Market Overview

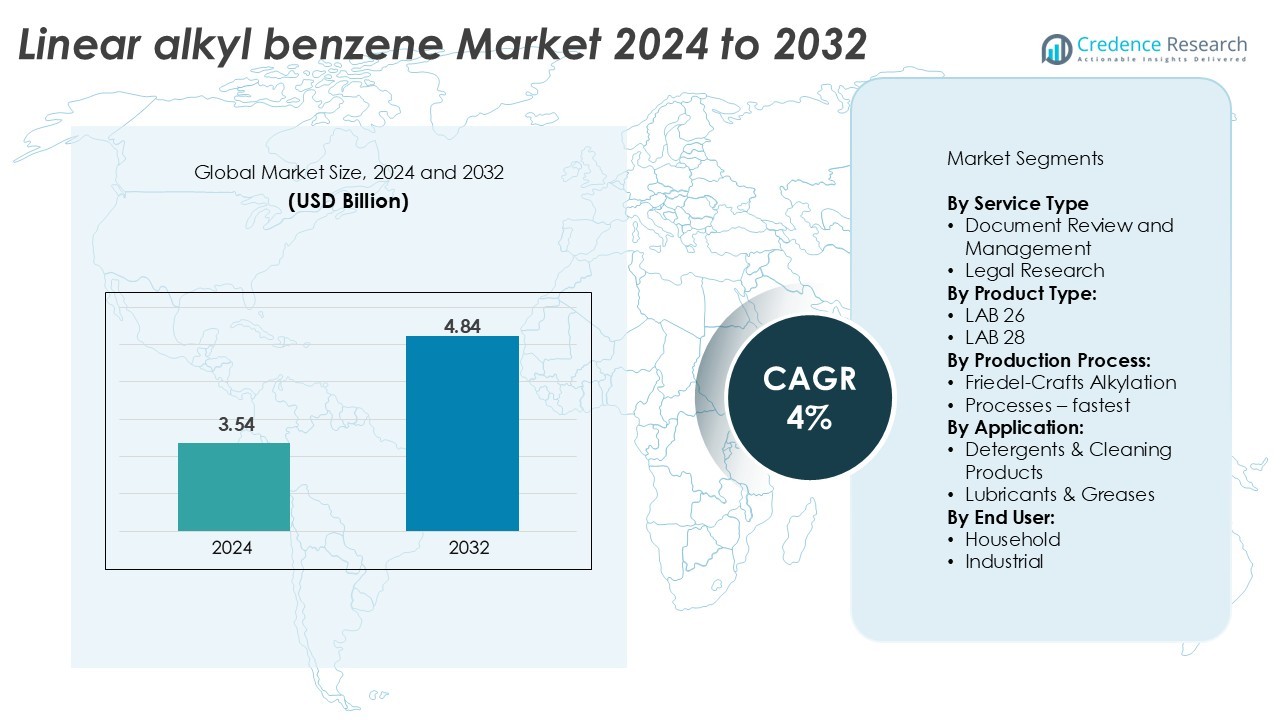

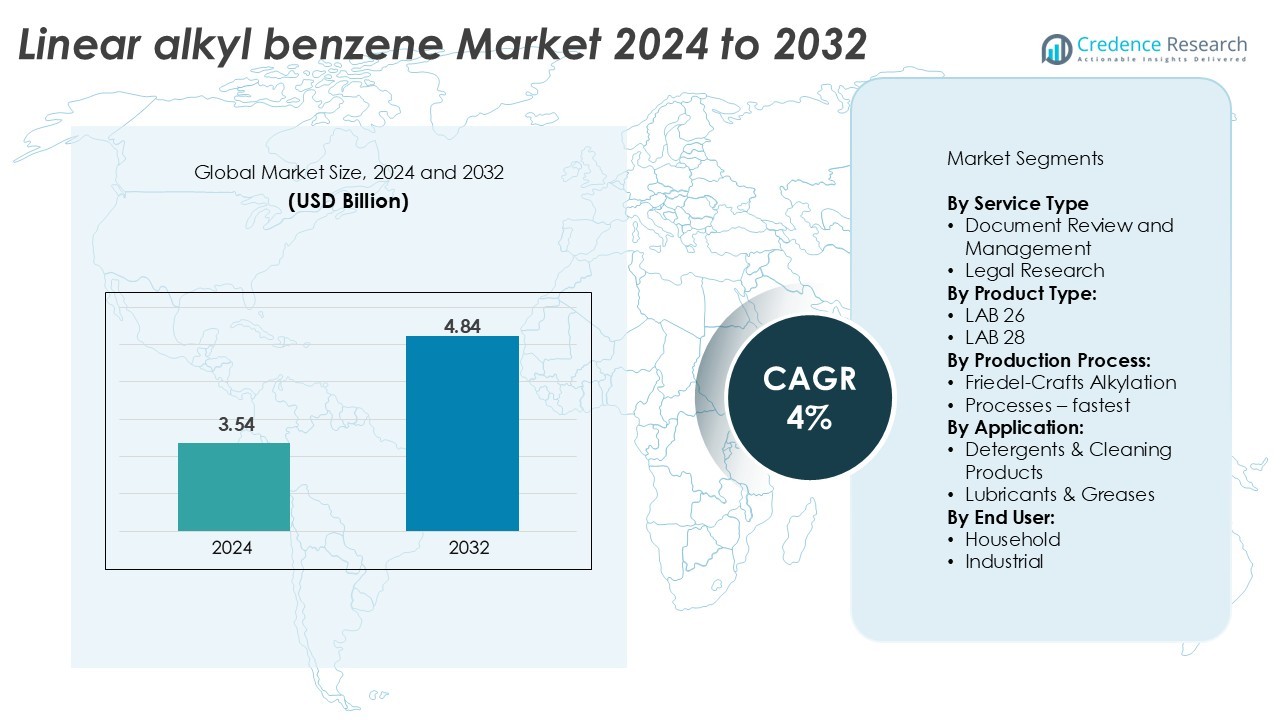

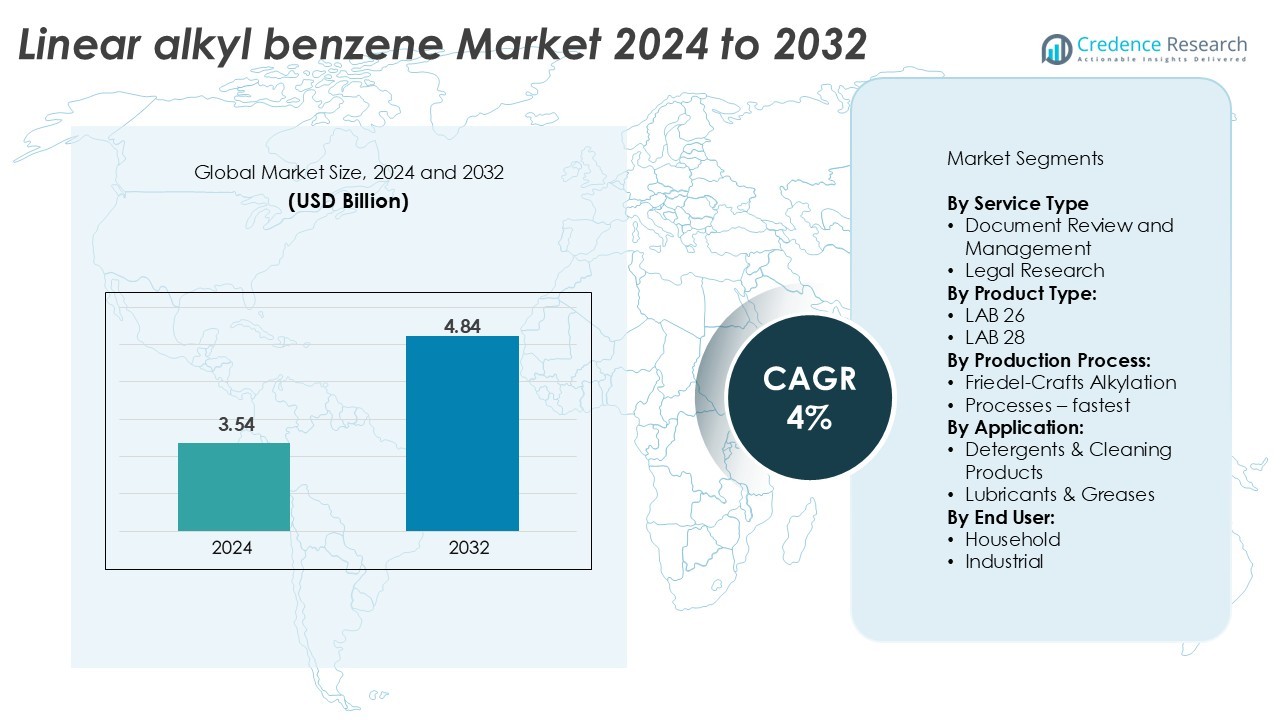

The Linear Alkyl Benzene (LAB) Market size was valued at USD 3.54 billion in 2024 and is anticipated to reach USD 4.84 billion by 2032, expanding at a CAGR of 4.0% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Linear Alkyl Benzene (LAB) Market Size 2024 |

USD 3.54 Billion |

| Linear Alkyl Benzene (LAB) Market, CAGR |

4.0% |

| Linear Alkyl Benzene (LAB) Market Size 2032 |

USD 4.84 Billion |

The linear alkyl benzene (LAB) market is led by major players such as Reliance Industries Limited, Sasol, Cepsa, Indorama Ventures Public Limited, Chevron Phillips Chemical Company, ISU Chemical, Honeywell International Inc., and SABIC, alongside regional manufacturers like Unggul Indah Cahaya Tbk, Tamilnadu Petroproducts Limited, and Deten Quimica S.A. These companies focus on process innovation, sustainability, and production capacity expansion to strengthen their market positions. Asia Pacific dominates the global LAB market with a 46.8% share, driven by high detergent consumption and large-scale chemical manufacturing in China and India. North America follows with a 23.4% share, supported by advanced refining infrastructure and sustainable surfactant initiatives, while Europe holds a 18.6% share, emphasizing eco-friendly production and regulatory compliance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Linear Alkyl Benzene Market was valued at USD 3.54 billion in 2024 and is projected to reach USD 4.84 billion by 2032, growing at a CAGR of 4% during the forecast period.

- Market growth is driven by rising detergent consumption and increasing demand for biodegradable surfactants across household and industrial applications.

- Key trends include a shift toward eco-friendly and bio-based LAB production, along with technological advancements in alkylation processes to improve efficiency and reduce emissions.

- The competitive landscape features major players such as Reliance Industries, Sasol, Cepsa, Indorama Ventures, and SABIC, focusing on sustainability, capacity expansion, and regional supply chain integration.

- Asia Pacific leads the market with a 46.8% share, followed by North America (23.4%) and Europe (18.6%), while LAB 26 dominates by product type with 42.75% share, and Detergents & Cleaning Products lead by application with 53.87% share in 2025.

Market Segmentation Analysis:

By Product Type:

The LAB 26 segment dominated the linear alkyl benzene market in 2024, capturing approximately 42.7% share. Its balanced chain length, superior biodegradability, and strong performance in detergent formulations make it the preferred choice for major manufacturers. The segment’s dominance is supported by increasing demand for sustainable and high-performing surfactants in household and industrial cleaning products. LAB 28, though slightly longer in chain length, is gaining traction due to its use in industrial-grade detergents requiring greater viscosity and temperature stability, supporting its projected faster growth in the coming years.

- For instance, Cepsa Química launched its “NextLab-R Low-Carbon” version of LAB in October 2024, achieving a measured cradle-to-gate carbon footprint of -0.28 kg CO₂-equivalent per kg of product.

By Production Process:

The Friedel-Crafts alkylation process accounted for the majority share in 2024, contributing around 71.3% of total production. Its dominance is due to cost efficiency, scalability, and high-quality output with consistent linearity. However, newer detergent alkylation processes are emerging as the fastest-growing production route, driven by their eco-friendly catalysts and reduced environmental footprint. These processes lower waste generation and energy consumption, aligning with sustainability goals and regulatory compliance, encouraging adoption among major chemical producers worldwide.

- For instance, Chevron Phillips Chemical Company has a history of technological innovation, including in catalyst and reactor design, aimed at improving process efficiency and sustainability. For example, the company has commercialized new catalysts to enhance its chemical processes and has made significant improvements to its polyethylene production technology over several decades.

By Application

The detergents and cleaning products segment held the dominant market share of 84.6% in 2024, supported by growing consumption of household and industrial detergents across developing economies. Rising urbanization, hygiene awareness, and the expansion of personal care and cleaning industries drive this dominance. Linear alkyl benzene serves as a vital feedstock for producing linear alkylbenzene sulfonate (LAS), a key biodegradable surfactant. The lubricants and greases segment contributes modestly but steadily, benefiting from LAB’s use as a thermal-stable additive and solvent base in industrial lubrication applications.

Key Growth Drivers

Rising Demand from the Detergent Industry

The detergent industry remains the primary growth driver of the linear alkyl benzene (LAB) market, accounting for a significant share of global consumption. LAB’s superior surfactant properties, biodegradability, and compatibility with various formulations make it indispensable in both household and industrial cleaning applications. The growing preference for liquid detergents, especially in developing economies such as India, Brazil, and Indonesia, continues to boost demand. Increasing hygiene awareness, population growth, and urbanization are driving large-scale consumption across residential and institutional sectors. Furthermore, manufacturers are investing in bio-based LAB production to align with sustainability goals, reinforcing long-term market expansion.

- For instance, Sasol is advancing its production of some bio-based chemicals through a mass-balance approach, which accounts for bio-based raw materials in its existing production processes. In October 2025, Sasol announced the launch of a new bio-circular surfactant, LIVINEX IO 7, derived from insect oil, available in European markets.

Expanding Industrial and Lubricant Applications

The use of LAB is expanding beyond detergents into industrial lubricants, greases, and oil additives, driven by its strong thermal stability and solvency. LAB derivatives, particularly linear alkylbenzene sulfonate (LAS), enhance lubricant performance by reducing friction and improving oxidation resistance. The automotive and manufacturing sectors are witnessing rising consumption of LAB-based lubricants for machinery and heavy-duty engines. Rapid industrialization across emerging markets further supports this growth. Additionally, advancements in synthetic oil formulations and additive technologies have created new opportunities for LAB suppliers to diversify applications. This broadening of end-use industries is expected to strengthen the market’s industrial footprint and revenue potential over the forecast period.

- For instance, Chevron Phillips Chemical is a major producer of high-quality polyalphaolefins (PAOs), which are used as synthetic base oils in the formulation of high-performance lubricants.

Technological Advancements in Production Processes

Technological progress in LAB manufacturing processes, particularly the adoption of efficient catalyst systems and energy-saving methods, is a key market driver. The Friedel-Crafts Alkylation process continues to dominate due to its proven reliability, but emerging eco-friendly alternatives are gaining traction. Innovations such as solid acid catalysts and continuous alkylation systems have reduced by-product formation and improved yield consistency. These advancements enhance cost-efficiency while minimizing environmental impact, making LAB production more sustainable. Additionally, refinery integration and feedstock optimization strategies are enabling companies to improve operational flexibility and supply chain efficiency. Continuous R&D investments in cleaner, high-throughput technologies are expected to reshape the market’s competitiveness and long-term sustainability.

Key Trends & Opportunities

Shift Toward Sustainable and Bio-Based LAB Production

Sustainability has become a defining trend in the LAB market as manufacturers respond to tightening environmental regulations and consumer demand for eco-friendly products. Bio-based LAB derived from renewable raw materials such as plant oils is emerging as a viable alternative to petroleum-based variants. Companies are exploring feedstock diversification to lower carbon emissions and improve biodegradability. Strategic collaborations between chemical producers and renewable energy firms are facilitating the development of circular production models. This transition toward greener LAB is opening opportunities for innovation and differentiation in a market traditionally dependent on petrochemical sources.

- For instance, Cepsa has pioneered the production of bio-based LAB using renewable raw materials, which allows manufacturers of household detergents to potentially reduce their carbon footprint (GWP index) by up to 25%.

Increasing Adoption in Emerging Economies

Rapid urbanization, industrialization, and rising disposable incomes in emerging economies are creating strong growth opportunities for LAB producers. Asia-Pacific, Africa, and Latin America are witnessing a surge in detergent and cleaning product consumption due to expanding middle-class populations and improved living standards. Governments’ hygiene campaigns and the growing retail presence of multinational detergent brands are further fueling demand. Regional manufacturing investments and capacity expansions by global players are helping bridge supply gaps. These regions offer high-volume potential and favorable cost structures, making them key investment destinations for both established and new entrants.

- For instance, Procter & Gamble expanded its innovation footprint in Brazil with a new Latin American Innovation Center at its Louveira campus, focusing on research and development for the region.

Key Challenges

Volatility in Raw Material Prices

Fluctuations in raw material costs, particularly benzene and kerosene, pose a major challenge to LAB manufacturers. Since these inputs are derived from crude oil, any instability in global oil markets directly impacts production costs. Price volatility reduces profit margins and complicates long-term supply contracts for producers. Additionally, geopolitical tensions and refinery shutdowns often disrupt raw material availability, leading to short-term market imbalances. Companies are responding through vertical integration, strategic sourcing, and the use of alternative feedstocks, yet dependency on petrochemical inputs continues to expose the market to pricing risks.

Environmental Regulations and Sustainability Pressure

Stringent environmental standards concerning chemical emissions, waste management, and biodegradability are increasing operational challenges for LAB producers. Regulatory agencies across Europe and North America are emphasizing low-toxicity, eco-friendly surfactant alternatives, pressuring traditional LAB suppliers to innovate. Compliance with REACH and EPA norms requires costly process upgrades and sustainable material sourcing. Waste disposal and catalyst management during the alkylation process also pose environmental concerns. While technological innovations are mitigating some impacts, the transition to cleaner processes demands significant capital investment. Balancing production efficiency with environmental responsibility remains a key challenge shaping the future of the LAB market.

Regional Analysis

Asia-Pacific

Asia-Pacific dominated the linear alkyl benzene market in 2024, holding around 46.8% share. The region’s leadership stems from high detergent consumption in populous countries like China, India, and Indonesia. Expanding industrial manufacturing, urbanization, and increasing hygiene awareness drive product demand. Strong presence of key manufacturers and growing investments in modern alkylation plants further enhance market performance. Government focus on sustainable chemical production and export-oriented growth strategies continue to strengthen the region’s dominance, while rising middle-class income levels contribute to steady detergent consumption growth across both urban and rural areas.

North America

North America accounted for approximately 23.4% market share in 2024, driven by strong demand from the household and industrial cleaning sectors. The region benefits from advanced production facilities, technological innovation, and stringent environmental standards promoting biodegradable surfactants. Growing awareness of eco-friendly cleaning agents and rising use in specialty detergents and industrial lubricants support regional growth. The U.S. remains the leading market due to high detergent penetration and the presence of major chemical manufacturers investing in process efficiency and catalyst technology. Demand for LAB-based formulations continues to expand across both residential and institutional cleaning applications.

Europe

Europe captured nearly 18.6% share of the linear alkyl benzene market in 2024, supported by strong environmental policies and sustainable product innovation. European manufacturers are shifting toward cleaner alkylation processes and renewable feedstocks to meet EU sustainability goals. The market benefits from consistent detergent consumption in developed economies such as Germany, France, and the U.K. Growing use of biodegradable surfactants in industrial cleaning applications further supports market expansion. However, regulatory pressure on non-renewable hydrocarbons has encouraged research into green alternatives, driving gradual transformation of the LAB value chain toward sustainable and energy-efficient production models.

Latin America

Latin America held around 6.9% market share in 2024, fueled by increasing detergent and personal care consumption in Brazil, Mexico, and Argentina. Rising urbanization, improving living standards, and expanding retail distribution networks drive regional growth. The shift toward packaged cleaning products and awareness of hygiene maintenance in post-pandemic conditions also strengthen market demand. Local producers are expanding capacities to meet regional requirements, while imports supplement demand gaps. Favorable government policies promoting industrial chemical development and foreign investments in manufacturing sectors further enhance the growth prospects of linear alkyl benzene production and usage across the region.

Middle East & Africa

The Middle East & Africa region represented approximately 4.3% share in 2024, with demand concentrated in detergent and industrial applications. Growing population, rapid urbanization, and industrial diversification initiatives, particularly in the GCC countries, are boosting product adoption. Investments in downstream petrochemical projects provide easy access to raw materials such as benzene and kerosene, enhancing production efficiency. Africa’s detergent market expansion, driven by economic growth and hygiene awareness, is further supporting LAB consumption. Regional manufacturers are exploring cost-effective alkylation technologies to cater to local markets and reduce dependency on imported finished detergent intermediates.

Market Segmentations:

By Product Type:

By Production Process:

- Friedel-Crafts Alkylation

- Processes – fastest

By Application:

- Detergents & Cleaning Products

- Lubricants & Greases

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The linear alkyl benzene (LAB) market is moderately consolidated, with leading players focusing on capacity expansion, technological upgrades, and sustainable production. Key companies include CEPSA Química, Sasol Limited, Reliance Industries Limited, Farabi Petrochemicals Company, Isu Chemical, Huntsman Corporation, Nirma Limited, and Chevron Phillips Chemical Company. These firms emphasize process optimization and catalyst innovation to enhance production efficiency and reduce environmental impact. Strategic partnerships and investments in renewable feedstock are gaining momentum as producers adapt to tightening sustainability standards. Asian manufacturers, particularly from India, China, and South Korea, are expanding regional supply chains to meet rising detergent demand. Meanwhile, global players are exploring vertical integration and R&D initiatives to strengthen their competitive edge. The growing shift toward bio-based LAB and eco-friendly surfactants continues to drive differentiation strategies, pushing companies to balance cost efficiency, product quality, and regulatory compliance in a highly competitive global market.

Key Player Analysis

- Reliance Industries Limited

- Sasol

- Honeywell International Inc.

- ISU Chemical

- Deten Quimica S.A.

- Cepsa

- Formosan Union Chemical Corp.

- Indorama Ventures Public Limited

- Kraton Polymers

- Chevron Phillips Chemical Company

- Unggul Indah Cahaya Tbk

- Huntsman International LLC

- Fushun Petrochemicals

- Petrokimia Gresik

- SBK Holding

- Pupuk Kaltim

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Recent Developments

- In October 2025, ISU Chemical recently highlighted that its Linear Alkyl Benzene (LAB) is now formulated to dissolve rapidly in water, enhancing its environmental compatibility. This advancement reflects the company’s ongoing research and development efforts focused on sustainable and eco-friendly chemical solutions.

- In September 2025, Indorama Ventures showcased its latest innovations and long-term value creation strategy under the theme “Sustainable Value Creation” at the Sustainability Expo (SX) 2025. They highlighted its commitment to sustainability and innovation, focusing on the development of eco-friendly products.

- In October 2024, Cepsa Química introduced NextLab-R Low Carbon, the world’s first Linear Alkyl Benzene (LAB) capable of achieving a carbon footprint reduction of up to -102%. This innovative product is the result of combining the use of alternative renewable raw materials and renewable energy.

Report Coverage

The research report offers an in-depth analysis based on Product type, Production process, Application, End user and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion on in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand steadily, driven by growing detergent and cleaning product demand.

- Bio-based and eco-friendly LAB production will gain momentum as sustainability regulations tighten.

- Technological advancements in alkylation processes will improve yield efficiency and reduce emissions.

- Asia Pacific will remain the leading regional market due to industrial expansion and population growth.

- North America will see stable growth supported by innovation in surfactant and specialty chemical production.

- Europe will focus on circular production models and strict compliance with environmental standards.

- Emerging markets in Latin America and Africa will offer new investment opportunities for LAB producers.

- Strategic collaborations among chemical manufacturers will accelerate product diversification and market penetration.

- The demand for LAB in lubricants and greases will increase with rising industrial and automotive activities.

- Continuous R&D efforts toward low-carbon feedstocks will shape the industry’s long-term competitiveness.