Market Overview:

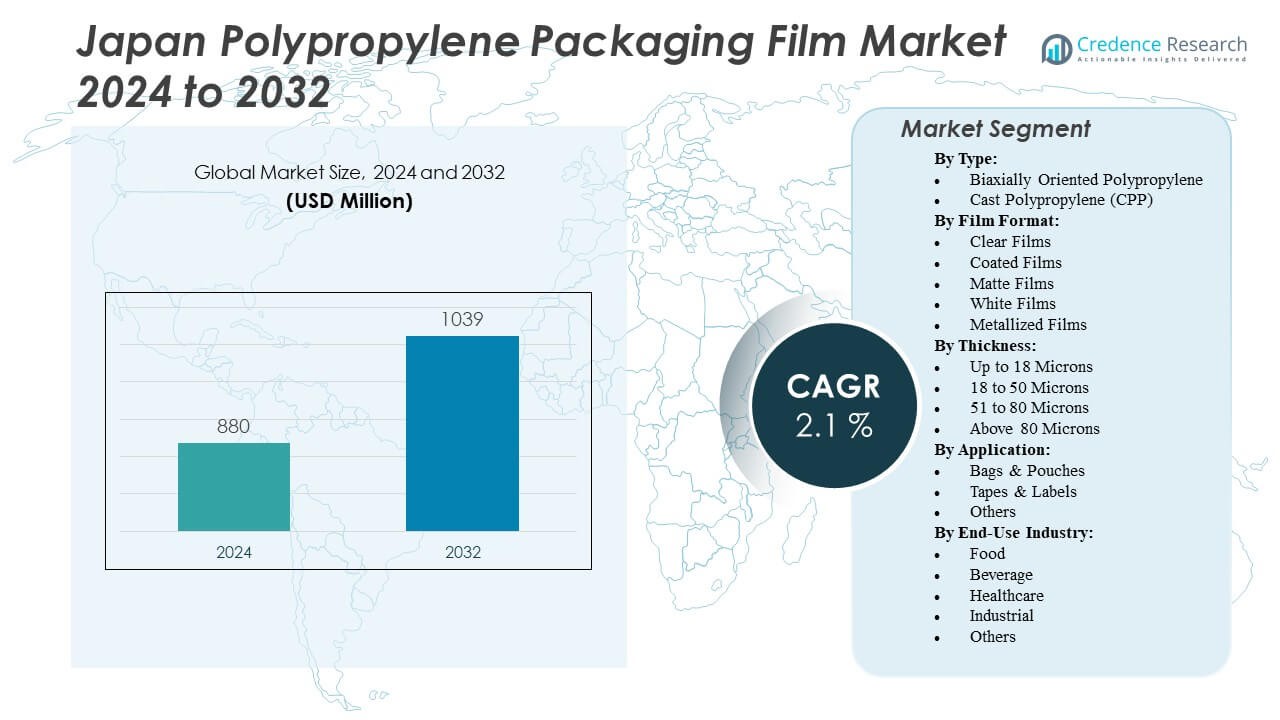

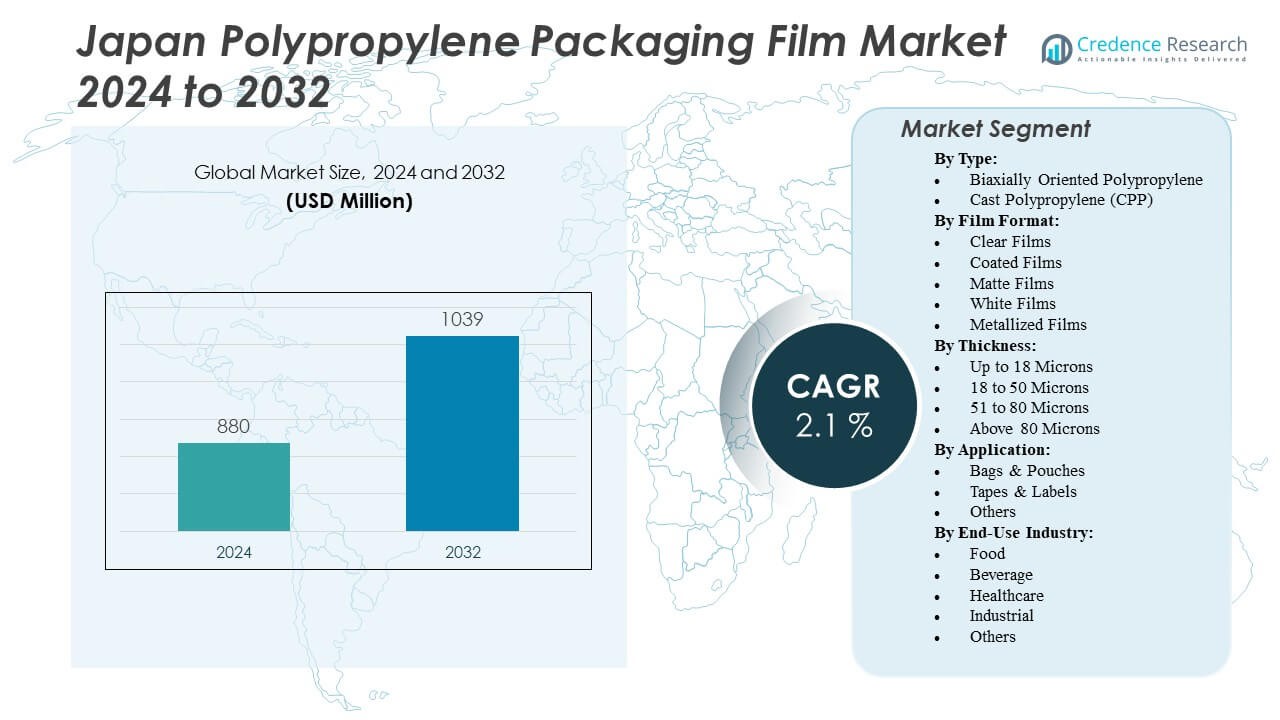

The Japan Polypropylene Packaging Film Market is projected to grow from USD 880 million in 2024 to an estimated USD 1039 million by 2032, with a compound annual growth rate (CAGR) of 2.1% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Polypropylene Packaging Film Market Size 2024 |

USD 880 Million |

| Japan Polypropylene Packaging Film Market, CAGR |

2.1% |

| Japan Polypropylene Packaging Film Market Size 2032 |

USD 1039 Million |

The growth of the Japan Polypropylene Packaging Film Market is primarily driven by the increasing demand from the food and beverage sector, fueled by rising consumer preferences for convenient and sustainable packaging solutions. Growing awareness regarding hygiene and extended shelf-life further encourages the adoption of polypropylene films, especially in packaged and processed foods. In addition, technological advancements enhancing film durability, flexibility, and barrier properties are boosting its application across pharmaceutical, cosmetic, and retail sectors, contributing significantly to the overall market expansion.

Regionally, Kanto remains a dominant contributor to the Japan Polypropylene Packaging Film Market due to its strong industrial presence and higher concentration of food processing and pharmaceutical manufacturers. Kansai and Chubu regions follow closely, supported by robust manufacturing bases and extensive retail networks. Emerging regions like Kyushu and Tohoku show promising growth potential, driven by increasing industrial activities and government-supported initiatives promoting sustainable packaging practices. Urbanization and changing consumer lifestyles in these areas further amplify the demand for polypropylene packaging films, signaling future market opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Japan Polypropylene Packaging Film Market was valued at USD 880 million in 2024 and is projected to reach USD 1039 million by 2032, growing at a CAGR of 2.1%.

- Rising demand for packaged food, pharmaceuticals, and personal care products is driving consistent adoption of polypropylene films across industries.

- Regulatory support for recyclable materials and lightweight packaging formats strengthens market expansion opportunities.

- Volatility in raw material prices and dependence on petrochemical supply chains limit cost predictability for manufacturers.

- Kanto region leads the market with a 40% share, supported by dense industrial activity and established logistics infrastructure.

- Kansai and Chubu regions continue to exhibit strong demand, driven by food, healthcare, and automotive sector requirements.

- Emerging regions like Kyushu and Tohoku show rising consumption trends, encouraged by industrial revitalization programs and growing urbanization.

Market Drivers:

Increasing Demand from Food and Beverage Industry Boosting Adoption

The rising demand for convenience-oriented packaged foods drives the Japan Polypropylene Packaging Film Market. Consumer preferences towards hygienic, ready-to-eat meals enhance the need for reliable and efficient packaging solutions. Polypropylene films offer excellent barrier properties, extending shelf life and ensuring product freshness, further accelerating market penetration. Heightened hygiene concerns among consumers amplify demand for food-grade packaging films, particularly polypropylene, renowned for its non-reactive nature. Expansion in fast-moving consumer goods (FMCG) distribution networks necessitates robust, flexible packaging options to maintain product integrity. The proliferation of convenience stores and supermarkets increases dependency on lightweight, cost-effective packaging, supporting the polypropylene film adoption.

- For example, TorayIndustries’ Torayfan™ ultra-high–barrier BOPP films, such as the CB3 series, deliver outstanding protection for food packaging. Their oxygen transmission rate (OTR) is around 0.06 cc/100 in²/day at 73 °F and 0% relative humidity—equivalent to roughly 0.9 cc/m²/day—while retaining excellent moisture-barrier performance, commonly around 3.1–3.4 g/m²/day MVTR. These films achieve superior clarity, puncture resistance, and oil resistance without PVdC coatings.

Strong Regulatory Support for Sustainable Packaging Initiatives

Government regulations encouraging sustainable packaging solutions significantly influence the Japan Polypropylene Packaging Film Market. Initiatives promoting reduced carbon footprints and minimal environmental impact motivate manufacturers to adopt recyclable polypropylene films. Favorable regulatory frameworks supporting lightweight, energy-efficient packaging materials incentivize the transition toward polypropylene film solutions. Policymakers increasingly mandate sustainable practices within industrial and consumer segments, enhancing the attractiveness of polypropylene packaging. Incentives and subsidies provided by government bodies assist industry participants in investing in eco-friendly polypropylene packaging technologies. Strategic collaborations between regulatory bodies and packaging companies focus on sustainability targets, driving long-term demand growth. Awareness campaigns highlighting environmental advantages of polypropylene films, such as lower waste generation, stimulate broader consumer acceptance.

Robust Pharmaceutical and Healthcare Industry Expanding Market Scope

The thriving pharmaceutical and healthcare industries are pivotal drivers of the Japan Polypropylene Packaging Film Market. Heightened emphasis on secure, tamper-evident packaging for pharmaceuticals enhances polypropylene film usage due to superior protective qualities. Polypropylene films’ chemical resistance and moisture barrier attributes meet stringent pharmaceutical packaging standards, promoting wider acceptance. Growth in over-the-counter medications and nutraceuticals accelerates the need for reliable packaging options, amplifying polypropylene film applications. Heightened investment in healthcare infrastructure and increased healthcare expenditure further propel demand for polypropylene-based medical packaging solutions. Continuous advancements in medical device packaging necessitate materials like polypropylene, renowned for sterility preservation and ease of handling. Expanding exports of pharmaceutical products reinforce the critical role of polypropylene packaging in protecting products during transit.

- For instance, in July 2025, Dai Nippon Printing (DNP) announced the development of a mono-material polypropylene (PP) film lid for Press Through Packaging (PTP), designed to replace traditional aluminum foil. According to DNP, the film achieves a water vapor transmission rate of 0.2 g/m²·day or less, meeting key pharmaceutical packaging requirements. The PP lid also satisfies Japan’s rigorous standards for sealability and printability, supporting both environmental goals and product protection.

Advancements in Retail and E-commerce Enhancing Packaging Demand

The rapid growth of retail and e-commerce sectors significantly impacts the Japan Polypropylene Packaging Film Market. Consumers increasingly prefer secure, lightweight packaging solutions that ensure damage-free product delivery. Polypropylene films deliver superior puncture resistance, transparency, and moisture barrier characteristics, meeting essential e-commerce packaging requirements. The evolving landscape of online shopping generates demand for versatile, aesthetically appealing packaging that supports branding and consumer engagement strategies. Innovative polypropylene packaging solutions facilitate effective product differentiation, enabling brands to maintain competitive market positions. Increased emphasis on user-friendly packaging designs that allow ease of opening and resealing enhances polypropylene film adoption. Continuous improvements in logistics and warehousing infrastructures further necessitate reliable, durable packaging solutions, highlighting polypropylene’s advantages.

Market Trends:

Growing Preference for Transparent and High-Clarity Packaging Solutions

The Japan Polypropylene Packaging Film Market experiences a strong trend toward transparent packaging solutions, enhancing consumer product visibility. Manufacturers increasingly seek polypropylene films with enhanced clarity, improving shelf appeal and consumer confidence. Transparent packaging enables clear brand communication and aids consumers in assessing product quality before purchase. Retailers favor transparent films for improved merchandising, promoting an attractive visual presentation of products. Continuous product development efforts concentrate on refining polypropylene film transparency to cater to premium food and personal care segments. Market players invest in advanced production technologies capable of producing films with superior gloss and optical clarity. Transparent polypropylene films cater effectively to modern retail environments demanding visually appealing displays.

- For instance, Toyobo Co., Ltd. introduced ECOSYAR™ VP001, a high-barrier transparent biaxially oriented polypropylene (BOPP) film produced using proprietary vapor deposition on a heat-resistant BOPP base. This film achieves enhanced barrier properties to oxygen and water vapor while maintaining full transparency, and is specifically designed to support mono-material, recyclable packaging as verified by its compliance with Japan’s Product Liability Act and related health ministry standards.

Adoption of Lightweight Films for Cost and Efficiency Advantages

Manufacturers within the Japan Polypropylene Packaging Film Market actively pursue lightweight packaging solutions for economic and operational advantages. Lightweight polypropylene films reduce transportation costs and lower logistical expenses due to decreased material weight. Industries appreciate polypropylene’s superior strength-to-weight ratio, facilitating effective protection despite reduced thickness. Companies increasingly shift toward thinner film formulations, maintaining robust barrier properties and structural integrity. Lightweight polypropylene films align with sustainability goals by minimizing raw material consumption and reducing waste. Enhanced machinery capabilities enable the precise production of ultra-thin polypropylene films without compromising performance characteristics. Lightweight packaging solutions facilitate streamlined storage and handling processes, increasing operational efficiency.

- For instance, Cosmo Films Ltd has commercialized BOPP grades and cast polypropylene films with thicknesses as low as 12µm, while retaining critical performance attributes such as high tensile strength and essential barrier properties.

Rise in Anti-microbial and Functional Packaging Applications

The Japan Polypropylene Packaging Film Market witnesses increased applications of anti-microbial and functional films across diverse sectors. Manufacturers incorporate advanced additives in polypropylene films to deliver anti-microbial properties, safeguarding packaged products from contamination. Functional films with UV protection or moisture-absorption properties further expand polypropylene’s application potential in sensitive product packaging. Heightened consumer awareness regarding health and safety boosts demand for packaging solutions offering active product protection features. Polypropylene’s compatibility with functional additives enhances market opportunities within pharmaceutical, food, and personal care industries. Market players invest in research and development to create polypropylene films featuring enhanced functionality tailored to specialized packaging requirements. Growing preference for active packaging solutions, such as oxygen-scavenging films, reinforces polypropylene film adoption.

Increased Application in Recyclable and Circular Packaging Practices

The emphasis on recyclability and circular economy initiatives significantly influences the Japan Polypropylene Packaging Film Market. Companies increasingly opt for polypropylene films due to their recyclable characteristics, aligning with eco-friendly packaging trends. Polypropylene packaging’s ease of recycling drives adoption among environmentally conscious brands and consumers. Market participants actively engage in developing recyclable film formulations supporting circular economy goals. Industry collaboration between manufacturers, recyclers, and regulators facilitates polypropylene’s integration into sustainable packaging infrastructures. The emergence of mono-material packaging solutions, primarily polypropylene-based, simplifies recycling processes and promotes market growth. Growing consumer advocacy for sustainable purchasing choices reinforces polypropylene packaging’s acceptance.

Market Challenges Analysis:

Fluctuations in Raw Material Prices Affecting Production Costs

Fluctuations in raw material costs present a significant challenge for the Japan Polypropylene Packaging Film Market. Polypropylene film production depends heavily on petrochemical derivatives, subject to global oil price volatility. Manufacturers face difficulties maintaining stable pricing strategies amid unpredictable raw material expenses. Sudden price hikes disrupt production planning and profitability, posing considerable financial risks to market participants. Companies struggle to transfer increased costs onto customers, risking loss of market competitiveness. Supply chain disruptions exacerbate raw material availability, further complicating production schedules and inventory management. Dependence on imported petrochemicals amplifies vulnerability to geopolitical tensions and global economic fluctuations.

Environmental Concerns and Regulatory Pressure Restricting Market Growth

Increasing environmental concerns and regulatory pressures present significant hurdles for the Japan Polypropylene Packaging Film Market. Regulatory authorities impose stringent environmental standards, compelling companies to adopt costly sustainable practices. Growing consumer activism regarding plastic pollution pressures manufacturers to explore eco-friendly alternatives despite potential higher production expenses. Companies face intensified scrutiny over packaging waste management, necessitating investment in efficient recycling infrastructures. Regulatory mandates enforcing reduced plastic consumption complicate market dynamics, demanding substantial product innovation and reformulation. Public campaigns emphasizing environmental impact contribute to consumer preference shifts, posing risks to traditional polypropylene film adoption. Balancing environmental compliance and cost-effectiveness remains a persistent challenge within the industry.

Market Opportunities:

Expanding Application Scope in Personal Care and Cosmetics Sector

The expanding personal care and cosmetics industries provide significant opportunities for the Japan Polypropylene Packaging Film Market. Rising consumer inclination toward premium and aesthetically appealing packaging solutions increases polypropylene film adoption within these sectors. Polypropylene films’ versatility enables innovative packaging designs that enhance brand differentiation and consumer engagement. Growing demand for compact, convenient, and travel-friendly cosmetic packaging expands polypropylene’s application prospects. Product innovations catering specifically to personal care market requirements, such as tamper-evident and moisture-resistant films, further drive market opportunities. Manufacturers can leverage polypropylene’s superior printing capabilities for high-quality branding and visual appeal enhancement. The personal care industry’s shift toward sustainable packaging further amplifies demand for recyclable polypropylene film options.

Growing Potential in Biodegradable and Bio-based Polypropylene Films

Increasing interest in biodegradable and bio-based materials presents notable opportunities for the Japan Polypropylene Packaging Film Market. Consumer preference for environmentally friendly products encourages manufacturers to explore bio-derived polypropylene alternatives. Advances in biopolymer technology facilitate the development of polypropylene films sourced from renewable raw materials. Companies introducing biodegradable polypropylene films benefit from enhanced brand reputation and consumer acceptance. Regulatory incentives promoting bio-based packaging further bolster market opportunities in sustainable polypropylene film formulations. Industry partnerships focusing on research and development enable accelerated commercialization of bio-based polypropylene films. Manufacturers gain competitive advantages by pioneering eco-friendly film options compatible with existing recycling infrastructures.

Market Segmentation Analysis:

By type, the Japan Polypropylene Packaging Film Market by type includes Biaxially Oriented Polypropylene (BOPP) and Cast Polypropylene (CPP). BOPP leads the segment due to superior barrier properties, durability, and high clarity, suitable for various consumer goods. CPP films gain demand owing to flexibility and excellent seal strength, ideal for lamination and high-speed packaging lines.

By film format, clear films dominate, driven by rising demand for visually appealing packaging across food and personal care industries. Metallized films exhibit strong growth, attributed to effective barrier protection and enhanced aesthetic appeal. Matte and white films gain popularity among premium consumer segments due to sophisticated visual presentation, whereas coated films find niche applications requiring specialized protective properties.

By thickness segment of 18 to 50 microns holds significant market share, favored for balanced strength, flexibility, and affordability across diverse applications. Films up to 18 microns gain traction due to lightweight packaging needs in snacks and confectionery sectors. Films exceeding 51 microns cater predominantly to robust industrial and heavy-duty packaging applications.

By applications, bags & pouches represent the largest segment, reflecting growing demand in food, beverages, and retail packaging. Tapes & labels witness steady adoption, supported by expanding industrial activities requiring durable labeling solutions.

- For instance, advanced BOPP and CPP films are widely used in tapes and labels, offering excellent dimensional stability and printability. These substrates support industrial labeling in automated logistics where moisture and abrasion resistance are essential.

By end-use industry, the food sector leads, driven by increased consumption of packaged convenience products and heightened hygiene standards. Healthcare follows, benefiting from polypropylene’s sterile and protective attributes, essential in pharmaceutical packaging. Industrial sectors steadily adopt these films for reliable and robust packaging requirements.

- For instance, food processors in the Kansai region use antifog shrink films to keep prepared meals visually clear and condensation-free during retail display. Transparent oxide-coated films, such as SiOx-coated polypropylene, are also adopted for packaging oxygen-sensitive foods requiring high barrier protection.

Segmentation:

By Type:

- Biaxially Oriented Polypropylene (BOPP)

- Cast Polypropylene (CPP)

By Film Format:

- Clear Films

- Coated Films

- Matte Films

- White Films

- Metallized Films

By Thickness:

- Up to 18 Microns

- 18 to 50 Microns

- 51 to 80 Microns

- Above 80 Microns

By Application:

- Bags & Pouches

- Tapes & Labels

- Others

By End-Use Industry:

- Food

- Beverage

- Healthcare

- Industrial

- Others

By Region:

- Kanto

- Kansai

- Chubu

- Kyushu

- Tohoku

- Others

Regional Analysis:

The Kanto region dominates the Japan Polypropylene Packaging Film Market, accounting for approximately 40% market share. Its strong position derives from extensive industrial activities, particularly in food processing, pharmaceuticals, and consumer goods manufacturing. Tokyo and its surrounding metropolitan areas drive considerable demand for packaging films due to high urban density and consumer spending power. The presence of numerous leading packaging companies and advanced logistics infrastructure further strengthens Kanto’s market leadership. Continuous expansion of convenience retail channels and supermarkets significantly enhances polypropylene film usage in daily consumer applications. Kanto’s advanced technology adoption and focus on sustainability contribute positively to market dynamics, ensuring its continued prominence.

Kansai holds the second-largest share, capturing roughly 25% of the Japan Polypropylene Packaging Film Market. It benefits from robust industrial bases concentrated in Osaka, Kyoto, and Kobe, housing major manufacturing clusters. Kansai’s thriving food and beverage sector consistently requires innovative, reliable packaging solutions, supporting polypropylene film adoption. Strategic connectivity through major ports and extensive transportation networks facilitates seamless supply chain integration, promoting efficient packaging distribution. Companies within the region actively invest in research to improve packaging durability, transparency, and sustainability, driving market growth. Kansai’s vibrant retail industry further stimulates demand for polypropylene films, catering to diverse consumer preferences.

Emerging regions such as Chubu, Kyushu, and Tohoku collectively account for about 35% of the Japan Polypropylene Packaging Film Market. Chubu’s rapidly expanding automotive and electronics industries increasingly require advanced packaging solutions, elevating polypropylene film usage. In Kyushu, investments in food processing and agriculture boost demand for efficient and sustainable packaging films. Government-backed initiatives in Tohoku promote industrial revitalization, generating opportunities for polypropylene film manufacturers targeting consumer goods and pharmaceuticals. Growing urbanization and evolving consumer lifestyles in these regions enhance overall packaging film consumption. Manufacturers actively pursue opportunities presented by regional economic development programs, further solidifying their market presence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Toray Industries, Inc. (including Toray Advanced Film Co., Ltd.)

- Cosmo Films Ltd.

- Futamura Chemical Co., Ltd.

- Toyobo Co., Ltd.

- Mitsui Chemicals Tohcello, Inc.

- Takigawa Corporation

- Rengo Co., Ltd.

- Toppan Packaging Product Co., Ltd./Toppan Holdings Inc.

- Gunze Limited

- RM Tohcello Co., Ltd.

- KOHJIN Film & Chemicals Co., Ltd.

- Polyplex Corporation Ltd.

- Idemitsu Unitech Co., Ltd.

Competitive Analysis:

The Japan Polypropylene Packaging Film Market features several leading players competing on innovation, production capacity, and sustainability initiatives. Toray Industries, Mitsui Chemicals Tohcello, Toyobo, and Futamura Chemical hold prominent positions, leveraging advanced technologies and broad product portfolios. Companies continuously enhance barrier properties, film clarity, and coating functionalities to suit evolving industry needs. Market participants prioritize development of bio-based and recyclable polypropylene films to align with regulatory mandates and consumer demand. It pursues strategic partnerships and capacity expansion to secure supply chain resilience and maintain competitive edge. Regional players such as Toppan Packaging and Gunze differentiate through localized service support and strong relationships with domestic end-use industries. Competition intensifies around premium films that offer superior moisture resistance, puncture strength, and printability. Strategic investment in R&D and sustainability credentials defines leading firms’ approach to capturing greater market share.

Recent Developments:

- In July 2025, Futamura Chemical Co., Ltd. announced a significant £15 million sustainability investment at its UK site. This move is designed to reduce emissions and energy usage by repurposing production waste gases to power plant operations—supporting the manufacture of its renewable, compostable NatureFlex™ packaging films

- In May 2025, Cosmo Films Ltd. began production of sunshield films and completed pilot runs with distributors to support this new specialty film, underscoring its push toward innovation and efficiency. Over the past three years, the company invested approximately ₹1,180 crore into new production lines and technologies that are poised to drive up future revenues and profitability.

- In March 2025, Toray Industries, Inc. unveiled a high-precision hollow fiber membrane module designed for advanced filtration, signaling a stride forward in separation technologies for industrial and environmental applications. Additionally, by July 2025, Toray announced the launch of ARTORAYTM nonwoven fabric series, composed of olefin filament yarn, which reinforces its innovation in the advanced materials space.

- In February 2025, Toyobo Co., Ltd. decided to renovate its Tsuruga Film Plant, increasing production capacity for its COSMOSHINE SRF® PET films, which are crucial in polarizer protection for LCD screens. The renovation is set to boost output by 30% by fiscal year 2026, meeting the rising demand for larger display panels

Market Concentration & Characteristics:

The Japan Polypropylene Packaging Film Market exhibits moderate concentration, dominated by a handful of major firms while numerous mid-size players operate in regional and niche segments. It reflects an oligopolistic structure where Toray, Mitsui Chemicals, Toyobo, and Futamura Chemical maintain significant influence over pricing and technology direction. Smaller and regional suppliers compete on customized solutions and responsive local support. Centralized production facilities in Kanto and Kansai regions drive economies of scale and efficient distribution. Demand from food, healthcare, and industrial sectors promotes steady volume growth and justifies high-capacity investments by key manufacturers. Overall, the market balances competitive innovation with collaboration on sustainable packaging standards.

Report Coverage:

The research report offers an in-depth analysis based on Type, Film Format, Thickness, Application and End-Use Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for recyclable and sustainable polypropylene films will accelerate, driven by evolving consumer preferences and regulatory frameworks.

- Increased adoption in pharmaceutical packaging, supported by polypropylene’s chemical resistance and suitability for sterile environments, will expand market scope.

- Continuous innovation in transparent, high-clarity films will address rising demand from premium food and personal care sectors.

- Growth of lightweight film solutions will continue, driven by efficiency needs within logistics and e-commerce operations.

- Bio-based polypropylene film advancements will create significant opportunities, aligning with broader environmental sustainability goals.

- Expansion in convenient packaging formats, such as resealable and easy-to-open designs, will enhance polypropylene film adoption among consumer segments.

- Technological improvements in anti-microbial and functional film coatings will extend product shelf-life, driving market penetration.

- Strategic industry collaborations aimed at enhancing recyclability infrastructure will positively impact polypropylene film consumption.

- Rising investments in advanced manufacturing capabilities will support increased product customization and specialized film applications.

- Emerging regional markets like Kyushu and Tohoku will contribute to overall growth, benefiting from governmental industrial revitalization initiatives.