Market Overview:

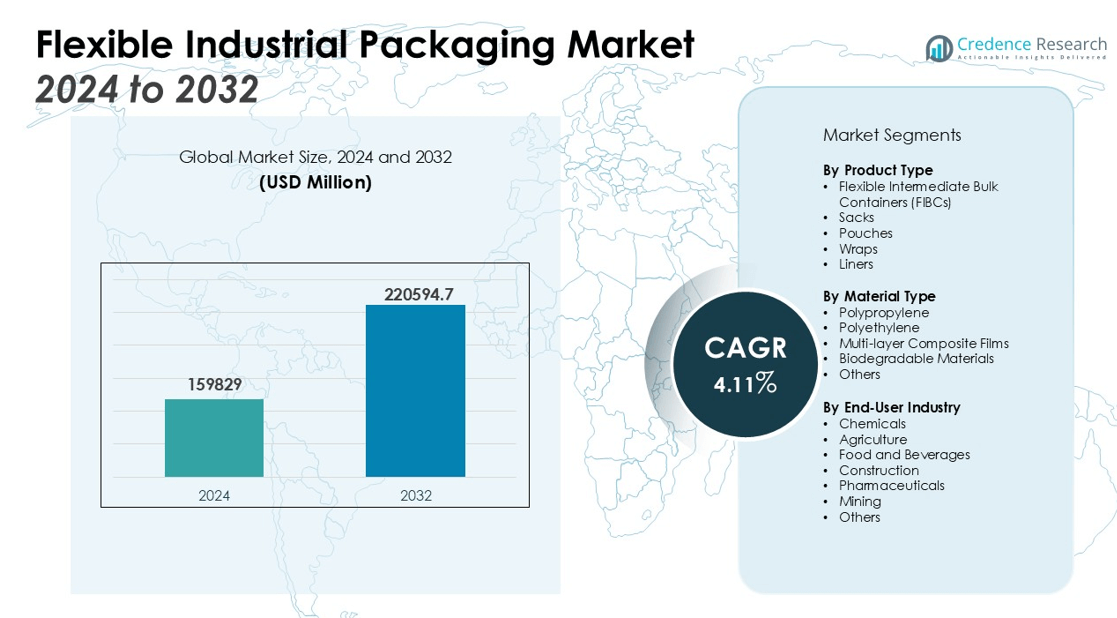

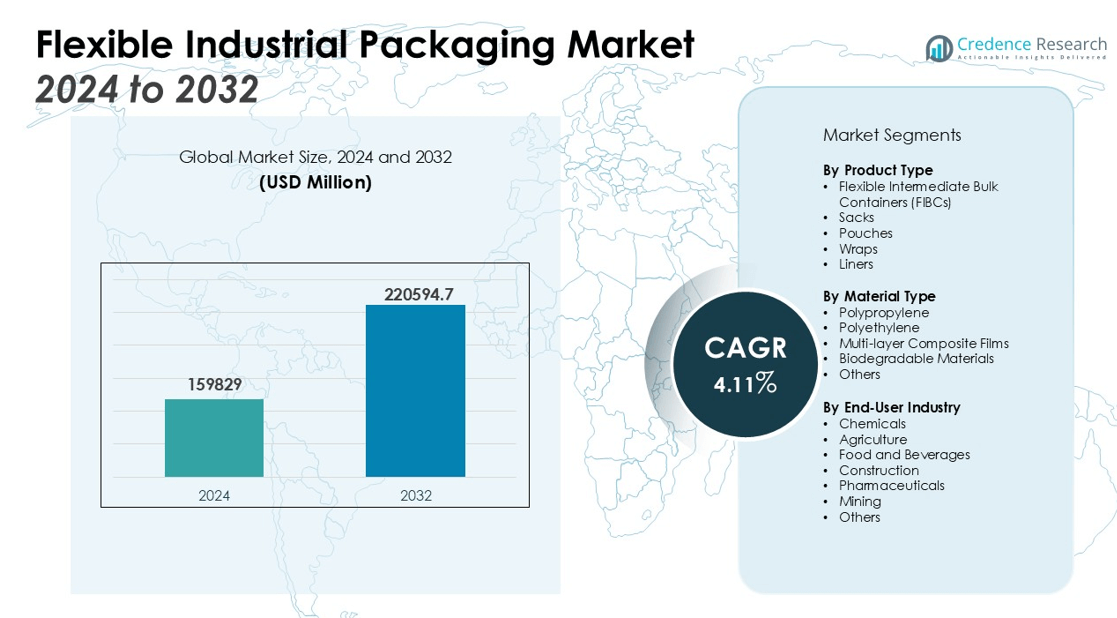

The Flexible Industrial Packaging Market size was valued at USD 159829 million in 2024 and is anticipated to reach USD 220594.7 million by 2032, at a CAGR of 4.11% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flexible Industrial Packaging Market Size 2024 |

USD 159829 million |

| Flexible Industrial Packaging Market, CAGR |

4.11% |

| Flexible Industrial Packaging Market Size 2032 |

USD 220594.7 million |

Key drivers fueling market growth include rising industrialization, expanding chemical and pharmaceutical sectors, and the growing emphasis on sustainability. Flexible industrial packaging offers enhanced product safety, easy handling, and space efficiency, making it suitable for transporting chemicals, minerals, food ingredients, and construction materials. Technological advancements in material science have led to improved barrier properties, reusability, and recyclability, further supporting adoption in various end-use industries. The increasing demand for customized and value-added packaging solutions is also accelerating market expansion.

Regionally, Asia Pacific holds the largest share of the Flexible Industrial Packaging Market, propelled by rapid manufacturing growth and strong infrastructure investments in China, India, and Southeast Asia. North America and Europe follow, supported by advanced industrial bases and stringent regulatory frameworks promoting sustainable and efficient packaging solutions. Major industry players are expanding their presence in emerging markets to capitalize on new growth opportunities.

Market Insights:

- The Flexible Industrial Packaging Market was valued at USD 159,829 million in 2024 and is projected to reach USD 220,594.7 million by 2032, exhibiting a CAGR of 4.11% during the forecast period.

- Rapid industrialization, robust expansion in chemical and pharmaceutical sectors, and strong emphasis on sustainability are key drivers fueling market growth.

- Flexible industrial packaging delivers superior product safety, efficient handling, and space-saving benefits, supporting use in chemicals, minerals, food ingredients, and construction materials.

- Advanced material science has enabled improved barrier properties, reusability, and recyclability, expanding adoption across a range of end-use industries.

- Market challenges include fluctuating raw material prices, supply chain disruptions, and complex regulatory requirements, impacting profit margins and operational planning.

- Asia Pacific held 44% of the market share in 2024, led by industrial growth and infrastructure investment, while North America and Europe accounted for 26% and 19%, respectively.

- Major players are increasing investments in emerging markets and leveraging technological advancements to offer customized, value-added packaging solutions and maintain a competitive edge.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Industrialization and Expansion of Manufacturing Sectors Across Developing Economies

The Flexible Industrial Packaging Market is experiencing robust growth due to increased industrial activity in emerging economies. Countries such as China, India, Brazil, and Vietnam are witnessing rapid expansion in manufacturing, chemicals, construction, and agricultural sectors. These industries require efficient, durable, and lightweight packaging to store and transport large volumes of goods. Flexible packaging formats—such as FIBCs (Flexible Intermediate Bulk Containers), sacks, and pouches—are meeting these needs due to their adaptability and cost-effectiveness. Industrial producers are shifting preferences from rigid to flexible packaging solutions for easier handling and reduced logistics costs. The market is benefiting from investments in automation and infrastructure that support high-volume production and fast distribution cycles.

- For instance, SINOPACK INDUSTRIES LTD. in China operates two FIBC manufacturing plants in Lianyungang city with an annual capacity of 1.5 million big bags, serving a wide range of global industries.

Growing Focus on Product Safety and Regulatory Compliance Across End-Use Industries

Stringent regulations around safety, hygiene, and contamination control are prompting manufacturers to adopt advanced flexible packaging materials. The Flexible Industrial Packaging Market meets strict standards for transporting hazardous chemicals, food ingredients, and pharmaceuticals, where product integrity is critical. High-performance barrier films and multi-layer laminates protect contents from moisture, oxygen, and external contaminants. Companies are seeking packaging solutions that comply with international transportation and safety guidelines, enhancing the market’s reliability and appeal. End users value tamper-evident, leak-proof, and traceable packaging to safeguard supply chains. This growing focus on compliance is driving the adoption of innovative and compliant packaging formats.

Emphasis on Sustainability and Environmental Responsibility in Industrial Packaging

Sustainability has emerged as a major driver influencing procurement decisions in the Flexible Industrial Packaging Market. Companies are looking for packaging solutions that reduce carbon footprint, utilize recycled materials, and support circular economy initiatives. Flexible packaging uses less raw material and energy than rigid alternatives, lowering overall environmental impact. Manufacturers are innovating with bio-based, recyclable, and reusable materials to align with green regulations and customer preferences. Eco-labeling and certifications provide additional incentives for industrial customers to adopt sustainable packaging. This industry-wide emphasis on sustainability is catalyzing research and development in advanced materials and eco-friendly design.

- For instance, Crown Holdings’ Transit Packaging Division has incorporated high levels of recycled content in its manufacturing, having added almost 18 billion cans of capacity and opened 5 new plants since 2019 to meet rising demand for recyclable options.

Advancements in Packaging Technology Enhancing Efficiency and Customization

Recent advances in material science and packaging technology are transforming the capabilities of flexible industrial packaging. Innovations such as anti-static coatings, UV protection, and improved load-bearing strength expand its applicability across sectors. Digital printing and smart packaging features offer enhanced branding, traceability, and real-time monitoring. It enables tailored solutions to meet specific requirements, from chemical resistance to stackability for bulk handling. Industrial buyers are adopting flexible packaging that can integrate smart sensors for inventory and quality control. The trend toward customization and value-added features is fueling continuous product development, keeping the market highly competitive and innovation-driven.

Market Trends:

Surge in Demand for Sustainable and Eco-Friendly Flexible Packaging Solutions

The Flexible Industrial Packaging Market is experiencing a pronounced shift toward sustainable and eco-friendly materials. Manufacturers are introducing recyclable, biodegradable, and compostable packaging options to meet the evolving expectations of regulatory bodies and environmentally conscious clients. The adoption of bio-based polymers and recycled content has expanded, with industrial users seeking to lower environmental footprints and comply with green supply chain mandates. Companies are pursuing circular economy initiatives, using packaging designed for reuse and easy material recovery. The rise of eco-labeling and sustainability certifications has influenced purchasing decisions among key industrial buyers. It is driving innovation in material science, leading to advanced products with lower carbon footprints and improved end-of-life management.

- For instance, Taghleef Industries’ NATIVIA® films are certified to fully biodegrade within six months under industrial composting conditions according to the EN 13432 standard, providing a practical end-of-life solution for flexible packaging.

Adoption of Advanced Functionalities and Smart Packaging Technologies

There is a growing emphasis on advanced functionalities within the Flexible Industrial Packaging Market, driven by technological advancements and changing customer needs. High-barrier films, anti-static properties, and UV protection have become standard in many applications, enhancing product safety and shelf life. Smart packaging technologies, including integrated sensors and digital tracking features, are enabling real-time monitoring, improved traceability, and greater supply chain transparency. Customization and value-added solutions, such as branded printing and tamper-evident closures, are gaining prominence among industrial end users. It enables businesses to address product-specific requirements and enhance operational efficiency. The integration of technology and functional enhancements continues to redefine competitive dynamics in the flexible industrial packaging sector.

- For instance, Uflex’s Asepto division produces over 10 billion uniquely printed aseptic liquid packaging packs every year, providing advanced anti-counterfeit features for beverage and dairy brands worldwide.

Market Challenges Analysis:

Fluctuating Raw Material Prices and Supply Chain Volatility Impacting Profit Margins

The Flexible Industrial Packaging Market faces significant challenges from fluctuating raw material prices and ongoing supply chain disruptions. Volatility in the cost of polymers, resins, and specialty films can erode manufacturer profit margins and complicate long-term planning. Supply chain delays caused by geopolitical tensions, logistical bottlenecks, and trade regulations disrupt production cycles and increase lead times. Companies operating in this market must implement risk mitigation strategies to manage unpredictable input costs. It creates a challenging environment for stable pricing and reliable delivery commitments. Rapidly changing market dynamics often force industry players to reassess procurement and inventory management practices.

Complex Regulatory Requirements and Recycling Infrastructure Limitations

Complex and evolving regulations around packaging waste, recycling, and product safety create operational hurdles for the Flexible Industrial Packaging Market. Compliance with diverse global and regional standards requires continuous monitoring and adaptation. Limited recycling infrastructure in certain regions restricts the adoption of eco-friendly flexible packaging, especially in developing economies. It poses barriers for manufacturers aiming to meet customer demands for sustainability. Strict regulations on hazardous material transport and food safety further increase the compliance burden on producers. Companies must invest in compliance systems and adapt quickly to avoid penalties and maintain market access.

Market Opportunities:

Expansion into Emerging Markets and Untapped Industrial Sectors

The Flexible Industrial Packaging Market presents substantial opportunities through expansion into emerging economies and untapped industrial sectors. Rapid urbanization and infrastructure development in Asia Pacific, Latin America, and Africa are fueling demand for efficient packaging solutions across construction, chemicals, and agriculture. Companies can leverage rising investments in manufacturing to establish local production and distribution capabilities. It enables manufacturers to respond quickly to evolving customer needs and regulatory requirements. Growth in new industrial verticals, such as renewable energy and specialty chemicals, opens additional avenues for tailored packaging solutions. Strategic collaborations with regional players can enhance market penetration and brand visibility.

Innovation in Smart Packaging and Sustainable Materials

Opportunities are emerging from the growing demand for smart packaging technologies and sustainable materials in the Flexible Industrial Packaging Market. Manufacturers are developing advanced packaging that incorporates real-time monitoring, traceability, and anti-counterfeit features to enhance product safety and supply chain transparency. Investment in bio-based polymers, recyclable films, and reusable solutions aligns with global sustainability goals. It supports brand differentiation and addresses stringent environmental standards. Companies adopting digital printing and customized packaging designs can capture niche industrial applications. A focus on innovation and value-added services positions industry leaders to capitalize on evolving customer expectations and regulatory shifts.

Market Segmentation Analysis:

By Product Type

The Flexible Industrial Packaging Market features a diverse range of products, including Flexible Intermediate Bulk Containers (FIBCs), sacks, pouches, and wraps. FIBCs dominate due to their high load-bearing capacity, durability, and efficiency in handling bulk goods. Sacks and pouches offer versatility for packaging powders, granules, and food ingredients. Wraps are used for securing and protecting palletized goods during storage and transportation. The adoption of value-added features such as tamper-evident seals and anti-static coatings enhances functionality across these product types. Product innovation remains central as manufacturers introduce solutions tailored to specific industrial applications.

- For instance, Romaco’s Pouch Packing Solutions achieve production speeds of over 600 pouches per minute while maintaining airtight sealing, enhancing both efficiency and product protection in high-volume food and pharmaceutical applications.

By Material Type

The Flexible Industrial Packaging Market relies on a variety of materials, including polyethylene, polypropylene, and multi-layer composite films. Polypropylene leads market share due to its strength, lightweight nature, and chemical resistance. Polyethylene is widely used for its flexibility and cost-effectiveness, especially in sacks and pouches. Multi-layer composites deliver enhanced barrier properties for sensitive goods. The industry is witnessing a shift toward recyclable and bio-based materials, supporting sustainability goals. Material selection is often determined by end-use requirements such as load capacity, moisture resistance, and regulatory compliance.

- For instance, Dallas Plastics manufactures multi-layer co-extruded films, offering structures with up to 9 layers, which provide extended shelf life for perishable products by outperforming mono-layer alternatives in moisture and oxygen barrier performance.

By End-User Industry

The Flexible Industrial Packaging Market serves a broad spectrum of end-user industries, with chemicals, agriculture, food and beverages, construction, and pharmaceuticals representing major segments. The chemical industry demands robust, leak-proof packaging for hazardous materials. Agriculture utilizes bulk bags and sacks for grains, seeds, and fertilizers. Food and beverage companies prefer pouches and multi-layer films for hygiene and shelf-life extension. Construction and pharmaceuticals benefit from specialized packaging that meets strict safety and compliance standards. It enables efficient handling and transportation of varied industrial products.

Segmentations:

By Product Type

- Flexible Intermediate Bulk Containers (FIBCs)

- Sacks

- Pouches

- Wraps

- Liners

By Material Type

- Polypropylene

- Polyethylene

- Multi-layer Composite Films

- Biodegradable Materials

- Others

By End-User Industry

- Chemicals

- Agriculture

- Food and Beverages

- Construction

- Pharmaceuticals

- Mining

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific Commands Largest Share Driven by Industrial Growth and Investment

The Asia Pacific region accounted for 44% of the Flexible Industrial Packaging Market in 2024, securing the largest market share due to rapid industrialization, expanding manufacturing sectors, and large-scale infrastructure projects. Countries such as China, India, and Indonesia continue to drive substantial demand through investments in construction, chemicals, and agriculture, which increases the need for flexible packaging solutions. Local manufacturers benefit from cost-effective production and access to abundant raw materials. Demand for efficient and sustainable packaging formats has prompted global players to establish manufacturing bases and partnerships within the region. It supports faster delivery times, enhanced supply chain responsiveness, and improved customer service. Regulatory emphasis on sustainability and waste reduction further accelerates innovation and adoption.

North America Maintains Strong Position with Technological Advancement and Regulatory Support

North America represented 26% of the Flexible Industrial Packaging Market in 2024, maintaining a strong position supported by its mature industrial base, high automation levels, and robust regulatory environment. The United States and Canada prioritize packaging solutions that comply with safety, traceability, and environmental standards. Investment in R&D drives the development of high-performance, recyclable, and smart packaging options tailored to diverse industrial needs. Leading companies focus on digital transformation, sustainability, and custom solutions to strengthen market position. It fosters competitive advantages in terms of product quality, efficiency, and compliance. Ongoing efforts to reduce plastic waste and increase recycling rates influence purchasing decisions and product innovation.

Europe Demonstrates Leadership in Sustainable Packaging and Industry 4.0 Integration

Europe held a 19% share of the Flexible Industrial Packaging Market in 2024, reinforcing its role as a leader in sustainable packaging adoption, driven by stringent environmental regulations and a commitment to circular economy principles. Countries such as Germany, France, and the UK drive demand for recyclable and biodegradable flexible packaging in industrial applications. Manufacturers in Europe invest in advanced materials, automation, and smart packaging technologies aligned with Industry 4.0 objectives. It enhances operational efficiency, supply chain transparency, and environmental performance. The region’s proactive stance on eco-labeling and green procurement supports the shift toward innovative, value-added packaging formats. Collaboration among industry players and policymakers accelerates the transition to a low-carbon, sustainable packaging ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Amcor Plc

- Berry Global Group, Inc.

- Mondi plc

- Constantia Flexibles

- Sealed Air Corporation

- Sonoco Products Company

- Huhtamaki Oyj

- TC Transcontinental Inc.

- UFlex Limited

- ProAmpac LLC

- CCL Industries

Competitive Analysis:

The Flexible Industrial Packaging Market remains highly competitive, with leading players such as Amcor Plc, Berry Global Group, Mondi plc, and Constantia Flexibles driving innovation and market share. These companies invest in advanced materials, automation, and sustainable solutions to meet evolving customer demands and regulatory requirements. The market features a mix of global giants and regional manufacturers, fostering a dynamic environment for product development and cost competitiveness. Key players prioritize R&D to introduce recyclable, biodegradable, and high-performance packaging formats. Strategic collaborations, mergers, and acquisitions strengthen distribution networks and expand product portfolios. It maintains intense rivalry due to increasing demand for customization, enhanced barrier properties, and eco-friendly solutions. Market leaders continually adapt to shifting trends in industrial applications, digital printing, and supply chain integration to secure long-term growth and customer loyalty.

Recent Developments:

- In June 2025, Amcor launched a new Perflex® shrink bag with a built-in handle for Butterball turkey breast, reducing packaging material and improving production efficiency.

- In February 2025, Mondi announced an extension of its partnership with the UN World Food Programme for three more years to develop sustainable packaging for humanitarian purposes.

- In May 2025, Constantia Flexibles, in partnership with Delica AG (Migros Industrie), launched EcoVerHighPlus, a recyclable-ready mono PP laminate for coffee packaging.

Market Concentration & Characteristics:

The Flexible Industrial Packaging Market demonstrates moderate to high market concentration, with a core group of multinational players controlling significant shares alongside a large number of regional and local firms. It features a mix of standardized and highly customized products, reflecting diverse industry needs across chemicals, agriculture, food, and construction. The market emphasizes product durability, regulatory compliance, and sustainability, driving investments in recyclable and advanced material solutions. Companies compete on quality, innovation, cost efficiency, and the ability to deliver tailored packaging formats. It is characterized by rapid technological advancements, strong focus on eco-friendly practices, and close alignment with evolving industrial supply chain requirements.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Material Type, End-User Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Manufacturers will invest in recyclable and bio‑based materials to meet rising sustainability mandates.

- Smart packaging solutions with embedded sensors will gain traction for real-time tracking and quality control.

- Demand for customized and value-added packaging features will intensify across end‑user industries.

- Regional expansion in emerging economies will continue, driven by growth in construction, agriculture, and chemical sectors.

- Flexible Intermediate Bulk Containers (FIBCs) will maintain dominance due to strength and bulk handling efficiency.

- Multi‑layer composite films will increase adoption for high‑barrier industrial applications.

- Partnerships and acquisitions will accelerate to improve global distribution and diversify product offerings.

- Automation and Industry 4.0 integration will improve production efficiency and support rapid customization.

- Digital printing will become standard, enabling branding, traceability, and variable data applications.

- Resilient supply chain strategies will become essential to mitigate risk from material price volatility and logistics disruption.