Market Overview

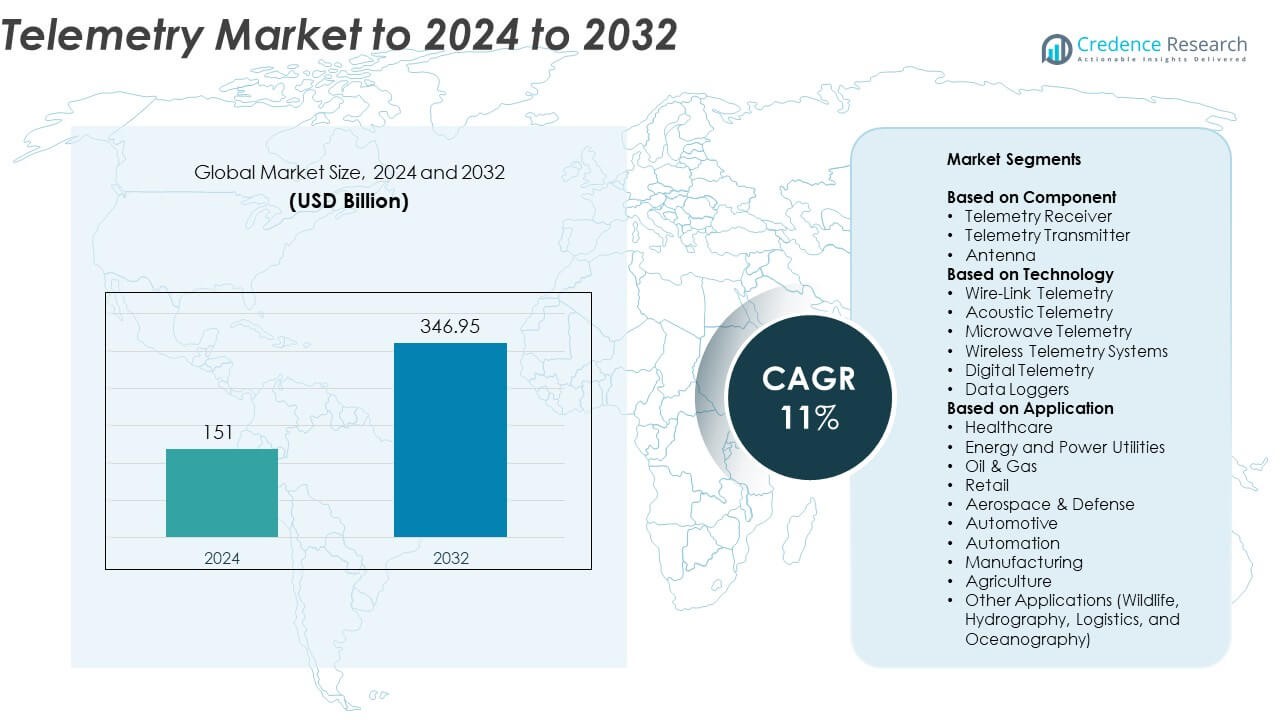

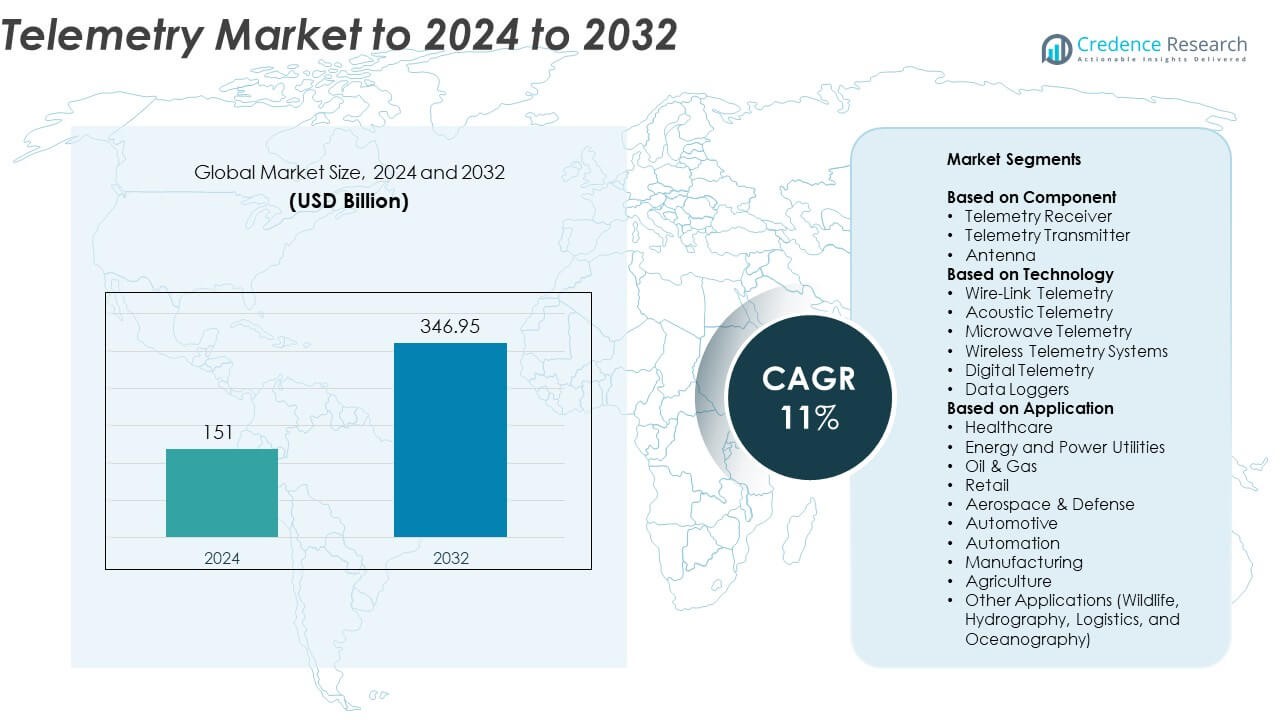

The Telemetry Market size was valued USD 151 billion in 2024 and is anticipated to reach USD 346.95 billion by 2032, at a CAGR of 11% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Telemetry Market Size 2024 |

USD 151 Billion |

| Telemetry Market, CAGR |

11% |

| Telemetry Market Size 2032 |

USD 346.95 Billion |

The telemetry market is led by major players including Honeywell International Inc., Siemens AG, Philips Healthcare, GE Healthcare, IBM Corp., and Schlumberger Ltd., which collectively drive innovation through advanced wireless systems, sensor technologies, and data analytics integration. These companies focus on developing reliable, real-time communication networks across industries such as aerospace, defense, healthcare, and automotive. North America dominates the global telemetry market with a 38.6% share in 2024, supported by strong technological infrastructure and early adoption of IoT and 5G connectivity. Europe follows with 27.4% share, driven by industrial automation and stringent regulatory frameworks promoting telematics and digital monitoring.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The telemetry market was valued at USD 151 billion in 2024 and is projected to reach USD 346.95 billion by 2032, growing at a CAGR of 11%.

- Growing adoption of IoT, wireless communication, and connected devices across industries drives market expansion.

- Integration of 5G, AI, and cloud-based telemetry platforms enhances real-time data transmission and predictive analytics capabilities.

- The market remains highly competitive with companies investing in advanced sensor technologies, automation systems, and cybersecurity solutions to strengthen their global presence.

- North America leads with 38.6% share, followed by Europe with 27.4%, while the telemetry transmitter segment dominates with 41.8% share due to its vital role in data communication.

Market Segmentation Analysis:

By Component

The telemetry transmitter segment dominates the market, accounting for around 41.8% share in 2024. This dominance is attributed to its critical role in collecting and transmitting real-time data from sensors to monitoring systems across industries. Advancements in miniaturization, power efficiency, and wireless communication enhance transmitter reliability in harsh environments. Increasing adoption of IoT-enabled devices in aerospace, automotive, and healthcare sectors further accelerates demand. Telemetry receivers and antennas also show notable growth due to their integration in complex communication networks and expansion of remote monitoring infrastructure.

- For instance, the L3Harris CSS-905A S-band airborne telemetry transmitter has a 4.8-cubic-inch (12.19 cubic cm) design.

By Technology

Wireless telemetry systems lead the market with about 36.2% share in 2024. Their strong position stems from widespread adoption in industries requiring remote and real-time monitoring, such as healthcare, energy, and automotive. These systems offer enhanced flexibility, scalability, and cost efficiency compared to wired alternatives. Growing use of advanced communication technologies like 5G, Bluetooth, and satellite telemetry boosts connectivity performance. Meanwhile, digital telemetry and data loggers are gaining traction for providing high-speed, accurate, and continuous data transmission across industrial automation and defense applications.

- For instance, FreeWave’s FGR3 industrial radios enable wireless telemetry up to 97 km (60 miles) line-of-sight and support 128/256-bit AES encryption for remote monitoring.

By Application

The aerospace and defense segment dominates the telemetry market, holding approximately 32.7% share in 2024. This leadership results from extensive use of telemetry in aircraft performance tracking, missile guidance, and satellite communication. Rising investments in space exploration and defense modernization programs across the U.S., China, and India drive segment growth. The healthcare and automotive sectors are also expanding rapidly due to remote patient monitoring systems and vehicle telematics adoption. Increasing deployment in agriculture and manufacturing supports operational efficiency through real-time asset tracking and predictive maintenance.

Key Growth Drivers

Rising Adoption of IoT and Connected Devices

The increasing integration of IoT and connected sensors across industries is a major growth driver for the telemetry market. These devices enable real-time data collection, remote monitoring, and performance optimization in sectors such as healthcare, automotive, and energy. Advancements in cloud connectivity and data analytics enhance decision-making accuracy and operational efficiency. Growing implementation of smart infrastructure and digital transformation initiatives further strengthens the need for advanced telemetry systems globally.

- For instance, BMW Brilliance’s private 5G network achieved 1 Gbit/s data rates and 100% plant coverage, streaming test-vehicle data to a central data center.

Expanding Aerospace and Defense Applications

Telemetry plays a crucial role in aerospace and defense for tracking flight data, missile testing, and satellite communication. Continuous investments in space programs and defense modernization initiatives are fueling demand for high-performance telemetry systems. Governments and private organizations are emphasizing data-driven mission control and precision tracking. This focus on security and mission success enhances telemetry’s importance in aviation testing, space exploration, and military operations.

- For instance, Rolls-Royce’s Engine Health Monitoring continuously tracks over 8,000 aircraft across civil and business fleets to support predictive decisions

Growing Demand in Healthcare Monitoring Systems

The healthcare sector increasingly relies on telemetry for continuous patient monitoring, remote diagnostics, and data management. The rise in chronic diseases and demand for efficient telemedicine services are driving adoption of wireless telemetry devices. Hospitals and healthcare providers use telemetry for real-time cardiac and vital sign monitoring, improving patient safety. The growing trend toward home-based healthcare and wearable medical technologies further accelerates the market’s expansion in this segment.

Key Trends & Opportunities

Integration of 5G and Cloud-Based Telemetry Platforms

The adoption of 5G networks is transforming telemetry capabilities with faster data transmission and lower latency. Cloud-based telemetry solutions allow centralized data storage, advanced analytics, and enhanced scalability. These innovations improve communication efficiency across sectors such as automotive, energy, and industrial automation. The synergy between 5G and cloud computing opens new opportunities for remote monitoring and predictive maintenance applications worldwide.

- For instance, Sequans’ Calliope 2 Cat-1bis IoT modules deliver 10 Mbps downlink / 5 Mbps uplink and support low-power modes down to 1 µA deep sleep for cloud-connected telemetry.

Advancement in AI-Driven Predictive Analytics

Artificial intelligence is increasingly being integrated into telemetry systems for intelligent data interpretation and anomaly detection. Predictive analytics supports real-time decision-making and helps prevent system failures. Industries like manufacturing, energy, and aerospace benefit from improved efficiency and reduced operational risks. The convergence of AI, machine learning, and telemetry technologies enables smarter systems and drives the next phase of digital transformation.

- For instance, Uptake’s Asset Strategy Library spans 58,000+ universal failure modes and 178,000+ as-found reportable conditions to drive AI-based predictive maintenance.

Key Challenges

Data Security and Privacy Concerns

The massive data generated through telemetry systems raises challenges related to cybersecurity and privacy. Sensitive information transmitted over wireless networks is vulnerable to unauthorized access and breaches. Industries such as healthcare and defense face strict compliance requirements for data protection. Addressing these concerns through robust encryption and secure communication protocols remains critical for market growth and user trust.

High Implementation and Maintenance Costs

Deploying telemetry infrastructure involves significant investment in hardware, software, and data management systems. Small and medium-sized enterprises often struggle to adopt these technologies due to cost constraints. Maintenance of sensors, transmitters, and receivers also adds to long-term operational expenses. The need for skilled professionals and integration with legacy systems further limits widespread adoption in cost-sensitive markets.

Regional Analysis

North America

North America dominates the telemetry market with around 38.6% share in 2024. The region’s leadership is driven by strong adoption across aerospace, defense, and healthcare sectors. Advanced technological infrastructure, government defense programs, and high investments in IoT connectivity further support growth. The U.S. leads due to major manufacturers and active space exploration projects. Expanding use of telemetry in automotive telematics and energy management also contributes to market expansion. Canada and Mexico show rising potential with industrial automation and renewable energy applications strengthening demand for remote monitoring solutions.

Europe

Europe holds approximately 27.4% share of the global telemetry market in 2024. The region benefits from robust aerospace research, automotive innovation, and sustainable energy initiatives. Countries such as Germany, the U.K., and France lead in integrating telemetry into industrial automation and defense applications. Stringent emission and safety regulations promote vehicle telematics adoption. Growth in healthcare telemetry, supported by digital health reforms and aging populations, further strengthens regional demand. Continuous R&D investments and cross-border collaboration on satellite communication systems sustain Europe’s position as a key telemetry technology hub.

Asia Pacific

Asia Pacific accounts for nearly 22.8% share in 2024, emerging as the fastest-growing region in the telemetry market. Rapid industrialization, expanding automotive production, and defense modernization drive regional adoption. China, Japan, and India are leading contributors, supported by government investments in smart cities and 5G infrastructure. The growing use of telemetry in manufacturing, agriculture, and healthcare sectors fuels additional opportunities. Rising demand for low-cost wireless telemetry solutions and increasing digital transformation across industries strengthen Asia Pacific’s competitive edge in the global market.

Latin America

Latin America captures about 6.4% share in the telemetry market in 2024. The region’s growth is supported by expanding oil and gas exploration, renewable energy projects, and emerging automotive telematics applications. Brazil and Mexico lead adoption with increased focus on energy efficiency and industrial automation. The integration of telemetry in healthcare monitoring and smart infrastructure projects is gaining momentum. However, budget limitations and uneven technological access slow widespread implementation. Growing investments in digital connectivity and defense modernization are expected to enhance market penetration across key Latin American economies.

Middle East & Africa

The Middle East and Africa hold around 4.8% share of the telemetry market in 2024. The demand is primarily driven by the oil and gas sector, where telemetry supports real-time pipeline monitoring and production efficiency. Countries such as Saudi Arabia, the UAE, and South Africa are adopting telemetry in energy, defense, and smart city projects. Growing healthcare digitization and infrastructure expansion also stimulate adoption. Despite challenges such as limited local manufacturing and high setup costs, increasing public–private partnerships are expected to accelerate regional market development over the coming years.

Market Segmentations:

By Component

- Telemetry Receiver

- Telemetry Transmitter

- Antenna

By Technology

- Wire-Link Telemetry

- Acoustic Telemetry

- Microwave Telemetry

- Wireless Telemetry Systems

- Digital Telemetry

- Data Loggers

By Application

- Healthcare

- Energy and Power Utilities

- Oil & Gas

- Retail

- Aerospace & Defense

- Automotive

- Automation

- Manufacturing

- Agriculture

- Other Applications (Wildlife, Hydrography, Logistics, and Oceanography)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The telemetry market is characterized by strong competition among key players such as Honeywell International Inc., Philips Healthcare, Siemens AG, BioTelemetry, Inc., IBM Corp., Rogers Communications, Inc., GE Healthcare, Cobham Plc., Schlumberger Ltd., Finmeccanica SPA, Lindsay Corporation, Sierra Wireless, Inc., Schneider Electric, Astro-Med, Inc., Bayerische Motoren Werke AG (BMW), and L-3 Communications Holdings Inc. The competitive environment is driven by continuous innovation in wireless communication, sensor technologies, and data analytics. Companies are focusing on enhancing system accuracy, connectivity, and integration with IoT and AI-based platforms. Strategic collaborations, mergers, and product launches are common strategies to expand market presence and technological capabilities. Increasing demand from sectors like aerospace, healthcare, automotive, and energy encourages investments in advanced telemetry solutions. Firms are also prioritizing cybersecurity measures and cloud-based telemetry platforms to improve reliability and scalability, ensuring long-term competitiveness in a rapidly evolving global market.

Key Player Analysis

- Honeywell International Inc.

- Philips Healthcare

- Siemens AG

- BioTelemetry, Inc.

- IBM Corp.

- Rogers Communications, Inc.

- GE Healthcare

- Cobham Plc.

- Schlumberger Ltd.

- Finmeccanica SPA

- Lindsay Corporation

- Sierra Wireless, Inc.

- Schneider Electric

- Astro-Med, Inc.

- Bayerische Motoren Werke AG (BMW)

- L-3 Communications Holdings Inc.

Recent Developments

- In 2025, Siemens showcased next-generation industrial AI and automation solutions at Hannover Messe 2025, including telemetry-driven Industrial Foundation Model (IFM) and virtual PLC deployments.

- In 2025, Philips Healthcare launched an innovative smart telemetry platform focused on cardiac monitoring to address healthcare challenges such as staff shortages and alarm overload.

- In 2025, Honeywell has introduced enhanced telemetry platforms for industrial and building automation, integrating AI and edge computing to improve predictive maintenance and operational insights.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Component, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The telemetry market will experience strong growth due to increasing automation across industries.

- Advancements in 5G and IoT will enhance data transmission speed and connectivity reliability.

- The healthcare sector will see rising adoption of wireless telemetry for remote patient monitoring.

- Space exploration and defense modernization will drive long-term investment in telemetry technologies.

- Integration of AI-based analytics will enable predictive maintenance and smarter data insights.

- Automotive telematics will expand rapidly with electric and connected vehicle developments.

- Cloud-based telemetry platforms will gain traction for real-time and large-scale data management.

- Energy and utilities will adopt telemetry for grid optimization and environmental monitoring.

- Collaboration between technology providers and industrial manufacturers will spur innovation.

- Emerging markets in Asia Pacific and Latin America will present strong growth opportunities through digital transformation.