Market Overview:

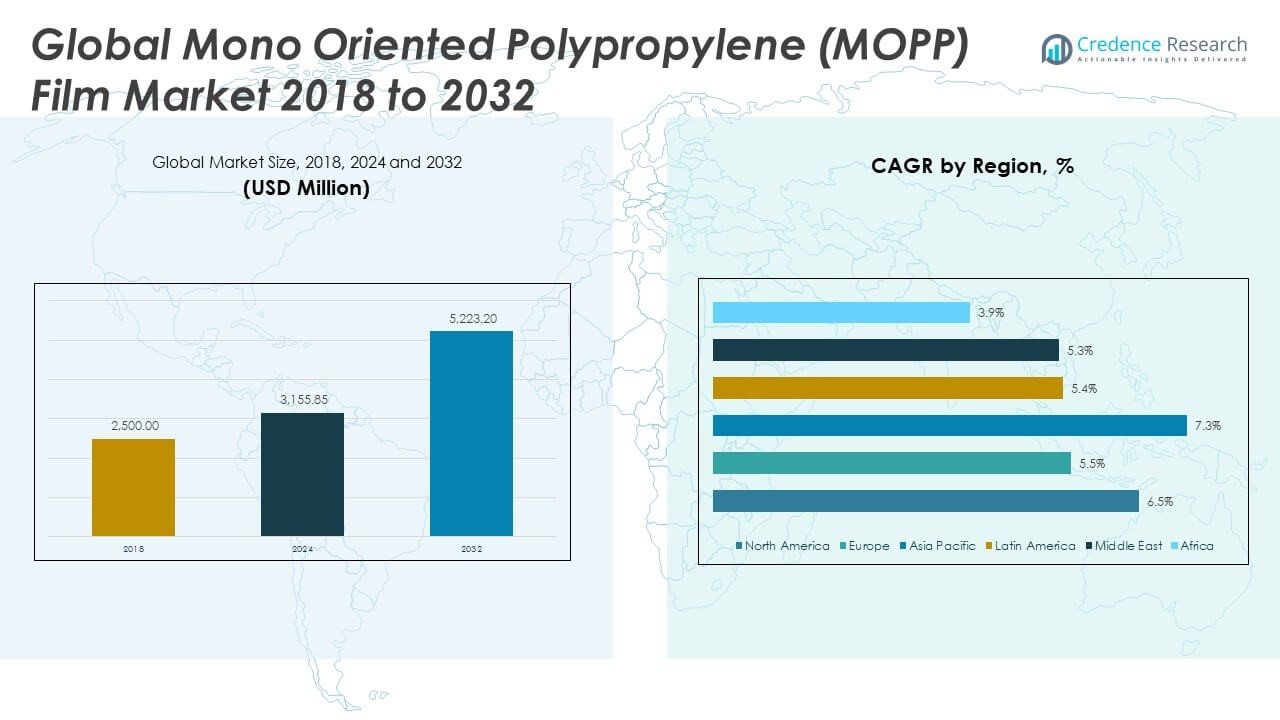

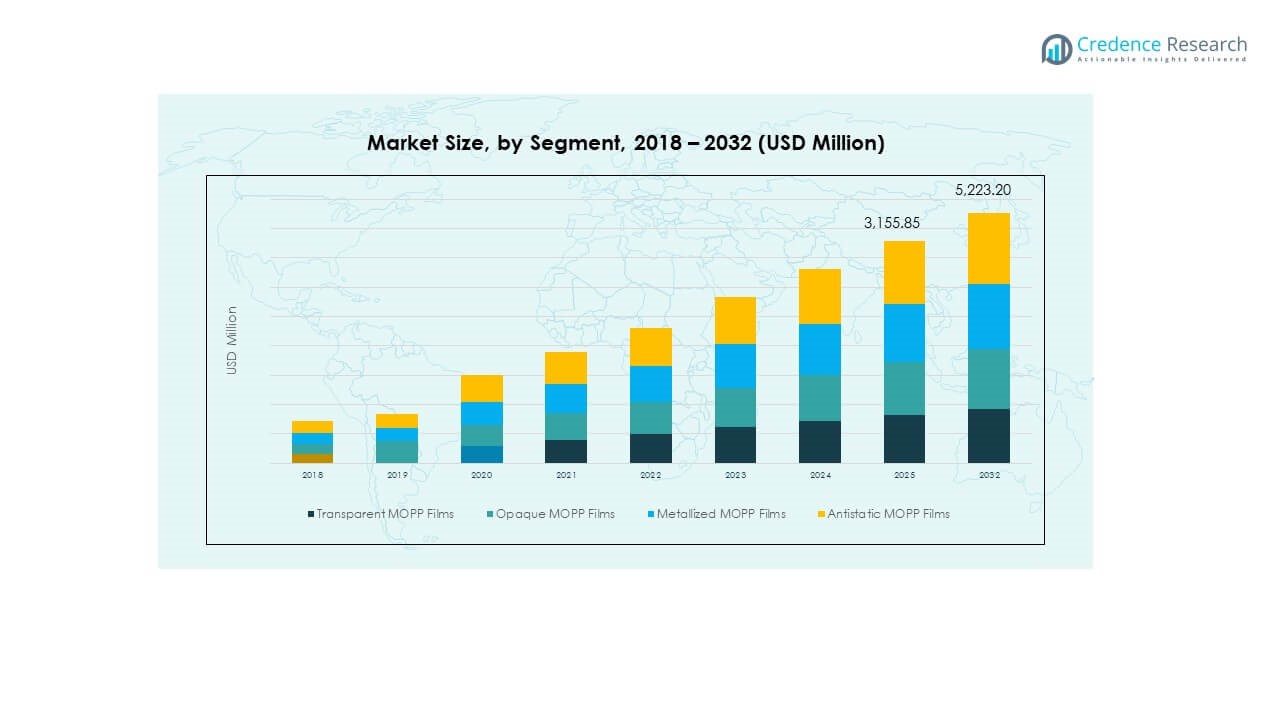

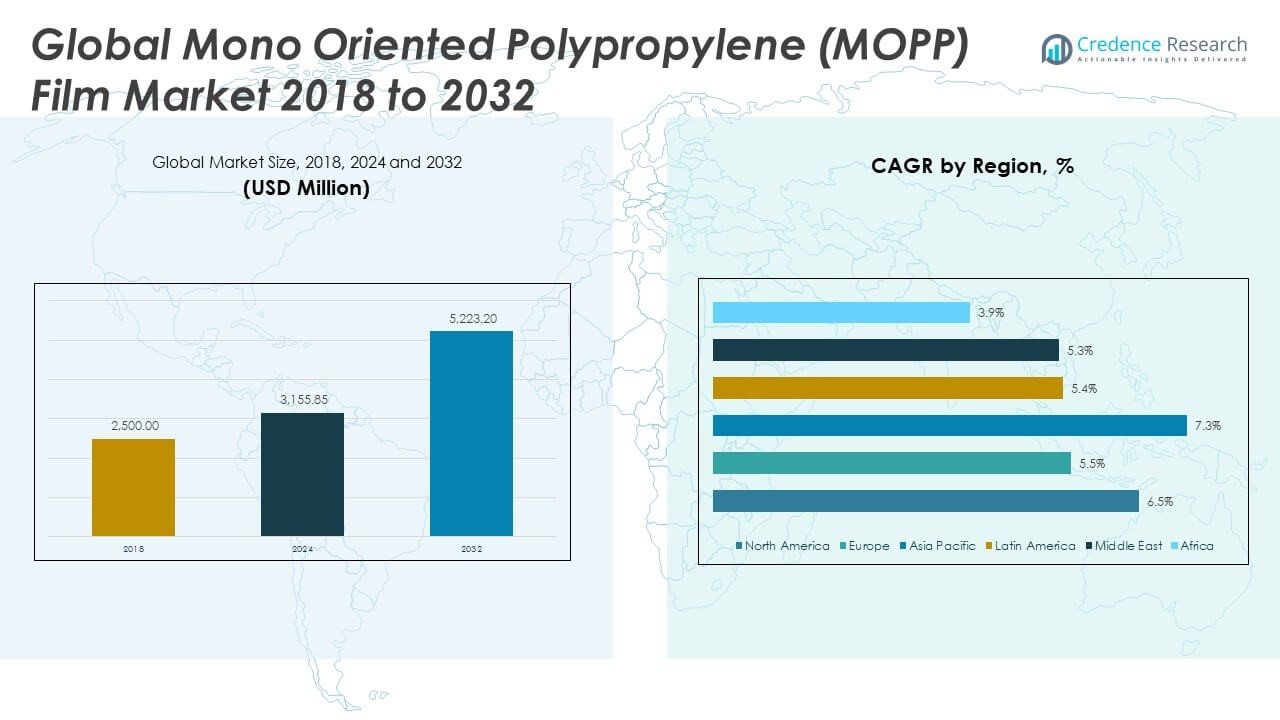

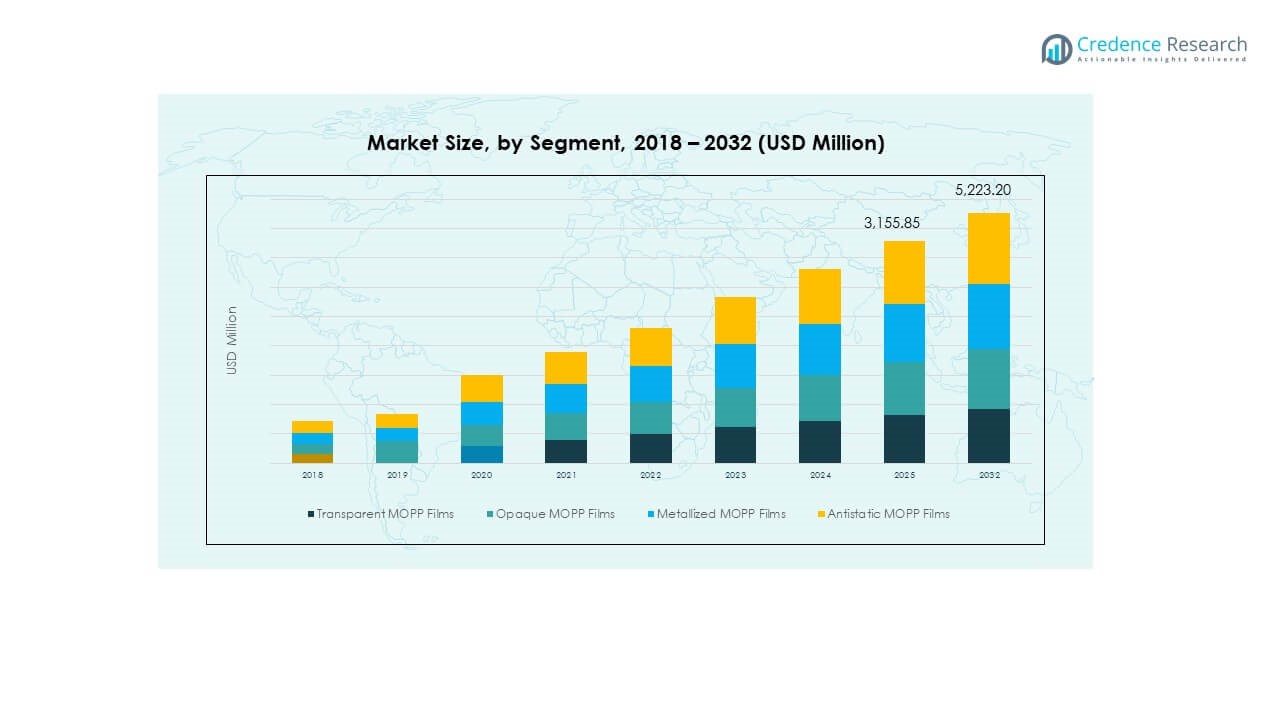

The Mono Oriented Polypropylene (MOPP) Film Market size was valued at USD 2,500.00 million in 2018 to USD 3,155.85 million in 2024 and is anticipated to reach USD 5,223.20 million by 2032, at a CAGR of 6.54% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mono Oriented Polypropylene (MOPP) Film Market Size 2024 |

USD 3,155.85 Million |

| Mono Oriented Polypropylene (MOPP) Film Market, CAGR |

6.54% |

| Mono Oriented Polypropylene (MOPP) Film Market Size 2032 |

USD 5,223.20 Million |

The growth of the Mono Oriented Polypropylene (MOPP) Film Market is driven by increasing demand from the packaging industry due to its superior tensile strength, printability, and recyclability. Industries such as food and beverage, pharmaceuticals, and consumer goods are widely adopting MOPP films for labeling, wrapping, and decorative packaging, as companies seek lightweight, cost-effective, and sustainable solutions. The expanding e-commerce sector and rising need for secure, attractive packaging also bolster the market’s growth. Manufacturers are investing in R&D to develop advanced grades of MOPP films with improved barrier properties and performance.

Geographically, Asia-Pacific leads the Mono Oriented Polypropylene (MOPP) Film Market due to its large-scale packaging production and consumption in countries like China, India, and Japan. North America and Europe follow with strong adoption in food, healthcare, and retail sectors. Emerging economies in Latin America and the Middle East & Africa are witnessing growing demand, driven by rapid industrialization, urbanization, and increasing consumer awareness of sustainable packaging. Government regulations promoting recyclable materials and shifting preferences toward eco-friendly packaging further support market penetration in these developing regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Mono Oriented Polypropylene (MOPP) Film Market was valued at USD 3,155.85 million in 2024 and is projected to reach USD 5,223.20 million by 2032, growing at a CAGR of 6.54%.

- Demand from the food and beverage sector remains a key growth driver due to the film’s strength, printability, and moisture resistance.

- Rising preference for recyclable mono-material packaging enhances the market’s relevance in sustainability-driven industries.

- Fluctuating polypropylene resin prices and supply chain disruptions pose ongoing challenges for manufacturers.

- Asia Pacific holds the largest share at 46.18%, driven by high packaging demand and strong regional production capacity.

- North America shows significant growth backed by e-commerce expansion and sustainability regulations.

- Market growth in Europe is supported by regulatory mandates and innovation in recyclable and high-clarity MOPP films.

Market Drivers:

Expanding Use in Flexible Packaging Across Food and Beverage Industry Drives Market Growth

The food and beverage industry continues to be a primary driver for the Mono Oriented Polypropylene (MOPP) Film Market. Rising demand for flexible, lightweight, and durable packaging materials has pushed manufacturers to adopt MOPP films due to their high tensile strength and moisture resistance. MOPP films support high-quality print finishes, making them ideal for attractive labeling and branding. Growth in packaged and ready-to-eat foods, especially in urban areas, strengthens the demand. The shift toward single-serve and convenience packaging fuels consumption further. Companies are leveraging MOPP films to enhance shelf appeal and product protection. It offers cost advantages and operational efficiency in high-speed packaging lines.

- For example, Taghleef Industries, a leading global producer of oriented polypropylene films, offers high-performance MOPP films under its EXTENDO® and NATIVIA® brands. These films are widely adopted in the food and beverage industry due to their moisture barrier properties, mechanical strength, and suitability for high-speed form-fill-seal (FFS) packaging lines, supporting extended shelf life and operational efficiency.

Rising Demand for Sustainable and Recyclable Materials Across Industries Fuels Adoption

Sustainability has become a core priority for packaging producers and end users alike, directly impacting the Mono Oriented Polypropylene (MOPP) Film Market. Growing environmental awareness and global regulations on single-use plastics are encouraging manufacturers to shift toward recyclable packaging solutions. MOPP films align well with circular economy goals, offering full recyclability and low environmental impact. Companies in cosmetics, personal care, and household goods are replacing traditional films with MOPP alternatives to enhance their sustainability profiles. Brand owners seek materials that reduce carbon footprint without compromising performance. It supports these efforts with its low weight, low energy requirements for processing, and non-toxic disposal. The recyclability of MOPP films provides a market edge, especially in regions with strict waste management rules.

Growth in E-commerce and Retail Packaging Solutions Accelerates Film Utilization

The rapid expansion of the global e-commerce sector drives substantial demand for high-performance packaging solutions like MOPP films. With increasing shipments of consumer goods, electronics, and perishables, companies require packaging that offers strength, tamper resistance, and visual appeal. MOPP films provide superior sealing, clarity, and branding flexibility that meet e-commerce packaging standards. It enhances customer experience through better product presentation and secure handling. The surge in online grocery and personal care deliveries further increases film demand for pouching and wrapping. Retail chains also prefer MOPP films for display-ready packaging that attracts shelf attention and resists wear. Demand intensifies as businesses optimize logistics and reduce packaging weight and volume.

Technological Advancements and Customization in Film Properties Strengthen Market Position

Continuous innovation in film extrusion and orientation technologies significantly influences the Mono Oriented Polypropylene (MOPP) Film Market. Manufacturers are developing specialized grades with enhanced mechanical, thermal, and barrier properties tailored to industry-specific requirements. High-clarity, heat-resistant, and anti-static variants now serve electronics, logistics, and medical sectors. It benefits from ongoing R&D that enables cost-effective production of customized solutions. Investments in multilayer co-extrusion and surface treatment processes improve printability and compatibility with advanced adhesives. These developments expand MOPP film applications beyond traditional uses. Companies prioritize performance differentiation and value-added features, such as anti-fog and UV resistance.

- For instance, Innovia Films has developed Propafilm® Strata SLF, a pioneering mono-structure BOPP/MOPP film that delivers significantly enhanced oxygen and moisture barrier performance, tailored for high-speed form-fill-seal (FFS) packaging systems used in food and consumer goods sectors.

Market Trends

Growing Shift Toward High-Performance Labels and Wraps in Specialty Applications

The Mono Oriented Polypropylene (MOPP) Film Market is witnessing a notable trend in specialty applications like tamper-evident labels and heat-shrink wraps. Industries such as pharmaceuticals, electronics, and automotive seek labeling films that offer durability and visual quality. MOPP films meet these needs through excellent dimensional stability and tear resistance. It enables efficient high-speed printing and automated application. Tamper-evident seals made from MOPP enhance consumer safety and regulatory compliance. Demand is growing for premium appearance and customization in product identification solutions. The film’s compatibility with UV inks and digital printing processes supports design innovation. Market players are developing unique formulations to cater to specific end-use sectors.

- For example, Polyart® TE is a tamper-evident HDPE facestock engineered for pharmaceutical and security labeling applications. It delivers immediate delamination and shredding at the first attempt of removal, making tampering evident. The film resists water, grease, most chemicals, and remains stable at low temperatures down to −60 °C (−76 °F). Its high dimensional stability, strong printability, and ease of converting support efficient high-speed label production systems.

Adoption of Transparent Films with High Gloss Finish for Visual Branding Appeal

Brand visibility and shelf impact remain crucial in competitive consumer markets, driving the trend toward high-gloss, transparent MOPP films. These films enable clear views of the product while offering a premium look and feel. It supports strong visual branding, particularly in packaged snacks, health supplements, and cosmetics. Transparent MOPP films help manufacturers enhance packaging without adding costs through external coatings. Converters appreciate their ability to maintain ink fidelity and consistency under various printing techniques. The trend aligns with minimalist packaging designs preferred by eco-conscious and urban consumers. Enhanced clarity and gloss also contribute to better shelf differentiation. These films continue gaining traction among global FMCG brands.

Emergence of Anti-Microbial and Barrier Films for Health and Hygiene Applications

Growing health and hygiene concerns have prompted interest in MOPP films with added functional coatings, including antimicrobial and oxygen barrier layers. Healthcare and personal care sectors increasingly adopt films that safeguard product integrity. It responds to these needs by integrating active protection technologies into standard formats. These innovations address shelf-life extension and contamination prevention. COVID-19 accelerated demand for antimicrobial packaging, and manufacturers have continued to invest in such developments. Barrier-enhanced MOPP films also cater to sensitive pharmaceutical packaging. The trend supports premium positioning of healthcare products while ensuring safety compliance. It strengthens the role of MOPP films in critical packaging segments.

Increased Use of Matte and Soft-Touch MOPP Films in Luxury and Premium Packaging

Aesthetic appeal is gaining importance in the premium packaging space, prompting the adoption of matte and soft-touch MOPP films. These variants offer a tactile feel and sophisticated visual appearance, ideal for cosmetics, gourmet food, and specialty beverages. It enables differentiation without compromising recyclability or process compatibility. Matte finishes reduce glare while conveying luxury cues to end users. Soft-touch films provide sensory engagement, often associated with high-end retail. These films also support embellishments such as foil stamping and embossing. The packaging sector values this versatility in creating distinctive unboxing experiences. Brands utilize these trends to reinforce quality perception.

- For example, CloudFilm offers a soft touch matte BOPP film, featuring a velvety matte texture and scratch-resistant surface, engineered through proprietary co-extrusion and surface finish technology. This film is specifically designed for luxury packaging markets—including cosmetics and high-end goods—where visual and tactile quality matte.

Market Challenges Analysis

Fluctuating Raw Material Prices and Supply Chain Disruptions Limit Market Stability

One of the primary challenges for the Mono Oriented Polypropylene (MOPP) Film Market is the volatility in raw material prices, particularly polypropylene resin. Prices are affected by fluctuations in crude oil and global supply-demand dynamics. It creates cost pressure for manufacturers, especially those operating on thin margins. Supply chain disruptions, including geopolitical tensions and port delays, further strain material availability and lead times. Small and mid-sized producers face difficulties in securing consistent raw material access, limiting production planning and scalability. Cost variability reduces competitiveness and weakens customer retention. To mitigate risks, companies explore alternate feedstocks and long-term supply contracts. Still, managing cost efficiency remains complex in the current landscape.

Limited Compatibility with Certain Packaging Lines and Regulatory Restrictions Slow Adoption

Although MOPP films offer numerous advantages, their compatibility with legacy packaging systems poses integration issues. Some manufacturers encounter challenges adapting MOPP films to sealing and form-fill-seal machines designed for other materials. It leads to increased capital expenditure and operational delays. Certain food safety regulations and recycling standards vary across regions, restricting uniform application of MOPP films. These compliance-related barriers deter global standardization and cross-border supply agreements. Market penetration remains uneven due to differences in film specifications and recyclability benchmarks. Regulatory ambiguity around multi-layered flexible packaging adds further complexity. Manufacturers must invest in certification and testing to meet evolving legal and environmental frameworks.

Market Opportunities

Rising Investment in Sustainable Packaging Infrastructure Presents Strong Growth Potential

The shift toward circular economy models and government incentives for recyclable materials create favorable conditions for the Mono Oriented Polypropylene (MOPP) Film Market. Countries are implementing extended producer responsibility (EPR) laws and plastic bans that favor recyclable mono-materials. It benefits from these regulations due to its single polymer composition and compatibility with closed-loop recycling systems. Public-private partnerships and funding in recycling infrastructure enhance material recovery prospects. Brands are aligning their packaging portfolios with sustainability goals, boosting long-term demand for MOPP films.

Emerging Demand from Smart Packaging and Interactive Labeling Applications Opens New Avenues

Technological advancements in packaging are unlocking opportunities for MOPP films in smart and interactive labeling. Augmented reality tags, QR codes, and embedded sensors require films with specific surface and optical properties. It supports such use cases through superior print clarity and stability under electronic encoding. Growth in smart retail and traceability solutions drives demand for functional, adaptable substrates. This opens new application frontiers in food safety, logistics, and authentication.

Market Segmentation Analysis:

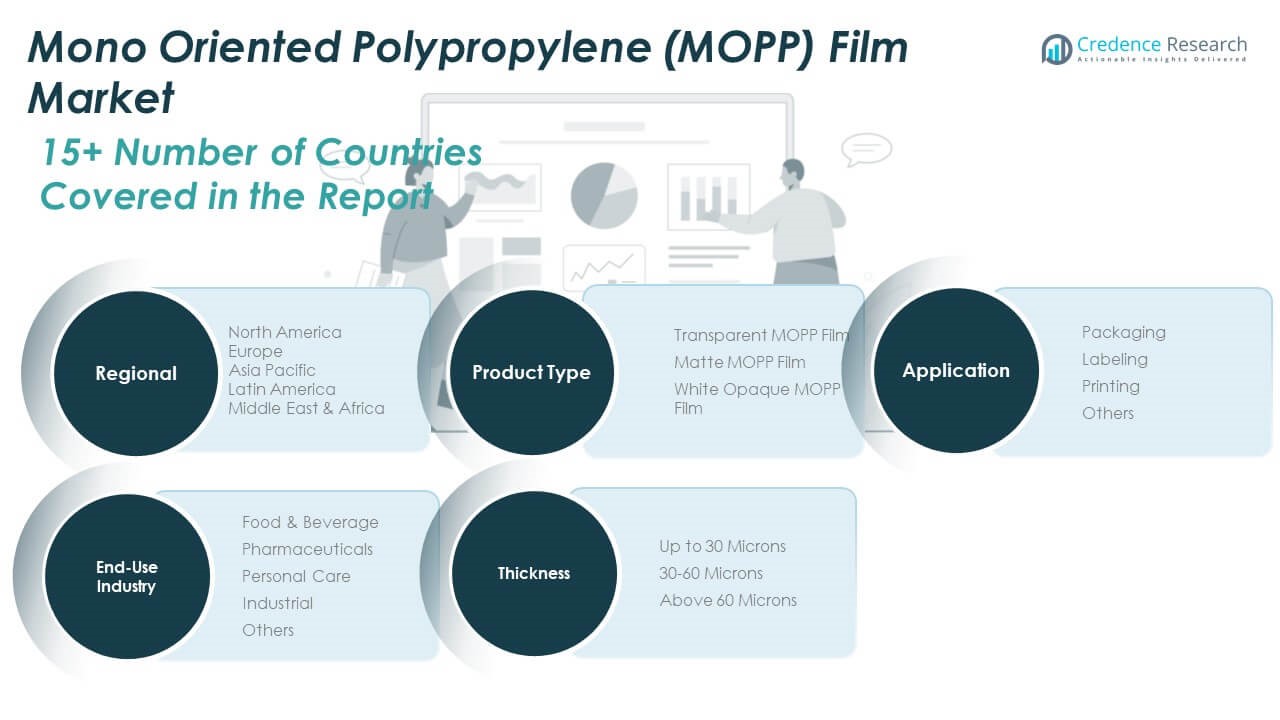

The Mono Oriented Polypropylene (MOPP) Film Market is segmented by product type, application, end-user industry, and thickness, reflecting its versatility across diverse packaging needs.

By product type

Transparent MOPP films lead demand due to their high clarity and printability, followed by matte variants that offer premium aesthetics for luxury packaging. White opaque MOPP films serve labeling and protective applications where opacity and barrier are crucial.

- For example, Innovia Films’ Propafilm™ RX (RXE) is a transparent, PVdC-coated BOPP film engineered for flow-wrap and horizontal form-fill-seal packaging of biscuit and confectionery products. It features a wide sealing temperature range, low-temperature seal activation, and excellent moisture and aroma barrier performance, enabling stable operation at high production speeds such as ~80 m/min on HFFS lines with strong seal integrity and minimal package defects.

By application

Packaging dominates due to wide use in food wraps, pouches, and overwraps, while labeling and printing segments benefit from the film’s dimensional stability and surface adaptability.

- For instance, Jindal Poly Films supplies transparent, heat-sealable BOPP films optimized for overwrap applications in confectionery and chocolate packaging, designed for high-speed formats like OW and HFFS. Certain Bicor™ clear coated grades (e.g. MB866, MM648) deliver low WVTR levels around 0.5 g/m²/day under 38 °C/90 % RH conditions to help extend product freshness.

By end-user industry

Food and beverage represent the largest share due to safety, visual appeal, and performance requirements. Pharmaceuticals adopt MOPP films for compliance-friendly, tamper-evident formats. The personal care segment demands superior appearance and branding support. Industrial usage grows for component protection and insulation.

By thickness

30–60 microns is the most preferred range, balancing strength and flexibility. Films above 60 microns are used in heavy-duty wraps, while those up to 30 microns suit lightweight applications.

Segmentation:

By Product Type

- Transparent MOPP Film

- Matte MOPP Film

- White Opaque MOPP Film

By Application

- Packaging

- Labeling

- Printing

- Others

By End-User Industry

- Food & Beverage

- Pharmaceuticals

- Personal Care

- Industrial

- Others

By Thickness

- Up to 30 Microns

- 30–60 Microns

- Above 60 Microns

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Regional Analysis:

North America

The North America Mono Oriented Polypropylene (MOPP) Film Market size was valued at USD 602.50 million in 2018 to USD 746.66 million in 2024 and is anticipated to reach USD 1,233.21 million by 2032, at a CAGR of 6.5% during the forecast period. North America accounted for 23.65% of the global MOPP film market share in 2024. The region’s market is driven by the presence of advanced packaging technologies and strong demand across food, pharmaceuticals, and personal care sectors. It benefits from high consumer awareness regarding sustainable packaging and recyclability. U.S.-based manufacturers are investing in eco-friendly packaging lines, expanding MOPP film integration across product categories. Growth in e-commerce and cold-chain logistics further boosts regional film usage. Regulatory support for recyclable and mono-material packaging promotes wider adoption. The U.S. and Canada lead in innovation and application diversity. Ongoing advancements in high-clarity and barrier MOPP films strengthen regional competitiveness.

Europe

The Europe Mono Oriented Polypropylene (MOPP) Film Market size was valued at USD 485.00 million in 2018 to USD 579.96 million in 2024 and is anticipated to reach USD 886.65 million by 2032, at a CAGR of 5.5% during the forecast period. Europe accounted for 18.37% of the global market share in 2024. The region’s market is shaped by strict environmental regulations and strong recycling mandates. It experiences growing demand from sectors focused on compliance and circular packaging models. Countries like Germany, France, and the UK promote MOPP films as sustainable alternatives for flexible and rigid packaging. The food and beverage sector is a major consumer, followed by healthcare and cosmetics. European converters are emphasizing innovation in compostable coatings and water-based inks on MOPP substrates. Technological integration with digital printing improves product customization. The region’s strong retail infrastructure supports high-volume consumption of label and wrap applications.

Asia Pacific

The Asia Pacific Mono Oriented Polypropylene (MOPP) Film Market size was valued at USD 1,127.50 million in 2018 to USD 1,457.52 million in 2024 and is anticipated to reach USD 2,550.49 million by 2032, at a CAGR of 7.3% during the forecast period. Asia Pacific held the largest market share at 46.18% in 2024. High population density, urbanization, and expanding middle-class income drive consumption across food, retail, and pharmaceutical sectors. It benefits from a robust manufacturing base in China, India, South Korea, and Japan. Local producers offer cost-competitive and customizable MOPP film solutions. Rapid growth in e-commerce and FMCG sectors contributes to high-volume packaging demand. Regional governments are encouraging recyclable material adoption through incentives and policy shifts. MOPP films are widely used in flexible pouches, overwraps, and decorative applications. Technological upgrades and export-oriented production add momentum to regional expansion.

Latin America

The Latin America Mono Oriented Polypropylene (MOPP) Film Market size was valued at USD 133.00 million in 2018 to USD 165.97 million in 2024 and is anticipated to reach USD 251.08 million by 2032, at a CAGR of 5.4% during the forecast period. Latin America captured 5.26% of the global MOPP film market share in 2024. Brazil and Mexico lead the demand, driven by increasing use in snack foods, beverages, and agricultural packaging. It shows growth in flexible formats as small and medium enterprises transition from rigid to lightweight films. Domestic production capacity is growing, though imports still play a key role. Consumer preference for value-added packaging supports film adoption in retail. Regional converters are adopting energy-efficient extrusion technologies to meet global standards. MOPP films are used in shrink sleeves and labeling across expanding product categories. Regulatory awareness around recyclability is gradually increasing.

Middle East

The Middle East Mono Oriented Polypropylene (MOPP) Film Market size was valued at USD 103.00 million in 2018 to USD 122.43 million in 2024 and is anticipated to reach USD 184.41 million by 2032, at a CAGR of 5.3% during the forecast period. It held a 3.88% share of the global market in 2024. GCC countries, led by the UAE and Saudi Arabia, drive demand through retail expansion and infrastructure modernization. It supports diversified applications including dairy, confectionery, and hygiene product packaging. Regional firms are investing in packaging automation and film lamination technologies. Demand for durable, print-friendly materials positions MOPP films as a preferred option. Rising disposable income boosts branded product consumption, driving premium packaging growth. Strategic trade partnerships enhance material availability and market integration. National sustainability initiatives encourage local firms to adopt recyclable films. Imports remain critical for specialty grades and customized films.

Africa

The Africa Mono Oriented Polypropylene (MOPP) Film Market size was valued at USD 49.00 million in 2018 to USD 83.33 million in 2024 and is anticipated to reach USD 117.36 million by 2032, at a CAGR of 3.9% during the forecast period. Africa represented 2.64% of the global market share in 2024. Market growth is driven by packaging needs in food, beverage, and basic consumer goods segments. It sees increasing interest from regional processors adopting flexible packaging formats. South Africa, Nigeria, and Kenya are key contributors to regional demand. Infrastructure limitations and import dependence remain challenges. Local industries are gradually investing in recyclable and lightweight materials to meet sustainability goals. International players are entering partnerships to expand distribution and support market education. MOPP films offer cost-effective solutions where affordability and durability are crucial. The market is at a developing stage with future growth tied to industrial and retail expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Toray Industries, Inc.

- Jindal Poly Films Ltd.

- Cosmo Films Ltd.

- Taghleef Industries

- Treofan Group

- Innovia Films

- SRF Limited

- Polinas

- Uflex Ltd.

- Vibac Group S.p.A.

- Inteplast Group

- Flex Films

- Manucor S.p.A.

- Altopro S.A.

- Futamura Chemical Co., Ltd.

Competitive Analysis:

Leading players in the Mono Oriented Polypropylene (MOPP) Film Market focus on product differentiation, capacity expansion, and strategic partnerships to gain edge. Industry incumbents invest in advanced technologies to deliver high-clarity, barrier-enhanced, and specialty-grade films that meet stringent sector standards. It leverages scalable manufacturing facilities to reduce per-unit cost and supports high-volume orders across food, pharmaceutical, and packaging clients. Companies pursue geographic expansion to serve emerging markets and align with regional recycling regulations. Several firms engage in joint ventures or alliances to improve supply chain integration and reduce lead times. Pricing discipline and long-term supplier contracts support margin stability amid feedstock volatility. Competitive advantage emerges through customer support, R&D capabilities, and certification credentials. It positions companies to serve premium and standard segments while adapting to evolving regulatory and sustainability demands.

Recent Developments:

- In March 2025, Toray Industries, Inc. announced the development of a high-precision hollow fiber membrane module for food and beverage production and bio-related applications, utilizing advanced nano-pore structural control technology. This innovation reflects Toray’s ongoing commitment to new product creation within the specialty films and material sectors.

- In August 2024, Jindal Poly Films Ltd.’s subsidiary, JPFL Films, revealed plans to establish a new 60,000 tonne/year BOPP (biaxially oriented polypropylene) film unit at its existing Nashik complex in India.

- In August 2024, Cosmo Films Ltd. launched seven new specialty films tailored for the U.S. market during its appearance at Label Expo Americas 2024. The new products, targeting label and flexible packaging sectors, include PVC-free graphic films, high-shrink label films, heat-resistant lamination films, and non-tear elongation films, aligning with Cosmo’s focus on innovative and sustainable packaging solutions.

Market Concentration & Characteristics:

The Mono Oriented Polypropylene (MOPP) Film Market exhibits moderate concentration, with a handful of global manufacturers holding substantial shares and many regional players supplying niche demand. It benefits from economies of scale driven by high capital and technical requirements in extrusion and film orientation processes. Larger firms leverage global infrastructure, strong distribution networks, and brand recognition to maintain market leadership. Specialized regional producers compete via localized customization, lower lead times, and flexible order quantities. Market structure combines vertical integration into resin supply or packaging conversion facilities, improving cost control. It demands consistent quality, regulatory compliance, and continuous innovation. Buyers evaluate supplier certifications, performance metrics, and customer support when choosing vendors. Increased environmental regulations and shifting customer preferences toward recyclable mono-material drive consolidation and strategic investment.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Application, End-User Industry and Thickness. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for recyclable and mono-material packaging will strengthen the adoption of MOPP films across FMCG and retail sectors.

- Advancements in surface treatment and barrier technology will expand applications in pharmaceuticals and electronics.

- Growth in e-commerce logistics will drive the need for durable and tamper-resistant flexible films.

- Regulatory pressure for sustainable packaging will boost preference for MOPP over multi-layered non-recyclable films.

- Investment in automated packaging infrastructure will increase compatibility with MOPP film formats.

- Customization trends in branding and label printing will favor high-clarity, print-ready MOPP grades.

- Emerging markets in Asia, Latin America, and Africa will contribute significantly to volume expansion.

- Strategic mergers and capacity expansions by global players will enhance production scalability.

- Development of specialty variants such as antimicrobial and matte films will create new revenue streams.

- Continued R&D in lightweight, high-strength formulations will reinforce MOPP film competitiveness in global packaging innovation.