| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sack Kraft Paper Market Size 2024 |

USD 10,488.8 million |

| Sack Kraft Paper Market, CAGR |

3.33% |

| Sack Kraft Paper Market Size 2032 |

USD 13,598.4 million |

Market Overview:

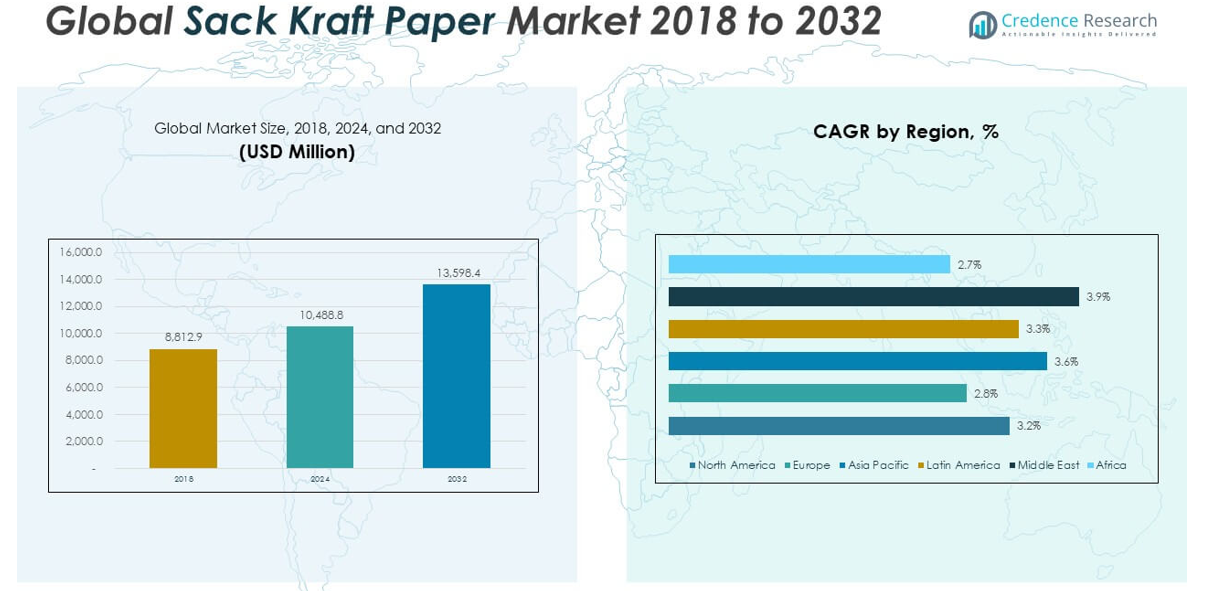

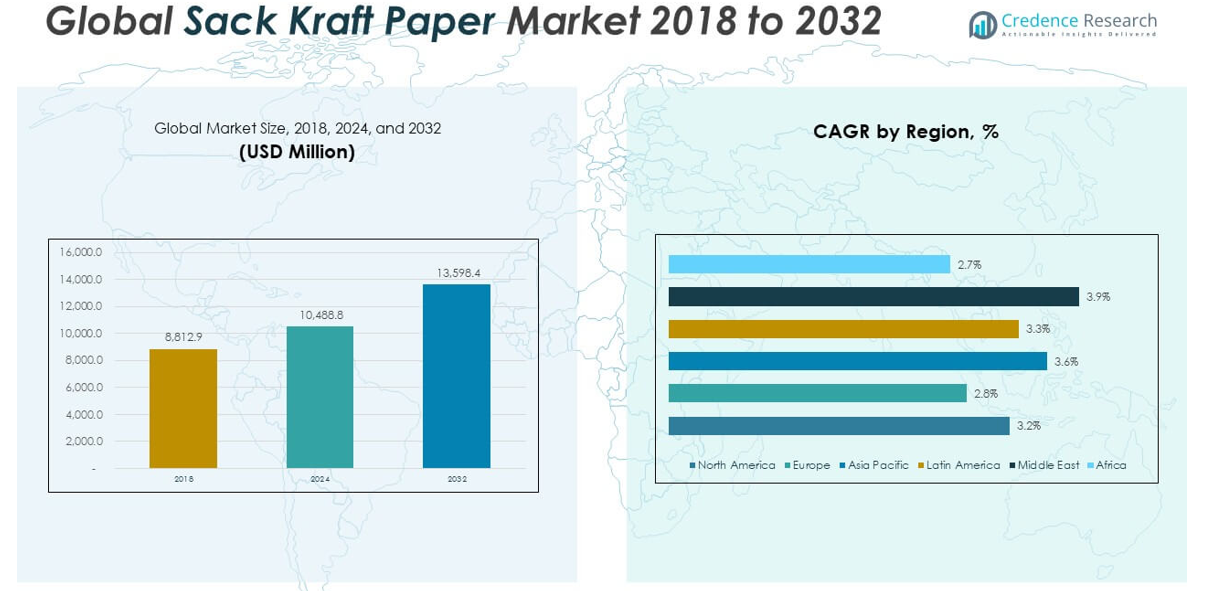

The Global Sack Kraft Paper Market size was valued at USD 8,812.9 million in 2018 to USD 10,488.8 million in 2024 and is anticipated to reach USD 13,598.4 million by 2032, at a CAGR of 3.33% during the forecast period.

Key factors driving the global sack kraft paper market include increasing regulatory pressure to reduce plastic use, rising consumer preference for eco-friendly packaging solutions, and the expansion of industries that rely heavily on durable, biodegradable packaging. Many governments are enforcing strict environmental policies that restrict single-use plastics, pushing companies to adopt sustainable alternatives like sack kraft paper. In the construction sector, the rising demand for cement and other building materials packaged in strong, tear-resistant sacks has significantly boosted product usage. Similarly, the rapid growth of e-commerce, food delivery, and ready-to-eat segments has led to increased demand for sustainable, high-performance packaging that ensures product safety during transport. Innovations in sack kraft paper—such as moisture-resistant coatings and multi-ply structures—are further expanding its application across challenging environments, making it suitable for packaging chemicals, fertilizers, and other industrial goods.

Regionally, Europe remains the dominant market due to strict environmental regulations, well-established recycling infrastructure, and a strong emphasis on sustainable packaging solutions. The region consistently leads global consumption, particularly in sectors like construction, agriculture, and industrial packaging. Asia-Pacific, however, is the fastest-growing region, driven by rapid industrialization, urbanization, and a surge in infrastructure development in countries such as China, India, and Southeast Asian nations. The increasing demand for packaged consumer goods and agricultural products is fueling sack kraft paper adoption across the region. North America is also witnessing stable growth, supported by eco-regulatory compliance, strong retail demand, and innovation in packaging design. Meanwhile, Latin America and the Middle East & Africa present moderate yet promising opportunities, primarily led by agriculture and infrastructure investments. Overall, regional dynamics reflect a global shift toward sustainable materials, with both developed and emerging markets contributing to the sector’s continued expansion.

Market Insights:

- The Global Sack Kraft Paper Market was valued at USD 8,812.9 million in 2018 and reached USD 10,488.8 million in 2024. It is projected to grow to USD 13,598.4 million by 2032, registering a CAGR of 3.33% during the forecast period. This steady growth reflects sustained demand across industries that rely on strong, biodegradable packaging materials.

- Governments across major regions are enforcing restrictions on single-use plastics, creating significant opportunities for sack kraft paper as an environmentally friendly alternative. Its recyclability and compostable nature make it an ideal solution for companies seeking to comply with regulatory mandates and enhance their sustainability credentials.

- Demand from the construction and agriculture sectors remains a core driver for sack kraft paper, as the material is widely used for packaging cement, fertilizers, and animal feed. Rapid urbanization and infrastructure development in emerging economies are further accelerating the need for high-strength, tear-resistant sacks.

- Growth in e-commerce, online grocery delivery, and food takeaway has led to increasing use of sack kraft paper in both primary and secondary packaging. Brands are turning to it for its durability and ability to support high-quality printing, aligning with both protection and marketing goals.

- Ongoing product innovations such as moisture-resistant coatings, multi-wall sack designs, and enhanced fiber treatments are enabling sack kraft paper to serve more demanding packaging applications. These developments expand its relevance in sectors requiring resistance to moisture, fine particles, and high mechanical stress.

- Despite its advantages, the market faces challenges due to volatile wood pulp prices and global supply chain disruptions. Manufacturers must manage cost fluctuations while maintaining quality and competitiveness, especially in high-volume, price-sensitive segments.

- Europe remains the leading region in sack kraft paper consumption, driven by strong recycling infrastructure and environmental policies. Asia-Pacific is the fastest-growing region, supported by industrial expansion in China, India, and Southeast Asia. North America shows steady growth, while Latin America and the Middle East & Africa offer moderate but rising potential.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Sustainability Mandates and Global Shift Away from Plastic-Based Packaging:

Government regulations across major economies are increasingly targeting the reduction of plastic waste, driving the demand for biodegradable and recyclable alternatives. The Global Sack Kraft Paper Market is directly benefiting from this trend due to the material’s compostability and minimal environmental impact. Single-use plastic bans and strict recycling mandates in Europe, North America, and parts of Asia-Pacific are accelerating the replacement of plastic sacks with paper-based options. End users in sectors such as construction, food, agriculture, and chemicals are adopting sack kraft paper to comply with new environmental standards. Brands are also positioning themselves as sustainable by transitioning to eco-friendly packaging. This regulatory shift is creating a long-term structural tailwind for the adoption of sack kraft paper across both mature and developing markets.

- For instance, Mondi Group has implemented advanced manufacturing techniques and acquired new converting lines, increasing its annual production capacity by 150–180 million paper bags in Egypt, directly replacing plastic sacks for major cement producers.

Rising Demand from Construction, Agriculture, and Industrial Goods Sectors:

The strength and durability of sack kraft paper make it a preferred material for heavy-duty applications in construction, agriculture, and industrial packaging. It is extensively used to package cement, gypsum, animal feed, and fertilizers, where product integrity and handling convenience are critical. With infrastructure development accelerating in emerging economies and urban renewal projects increasing in mature markets, demand for high-performance packaging is growing steadily. Manufacturers are choosing sack kraft paper due to its superior tear resistance, tensile strength, and ability to support multi-layer formats. The Global Sack Kraft Paper Market continues to expand as these sectors scale up operations and prioritize materials that ensure product safety and environmental compliance. Industrial users also favor sack kraft paper for its ability to maintain performance in high-moisture and rugged handling conditions.

- For instance, Segezha Group increased its sack kraft paper production to 450,000 tons annually by 2021, supporting high-volume cement and fertilizer packaging in global construction and agriculture markets.

Growth in E-Commerce, Retail Packaging, and Food Delivery Applications:

The surge in e-commerce and food delivery services is driving the need for packaging that is both strong and sustainable. Sack kraft paper is emerging as a viable solution for secondary and primary packaging across online retail, grocery delivery, and takeaway food segments. Its printability, stiffness, and high tensile properties enable effective branding while ensuring product protection during transit. Companies are increasingly moving toward recyclable kraft paper bags, sacks, and wraps to align with consumer expectations for sustainability. In the Global Sack Kraft Paper Market, this growing retail adoption is opening up new opportunities beyond traditional industrial uses. It supports eco-conscious consumerism while offering manufacturers and retailers a reliable, scalable packaging alternative.

Technological Advancements and Product Innovations Expanding Application Scope:

Continuous innovation in sack kraft paper manufacturing is driving its penetration across diverse end-user industries. Advances such as wet-strength grades, barrier coatings, and multi-wall sack formats are enabling its use in packaging moisture-sensitive goods, chemicals, and powdered products. These improvements enhance the paper’s performance, expanding its competitiveness against synthetic and plastic-based alternatives. Manufacturers are investing in production upgrades to improve tensile strength, print quality, and sealability. It is now feasible to use sack kraft paper in automated filling lines and in applications requiring high load-bearing capacity. The Global Sack Kraft Paper Market is evolving from a commodity segment into a value-added packaging solution with customized grades and formats tailored to specific industrial requirements.

Market Trends:

Shift Toward Bleached Sack Kraft Paper for Premium and Branded Packaging:

A notable trend within the Global Sack Kraft Paper Market is the increasing use of bleached sack kraft paper for high-end and branded packaging applications. Businesses in the food, cosmetics, and personal care sectors are adopting bleached variants for their clean, white appearance and superior printability. These products allow for sharp logos, detailed graphics, and a premium look that aligns with consumer preferences for quality presentation. Unlike natural brown kraft, bleached paper enhances shelf visibility and marketing potential. Companies focused on aesthetics and consumer engagement are driving demand for customized sack kraft formats in bleached form. It is pushing producers to expand their product portfolios and offer tailored grades for both visual and functional performance.

- For instance, Mondi Group offers Ad/Vantage Speed White, a high-porosity, semi-extensible bleached sack kraft paper grade that delivers outstanding printability and is widely adopted by food, cosmetics, and retail brands for premium packaging.

Rising Preference for Lightweight and High-Strength Paper Grades:

The industry is witnessing a clear shift toward lightweight sack kraft papers that deliver high performance while reducing overall material usage. Customers are demanding paper grades that help lower shipping costs and environmental footprint without compromising strength and durability. Manufacturers are developing thinner yet stronger sack kraft papers by improving fiber processing and layering techniques. This trend aligns with cost-optimization goals across packaging-intensive sectors, especially in bulk commodity transport. The Global Sack Kraft Paper Market is responding with innovations that meet both sustainability and economic efficiency targets. It encourages continuous product development focused on maximizing strength-to-weight ratios.

- For instance, Eurosac reports that the strength of sack kraft paper has been optimized by 45% over the past two decades, allowing for substantial reductions in material use without sacrificing product protection.

Growth of Custom-Engineered Sack Designs and Multi-Ply Constructions:

A growing trend is the demand for engineered sack designs that address specific use-case requirements across different industries. Companies are moving away from standard sack formats toward customized solutions with features like anti-slip coatings, barrier liners, and vented designs for quick filling. Multi-ply constructions are gaining traction where moisture resistance, puncture protection, and print layering are needed simultaneously. This customization enhances product safety during handling, storage, and transport while offering improved visual appeal. The Global Sack Kraft Paper Market is benefiting from this shift by offering greater value through tailored sack configurations. It reflects a market-wide push toward precision in packaging design to support operational efficiency and brand identity.

Expansion of Hybrid Packaging Solutions Combining Paper with Other Materials:

Hybrid packaging—where sack kraft paper is combined with bio-polymers, aluminum layers, or water-resistant coatings—is becoming increasingly relevant in applications requiring enhanced barrier properties. These solutions address the limitations of conventional paper in handling liquids, oils, or fine powders. Manufacturers are investing in technologies that bond kraft paper with complementary materials while preserving recyclability. The Global Sack Kraft Paper Market is seeing a rise in these multi-material innovations to meet the packaging needs of sensitive or high-risk goods. It offers packaging flexibility while extending kraft paper’s functional reach into new industries and product categories.

Market Challenges Analysis:

Volatility in Raw Material Prices and Supply Chain Disruptions:

Fluctuating prices of wood pulp, the primary raw material used in sack kraft paper production, continue to challenge market stability and profit margins. Pulp prices are influenced by global demand-supply imbalances, energy costs, and forestry regulations, making long-term cost forecasting difficult for manufacturers. Disruptions in the global supply chain—due to geopolitical conflicts, labor shortages, or port congestion—further compound sourcing difficulties. The Global Sack Kraft Paper Market is particularly sensitive to these fluctuations given its reliance on continuous and cost-effective raw material availability. Producers often face pressure to absorb rising input costs or pass them onto customers, which can affect competitiveness. It creates an unpredictable cost environment that complicates pricing strategies and investment planning.

Competition from Plastic and Alternative Sustainable Materials:

Despite regulatory shifts favoring sustainable packaging, sack kraft paper continues to face stiff competition from advanced plastic films and emerging bio-based materials. High-performance plastics often offer superior moisture resistance, lighter weight, and cost efficiency, especially for specific industrial applications. In parallel, innovations in biodegradable plastics and molded fiber products are giving buyers more environmentally friendly alternatives beyond paper. The Global Sack Kraft Paper Market must continually innovate to stay relevant in sectors where functionality is critical. Limitations in water resistance, barrier protection, and durability under certain conditions can restrict adoption in high-risk packaging segments. It forces manufacturers to invest in coatings and treatments, which can increase production complexity and cost.

Market Opportunities:

Expansion into Emerging Markets with Growing Infrastructure and Industrialization:

Rising infrastructure development and industrialization in regions such as Asia-Pacific, Latin America, and Africa present strong growth potential. Countries like India, Vietnam, and Brazil are experiencing increased demand for cement, fertilizers, and packaged agricultural inputs, all of which rely on heavy-duty sack packaging. The Global Sack Kraft Paper Market can leverage this trend by aligning supply chains and distribution networks with regional construction and agriculture booms. Expanding into these geographies offers access to high-volume, cost-sensitive markets eager for sustainable packaging alternatives. Governments in these regions are also encouraging eco-friendly materials, creating favorable policy conditions. It positions sack kraft paper as a viable substitute to plastic in new growth corridors.

Product Development for Niche and High-Performance Applications:

The market offers opportunities in developing specialized sack kraft paper grades tailored for food, pharma, and chemical applications. These industries demand high barrier properties, precise printability, and compliance with hygiene standards. Innovations such as coated papers, moisture-resistant variants, and anti-slip finishes can expand usage in sensitive or regulated sectors. The Global Sack Kraft Paper Market can capture value by catering to these evolving functional requirements. It supports premium product positioning and margin improvement. Custom-engineered solutions provide manufacturers with competitive differentiation in an increasingly crowded packaging landscape.

Market Segmentation Analysis:

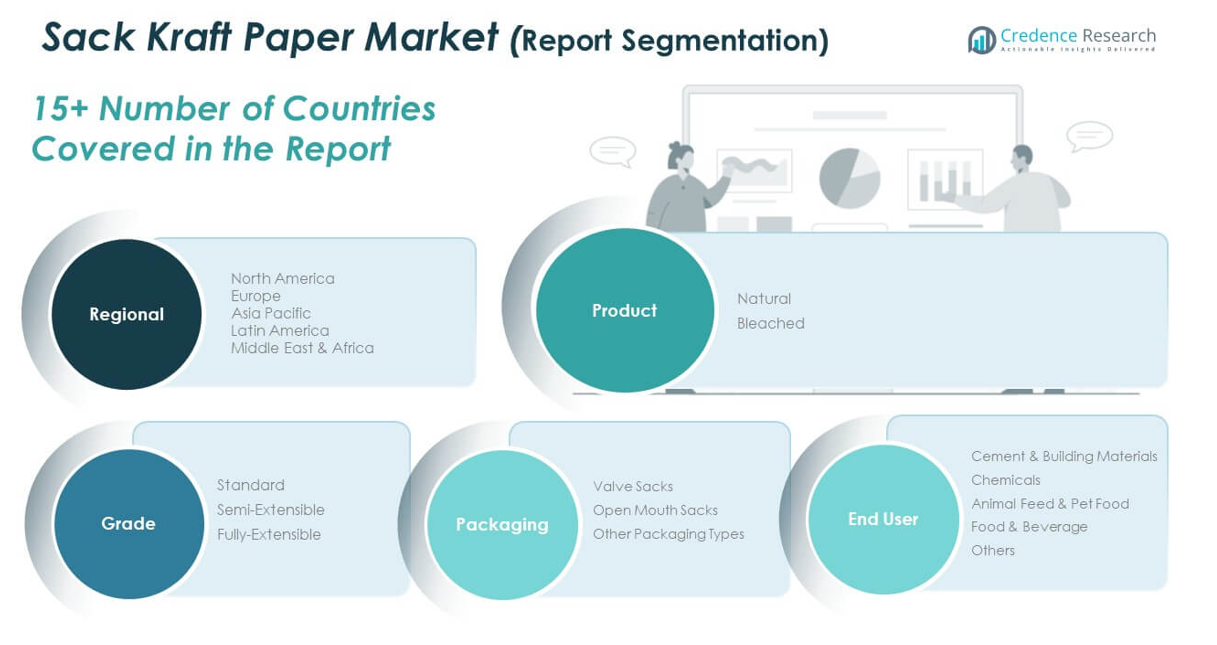

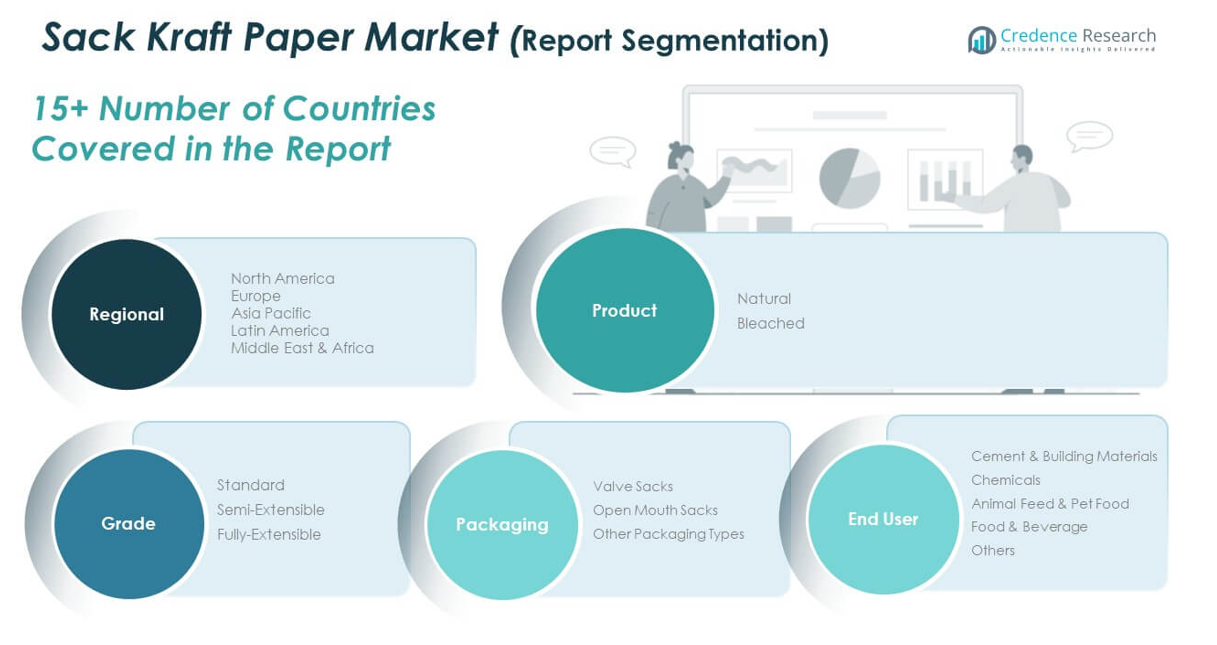

By Product

The market is divided into natural and bleached sack kraft paper. Natural sack kraft paper holds a larger share due to its cost-effectiveness and widespread use in industrial packaging, particularly in the cement and agriculture sectors. Bleached sack kraft paper, known for its superior aesthetics and printability, is gaining traction in food, cosmetics, and retail applications where branding and appearance matter.

- For instance, Mondi Group supplies both types, with natural sack kraft paper widely used in industrial packaging for cement and agriculture due to its high tear resistance and cost efficiency, while bleached sack kraft paper is increasingly specified for food, cosmetics, and retail applications requiring superior printability and aesthetics.

By Grade

Standard grade dominates the Global Sack Kraft Paper Market, offering a balanced combination of strength and affordability. Semi-extensible and fully-extensible grades are witnessing rising demand, especially in high-load and high-stress applications. Their enhanced stretchability and burst resistance make them suitable for automated filling and heavy-duty transport packaging.

- For instance, BillerudKorsnäs delivers sack paper grades with very high balanced TEA index, enabling significant material reduction while maintaining required sack strength for 25 kg goods.

By Packaging

Valve sacks account for the largest market share due to their compatibility with high-speed filling lines and suitability for powdered materials like cement, chemicals, and fertilizers. Open mouth sacks are preferred for products that require manual or semi-automatic filling. Other packaging types, including pasted or sewn sacks, serve specialized industrial needs.

By End User Industry

Cement and building materials represent the leading end-use segment, driven by infrastructure development. The chemicals sector relies on sack kraft paper for secure packaging of dry and granular substances. Animal feed and pet food use the material for its strength and breathability, while the food and beverage industry increasingly adopts it for sustainability and regulatory compliance. Other users include agriculture and retail sectors seeking eco-friendly packaging options.

Segmentation:

By Product

By Grade

- Standard

- Semi-Extensible

- Fully-Extensible

By Packaging

- Valve Sacks

- Open Mouth Sacks

- Other Packaging Types

By End User Industry

- Cement & Building Materials

- Chemicals

- Animal Feed & Pet Food

- Food & Beverage

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Sack Kraft Paper Market size was valued at USD 1,772.27 million in 2018, reached USD 2,096.72 million in 2024, and is projected to reach USD 2,696.57 million by 2032, growing at a CAGR of 3.2% during the forecast period. North America holds a notable share in the Global Sack Kraft Paper Market, supported by mature industrial infrastructure and widespread sustainable packaging practices. Strong demand from construction, chemicals, and animal feed sectors continues to drive consumption. Growth in e-commerce and food delivery is expanding the use of sack kraft paper in secondary and primary packaging. Regulatory support for plastic alternatives in the U.S. and Canada is accelerating eco-friendly adoption. The region shows a preference for high-strength and coated kraft grades. It is expected to maintain stable growth with increasing emphasis on performance-driven, certified solutions.

Europe

The Europe Sack Kraft Paper Market size was USD 2,262.27 million in 2018, reached USD 2,617.41 million in 2024, and is forecasted to hit USD 3,263.63 million by 2032, at a CAGR of 2.8%. Europe holds the second-largest share in the Global Sack Kraft Paper Market and leads in sustainability adoption. Stringent regulations on single-use plastics and a well-established recycling infrastructure continue to support paper-based packaging. High demand from cement, food processing, and animal feed sectors sustains market stability. Germany, France, and the UK remain the key contributors, backed by innovation and green policy enforcement. Consumers and businesses emphasize eco-certification and product traceability. It benefits from consistent industrial demand and export-oriented production.

Asia Pacific

The Asia Pacific Sack Kraft Paper Market was valued at USD 3,234.33 million in 2018, rose to USD 3,907.84 million in 2024, and is expected to reach USD 5,167.41 million by 2032, at a CAGR of 3.6%. Asia Pacific dominates the Global Sack Kraft Paper Market in both revenue and growth rate. Rapid industrialization, urban development, and infrastructure projects across China, India, and Southeast Asia drive demand. The region benefits from large-scale usage in construction, agriculture, and consumer goods packaging. Cost-sensitive buyers prefer high-strength, affordable sack paper formats. Manufacturers are expanding capacity and offering localized grades to meet specific application needs. It remains a prime region for investment and expansion due to its scale and policy shift toward sustainable materials.

Latin America

The Latin America Sack Kraft Paper Market was valued at USD 362.21 million in 2018, grew to USD 430.64 million in 2024, and is projected to reach USD 557.54 million by 2032, at a CAGR of 3.3%. Latin America is a developing market driven by agriculture, mining, and infrastructure growth. Brazil and Argentina lead demand for sack kraft paper used in fertilizers, food products, and animal feed. Shifting from plastic to biodegradable packaging is gaining momentum through policy reforms. Manufacturers are adopting higher-grade paper formats like semi- and fully-extensible sacks for durability. The region presents strong growth potential supported by a growing population and export-based agricultural sector. It continues to attract interest for localized production and sustainable packaging development.

Middle East

The Middle East Sack Kraft Paper Market size was USD 961.49 million in 2018, increased to USD 1,183.44 million in 2024, and is expected to reach USD 1,601.90 million by 2032, growing at a CAGR of 3.9%. The region is emerging as a high-growth contributor to the Global Sack Kraft Paper Market. Demand is driven by major infrastructure and construction activities, particularly in GCC countries. The rise in agricultural production and food security initiatives is boosting the need for eco-friendly sacks. Chemical and industrial sectors are increasingly turning to sack kraft paper for its strength and sustainability. Urbanization and regulatory support for alternatives to plastic packaging are strengthening market adoption. It is becoming a key region for packaging manufacturers seeking volume growth in industrial and commercial sectors.

Africa

The Africa Sack Kraft Paper Market was valued at USD 220.32 million in 2018, grew to USD 252.78 million in 2024, and is projected to reach USD 311.40 million by 2032, at a CAGR of 2.7%. Africa currently holds a smaller share of the Global Sack Kraft Paper Market but shows long-term growth prospects. Infrastructure development and economic growth in countries like South Africa, Egypt, and Nigeria support steady demand. Cement and agricultural packaging are primary end uses, requiring durable and cost-effective sack materials. Recycling and production infrastructure are still developing, limiting regional capacity. Local firms are beginning to explore kraft paper for export packaging and industrial applications. It offers future opportunities for manufacturers aligned with environmental policies and sustainable packaging demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BillerudKorsnas AB

- DS Smith

- Gascogne Group

- Horizon Pulp & Paper Ltd.

- International Paper Company

- KapStone Paper and Packaging Corporation (WestRock)

- Mondi PLC

- Natron-Hayat d.o.o

- Nordic Paper AS

- Segezha Group

Competitive Analysis:

The Global Sack Kraft Paper Market is highly competitive, with key players focusing on product innovation, capacity expansion, and sustainable practices to strengthen market presence. Leading companies such as DS Smith, BillerudKorsnas AB, Mondi PLC, and Segezha Group dominate through integrated supply chains and diversified product portfolios. It is characterized by strategic mergers, acquisitions, and collaborations aimed at geographic expansion and technological advancement. Manufacturers are investing in lightweight, high-strength grades and moisture-resistant coatings to meet evolving customer demands. The market sees rising competition from regional producers offering cost-effective alternatives. Global players are emphasizing circular economy principles and eco-certifications to align with regulatory expectations and consumer preferences. It continues to evolve as companies differentiate through performance, sustainability, and customization, particularly in high-growth regions such as Asia-Pacific and Latin America. Competitive intensity remains strong, with innovation and operational efficiency playing a critical role in maintaining market leadership.

Recent Developments:

- In June 2025, Billerud also highlighted its advancements in lightweight dairy packaging, achieving weight reductions of 13% for a 4-pack and 17% for a multipack solution, demonstrating a commitment to combining strength, sustainability, and material efficiency in fiber-based packaging.

- In March 2025, BillerudKorsnäs ABlaunched ConFlex® HeatSeal, a recyclable, heat-sealable paper packaging material designed to replace plastic-based flexible packaging. This innovation supports the global shift toward sustainable packaging and provides a solution that meets recyclability standards while maintaining strong seal integrity for various sack and bag applications.

- In February 2025, International Paper Companycompleted the acquisition of DS Smith, creating a new global leader in sustainable packaging solutions. The combined company now operates in over 30 countries across North America and EMEA, offering an expanded portfolio and enhanced innovation capabilities for sack kraft and containerboard products.

- In November 2024, Gascogne Groupannounced a capital increase of €20.937 million to support the acquisition of a new paper machine at its Mimizan site. This investment is intended to optimize production and energy efficiency, directly enhancing the group’s capacity to supply high-performance sack kraft paper for industrial and consumer packaging applications.

Market Concentration & Characteristics:

The Global Sack Kraft Paper Market exhibits moderate to high market concentration, with a few large players controlling a significant share of global production and distribution. It features vertically integrated operations, strong supply chain networks, and long-term partnerships with end-use industries. The market is characterized by standardized product types, regional customization, and growing demand for high-performance and sustainable paper grades. Barriers to entry remain moderate due to capital investment requirements, environmental compliance, and raw material sourcing challenges. It is shaped by stability in demand from sectors like cement, chemicals, and agriculture, along with innovation in packaging formats. Competitive dynamics are influenced by pricing, product quality, and the ability to meet eco-certification standards.

Report Coverage:

The research report offers an in-depth analysis based on by product, grade, packaging type, and end-user industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Sack Kraft Paper Market is expected to grow steadily, driven by demand for sustainable and recyclable packaging across industrial sectors.

- Rising infrastructure and construction activity worldwide will continue to support strong consumption of valve sacks in cement and building material applications.

- E-commerce and food delivery growth will create new opportunities for bleached sack kraft paper in retail-ready and branded packaging.

- Product innovations, including moisture-resistant coatings and lightweight high-strength grades, will expand application scope.

- Manufacturers will increasingly adopt automation and digital printing technologies to enhance efficiency and customization.

- Asia-Pacific will remain the fastest-growing region due to rapid industrialization and expanding urban population.

- Strict environmental regulations and plastic bans in developed and developing regions will accelerate paper-based packaging substitution.

- Strategic investments in regional production facilities will strengthen supply chain resilience and reduce dependency on imports.

- Consumer and brand preferences for eco-certified and traceable packaging materials will shape future product development.

- Competitive intensity will rise as both global and regional players focus on cost-effective, value-added sack kraft solutions.