Market Overview

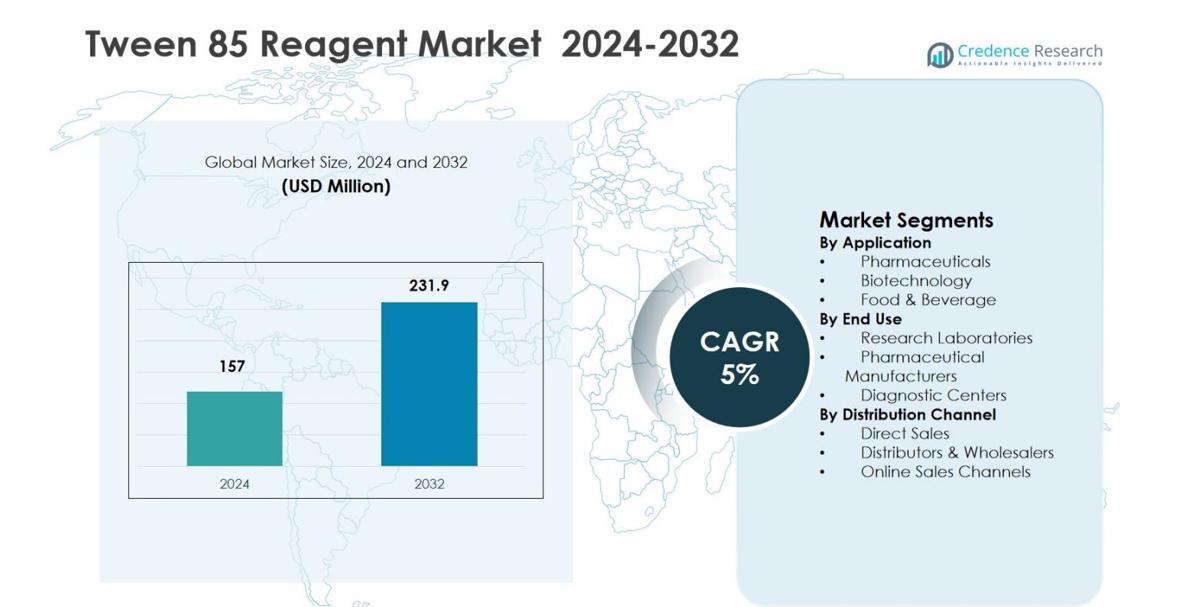

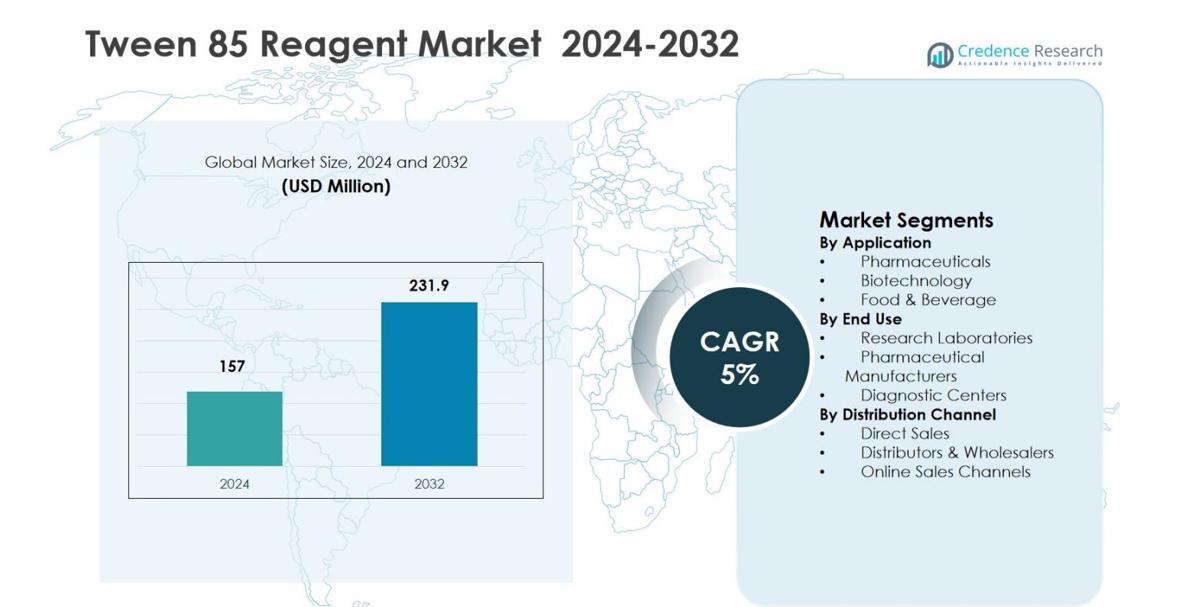

Tween 85 Reagent Market size was valued at USD 157 million in 2024 and is anticipated to reach USD 231.9 million by 2032, growing at a CAGR of 5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tween 85 Reagent Market Size 2024 |

USD 157 million |

| Tween 85 Reagent Market, CAGR |

5% |

| Tween 85 Reagent Market Size 2032 |

USD 231.9 million |

Tween 85 Reagent Market is shaped by the presence of established global and regional manufacturers including Merck KGaA (Sigma-Aldrich), Croda International Plc, Matangi Industries, Vasudha Chemicals Private Limited, Viswaat Chemicals Limited, Silver Fern Chemical, IRO Surfactant Co., Ltd., Ultra Chemical Works, Shree Chem, and Choice Chemicals. These companies focus on pharmaceutical-grade purity, consistent batch quality, and regulatory compliance to support demand from drug formulation, biologics, and research applications. Regionally, North America led the Tween 85 Reagent Market with a market share of 34.6% in 2024, driven by strong pharmaceutical manufacturing and biotechnology research. Europe followed with 27.8%, supported by a mature life sciences ecosystem, while Asia Pacific accounted for 25.1%, reflecting rapid growth in pharmaceutical production and contract manufacturing activities.

Market Insights

- Tween 85 Reagent Market was valued at USD 157 million in 2024 and is projected to reach USD 231.9 million by 2032, growing at a CAGR of 5% during the forecast period.

- Market growth is driven by rising pharmaceutical and biologics manufacturing, with the pharmaceuticals application segment holding a dominant share of 46.2% in 2024 due to extensive use in drug formulation, vaccines, and injectable products.

- Ongoing trends include increasing demand for high-purity and pharmaceutical-grade reagents, expansion of direct sales channels, and growing adoption in biotechnology research and specialty food applications.

- Market structure reflects the presence of global and regional suppliers focused on quality consistency, regulatory compliance, and long-term supply agreements, while challenges include regulatory requirements and raw material price volatility.

- Regionally, North America led the market with a 34.6% share in 2024, followed by Europe at 27.8% and Asia Pacific at 25.1%, supported by strong pharmaceutical manufacturing, research infrastructure, and expanding contract manufacturing activities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application:

The Tween 85 Reagent Market by application shows strong demand from pharmaceuticals, which held the dominant share of 46.2% in 2024. Pharmaceutical applications lead due to extensive use of Tween 85 as a non-ionic surfactant and emulsifier in drug formulation, vaccine production, and parenteral preparations, where stability and solubilization are critical. Growing biologics manufacturing, rising injectable drug volumes, and stringent formulation standards continue to drive adoption. Biotechnology accounted for a significant secondary share, supported by cell culture and protein stabilization needs, while food & beverage applications expanded steadily due to emulsification requirements.

- For instance, Ataman Kimya highlights polysorbate 85 (Tween 85) as a key excipient in injectable drugs, vaccines, and intravenous fluids to stabilize emulsions and prevent precipitation of active pharmaceutical ingredients in liquid formulations.

By End Use:

Based on end use, pharmaceutical manufacturers dominated the Tween 85 Reagent Market with a market share of 49.8% in 2024. This dominance is driven by large-scale consumption in drug manufacturing, vaccine production, and excipient formulation processes that require consistent quality and regulatory compliance. Increasing global pharmaceutical output, expansion of biologics pipelines, and rising contract manufacturing activities reinforce demand from this segment. Research laboratories followed with strong uptake due to experimental and analytical usage, while diagnostic centers maintained stable growth supported by reagent-based testing and assay preparation.

- For instance, Croda Industrial Specialties produces Tween 85 as an ethoxylated sorbitan triester for oil-in-water emulsions in injectable drugs, enhancing solubility of active ingredients in vaccine and IV fluid production.

By Distribution Channel:

The distribution channel analysis indicates that direct sales accounted for the largest share of 44.5% in 2024 in the Tween 85 Reagent Market. Direct sales dominate as pharmaceutical and biotechnology companies prefer sourcing directly from manufacturers to ensure product traceability, quality assurance, and long-term supply agreements. This channel benefits from bulk purchasing, technical support, and regulatory documentation. Distributors and wholesalers captured a considerable share by serving small- and mid-scale buyers, while online sales channels expanded rapidly due to improved logistics, digital procurement platforms, and broader accessibility.

Key Growth Drivers

Expansion of Pharmaceutical and Biologics Manufacturing

The Tween 85 Reagent Market is strongly driven by the rapid expansion of pharmaceutical and biologics manufacturing activities worldwide. Tween 85 is widely used as a non-ionic surfactant and emulsifier in injectable drugs, vaccines, and complex formulations that require enhanced solubility and stability. Rising production of monoclonal antibodies, biosimilars, and specialty injectables has increased the need for high-purity excipients. Additionally, growing reliance on contract development and manufacturing organizations is boosting large-scale consumption, supporting sustained demand across regulated pharmaceutical production environments.

- For instance, Ningbo Inno Pharmchem Co., Ltd. supplies pharmaceutical-grade Tween 85 that improves drug solubility and maintains uniform dispersion in formulations, facilitating efficient API absorption into the bloodstream or target tissues like tumor sites via stabilized liposomes and niosomes.

Rising Biotechnology Research and Development Activities

Increasing biotechnology research and development significantly supports the growth of the Tween 85 Reagent Market. The reagent is extensively used in cell culture media preparation, protein stabilization, and enzyme-based assays, making it essential for laboratory and pilot-scale applications. Expanding academic research, higher government and private funding, and the establishment of new life-science laboratories are driving steady demand. Moreover, the growing focus on advanced therapies, including gene-based and cell-based treatments, continues to reinforce the importance of Tween 85 in biotechnology workflows.

- For instance, McColl-Lockwood Laboratory at Carolinas Medical Center developed Tween 85-modified low molecular weight PEI copolymers (Z polymers) for enzyme-based exon-skipping assays, enhancing phosphorodiamidate morpholino oligomer delivery with 20-fold efficiency in vitro over naked PMO.

Growing Use in Food and Specialty Industrial Applications

The expanding use of Tween 85 as an emulsifier in food and specialty industrial applications is another important growth driver. In the food and beverage sector, Tween 85 enhances texture consistency, improves ingredient dispersion, and supports shelf-life stability in processed products. Rising consumption of packaged and convenience foods is encouraging manufacturers to adopt reliable emulsifying agents. Beyond food applications, increasing use in cosmetics and specialty chemical formulations is broadening the application base, contributing to diversified and stable market growth.

Key Trends & Opportunities

Shift Toward High-Purity and Pharmaceutical-Grade Reagents

A major trend in the Tween 85 Reagent Market is the growing preference for high-purity and pharmaceutical-grade products. End users, particularly in pharmaceuticals and biotechnology, are prioritizing reagents that meet stringent quality and regulatory standards. This trend creates opportunities for manufacturers to invest in advanced purification technologies and validated quality systems. Suppliers offering pharmacopeia-compliant and application-specific grades can strengthen their market position and capture higher-value demand from regulated end-use industries.

- For instance, Vasudha Chemicals offers VASUDHAPOL S 85, a high-grade Polysorbate 85 designed for high-purity applications in pharmaceuticals. This yellow to amber liquid serves as a robust emulsifier suitable for regulated formulations.

Expansion of Direct and Digital Distribution Channels

The increasing adoption of direct sales and digital procurement channels presents significant opportunities in the Tween 85 Reagent Market. Pharmaceutical and biotechnology companies favor direct sourcing to ensure supply security, quality documentation, and technical support. Simultaneously, online sales platforms are gaining traction among research laboratories and smaller buyers due to ease of access and faster procurement. This evolving distribution landscape enables suppliers to expand their customer base, enhance operational efficiency, and improve market reach across regions.

- For instance, Merck’s Sigma-Aldrich E‑Shop allows researchers and procurement teams to request quotes, place orders, and track deliveries in real time through sigmaaldrich.com, with orders picked, packed, and shipped within minutes via integrated fulfillment systems.

Key Challenges

Regulatory Compliance and Quality Assurance Requirements

Regulatory compliance and quality assurance remain critical challenges for the Tween 85 Reagent Market. Pharmaceutical and biotechnology applications require consistent batch quality, traceability, and adherence to multiple international standards. Even minor deviations in formulation or impurity levels can impact product performance and safety. Maintaining strict quality controls increases production complexity and operational costs. Smaller manufacturers often face difficulties meeting these requirements, creating high entry barriers and intensifying competition among established, compliant suppliers.

Raw Material Price Volatility and Supply Chain Risks

Volatility in raw material prices and supply chain risks pose ongoing challenges in the Tween 85 Reagent Market. The production of Tween 85 depends on fatty acids and ethoxylation inputs that are sensitive to fluctuations in petrochemical and agricultural markets. Rising input costs can pressure profit margins and pricing strategies. In addition, supply chain disruptions and logistical constraints may affect timely availability, which is particularly critical for pharmaceutical and research users requiring uninterrupted reagent supply.

Regional Analysis

North America

North America held a leading share of 34.6% in 2024 in the Tween 85 Reagent Market, driven by strong pharmaceutical manufacturing, advanced biotechnology research, and high regulatory standards. The region benefits from widespread use of Tween 85 in injectable drugs, vaccines, and biologics, supported by a robust presence of pharmaceutical companies and contract manufacturing organizations. Increasing research funding, expanding clinical trials, and continuous innovation in drug formulation further strengthen demand. Well-established distribution networks and preference for pharmaceutical-grade reagents also contribute to sustained market leadership across the United States and Canada.

Europe

Europe accounted for 27.8% of the Tween 85 Reagent Market in 2024, supported by a mature pharmaceutical industry and strong biotechnology research infrastructure. Countries such as Germany, France, and the United Kingdom drive regional demand through extensive use of Tween 85 in drug formulation, biologics production, and laboratory applications. Strict quality and regulatory frameworks encourage consistent consumption of high-purity reagents. Additionally, rising investments in biosimilars, increasing collaboration between research institutions and manufacturers, and steady growth in food and specialty chemical applications support stable market expansion across the region.

Asia Pacific

Asia Pacific captured 25.1% market share in 2024, reflecting rapid growth in pharmaceutical manufacturing and expanding biotechnology capabilities. Countries including China, India, Japan, and South Korea are major contributors due to increasing drug production, growing contract manufacturing activities, and rising research investments. The region benefits from cost-effective manufacturing, expanding healthcare infrastructure, and strong demand from research laboratories. Increasing adoption of Tween 85 in food processing and specialty applications further supports growth, positioning Asia Pacific as the fastest-growing regional market during the forecast period.

Latin America

Latin America represented 7.2% of the Tween 85 Reagent Market in 2024, driven by gradual expansion of pharmaceutical production and improving research infrastructure. Brazil and Mexico are key markets, supported by rising domestic drug manufacturing and increasing use of reagents in laboratory and diagnostic applications. Growing healthcare spending and expanding food processing industries contribute to steady demand for emulsifiers such as Tween 85. Although regulatory and supply chain challenges persist, increasing foreign investment and regional manufacturing initiatives continue to support moderate but consistent market growth.

Middle East & Africa

The Middle East & Africa accounted for 5.3% market share in 2024, reflecting emerging demand across pharmaceutical, research, and food processing sectors. Growth is supported by expanding healthcare infrastructure, increasing government focus on local pharmaceutical production, and rising research activities in select countries. The region shows steady adoption of Tween 85 in laboratory reagents and specialty formulations, particularly in the Gulf countries. While market penetration remains comparatively lower, improving regulatory frameworks and investments in healthcare and life sciences are gradually strengthening regional demand.

Market Segmentations:

By Application

- Pharmaceuticals

- Biotechnology

- Food & Beverage

By End Use

- Research Laboratories

- Pharmaceutical Manufacturers

- Diagnostic Centers

By Distribution Channel

- Direct Sales

- Distributors & Wholesalers

- Online Sales Channels

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Merck KGaA (Sigma-Aldrich), Croda International Plc, Matangi Industries, Vasudha Chemicals Private Limited, Viswaat Chemicals Limited, Silver Fern Chemical, IRO Surfactant Co., Ltd., Ultra Chemical Works, Shree Chem, and Choice Chemicals represent the key participants shaping the Tween 85 Reagent Market. The market features a mix of global chemical majors and regional manufacturers focused on pharmaceutical-grade and industrial-grade polysorbates. Leading players emphasize product purity, batch consistency, and regulatory compliance to support pharmaceutical and biotechnology applications. Strategic priorities include capacity expansion, strengthening direct sales channels, and enhancing quality assurance systems. Companies are also differentiating through customized grades, technical support, and long-term supply agreements with pharmaceutical manufacturers and research institutions. Growing demand from biologics, vaccines, and specialty formulations is encouraging investments in advanced processing and quality control, intensifying competition while reinforcing barriers to entry for smaller suppliers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Merck KGaA (Sigma-Aldrich)

- Croda International Plc

- Silver Fern Chemical

- Matangi Industries

- Vasudha Chemicals Private Limited

- Ultra Chemical Works

- Viswaat Chemicals Limited

- IRO Surfactant Co., Ltd.

- Shree Chem

- Choice Chemicals

Recent Developments

- In December 2025, Croda International Plc announced a strategic supply partnership with Amino GmbH to strengthen global availability of high-purity pharmaceutical ingredients, enhancing support for biopharmaceutical formulation and manufacturing.

- In December 2025, Merck’s Sigma-Aldrich brand maintained an updated specification and application profile for TWEEN 85 (CAS 9005‑70‑3), documenting its use as a polyoxyethylene sorbitan trioleate surfactant in studies evaluating potential pharmaceutical and biochemical applications.

- In March 2023, IRO Surfactant Co., Ltd. updated its Tween‑85 (Polysorbate‑85, CAS 9005‑70‑3) product profile as an amber, non‑toxic, water‑soluble nonionic surfactant for use across detergents, cosmetics, and other industrial formulations

Report Coverage

The research report offers an in-depth analysis based on Application, End Use, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Tween 85 Reagent Market will continue to expand due to sustained demand from pharmaceutical and biologics manufacturing.

- Increasing production of injectable drugs and vaccines will support long-term consumption of high-purity Tween 85.

- Growth in biotechnology research and cell culture applications will strengthen reagent usage across laboratories.

- Rising adoption in biosimilars and specialty therapeutics will enhance market penetration.

- Manufacturers will increasingly focus on pharmaceutical-grade and application-specific product offerings.

- Direct sales channels will gain further importance as buyers prioritize supply reliability and quality assurance.

- Digital procurement platforms will improve accessibility for small and mid-scale end users.

- Expansion of pharmaceutical manufacturing in emerging economies will accelerate regional demand growth.

- Investments in quality control and regulatory compliance will intensify competition among suppliers.

- Diversification into food, cosmetics, and specialty chemical applications will support market resilience.