Market Overview:

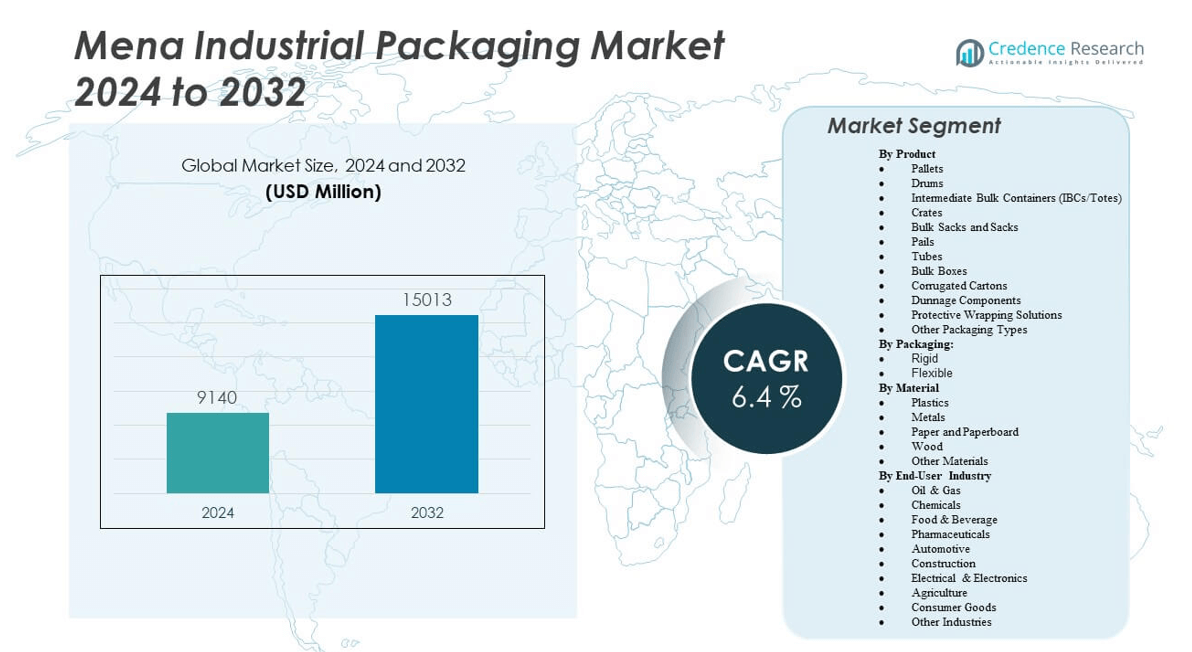

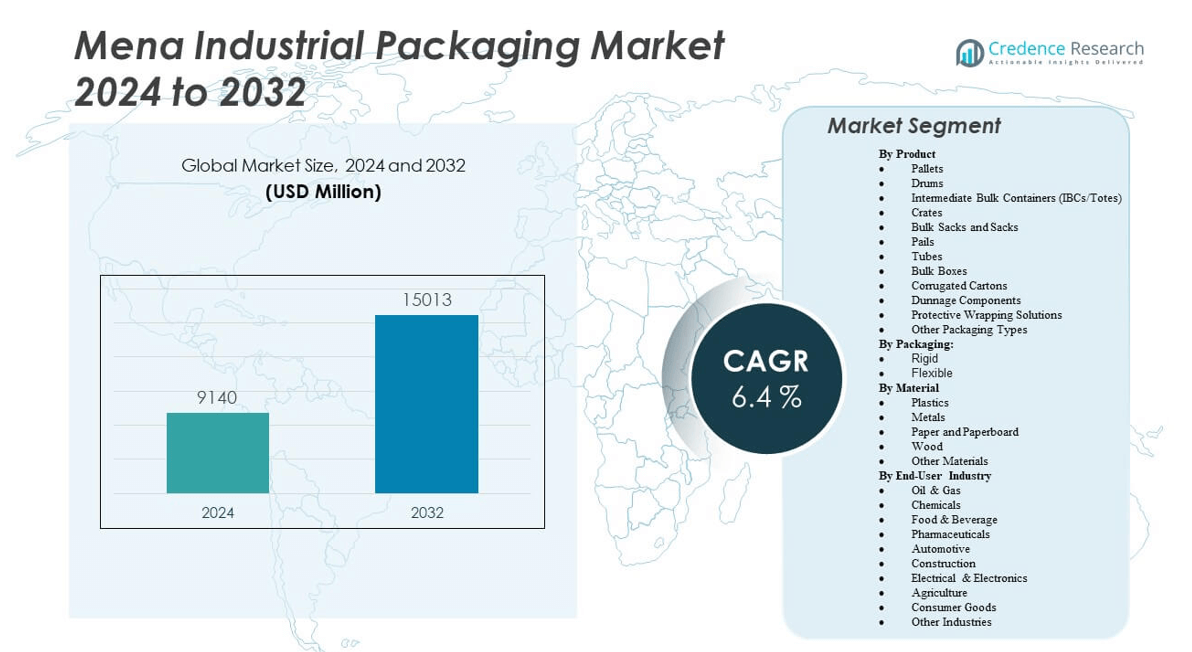

The MENA Industrial Packaging Market is projected to grow from USD 9140 million in 2024 to an estimated USD 15013 million by 2032, with a compound annual growth rate (CAGR) of 6.4 % from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| MENA Industrial Packaging Market Size 2024 |

USD 9140 million |

| MENA Industrial Packaging Market, CAGR |

6.4% |

| MENA Industrial Packaging Market Size 2032 |

USD 15013 million |

The market is gaining momentum as manufacturers and distributors respond to growing demand for efficient and sustainable packaging solutions across industrial sectors. Rising industrial output and expanding logistics networks drive investments in durable, high-performance packaging that protect goods and optimize transport efficiency. Businesses actively adopt eco‑friendly materials and innovative packaging technologies to reduce waste and meet regulatory requirements, while supply chain modernization accelerates uptake of automated container and pallet solutions to support faster, safer, and more cost‑efficient operations.

Within the MENA region, Gulf Cooperation Council countries such as the UAE and Saudi Arabia lead industrial packaging demand due to robust petrochemical, food and beverage, and manufacturing industries. Meanwhile, emerging markets like Egypt and Morocco are showing increasing adoption, supported by growing industrial investment and infrastructure development. North African nations benefit from expanding export corridors and rising domestic production, positioning them as rapidly evolving contributors in the MENA industrial packaging landscape.

Market Insights:

- The Mena Industrial Packaging Market is valued at USD 9,140 million in 2024 and expected to reach USD 15,013 million by 2032, growing at a CAGR of 6.4%.

- Strong demand from oil & gas, chemicals, and construction sectors continues to fuel growth in high-performance and compliant packaging formats.

- Rising investments in logistics infrastructure and industrial hubs across Saudi Arabia, UAE, and Egypt are expanding packaging needs.

- Regulatory pressure on safety, handling, and labeling is pushing manufacturers to adopt durable and certified packaging solutions.

- High raw material and energy costs present margin pressures for packaging producers across the region.

- The GCC dominates the market with a 48% share, followed by North Africa at 32% and the Levant at 20%, reflecting industrial activity concentration.

- Disparities in regional standards and fragmented supply chains limit scalability and increase operational complexity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Expansion of Industrial and Petrochemical Output Drives Packaging Demand

Industrial growth across the MENA region continues to expand rapidly, especially in sectors such as petrochemicals, manufacturing, and oil & gas. These industries rely heavily on durable and specialized packaging formats to ensure safety and regulatory compliance during transport and storage. The Mena Industrial Packaging Market benefits from this surge, driven by rising production volumes and export-oriented strategies. Companies seek packaging solutions that offer resistance to harsh environmental conditions and chemical exposure. Governments are investing in industrial infrastructure to diversify economies, which boosts demand for intermediate bulk containers, drums, sacks, and pallets. Large-scale projects in Saudi Arabia, the UAE, and Qatar create recurring procurement cycles for industrial packaging. Regional suppliers upgrade machinery and design to meet new client specifications. The combination of local demand and export logistics fuels steady packaging innovation and market penetration.

- For instance, Saudi Aramco’s expansion of its petrochemical operations has driven the adoption of UN-certified dangerous goods packaging and corrosion-resistant containers to ensure compliance and safety in transport and storage. As of the end of 2024, Aramco’s net chemicals production capacity including SABIC was 57.6 million metric tons per year.

Regulatory Focus on Safety and Material Handling Efficiency Supports Growth

Authorities across MENA are enforcing stricter safety norms for industrial operations, which elevates the role of compliant packaging systems. Industries are under pressure to implement standards for chemical resistance, structural integrity, and product labeling. The Mena Industrial Packaging Market gains traction from this trend, as stakeholders align packaging materials and formats with ISO and local regulatory benchmarks. It pushes manufacturers to introduce packaging that minimizes leakage, contamination, and handling risk. The logistics sector also benefits, with palletized and modular systems streamlining cargo inspection and customs clearance. Government mandates on workplace safety indirectly boost the packaging sector by encouraging bulk and secure formats. These developments increase the reliance on engineered packaging, especially for sensitive or hazardous materials. The market integrates technical design to address regulatory-driven performance requirements.

- For instance, chemical producers such as SABIC (Saudi Basic Industries Corporation) have implemented packaging systems that comply with ISO 9001 certification across their major facilities, handling over 60 million metric tons of consignments annually without reported regulatory violations related to packaging safety.

Rise in Export-Oriented Manufacturing Amplifies Packaging Needs

Countries in the MENA region aim to become global manufacturing and re-export hubs, particularly in chemicals, electronics, and processed foods. This shift drives demand for packaging formats that preserve product integrity across long distances. The Mena Industrial Packaging Market responds to this shift by offering solutions that enhance load stability and traceability. Firms invest in tamper-evident seals, RFID integration, and moisture-barrier layers to comply with destination market regulations. Export-focused industries value customizable packaging formats that fit diverse regulatory and shelf-life criteria. Packaging manufacturers work closely with exporters to optimize logistics and reduce return costs from damage or non-compliance. Trade corridors such as the Red Sea and Gulf ports increase packaging throughput across sectors. Rising trade volumes create recurring bulk orders for corrugated boxes, flexitanks, and multi-wall bags.

Sustainability and Circular Economy Targets Encourage Material Shifts

Environmental policies across the region emphasize reduced packaging waste and increased recyclability, particularly for industrial applications. Corporations respond by shifting toward mono-material packaging, biodegradable polymers, and reusable pallets. The Mena Industrial Packaging Market adopts these trends to align with national circular economy strategies. It stimulates R&D into low-impact raw materials and modular designs for reusability. Businesses factor sustainability metrics into procurement decisions, replacing mixed-material formats with recyclable options. Packaging providers differentiate their offerings through life-cycle assessments and carbon labeling. Clients seek packaging that lowers waste management costs while maintaining structural performance. Investments in recycling infrastructure enhance material recovery and looped supply chains. These factors position sustainability as a central design parameter across the market.

Market Trends

Growth in Smart Packaging Technologies Enhances Logistics Integration

Smart packaging technologies such as RFID tags, QR codes, and sensor-enabled formats are gaining ground in industrial segments. These tools allow real-time monitoring of cargo conditions, shipment traceability, and automation in warehouse operations. The Mena Industrial Packaging Market incorporates these features to improve logistics accuracy and reduce errors. Advanced tracking boosts visibility and streamlines customs processes across high-traffic ports. Companies deploy digital twins and IoT systems to manage inventory and shipping documentation via integrated platforms. Manufacturers offer packaging with embedded data capture systems for temperature, pressure, and shock. This innovation improves reliability in sensitive cargo handling, especially chemicals and pharmaceuticals. The region’s logistics modernization efforts directly support adoption of smart packaging formats. It creates a high-tech dimension to industrial packaging demand.

Customization and Branding Demand Influences Packaging Design in B2B Markets

Although industrial packaging primarily serves functional purposes, companies increasingly request customizations aligned with brand identity. High-value shipments and B2B marketing rely on recognizable, differentiated packaging. The Mena Industrial Packaging Market sees growing orders for branded crates, embossed drums, and printed corrugated boxes. Custom color coding, logos, and labeling improve traceability and support marketing for large exporters. It allows businesses to extend their identity across the supply chain. Sectors such as electronics and chemicals require batch-specific design and branding for compliance and authenticity assurance. Printing technologies such as flexography and digital printing evolve to meet industrial-grade output. Businesses consider packaging part of their brand narrative in export-focused supply chains. This trend shifts packaging procurement from utility-only to strategic branding tools.

- For example, ProAmpac’s digital printing operations in the U.S. and U.K. enable production of digitally printed prototypes tailored for industrial clients and short runs under 15,000ft, supporting rapid customization and brand differentiation on packaging.

Digital Transformation Across Supply Chains Fuels Demand for Integration-Ready Formats

Enterprises across the region digitize supply chains to achieve operational agility, requiring packaging to support automation and data workflows. The Mena Industrial Packaging Market evolves to supply integration-ready formats for robotics, conveyor systems, and smart warehouses. Standardized pallet dimensions, automated fill/stack solutions, and barcode-compatible designs simplify process integration. Industries shift toward packaging that enables hands-free loading, unloading, and scanning operations. It reduces manual errors and improves worker safety in high-volume environments. Packaging suppliers partner with automation firms to co-develop optimized solutions for repetitive tasks. Integration-ready formats lower downtime and align with lean manufacturing principles. Digitization reshapes industrial packaging into a functional component of the broader smart factory ecosystem.

- For instance, PGP International’s California plant integrated automated packaging lines featuring high-speed filling, ultrasonic sealing, and automated palletizing—eliminating manual intervention in filling, capping, and labeling, which increased packaging throughput and improved power efficiency

E-commerce B2B Channels Influence Bulk Packaging Innovation

Online procurement platforms for industrial supplies continue to grow across MENA, changing how businesses source and use packaging. This shift requires packaging that suits digital cataloging, fast delivery, and damage prevention during courier shipping. The Mena Industrial Packaging Market adapts by offering modular, collapsible, and lightweight bulk packaging for e-commerce-driven logistics. It also emphasizes reusability and compact storage to meet new shipping requirements. Packaging must accommodate rapid dispatch from fulfillment centers while retaining strength during transit. Vendors develop web-optimized packaging SKUs for digital buyers in the industrial space. Marketplaces and distributors offer bundled packaging options with clear specifications for digital procurement. E-commerce reshapes industrial packaging toward more adaptable, B2B-ready formats.

Market Challenges Analysis

Lack of Standardization and Fragmented Supply Chains Limit Scalability

Industrial packaging providers in the MENA region face significant challenges due to the lack of harmonized standards across countries. Packaging dimensions, labeling protocols, and compliance requirements vary widely between GCC, Levant, and North African markets. The Mena Industrial Packaging Market struggles to scale solutions regionally because clients demand localized specifications. This fragmentation increases lead times and complicates logistics coordination. Smaller suppliers find it difficult to upgrade infrastructure or meet specialized requests without standard references. The absence of centralized regulatory alignment also affects product certifications and cross-border operations. It creates friction between packaging design and market accessibility. The lack of consistency undermines operational efficiency and introduces high variability in manufacturing workflows.

High Raw Material and Energy Costs Pressure Profit Margins

Industrial packaging production relies heavily on raw materials like plastic resins, kraft paper, and steel components, which remain vulnerable to price volatility. The Mena Industrial Packaging Market faces cost pressures from rising global commodity prices and energy inputs. Manufacturers must absorb or pass on costs to clients, creating instability in long-term contracts. Local sourcing remains limited, pushing dependency on imports that add freight and customs costs. Energy-intensive production processes further escalate expenses, especially for molded containers and metal drums. These fluctuations strain profitability, particularly for SMEs with limited pricing power. Cost-sensitive sectors delay procurement or downsize orders during inflationary periods. Market competitiveness narrows as firms struggle to balance pricing, quality, and material availability.

Market Opportunities

Investments in Economic Zones and Manufacturing Hubs Unlock New Demand

Governments across the MENA region are aggressively expanding industrial zones and free trade areas to attract global manufacturers. These zones offer packaging firms a steady customer base with large-scale, export-focused requirements. The Mena Industrial Packaging Market stands to benefit by aligning production with these growing clusters. Packaging companies can co-locate near industrial clients, reducing lead times and improving service responsiveness. Infrastructure development in logistics corridors enhances last-mile packaging delivery. Economic incentives and duty exemptions within these zones lower operating costs for packaging suppliers. Large multinationals entering these hubs seek reliable, localized packaging partners. This creates long-term supply contracts and joint innovation opportunities for packaging design and sustainability.

Sustainability Certifications and Green Packaging Standards Create Competitive Differentiation

With regional and global companies pursuing ESG goals, there is a rising demand for packaging suppliers that offer sustainable, verifiable solutions. The Mena Industrial Packaging Market sees opportunity in developing products that meet ISO 14001, FSC, or cradle-to-cradle certification standards. Firms can capture niche markets by supplying bio-based, compostable, or recyclable industrial packaging formats. Industrial clients prefer packaging that supports circular economy initiatives without sacrificing functionality. Achieving green certification opens doors to international contracts where compliance is mandatory. This positioning allows packaging firms to charge premium rates while reducing customer risk exposure. It also facilitates entry into export-sensitive sectors such as pharmaceuticals and electronics. The shift toward sustainability redefines competitive advantage in industrial packaging.

Market Segmentation Analysis:

By product type, the Mena Industrial Packaging Market comprises a wide array of product types tailored to industrial handling and transport requirements. Pallets, drums, and intermediate bulk containers (IBCs) lead in volume due to their application in oil, gas, and chemical sectors. Crates, bulk sacks, and corrugated cartons are widely used in agriculture, food, and construction industries. Pails, tubes, and protective wrapping solutions serve niche applications requiring secure, small-batch containment. Dunnage components and bulk boxes support logistics efficiency for large-scale shipments. It continues to evolve as product complexity and regulatory needs increase.

- For example, Almarai MENA’s leading dairy producer uses corrugated cartons and bulk boxes for automated handling and export of over 2 billion packaged units per yearin the food sector. These examples reflect tailored product adoption across key industries.

By packaging format, rigid packaging dominates due to its strength and durability, supporting heavy and hazardous goods. Flexible packaging is gaining traction in sectors requiring space-saving, lightweight, and moisture-resistant solutions. It offers cost advantages and enhances operational agility across multiple industries.

By Material-wise, plastics hold the largest share in the Mena Industrial Packaging Market due to versatility, chemical resistance, and lower weight. Metals are used for high-strength applications, particularly in drums and IBCs. Paper and paperboard suit bulk sacks and corrugated packaging for lower-risk goods. Wood remains relevant in pallet and crate manufacturing, while other materials serve specialty demands.

- For example, Al Rashed Wood Productsin Saudi Arabia provides ISPM-15 certified wood pallets for leading exporters, manufacturing 400,000 units annually to support global trade logistics.

By end-user industries, oil & gas and chemicals are the primary consumers due to high safety and compliance needs. Food & beverage, pharmaceuticals, and automotive follow with demand for protective and hygienic packaging. Construction, electronics, agriculture, and consumer goods sectors contribute to diversified adoption, each driving tailored packaging requirements based on logistics, product sensitivity, and operational efficiency.

Segmentation:

By Product

- Pallets

- Drums

- Intermediate Bulk Containers (IBCs/Totes)

- Crates

- Bulk Sacks and Sacks

- Pails

- Tubes

- Bulk Boxes

- Corrugated Cartons

- Dunnage Components

- Protective Wrapping Solutions

- Other Packaging Types

By Packaging:

By Material

- Plastics

- Metals

- Paper and Paperboard

- Wood

- Other Materials

By End-User Industry

- Oil & Gas

- Chemicals

- Food & Beverage

- Pharmaceuticals

- Automotive

- Construction

- Electrical & Electronics

- Agriculture

- Consumer Goods

- Other Industries

By Region

- Gulf Cooperation Council (GCC)

- North Africa

- Levan

Regional Analysis:

The Gulf Cooperation Council (GCC) region dominates the Mena Industrial Packaging Market with a market share of 48%. Countries such as Saudi Arabia, the United Arab Emirates, and Qatar lead due to their robust petrochemical, oil and gas, and manufacturing sectors. These industries demand high-performance packaging formats for safe storage and transportation of hazardous and non-hazardous goods. Governments support industrial diversification, which drives investments in modern packaging infrastructure. The region also benefits from advanced logistics hubs, strong export orientation, and growing sustainability goals. It consistently adopts automation and smart packaging technologies to improve efficiency and compliance.

North Africa holds a 32% share of the Mena Industrial Packaging Market, with Egypt and Morocco emerging as key contributors. Their growing industrial bases, driven by automotive, food processing, and construction sectors, generate steady demand for bulk and protective packaging. Egypt’s strategic location and investment in the Suez Canal Economic Zone further enhance its importance in trade logistics. Morocco leverages trade agreements and export-oriented production to drive packaging volumes. The region’s packaging industry focuses on cost-effective and recyclable materials to meet both local and international standards. It shows strong growth potential due to infrastructure upgrades and a rising middle-income manufacturing base.

The Levant region accounts for 20% of the Mena Industrial Packaging Market, with Jordan and Lebanon being the primary markets. While smaller in scale, it remains strategically important due to its role in cross-border trade and distribution. Lebanon’s ports and Jordan’s industrial parks create localized packaging demand, especially in chemicals, consumer goods, and pharmaceuticals. The market faces challenges in terms of political stability and import dependency for raw materials. However, it continues to attract regional packaging suppliers aiming to expand their footprint. It focuses on flexible, space-saving packaging designs suited for dense urban logistics and fragmented supply chains.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Takween Advanced Industries

- Greif, Inc.

- Mauser Group B.V.

- Gulf Plastic Industries Company SAOG

- Clouds Drums L.L.C.

- Packaging Products Company (PPC)

- Saudi Plastic Packaging Systems Co. Ltd.

- Saudi Arabian Packaging Industry WLL (SAPIN)

- Arabian Plastics Industrial Company Limited (APICO)

- National Plastic Factory LLC

- Arnon Plastic Industry Co. Ltd. (Bawan)

- Napco Group (Napco National)

- Sealed Air Corporation (Sealed Air Saudi Arabia)

- SABIC – Saudi Basic Industries Corporation

- KANR For Plastic Industries

- Al Nawakheth Factory Company

Competitive Analysis:

The Mena Industrial Packaging Market features a mix of global manufacturers and strong regional players competing across material types and end-use sectors. Key companies include Greif Inc., Mondi Group, Napco National, INDEVCO Group, and Mauser Packaging Solutions. It emphasizes innovation in bulk containers, rigid plastics, and corrugated packaging to meet evolving industrial demands. Companies invest in automation, sustainable materials, and smart packaging technologies to improve efficiency and compliance. Local firms leverage proximity and cost advantages to serve regional clients with customized solutions. Strategic partnerships, mergers, and capacity expansions remain core tactics for market share consolidation. The market continues to evolve through investments in digital logistics, recyclable formats, and performance-engineered designs. It remains highly competitive, with differentiation driven by product durability, regulatory alignment, and service responsiveness.

Recent Developments:

- In January 2025, National Plastic Factory LLC (NPF) entered into a long-term partnership with SCHÜTZ, a leading global manufacturer of industrial packaging. The agreement will see NPF produce high-quality ECOBULK IBCs in Saudi Arabia using original SCHÜTZ equipment, with the first deliveries scheduled for 2026.

- In July 2025, the Plastic Recycling Show Middle East & Africa (PRS ME&A) announced the Circular Packaging Association as its Official Knowledge Partner for the upcoming event in Dubai

- In May 2024, Mauser Group B.V. (Mauser Packaging Solutions) announced the acquisition of Taenza, S.A. de C.V., a manufacturer of tin-steel cans and pails based in Mexico. This move adds substantial manufacturing capacity and a strong market position in Mexico to Mauser’s global portfolio, strengthening its regional presence and capabilities

Market Concentration & Characteristics:

The Mena Industrial Packaging Market exhibits moderate concentration with a mix of multinational corporations and regional firms competing across various segments. It features a strong presence of vertically integrated players capable of offering end-to-end packaging solutions. The market favors companies that can deliver high-volume, customized, and compliant packaging formats for diverse industrial applications. It is characterized by high demand for bulk containers, rigid plastics, and fiber-based materials across petrochemical, food processing, and construction sectors. Buyers prioritize durability, supply consistency, and cost-efficiency, driving suppliers to focus on quality assurance and logistics integration. Regional disparities in regulations and infrastructure influence product specifications and service models. It maintains dynamic characteristics shaped by trade flows, industrial investments, and sustainability mandates.

Report Coverage:

The research report offers an in-depth analysis based on, Product, Packaging, Material, and End-User Industry, It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for eco-friendly and recyclable packaging solutions will increase due to rising regulatory and corporate sustainability goals.

- Smart packaging technologies will gain wider adoption to support traceability and supply chain automation.

- Industrial expansion in Egypt, Morocco, and Saudi Arabia will drive new demand for durable and compliant packaging formats.

- Regional investments in logistics and infrastructure will improve last-mile packaging efficiency and delivery speed.

- Export-driven industries will push packaging suppliers to offer globally compliant, high-performance solutions.

- Customization and branding in industrial packaging will rise, especially among exporters targeting premium markets.

- Increased use of automation in manufacturing will favor standardized, integration-ready packaging formats.

- Rising raw material volatility will encourage the use of alternative and locally sourced packaging materials.

- E-commerce growth in industrial supply channels will reshape packaging formats for compactness and durability.

- Strategic partnerships between local producers and multinational firms will expand production capacity and technical innovation.