Market Overview

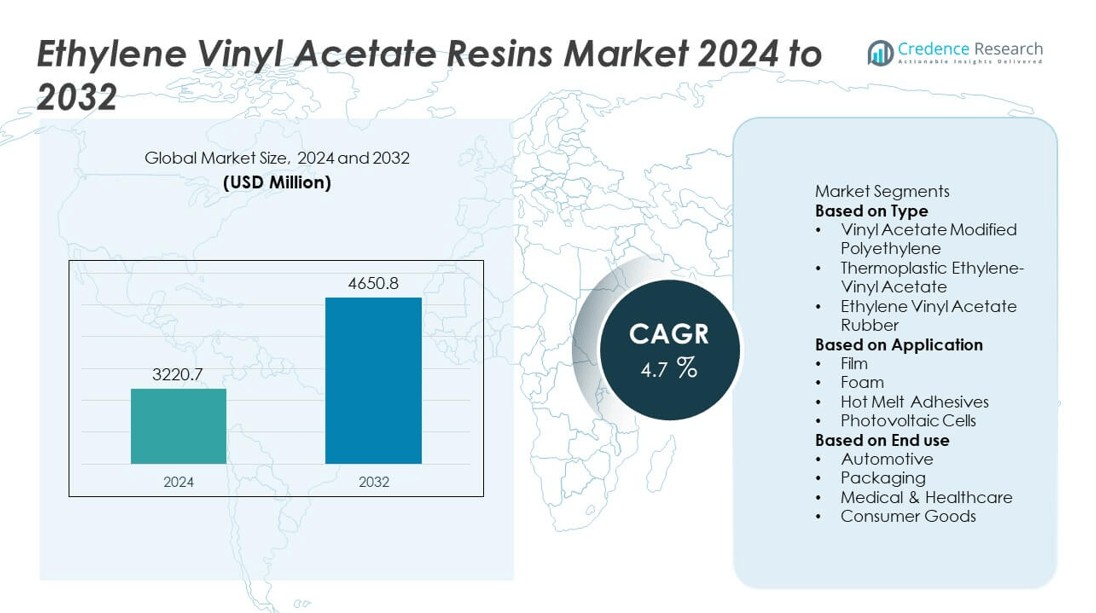

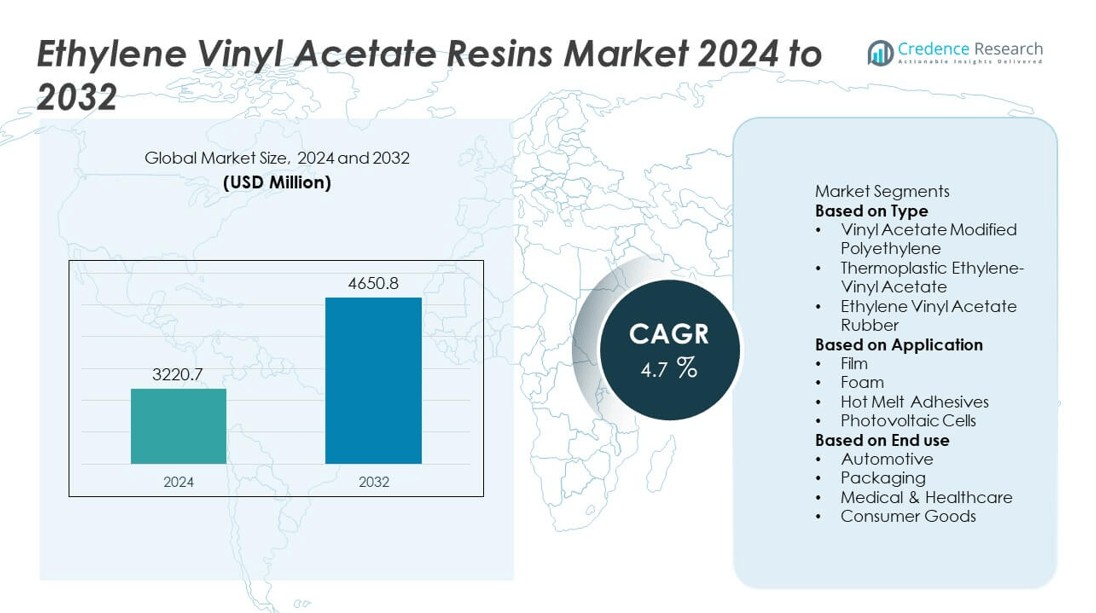

The Ethylene Vinyl Acetate (EVA) Resins Market was valued at USD 3,220.7 million in 2024 and is projected to reach USD 4,650.8 million by 2032, growing at a CAGR of 4.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ethylene Vinyl Acetate Resins Market Size 2024 |

USD 3,220.7 million |

| Ethylene Vinyl Acetate Resins Market, CAGR |

4.7% |

| Ethylene Vinyl Acetate Resins Market Size 2032 |

USD 4,650.8 million |

The Ethylene Vinyl Acetate Resins Market grows due to rising demand from packaging, footwear, solar encapsulation, and automotive sectors, driven by EVA’s flexibility, durability, and sealing efficiency. Expansion of renewable energy projects, particularly solar power, boosts consumption of EVA encapsulants with high transparency and UV resistance.

North America leads the Ethylene Vinyl Acetate Resins Market, driven by strong demand in packaging, automotive, and renewable energy sectors, supported by advanced manufacturing infrastructure. Europe follows with high adoption in specialty packaging, solar encapsulation, and automotive applications, influenced by stringent environmental regulations and a push for recyclable materials. Asia-Pacific is witnessing the fastest growth, fueled by large-scale manufacturing in China, expanding footwear production in Southeast Asia, and significant solar power investments in Japan and India. Latin America and the Middle East & Africa are gradually expanding adoption through construction, packaging, and renewable energy initiatives. Key players shaping the market include Exxon Mobil Corp., known for its broad EVA product range; Dow Inc., offering high-performance grades for diverse applications; LyondellBasell Industries Holdings B.V., focusing on sustainable polymer solutions.

Market Insights

- The Ethylene Vinyl Acetate Resins Market was valued at USD 3,220.7 million in 2024 and is projected to reach USD 4,650.8 million by 2032, growing at a CAGR of 4.7% during the forecast period.

- Rising demand from packaging, footwear, automotive, and renewable energy industries is driving market expansion due to EVA’s flexibility, durability, and superior sealing properties.

- Technological advancements, including high-performance EVA grades with enhanced UV resistance, improved adhesion, and bio-based alternatives, are shaping industry trends and meeting sustainability requirements.

- The competitive landscape is defined by major players such as Exxon Mobil Corp., Dow Inc., LyondellBasell Industries Holdings B.V., Arkema, and LG Chem, focusing on product innovation, sustainable manufacturing, and global supply chain strengthening.

- Price volatility of petrochemical feedstocks and competition from alternative materials like thermoplastic polyurethanes and biodegradable polymers act as key restraints to market growth.

- North America leads the market with strong demand across packaging, automotive, and solar sectors, while Asia-Pacific is the fastest-growing region, driven by large-scale manufacturing in China, rising solar installations in India, and expanding footwear production in Southeast Asia.

- Europe maintains steady demand, particularly in high-value packaging and renewable energy applications, while Latin America and the Middle East & Africa are witnessing gradual adoption through construction, automotive, and energy projects supported by local manufacturing investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand from the Packaging Industry

The Ethylene Vinyl Acetate Resins Market benefits from strong growth in the global packaging sector. EVA’s flexibility, clarity, and resistance to cracking make it an ideal material for film applications, including food packaging and medical pouches. Its ability to seal at low temperatures enhances production efficiency for packaging manufacturers. The material’s compatibility with other polymers allows for tailored performance in multilayer film structures. It supports shelf-life extension, a key priority for food and pharmaceutical packaging. Increasing e-commerce activity further drives demand for durable and protective packaging materials.

- For instance, ExxonMobil’s EVA 20020FL resin facilitates extrusion coating at 220 °C and initiates sealing at substantially lower temperatures while maintaining high clarity and extremely low gel content—processing above 240 °C may cause degradation.

Expansion in Renewable Energy Applications

EVA resins are widely used in solar photovoltaic module encapsulation due to their excellent adhesion, transparency, and UV resistance. Their role in protecting solar cells from environmental damage makes them critical for long-term performance. The shift toward renewable energy sources has increased global solar installations, boosting EVA consumption. It offers high light transmittance, which enhances energy conversion efficiency in solar panels. Strong demand in emerging markets with favorable solar policies supports volume growth. Continuous improvements in EVA formulations are extending panel lifespan and operational reliability.

- For instance, Arkema developed its ENCOR® EVA encapsulant grade with a light transmittance of over 91% at 1 mm thickness and a UV aging resistance exceeding 4,000 hours, improving photovoltaic module efficiency and extending operational life beyond 25 years.

Growing Footwear Manufacturing Industry

The footwear industry relies heavily on EVA for producing lightweight, shock-absorbing midsoles and outsoles. Its resilience, cushioning properties, and moldability make it a preferred material for sports, casual, and safety footwear. Rising consumer demand for comfort and performance-driven shoes boosts EVA usage. It enables manufacturers to achieve design flexibility while reducing overall product weight. Global sportswear brands are incorporating higher EVA content to improve durability and comfort. Increasing production in Asia-Pacific strengthens the material’s supply chain for footwear applications.

Rising Use in Automotive and Construction Sectors

EVA resins are gaining traction in automotive interiors, gaskets, and sealants due to their vibration dampening and chemical resistance properties. Their weatherability and bonding capabilities make them suitable for roofing membranes and flooring materials in construction. It helps manufacturers meet performance standards while maintaining cost efficiency. Infrastructure growth in developing economies is driving demand for EVA-based adhesives and sealants. Automotive electrification trends are creating opportunities for EVA in wire and cable insulation. The material’s versatility ensures its adoption across multiple high-growth industrial sectors.

Market Trends

Increasing Adoption of Bio-Based and Sustainable EVA

The Ethylene Vinyl Acetate Resins Market is witnessing a shift toward bio-based variants to meet sustainability goals and regulatory requirements. Manufacturers are developing EVA grades derived from renewable feedstocks, reducing dependence on fossil fuels. Bio-based EVA offers comparable mechanical and optical properties to conventional grades, enabling direct substitution in packaging, footwear, and solar applications. It supports brand strategies focused on reducing carbon footprints. Growing consumer preference for eco-friendly materials is encouraging investment in large-scale production of sustainable EVA. Government policies promoting green materials further strengthen this trend.

- For instance, A government environmental certification document highlights that a certified bio-based EVA displays identical tensile strength and melt flow characteristics compared to a reference petroleum-based grade, while passing equivalent food-contact safety tests.

Advancements in High-Performance EVA Grades

Technological innovation is enabling the development of EVA resins with enhanced thermal stability, UV resistance, and adhesion properties. High-performance grades cater to demanding applications such as solar encapsulation, medical devices, and automotive components. It delivers improved durability under extreme environmental conditions, extending product lifecycles. Manufacturers are introducing EVA with tailored vinyl acetate content to optimize flexibility and clarity for specific uses. The trend aligns with the need for material solutions that meet both functional and regulatory standards. Customization capabilities are enhancing EVA’s appeal across specialized industries.

- For instance, Arkema’s ENCOR® EVA 4260 photovoltaic encapsulant grade provides light transmittance above 91% at 1 mm thickness, adhesion to glass exceeding 60 N/cm after curing, and UV-aging resistance tested for over 4,000 hours without delamination, ensuring extended module performance in harsh climates.

Rising Use in Specialty Packaging Applications

EVA resins are increasingly used in niche packaging formats, including shrink films, stretch wraps, and hot-melt adhesives. Their sealing efficiency and compatibility with diverse substrates make them ideal for complex packaging designs. It enables manufacturers to deliver enhanced product protection and aesthetic appeal. Growth in fresh food and medical packaging is particularly driving adoption. EVA’s ability to maintain performance across varying temperature conditions adds value in cold-chain logistics. Market players are targeting premium packaging segments where material quality is a key differentiator.

Integration into Advanced Footwear Designs

The footwear sector is leveraging EVA’s properties to create lightweight, ergonomic, and high-performance products. Sports and athleisure brands are using EVA in combination with other advanced materials for cushioning systems. It provides designers with versatility in shaping and density control, supporting innovation in comfort and performance. Increasing demand for customized and sustainable footwear is pushing the use of modified EVA compounds. Global brands are adopting EVA blends to achieve unique color, texture, and weight profiles. This trend is enhancing the material’s position as a staple in next-generation footwear manufacturing.

Market Challenges Analysis

Volatility in Raw Material Prices and Supply Constraints

The Ethylene Vinyl Acetate Resins Market faces challenges from fluctuating prices of ethylene and vinyl acetate monomers, which are derived from petrochemical feedstocks. Price instability impacts production costs and reduces profit margins for manufacturers. Supply chain disruptions, driven by geopolitical tensions, plant shutdowns, and transportation bottlenecks, further strain availability. It creates uncertainty for end-users dependent on consistent material supply. Manufacturers are under pressure to secure long-term contracts and diversify sourcing strategies to mitigate risks. Any sustained price surge in feedstocks can slow adoption in price-sensitive markets.

Competition from Alternative Materials and Environmental Concerns

EVA resins compete with materials such as thermoplastic polyurethanes, polyethylene, and biodegradable polymers, which offer similar performance in certain applications. Increasing environmental regulations on plastic usage are driving some end-users toward fully compostable or recyclable options. It must adapt to evolving sustainability requirements to maintain market relevance. The production process also generates emissions that are under scrutiny in regions with strict environmental standards. Innovation in bio-based EVA grades is addressing part of this challenge, but adoption remains limited by higher production costs. Intense competition and regulatory pressure require continuous investment in greener technologies and material optimization.

Market Opportunities

Rising Demand from the Renewable Energy Sector

The Ethylene Vinyl Acetate Resins Market holds significant growth potential in the solar energy industry, where EVA is widely used for photovoltaic module encapsulation. Its superior transparency, adhesion, and UV resistance enhance solar cell efficiency and durability. Increasing global solar installations, supported by government incentives and renewable energy targets, are expanding EVA consumption. It offers the performance stability required for modules operating in diverse environmental conditions. Manufacturers investing in high-performance solar-grade EVA formulations can capture opportunities in both utility-scale and residential projects. Growth in emerging economies with large-scale solar initiatives further strengthens this opportunity.

Expansion in Sustainable and High-Value Packaging Solutions

The growing emphasis on sustainable packaging is creating demand for bio-based and recyclable EVA grades. Its sealing efficiency, flexibility, and compatibility with various substrates make it ideal for premium food, medical, and industrial packaging applications. Rising e-commerce and cold-chain logistics require durable, high-performance packaging films where EVA provides superior mechanical and barrier properties. It supports the development of multilayer structures that enhance product shelf life while meeting environmental regulations. Companies introducing eco-friendly EVA variants stand to benefit from shifting consumer preferences and tightening sustainability standards. The trend toward customized and value-added packaging formats further enhances EVA’s market potential.

Market Segmentation Analysis:

By Type

The Ethylene Vinyl Acetate Resins Market is segmented into low vinyl acetate content EVA, medium vinyl acetate content EVA, and high vinyl acetate content EVA. Low vinyl acetate grades offer high tensile strength and puncture resistance, making them suitable for films, sheets, and wire and cable applications. Medium vinyl acetate grades provide balanced flexibility and strength, often used in footwear soles, adhesives, and automotive parts. High vinyl acetate grades deliver superior elasticity, adhesion, and clarity, serving specialized applications such as solar encapsulation and medical packaging. It benefits from ongoing advancements in polymerization technology that enhance processing efficiency and property control across these segments.

- For instance, an EVA grade designed for hot-melt systems lists a melt index of 43 g/10 min (190 °C/2.16 kg), density of 0.948 g/cm³, and a peak melting temperature of 69 °C, specifications used by adhesive formulators to achieve fast flow and reliable set at controlled lamination temperatures.

By Application

Key applications include films, adhesives and sealants, foams, and others. Films represent a major share due to widespread use in packaging, greenhouse coverings, and lamination processes. EVA-based adhesives and sealants offer strong bonding, heat resistance, and flexibility, making them ideal for construction, automotive, and footwear manufacturing. Foams are extensively used in sports equipment, orthotics, and protective gear due to their cushioning and lightweight properties. It addresses a broad range of performance requirements, from clarity and flexibility in packaging films to structural resilience in industrial applications. The adaptability of EVA across diverse industries ensures sustained application growth.

- For instance, a lamination durability study reported that properly cured EVA sheets exhibit peel strength at the glass‑EVA interface between approximately 80 N/cm and 100 N/cm, providing essential bonding strength for long-term module reliability.

By End Use

Major end-use sectors include packaging, footwear, solar, automotive, and others. The packaging industry remains a primary consumer, leveraging EVA’s sealing efficiency, moisture resistance, and compatibility with food safety standards. Footwear manufacturing depends on EVA for comfort, durability, and weight reduction in soles and midsoles. The solar industry relies on EVA encapsulants to protect photovoltaic cells, enhancing panel life and energy output. Automotive applications range from interior trims to vibration-dampening components. It supports varied industrial needs through customizable properties, enabling manufacturers to meet specific performance, cost, and regulatory requirements across global markets.

Segments:

Based on Type

- Vinyl Acetate Modified Polyethylene

- Thermoplastic Ethylene-Vinyl Acetate

- Ethylene Vinyl Acetate Rubber

Based on Application

- Film

- Foam

- Hot Melt Adhesives

- Photovoltaic Cells

Based on End use

- Automotive

- Packaging

- Medical & Healthcare

- Consumer Goods

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 33.5% of the Ethylene Vinyl Acetate Resins Market in 2024, supported by strong demand from packaging, automotive, and renewable energy sectors. The United States leads the region with advanced manufacturing facilities, established polymer processing industries, and high adoption of EVA in solar encapsulation and flexible packaging. Canada and Mexico contribute through expanding automotive production and industrial packaging requirements. The region benefits from consistent innovation in EVA formulations aimed at improving performance and sustainability. It is also witnessing an increase in demand for bio-based EVA driven by regulatory pressure to reduce carbon emissions. High levels of research and development investment, along with strong integration between resin producers and end-use industries, sustain the region’s leadership position.

Europe

Europe holds 28.1% of the market, driven by stringent environmental regulations and strong industrial demand for high-performance materials. Germany, France, and Italy are key markets, leveraging EVA in automotive interiors, specialty packaging, and photovoltaic modules. The UK and Spain contribute significantly through their renewable energy projects, particularly in solar power installations. It benefits from a mature packaging industry with high demand for flexible films and food-safe materials. The European market is seeing growing interest in recyclable and bio-based EVA to align with the EU’s circular economy goals. Collaborative initiatives between resin manufacturers and downstream industries are enhancing product innovation and market adaptability.

Asia-Pacific

Asia-Pacific represents 27.4% of the global market and is the fastest-growing regional segment. China dominates production and consumption, driven by large-scale packaging manufacturing, footwear production, and rapid expansion of solar energy capacity. Japan, South Korea, and India also show strong growth, supported by automotive manufacturing and industrial applications. Southeast Asian nations, including Vietnam, Indonesia, and Thailand, are emerging as manufacturing hubs for EVA-based footwear and packaging materials. It benefits from cost-efficient production, increasing domestic demand, and government incentives for renewable energy projects. The presence of major global and regional EVA producers ensures a steady supply and competitive pricing.

Latin America

Latin America holds 6.2% of the market, with Brazil and Mexico leading adoption due to growth in construction, automotive, and flexible packaging industries. EVA resins are used extensively in footwear manufacturing, especially in Brazil, which serves as a major export base. Solar power initiatives in Chile and Mexico are creating additional demand for EVA encapsulants. It faces certain challenges, including raw material cost fluctuations and infrastructure constraints, but steady investment in manufacturing capacity is improving regional competitiveness. The shift toward sustainable materials is gradually influencing purchasing decisions, especially in the packaging sector.

Middle East & Africa

The Middle East & Africa region accounts for 4.8% of the global market, with GCC countries such as Saudi Arabia, UAE, and Qatar leading consumption in construction, automotive, and packaging applications. South Africa is an important market within Africa, utilizing EVA in mining safety equipment, footwear, and industrial films. Solar energy projects in the Middle East are boosting demand for high-quality EVA encapsulants. It benefits from abundant petrochemical feedstocks, enabling competitive resin production. However, market growth is moderated by varying industrial capabilities and reliance on imports in some African nations. Strategic collaborations between global resin producers and regional converters are expected to enhance EVA adoption in the coming years.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Key Player Analysis

- LG Chem

- Eastman Chemical Company

- Borealis AG

- Celanese Corp.

- Dow Inc.

- INEOS

- LyondellBasell Industries Holdings B.V.

- Exxon Mobil Corp.

- Total

- Arkema

Competitive Analysis

The competitive landscape of the Ethylene Vinyl Acetate Resins Market is shaped by the strategies and product innovations of leading players such as Exxon Mobil Corp., Dow Inc., LyondellBasell Industries Holdings B.V., Eastman Chemical Company, Arkema, Borealis AG, Celanese Corp., INEOS, Total, and LG Chem. These companies compete through technological advancements, capacity expansions, and diversification of application-specific EVA grades. Exxon Mobil Corp. and Dow Inc. lead in large-scale production capabilities, offering a wide range of EVA grades for packaging, solar encapsulation, and footwear applications. LyondellBasell Industries Holdings B.V. focuses on sustainable polymer solutions, enhancing its portfolio with eco-friendly EVA variants. Eastman Chemical Company and Arkema are recognized for specialty EVA grades with high clarity, adhesion, and UV stability, targeting high-performance industrial uses. Borealis AG and Celanese Corp. strengthen their market positions through innovation in customized EVA formulations for automotive and construction applications. INEOS, Total, and LG Chem leverage strong regional supply networks and integrated petrochemical operations to maintain cost competitiveness. Across the market, competition centers on balancing product performance, sustainability, and pricing efficiency to address evolving customer demands globally.

Recent Developments

- In September 2024, Dow Inc., through its joint venture with Mitsui, launched mass-balanced biomass EVA (ethylene-vinyl acetate) and LDPE (low-density polyethylene) products. These new materials offer the same performance as conventional petroleum-based products while significantly reducing lifecycle greenhouse gas emissions

- In June 2023, LyondellBasell Industries, through a joint venture, enabled EVA copolymer production at PetroChina Guangxi Petrochemical’s Qinzhou facility using its Lupotech process, enhancing manufacturing efficiency and output capacity.

- In February 2023, Celanese Corp. completed an ultra-low capital expansion at its Edmonton, Alberta facility, repurposing existing assets to increase EVA production capacity by 35% to meet rising demand in packaging and industrial applications.

Market Concentration & Characteristics

The Ethylene Vinyl Acetate Resins Market is moderately consolidated, with a mix of global chemical giants and regional producers competing across diverse application segments. Leading players such as Exxon Mobil Corp., Dow Inc., LyondellBasell Industries Holdings B.V., Arkema, LG Chem, and Celanese Corp. maintain strong market positions through integrated production capabilities, broad product portfolios, and established distribution networks. It is characterized by high product versatility, serving industries from packaging and footwear to solar energy and automotive. Technological advancements, including bio-based EVA production and high-performance grade development, are key competitive differentiators. Price volatility in petrochemical feedstocks, environmental regulations, and shifting demand patterns influence market dynamics. Strategic partnerships, capacity expansions, and geographic diversification remain central to competitive strategy, enabling companies to strengthen supply reliability and meet evolving customer requirements across global markets.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Bio-based EVA production will gain momentum to meet sustainability goals.

- Demand from solar encapsulation will grow with renewable energy expansion.

- High-performance EVA grades will see increased adoption in specialty applications.

- Packaging innovation will drive EVA usage in premium and flexible formats.

- Footwear manufacturing will continue to rely on EVA for lightweight cushioning.

- Asia-Pacific will experience the fastest production and consumption growth.

- Recycling initiatives will shape EVA formulation and end-of-life management.

- Automotive applications will expand with electric vehicle component demand.

- Strategic mergers and capacity expansions will strengthen global supply networks.

- Regulatory compliance will accelerate the shift toward environmentally friendly EVA variants.