Market Overview

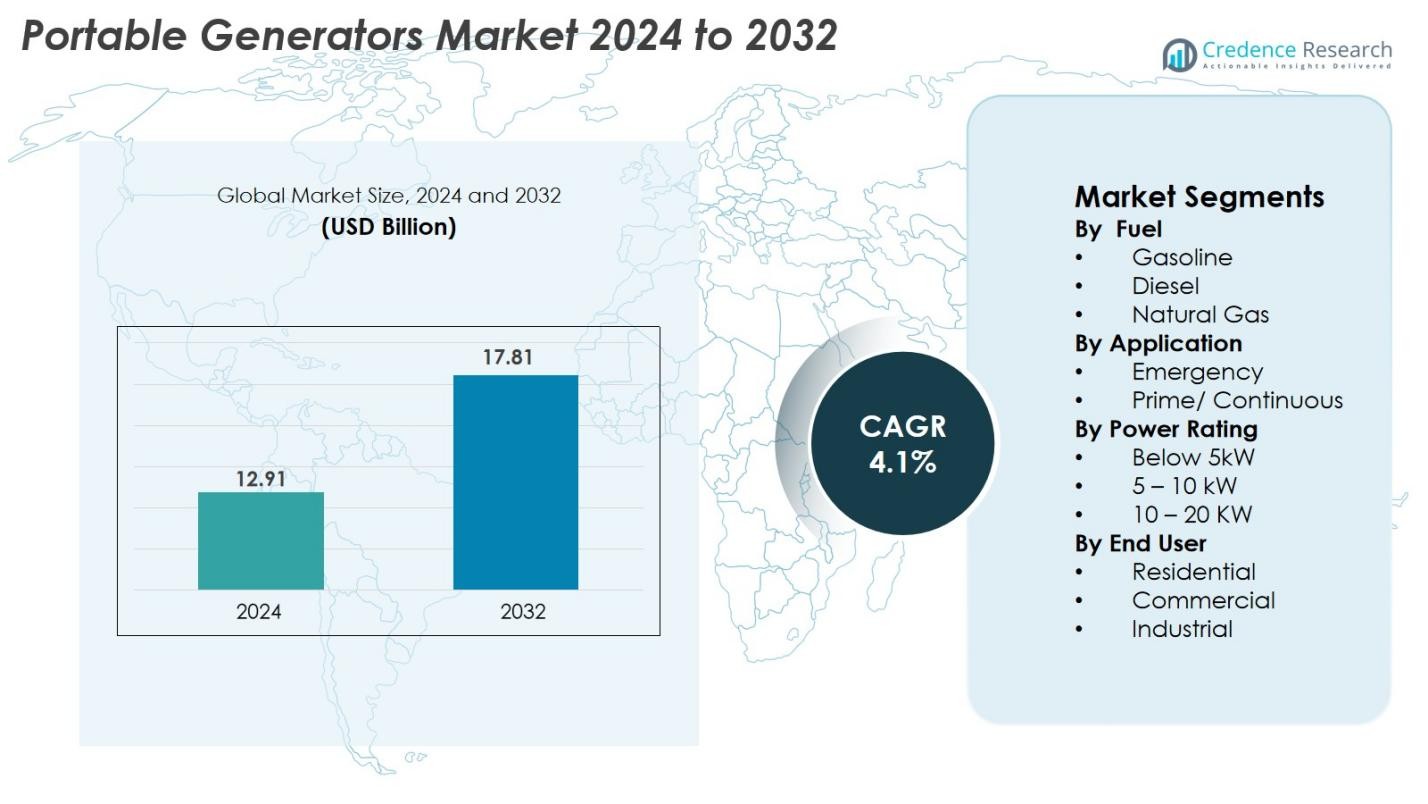

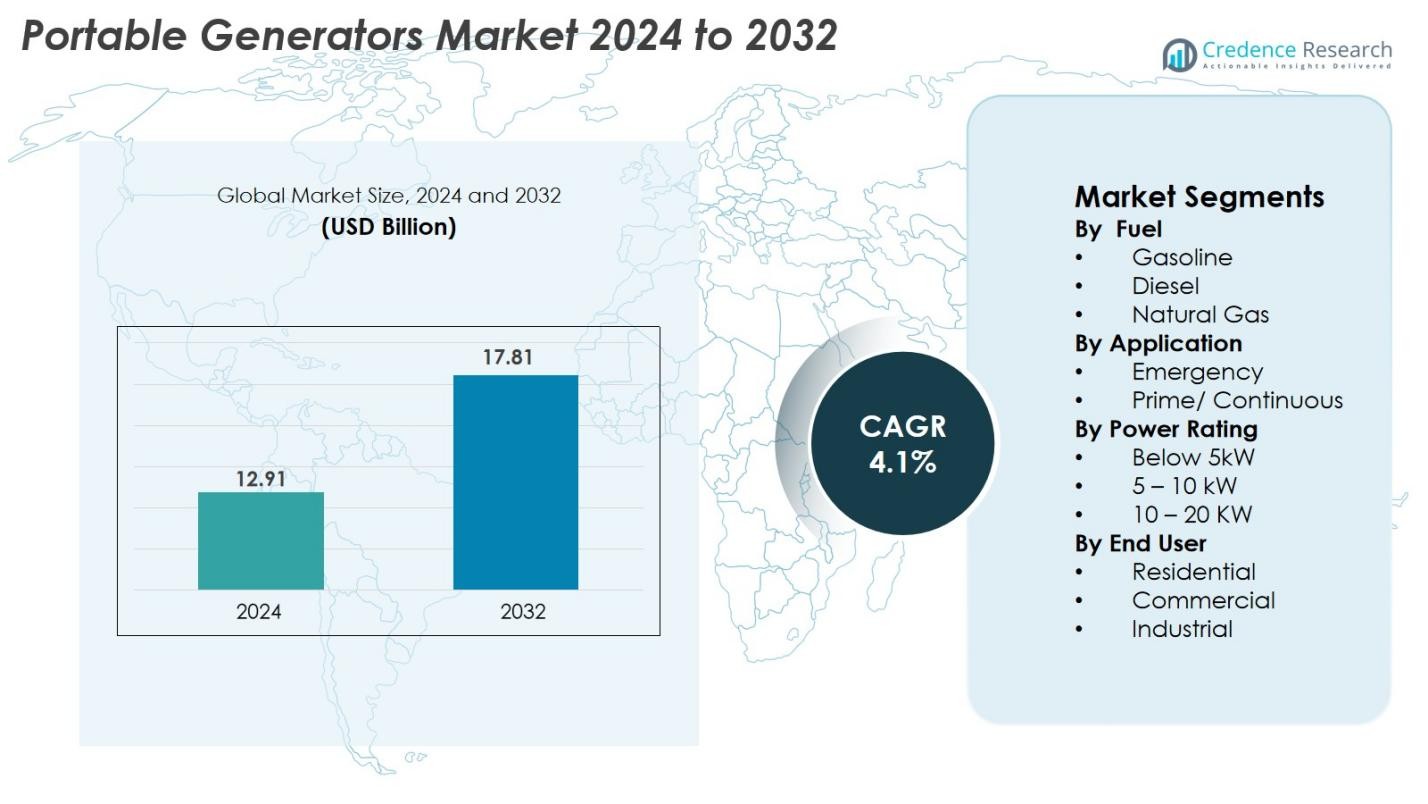

Portable Generators market size was valued at USD 12.91 Billion in 2024 and is anticipated to reach USD 17.81 Billion by 2032, at a CAGR of 4.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Portable Generators market Size 2024 |

USD 12.91 Billion |

| Portable Generators market , CAGR |

4.1% |

| Portable Generators market Size 2032 |

USD 17.81 Billion |

The Portable Generators market is driven by strong participation from leading manufacturers, including Honda, Generac, Yamaha, Cummins, Caterpillar, Kohler, Briggs & Stratton, Champion Power Equipment, Atlas Copco, and Wacker Neuson, each offering diversified product portfolios across residential, commercial, and industrial applications. These companies compete through advancements in inverter technology, fuel efficiency, noise reduction, and digital monitoring features. Regionally, Asia-Pacific leads the global market with a 38.2% share, supported by rapid construction growth, frequent outages, and expanding industrial activity. North America follows with 34.6%, driven by high residential adoption and strong demand for emergency backup power. Europe maintains a solid 27.4% share due to stringent regulations and rising use in commercial and event applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Portable Generators market was valued at USD 12.91 Billion in 2024 and is projected to reach USD 17.81 Billion by 2032, expanding at a CAGR of 4.1% during the forecast period.

- Market growth is driven by increasing power outages, expanding construction activities, and rising residential demand for emergency backup solutions, especially in regions with unstable electricity infrastructure.

- Key trends include the adoption of inverter generators, low-emission models, and smart monitoring features, along with a shift toward fuel-efficient and quieter portable power systems.

- Competition intensifies as major players such as Honda, Generac, Yamaha, Cummins, Caterpillar, and Kohler focus on product innovation, noise reduction, and expanded distribution networks to strengthen market presence.

- Regionally, Asia-Pacific leads with a 38.2% share, followed by North America at 34.6% and Europe at 27.4%, while the Below 5 kW segment dominates with a 52.4% share due to strong residential and light-commercial usage.

Market Segmentation Analysis

By Fuel

Gasoline dominated the Portable Generators market in 2024 with a 46.3% share, driven by its widespread availability, lower upfront cost, and suitability for residential and light-commercial use. The segment benefits from easy refueling, compact designs, and strong adoption for outdoor activities and home backup needs. Diesel generators hold notable presence due to higher fuel efficiency and durability in heavy-duty applications, while natural gas units grow steadily as consumers shift toward cleaner, low-emission alternatives supported by expanding gas infrastructure and rising preference for sustainable backup power solutions.

- For instance, the Honda EU2200i gasoline portable generator delivers a continuous output of 1,800 watts (15A) with a maximum output of 2,200 watts. It has a fuel tank capacity of approximately 3.6 liters (0.95 US gallons). The generator’s runtime is up to 8.1 hours on a single tank when operating at a quarter load (around 450 watts), utilizing its Eco-Throttle system; at its full rated load of 1,800 watts, the runtime is approximately 3.2 hours.

By Application

The Emergency segment led the market with a 58.7% share in 2024, supported by increasing grid instability, rising frequency of extreme weather events, and higher residential demand for backup power during outages. The segment benefits from rapid deployment capability, portability, and compatibility with various fuel options. Prime/Continuous applications grow at a stable pace, fueled by construction, off-grid operations, and remote industrial activities requiring dependable power. Rising commercial expansion across developing economies continues to enhance adoption in both planned and unplanned power-supply scenarios.

- For instance, Cummins’ C150D6 emergency generator provides a rated output of 150 kW with an automatic transfer capability that restores critical loads within under 10 seconds, illustrating the reliability required during grid failures

By Power Rating

Generators Below 5 kW accounted for the largest share at 52.4% in 2024, driven by strong household adoption, lightweight designs, and affordability. This range is preferred for home appliances, small tools, camping, and emergency backup during short-duration outages. The 5–10 kW category grows steadily with expanding usage in small businesses, job sites, and medium-load residential applications requiring higher performance. Units in the 10–20 kW range gain traction in commercial facilities, farms, and industrial sites due to stronger output, longer runtime, and compatibility with heavy-duty power requirements.

Key Growth Drivers

Growing Dependence on Backup Power Amid Grid Instability

The increasing frequency of power outages caused by extreme weather events, grid failures, and rising electricity demand continues to significantly drive the portable generators market. Households and small businesses increasingly rely on portable units to ensure uninterrupted operations during unplanned outages. Urbanization and infrastructure strain further intensify the need for dependable backup power, especially in regions with unreliable grids. Portable generators offer a flexible and quick-deployment alternative to stationary systems, making them ideal for emergencies. Additionally, outage-prone regions across Asia-Pacific, Africa, and parts of North America show accelerated adoption as consumers seek cost-effective power continuity solutions. This shift is amplified by rising remote work patterns, dependence on digital devices, and heightened awareness of disaster preparedness. Together, these factors strengthen long-term demand for compact, fuel-efficient generators.

- For instance, Caterpillar’s RP7500E portable generator provides 7,500 running watts with a 420 cc OHV engine and offers a runtime of up to 11 hours at half load, enabling reliable backup power for small businesses and residential users during grid disruptions.

Expansion of Construction and Industrial Activities

Rapid expansion of construction, mining, oil & gas, and infrastructure development projects fuels strong demand for portable generators capable of supporting tools, lighting, and temporary site operations. Construction contractors increasingly prefer portable units due to their mobility, easy installation, and suitability for off-grid and remote locations. Industrial growth in emerging economies accelerates equipment needs, particularly in regions where access to stable grid power remains limited. Portable diesel and gasoline generators play a vital role in powering small machinery, welding units, and emergency site operations. Growth in the rental equipment industry also boosts adoption, with fleet owners expanding generator inventories to meet short-term project requirements. Furthermore, infrastructure modernization programs, smart city initiatives, and increased public investment in transportation facilities create consistent demand for portable power systems across commercial and industrial segments.

- For instance, Atlas Copco’s QAS 60 portable generator delivers 48 kW prime power and features a rugged skid base with a heavy-duty alternator, enabling reliable operation in harsh construction and mining sites.

Rising Adoption in Residential and Recreational Applications

Residential adoption of portable generators is rising significantly due to growing lifestyle shifts, increased spending on home improvement, and higher awareness of emergency preparedness. Consumers increasingly invest in compact, low-noise generators to support essential appliances, HVAC systems, and medical equipment during power disruptions. Recreational activities—including camping, RV travel, outdoor events, and mobile businesses—further strengthen demand for lightweight inverter generators. The trend is especially pronounced in the U.S., Canada, Europe, and Japan, where households prioritize comfort, safety, and uninterrupted living. Manufacturers are launching fuel-efficient, low-emission models with advanced inverters, remote monitoring, and parallel capability to meet evolving user preferences. The growing popularity of do-it-yourself (DIY) tools and home workshops also contributes to sustained demand for portable power solutions across residential and leisure environments.

Key Trends & Opportunities

Shift Toward Eco-Friendly, Low-Emission Generators

A major trend reshaping the market is the rising emphasis on cleaner, environmentally responsible portable generators. Regulatory bodies such as EPA, CARB, and European agencies are implementing stringent emission standards, pushing manufacturers to innovate with low-emission engines, advanced combustion systems, and hybrid technologies. Consumers increasingly seek quieter, fuel-efficient, and low-carbon alternatives to conventional gasoline units. This shift opens strong opportunities for natural gas, dual-fuel, inverter-based, and hybrid power systems. Advances in battery storage also encourage integration of portable power stations with generator systems for silent operation during low-load periods. Sustainability-oriented product lines attract homeowners, commercial users, and government agencies seeking compliance with green building and energy-efficiency mandates. As environmental awareness grows globally, the market sees accelerated transition toward next-generation low-emission portable generators.

· For instance, Honda’s EU3200i inverter generator operates with emissions low enough to meet both EPA and CARB standards and produces a noise level that ranges from 54 dBA at 1/4 load to 58 dBA at rated load, supporting eco-sensitive applications.

Technological Upgrades and Smart Connectivity Features

Rapid technological innovation presents major opportunities in the portable generators market. Manufacturers increasingly incorporate digital monitoring, remote diagnostics, automatic choke systems, and smart throttling technologies to enhance user convenience and performance. IoT-enabled portable generators allow remote start, fuel tracking, performance analytics, and predictive maintenance via mobile apps. Parallel-connectable inverter generators are gaining traction, enabling users to combine two small units for higher output without compromising fuel efficiency. Noise-reduction mechanisms, improved mufflers, and compact engine designs further elevate product appeal for home and recreational use. These advancements position portable generators as smarter, more adaptable, and user-friendly power solutions, meeting evolving consumer expectations for efficiency, safety, and modern functionality.

· For instance, Generac’s GP3500Io features PowerDial™ technology for integrated start/run/stop control and has USB ports for charging mobile devices, but it does not support Bluetooth connectivity through the Mobile Link™ app.

Key Challenges

Stringent Environmental Regulations on Emissions and Noise

One of the most pressing challenges for the portable generators industry is the increasing stringency of emission and noise regulations across major markets. Environmental agencies enforce limits on particulate matter, NOx, CO, and hydrocarbon emissions, requiring engine redesigns, cleaner fuel systems, and advanced after-treatment technologies. Meeting regulatory requirements increases manufacturing costs and extends product development timelines. Noise restrictions in residential neighborhoods, construction zones, and recreational areas further limit deployment and force manufacturers to invest in advanced acoustic engineering. Older or low-priced models risk losing market eligibility as stricter rules take effect. Compliance burdens particularly impact small manufacturers, who face higher production costs and certification hurdles, challenging their competitiveness in global markets.

Fluctuating Fuel Prices and Rising Operating Costs

Volatile gasoline and diesel prices pose a significant challenge to portable generator adoption, particularly among price-sensitive users. As fuel costs fluctuate due to geopolitical tensions, supply constraints, and global oil market dynamics, operational expenses for portable generators become unpredictable. High fuel costs discourage frequent usage, especially in regions dependent on imported petroleum products. Additionally, diesel engines require regular servicing, oil changes, and maintenance checks, increasing the total cost of ownership for commercial and industrial users. These economic pressures push some consumers to explore alternative options such as battery-powered portable stations or hybrid systems. As operating costs rise, market growth potential for conventional fuel-based generators faces increasing constraints.

Regional Analysis

North America

North America dominated the Portable Generators market in 2024 with a 34.6% share, driven by frequent weather-related outages, aging grid infrastructure, and high adoption of home backup solutions. The U.S. leads the region due to strong demand from residential users, recreational applications, and construction sites requiring dependable temporary power. Growing popularity of inverter generators, emergency preparedness spending, and supportive regulatory standards for low-emission units further enhance market growth. Additionally, rising outdoor activities, expansion of rental equipment fleets, and increased reliance on portable power for small businesses continue to strengthen regional demand.

Europe

Europe accounted for 27.4% of the market in 2024, supported by rising demand for portable power during construction, event management, and emergency response operations. Countries such as Germany, the UK, France, and Italy contribute significantly due to strong industrial activity and strict grid-stability requirements. The region’s emphasis on low-emission generators and compliance with EU environmental regulations accelerates adoption of natural gas and inverter-based units. Growth in outdoor recreation, mobile businesses, and remote-site operations further stimulates market expansion. Increasing electrification of remote areas and adoption of backup solutions for data centers and SMEs also contribute to Europe’s steady market performance.

Asia-Pacific

Asia-Pacific held the largest share globally at 38.2% in 2024, driven by rapid urbanization, infrastructure development, and high reliance on portable power across construction, small industries, and residential users. Countries such as China, India, Japan, and Indonesia experience frequent grid instability, creating strong demand for affordable gasoline and diesel portable generators. Rising adoption in rural electrification projects, outdoor commercial activities, and small workshops further expands the market. Growth of the manufacturing and construction sectors, along with increased investment in backup systems for SMEs, positions Asia-Pacific as the fastest-growing region during the forecast period.

Latin America

Latin America captured 6.1% of the Portable Generators market in 2024, supported by growing construction activities, remote industrial operations, and recurring power outages across Brazil, Mexico, Chile, and Colombia. Economic expansion in residential and small commercial sectors, combined with increased infrastructure development, drives demand for compact and mid-range portable generators. The region also experiences rising adoption in agriculture, mining, and oil & gas operations where temporary off-grid power is essential. Although price sensitivity remains high, increasing availability of cost-efficient gasoline units and expanding rental equipment fleets contribute to steady market growth.

Middle East & Africa (MEA)

MEA accounted for 3.7% of the market in 2024, driven by high demand from construction, mining, oil & gas, and remote-site operations requiring reliable off-grid power. The UAE, Saudi Arabia, South Africa, and Nigeria represent major markets due to expanding infrastructure and frequent power supply gaps. Portable diesel generators remain widely preferred for their durability in harsh climates, while lightweight gasoline units gain traction among residential and small-business users. Growth in tourism, outdoor events, and commercial expansion also supports market penetration. Increasing investment in energy diversification and electrification projects is expected to enhance future adoption.

Market Segmentations

By Fuel

- Gasoline

- Diesel

- Natural Gas

By Application

- Emergency

- Prime/ Continuous

By Power Rating

- Below 5kW

- 5 – 10 kW

- 10 – 20 KW

By End User

- Residential

- Commercial

- Industrial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Portable Generators market is characterized by strong participation from global and regional manufacturers offering diverse fuel types, power ratings, and technology-driven models. Leading companies such as Honda, Generac, Yamaha, Cummins, Caterpillar, Kohler, Briggs & Stratton, Atlas Copco, Siemens, Champion Power Equipment, Honeywell International, Duromax, Loncin, Inmesol, Himoinsa, Wacker Neuson, Pulsar Products, and Wen Generators actively compete through product innovation, fuel efficiency improvements, and expansion of inverter-based, low-emission units. Many players focus on strengthening dealer networks, advancing noise-reduction technologies, and enhancing digital monitoring capabilities to increase consumer appeal. Strategic partnerships, capacity expansion, and rental fleet integrations also shape competition as demand rises across residential, construction, and industrial sectors. Additionally, manufacturers increasingly invest in lightweight, hybrid, and clean-fuel solutions to meet global regulatory standards and shifting customer preferences.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kohler (US)

- Atlas Copco (Sweden)

- Duromax (California)

- Rato Europe (Italy)

- Honeywell International Inc. (US)

- Loncin (China)

- Briggs and Stratton (US)

- Inmesol (Spain)

- Siemens (Germany)

- Champion Power Equipment (US)

Recent Developments

- In August 2025, 2G Energy Inc. announced a strategic partnership with CK Power to market, sell and service the new Demand Response generator line in North America.

- In June 2025, Cummins Inc. announced the launch of a new 17-litre engine platform generator set capable of producing up to 1 MW of power.

- In May 2025, Hitachi Energy successfully demonstrated its “HyFlex” hydrogen-powered portable generator in collaboration with Stena Line, PowerCell Group, Linde Gas and the Port of Gothenburg at berth in Sweden.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Power Rating End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for portable generators will rise steadily due to growing reliance on emergency backup power.

- Adoption of inverter and hybrid generators will accelerate as users prioritize efficiency and low noise.

- Cleaner fuel types such as natural gas and dual-fuel units will gain stronger market penetration.

- Smart connectivity features will increasingly become standard across mid- and high-range models.

- Construction and infrastructure expansion will continue supporting commercial and industrial demand.

- Residential usage will rise with increased home improvement spending and preparedness awareness.

- Manufacturers will focus more on low-emission engines to comply with evolving environmental regulations.

- Rental equipment companies will expand generator fleets to serve short-term and project-based needs.

- Product innovation will center on compact designs, improved portability, and longer runtime.

- Growth in outdoor recreation, mobile businesses, and remote activities will open new application opportunities.