Market Overview

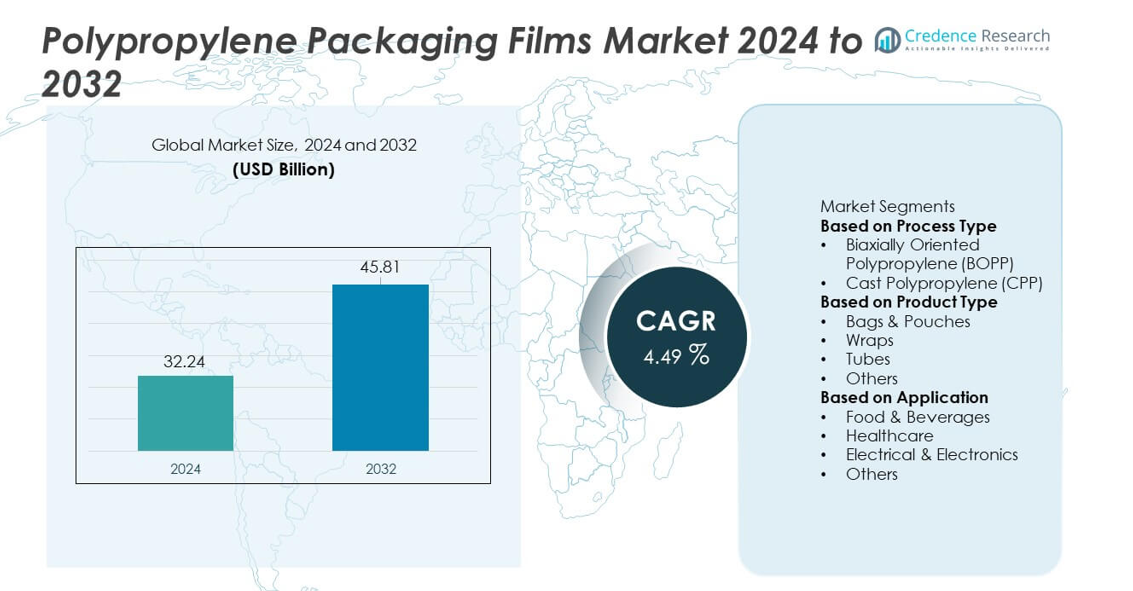

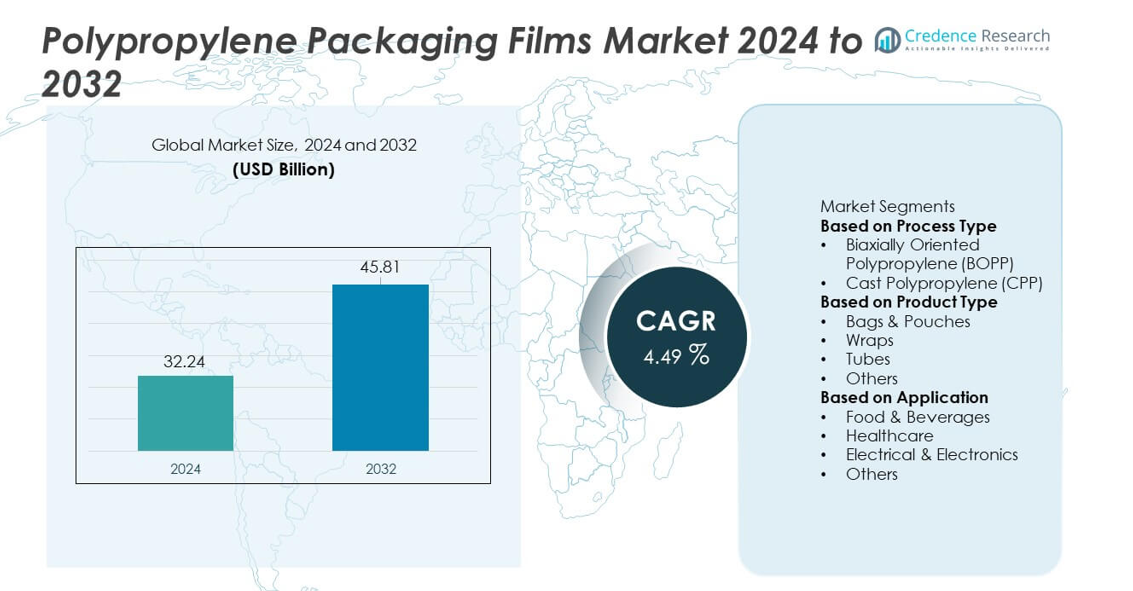

The Polypropylene Packaging Films market reached USD 32.24 billion in 2024 and is projected to rise to USD 45.81 billion by 2032, registering a CAGR of 4.49% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polypropylene Packaging Films Market Size 2024 |

USD 32.24 billion |

| Polypropylene Packaging Films Market, CAGR |

14.49% |

| Polypropylene Packaging Films Market Size 2032 |

USD 45.81 billion |

The Polypropylene Packaging Films market is shaped by key players including Toray Industries, UFlex Ltd., Jindal Poly Films Ltd., Cosmo Films Ltd., Innovia Films, Taghleef Industries, Inteplast Group, SRF Limited, Mitsui Chemicals Tohcello, Inc., and Polibak Plastic Industry Co. These companies expand their presence through advanced BOPP and CPP technologies, high-barrier films, and sustainable mono-material solutions. Asia Pacific leads the global market with a 38% share, supported by strong food processing, retail growth, and large-scale film manufacturing. North America follows with a 27% share, driven by demand for packaged foods and healthcare products, while Europe holds a 25% share backed by strict sustainability regulations.

Market Insights

- The Polypropylene Packaging Films market reached USD 32.24 billion in 2024 and will grow at a CAGR of 4.49% through 2032.

- Strong demand from food and beverage packaging drives expansion, with BOPP leading the process type segment with a 62% share due to its clarity and barrier strength.

- Rising adoption of high-barrier and recyclable films shapes market trends as brands shift toward mono-material packaging aligned with sustainability goals.

- Competition intensifies as major players invest in advanced extrusion lines, specialty coatings, and high-performance films to strengthen product portfolios.

- Asia Pacific leads with 38% share, followed by North America with 27% and Europe with 25%, while bags and pouches dominate product types with a 48% share across global applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Process Type

Biaxially Oriented Polypropylene (BOPP) dominates the process type segment with a 62% share, driven by its strong barrier properties, high clarity, and cost-effective performance in large-volume packaging. BOPP films gain wide use across food, personal care, and labeling due to their strength and printability. Cast Polypropylene (CPP) grows steadily as industries adopt flexible sealing films for snacks, bakery items, and medical packaging. Rising demand for lightweight and recyclable packaging materials further strengthens the shift toward BOPP. Its suitability for high-speed production lines and multilayer structures continues to support dominance across global packaging applications.

- For instance, Toray Industries expanded its BOPP film capacity by upgrading a production unit to meet rising demand, particularly for automotive capacitors and various packaging applications.

By Product Type

Bags and pouches lead the product type segment with a 48% share, supported by their widespread use in snacks, ready-to-eat foods, frozen items, and consumer goods. Their durability, heat-seal strength, and convenience drive strong adoption across retail and e-commerce channels. Wraps gain traction due to growing demand for protective and decorative packaging in food and industrial settings. Tubes and other formats serve niche applications requiring flexibility and moisture protection. Rising demand for lightweight, high-barrier packaging boosts the use of polypropylene films, with bags and pouches remaining the preferred format for cost-efficient mass-market packaging.

- For instance, UFlex commissioned a new high-speed multi-track sachet packaging line that operates at a high rate per minute per track, which provides a complete packaging solution.

By Application

Food and beverages dominate the application segment with a 55% share, driven by rising consumption of packaged snacks, dairy items, confectionery, and ready meals. Polypropylene films offer strong moisture resistance, seal integrity, and shelf-life extension, making them essential for food packaging. Healthcare applications grow as medical devices and pharmaceuticals require sterile, durable, and transparent packaging films. Electrical and electronics use polypropylene films for insulation and protective wrapping. Growing consumer demand for hygienic, lightweight, and recyclable packaging continues to support the strong position of food and beverages while encouraging expansion across other industrial sectors.

Key Growth Drivers

Rising Consumption of Packaged Food and Beverages

Global demand for packaged and ready-to-eat food drives strong adoption of polypropylene packaging films. These films offer moisture resistance, clarity, and durability, making them ideal for snacks, dairy, frozen foods, and bakery products. Growing retail penetration, rising disposable incomes, and the expansion of e-commerce strengthen film usage. Their compatibility with high-speed filling lines and flexible packaging formats improves operational efficiency for manufacturers. As consumers prefer hygienic and long-shelf-life products, polypropylene films continue to gain traction across mass-market food categories.

- For instance, Jindal Poly Films upgraded its food-grade BOPP line by adding a metallizer that is designed to provide robust barrier protection across various packaging and converting solutions.

Shift Toward Lightweight and Recyclable Packaging Materials

Sustainability initiatives encourage brands to reduce packaging weight and adopt recyclable materials, boosting demand for polypropylene films. Their low density, high strength, and compatibility with recycling streams make them a preferred choice over heavier substrates. Industries use polypropylene films to lower transportation costs and enhance environmental performance. Growth in mono-material packaging solutions strengthens adoption across FMCG, healthcare, and industrial sectors. As regulators promote circular economy practices, manufacturers increasingly shift toward polypropylene-based formats that meet strict sustainability requirements.

- For instance, Taghleef Industries developed a recyclable mono-PP film platform. The line employs advanced MDO stretching technology that achieves enhanced tensile strength values, supporting circular economy principles through improved end-of-life recyclability.

Expanding Applications Across Healthcare and Industrial Sectors

Healthcare and industrial sectors increase use of polypropylene films due to their strength, chemical resistance, and ability to maintain product integrity. Medical device packaging, pharmaceutical pouches, and sterile wraps benefit from their clarity, seal strength, and compliance with hygiene standards. Industrial users adopt polypropylene films for protective wrapping, insulation, and component packaging. Growth in logistics, electronics manufacturing, and global supply chains strengthens demand. As specialized applications rise, polypropylene films become integral to sectors requiring safe, durable, and cost-efficient packaging materials.

Key Trends & Opportunities

Rising Adoption of High-Barrier and Functional Films

Manufacturers develop advanced high-barrier BOPP films to extend shelf life and protect sensitive products from moisture, oxygen, and odors. Functional films with metallization, coatings, or antimicrobial properties gain traction in food, healthcare, and electronics. Demand grows for films that support premium packaging, improved sustainability, and extended freshness. As brands seek better product presentation and longer storage stability, opportunities increase for innovative polypropylene films with enhanced performance. This shift encourages investments in specialty films designed for efficiency and protection across diverse end-use markets.

- For instance, Cosmo Films introduced a high-barrier BOPP film with an oxygen transmission rate below 10 cubic centimeters per square meter per day. The film uses a proprietary coating line capable of delivering 1,500 meters per minute, improving output for food and nutraceutical packaging.

Growth of Flexible Packaging in E-Commerce and Retail

E-commerce expansion boosts demand for lightweight, durable, and puncture-resistant packaging, positioning polypropylene films as a preferred material. Their strength, printability, and versatility support branding needs and product protection during shipment. Retailers adopt flexible packaging formats to reduce storage space and improve shelf appeal. Rising use of resealable pouches, protective wraps, and multi-layer films creates new opportunities for polypropylene film manufacturers. As online shopping accelerates globally, demand for efficient and visually appealing flexible packaging continues to grow.

- For instance, Inteplast Group expanded its flexible packaging operations to include lines for e-commerce shipments as part of its focus on sustainable, mono-material solutions.

Key Challenges

Volatility in Raw Material Prices

Polypropylene films rely heavily on petrochemical-based raw materials, making the market vulnerable to fluctuations in crude oil prices. Sudden cost increases disrupt production budgets and reduce profit margins for manufacturers. Volatility also affects pricing stability for end users across food, healthcare, and consumer goods sectors. Producers face challenges in balancing competitive pricing with quality performance. This instability drives companies to explore recycled polypropylene and alternative sourcing strategies to mitigate long-term cost risks.

Environmental Concerns and Recycling Limitations

Although polypropylene films are recyclable, inconsistent recycling infrastructure and low consumer participation limit effective recovery. Multi-layer structures, used for enhanced barrier properties, complicate recycling efforts. Increasing regulatory pressure on plastic waste management poses challenges for manufacturers relying on conventional plastic films. Companies must develop mono-material solutions, improve recyclability, and adopt circular economy models to remain compliant. These constraints require innovation in material science and recycling technologies to reduce environmental impact and maintain market acceptance.

Regional Analysis

North America

North America holds a 27% share of the Polypropylene Packaging Films market, driven by strong demand from packaged food, beverages, pharmaceuticals, and consumer goods. The region benefits from advanced manufacturing capabilities and high adoption of BOPP and CPP films in sustainable and lightweight packaging formats. Growth in e-commerce further accelerates demand for durable pouches, wraps, and protective films. Increasing focus on recyclable packaging supports wider use of mono-material polypropylene solutions. Strong investments in food processing, healthcare distribution, and retail packaging reinforce the region’s steady growth trajectory.

Europe

Europe accounts for a 25% share, supported by strict sustainability regulations and rising demand for recyclable and low-carbon packaging materials. Food and beverage brands lead adoption of BOPP films due to high clarity, barrier strength, and reduced material usage. Pharmaceutical companies rely on polypropylene films for sterile, tamper-resistant packaging. Growth in private-label retail and premium packaged goods strengthens market expansion. The region’s strong recycling targets and circular economy initiatives promote the shift toward mono-material flexible packaging, increasing the demand for polypropylene films across major economies such as Germany, France, and the U.K.

Asia Pacific

Asia Pacific dominates the market with a 38% share, driven by high-volume manufacturing in food processing, personal care, and household products. Rapid urbanization, growing packaged food consumption, and expanding retail networks boost demand for flexible polypropylene packaging. China, India, Japan, and Southeast Asia lead production and consumption due to strong industrial capabilities and cost advantages. The region also benefits from the rapid growth of e-commerce, which increases demand for protective and lightweight packaging films. Manufacturers invest in advanced BOPP and CPP production lines to meet rising consumption across diverse end-use industries.

Latin America

Latin America holds a 6% share, driven by increased use of polypropylene films in food, beverages, and household product packaging. Brazil and Mexico lead regional demand due to their expanding food processing industries and rising consumption of packaged goods. Growing adoption of flexible packaging in snacks, dairy items, and frozen foods supports market growth. Economic improvements and expanding retail presence contribute to higher polypropylene film usage. Although production capacity remains limited in some countries, rising investments in local packaging facilities enhance regional availability and support long-term demand.

Middle East & Africa

The Middle East & Africa region accounts for a 4% share, supported by growing demand for packaged foods, pharmaceuticals, and personal care products. Rising urbanization and expanding retail distribution networks drive adoption of polypropylene packaging films across key markets such as the UAE, Saudi Arabia, and South Africa. Local manufacturers increasingly shift toward high-barrier and lightweight packaging solutions to meet consumer preferences. Although recycling infrastructure remains limited, regional investments in modern packaging technologies strengthen market growth. The rise of food exports and pharmaceutical distribution further boosts demand for durable and cost-efficient polypropylene films.

Market Segmentations:

By Process Type

- Biaxially Oriented Polypropylene (BOPP)

- Cast Polypropylene (CPP)

By Product Type

- Bags & Pouches

- Wraps

- Tubes

- Others

By Application

- Food & Beverages

- Healthcare

- Electrical & Electronics

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Polypropylene Packaging Films market features leading players such as Toray Industries, UFlex Ltd., Jindal Poly Films Ltd., Cosmo Films Ltd., Innovia Films, Taghleef Industries, Inteplast Group, SRF Limited, Mitsui Chemicals Tohcello, Inc., and Polibak Plastic Industry Co. These companies compete through advancements in BOPP and CPP technologies, expanded production capacities, and a focus on high-barrier, recyclable, and mono-material film solutions. Many players strengthen their portfolios by developing specialty films for food, healthcare, and industrial applications while meeting rising sustainability requirements. Strategic investments in new extrusion lines, energy-efficient processes, and global supply chain integration support competitiveness. Collaboration with FMCG brands and packaging converters enhances product innovation and market reach. Continuous R&D in surface treatments, metallization, and coating technologies helps companies address demand for durable, lightweight, and cost-effective polypropylene packaging films across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Toray Industries, Inc.

- UFlex Ltd.

- Jindal Poly Films Ltd.

- Cosmo Films Ltd.

- Innovia Films

- Taghleef Industries

- Inteplast Group

- SRF Limited

- Mitsui Chemicals Tohcello, Inc.

- Polibak Plastic Industry Co.

Recent Developments

- In September 2025, Toray Industries, Inc. announced it will exhibit at the global plastics trade show K 2025 — signalling ongoing activity in plastics/film business.

- In July 2025, Innovia Films introduced a full range of mono-material BOPP packaging films compliant with the Packaging and Packaging Waste Regulation (PPWR). These films aim to replace mixed-material structures and improve recyclability.

- In April 2024, UFlex Ltd. signed a long-term power purchase agreement (PPA) with Amplus Phoenix Private Limited to source solar power for its packaging-films plant in Dharwad, Karnataka.

Report Coverage

The research report offers an in-depth analysis based on Process Type, Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as packaged food consumption increases across global markets.

- Adoption of recyclable mono-material packaging will expand in response to sustainability goals.

- High-barrier BOPP films will gain traction for longer shelf-life applications.

- E-commerce growth will drive higher use of durable and lightweight flexible packaging.

- Healthcare packaging will expand as sterile and tamper-resistant films gain importance.

- Advancements in coating and metallization technologies will enhance film performance.

- Brands will shift toward downgauged films to reduce material use and improve efficiency.

- Automation in film extrusion and converting will improve output and consistency.

- Regional manufacturers will invest in new production lines to meet rising local demand.

- Regulatory pressure will accelerate innovation in sustainable and recyclable polypropylene film solutions.