for diagnostic housings, reusable surgical instruments, sterilizable components, and laboratory equipment requiring high dimensional stability. Unlike many engineering plastics, PPO withstands repeated autoclave cycles without significant degradation, making it suitable for long-life medical systems. In chemical processing, PPO’s resistance to acids, alkalis, and industrial solvents supports its integration into pumps, valve components, flow meters, and containment systems used in corrosive environments. As healthcare infrastructure expands and chemical plants modernize, demand rises for materials that deliver longevity, safety, and structural reliability—positioning PPO as a prime beneficiary of these emerging opportunities.

· For instance, RTP Company’s RTP 1400 Series PPO compounds carry a UL94 V-0 flame rating at 1.5 mm and provide dielectric strength above 20 kV/mm, supporting safe use in sterilizable medical housings and solvent-resistant lab-equipment frames.

Key Challenges

High Production Costs and Complex Processing Requirements

One of the major challenges restricting PPO adoption is its relatively high production cost and complex processing characteristics. Pure PPO exhibits high melt viscosity, making it difficult to mold without specialized equipment or blending with other polymers. This increases manufacturing costs for OEMs compared to alternatives such as ABS, PC, or standard engineering plastics. Energy-intensive processing, the need for controlled temperature profiles, and stringent material handling requirements further elevate operational expenses. Smaller manufacturers often face barriers in adopting PPO due to limited compounding capabilities or higher tooling investments. As cost-sensitive industries such as consumer electronics and automotive compete to optimize margins, pricing pressures may limit the penetration of PPO in lower-end applications despite its performance advantages.

Competition from Alternative Engineering Polymers and Regulatory Pressures

PPO resins face stiff competition from widely adopted engineering polymers such as polycarbonate (PC), polyamide (PA), PBT, and high-performance composites that offer comparable mechanical or thermal properties at lower cost. These alternatives have broader processing windows and established supply chains, making them attractive to manufacturers seeking cost efficiency. Additionally, evolving environmental regulations and sustainability mandates challenge PPO producers to reduce emissions, improve recyclability, and develop eco-friendly formulations. Although PPO blends are recyclable, they require specialized processing infrastructure that is not widely available. This combination of competitive material options and regulatory compliance pressures poses constraints on long-term market expansion unless producers invest in greener, more versatile PPO solutions.

Regional Analysis

North America

North America accounts for approximately 32% of the global PPO resins market, driven by strong demand across automotive lightweighting, industrial automation, and high-reliability electrical components. The U.S. remains the primary contributor, supported by large-scale EV manufacturing, aerospace electronics, and data-center infrastructure requiring high-temperature, flame-retardant polymers. Medical device manufacturers also boost adoption due to PPO’s sterilization resistance and biocompatibility. Ongoing investments in high-voltage grid modernization and semiconductor fabrication further strengthen regional consumption. The presence of major polymer producers and advanced compounding facilities reinforces North America’s leadership.

Europe

Europe holds around 27% market share, supported by stringent regulatory standards that encourage the use of high-performance, halogen-free, and thermally stable engineering plastics. Germany, France, and the UK lead adoption across automotive modules, EV charging infrastructure, industrial machinery, and chemical processing equipment. The region’s robust appliance industry and strong focus on energy-efficient products favor PPO-based blends with enhanced mechanical stability. Rising demand for precision electronic components in industrial automation and renewable energy systems also contributes. Europe’s commitment to material innovation and sustainability further accelerates PPO penetration into next-generation electrical systems.

Asia-Pacific

Asia-Pacific dominates the global PPO resins market with an estimated 34% share, supported by extensive electronics manufacturing, high-volume automotive production, and rapid industrialization. China, Japan, South Korea, and Taiwan drive large-scale consumption due to their leadership in semiconductors, consumer electronics, and EV battery systems requiring high-dielectric, heat-resistant materials. Growing chemical processing capacity and expansion of regional medical device manufacturing further elevate demand. Government incentives for electric mobility and smart manufacturing accelerate the adoption of PPO-based engineering plastics. APAC’s competitive manufacturing ecosystem and rising exports strengthen its position as the fastest-growing regional market.

Latin America

Latin America holds roughly 5% market share, driven by gradual expansion in automotive assembly, electrical infrastructure upgrades, and industrial equipment manufacturing. Brazil and Mexico lead regional demand as OEMs adopt PPO-based resins for connectors, housings, and lightweight automotive components. Growth in consumer electronics imports and local appliance production also supports consumption. While adoption remains moderate, investments in petrochemical capacity and renewable energy infrastructure provide emerging opportunities for PPO applications in high-temperature electrical systems. However, supply-chain limitations and cost pressures moderately restrain penetration relative to more industrialized regions.

Middle East & Africa

The Middle East & Africa region represents about 2% of global PPO resin demand, supported primarily by the expansion of industrial automation, oil and gas processing equipment, and electrical grid modernization projects. GCC nations drive consumption through investments in high-performance materials for pumps, flow systems, and corrosion-resistant components used in harsh operating environments. South Africa contributes modestly through automotive and appliance manufacturing. Although the market is small, rising infrastructure development and diversification into electronics assembly and medical equipment offer long-term growth potential. Limited local polymer compounding capabilities remain a key constraint.

Market Segmentations:

By Type:

By Application:

- Electronic and Electrical

- Automotive Industry

- Machinery Industry

- Chemical Industry

- Medical Instruments

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Polyphenylene Oxide (PPO) resins market features a moderately consolidated competitive landscape dominated by global chemical producers and specialty polymer manufacturers that focus on advanced engineering plastics. Leading companies emphasize the development of high-performance PPO blends with enhanced processability, flame retardancy, and compatibility with automotive, electrical, and industrial applications. Strategic priorities include capacity expansions, technology upgrades in compounding, and partnerships with OEMs to supply application-specific formulations for electrical housings, EV components, and precision molded parts. Established players maintain strong competitive positions through extensive R&D pipelines, broad distribution networks, and vertically integrated production systems. Growing demand for lightweight materials and heat-resistant polymers has intensified competition among suppliers specializing in PPE/PS and PPE/PA alloys. Regional manufacturers in Asia-Pacific also strengthen their presence by offering cost-efficient, customized grades tailored to electronics and automotive markets. Overall, competitive dynamics continue to evolve as companies invest in material innovation, sustainable formulations, and expanded end-use collaboration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2024, Kingfa announced the launch of its enhanced engineering-plastics portfolio featuring new high-temperature and flame-retardant grades, including reinforced PPO composites aimed at EV electrical modules and industrial components. The update strengthens Kingfa’s global footprint in advanced polymer solutions and supports growing demand for lightweight structural materials.

- In March 2024, RTP Company expanded its North American compounding capacity by adding new high-temperature engineering-polymer lines at its Winona, Minnesota facility. This upgrade supports increased production of specialty materials, including PPO-based compounds within the RTP 1400 Series, and enhances supply capabilities for electrical, automotive, and medical OEMs seeking flame-retardant and dielectric-stable PPO formulations.

- In April 2024, Mitsubishi Engineering-Plastics announced a capacity optimization program for its MODIC™ PPO/PPE product line, focusing on improved energy-efficient production and expanded supply for automotive electronics and high-temperature electrical enclosures. The initiative aligns with rising adoption of PPO blends in EV and power-device applications.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly shift toward PPO-based alloys that offer improved processability and enhanced mechanical performance.

- Automotive manufacturers will expand PPO adoption for lightweight EV components, battery insulation, and high-temperature electrical modules.

- Demand for PPO in compact electronic devices will grow as manufacturers seek materials with strong dielectric strength and thermal stability.

- Advanced compounding technologies will enable development of flame-retardant, halogen-free PPO grades aligned with global safety standards.

- Medical device producers will use more PPO due to its sterilization resistance and biocompatibility in reusable equipment.

- Industrial automation and robotics will drive PPO usage in precision housings, connectors, and high-strength insulating parts.

- Rising investments in renewable energy infrastructure will create new opportunities for PPO in power electronics and high-current systems.

- Asia-Pacific will strengthen its position as the fastest-growing manufacturing and export hub for PPO-based materials.

- Producers will focus on sustainable PPO formulations and improved recyclability to meet environmental regulations.

- Strategic partnerships between polymer manufacturers and OEMs will accelerate development of application-specific PPO solutions.