Market Overview:

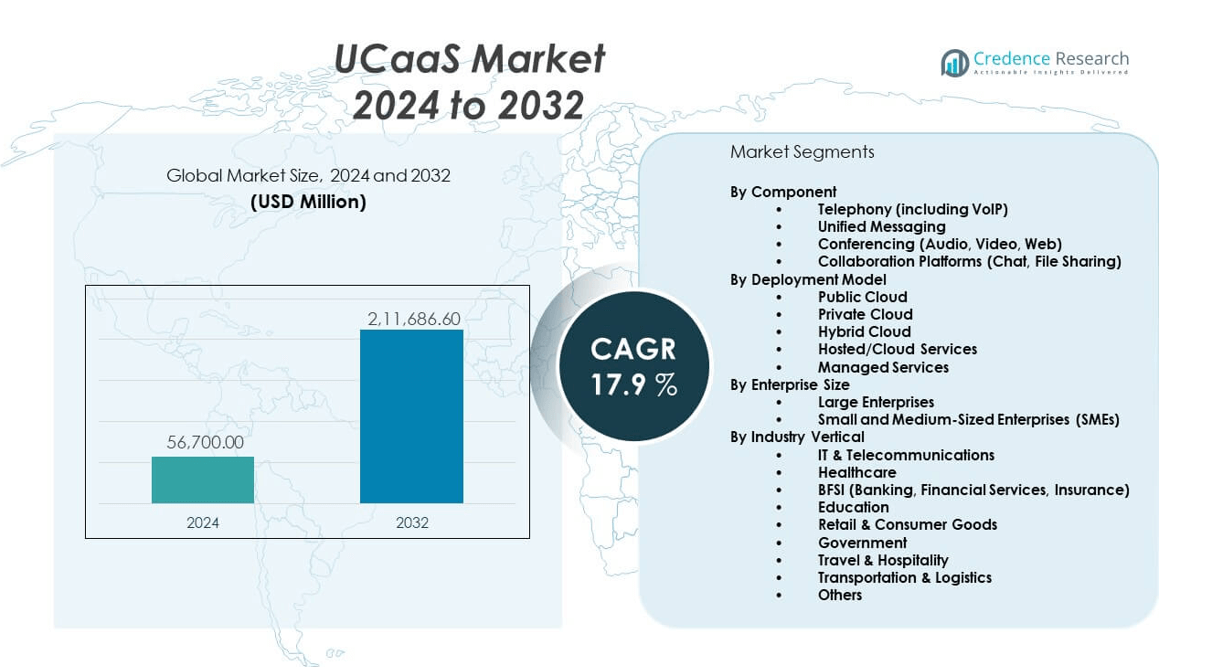

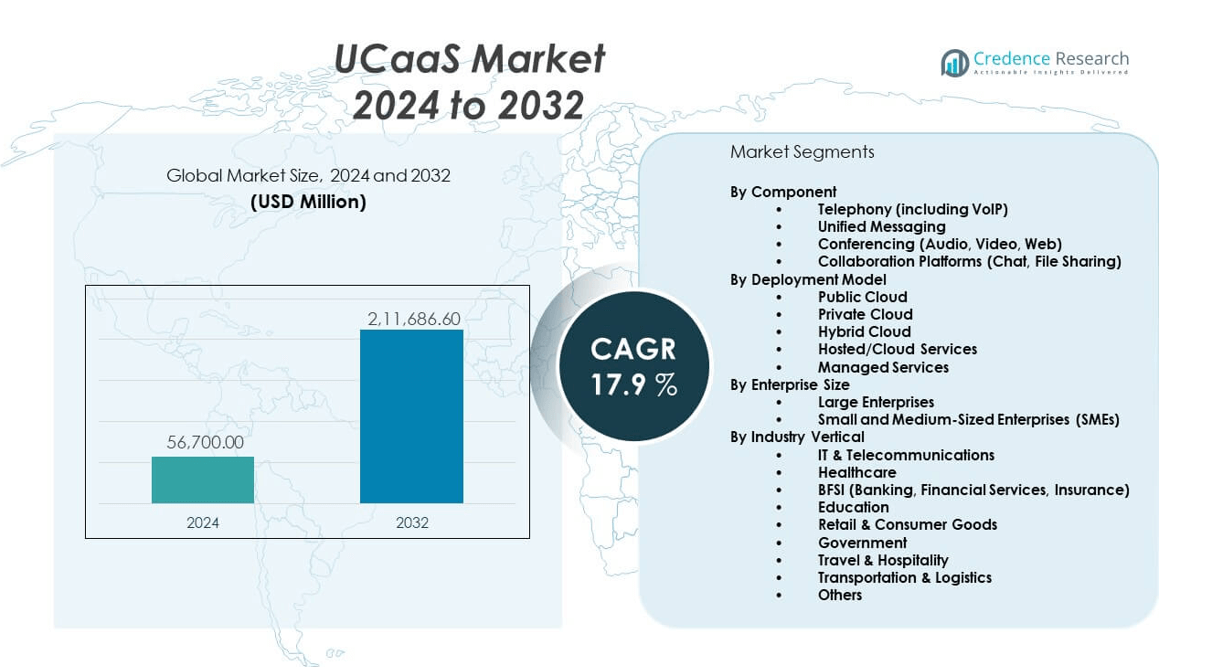

The UCaaS market is projected to grow from USD 56,700 million in 2024 to an estimated USD 211,686.6 million by 2032, with a compound annual growth rate (CAGR) of 17.9% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2019-2022 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| UCaaS market Size 2024 |

USD 56,700 million |

| UCaaS market, CAGR |

17.9% |

| UCaaS market Size 2032 |

USD 211,686.6 million |

The UCaaS market is expanding rapidly due to the increasing demand for remote work infrastructure, real-time collaboration tools, and integrated communication platforms. Organizations are adopting unified communication solutions to streamline operations, reduce costs, and improve workforce productivity. The shift toward cloud-based communication is accelerating as businesses seek scalable, secure, and flexible systems to support hybrid work models. Continuous innovation in video conferencing, messaging, and VoIP technologies fuels adoption across small to large enterprises globally.

North America leads the UCaaS market, driven by strong enterprise digitalization, high cloud adoption rates, and the presence of major service providers. Europe follows, with countries embracing regulatory-compliant collaboration tools and cross-border operations. Asia-Pacific is emerging as a high-growth region due to expanding internet penetration, increasing remote work adoption, and rising digital investments in countries like India, China, and Southeast Asia. Latin America and the Middle East are gradually expanding with improving IT infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The UCaaS market is projected to grow from USD 56,700 million in 2024 to USD 211,686.6 million by 2032, registering a CAGR of 17.9% during the forecast period.

- Growing demand for real-time collaboration, hybrid work infrastructure, and cloud-native communication platforms is driving enterprise adoption globally.

- Cost optimization, operational agility, and improved employee productivity are key drivers accelerating the shift toward unified communication services.

- Security concerns, data privacy regulations, and integration challenges with legacy systems remain critical restraints limiting full-scale adoption in some regions.

- North America holds the largest share due to early cloud adoption, strong digital infrastructure, and presence of top-tier UCaaS providers.

- Europe shows steady growth driven by GDPR-compliant solutions and adoption across regulated industries like BFSI and healthcare.

- Asia-Pacific is the fastest-growing region due to rising internet penetration, cloud investments, and remote workforce expansion across India, China, and Southeast Asia.

Market Drivers:

Rapid Adoption of Cloud Technologies Across Enterprises:

Cloud computing continues to reshape enterprise IT infrastructure, driving demand for scalable and cost-effective communication platforms. The UCaaS market benefits from organizations migrating legacy systems to cloud-based unified communications to reduce capital expenditure and streamline operations. Businesses value the flexibility and agility of cloud-based voice, video, messaging, and collaboration tools, especially under hybrid work models. Vendors deliver seamless integration with existing IT ecosystems, enhancing user experience and simplifying deployment. IT departments face growing pressure to support distributed teams and remote operations, accelerating cloud transformation. UCaaS provides secure access across devices and locations, improving workflow continuity. This shift supports faster decision-making, productivity gains, and business continuity. The UCaaS market gains momentum from enterprises prioritizing digital agility and cost-efficiency.

- For instance, Microsoft Teams, part of Microsoft’s UCaaS suite, reported over 320 million monthly active users in 2024, fueled by enterprises migrating legacy PBX systems to Microsoft’s cloud-based communications. Google Workspace’s integration of voice, chat, and video supported a 28% year-over-year growth in adoption by enterprise clients in 2023, driven by its ability to consolidate collaboration and streamline workflow across distributed workforces.

Rising Demand for Workforce Mobility and Remote Collaboration:

The global shift toward remote work and mobile-first environments drives enterprises to invest in scalable communication solutions. The UCaaS market supports distributed teams with real-time collaboration tools accessible on desktops, laptops, and mobile devices. It enables organizations to ensure workforce connectivity without location constraints. The demand for video conferencing, instant messaging, and shared workspaces has surged post-pandemic, prompting companies to replace static, on-premise systems. UCaaS platforms integrate voice, messaging, and video into unified dashboards that improve efficiency and user satisfaction. Enterprises adopt mobile UCaaS apps to empower frontline workers and remote employees. This trend aligns with business continuity planning and disaster recovery strategies. The UCaaS market responds to the growing need for uninterrupted, location-independent communication capabilities.

- For instance, Cisco Webex recorded more than 60 billion meeting minutes per month in 2023, supporting workforce mobility as over 80% of Fortune 500 companies deployed its unified platform to enable secure, real-time collaboration across desktop and mobile devices.

Cost Optimization and Streamlined IT Management:

Enterprises seek communication solutions that reduce total cost of ownership and simplify infrastructure. The UCaaS market provides a subscription-based model that eliminates the need for large upfront capital investments. It replaces multiple disjointed communication tools with a single, integrated platform, reducing vendor complexity. Businesses gain predictable billing and lower maintenance costs through managed cloud services. Centralized administration and automated updates decrease IT workload and minimize system downtime. UCaaS platforms provide scalability without physical hardware upgrades, aligning with evolving business demands. Organizations benefit from faster onboarding of new users and features. Cost-conscious businesses are prioritizing cloud adoption to gain operational efficiency and competitive advantage. The UCaaS market meets financial and administrative objectives of enterprises aiming for leaner communication strategies.

Integration with Business Applications and Analytics Tools:

Enterprises demand unified communication platforms that align with CRM, ERP, and productivity suites. The UCaaS market meets this demand by enabling native integration with tools such as Microsoft 365, Salesforce, Google Workspace, and Slack. This alignment helps businesses streamline workflows, reduce context switching, and boost user adoption. UCaaS providers offer APIs and low-code environments that facilitate customization for sector-specific needs. Embedded analytics capabilities allow businesses to monitor call quality, team performance, and user engagement in real time. Advanced reporting supports decision-making and helps in identifying communication bottlenecks. IT departments benefit from consolidated dashboards and visibility into usage metrics. This integration extends the strategic value of UCaaS investments. The UCaaS market capitalizes on demand for smarter, data-driven collaboration ecosystems.

Market Trends:

AI-Powered Enhancements to UCaaS Capabilities:

Vendors are embedding artificial intelligence across UCaaS platforms to enhance user experience and automate routine tasks. The UCaaS market evolves with features like real-time transcription, sentiment analysis, voice commands, and intelligent virtual assistants. AI-driven noise suppression, background adjustment, and meeting summarization improve productivity during virtual meetings. These technologies help reduce fatigue, ensure inclusivity, and support accessibility for diverse users. Natural language processing capabilities enable better interpretation of voice and text inputs across global teams. Machine learning algorithms optimize call routing and prioritize network traffic based on usage patterns. Smart recommendations based on historical behavior improve collaboration workflows. The UCaaS market leverages AI to deliver context-aware, intelligent communication experiences.

- For instance, Microsoft Copilot, integrated across Teams, teams that use AI-powered meeting notes experience a 30% reduction in meeting time and a 25% increase in productivity.

Expansion of Industry-Specific UCaaS Solutions:

Organizations in regulated sectors such as healthcare, finance, and legal services demand specialized UCaaS offerings. The UCaaS market addresses compliance and security needs with industry-specific features like HIPAA, FINRA, and GDPR adherence. Vendors provide pre-configured solutions tailored to the workflows of sector-specific users. These include secure messaging, call recording, and role-based access controls that meet audit and governance requirements. Vertical-focused UCaaS solutions support operational workflows such as patient consultations, remote advisory, and legal case reviews. This trend reduces deployment complexity and accelerates adoption in conservative industries. The UCaaS market expands its reach by aligning solutions with sector priorities. It builds long-term value by supporting domain-specific collaboration needs.

- For instance, 8×8 launched its Healthcare Cloud Communications solution in 2023, enabling providers to maintain HIPAA compliance with encrypted messaging and call recording—a solution now used by over 1,000 healthcare organizations in the U.S. Vonage partnered with leading financial institutions to deliver FINRA-compliant unified communications, supporting secure recordkeeping and audit-ready storage for investment advisory teams.

Unified Communications as a Service for Small and Medium Enterprises (SMEs):

SMEs seek affordable, scalable, and easy-to-deploy communication platforms to support lean operations. The UCaaS market tailors’ offerings with simplified pricing models, bundled features, and minimal onboarding requirements for small businesses. Vendors emphasize intuitive interfaces and mobile compatibility to address limited IT resources in smaller firms. SMEs adopt UCaaS to maintain professionalism and continuity in customer interactions. Cloud-native platforms support fast scaling as these businesses grow or contract. White-label partnerships and managed service models help service providers extend UCaaS to underserved markets. Localized support and language customization improve adoption in regional markets. The UCaaS market grows its base by addressing the dynamic needs of global SMEs.

Growing Use of UCaaS in Hybrid and Borderless Workplaces:

Workforce expectations around flexibility and digital collaboration have reshaped enterprise communication models. The UCaaS market supports hybrid workplace strategies by enabling seamless transitions between office, remote, and mobile environments. Organizations use UCaaS to create consistent user experiences regardless of location or device. The market sees rising demand for cloud-based platforms that unify communication tools across physical and virtual spaces. Employees benefit from integrated calendars, video calls, file sharing, and chat through centralized hubs. HR and operations teams use UCaaS analytics to track employee engagement and communication trends. The shift toward location-independent work fosters broader adoption across industries. The UCaaS market responds with solutions that support both synchronous and asynchronous workflows.

Market Challenges Analysis:

Data Security and Compliance Concerns Among Enterprise Users:

Enterprises operating in highly regulated sectors remain cautious about fully migrating to cloud-based communication platforms. The UCaaS market faces trust-related challenges due to concerns over data breaches, unauthorized access, and privacy violations. Organizations hesitate to adopt platforms unless they offer robust encryption, compliance certifications, and secure access controls. Regional data residency laws and cross-border data transfer restrictions add complexity for global deployments. Providers must invest in multi-layered security frameworks and continuous audits to reassure enterprise customers. The inability to meet evolving compliance mandates can limit market penetration, particularly in sectors like banking and government. The UCaaS market must balance innovation with stringent data protection measures to maintain customer confidence.

Interoperability Limitations and Infrastructure Dependencies:

UCaaS adoption often requires integration with existing on-premise infrastructure and third-party applications. The UCaaS market encounters resistance when platforms lack interoperability with legacy PBX systems, proprietary communication tools, or sector-specific software. Migration complexity increases when network bandwidth, latency, or compatibility issues hinder seamless deployment. Organizations may delay transitions if UCaaS offerings require infrastructure overhauls or lack hybrid deployment options. Vendors that fail to support multi-vendor ecosystems or lack open API support risk losing traction. Technical support gaps and integration bottlenecks reduce user satisfaction and increase implementation costs. The UCaaS market must address these infrastructure-related barriers to enable smooth transitions and maximize value delivery.

Market Opportunities:

Rising Demand from Emerging Economies and Underserved Segments:

Developing regions in Asia-Pacific, Latin America, and the Middle East present growth opportunities as businesses digitize and expand communication capabilities. The UCaaS market can tap into demand from local enterprises and SMEs in these regions seeking affordable, scalable, and mobile-compatible platforms. Partnerships with telecom providers, resellers, and local MSPs can strengthen presence in price-sensitive markets. The UCaaS market gains strategic value by supporting underserved businesses in digital transformation journeys.

Expansion of Embedded Communications Through CPaaS Integration:

Embedding communication functions into websites, applications, and services via CPaaS (Communication Platform as a Service) opens new use cases. The UCaaS market can expand by offering modular APIs and SDKs that support chatbots, video calls, alerts, and notifications within customer-facing applications. Businesses gain agility and differentiation by customizing communication flows, and UCaaS vendors unlock cross-market growth potential.

Market Segmentation Analysis:

By Component

The component segment of the UCaaS market includes telephony (including VoIP), unified messaging, conferencing, and collaboration platforms. Telephony remains the dominant segment due to widespread use across enterprises for internal and external communication. Conferencing tools, especially video and web conferencing, are expanding rapidly as hybrid and remote work models persist. Unified messaging integrates email, SMS, and voice into a single interface, enhancing efficiency. Collaboration platforms that enable real-time chat and file sharing are becoming essential for team productivity, particularly in distributed workforce environments.

- For instance, Microsoft Teams Phone (VoIP telephony) registered over 17 million PSTN users as of early 2024, making it one of the largest enterprise telephony solutions globally. Zoom Video Communications facilitated over 3 trillion annual meeting minutes in 2023, with conferencing being the fastest-expanding component among enterprise clients.

By Deployment Model

Public cloud holds the largest share in the deployment model segment, driven by its flexibility, scalability, and low upfront cost. Private cloud solutions appeal to organizations in regulated industries requiring enhanced control over data. Hybrid cloud adoption is rising as enterprises seek a balance between security and accessibility. Hosted/cloud services provide comprehensive solutions without internal infrastructure demands, while managed services offer ongoing support, making them ideal for organizations with limited IT resources.

- For instance, Zoom Node, rolled out in 2024, now enables select companies to balance on-premises data control with collaborative cloud services.

By Enterprise Size

Large enterprises dominate the UCaaS market by revenue share due to their global operations and complex communication needs. These organizations implement advanced UCaaS solutions to improve cross-functional collaboration and system integration. Small and medium-sized enterprises (SMEs) are the fastest-growing segment, leveraging UCaaS for cost efficiency, scalability, and customer engagement. Simplified interfaces and flexible pricing models are helping SMEs accelerate adoption across sectors.

By Industry Vertical

IT & telecommunications lead in UCaaS adoption, followed by BFSI and healthcare, where secure, real-time communication is critical. Educational institutions invest in UCaaS for remote learning and academic coordination. Retail and consumer goods firms use these platforms for customer service and supply chain communication. Government, travel, hospitality, and logistics sectors rely on UCaaS to improve operational responsiveness, workforce collaboration, and service delivery.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segmentation:

By Component

- Telephony (including VoIP)

- Unified Messaging

- Conferencing (Audio, Video, Web)

- Collaboration Platforms (Chat, File Sharing)

By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

- Hosted/Cloud Services

- Managed Services

By Enterprise Size

- Large Enterprises

- Small and Medium-Sized Enterprises (SMEs)

By Industry Vertical

- IT & Telecommunications

- Healthcare

- BFSI (Banking, Financial Services, Insurance)

- Education

- Retail & Consumer Goods

- Government

- Travel & Hospitality

- Transportation & Logistics

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Maintains Strong Leadership Driven by Cloud Maturity

North America leads the UCaaS market with a dominant share of 35.1%, supported by widespread adoption of cloud infrastructure and advanced communication technologies. Enterprises across the U.S. and Canada integrate UCaaS solutions to support hybrid work models, reduce operational costs, and improve team collaboration. The region benefits from strong presence of major providers such as Microsoft, Cisco, and RingCentral, along with favorable digital transformation policies. High penetration of mobile and broadband connectivity enables seamless access to cloud-based communication services. Businesses in sectors like IT, BFSI, and healthcare continue to prioritize unified platforms that ensure scalability and compliance. The mature enterprise environment accelerates innovation and supports sustained market expansion in North America.

Europe Gains Traction Through Regulatory Compliance and Vertical Adoption

Europe holds the second-largest share of 28.4% in the UCaaS market, driven by growing demand from sectors with complex regulatory needs. Countries like Germany, the UK, and France deploy UCaaS platforms that comply with GDPR and local data sovereignty requirements. Enterprises in manufacturing, finance, and public services adopt these solutions to improve cross-border communication and operational efficiency. Cloud migration initiatives across Western and Northern Europe support uptake of unified platforms with built-in security and collaboration features. The region sees steady demand for vertical-specific UCaaS offerings tailored for compliance, multilingual support, and sector customization. Vendor partnerships with local telecom operators improve regional delivery and expand customer reach.

Asia-Pacific Emerges as High-Growth Region with Strong SME Participation

Asia-Pacific accounts for 22.1% of the UCaaS market, showing strong growth driven by increasing digitization across emerging economies. Countries like China, India, Japan, and Australia invest in cloud-based communication to support agile, mobile-enabled workforces. SMEs across urban and semi-urban areas adopt UCaaS to enhance customer service, reduce IT complexity, and scale operations affordably. Telecom-led deployments and regional cloud infrastructure expansion accelerate service availability. Language localization, mobile-first solutions, and bundled offerings improve adoption across diverse industries. The region benefits from government-backed digital initiatives and rising internet penetration. Asia-Pacific continues to gain relevance in the UCaaS market with expanding demand across mid-sized enterprises and tech-forward startups.

Key Player Analysis:

- Microsoft Corporation (Teams)

- Cisco Systems, Inc. (Webex)

- RingCentral, Inc.

- 8×8, Inc.

- Zoom Video Communications, Inc.

- Vonage

- Avaya Inc.

- Mitel Networks Corp.

- Google (Google Meet, Google Voice)

- Intermedia

- Tata Communications

- Verizon Communications, Inc.

- BT Group plc

- GoTo (formerly LogMeIn)

- Comcast (Masergy)

- Windstream

- Nextiva

- Aircall

- Dstny

- Gamma

- Enreach

Competitive Analysis:

The UCaaS market is highly competitive, with global technology leaders and specialized vendors vying for market share. Key players such as Microsoft, Cisco, RingCentral, Zoom, and 8×8 dominate through comprehensive platforms and strong enterprise relationships. These companies invest heavily in feature enhancements, AI integration, and global infrastructure to differentiate their offerings. Competition centers on scalability, security, ease of integration, and user experience. Mid-sized and emerging providers like Vonage, Nextiva, and Aircall compete by targeting SMEs with simplified pricing and vertical-specific solutions. Strategic partnerships, reseller networks, and product bundling help firms strengthen customer retention. The market favors innovation and rapid deployment, rewarding vendors that align closely with evolving enterprise communication needs.

Recent Developments:

- In July 2025, Microsoft Corporation introduced new multilingual meeting features for Teams, allowing interpreters to be added to meetings so participants can select channels for real-time translation. This follows a major transition: as of July 1, 2025, all users must move from the classic Teams app to the updated version across all supported platforms, as the classic app is now officially retired. Recent updates also include enhanced spell check, flexible notification placement, and improved calendar integration across Teams and Outlook.

- In June 2025, Cisco Systems, Inc. delivered a suite of AI-driven enhancements to Webex at Cisco Live in San Diego. Highlights include a new AI Receptionist, AI voice-powered call handling, MMS text support in Webex Calling, instant voicemail transcription, and seamless integration of Webex Calling into Microsoft Teams. New features also include smarter meeting device management and expanded in-call analytics, further supporting hybrid work and customer experience innovation.

- In June 2025, RingCentral, Inc. released updates to its desktop and events platforms, improving performance, annotation tools, and notification options. The June release also enhanced event analytics by enabling integration with HubSpot, providing organizers better visitor engagement tracking. The Certified Delivery Partner program expanded globally, supporting large-scale enterprise UCaaS deployments and achieving 35% annual growth.

- In July 2025, Zoom Video Communications, launched a new Auto Dialer for outbound AI-driven calling, released RealTime Media Streams (direct access to video and transcript data), and made major AI Companion upgrades. Meeting capacity was also increased to 3,000 and 5,000 participants for large events. AI-powered translation, third-party app integrations, and improved onboarding experiences were added to further streamline collaboration.

Market Concentration & Characteristics:

The UCaaS market exhibits moderate-to-high concentration, led by a few dominant global players with extensive cloud ecosystems. It features a mix of platform giants, telecom operators, and pure-play vendors. The market shows high innovation intensity, driven by AI integration, cross-platform compatibility, and cloud-native design. Vendors compete on service reliability, security compliance, pricing models, and regional data residency. It supports a broad customer base across enterprise sizes and verticals, making versatility a key success factor.

Report Coverage:

The research report offers an in-depth analysis based on component, enterprise size, industry vertical and deployment model segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand will grow due to permanent shifts toward hybrid and remote work models

- AI and automation will redefine productivity features across UCaaS platforms

- SMEs will accelerate adoption driven by affordable subscription models

- Public cloud deployment will continue to dominate over on-premise alternatives

- Industry-specific solutions will expand, particularly in healthcare and finance

- Integration with collaboration and CRM tools will become standard practice

- Providers will invest in data security and compliance features to attract regulated sectors

- Regional expansion will intensify across Asia-Pacific and Latin America

- Strategic alliances between telecom providers and UCaaS vendors will increase

- Real-time analytics and user behavior insights will shape platform improvements