Market Overview:

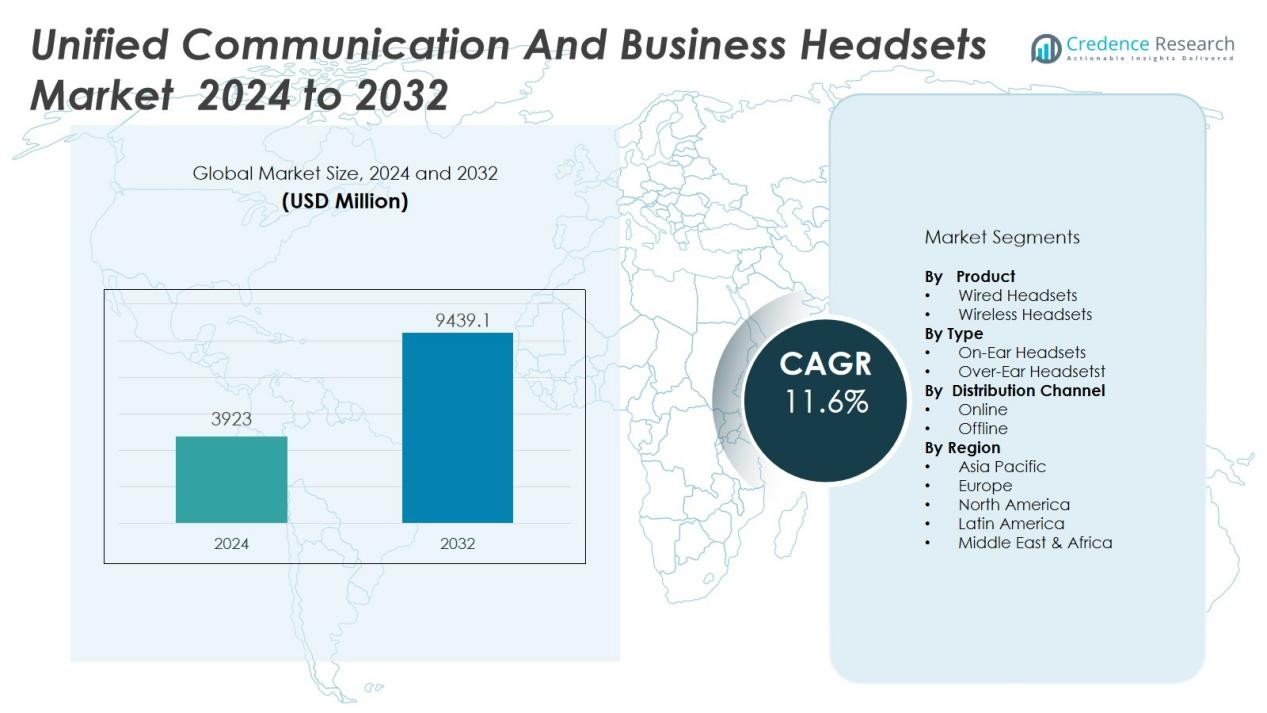

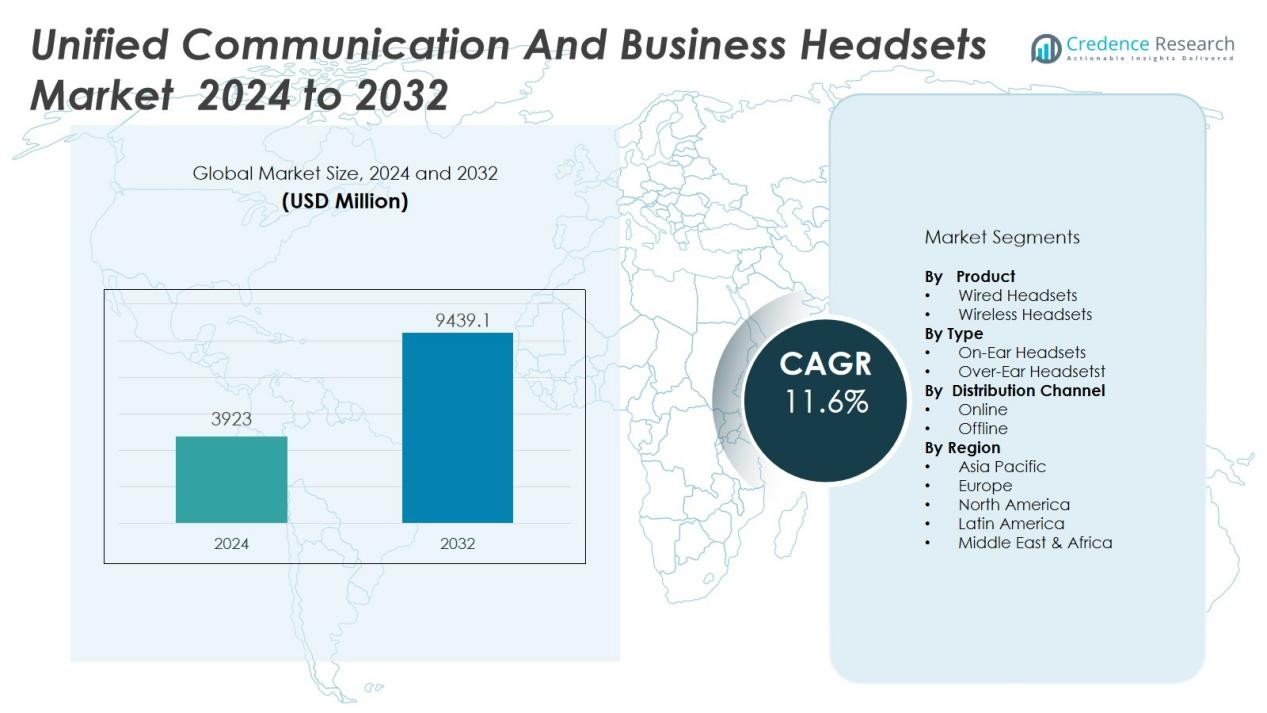

The Unified communication and business headsets market size was valued at USD 3923 million in 2024 and is anticipated to reach USD 9439.1 million by 2032, at a CAGR of 11.6 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Unified communication and business headsets Market Size 2024 |

USD 3923 Million |

| Unified communication and business headsets Market, CAGR |

11.6 % |

| Unified communication and business headsets Market Size 2032 |

USD 9439.1 Million |

Market drivers include the surge in virtual meetings, webinars, and collaborative workflows across industries such as IT, BFSI, healthcare, and education. Demand for noise-canceling technology, wireless connectivity, and integration with unified communication platforms fuels innovation in headset design and functionality. Organizations prioritize solutions that offer superior audio clarity, user comfort, and compatibility with multiple devices to ensure effective communication in dynamic work environments.

North America dominates the unified communication and business headsets market, driven by early technology adoption and high enterprise IT spending. Europe follows, supported by strict regulatory standards for workplace ergonomics and communication efficiency. The Asia-Pacific region exhibits rapid growth due to expanding corporate sectors, increasing digital transformation, and a rising remote workforce in countries such as China, India, and Japan.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The market was valued at USD 3,923 million in 2024 and is set to reach USD 9,439.1 million by 2032.

- Hybrid and remote work adoption drives demand for advanced headsets supporting seamless virtual collaboration.

- Wireless and noise-canceling headsets gain traction, driven by user need for flexibility and superior audio clarity.

- Integration with platforms like Microsoft Teams and Zoom fuels product innovation and enhances connectivity.

- Price sensitivity and intense competition create challenges for vendors to balance innovation with affordability.

- North America leads with 38% market share due to high technology adoption and strong enterprise IT investment.

- Asia-Pacific exhibits the fastest growth, driven by digital transformation, expanding corporate sectors, and a rising remote workforce.

Market Drivers:

Adoption of Hybrid and Remote Work Models Fuels Demand:

The Unified communication and business headsets market grows as organizations adopt hybrid and remote work models. Enterprises require advanced audio solutions to support seamless communication across geographically dispersed teams. It drives the need for high-performance headsets that ensure audio clarity, reliability, and user comfort in virtual meetings. Companies prioritize headsets compatible with unified communication platforms to improve collaboration and productivity.

- For instance, Poly Savi 8200 Series, including the 8220 model, delivers up to 590 ft (180 meters) of wireless talk range and up to 13 hours of talk time on a single charge, enabling professionals to stay connected and productive throughout the workday without interruption.

Rising Integration with Unified Communication Platforms Enhances Value:

Unified communication and business headsets now offer greater integration with leading platforms such as Microsoft Teams, Zoom, and Cisco Webex. Businesses seek solutions that facilitate effortless connectivity across multiple devices and software environments. This trend strengthens demand for headsets with built-in controls, plug-and-play features, and enhanced interoperability. It encourages continuous innovation in headset design and feature sets.

Emphasis on Noise Cancellation and User Comfort Drives Innovation:

Market growth is propelled by increasing demand for noise-canceling technology and ergonomic designs. Professionals working in open offices or remote settings require headsets that reduce background noise and enhance voice clarity. Manufacturers invest in research to deliver products that prioritize comfort during extended use and deliver superior sound quality. It supports higher user satisfaction and operational efficiency.

- For instance, Sony’s WH-1000XM4 headphones offer industry-leading noise cancellation with dual noise sensor technology and deliver up to 30 hours of battery life for uninterrupted all-day use, highlighting both comfort and technical achievement in user experience.

Focus on Digital Transformation and IT Infrastructure Upgrades Supports Expansion:

Enterprises are investing in digital transformation initiatives, modernizing their IT infrastructure, and deploying unified communication tools. This shift supports the adoption of advanced business headsets that align with cloud-based collaboration solutions and flexible work strategies. The Unified communication and business headsets market benefits as organizations prioritize solutions that improve workflow integration, security, and scalability. It underpins the sustained expansion of the market globally.

Market Trends:

Rising Preference for Wireless and Smart Headsets Shapes Product Development:

The Unified communication and business headsets market sees strong momentum in wireless and smart headset adoption. Enterprises favor wireless models that offer flexibility and support mobility for users working from different locations or on the move within offices. Bluetooth-enabled devices, longer battery life, and quick charging features gain traction among corporate buyers. Voice-activated controls, touch-sensitive interfaces, and integration with virtual assistants such as Siri, Alexa, and Google Assistant further drive user adoption. It prompts manufacturers to focus on designing lightweight, portable headsets with intelligent features that meet evolving workplace demands. This trend leads to broader acceptance of headsets in dynamic business environments, reinforcing innovation across the industry.

- For instance, Apple’s AirPods Pro (2nd generation) offer up to 6 hours of listening time on a single charge and are equipped with personalized spatial audio and seamless integration with Siri, supporting efficient hands-free interaction in corporate workflows.

Growing Demand for Advanced Audio Technology and AI Integration Enhances User Experience:

Market participants emphasize audio quality by incorporating advanced sound engineering, AI-driven noise cancellation, and adaptive microphones into their product portfolios. Organizations seek headsets that minimize background noise and optimize speech recognition, supporting productivity during virtual meetings and calls. AI-powered features, such as automatic voice level adjustment and background sound analysis, elevate user experience and set new standards for business communication tools. The Unified communication and business headsets market benefits from continuous advancements in audio processing and cloud-based software updates. It positions leading brands to differentiate their offerings through technology, creating new opportunities for growth and customer engagement.

- For instance, Orosound Labs’ AI-driven ANC adapts to real-time sound environments and user physiology, delivering up to 40dB attenuation with 48kHz per second adaptive noise management and 5μs low latency for seamless transitions.

Market Challenges Analysis:

Pricing Pressures and Intense Market Competition Limit Profit Margins:

The Unified communication and business headsets market faces pricing pressures due to intense competition and a large number of vendors. Price-sensitive customers compare multiple brands and expect feature-rich headsets at lower costs. It creates challenges for manufacturers to balance innovation with affordability. New entrants and generic brands further compress margins for established players. Cost-driven procurement in large enterprises intensifies the need for discounts and flexible pricing. Sustaining profitability in such an environment requires continuous operational efficiency and strategic differentiation.

Technical Compatibility and Integration Issues Hinder Seamless Adoption:

Frequent updates in unified communication platforms and diverse enterprise IT environments create technical compatibility concerns for headset vendors. Organizations require headsets that integrate flawlessly with multiple devices, operating systems, and collaboration tools. It raises the complexity of product development and support. Lack of universal standards often leads to inconsistent user experiences and increased support costs for IT teams. Businesses may face delays in large-scale headset rollouts or experience resistance from users accustomed to legacy devices. Overcoming these integration challenges is critical for wider adoption and customer satisfaction.

Market Opportunities:

Expansion of Hybrid Work Models and Emerging Markets Presents New Growth Frontiers:

The Unified communication and business headsets market gains new opportunities from the rapid expansion of hybrid work models and growth in emerging economies. Organizations across sectors adopt flexible work arrangements, increasing the demand for high-quality headsets that support productivity in remote and office environments. Companies entering new markets such as Southeast Asia, Latin America, and Africa benefit from rising digitalization and corporate investment in communication technology. It enables vendors to reach untapped customer segments and address evolving enterprise needs. Customizing solutions for different languages, regulatory standards, and network conditions unlocks further market growth.

Integration with Advanced Collaboration Tools and Smart Technologies Drives Value Creation:

Vendors in the Unified communication and business headsets market can create value by integrating products with advanced collaboration tools and smart technologies. Headsets that connect seamlessly with unified communication platforms, AI-driven applications, and cloud-based management systems attract enterprise buyers. It opens pathways for subscription-based services, remote device management, and real-time analytics. Expanding feature sets to include health monitoring, biometric authentication, and voice assistance addresses new business requirements. Companies that innovate in software and hardware integration stand to capture greater market share and improve customer loyalty.

Market Segmentation Analysis:

By Product:

The Unified communication and business headsets market segments by product into wired and wireless headsets. Wireless headsets command the largest share, driven by growing demand for flexibility, mobility, and ease of use in hybrid and remote work environments. Enterprises prefer wireless models for their seamless integration with unified communication platforms and enhanced user comfort. Wired headsets retain relevance in call centers and budget-conscious organizations, where reliability and cost efficiency are critical.

- For instance, the Sennheiser HD 300 Pro wired headset delivers superior ambient noise attenuation of up to 32 dB, ensuring dependable performance and clear communication even in loud environments.

By Type:

By type, the market divides into on-ear and over-ear headsets. Over-ear headsets dominate due to their superior noise-canceling capabilities and user comfort during extended use. Professionals working in busy office settings or open workspaces value the enhanced audio isolation these headsets provide. On-ear headsets appeal to users seeking lightweight designs and portability, making them suitable for short calls and mobile professionals.

- For instance, Bose QuietComfort Ultra headphones achieve up to 24 hours of continuous playback, leveraging microphones both inside and outside the earcups for real-time noise cancellation adaptation.

By Distribution Channel:

The Unified communication and business headsets market includes distribution channels such as online and offline sales. Online channels experience robust growth due to rising preference for digital procurement, wide product variety, and transparent pricing. Enterprises and individual buyers utilize e-commerce platforms for convenient comparison and fast delivery. Offline channels, including specialty stores and authorized dealers, remain important for customers who require product demonstrations and immediate technical support.

- Eartec has solidified its presence in the offline segment by providing full duplex wireless communication systems capable of supporting up to 16 crew members with a battery life of 10 hours per device, which are widely adopted for instant demonstrations and deployment by enterprise clients globally.

Segmentations:

By Product:

- Wired Headsets

- Wireless Headsets

By Type:

- On-Ear Headsets

- Over-Ear Headsets

By Distribution Channel:

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America :

North America holds 38% share of the Unified communication and business headsets market, driven by robust technology adoption and high enterprise IT spending. Organizations across the United States and Canada invest in advanced communication tools to support hybrid and remote workforces. Leading companies adopt high-performance headsets to ensure seamless integration with unified communication platforms and improve team collaboration. The region benefits from established distribution networks and rapid deployment of new audio technologies. Enterprises in North America prioritize employee well-being and productivity, fueling demand for ergonomic and feature-rich headset solutions. Regulatory standards and data security requirements encourage adoption of secure and compatible devices.

Europe :

Europe commands 29% share of the Unified communication and business headsets market, supported by widespread digital transformation and a focus on workplace ergonomics. Enterprises in Germany, the United Kingdom, France, and Nordic countries emphasize efficient communication tools and employee comfort. Organizations invest in noise-canceling headsets and wireless solutions that comply with local regulatory standards. The European market values integration with leading unified communication platforms, supporting digitalization strategies across industries. Demand for sustainability and eco-friendly materials influences purchasing decisions. The presence of global and regional vendors strengthens market competition and drives ongoing product innovation.

Asia-Pacific:

Asia-Pacific holds 23% share of the Unified communication and business headsets market and displays the fastest growth rate among major regions. Countries such as China, India, Japan, and South Korea experience a surge in corporate digitalization and remote workforce adoption. Enterprises invest in unified communication headsets to enhance collaboration, reduce travel costs, and increase operational efficiency. Rapid urbanization, increasing internet penetration, and investments in IT infrastructure create new opportunities for headset manufacturers. Local and international vendors compete to serve diverse customer needs, driving product availability and affordability. The region’s growth trajectory is sustained by rising demand from small and medium enterprises and large multinational corporations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Agero Inc.

- Mitacs

- Aplicom

- Octo Telematics S.p.A

- Masternaut Limited.

- Meta System S.p.A

- TomTom Telematics BV

- TRIMBLE INC.

- MiX Telematics.

- Sierra Wireless

Competitive Analysis:

The Unified communication and business headsets market features intense competition among global and regional players focused on product innovation, integration, and user experience. Leading companies such as Agero Inc., Mitacs, Aplicom, Octo Telematics S.p.A, Masternaut Limited, Meta System S.p.A, TomTom Telematics BV, and TRIMBLE INC. drive advancements in wireless technology, noise-canceling features, and smart integration with unified communication platforms. It emphasizes strong brand presence, extensive distribution networks, and continuous product development to capture market share. Companies invest in R&D to enhance audio quality, battery life, and device compatibility across hybrid work environments. Strategic partnerships, mergers, and new product launches strengthen market positions and expand customer reach. The competitive landscape remains dynamic, shaped by evolving business needs and the demand for reliable, scalable, and high-performance headset solutions.

Recent Developments:

- In May, 2024, Meta System announced it will build a new electronics facility for e-mobility production, managed with Critical Manufacturing’s MES system.

- In February 2025, BMW and Volvo confirmed their commitment to continue contract with Meta System in Italy.

Market Concentration & Characteristics:

The Unified communication and business headsets market features a moderate-to-high level of concentration, with a few global players such as Jabra (GN Audio), Plantronics (Poly/HP), Logitech, and Sennheiser holding significant market shares. It demonstrates strong brand loyalty and frequent innovation, as leading companies introduce advanced wireless, AI-driven, and ergonomic headset solutions. The market attracts new entrants and regional vendors, but established brands maintain competitive advantage through integrated software, reliability, and customer support. It is characterized by continuous product development, high emphasis on interoperability, and growing demand for headsets that meet evolving enterprise communication needs.

Report Coverage:

The research report offers an in-depth analysis based on Product, Type, Distribution Channel and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Unified communication and business headsets market tightens integration with UCaaS platforms, aligning hardware seamlessly with cloud-native communication tools. Users gain simplified device management and faster deployment.

- AI-powered features become standard. It enables automatic voice level adjustment, emotion detection, transcription, and background analysis to optimize call clarity and productivity.

- Personalizable audio profiles gain traction. It allows enterprises to offer users customized sound settings tailored to their acoustic environments and communication habits.

- Portable true‑wireless earbuds and lightweight headsets gain demand. It supports mobility during hybrid work and in teamwork across multiple on-site locations.

- Hybrid work adoption strengthens demand for robust, high-quality headsets built for both remote and on-premise collaboration. It supports business continuity and workflow resilience.

- Demand for enterprise-grade noise cancellation and adaptive microphones grows. It enhances audio clarity in open offices and remote settings.

- Augmented reality (AR) meetings and virtual collaboration tools create demand for headset compatibility with immersive environments and real-time interaction features.

- Enterprise rollouts leverage cloud-based device management, remote diagnostics, and analytics dashboards. It supports centralized control and cost-efficient deployment.

- Growth in emerging markets, particularly Asia-Pacific and Latin America, opens fresh revenue streams. Vendors can tailor products to local language, regulatory, and network needs.

- Sustainability and eco-friendly materials influence purchasing decisions. It creates opportunities for brands adopting green design and packaging to differentiate in enterprise deals.