Market Overview

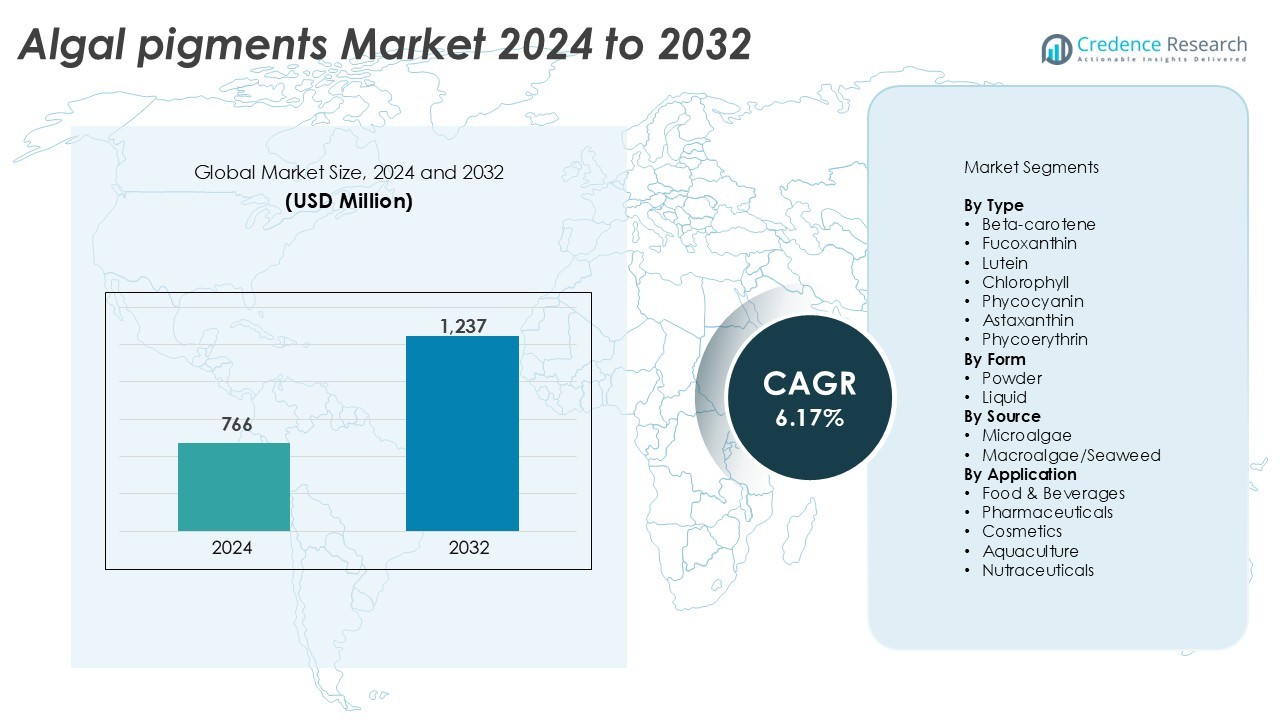

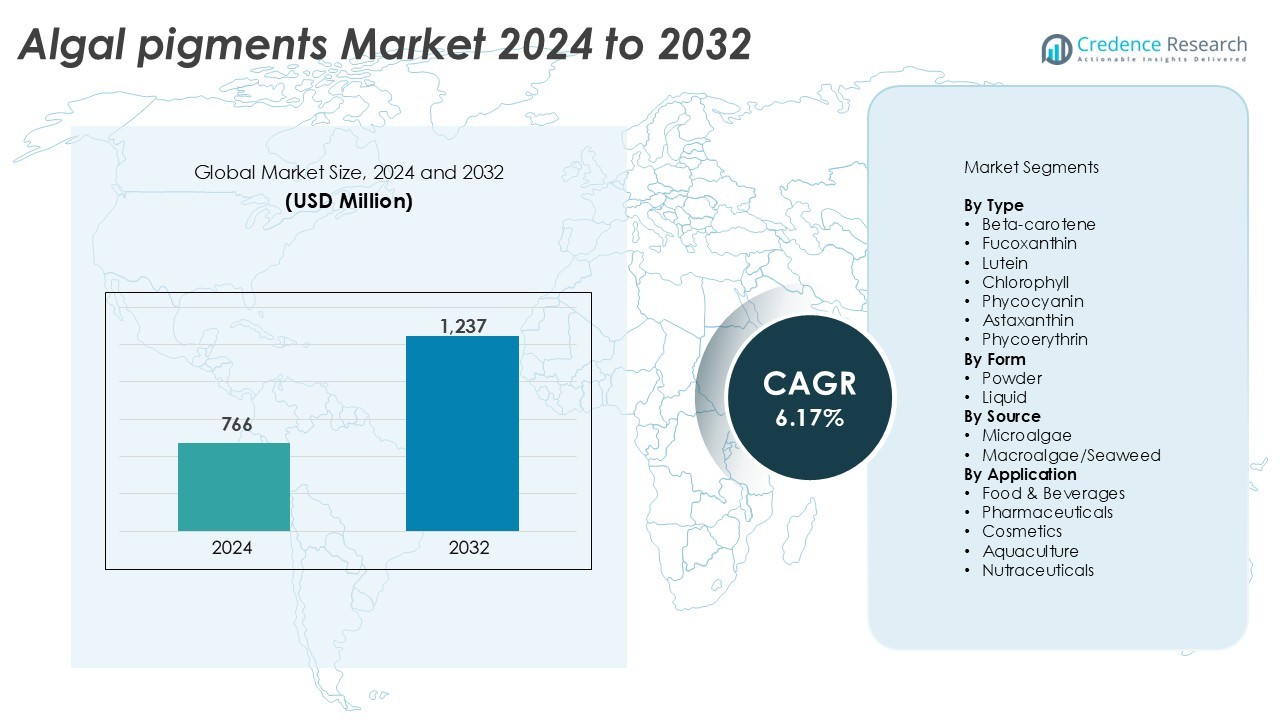

The Algal Pigments Market was valued at USD 766 million in 2024 and is projected to reach USD 1,237 million by 2032, registering a CAGR of 6.17% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Algal Pigments Market Size 2024 |

USD 766 Million |

| Algal Pigments Market, CAGR |

6.17% |

| Algal Pigments Market Size 2032 |

USD 1,237 Million |

The algal pigments market features prominent players such as DIC Corporation, BASF SE, Cyanotech Corporation, Parry Nutraceuticals, Algatechnologies Ltd., Naturex S.A., ExcelVite Sdn. Bhd., Fuji Chemical Industries Co. Ltd., Phycom Microalgae, and E.I.D. Parry (India) Limited. These companies emphasize innovation in algae cultivation, extraction efficiency, and product quality to serve food, nutraceutical, and cosmetic sectors. Strategic collaborations, technological advancements, and sustainability initiatives strengthen their market positions. North America leads the global algal pigments market with a 35% share, driven by advanced biotechnology infrastructure and strong consumer demand for natural ingredients, followed by Europe with a 30% share, supported by strict regulatory standards favoring clean-label products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Algal Pigments Market was valued at USD 766 million in 2024 and is projected to reach USD 1,237 million by 2032, growing at a CAGR of 6.17%.

- Rising demand for natural colorants in food, beverages, nutraceuticals, and cosmetics drives market growth, supported by increasing preference for plant-based and sustainable ingredients.

- Technological advancements in microalgae cultivation and eco-friendly extraction processes enhance pigment yield and purity, creating opportunities for innovation and scalability.

- Leading players such as DIC Corporation, BASF SE, and Cyanotech Corporation focus on product diversification, partnerships, and R&D to maintain competitiveness in global markets.

- North America leads with a 35% share, followed by Europe with 30%, while beta-carotene dominates the type segment with a 27% share, driven by its widespread use as a natural antioxidant and colorant.

Market Segmentation Analysis:

By Type

Beta-carotene dominates the algal pigments market, accounting for a 27% share in 2024. Its strong demand stems from widespread use as a natural colorant and antioxidant in food, beverages, and dietary supplements. The pigment’s stability and high yield from microalgae such as Dunaliella salina make it commercially preferred. Fucoxanthin and astaxanthin are also gaining traction due to their proven health benefits and growing use in nutraceuticals and cosmetics. Rising interest in natural alternatives to synthetic dyes continues to support steady growth across all pigment categories.

- For instance, BASF SE produces natural, high-purity beta-carotene from the microalgae Dunaliella salina, primarily under the brand name Betatene®, using a process involving cultivation in open-air seawater lagoons in Australia. In these conditions, the algae can accumulate significant concentrations of beta-carotene, often reported in scientific literature as reaching up to 14% of dry weight (140 mg per gram), although specific average production yields can vary based on cultivation conditions.

By Form

The powder segment leads the market with a 68% share, driven by its long shelf life, ease of transport, and compatibility with various applications. Powdered algal pigments are widely used in food processing, cosmetics, and pharmaceuticals for stable coloration and nutrient enrichment. Liquid pigments, although less dominant, are expanding in beverage and aquaculture formulations where solubility and quick dispersion are essential. The shift toward processed food and functional beverages continues to strengthen demand for powdered pigment forms.

- For instance, Fermentalg introduced a liquid phycocyanin extract with 30 g/L concentration, improving solubility for sports drink and dairy formulations.

By Source

Microalgae represent the dominant source segment with a 71% share, supported by high pigment concentration and controlled cultivation conditions. Species such as Spirulina, Chlorella, and Dunaliella provide consistent yields and allow year-round production. The scalability of photobioreactors and closed-culture systems enhances productivity while maintaining purity standards. Macroalgae or seaweed contribute to niche segments like fucoxanthin extraction but face limitations in pigment density and seasonal availability. Increasing R&D in microalgae-based bioprocessing continues to reinforce its leadership in commercial pigment production.

Key Growth Drivers

Rising Demand for Natural and Sustainable Colorants

The shift toward natural ingredients in food, cosmetics, and pharmaceuticals is a major growth driver for the algal pigments market. Consumers increasingly reject synthetic dyes linked to health concerns, favoring eco-friendly and plant-based alternatives. Algal pigments such as beta-carotene, phycocyanin, and astaxanthin offer strong coloring capabilities with added antioxidant and anti-inflammatory benefits. Manufacturers leverage these pigments for clean-label formulations, enhancing brand appeal. Supportive regulations promoting natural additives and sustainable sourcing practices further strengthen adoption across key industries, particularly in Europe and North America.

- For instance, Chr. Hansen (now part of Novonesis) developed its FruitMax® red series from a unique, non-GMO sweet potato variety, achieving a plant-based, vibrant red color as an alternative to carmine and synthetic dyes.

Expanding Applications in Nutraceuticals and Functional Foods

Algal pigments are witnessing growing use in nutraceuticals and functional food products due to their bioactive properties. These pigments provide essential nutrients, boost immunity, and support cellular health, aligning with rising consumer focus on wellness and preventive healthcare. Companies incorporate lutein, chlorophyll, and astaxanthin in supplements and fortified foods to enhance visual and cardiovascular health. The functional beverage segment also benefits from natural pigment inclusion for visual appeal and nutritional enhancement. Increased investment in R&D to validate health claims continues to fuel market penetration.

- For instance, Fuji Chemical Industries Co. Ltd. produces natural astaxanthin from Haematococcus pluvialis using a proprietary supercritical CO₂ extraction process that yields 50 milligrams of astaxanthin per gram of biomass, ensuring superior antioxidant potency in nutraceutical formulations.

Technological Advancements in Algae Cultivation and Extraction

Innovations in photobioreactor systems and bioprocessing technologies have improved pigment yield, purity, and cost efficiency. Controlled environmental systems enable higher biomass productivity and pigment extraction from specific algae strains such as Spirulina and Dunaliella salina. Supercritical CO₂ and ultrasound-assisted extraction methods enhance pigment recovery while preserving bioactivity. These advancements lower production costs and improve scalability for commercial operations. Growing collaboration between biotechnology firms and pigment producers accelerates technological integration, supporting mass production and consistent quality supply to meet industrial-scale demand.

Key Trends & Opportunities

Growth in Cosmetics and Personal Care Applications

The cosmetics sector increasingly adopts algal pigments for their natural coloring and skincare benefits. Pigments like phycocyanin and astaxanthin possess strong antioxidant and UV-protection properties, making them ideal for anti-aging and skin-repair formulations. Clean-label beauty trends and vegan formulations have accelerated product innovation in creams, lip balms, and hair care products. Brands highlight sustainability and marine-derived ingredients to appeal to eco-conscious consumers. This expansion presents significant opportunities for pigment producers to diversify offerings and establish partnerships with cosmetic manufacturers.

- For instance, Gelyma developed the “SUN’ALG®” microalgae + seed‑oil complex—combining extracts of Dunaliella salina (β‑carotene rich) and Haematococcus pluvialis (astaxanthin rich)—which demonstrated gene‑expression increases (e.g., NQO1 ×125, AKR1C3 ×328) and inhibition of IL‑8 release by 33 – 44 % in clinical tests.

Rising Focus on Circular Bioeconomy and Waste Utilization

The algal pigments market is aligning with global bioeconomy goals by utilizing industrial CO₂ emissions and wastewater in algae cultivation. Companies are investing in integrated systems that convert waste streams into valuable pigments, reducing environmental impact and production costs. Algal biorefineries further optimize resource use by extracting multiple high-value compounds from a single biomass. This circular production approach enhances profitability and sustainability, positioning algae-derived pigments as key components of next-generation green manufacturing ecosystems.

Expanding Industrial and Pharmaceutical Applications

Beyond food and cosmetics, algal pigments are gaining traction in pharmaceuticals for their therapeutic properties. Beta-carotene and lutein are incorporated in eye-health formulations, while astaxanthin shows potential in anti-inflammatory treatments. Research into microalgae-based biopolymers and biosensors also opens new industrial applications. The increasing cross-sector integration of algal biotechnology supports diversification, creating long-term growth prospects for pigment producers targeting medical, diagnostic, and biotechnological industries.

Key Challenges

High Production and Processing Costs

Despite technological progress, the algal pigment industry faces cost challenges linked to cultivation and extraction. Maintaining controlled environments, specialized reactors, and energy-intensive harvesting systems increases operational expenses. Small-scale producers struggle with capital requirements and limited economies of scale. Inconsistent pigment yield due to strain variability further affects production efficiency. These cost barriers restrict competitiveness against synthetic pigments, compelling manufacturers to focus on optimizing cultivation systems and developing low-cost extraction technologies for wider market adoption.

Quality Standardization and Regulatory Compliance

Ensuring consistent pigment quality and meeting diverse international regulations present major hurdles for market participants. Variations in pigment concentration and purity across algae species make standardization difficult. Different regions impose strict labeling and safety norms for natural colorants used in food, drugs, and cosmetics. Regulatory approval processes can be lengthy and costly, delaying commercialization. Manufacturers must invest in advanced testing, traceability systems, and certifications to build trust and meet compliance standards, particularly in markets such as the EU and the U.S.

Regional Analysis

North America

North America dominates the algal pigments market with a 35% share in 2024. The region benefits from strong demand for natural colorants across food, nutraceutical, and cosmetic industries. The U.S. leads production due to advanced biotechnology infrastructure and increasing investments in microalgae-based products. Supportive regulations by the FDA and growing consumer awareness of clean-label products drive market expansion. The presence of key players and partnerships between research institutions and pigment manufacturers continue to strengthen North America’s leadership in innovation and large-scale algae cultivation.

Europe

Europe holds a 30% market share, driven by strict regulations on synthetic additives and growing emphasis on sustainability. Countries like Germany, France, and the Netherlands lead adoption due to strong bioeconomy policies and technological advancements in algae processing. The demand for vegan, natural, and organic ingredients supports the expansion of algal pigment use in food and personal care applications. EU initiatives promoting circular economy practices and carbon-neutral production further stimulate investment in algae biotechnology. Europe’s commitment to environmental standards continues to enhance its competitive position in global pigment exports.

Asia-Pacific

Asia-Pacific accounts for a 25% market share and is the fastest-growing regional segment. The region’s growth is supported by abundant seaweed resources, low production costs, and expanding demand for natural ingredients in Japan, China, and South Korea. Government support for marine biotechnology and sustainable aquaculture boosts algae-based pigment production. Rising health awareness and the growing nutraceutical sector fuel adoption in dietary supplements and functional foods. Increasing collaboration between research institutions and private firms enhances pigment quality and extraction efficiency, positioning Asia-Pacific as a key hub for algal pigment manufacturing.

Latin America

Latin America captures an 8% share of the algal pigments market, driven by emerging algae cultivation projects in Brazil, Chile, and Mexico. The region’s favorable climatic conditions and access to marine resources support large-scale algae farming. Increasing use of natural pigments in processed food, beverages, and aquaculture feed drives market adoption. Government programs promoting bio-based industries and research collaborations in marine biotechnology are strengthening regional capabilities. Although still developing, Latin America’s growing focus on sustainable production positions it as an upcoming contributor to the global algae pigment supply chain.

Middle East & Africa

The Middle East & Africa region holds a 2% market share, with gradual adoption led by niche applications in cosmetics and dietary supplements. Limited freshwater resources encourage interest in marine and desert algae cultivation systems. Countries such as the UAE and South Africa are exploring algae-based pigment production through pilot projects and research partnerships. Growing consumer awareness of natural ingredients and diversification of food processing industries support future market potential. However, infrastructure challenges and limited R&D investments currently restrict large-scale commercialization in this region.

Market Segmentations:

By Type

- Beta-carotene

- Fucoxanthin

- Lutein

- Chlorophyll

- Phycocyanin

- Astaxanthin

- Phycoerythrin

By Form

By Source

- Microalgae

- Macroalgae/Seaweed

By Application

- Food & Beverages

- Pharmaceuticals

- Cosmetics

- Aquaculture

- Nutraceuticals

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The algal pigments market is moderately consolidated, with key players focusing on innovation, scalability, and sustainable production. Leading companies such as DIC Corporation, Cyanotech Corporation, Algatechnologies Ltd., Parry Nutraceuticals, and BASF SE dominate through advanced cultivation systems and patented extraction processes. These firms invest heavily in biotechnological research to enhance pigment yield, purity, and environmental efficiency. Strategic alliances, mergers, and facility expansions are common to strengthen global reach and supply chain resilience. For instance, several players are integrating closed photobioreactor systems to achieve higher productivity and lower contamination risks. Rising competition from regional startups in Asia-Pacific, focusing on cost-effective production and novel pigment formulations, adds dynamism to the market. The overall competitive environment emphasizes product differentiation, sustainable sourcing, and compliance with stringent regulatory standards governing natural colorant use in food, pharmaceuticals, and cosmetics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DIC Corporation

- Cyanotech Corporation

- Döhler GmbH

- BASF SE

- Sensient Technologies Corporation

- E.I.D. – Parry (India) Limited

- Naturex (part of Givaudan)

- DDW The Color House

- Chr. Hansen Holding A/S

- FMC Corporation

Recent Developments

- In January 2025, Algaia S.A. launched a new line of enhanced-stability algal pigments designed for beverage applications. The pigments meet clean-label and regulatory standards while offering improved performance. This innovation was confirmed in a March 2025 Meticulous Research® press release via PR Newswire.

- In July 2023, Brevel, an Israeli startup, announced that it successfully concluded an USD 18.5 million seed round to scale up its algae-based ingredient manufacturing platform. The funding includes USD 8.4 million converted from grants and convertible loans, which were initially announced last year.

Report Coverage

The research report offers an in-depth analysis based on Type, Form, Source, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for natural and sustainable colorants will continue to drive steady market expansion.

- Advancements in algae cultivation and extraction will enhance pigment yield and cost efficiency.

- Microalgae-based pigments will gain dominance due to higher concentration and controlled production.

- Increasing applications in food, cosmetics, and nutraceuticals will diversify revenue sources.

- Rising consumer awareness of clean-label products will accelerate adoption in premium brands.

- Collaborations between biotech firms and pigment producers will strengthen global supply chains.

- Regional players in Asia-Pacific will expand production capacity to meet growing global demand.

- Regulatory support for natural additives will favor market penetration across developed economies.

- Integration of circular bioeconomy principles will improve sustainability and reduce waste.

- Ongoing R&D investment will lead to development of new pigments with enhanced stability and functionality.