Market Overview

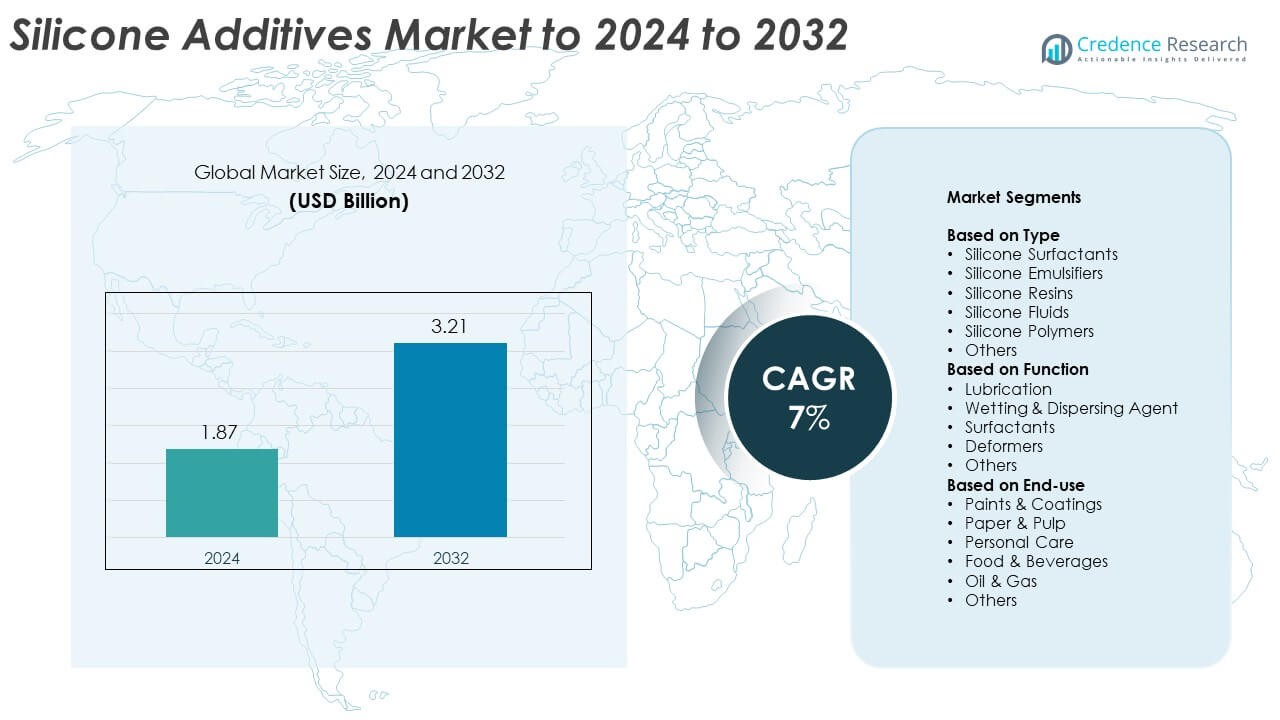

The Silicone Additives Market size was valued at USD 1.87 billion in 2024 and is anticipated to reach USD 3.21 billion by 2032, at a CAGR of 7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Silicone Additives Market Size 2024 |

USD 1.87 Billion |

| Silicone Additives Market, CAGR |

7% |

| Silicone Additives Market Size 2032 |

USD 3.21 Billion |

The Silicone Additives Market is led by major players including Dow, Wacker Chemie, Shin-Etsu, Evonik, Momentive Performance Materials, Elkem, Siltech, ALTANA, BYK, and BRB International. These companies dominate through innovation, extensive product portfolios, and strong global distribution networks. The market is regionally led by Asia-Pacific, which accounted for a 33.8% share in 2024, driven by rapid industrialization and rising demand in paints and coatings. North America followed with 27.3%, fueled by growth in personal care and construction sectors, while Europe held a 25.6% share, supported by strict environmental regulations favoring eco-friendly silicone formulations.

Market Insights

- The silicone additives market was valued at USD 1.87 billion in 2024 and is projected to reach USD 3.21 billion by 2032, growing at a CAGR of 7%.

- Growth is driven by increasing demand in paints, coatings, and personal care applications due to their superior performance and stability.

- The market is witnessing a trend toward eco-friendly, bio-based silicone additives as regulations tighten on emissions and chemical content.

- Competition remains high, with global players investing in R&D and expanding regional production capacities to enhance sustainability and efficiency.

- Asia-Pacific led with a 33.8% share in 2024, followed by North America at 27.3% and Europe at 25.6%, while the silicone surfactants segment dominated by type with a 33.5% share.

Market Segmentation Analysis:

By Type

The silicone surfactants segment dominated the silicone additives market in 2024 with a 33.5% share. This leadership stems from their extensive use in paints, coatings, and personal care products for improved spreadability and stability. Silicone surfactants reduce surface tension and enhance foam control, making them vital in waterborne formulations. The silicone resins and silicone fluids segments are also growing steadily due to their use in high-performance coatings and lubricants, supporting applications that demand superior weather resistance and heat stability across automotive and construction industries.

- For instance, Evonik shows a 0.1% silicone surfactant wetting 160 cm² on PVC and lowering surface tension to 21 mN/m in waterborne binders.

By Function

The lubrication segment held the largest share of 29.8% in 2024, driven by the growing need for high-performance lubricants in manufacturing and energy sectors. Silicone additives enhance friction reduction, improve surface smoothness, and extend equipment life under extreme conditions. Wetting and dispersing agents are also expanding as they improve pigment stability and uniformity in coatings and inks. The deformers segment continues to find rising use in chemical and food processing to ensure better foam control and process efficiency.

- For instance, DuPont’s silicone compound operates from −40 °C to 204 °C, supporting high-load sealing and lubrication.

By End-use

The paints and coatings segment led the silicone additives market in 2024 with a 37.2% share. Its dominance is fueled by the growing demand for durable, weather-resistant, and low-VOC coatings across automotive, construction, and industrial sectors. Silicone additives improve gloss, adhesion, and surface smoothness while preventing defects like cratering and foaming. The personal care and paper & pulp segments also demonstrate steady growth due to rising applications in skincare formulations and paper surface treatments aimed at improving texture and water resistance.

Key Growth Drivers

Rising Demand in Paints and Coatings

The increasing use of silicone additives in paints and coatings is a major growth driver. These additives improve weather resistance, surface smoothness, and anti-foaming properties, making them ideal for architectural and automotive coatings. Expanding infrastructure and renovation activities in Asia-Pacific and Europe further support this growth. The shift toward high-performance, low-VOC formulations enhances the demand for silicone-based solutions that ensure durability and eco-friendly performance across multiple end-use industries.

- For instance, Momentive reports surface tension of 20.5 mN/m at 0.1 wt%, enabling rapid wetting and flow.

Expanding Use in Personal Care Products

Growing adoption of silicone additives in skincare and haircare products drives market expansion. These additives provide smooth texture, better spreadability, and long-lasting effects in creams, lotions, and conditioners. Rising disposable income and increasing consumer awareness of premium personal care items accelerate product demand. Manufacturers are focusing on silicone emulsifiers and fluids that deliver enhanced sensory properties while maintaining product stability and compatibility with natural ingredients.

- For instance, Shin-Etsu lists an emulsifier with HLB 14.5 and viscosity 100 mm²/s, supporting stable fine emulsions.

Technological Advancements in Manufacturing

Continuous innovation in silicone chemistry and formulation techniques strengthens market growth. Advanced silicone polymers and resins with tailored molecular structures improve product efficiency and versatility. The development of hybrid and reactive silicone systems supports customized performance for coatings, lubricants, and sealants. Such advancements enable reduced additive dosage while maintaining high performance, helping industries achieve cost efficiency and compliance with sustainability regulations.

Key Trends & Opportunities

Shift Toward Eco-Friendly Silicone Additives

Growing environmental concerns and regulatory pressure are driving innovation in bio-based silicone additives. Manufacturers are investing in sustainable feedstocks and low-emission processes to reduce carbon impact. The trend toward green chemistry promotes silicone additives that maintain high performance while minimizing environmental risks. This shift creates strong opportunities for companies developing biodegradable and water-based silicone formulations.

- For instance, Elkem’s recycled-release range reports 1.1 kg CO₂e/kg, far below a ~6 kg CO₂e/kg industry average.

Increasing Integration in Food and Beverage Applications

The use of silicone additives in food processing and packaging presents emerging opportunities. These additives enhance lubrication, non-stick properties, and surface protection in production lines. Expanding packaged food demand and strict hygiene standards are encouraging adoption of food-grade silicone emulsifiers and release agents. Growing preference for safe, inert, and FDA-compliant materials further supports their use in this sector.

- For instance, Wacker confirms FDA 21 CFR 177.2600 compliance; typical pot life 6–8 hours at 23 °C and stabilizer need above ≈ 180 °C.

Key Challenges

High Production Costs and Raw Material Volatility

Fluctuations in raw material prices, especially for siloxanes and methylchlorosilanes, affect profit margins. High production and processing costs limit the widespread adoption of silicone additives among price-sensitive industries. The dependency on energy-intensive manufacturing processes further increases operational expenses. Companies face the challenge of balancing quality and cost while meeting rising global demand.

Regulatory Constraints and Environmental Concerns

Strict environmental regulations on silicone usage and disposal present significant challenges. Some silicone compounds are under scrutiny for their persistence in the environment, prompting restrictions in key regions. Compliance with REACH and EPA standards increases formulation complexity and development costs. Manufacturers must focus on developing environmentally safe alternatives to maintain market competitiveness and long-term sustainability.

Regional Analysis

North America

North America held a 27.3% share of the silicone additives market in 2024. The region’s growth is supported by rising demand in paints, coatings, and personal care applications. Strong construction and automotive sectors in the United States and Canada continue to drive adoption. Technological advancements and regulatory standards favoring low-VOC materials further boost silicone-based formulations. Growing use of silicone surfactants and resins in industrial lubricants and packaging applications also supports steady expansion. Manufacturers are investing in R&D to develop high-performance, sustainable silicone additives that meet environmental and performance requirements.

Europe

Europe accounted for 25.6% of the silicone additives market in 2024, driven by stringent environmental policies and growing preference for sustainable materials. Demand is high across the automotive, construction, and cosmetics industries. Germany, France, and the United Kingdom remain key contributors due to established manufacturing bases and regulatory compliance. The region’s transition toward green chemistry promotes the adoption of bio-based silicone additives. Increased R&D in high-performance resins and emulsifiers enhances product efficiency. Rising consumer awareness and demand for premium formulations continue to strengthen Europe’s position in the global market.

Asia-Pacific

Asia-Pacific dominated the silicone additives market in 2024 with a 33.8% share. Rapid industrialization, large-scale construction, and expanding automotive production in China, India, and Japan are major growth drivers. Increasing use of silicone emulsifiers and surfactants in paints, coatings, and personal care products fuels regional demand. Government support for sustainable manufacturing and rising export activities in specialty chemicals enhance market potential. Local producers are expanding capacity to meet global demand for advanced silicone additives. The region remains the fastest-growing due to continuous innovation and expanding downstream applications across multiple industries.

Latin America

Latin America captured 7.3% of the silicone additives market in 2024, supported by growth in industrial and packaging applications. Brazil and Mexico lead regional consumption due to increased infrastructure development and rising consumer demand for personal care products. Expanding use of silicone lubricants and emulsifiers in manufacturing and agriculture enhances market adoption. Local producers are gradually shifting toward environmentally safe formulations to align with global standards. Improved trade relations and investments in chemical manufacturing are expected to strengthen the region’s supply chain and support moderate but stable growth.

Middle East & Africa

The Middle East & Africa accounted for 6% of the silicone additives market in 2024. Growth is driven by increasing construction activities, oil and gas operations, and industrial applications. The UAE and Saudi Arabia lead demand with expanding infrastructure and manufacturing sectors. Rising awareness of performance-enhancing additives in coatings and lubricants further supports regional expansion. Local industries are adopting silicone-based materials for durability and heat resistance. Although smaller in size, the region shows growing potential due to diversification in end-use industries and increased focus on sustainable production practices.

Market Segmentations:

By Type

- Silicone Surfactants

- Silicone Emulsifiers

- Silicone Resins

- Silicone Fluids

- Silicone Polymers

- Others

By Function

- Lubrication

- Wetting & Dispersing Agent

- Surfactants

- Deformers

- Others

By End-use

- Paints & Coatings

- Paper & Pulp

- Personal Care

- Food & Beverages

- Oil & Gas

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The silicone additives market is characterized by strong competition among leading players such as Dow, Wacker Chemie, Shin-Etsu, Evonik, Momentive Performance Materials, Elkem, Siltech, ALTANA, BYK, and BRB International. The market structure reflects high consolidation, with global companies focusing on innovation and sustainable product development to strengthen their positions. Manufacturers are investing in advanced silicone formulations offering superior performance in coatings, lubricants, and personal care products. Strategic partnerships and capacity expansions in Asia-Pacific and Europe support growth through improved production efficiency and local supply reliability. Companies are also emphasizing eco-friendly and regulatory-compliant additives to align with sustainability goals. Ongoing R&D efforts aim to enhance multifunctional performance and cost-effectiveness while addressing diverse end-use industry needs.

Key Player Analysis

- Dow

- Wacker Chemie

- Shin-Etsu

- Evonik

- Momentive Performance Materials

- Elkem

- Siltech

- ALTANA

- BYK

- BRB International

Recent Developments

- In 2025, DOW Launched DOWSIL™ EG-4175 Silicone Gel, designed for high-voltage power electronics (IGBT modules) in EVs.

- In 2025, Shin-Etsu announced a number of new personal care products, including the KF-6070W (a silicone wax for feel enhancement) and KF-6080W (a silicone emulsifier).

- In 2023, BYK (part of the Altana Group) unveiled a range of new silicone-based wetting agents and flow promoters at the European Coatings Show in Nuremberg, Germany

Report Coverage

The research report offers an in-depth analysis based on Type, Function, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for silicone additives will rise with expanding construction and automotive sectors.

- Asia-Pacific will remain the fastest-growing region due to rapid industrialization.

- Paints and coatings will continue as the leading application segment globally.

- Manufacturers will focus on bio-based and low-VOC silicone additive formulations.

- Advancements in silicone polymer chemistry will improve product efficiency and cost-effectiveness.

- Increasing use in personal care and cosmetics will support steady market growth.

- Food and beverage processing applications will create new growth opportunities.

- Strategic partnerships and capacity expansions will strengthen supply chain stability.

- Regulatory pressure will drive innovation in environmentally safe silicone technologies.

- Digital monitoring and smart production methods will enhance manufacturing efficiency and quality control.