Market Overview:

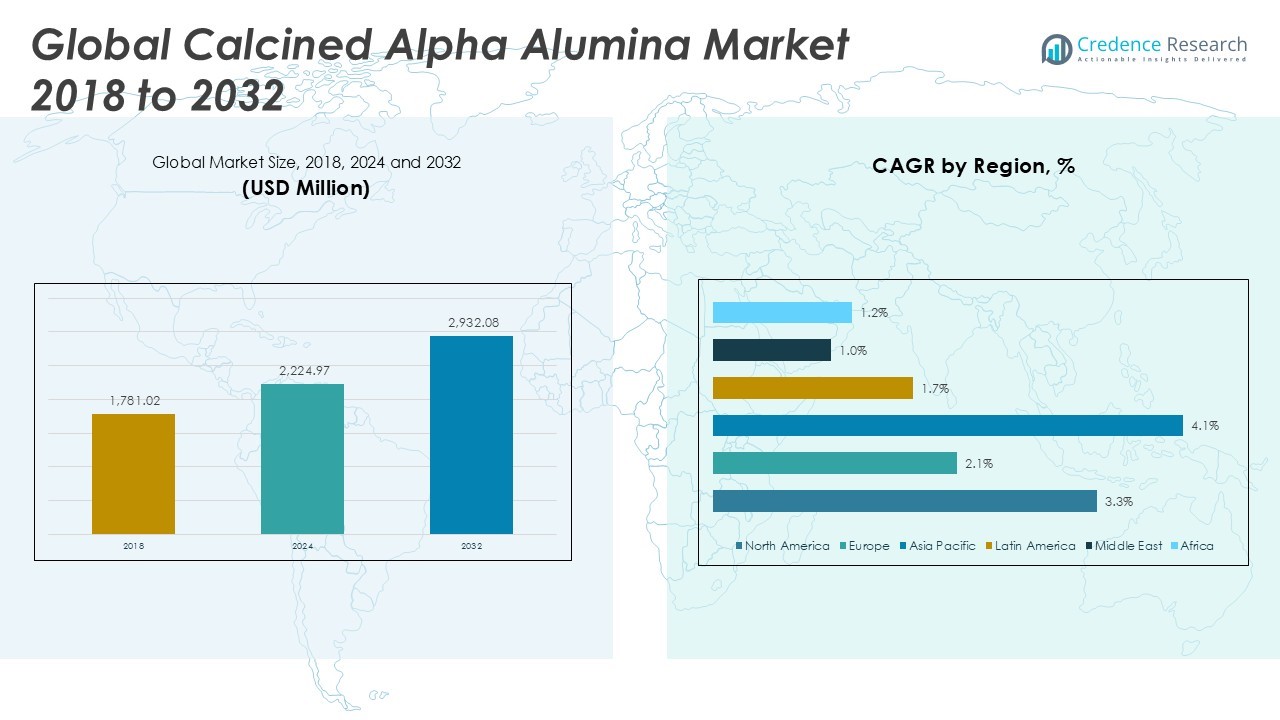

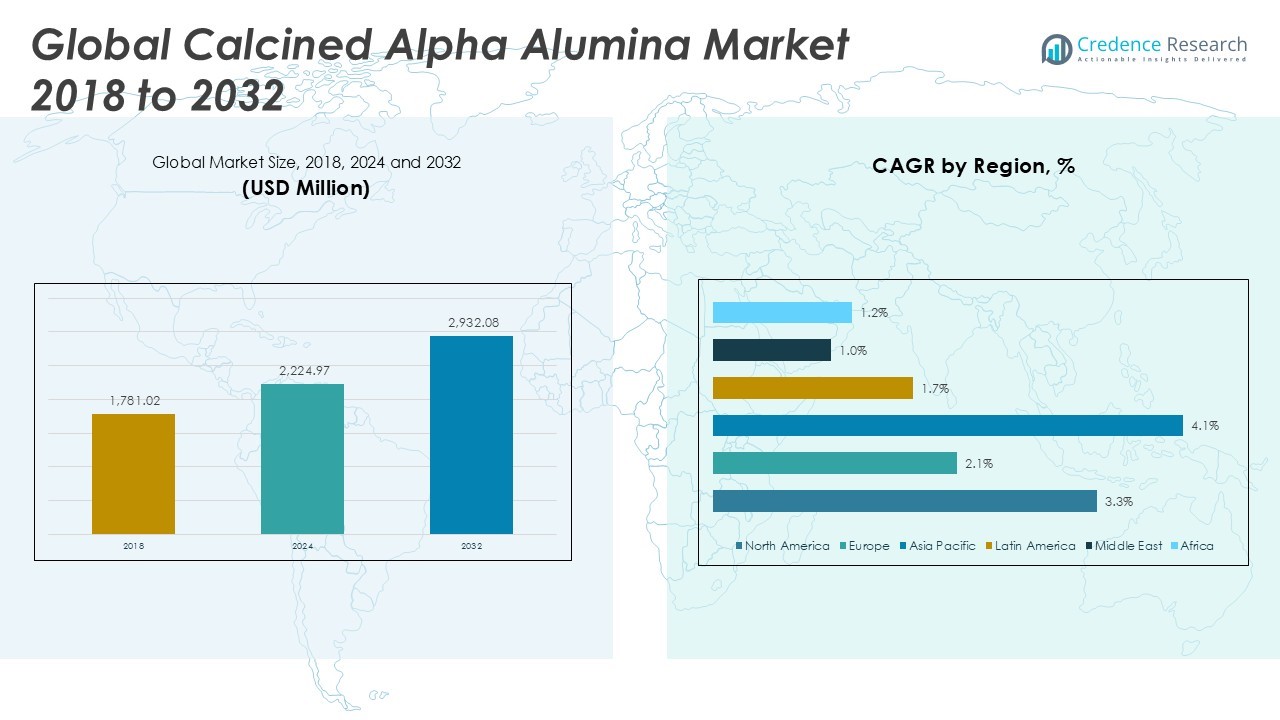

The Global Calcined Alpha Alumina Market size was valued at USD 1,781.02 million in 2018 to USD 2,224.97 million in 2024 and is anticipated to reach USD 2,932.08 million by 2032, at a CAGR of 3.27% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Calcined Alpha Alumina Market Size 2024 |

USD 2,224.97 Million |

| Calcined Alpha Alumina Market, CAGR |

3.27% |

| Calcined Alpha Alumina Market Size 2032 |

USD 2,932.08 Million |

Key market drivers include the rising adoption of calcined alpha alumina in the ceramics and refractories sector, where its exceptional hardness and thermal stability are highly valued. The growing consumption in the electronics industry, supported by increased production of semiconductors and advanced electronic components, also accelerates demand. Additionally, the material’s superior characteristics make it indispensable in abrasive and polishing applications, further expanding its industrial footprint. Its critical role in renewable energy and environmental technologies is also driving new growth avenues for manufacturers worldwide.

Regionally, Asia-Pacific dominates the Global Calcined Alpha Alumina Market, accounting for the largest share due to the rapid growth of the manufacturing sector in countries like China, India, and Japan. North America and Europe also contribute considerably, driven by technological innovation and investment in advanced materials. These regions benefit from established supply chains and ongoing research in high-performance ceramics and electronics. Growing government initiatives and industrial investments in clean energy and sustainability further strengthen regional market prospects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Calcined Alpha Alumina Market was valued at USD 1,781.02 million in 2018, reached USD 2,224.97 million in 2024, and is projected to reach USD 2,932.08 million by 2032, registering a CAGR of 3.27% during the forecast period.

- Ceramics and refractories drive core demand, leveraging calcined alpha alumina’s exceptional hardness, purity, and thermal stability for advanced products and industrial infrastructure.

- Electronics manufacturing accelerates market growth as semiconductor and smart device producers rely on high-purity alpha alumina for substrates, insulators, and circuit boards.

- Demand for abrasive and polishing applications continues to grow, supported by the need for precise finishing in optics, electronics, and automotive industries.

- Investments in renewable energy and environmental technologies open new market avenues, with calcined alpha alumina enhancing performance in filtration, catalyst, and energy generation systems.

- Volatility in raw material prices, supply chain disruptions, and compliance with strict environmental regulations remain key challenges for industry stakeholders.

- Asia Pacific dominates with a 52% share, led by China, India, and Japan, while North America and Europe maintain competitive positions through innovation, established supply chains, and a focus on sustainability.

Market Drivers:

Rising Demand from the Ceramics and Refractories Industries Fuels Growth

The ceramics and refractories sectors represent a major demand base for the Global Calcined Alpha Alumina Market. High purity and exceptional hardness make calcined alpha alumina an essential material in advanced ceramics, including spark plugs, electronic substrates, and wear-resistant coatings. Manufacturers in refractories value its superior thermal stability, chemical resistance, and mechanical strength. Increasing infrastructure development and investment in high-temperature industrial processes are boosting the uptake of specialty ceramics and refractory products. Construction and steel industries, especially in Asia-Pacific, continue to expand capacity, driving consistent volume requirements. These trends reinforce the strong correlation between ceramic innovation and demand for calcined alpha alumina.

Expansion of the Electronics and Electrical Sector Drives Consumption

The electronics industry continues to evolve, creating fresh avenues for the Global Calcined Alpha Alumina Market. Advanced components such as substrates, insulators, and circuit boards require high-performance ceramic materials, where calcined alpha alumina stands out for its dielectric properties and resistance to electrical breakdown. Increased production of semiconductors, LEDs, and passive electronic components accelerates the need for high-purity alumina. Consumer electronics and telecommunications industries contribute substantially to the upward trajectory, supported by the rising adoption of smart devices. The market responds to technical requirements for miniaturization and improved device reliability with greater shipments of alpha alumina.

- For instance, Sumitomo Chemical utilizes a hydrolysis process at its Ehime Works in Japan to manufacture high-purity alumina for critical electronic components, with an annual production capacity currently reaching 1,500 tonnes for advanced industry needs.

Growing Application in Polishing and Abrasive Materials Boosts Market Expansion

Calcined alpha alumina finds widespread application in abrasive and polishing products due to its controlled particle size, high hardness, and purity. The Global Calcined Alpha Alumina Market benefits from robust growth in precision finishing applications, such as optical lens polishing, silicon wafer processing, and automotive surface treatments. End users in metal fabrication and electronics manufacturing seek abrasive materials that deliver fine finishes and consistent performance. Technological upgrades in surface finishing and metalworking have triggered more sophisticated demands for abrasives, which drives producers to favor high-quality calcined alpha alumina. Rapid expansion in automotive and electronics manufacturing amplifies this effect.

- For instance, the Almatis ULTIMATE P 2500 alumina product features a primary crystal size of 0.5μm and is specifically engineered to achieve high-end, scratch-free surface finishing in automotive and optical applications.

Increasing Investments in Renewable Energy and Environmental Technologies Stimulate Demand

Investments in renewable energy and environmental protection technologies support broader opportunities for the Global Calcined Alpha Alumina Market. Filtration membranes, catalyst carriers, and wear-resistant components, all made from calcined alpha alumina, play crucial roles in advanced water treatment, air purification, and energy generation. Governments and private investors focus on sustainability and emission reduction, supporting industries that depend on specialized ceramic materials. The ability of calcined alpha alumina to enhance the efficiency and longevity of critical components positions it at the center of innovation in clean technology. Ongoing research in renewable energy and environmental sectors will continue to lift market prospects.

Market Trends:

Advancements in Manufacturing Processes and Material Innovation Shape Market Dynamics

Continuous improvements in manufacturing technology and process optimization are significantly influencing the Global Calcined Alpha Alumina Market. Producers invest in advanced calcination techniques to achieve higher purity levels, better particle size distribution, and enhanced product consistency. These innovations enable manufacturers to meet the evolving technical requirements of end-use industries such as ceramics, electronics, and abrasives. Strategic collaborations between industry leaders and research institutions accelerate the adoption of new processing methods and the development of value-added grades. The market witnesses a shift toward energy-efficient production and sustainable sourcing, driven by regulatory pressures and corporate sustainability goals. It embraces automation, digitalization, and quality control systems to optimize yield and reduce operational costs.

- For instance, Outotec introduced its GEN 5 alumina calciners, reducing energy consumption to approximately 3GJ per ton of alumina, significantly enhancing process efficiency compared to previous generations.

Rising Demand from High-Growth End-Use Sectors and Shift Toward Specialty Applications

Expanding applications in high-growth sectors continue to shape the direction of the Global Calcined Alpha Alumina Market. It benefits from the surge in demand for advanced ceramics, next-generation electronics, and renewable energy technologies, all of which require materials with superior thermal, electrical, and mechanical properties. The proliferation of electric vehicles, smart devices, and environmental technologies introduces new specialty uses for calcined alpha alumina. Manufacturers tailor product offerings to specific industry needs, focusing on purity, particle morphology, and performance characteristics. Growing interest in 3D printing and additive manufacturing also creates opportunities for specialized grades of alpha alumina. These trends collectively elevate the market’s value proposition across traditional and emerging applications.

- For instance, Alumina Systems GmbH used 99.9% pure alumina to produce a 530mm diameter gas distribution ring via 3D printing for semiconductor wafer coating equipment in 2022.

Market Challenges Analysis:

Volatility in Raw Material Prices and Supply Chain Constraints Impact Market Stability

Volatile prices of raw materials, particularly bauxite, present a significant challenge for the Global Calcined Alpha Alumina Market. Fluctuations in raw material supply can disrupt production planning and affect the cost structure for manufacturers. The market faces occasional shortages due to geopolitical factors, mining restrictions, and trade regulations in major bauxite-producing regions. Price instability puts pressure on profit margins and complicates long-term contracts with end users. Supply chain disruptions, including logistics bottlenecks and inconsistent quality, further hinder the ability to maintain reliable deliveries. These factors collectively challenge the operational resilience of market participants.

Stringent Environmental Regulations and High Production Costs Restrict Growth Potential

Stringent environmental regulations and rising energy costs pose hurdles for the Global Calcined Alpha Alumina Market. Compliance with emission standards and waste management requirements increases operational costs for manufacturers. Energy-intensive calcination processes add to cost pressures, especially where utilities are expensive or carbon taxes apply. Meeting evolving regulatory standards requires continuous investment in cleaner technologies and process upgrades. It limits the entry of new players and may slow expansion in certain regions. Sustaining profitability while addressing these compliance and cost challenges remains a critical concern for industry stakeholders.

Market Opportunities:

Expansion of Advanced Ceramics, Electronics, and Renewable Energy Applications Presents Strong Growth Prospects

Growth in advanced ceramics, electronics, and renewable energy creates substantial opportunities for the Global Calcined Alpha Alumina Market. Demand for high-performance ceramic components in automotive, medical, and aerospace sectors continues to rise, driving the need for materials with superior mechanical and thermal properties. The market also benefits from increasing investments in semiconductor manufacturing and next-generation electronic devices. Renewable energy industries, including solar and battery storage, require high-purity materials that enhance efficiency and product lifespan. Manufacturers who focus on developing specialized grades and value-added solutions are well positioned to capture new business from these expanding applications.

Focus on Sustainability, Circular Economy, and Product Customization Unlocks New Potential

Sustainability initiatives and circular economy practices open new avenues for the Global Calcined Alpha Alumina Market. It stands to gain from increased emphasis on eco-friendly production processes and the recycling of industrial materials. Adoption of cleaner calcination technologies and waste reduction strategies can strengthen market positioning and regulatory compliance. Growing customer preference for customized product grades tailored to specific performance criteria presents further opportunity. Close collaboration with end users to deliver innovative, application-specific materials supports long-term growth. Companies that align with global sustainability goals and adapt to evolving industry requirements will secure a competitive advantage.

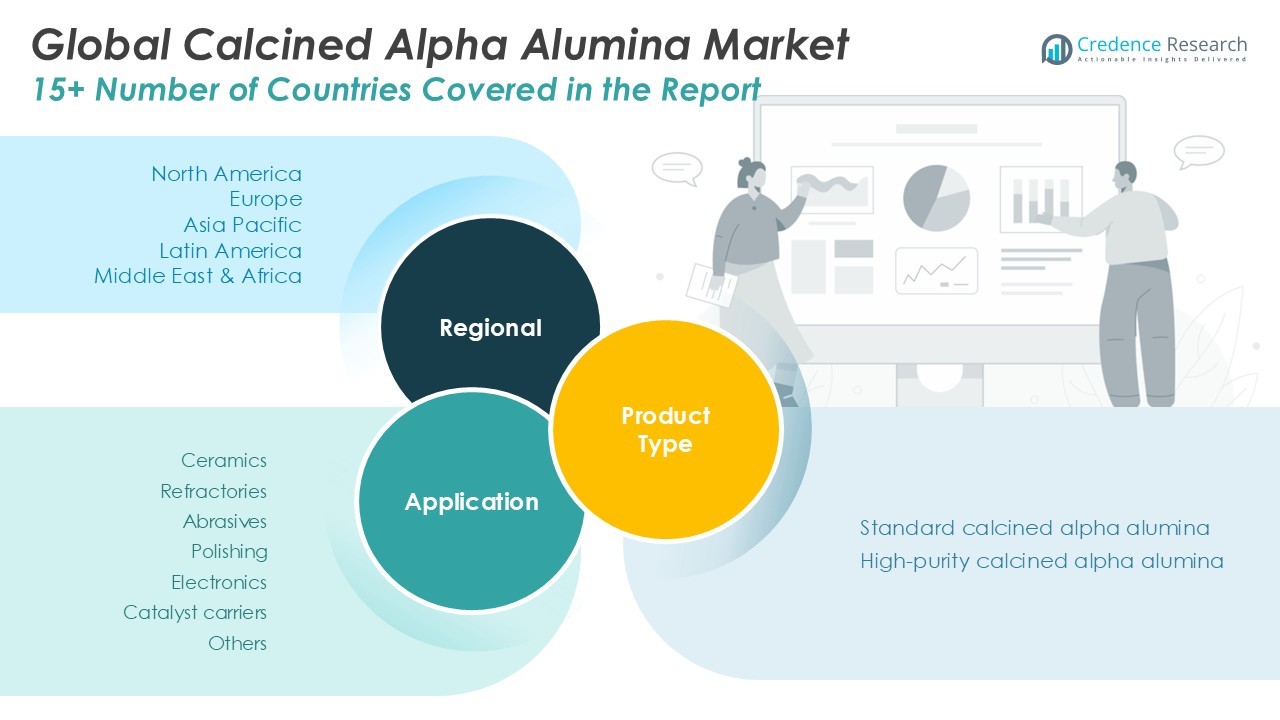

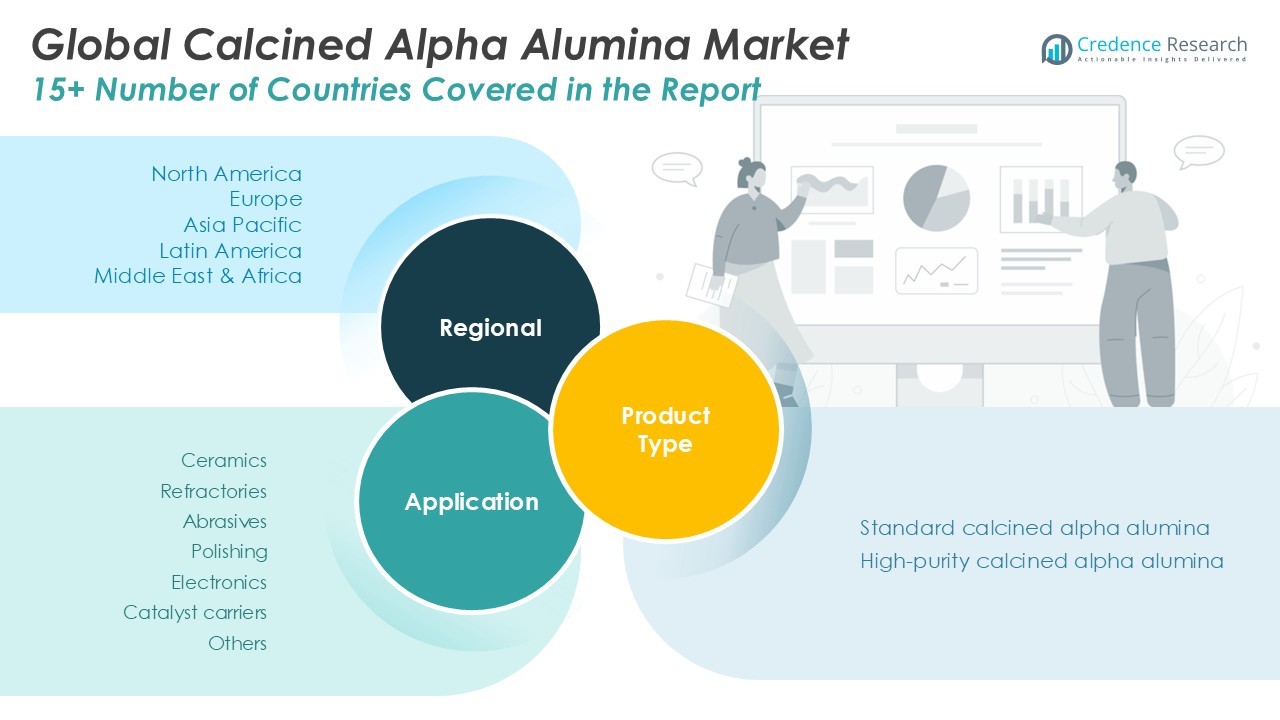

Market Segmentation Analysis:

By Product Type

The Global Calcined Alpha Alumina Market features two primary product segments: standard calcined alpha alumina and high-purity calcined alpha alumina. Standard grades account for a substantial share, supporting large-scale production in ceramics, abrasives, and refractories where a balance of cost and performance is critical. High-purity calcined alpha alumina, designed for advanced technical needs, addresses industries that require exceptional quality, such as electronics and specialty ceramics. It experiences rising demand as manufacturers pursue higher product standards and new applications in emerging technologies. The shift toward high-purity grades reflects evolving requirements for precision, consistency, and advanced material properties.

- For instance, Almatis CT 9 FG standard calcined alpha alumina exhibits a measured median particle size of 3.5μm, optimizing flow and compaction in refractory applications.

By Application

By application, the Global Calcined Alpha Alumina Market addresses a broad spectrum of industries, including ceramics, refractories, abrasives, polishing, electronics, and catalyst carriers. Ceramics and refractories lead the market, driven by ongoing infrastructure projects and industrial growth worldwide. Abrasives and polishing segments see robust expansion, fueled by growth in precision engineering, metalworking, and electronics manufacturing. The electronics sector, especially in semiconductors and advanced components, depends on high-purity calcined alpha alumina to meet stringent technical demands. The market also supports catalyst carriers and niche industrial uses, highlighting its adaptability and importance across diverse end-use segments.

- For instance, Hindalco produces calcined alumina grades for polishing applications from a plant with an installed capacity of 380,000 tons per annum, serving customers in more than 32 countries.

Segmentations:

By Product Type:

- Standard calcined alpha alumina

- High-purity calcined alpha alumina

By Application:

- Ceramics

- Refractories

- Abrasives

- Polishing

- Electronics

- Catalyst carriers

- Others

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

North America

The North America Global Calcined Alpha Alumina Market size was valued at USD 511.77 million in 2018 to USD 629.25 million in 2024 and is anticipated to reach USD 832.74 million by 2032, at a CAGR of 3.3% during the forecast period. North America holds a 22% share of the global market, anchored by the United States, where strong demand from electronics, ceramics, and automotive sectors drives growth. The region benefits from advanced manufacturing infrastructure, stable supply chains, and established distribution networks, enabling efficient delivery of high-quality, application-specific grades. Companies invest in product innovation, sustainability initiatives, and compliance with environmental regulations, which shape the competitive landscape. Producers focus on reliability and performance to meet diverse industry needs, supporting North America’s global leadership in high-performance materials.

Europe

The Europe Global Calcined Alpha Alumina Market size was valued at USD 351.66 million in 2018 to USD 416.57 million in 2024 and is anticipated to reach USD 502.04 million by 2032, at a CAGR of 2.1% during the forecast period. Europe accounts for a 14% share in the global market, led by Germany, France, and the UK. The region emphasizes advanced ceramics, precision manufacturing, and sustainable production processes, fueled by high standards for quality and environmental compliance. Demand is steady in automotive, electronics, and aerospace sectors, supported by strong R&D collaboration and well-developed logistics networks. The circular economy and strict regulatory environment encourage continual investment in greener production technologies, sustaining the region’s focus on innovation and quality.

Asia Pacific

The Asia Pacific Global Calcined Alpha Alumina Market size was valued at USD 743.49 million in 2018 to USD 964.72 million in 2024 and is anticipated to reach USD 1,352.35 million by 2032, at a CAGR of 4.1% during the forecast period. Asia Pacific commands the largest market share at 52%, propelled by rapid industrialization in China, India, and Japan. Growth in electronics, ceramics, and construction drives strong regional demand, supported by abundant raw materials, cost-effective production, and increasing foreign investment. Manufacturers in this region prioritize capacity expansion and technological upgrades to supply diverse domestic and export markets. Government initiatives in infrastructure and clean energy further amplify market growth, positioning Asia Pacific as the central engine for the global industry.

Latin America

The Latin America Global Calcined Alpha Alumina Market size was valued at USD 86.09 million in 2018 to USD 106.25 million in 2024 and is anticipated to reach USD 124.30 million by 2032, at a CAGR of 1.7% during the forecast period. Latin America holds a 4% share of the global market, with Brazil and Mexico as key consumers. Demand stems from ceramics, refractories, and emerging electronics sectors, while ongoing infrastructure development and industrial expansion provide a stable foundation. Producers adapt to local market needs, focusing on cost efficiency despite logistical and supply chain challenges. Alignment with international quality standards and investments in modernization help Latin American manufacturers maintain competitiveness and foster long-term growth.

Middle East

The Middle East Global Calcined Alpha Alumina Market size was valued at USD 48.89 million in 2018 to USD 55.72 million in 2024 and is anticipated to reach USD 61.70 million by 2032, at a CAGR of 1.0% during the forecast period. The region accounts for 3% of global market share, with demand driven by construction, refractories, and petrochemicals. Producers leverage proximity to energy resources and ongoing infrastructure projects to optimize costs. Market expansion is supported by industrial diversification strategies in GCC countries, though challenges include limited raw material processing and fluctuating demand. Efforts to localize manufacturing and invest in advanced technologies aim to strengthen the region’s position in the global market.

Africa

The Africa Global Calcined Alpha Alumina Market size was valued at USD 39.12 million in 2018 to USD 52.48 million in 2024 and is anticipated to reach USD 58.95 million by 2032, at a CAGR of 1.2% during the forecast period. Africa holds a 2% share in the global market, with South Africa leading regional consumption due to its established mining and manufacturing base. The region faces challenges from high import dependence, limited local production, and infrastructural gaps, yet gradual improvements in supply chains are evident. Governments prioritize industrialization and local value addition, while adoption of global quality standards and international partnerships enhance product availability. Africa’s future growth relies on continued investment in manufacturing capacity and technology transfer.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Sumitomo Chemical

- Baikowski

- Inframat Corporation

- Hindalco

- Nippon Light Metal

- Polar Sapphire

- Almatis

- Alteo

- Nabaltec

- Sasol

- CHALCO (China Aluminum Corporation)

- Showa Denko

Competitive Analysis:

The Global Calcined Alpha Alumina Market presents a competitive landscape defined by the presence of leading multinational companies and specialized regional players. Key industry participants include Sumitomo Chemical, Baikowski, Hindalco, Nippon Light Metal, Almatis, Alteo, Nabaltec, Sasol, CHALCO, Polar Sapphire, Inframat Corporation, and Showa Denko. These companies compete on factors such as product purity, innovation, production efficiency, and the ability to offer customized grades for specific end-use applications. The market sees ongoing investment in research and development, process optimization, and technology upgrades to strengthen product quality and meet evolving customer needs. Strategic partnerships, capacity expansions, and geographic diversification help leading players maintain their competitive edge. The Global Calcined Alpha Alumina Market continues to evolve, driven by technical requirements across ceramics, refractories, electronics, and polishing sectors, encouraging companies to focus on differentiation and long-term customer relationships.

Recent Developments:

- In June 2025, Sumitomo Chemical launched a new digital transformation management structure to strengthen its DX strategy empowered by AI, as part of its 2025–2027 Corporate Plan.

- In June 2025, Hindalco, through its subsidiary Aditya Holdings LLC, announced the $125 million acquisition of US-based AluChem Companies, Inc., a move expected to expand its specialty alumina presence in North America.

- In March 2025, Hindalco unveiled a new brand identity representing its transformation into an innovation-driven solutions provider for future industries such as e-mobility and electronics.

Market Concentration & Characteristics:

The Global Calcined Alpha Alumina Market displays moderate market concentration, with a mix of large international firms and niche regional producers shaping the competitive landscape. It features high barriers to entry due to significant capital investment, advanced process technology, and stringent quality requirements. Leading players leverage integrated supply chains and technological expertise to secure market share, while smaller companies often focus on specialized or local demands. The market values product consistency, purity, and the ability to meet application-specific standards. It adapts quickly to shifts in end-user industries, showing resilience and innovation across ceramics, refractories, abrasives, and advanced electronics sectors.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Manufacturers will accelerate the adoption of advanced calcination technologies to improve product quality and operational efficiency.

- Customization of alpha alumina grades will become more prominent to meet the specific needs of ceramics, electronics, and polishing sectors.

- Demand for high-purity calcined alpha alumina will increase in semiconductor and renewable energy applications.

- Companies will invest in expanding production capacity, especially in Asia Pacific, to serve both local and export markets.

- Strategic collaborations between industry players and research institutions will foster innovation and new product development.

- Environmental sustainability will shape industry practices, prompting investment in cleaner production methods and waste reduction.

- Regional players will enter niche application areas, intensifying competition and supporting localized supply.

- Technological advancements in automated manufacturing and digital quality control will enhance yield and consistency.

- Supply chain resilience will improve, driven by efforts to secure raw material sources and streamline logistics.

- The market will benefit from ongoing infrastructure projects, energy transition initiatives, and the evolution of high-performance end-use industries worldwide.