| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vacuum Insulation Panels Market Size 2023 |

USD 8145.6 Million |

| Vacuum Insulation Panels Market, CAGR |

4.8% |

| Vacuum Insulation Panels Market Size 2032 |

USD 12421.52 Million |

Market Overview:

Global Vacuum Insulation Panels Market size was valued at USD 8145.6 million in 2023 and is anticipated to reach USD 12421.52 million by 2032, at a CAGR of 4.8% during the forecast period (2023-2032).

The global vacuum insulation panels (VIPs) market is primarily driven by the growing demand for energy-efficient building materials, which is fueled by stringent energy conservation regulations in various regions. As governments and industries worldwide push for sustainable building practices and reduced energy consumption, VIPs have become a preferred choice for insulation solutions in both residential and commercial construction. The rise in energy prices and the growing need for improved thermal performance in buildings further support the demand for VIPs. Additionally, the expansion of cold chain logistics and the increasing demand for temperature-sensitive storage and transportation of perishable goods are significant drivers for the market. VIPs are highly valued in refrigeration, especially in sectors such as food, pharmaceuticals, and logistics, where maintaining precise temperature control is crucial.

Geographically, the Asia-Pacific region leads the global VIPs market, driven by rapid urbanization, industrial growth, and substantial investments in energy-efficient infrastructure. Countries like China and India are at the forefront of adopting sustainable construction practices and expanding their cold chain capabilities, thus increasing the demand for VIPs. North America and Europe are also significant markets, with strict environmental regulations and a growing focus on sustainability driving the adoption of VIPs in construction projects. In these regions, VIPs are gaining traction in residential, commercial, and industrial applications as building codes become more energy-conscious. The ongoing trend toward green buildings and renewable energy solutions in these areas further amplifies the demand for high-performance insulation materials like VIPs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The global vacuum insulation panels (VIPs) market is valued at USD 8,145.6 million in 2023 and is projected to reach USD 12,421.52 million by 2032, growing at a CAGR of 4.8% during the forecast period.

- The rising demand for energy-efficient building materials is a major driver of the market, as governments worldwide implement stringent energy conservation regulations.

- VIPs are increasingly used in both residential and commercial construction due to their superior thermal performance, making them ideal for energy-efficient buildings, retrofits, and renovations.

- The expansion of cold chain logistics, especially in food, pharmaceuticals, and biotechnology industries, significantly boosts the demand for VIPs in temperature-sensitive storage and transportation applications.

- Technological advancements in VIP manufacturing, including innovations in core materials and barrier films, are enhancing the performance and durability of VIPs, thereby opening new opportunities in sectors like electronics, aerospace, and automotive.

- Government regulations and sustainability initiatives, such as green building certifications, are accelerating the adoption of VIPs in construction projects across North America and Europe.

- The high initial cost of VIPs and concerns about their long-term durability and limited availability pose challenges to market growth, particularly in emerging markets where cost-effective alternatives are prevalent.

Market Drivers:

Rising Demand for Energy-Efficient Building Materials

One of the key drivers of the global vacuum insulation panels (VIPs) market is the increasing demand for energy-efficient building materials. As governments across the globe implement stringent energy efficiency standards and building codes, the need for advanced insulation solutions has escalated. VIPs, known for their exceptional thermal performance, are being adopted as a sustainable alternative to traditional insulation materials. Their ability to provide superior insulation in a thinner profile makes them ideal for applications where space is at a premium, such as in energy-efficient buildings, retrofits, and renovations. For instance, Panasonic Corporation has integrated vacuum insulation panels into its “ECONAVI” refrigerators and home appliances, reporting a reduction in annual energy consumption compared to previous models using conventional insulation. The growing focus on reducing energy consumption and greenhouse gas emissions in residential and commercial construction is significantly contributing to the uptake of VIPs.

Expansion of Cold Chain Logistics

The global expansion of cold chain logistics is another key driver for the VIPs market. Cold chain logistics is a vital component of industries such as pharmaceuticals, food, and biotechnologies, where precise temperature control is crucial for product safety and quality. VIPs are particularly effective in maintaining temperature stability during the storage and transportation of temperature-sensitive goods. With the increasing demand for perishable products globally, including frozen food, vaccines, and other pharmaceutical products, the need for high-performance insulation solutions has become more pronounced. VIPs provide a cost-effective and highly efficient solution for ensuring the integrity of goods throughout the cold chain, driving their adoption in refrigerated transportation and storage facilities.

Technological Advancements in VIPs

Technological advancements in vacuum insulation panels are also driving the market. Manufacturers are continuously improving the performance of VIPs by developing new materials and techniques that enhance their thermal conductivity and structural integrity. For instance, va-Q-tec has introduced the va-Q-check® quality control system, which allows for rapid and accurate monitoring of the vacuum status within each panel, ensuring long-term performance and reliability. Innovations such as the incorporation of advanced core materials and barrier films have increased the lifespan and reliability of VIPs, making them even more attractive for a variety of applications. These advancements are opening up new opportunities for VIPs in industries beyond construction, such as in electronics, automotive, and aerospace, where space-saving and thermal management are critical. As these technologies evolve, VIPs are expected to become more affordable, further increasing their adoption across various sectors.

Government Regulations and Sustainability Initiatives

Government regulations and sustainability initiatives are crucial drivers in the growth of the global VIPs market. Various countries, particularly in North America and Europe, have implemented strict regulations to reduce energy consumption and carbon emissions in buildings. These regulations often encourage the use of sustainable and high-performance insulation materials such as VIPs. Additionally, sustainability initiatives, such as green building certifications (e.g., LEED), are driving the adoption of VIPs in construction projects. As more companies and governments prioritize environmental responsibility, VIPs offer a viable solution to meet these sustainability goals. The combination of government incentives and a growing corporate focus on eco-friendly practices is accelerating the global adoption of VIPs in a range of industries.

Market Trends:

Growing Adoption in the Construction Industry

The global vacuum insulation panels (VIPs) market is experiencing a notable trend in the increased adoption of these panels within the construction industry. The demand for VIPs is being driven by the growing focus on energy-efficient buildings and sustainable architecture. As urbanization continues to accelerate, particularly in emerging markets such as Asia-Pacific and Latin America, there is a strong push for modern, high-performance building materials that support energy conservation efforts. VIPs are becoming a standard in green buildings due to their superior insulation properties, which help reduce heating and cooling costs while enhancing overall building energy efficiency. The trend toward eco-friendly building practices, coupled with government incentives for sustainable construction, is expected to continue fueling VIP adoption in residential, commercial, and industrial applications.

Integration of Advanced Materials and Designs

A key trend shaping the VIPs market is the integration of advanced materials and innovative designs aimed at improving the performance and versatility of vacuum insulation panels. Manufacturers are investing in research and development to enhance the thermal conductivity, mechanical properties, and durability of VIPs. The development of new barrier films, composite core materials, and flexible VIP designs has expanded the range of applications for these panels. This trend is evident in the growing use of VIPs in sectors such as automotive, aerospace, and electronics, where space optimization and efficient thermal insulation are critical. With these advancements, VIPs are increasingly being utilized in applications that were once dominated by traditional insulation materials, further contributing to market expansion.

Expansion in the Cold Chain Logistics Sector

Another significant trend in the global VIPs market is the growing demand for high-performance insulation solutions in cold chain logistics. As the global food and pharmaceutical industries expand, the need for advanced refrigeration technologies has increased. For instance, Pluss Advanced Technologies has developed Celsure® XL VIP Pallets, which combine VIPs with phase change material (PCM) technology to maintain precise temperature conditions for highly sensitive pharmaceuticals, vaccines, and clinical trial materials during transport and storage. VIPs are gaining traction in the cold chain sector due to their ability to maintain low temperatures while minimizing space and energy consumption. In the food industry, VIPs help preserve the quality and freshness of perishable goods, while in pharmaceuticals, they ensure the safe transport of temperature-sensitive drugs and vaccines. The increasing emphasis on food safety and drug efficacy is pushing the demand for VIPs, positioning them as a key solution for companies looking to optimize their logistics operations.

Focus on Sustainability and Regulatory Compliance

A growing trend within the VIPs market is the increasing emphasis on sustainability and regulatory compliance. Governments worldwide are setting stricter standards for energy efficiency in buildings, transportation, and manufacturing processes, which is driving the demand for high-performance materials like VIPs. VIPs contribute to reducing carbon footprints by providing superior thermal insulation with minimal material usage, making them an ideal solution for industries looking to comply with environmental regulations. For instance, va-Q-tec, a leading manufacturer, reports that all its VIPs are certified according to ISO standard 14021 and are produced climate-neutrally in Germany, using recycled materials and sustainable power generation methods. Additionally, the growing trend of corporate social responsibility (CSR) is encouraging companies to adopt green technologies, further accelerating the adoption of VIPs in sectors ranging from construction to logistics. As sustainability becomes a central focus for both governments and businesses, the demand for VIPs is expected to rise, in line with global efforts to reduce energy consumption and environmental impact.

Market Challenges Analysis:

High Initial Cost

One of the key restraints in the global vacuum insulation panels (VIPs) market is the relatively high initial cost of VIPs compared to traditional insulation materials. The manufacturing process of VIPs involves complex technology, including vacuum-sealing techniques and the use of specialized core materials and barrier films. These processes contribute to higher production costs, which can be a barrier for widespread adoption, particularly in cost-sensitive industries and regions. Although VIPs offer long-term energy savings and performance benefits, the upfront cost remains a significant challenge, especially for small and medium-sized enterprises that may not have the capital to invest in high-cost materials.

Limited Availability and Durability Concerns

Another challenge faced by the VIPs market is the limited availability of high-quality vacuum insulation panels and concerns related to their long-term durability. For example, va-Q-tec, a leading VIP manufacturer, notes that although their panels can insulate up to ten times better than traditional materials, there is a risk of vacuum loss over time due to punctures or damage to the vacuum-tight envelope, which is not always visible to the naked eye. The performance of VIPs can be affected over time due to factors such as vacuum degradation, moisture penetration, and physical damage to the panels. As VIPs are susceptible to punctures and other structural issues, their lifespan can be shorter compared to traditional insulation materials. Additionally, the availability of high-quality VIPs is still limited in some regions, which can hinder market growth, particularly in emerging economies where demand for cost-effective, energy-efficient solutions is growing rapidly.

Technological Limitations and Manufacturing Challenges

Technological limitations in VIPs production processes also pose a challenge. Although advancements are being made in enhancing the performance of VIPs, manufacturing these panels to meet varying industry specifications while maintaining affordability remains difficult. The complexity of producing VIPs with consistent quality and thermal efficiency limits their scalability and increases production time. As a result, achieving cost-effective mass production without compromising on the performance and quality of the panels is a significant hurdle that manufacturers continue to face.

Competition from Alternative Insulation Materials

The VIPs market also faces significant competition from alternative insulation materials, such as expanded polystyrene (EPS), polyurethane foam, and fiberglass, which are more affordable and readily available. These materials, although not as thermally efficient as VIPs, have been widely adopted in various industries due to their lower cost and ease of application. The competition from these well-established alternatives presents a challenge for the broader adoption of VIPs, especially in price-sensitive markets.

Market Opportunities:

The global vacuum insulation panels (VIPs) market presents significant opportunities in emerging markets, particularly in Asia-Pacific, Latin America, and parts of Africa, where rapid urbanization and infrastructure development are driving demand for energy-efficient building materials. As these regions continue to experience economic growth, there is a rising need for sustainable construction practices, which offers a substantial opportunity for VIPs. The increasing adoption of green building standards and energy-efficient building codes in countries like India, China, and Brazil is expected to fuel the demand for advanced insulation materials. Additionally, the growth of the cold chain logistics sector in these regions, driven by expanding food and pharmaceutical industries, provides another opportunity for VIP manufacturers to tap into the market. As these economies transition toward more sustainable and energy-conscious practices, the demand for high-performance insulation materials like VIPs is poised to increase significantly.

Another key opportunity in the VIPs market lies in ongoing technological advancements and product development. Manufacturers are investing in research and development to improve the efficiency, durability, and cost-effectiveness of VIPs. Innovations such as the development of more robust barrier films, improved core materials, and flexible panel designs are creating new avenues for VIP applications across industries such as automotive, aerospace, and electronics. As these technologies advance, VIPs are expected to become more affordable and versatile, expanding their potential use in a wide range of sectors beyond construction. This presents a significant growth opportunity, as industries continue to seek lightweight, energy-efficient solutions to optimize space and reduce thermal loss. The ongoing development of VIPs is likely to enhance their appeal and adoption in both existing and untapped markets.

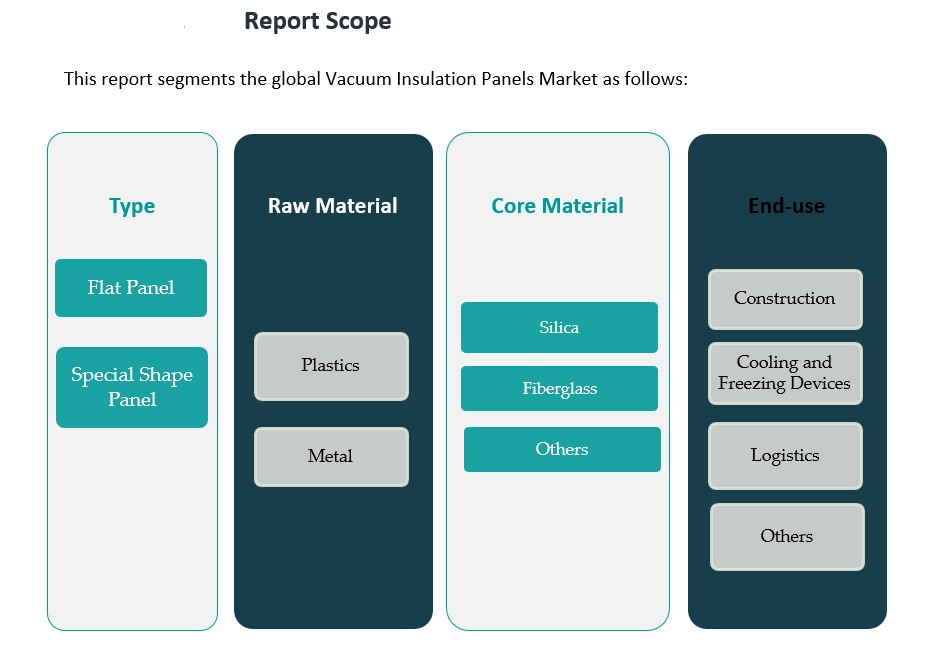

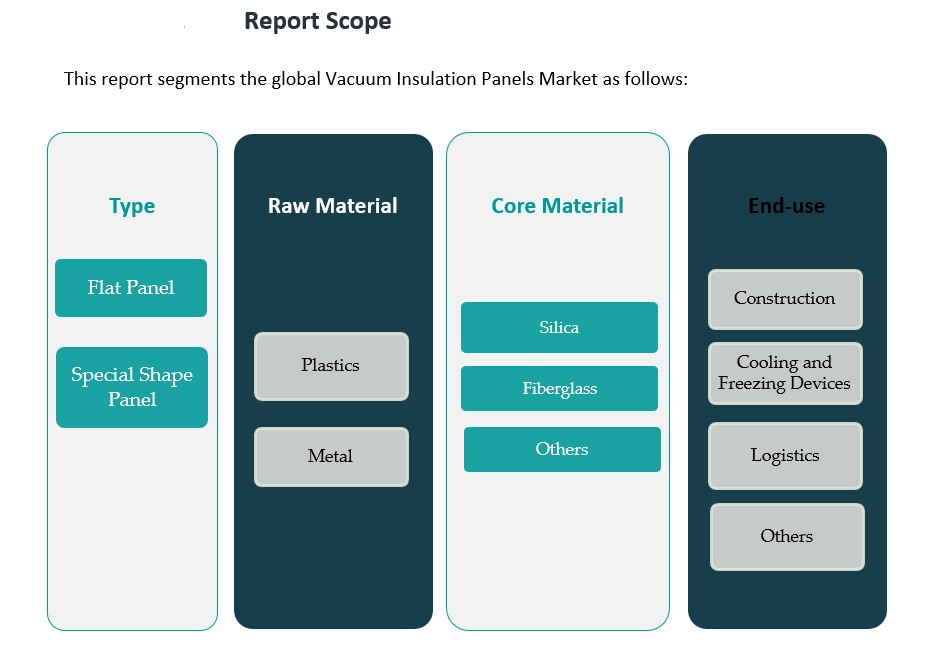

Market Segmentation Analysis:

The global vacuum insulation panels (VIPs) market is segmented into various categories based on type, raw material, core material, and end-use applications, each contributing to the market’s growth in distinct ways.

By Type Segment:

The market is primarily divided into Flat Panels and Special Shape Panels. Flat panels dominate the market due to their widespread use in building construction and refrigeration applications. Special shape panels, however, are gaining traction due to their versatility and use in complex or customized applications, such as aerospace and automotive industries, where unique shapes and dimensions are required.

By Raw Material Segment:

VIPs are produced using various raw materials, with Plastics and Metal being the most common. Plastics are favored for their cost-effectiveness and ease of fabrication, while metal panels provide enhanced durability and performance under extreme conditions. The choice of raw material influences the application, cost, and thermal performance of the panels.

By Core Material Segment:

The core materials used in VIPs include Silica, Fiberglass, and other materials. Silica is commonly used for its high thermal performance and insulation efficiency, while Fiberglass offers a balance of strength and insulation properties. Other materials are utilized in niche applications, providing alternatives where specialized properties are needed.

By End-Use Segment:

VIPs find application in Construction, Cooling and Freezing Devices, and Logistics, among others. The construction sector is the largest end-use segment, driven by the demand for energy-efficient buildings. Cooling and freezing devices, including refrigeration and cryogenic storage, also drive the demand for VIPs due to their excellent thermal insulation properties. The logistics sector, particularly in temperature-sensitive transportation, further contributes to market growth.

Segmentation:

By Type Segment

- Flat Panel

- Special Shape Panel

By Raw Material Segment

By Core Material Segment

By End-Use Segment

- Construction

- Cooling and Freezing Devices

- Logistics

- Others

Regional Analysis:

The global vacuum insulation panels (VIPs) market is witnessing robust growth across various regions, driven by the increasing demand for energy-efficient building materials and advanced insulation solutions in multiple sectors. The market is distributed across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with each region exhibiting unique growth dynamics.

Asia-Pacific: Market Leader

Asia-Pacific holds the largest market share in the global VIPs market, accounting for over 40% of the total market value. The region’s dominance is primarily due to the rapid urbanization, infrastructure development, and growing focus on sustainable construction in countries such as China, India, and Japan. As these countries continue to develop, there is a growing need for energy-efficient building materials to meet stringent energy-saving regulations. Additionally, the booming cold chain logistics industry in the region, driven by the increasing demand for temperature-sensitive goods, further drives the adoption of VIPs. With the rapid expansion of the middle class and increasing consumer spending, the demand for high-performance insulation solutions in both residential and commercial construction is expected to continue growing at a significant pace.

North America: Strong Regulatory Support

North America is another key player in the VIPs market, holding a substantial share of around 25%. The market growth in this region is supported by stringent building codes and energy efficiency regulations in the United States and Canada. Government initiatives promoting sustainability and reducing carbon footprints have driven the adoption of high-performance insulation materials, such as VIPs, in both residential and commercial sectors. Additionally, North America is witnessing a surge in the cold chain logistics market, particularly in the food and pharmaceutical industries, which further boosts the demand for VIPs in refrigeration and transportation applications.

Europe: Sustainability and Energy Efficiency

Europe accounts for approximately 20% of the global VIPs market. The region’s strong commitment to sustainability, coupled with regulatory pressures to reduce carbon emissions, is a significant driver for VIP adoption. The European Union has implemented various green building initiatives and energy-saving regulations that encourage the use of advanced insulation materials. Countries such as Germany, France, and the UK are at the forefront of adopting VIPs in construction projects to meet their environmental goals. Additionally, the cold chain logistics sector in Europe is expanding, particularly in the pharmaceutical industry, further driving the demand for VIPs.

Latin America and Middle East & Africa: Emerging Markets

Latin America and the Middle East & Africa together account for approximately 15% of the global VIPs market. These regions are emerging markets for VIPs, with rapid infrastructure development and increasing demand for energy-efficient construction solutions. In Latin America, countries such as Brazil and Mexico are investing in sustainable construction and energy-efficient technologies, creating opportunities for VIP manufacturers. Similarly, the Middle East, particularly the Gulf Cooperation Council (GCC) countries, is witnessing significant growth in the demand for green building materials as part of broader sustainability goals. While the adoption of VIPs in these regions is still in its nascent stage, the growing focus on energy efficiency and eco-friendly solutions presents substantial growth potential in the coming years.

Key Player Analysis:

- DOW

- OCI Ltd

- Kevothermal LLC

- Porextherm Dämmstoffe GmbH

- Thermocor

- Va-Q-Tec AG

- LG Hausys Ltd

- Panasonic Corporation

- Evonik Industries AG

- Microtherm Sentronic GmbH

- Morgan Advanced Materials PLC

- Avery Dennison Corporation

- BASF SE

- Knauf Insulation

- Kingspan Group plc

- Others

Competitive Analysis:

The global vacuum insulation panels (VIPs) market is highly competitive, with key players focusing on product innovation, strategic partnerships, and geographic expansion to capture a larger market share. Leading companies such as Evonik Industries, Panasonic Corporation, Kingspan Group, and Thermocore, Inc. are investing in research and development to enhance the performance and cost-effectiveness of VIPs. These companies are also focusing on expanding their product portfolios to include a wide range of VIPs suited for various applications, including construction, refrigeration, and automotive industries. Competition is intensifying as companies look to meet increasing demand for energy-efficient materials and capitalize on government initiatives promoting sustainability. Additionally, partnerships with construction firms and cold chain logistics providers are enabling players to increase their market presence. The market is also witnessing the emergence of regional players in Asia-Pacific and Latin America, further intensifying competition in these developing markets.

Recent Developments:

In 2023, Kingspan Group plc introduced a new range of vacuum insulation panels (VIPs) tailored specifically for the construction industry. This latest product line features enhanced thermal performance and durability, aiming to meet the growing demand for sustainable building materials and stricter energy efficiency standards within the sector.

Market Concentration & Characteristics:

The global vacuum insulation panels (VIPs) market exhibits a moderate level of concentration, with a few key players dominating the landscape. Companies like Evonik Industries, Kingspan Group, and Panasonic Corporation hold significant market shares, leveraging their strong brand presence, technological advancements, and extensive distribution networks. These leaders focus on product innovation and expanding their geographical footprint to maintain competitive advantages. The market is characterized by a mix of established global companies and emerging regional players. While the key players focus on high-performance VIPs for energy-efficient applications, regional companies in Asia-Pacific and Latin America are gaining traction by offering cost-effective alternatives tailored to local market needs. The market’s competitive environment is also driven by technological advancements, with manufacturers continuously enhancing the thermal efficiency, durability, and cost-effectiveness of VIPs. Additionally, collaborations and partnerships within industries like construction and cold chain logistics are becoming common to drive growth.

Report Coverage:

The research report offers an in-depth analysis based on Type, Raw Material, Core Material and End-Use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The global VIPs market is expected to continue its growth trajectory, driven by the increasing demand for energy-efficient and sustainable building materials.

- Emerging markets in Asia-Pacific and Latin America will present significant opportunities due to rapid urbanization and infrastructure development.

- Technological advancements in VIP manufacturing will make these panels more affordable and efficient, broadening their applications.

- Stringent energy efficiency regulations worldwide will further propel the adoption of VIPs in both residential and commercial construction.

- Cold chain logistics will remain a key growth driver, particularly in the food and pharmaceutical industries requiring temperature-sensitive transportation.

- Environmental sustainability initiatives and green building certifications will enhance the demand for VIPs in eco-friendly projects.

- Integration of VIPs in the automotive and electronics sectors will expand their market presence.

- Manufacturers will focus on enhancing product durability and flexibility, addressing concerns regarding long-term performance.

- Increased collaborations and partnerships with construction firms and logistics companies will strengthen market penetration.

- The competitive landscape will evolve as new regional players emerge, further intensifying competition and driving innovation.