Market overview

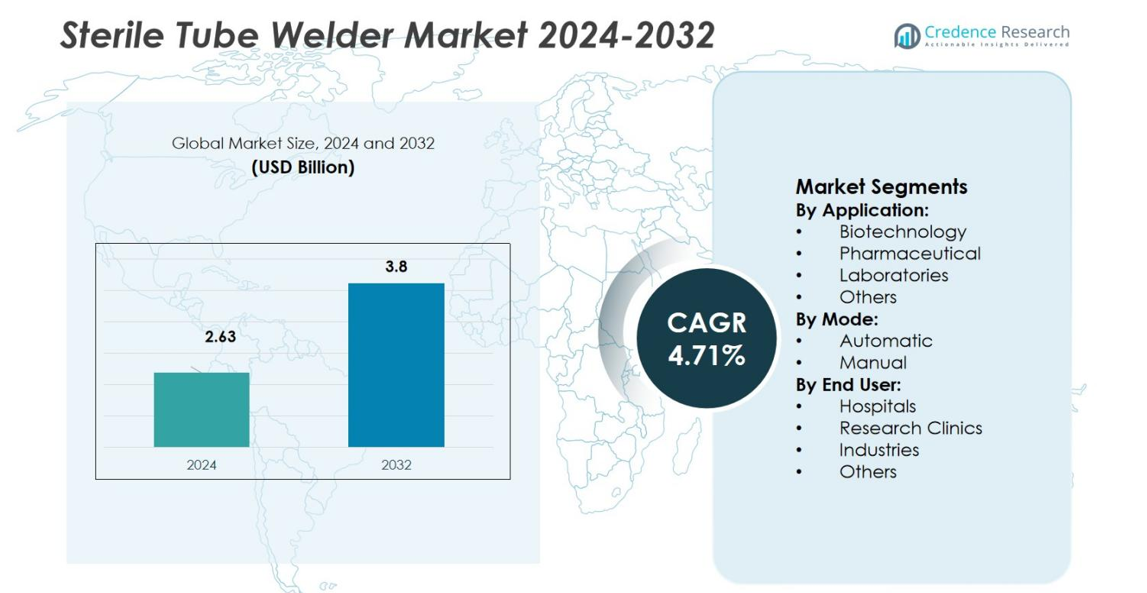

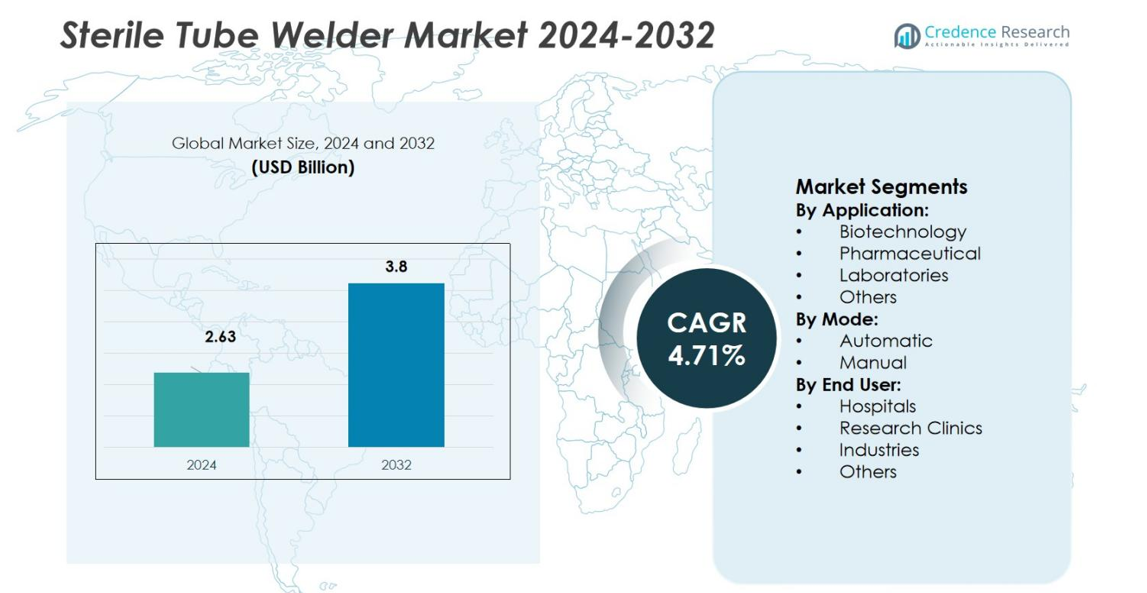

Sterile Tube Welder Market size was valued USD 2.63 Billion in 2024 and is anticipated to reach USD 3.8 Billion by 2032, at a CAGR of 4.71% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sterile Tube Welder Market Size 2024 |

USD 2.63 Billion |

| Sterile Tube Welder Market, CAGR |

4.71% |

| Sterile Tube Welder Market Size 2032 |

USD 3.8 Billion |

The Sterile Tube Welder Market is primarily driven by key players such as Sartorius AG, Terumo BCT, Inc., GE Healthcare, MGA Technologies, and Vante Biopharm / Sebra. These companies lead the market through innovative product offerings, continuous research and development, and strategic acquisitions. North America holds the largest market share, accounting for 35.4% in 2024, thanks to strong investments in biopharmaceutical manufacturing, a well-established healthcare infrastructure, and stringent infection-control regulations. Europe follows with a 28% share, benefiting from a mature biopharma industry and regulatory standards such as GMP. The Asia-Pacific region is rapidly emerging, with a market share of 22% in 2024, driven by rising healthcare investments and biotech growth. These regions are poised for significant growth, with suppliers focusing on enhancing automation, regulatory compliance, and regional support to capture opportunities in evolving markets.

Market Insights

- The Sterile Tube Welder Market was valued at USD 2.63 billion in 2024 and is projected to reach USD 3.8 billion by 2032, growing at a CAGR of 4.71% during the forecast period.

- The market is primarily driven by the increasing demand for sterile processing in biopharmaceuticals, blood transfusion services, and single-use bioprocessing systems.

- Key trends include the integration of automation and digital connectivity in sterile welders, enhancing process validation and reducing human error.

- The market faces restraints such as high capital costs and complexity for smaller end-users, limiting adoption in smaller laboratories and clinics.

- North America holds the largest share of the market at 35.4%, followed by Europe at 28%, with Asia-Pacific rapidly emerging at 22%. The biotechnology segment leads with 32.4% share in 2025, while automatic welders dominate the mode segment with 57.1% market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application:

In the application segment, the biotechnology sub‑segment leads with 32.4% share of the market revenue in 2025. This dominance is driven by the rapid expansion of biologics, cell and gene therapies, and vaccine manufacturing, all of which require sterile fluid transfers and single‑use tubing systems. Stringent regulatory mandates for sterility and the rising adoption of flexible processing platforms further boost demand. Pharmaceutical manufacturing and diagnostics follow, but biotechnology remains the key growth anchor.

- For instance, more than 70% of biopharmaceutical companies incorporate single-use upstream bioprocess containers to enhance process efficiency and maintain sterility during monoclonal antibody and recombinant protein production.

By Mode:

Within the mode segmentation, the automatic mode commands a clear leading position, accounting for 57.1% of global market revenue in 2025. The preference for automatic welders stems from their ability to deliver consistent, validated welds, reduce human error and labour costs, and integrate seamlessly into high‑throughput biopharmaceutical and blood‑processing operations. Manual welders retain relevance in smaller labs and cost‑sensitive settings, but automation is increasingly the standard for compliance‑driven sterile operations.

- For instance, Sartorius’ Biowelder® S automates aseptic welding of PVC and TPE tubing with visual guidance and provides easy export of weld logs and audit trails, facilitating GMP and CGT manufacturing compliance.

By End‑User:

In the end‑user dimension, the hospitals segment holds the largest share 36.8% in 2025 of the sterile tube welder market revenue. Hospitals drive demand through transfusion services, hospital‑based blood centres and large sterile‑processing units that demand contamination‑free tubing welds. The emphasis on infection control, expanding healthcare infrastructure and growing patient volumes fuel this trend. Research clinics, industrial biomanufacturing sites and other end‑users represent meaningful, but smaller‑share, niches in comparison.

Key Growth Drivers

Expansion of Biopharmaceutical and Cell-/Gene‑Therapy Manufacturing

The global sterile tube welder market is propelled by the rapid growth of biopharmaceutical manufacturing, especially cell and gene therapies, which demand aseptic fluid transfer and closed‑system integrity. Manufacturers rely on sterile welders to join thermoplastic tubing without exposing fluid paths to contamination, supporting single‑use platforms and modular processing units. With a growing pipeline of biologics, vaccines and personalized medicines, end‑users increasingly require sterile‑joining solutions to maintain GMP compliance and accelerate time‑to‑market. This dynamic underpins sustained uptake of sterile tube welding equipment globally.

- For instance, Cobetter’s Lifemeta™ Tube Welder offers sterile tube welding compatible with various TPE tubing brands, advancing aseptic connectivity in single-use biopharmaceutical solutions.

Strict Regulatory Emphasis on Aseptic Processing and Infection Control

Heightened regulatory scrutiny around contamination risk, particulate control and cross‑contamination in healthcare, blood‑processing and pharmaceutical production is driving demand for sterile tube welders. Standards such as GMP, ISO 13485 and FDA requirements push end‑users to adopt validated welding technologies as part of their closed‑system strategies. As health‑care providers and biopharma companies intensify focus on patient‑safety, infection‑control measures and process traceability, demand for reliable, documented sterile‑welding solutions continues to rise across hospitals, blood centres and manufacturing sites.

- For instance, Sartorius’ Biowelder® S supports aseptic welding of PVC and TPE tubing in Grade B and C clean rooms, validated by bacterial challenge testing to meet GMP and FDA-quality standards.

Adoption of Single‑Use Systems and Automation in Fluid‑Handling

The shift towards single‑use disposable components in bioprocessing and healthcare has elevated the role of sterile tube welders. Single‑use tubing sets require validated, contamination‑free joining between pre‑sterilised modules without conventional connectors. This trend, combined with automation and digital validation capabilities, encourages adoption of automatic sterile‑welding systems in high‑throughput settings. As end‑users seek to reduce cleaning‑validation burden, downtime and manual intervention, sterile welders that integrate with automated production lines become a key enabler of efficiency and scalability.

Key Trend & Opportunity

Regional Growth in Emerging Markets (Asia‑Pacific, Latin America)

Emerging markets in Asia‑Pacific and Latin America present compelling opportunities for growth of the sterile tube welder market. As governments invest in healthcare infrastructure, encourage local pharmaceutical and biotechnology manufacturing and raise standards of aseptic processing, demand for sterile welding solutions grows. Contract manufacturing organisations (CMOs) and biopharma plants setting up in these regions view advanced fluid‑joining technologies as a means to meet global regulatory expectations. Suppliers that establish cost‑effective local support and tailored systems stand to gain from this regional expansion.

- For instance, Samsung Biologics in South Korea has expanded its biomanufacturing capacity to 784,000 liters, heavily investing in automated sterile tubing welders to support large-scale biologics production and meet stringent aseptic process standards.

Integration of Digital, IoT and Industry 4.0 Capabilities

Sterile tube welder manufacturers are increasingly embedding digital monitoring, data‑logging, traceability and connectivity features in their systems—unlocking new functionality and value. These smart welders support in‑process validation, operator guidance, predictive maintenance and integration with MES/SCADA platforms. As biopharma and healthcare customers emphasize quality assurance and lifecycle documentation, welders offering real‑time analytics and digital verification become differentiators. This digital evolution opens a clear opportunity for product‑innovation and higher‑value service models in this market.

- For instance, Sartorius’ Biowelder® TC, which automates sterile connections between thermoplastic elastomer tubing with an intuitive LCD touchscreen, supporting real-time validation and total containment in biomanufacturing, from mAbs to vaccines.

Key Challenge

High Capital Cost and Complexity for Smaller End‑Users

One significant barrier in the sterile tube welder market is the comparatively high upfront cost and complexity of automatic or semi‑automatic systems, which can deter smaller labs, research clinics or small‑scale blood centres. These units demand investment in clean‑room infrastructure, operator training, validation protocols and maintenance. Some end‑users may opt for alternative tubing‑joining methods or manual systems to reduce cost. This cost‑sensitivity constrains adoption in budget‑constrained settings and slows full market penetration, particularly in emerging or smaller‑scale applications.

Competing Sealing Technologies and Substitution Threats

Despite growth, the sterile tube welder market faces a challenge from alternative technologies such as heat sealing, ultrasonic welding, laser welding or pre‑validated quick‑connect systems. These alternatives may offer lower cost, simpler operation or sufficient sterility in certain applications, reducing demand for dedicated sterile‑welders. End‑users evaluating cost‑benefit often consider these substitutes, which can slow adoption of the more sophisticated soldering‑style devices. The presence of viable alternatives therefore limits pricing power and may restrain market growth in less demanding segments.

Regional Analysis

North America

The North American region holds a leading position in the sterile tube welder market with a market share of 35.4% in 2024. This dominance is driven by strong investments in biopharmaceutical manufacturing, a mature healthcare infrastructure, and stringent infection‑control regulations. The United States features a deep base of single‑use technologies and automated processing platforms, which further boosts demand. Additionally, high prevalence of chronic diseases and an emphasis on transfusion safety reinforce adoption of sterile welding systems across blood‑processing and hospital settings. These factors position North America as the key regional hub for market growth.

Europe

In Europe, the sterile tube welder market commands 28% of global share in 2024, reflecting substantial activity within pharmaceutical and biotechnology sectors. The region benefits from regulatory frameworks such as GMP and Annex 1 that emphasize closed‑system and contamination‑free fluid handling. Major countries like Germany, France and the UK are investing heavily in next‑generation biologics and cell‑therapy infrastructure, driving demand. Additionally, the presence of many contract manufacturing organisations (CMOs) and blood‑service networks underpins the uptake of sterile welding solutions. Europe’s mature ecosystem and regulatory rigour support stable, albeit slower‑paced, growth.

Asia‑Pacific

The Asia‑Pacific region is rapidly emerging, though its share is smaller – 22% of the global sterile tube welder market in 2024. Growth is propelled by rising healthcare expenditure, expansion of biotech hubs in China, India and South Korea, and increasing adoption of single‑use bioprocessing systems. Multinational firms are establishing R&D and manufacturing bases in this region, which boosts demand for sterile fluid‑connection technologies. While infrastructure remains less mature compared to North America and Europe, the region exhibits the highest CAGR forecast, making it an important opportunity zone for suppliers.

Latin America

Latin America accounts for 8% of the global sterile tube welder market in 2024. The region’s growth is supported by improving healthcare infrastructure, expanding blood‑transfusion services, and increasing regulatory focus on aseptic processing. However, budget constraints and slower adoption of advanced single‐use technology limit penetration. Brazil and Mexico represent the major national markets, with suppliers needing tailored, cost-effective solutions and local support services to capture further opportunities in this region.

Middle East & Africa

The Middle East & Africa region holds 7% share of the market in 2024. Growth is driven by upward trends in healthcare investment, spill‑in from pharmaceutical and biotech manufacturing, and the need for sterile processing in emerging blood‑bank and transfusion centres. Nevertheless, infrastructure gaps, limited funding, and fragmented regulatory standards slow full adoption of high‑end sterile welding systems. Suppliers who build regional service networks, training programmes and lower‐cost configurations are better poised to secure future gains.

Market Segmentations:

By Application:

- Biotechnology

- Pharmaceutical

- Laboratories

- Others

By Mode:

By End User:

- Hospitals

- Research Clinics

- Industries

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the sterile tube welder market is shaped by key players including Sartorius AG, Terumo BCT, Inc., GE Healthcare, MGA Technologies, Vante Biopharm / Sebra, Genesis BPS, Biomen Biosystems Co., Ltd., SynGen, Inc., Sentinel Process Systems, Inc. and Flex Concepts, Inc.. These companies compete primarily on innovation, regulatory compliance, service support and global reach. The market is moderately consolidated with the top players continually expanding their product portfolios through new launches, enhanced automation features and integration with single‑use systems. Strategic alliances and acquisitions are also prominent as firms seek to bolster their sterile welding connectivity solutions tailored for biopharma, hospital and laboratory end‑users. As end‑users increasingly prioritise sterility assurance, speed, ease of validation and cost‑effectiveness, participants differentiate on validated data‑logging, connectivity to manufacturing execution systems (MES), and regional service networks. Robust after‑sales training, maintenance programs and local representation in growth regions further define competitive positioning. Continuous investment in R&D and alignment with evolving regulatory standards remain key to maintaining market share and margin.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Genesis BPS

- Flex Concepts, Inc.

- SynGen, Inc.

- Terumo BCT, Inc.

- MGA Technologies

- Sartorius AG

- Sentinel Process Systems, Inc.

- Biomen Biosystems Co., Ltd.

- Vante Biopharm / Sebra

- GE Healthcare

Recent Developments

- In January 2024, bms‑bloodcare launched its new sterile tube welder model STW6810‑EVA, designed specifically for dry–dry, wet–dry and wet–wet welding of EVA tubing to support gene therapy, cell therapy and stem‑cell research workflows.

- In July 2024 the Biowelder® S by Sartorius AG was launched to enable rapid, sterile welding of small‑bore PVC and TPE tubes in cleanrooms, supporting cell and gene therapy workflows.

- In 2023 the TSCD®‑II Sterile Tubing Welder from Terumo BCT, Inc. was upgraded with enhanced connectivity and performance for high‑throughput blood‑processing operations

Report Coverage

The research report offers an in-depth analysis based on Application, Mode, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of single‑use bioprocessing systems will drive increasing demand for sterile tube welders.

- Growing cell and gene therapy manufacturing will require higher volumes of sterile fluid connections and hence boost equipment shipments.

- Stricter regulatory standards for aseptic processing and contamination control will force end‑users to upgrade to automatic welders.

- Expansion of healthcare infrastructure and blood‑component processing facilities in emerging markets will open new regional growth opportunities.

- Integration of digital monitoring, IoT connectivity and data‑logging features into welders will enable value‑added service models and recurring revenue streams.

- Shift from manual to automatic welding systems will accelerate as end‑users prioritise consistent quality, operator ease and labour savings.

- Suppliers offering modular, flexible welding platforms compatible with multiple tubing materials (e.g., TPE, silicone) will gain competitive advantage.

- Cost pressures and budget constraints in smaller labs and clinics will encourage development of lower‑cost, compact welding solutions.

- The presence of alternate joining technologies (heat sealers, quick‑connects) will push weld‑equipment makers to differentiate on reliability, validation support and lifecycle services.

- Regional localisation of service networks and training in Asia‑Pacific, Latin America and MEA will become critical for capturing growth in non‑mature markets.