Market Overview:

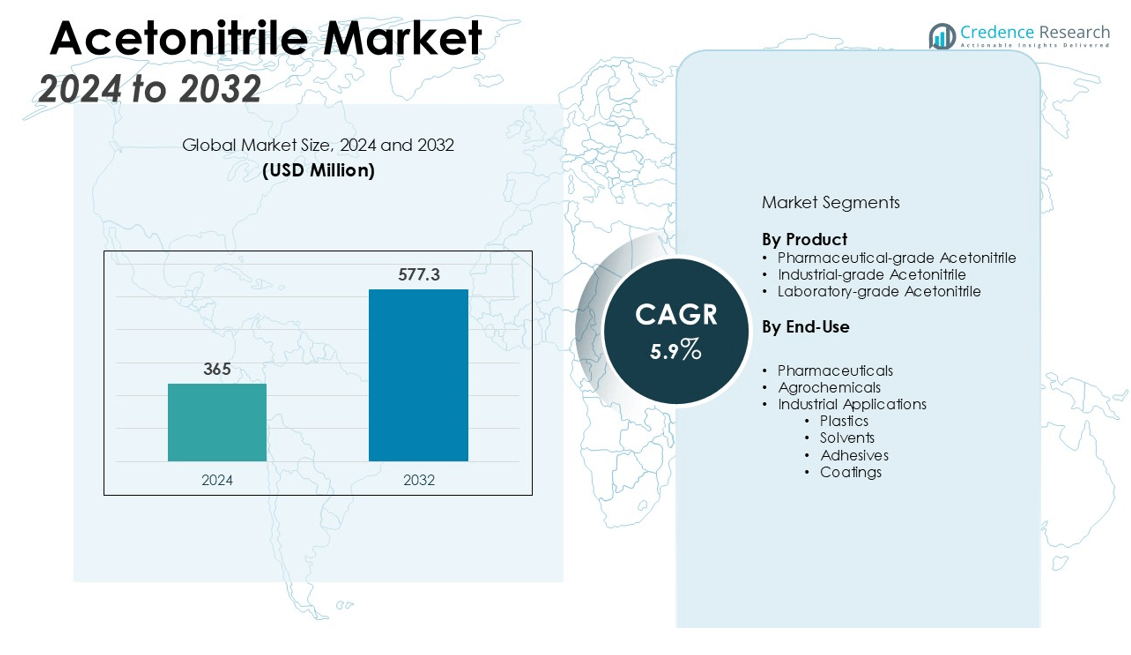

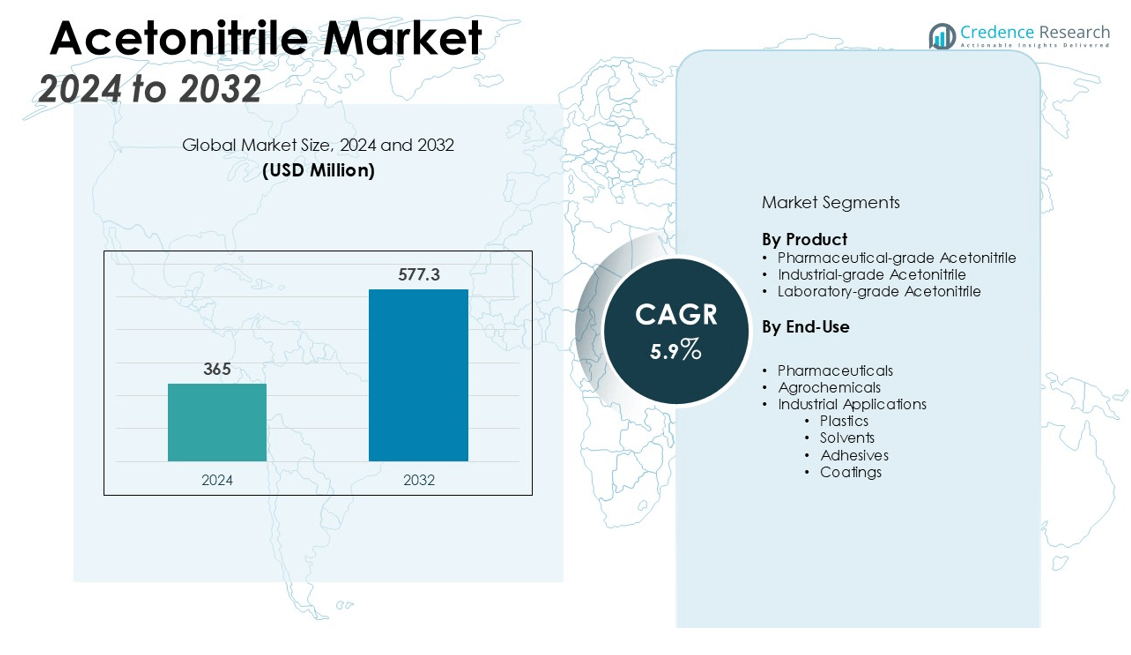

The Acetonitrile Market size was valued at USD 365 million in 2024 and is anticipated to reach USD 577.3 million by 2032, at a CAGR of 5.9% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Acetonitrile Market Size 2024 |

USD 365 million |

| Acetonitrile Market, CAGR |

5.9% |

| Acetonitrile MarketSize 2032 |

USD 577.3 million |

Key drivers of the Acetonitrile Market include its widespread use in the production of critical chemicals, especially in pharmaceutical applications for drug formulations and as a solvent in chemical syntheses. The rising demand for specialty chemicals and the continuous growth of the pharmaceutical and agrochemical industries are fueling the need for acetonitrile. Additionally, the shift towards more efficient and sustainable chemical processes is promoting the adoption of acetonitrile. The increasing emphasis on research and development in various sectors further accelerates its demand, particularly in high-performance laboratories.

Regionally, North America holds the largest market share due to the robust pharmaceutical and chemical industries in the United States and Canada. However, the Asia-Pacific region is expected to experience the highest growth rate during the forecast period, driven by rapid industrialization, increased manufacturing activities, and growing demand from emerging economies such as China and India. The region’s expanding biotechnology and healthcare sectors are also contributing to the growing consumption of acetonitrile.

Market Insights:

- The Acetonitrile Market was valued at USD 365 million in 2024 and is projected to reach USD 577.3 million by 2032, growing at a CAGR of 5.9%.

- The pharmaceutical sector is the largest consumer of acetonitrile, driven by its essential role in drug formulation and HPLC applications.

- The agrochemical industry is a significant driver, using acetonitrile in the production of pesticides and herbicides.

- Environmental and regulatory challenges related to acetonitrile’s VOC classification push manufacturers toward sustainable production methods.

- Volatility in raw material prices, such as ammonia and propylene, impacts production costs and market stability.

- North America holds 35% of the market share, driven by strong pharmaceutical and chemical industries in the U.S. and Canada.

- The Asia-Pacific region holds 25% of the market share and is expected to experience the highest growth, driven by industrialization and demand in emerging economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Widespread Use in Pharmaceutical Applications

The Acetonitrile Market benefits significantly from its widespread use in pharmaceutical applications. It serves as a critical solvent in the synthesis of various active pharmaceutical ingredients (APIs) and intermediates. The demand for acetonitrile is largely driven by its role in high-performance liquid chromatography (HPLC), a key technique in pharmaceutical analysis. As the pharmaceutical industry continues to grow, the need for acetonitrile in drug formulations and purity analysis also rises. Its indispensable role in this sector ensures consistent demand for the product.

- For instance, in a method developed by researchers at China Pharmaceutical University to analyze the cancer drug raltitrexed, HPLC using an acetonitrile-based mobile phase achieved a lower limit of quantification of 2.0 ng/ml.

Growth in Agrochemical Sector

The growing demand for agrochemicals, including herbicides, pesticides, and fungicides, is another key driver of the Acetonitrile Market. Acetonitrile is used as a solvent in the production of these chemicals, facilitating the synthesis of complex compounds. The increasing agricultural production and the need for crop protection solutions in both developed and developing countries further fuel the market. With the continued need to address food security challenges, acetonitrile plays a significant role in supporting agricultural chemical production.

- For instance, the synthesis of the technical active ingredient for Syngenta’s innovative Plinazolin technology is a complex process requiring 26 distinct chemical steps, where solvents like acetonitrile are essential.

Shift Towards Sustainable Chemical Processes

The shift toward more efficient and sustainable chemical processes is another driver for the acetonitrile market. Companies are focusing on adopting greener production methods, and acetonitrile, being a versatile solvent, fits well within these trends. Its use in replacing hazardous chemicals in various applications promotes its adoption across industries. Environmental regulations and a growing emphasis on reducing industrial waste also push for the use of safer solvents like acetonitrile in manufacturing processes.

Rising Demand from Emerging Economies

Emerging economies, especially in the Asia-Pacific region, are driving the demand for acetonitrile due to their rapid industrialization. Countries like China and India are expanding their pharmaceutical, chemical, and agrochemical industries, which in turn increases the need for acetonitrile. The rising disposable income and improving healthcare infrastructure in these regions further contribute to market growth. As these economies grow, acetonitrile continues to play a key role in supporting their expanding industrial sectors.

Market Trends:

Increased Demand for High-Quality Acetonitrile

The Acetonitrile Market is witnessing a growing trend towards the demand for high-purity acetonitrile. With the rise in pharmaceutical and biotechnology applications, the need for ultra-pure solvents has escalated. Acetonitrile’s high-purity grade is crucial for applications such as high-performance liquid chromatography (HPLC) and DNA sequencing, where impurities can lead to inaccurate results. Pharmaceutical companies, particularly in the development of new drugs and vaccines, require the highest standards of purity in solvents. This demand is pushing manufacturers to invest in advanced purification technologies to meet these stringent requirements, contributing to the overall growth of the market.

- For instance, the chemical manufacturer Birch Biotech produces PRISTINE® HPLC Grade Acetonitrile, which is refined to a standard that ensures the residue after evaporation is a maximum of 1 part per million.

Technological Advancements in Acetonitrile Production

The production process of acetonitrile has seen technological advancements that improve efficiency and reduce environmental impact. Newer production methods, such as the one-step method from propylene and ammonia, are becoming more common, enhancing the yield and purity of acetonitrile. These innovations help reduce production costs and minimize waste, addressing both economic and environmental concerns. Furthermore, technological improvements in recycling acetonitrile from industrial processes contribute to the sustainable growth of the market. As these production methods evolve, they increase the supply of acetonitrile while maintaining its quality, further bolstering its application across various industries.

- For instance, INEOS Nitriles is utilizing its advanced catalyst technology in an acrylonitrile plant designed to have a capacity of 425,000 tonnes.

Market Challenges Analysis:

Environmental and Regulatory Challenges

The Acetonitrile Market faces significant environmental and regulatory challenges. Acetonitrile is classified as a volatile organic compound (VOC) and is subject to strict environmental regulations in various regions. The chemical’s potential to contribute to air and water pollution has led to increasing scrutiny by regulatory bodies. Manufacturers are required to comply with these regulations, which can increase production costs and reduce operational flexibility. Moreover, the disposal of acetonitrile waste is a concern due to its toxic nature, necessitating stringent waste management practices to avoid environmental damage.

Volatility in Raw Material Prices

The Acetonitrile Market is also impacted by the volatility in the prices of raw materials used in its production, such as ammonia and propylene. These materials are subject to price fluctuations due to global supply chain disruptions, geopolitical factors, and fluctuations in crude oil prices. The rising cost of raw materials can increase production costs, impacting the overall profitability of acetonitrile manufacturers. These price fluctuations pose a challenge for companies in maintaining stable pricing for acetonitrile, which can affect long-term contracts and market stability.

Market Opportunities:

Expanding Applications in Biotechnology and Pharmaceuticals

The Acetonitrile Market presents significant growth opportunities through its expanding applications in biotechnology and pharmaceuticals. The increasing focus on biotechnology research, particularly in genomics and drug development, drives the demand for high-purity acetonitrile. It plays a vital role in various research applications such as DNA synthesis, HPLC analysis, and vaccine production. As pharmaceutical companies accelerate their drug discovery processes and invest in biologics and personalized medicine, the demand for acetonitrile in these areas will continue to grow, presenting lucrative opportunities for market players.

Adoption of Sustainable Practices and Recycling Technologies

Another key opportunity lies in the adoption of sustainable practices and the growing interest in recycling technologies. With increasing environmental concerns, there is a rising demand for the recycling of solvents like acetonitrile, which could drive market growth. Companies that invest in solvent recovery and recycling technologies can reduce waste, lower production costs, and meet environmental regulations. This shift towards more sustainable production practices aligns with global trends towards sustainability and offers companies a competitive advantage while addressing regulatory and environmental challenges.

Market Segmentation Analysis:

By Product

The Acetonitrile Market is segmented based on product types, with the major categories being pharmaceutical-grade, industrial-grade, and laboratory-grade acetonitrile. Pharmaceutical-grade acetonitrile holds the largest market share due to its critical role in drug formulation, biotechnology research, and analytical procedures like high-performance liquid chromatography (HPLC). Laboratory-grade acetonitrile is widely used in research environments, while industrial-grade acetonitrile finds extensive use in chemical production, particularly in the manufacturing of solvents, pesticides, and plastics. The increasing demand for high-purity acetonitrile in pharmaceutical and biotechnology applications continues to drive market growth, with laboratory-grade products also gaining traction due to expanding research activities globally.

- For instance, Trillium Renewable Chemicals is building the world’s first demonstration plant to convert plant-based glycerol into acrylonitrile and acetonitrile, a project backed by a significant U.S. Department of Energy award of $2.5 million.

By End-Use

The end-use segment of the Acetonitrile Market includes pharmaceuticals, agrochemicals, and industrial applications. The pharmaceutical sector dominates the market, driven by the rising need for acetonitrile in drug formulation, pharmaceutical synthesis, and analytical testing. Acetonitrile plays a key role in the production of active pharmaceutical ingredients (APIs) and in the purification of drugs. The agrochemical industry follows closely, utilizing acetonitrile in the production of pesticides and herbicides. The industrial applications segment covers a wide range of uses, including solvents in plastics, adhesives, and coatings. As the global demand for healthcare and agricultural products continues to rise, the market for acetonitrile in these sectors is expected to expand significantly. The Acetonitrile Market will see sustained growth from these end-use segments as they remain integral to various manufacturing and production processes.

- For instance, to meet rising demand from various end-use sectors, Jindal Speciality Chemicals Private Limited invested over Rs 100 crore to establish a new acetonitrile production facility in Kheda, Gujarat.

Segmentations:

By Product

- Pharmaceutical-grade Acetonitrile

- Industrial-grade Acetonitrile

- Laboratory-grade Acetonitrile

By End-Use

- Pharmaceuticals

- Agrochemicals

- Industrial Applications

- Plastics

- Solvents

- Adhesives

- Coatings

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds 35% of the global Acetonitrile Market, with the United States and Canada leading in demand due to their robust pharmaceutical and chemical industries. The demand for acetonitrile in pharmaceutical applications, particularly in drug formulation and analytical procedures, remains a key growth driver in the region. The U.S. leads in biotechnology and clinical research, further expanding the need for high-purity solvents. Furthermore, stringent regulations around product quality and purity in North America ensure that acetonitrile remains a crucial component in laboratory and industrial applications.

Europe

Europe accounts for 30% of the global Acetonitrile Market, driven by demand from the pharmaceutical, chemical, and agricultural sectors. The European Union’s strict environmental and regulatory standards drive innovation in solvent recovery and waste management, creating opportunities for sustainable acetonitrile production. The region’s focus on high-quality pharmaceutical products, particularly in countries like Germany, France, and the UK, sustains the demand for acetonitrile. The market is also supported by strong manufacturing and chemical production sectors, ensuring consistent demand from various industries.

Asia-Pacific

The Asia-Pacific region holds 25% of the global Acetonitrile Market, exhibiting the highest growth potential driven by rapid industrialization in countries such as China and India. Increased demand for acetonitrile in pharmaceuticals, agrochemicals, and electronics manufacturing supports market expansion. The focus on biotechnology, life sciences research, and agricultural chemical production accelerates acetonitrile consumption in the region. As these countries strengthen their industrial and pharmaceutical sectors, acetonitrile usage will rise, providing substantial growth opportunities. Additionally, the region’s cost-effective production capabilities contribute to its competitive edge in the global market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Cepsa

- INEOS

- Henan GP Chemicals Co.,Ltd

- Honeywell International Inc

- Zhengzhou Meiya Chemical Products Co.,Ltd

- Jindal Speciality Chemical

- Alkyl Amines Chemicals Limited

- Shandong Xinhua Pharma

Competitive Analysis:

The Acetonitrile Market is highly competitive, with key players focusing on product quality, production capacity, and geographical expansion. Prominent companies in the market include Sigma-Aldrich, Anhua Chemical, Shanghai Aladdin Bio-Chem Technology Co., Ltd., and Asahi Kasei Corporation. These companies are leveraging their extensive production capabilities and strong distribution networks to cater to diverse industries such as pharmaceuticals, agrochemicals, and industrial applications. Market players are also focusing on innovation and sustainable production methods, particularly in response to growing environmental concerns and regulations. The increasing demand for high-purity acetonitrile in pharmaceutical and biotechnology sectors further intensifies competition, encouraging companies to improve production processes and meet stringent quality standards. To stay ahead, companies are forming strategic partnerships, investing in research and development, and expanding their market presence, particularly in emerging markets across Asia-Pacific. This competitive landscape continues to drive advancements in acetonitrile production and usage.

Recent Developments:

- In April 2025, INEOS announced that the use of biomass is expected to lower CO2 emissions at its Grenadier production facility in France by 8,800 tonnes.

- In June 2025, Honeywell International Inc. presented at the SIAE Paris Air Show, where it discussed a transformative year that includes strategic acquisitions and spin-offs.

- In March 2023, Cepsa announced its plan to increase capital expenditure to €3.6 billion between 2023 and 2025, with more than half of the investment focused on sustainable businesses.

Market Concentration & Characteristics:

The Acetonitrile Market is moderately concentrated, with a few large players holding significant market shares. Key companies dominate production, leveraging economies of scale to meet the growing demand across pharmaceuticals, agrochemicals, and industrial sectors. Market characteristics include a strong emphasis on product purity, especially in pharmaceutical and biotechnology applications, where high-quality standards are essential. The market also features ongoing innovations in production processes, with companies focusing on sustainability and efficiency. Competition is driven by production capacity, regional expansion, and the ability to meet stringent regulatory standards. Companies are increasingly focused on securing long-term contracts, advancing research and development, and enhancing their distribution networks to maintain a competitive edge. The market’s steady demand from key sectors ensures stability, while new entrants continue to emerge, aiming to capitalize on growing industrialization, particularly in emerging economies.

Report Coverage:

The research report offers an in-depth analysis based on Product, End-Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The global Acetonitrile Market is projected to experience steady growth, with significant expansion expected in the coming years.

- Asia-Pacific is anticipated to continue its dominance, accounting for a significant share of global consumption, driven by rapid industrialization and increased pharmaceutical production.

- The pharmaceutical industry is expected to remain the leading end-user, utilizing acetonitrile for drug synthesis, high-performance liquid chromatography (HPLC) applications, and analytical processes.

- Advancements in biotechnology, particularly in DNA synthesis and protein purification, are expected to further increase demand for high-purity acetonitrile.

- The agrochemical sector’s use of acetonitrile in pesticide and herbicide production is projected to rise, contributing to the market’s growth.

- The electronics industry, especially in lithium-ion battery production, is gradually adopting acetonitrile, diversifying its application across various sectors.

- Sustainable production practices, including solvent recovery and bio-based synthesis methods, are gaining importance among manufacturers.

- Geopolitical factors and trade policies may influence supply chains, potentially affecting market dynamics and pricing strategies.

- Regulatory frameworks are becoming more stringent, encouraging the industry to adopt greener, safer, and more environmentally friendly production methods.

- Ongoing research and development efforts are expected to foster innovations in acetonitrile applications, expanding its market potential in emerging fields.