Market Overview

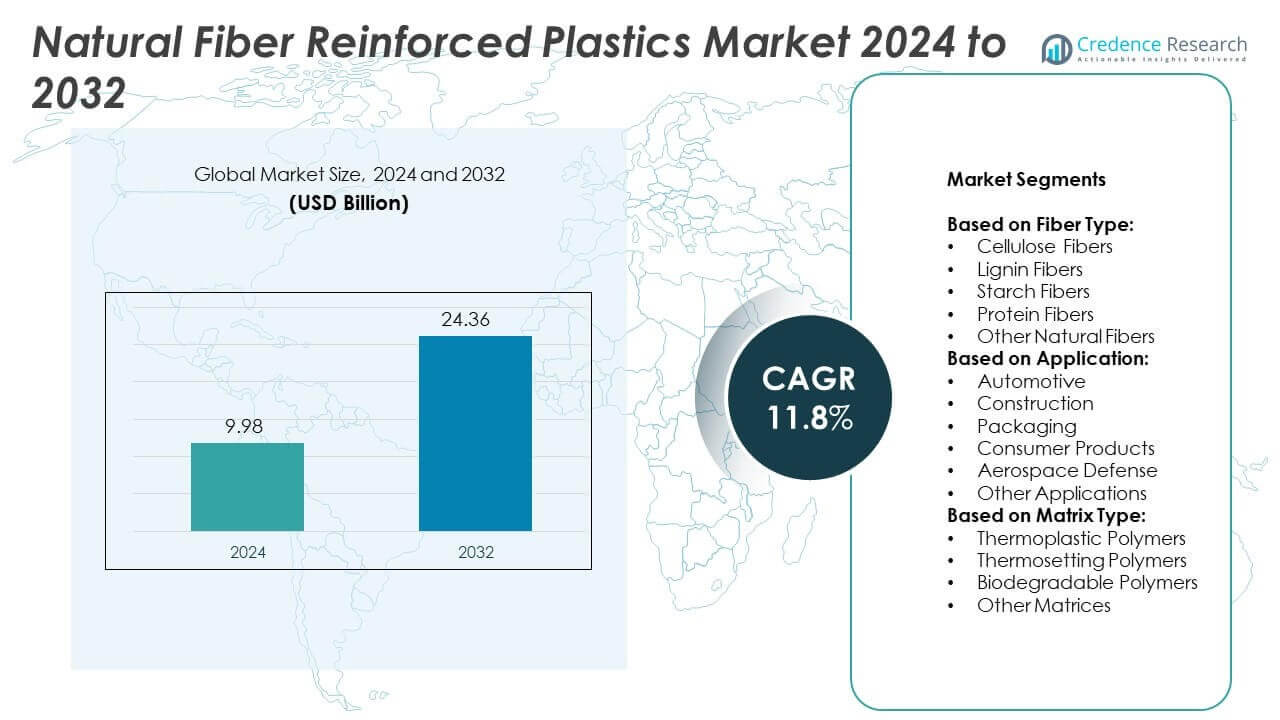

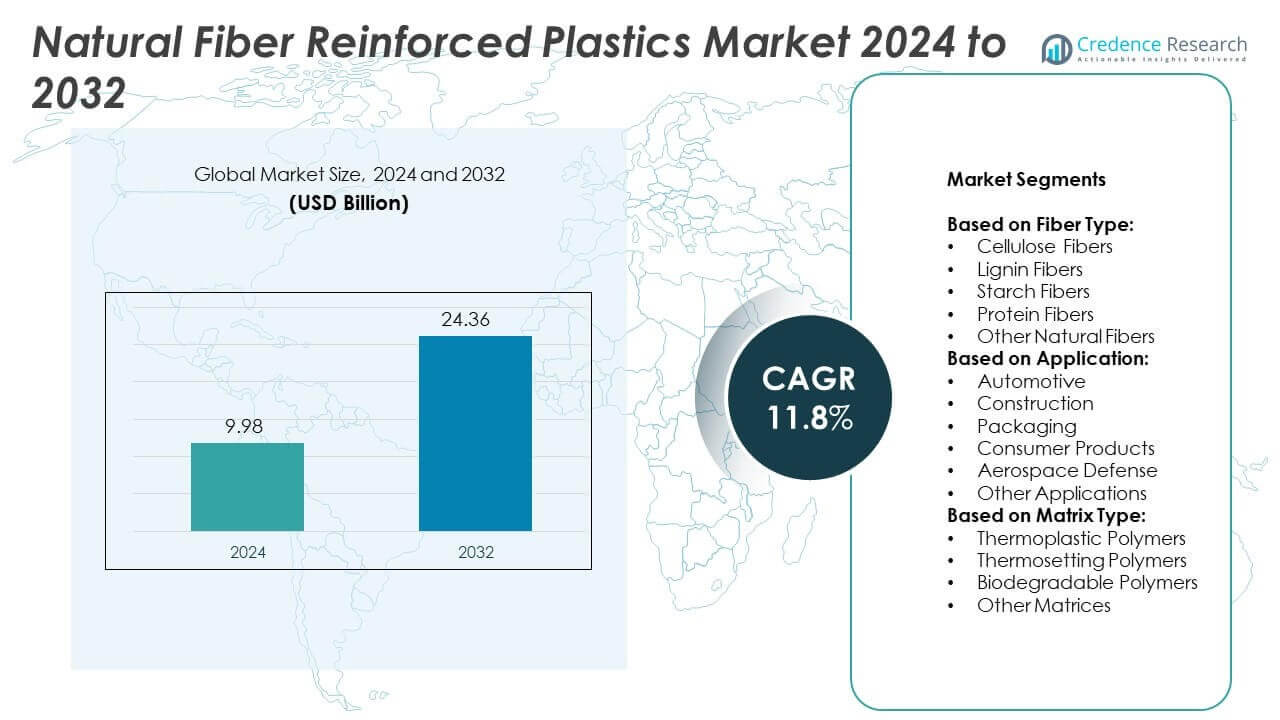

Natural Fiber Reinforced Plastics Market size was valued at USD 9.98 Billion in 2024 and is anticipated to reach USD 24.36 Billion by 2032, at a CAGR of 11.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Natural Fiber Reinforced Plastics Market Size 2024 |

USD 9.98 Billion |

| Natural Fiber Reinforced Plastics Market, CAGR |

11.8% |

| Natural Fiber Reinforced Plastics Market Size 2032 |

USD 24.36 Billion |

The Natural Fiber Reinforced Plastics market grows due to rising demand for lightweight, eco-friendly materials across automotive, construction, and packaging sectors. Stringent emission regulations and sustainability goals drive the shift from synthetic to bio-based composites. Manufacturers invest in hybrid composites and surface treatment innovations to improve strength and durability. Integration of biodegradable resins enhances product appeal in consumer and industrial applications. The market benefits from increasing raw material availability and supportive regulatory frameworks promoting renewable materials adoption.

North America leads the Natural Fiber Reinforced Plastics market due to strong adoption in automotive and construction sectors, followed by Europe with its strict environmental policies and mature industrial base. Asia Pacific shows rapid growth driven by abundant raw materials and expanding manufacturing. Latin America and the Middle East & Africa see rising interest through sustainable housing and packaging. Key players operating across these regions include Toray Advanced Materials Korea Inc., Solvay SA, Owens Corning, and LyondellBasell Industries Holdings B.V.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Natural Fiber Reinforced Plastics market was valued at USD 9.98 billion in 2024 and is projected to reach USD 24.36 billion by 2032, growing at a CAGR of 11.8%.

- Rising demand for lightweight, bio-based composites in automotive, construction, and packaging drives market growth.

- Market trends include the adoption of hybrid composites, bio-based resins, and fiber surface treatment technologies.

- Leading companies compete through R&D, product innovation, regional expansion, and customization for end-use industries.

- Moisture absorption, inconsistent fiber quality, and lack of global standardization pose key restraints.

- North America leads the market due to automotive use and strong construction demand, followed by Europe with strict environmental regulations and mature industries.

- Asia Pacific is the fastest-growing region, supported by abundant raw material supply, expanding industrial applications, and increasing sustainability focus.

Market Drivers

Strong Push Toward Lightweight and Fuel-Efficient Automotive Components

The automotive sector is a key growth driver for the Natural Fiber Reinforced Plastics market. OEMs demand lightweight materials to reduce vehicle weight and improve fuel economy. Natural fiber composites offer high strength-to-weight ratios, making them ideal for interior panels, door inserts, and dashboards. The market benefits from the shift toward electric vehicles, where weight reduction is essential for extending battery range. It helps automakers meet strict emissions and fuel efficiency standards without compromising safety. Increasing vehicle production across emerging economies further supports demand.

- For instance, BASF and FKuR are both active in developing and producing sustainable bioplastic materials. FKuR’s portfolio includes natural fiber composites (Fibrolon®) and bio-based polymer blends (Bio-Flex®). BASF’s portfolio includes certified compostable biopolymers like ecovio® (a blend of ecoflex® and PLA) and ecoflex®. A biomass-balanced grade of ecoflex® F Blend was launched in 2024, showing a 60% lower Product Carbon Footprint (PCF) compared to its standard grade, while offering the same properties and processing as the standard material.

Growing Focus on Sustainability and Renewable Material Adoption

Rising environmental awareness accelerates the shift to bio-based alternatives across industries. The Natural Fiber Reinforced Plastics market aligns with global sustainability goals by offering materials that are recyclable, biodegradable, and derived from renewable sources. Manufacturers aim to reduce reliance on fossil-based composites while maintaining product performance. It supports circular economy models by lowering carbon emissions and promoting responsible sourcing. Government incentives and green certification programs encourage the use of natural fiber-based solutions. Strong demand comes from packaging, construction, and consumer goods sectors.

- For instance, FlexForm Technologies manufactures natural fiber composite (NFC) materials from sustainable resources like kenaf, hemp, flax, and jute, blended with thermoplastic polymers such as polypropylene. These materials, which are used for automotive interior trim components, such as door panels and seatbacks, have seen wide adoption within the automotive industry. As of 2005, FlexForm’s products had been used in over 1.5 million vehicles in the US, with later reports indicating use in over 2 million vehicles by 2014 across cars, trucks, and aircraft interiors.

Expanding Applications Across Building and Construction Industry

The construction sector seeks materials that balance durability, performance, and environmental impact. The Natural Fiber Reinforced Plastics market supports this shift with composites used in decking, insulation panels, window frames, and wall claddings. It provides thermal insulation, resistance to corrosion, and low water absorption, improving energy efficiency and lifecycle costs. Builders prefer these solutions due to ease of installation and compliance with green building standards. Rising urbanization and infrastructure development in Asia and the Middle East create large-scale demand. The market benefits from public and private investment in sustainable housing.

Rising Demand for Low-Cost, High-Performance Alternatives to Synthetics

Natural fiber composites offer cost advantages over synthetic alternatives such as glass and carbon fibers. The Natural Fiber Reinforced Plastics market expands as manufacturers seek to lower raw material costs without compromising structural performance. It benefits small and medium enterprises across furniture, electronics, and sports goods industries. Higher availability of raw materials like flax, hemp, and jute reduces supply chain risks. Local sourcing supports economic development and job creation in rural areas. Consumer preference for eco-conscious products drives steady demand across mass-market applications.

Market Trends

Wider Use of Hybrid Composites for Improved Structural and Mechanical Performance

Manufacturers increasingly adopt hybrid composites that blend natural and synthetic fibers. These materials offer improved mechanical strength, durability, and moisture resistance over pure natural fiber composites. The Natural Fiber Reinforced Plastics market benefits from this trend in high-performance applications such as automotive underbody panels and structural components. It enables design flexibility while maintaining lightweight benefits. This shift helps industries meet both cost and performance targets. OEMs across transportation and industrial sectors invest in R&D to enhance hybrid composite formulations.

- For instance, JELU-WERK manufactures natural fiber products, including cellulose (JELUCEL®) and wood fibers (JELUXYL®), which are used as fillers and additives in biopolymer composites. The company also produces Wood-Plastic Composite (WPC) granulates under the JELUPLAST® brand, with the natural fiber proportion potentially ranging from 50% to 70%. The company processes approximately 45,000 tons of plant fibers annually, and in 2016, approximately 7,000 tons of these fibers were processed annually to produce bioplastic

Advancements in Surface Treatment and Fiber Modification Techniques

Innovations in surface treatment improve fiber-matrix adhesion, boosting product performance. Treatments like alkali processing, silane coupling, and plasma modification increase tensile strength and thermal stability. The Natural Fiber Reinforced Plastics market adopts these techniques to expand its application scope in engineering parts. It leads to better dimensional stability and resistance to environmental stress. These modifications support longer product life and reduce maintenance costs. Material scientists and producers continue to refine processes to standardize quality across batches.

- For instance, Tecnaro GmbH manufactures ARBOFORM, a biodegradable composite known as “liquid wood,” which is made from lignin and reinforcing natural fibers, such as hemp. ARBOFORM can be processed using standard plastics machinery like injection molding to produce molded parts. A datasheet for the ARBOFORM® F45 grade shows a tensile modulus of 6,000 MPa, though specific properties can vary depending on the product grade and composition

Rising Integration of Bio-Based Resins in Composite Production

Traditional petroleum-based resins are being replaced by bio-based alternatives in composite formulations. The Natural Fiber Reinforced Plastics market sees growing use of resins made from soy, corn, and other plant-based sources. It aligns with industry goals to reduce environmental footprint and meet sustainability targets. Bio-resins enhance biodegradability while maintaining strength and flexibility. Their adoption increases across packaging, agriculture, and low-load industrial components. Support from regulatory bodies and eco-certifications boosts market credibility.

Increased Focus on Aesthetic Appeal and Natural Texture in Consumer Goods

Consumers show strong preference for products with natural textures and appearances. The Natural Fiber Reinforced Plastics market responds by offering composites with visible fibers and organic finishes. It adds visual appeal to electronics, furniture, and household goods. Designers use these materials to enhance product differentiation and brand value. Natural textures help signal eco-friendliness and authenticity in premium product lines. This trend supports demand for value-added applications across both luxury and mass-market segments.

Market Challenges Analysis

Limited Moisture Resistance and Dimensional Stability Restrict Broader Adoption

Natural fibers tend to absorb moisture, which can lead to swelling, warping, or degradation over time. The Natural Fiber Reinforced Plastics market faces limitations in applications requiring high durability in humid or wet environments. It challenges material consistency and mechanical performance in outdoor use. Engineers must rely on treatments and coatings to overcome water sensitivity, which adds cost and process complexity. Inconsistent weather resistance hinders adoption in marine, heavy-duty automotive, and infrastructure applications. Companies continue to invest in improving water repellency through resin selection and fiber modification.

Lack of Standardization and Variability in Fiber Quality Impact Process Efficiency

Natural fibers differ in composition, length, and strength depending on source, cultivation, and processing methods. The Natural Fiber Reinforced Plastics market faces difficulty in achieving uniform quality across large-scale production. It creates challenges in automated manufacturing lines that require precise material behavior. This variability can lead to performance inconsistencies, higher rejection rates, and added inspection requirements. Absence of global standards for fiber grading and testing further complicates mass adoption. Manufacturers often invest in custom equipment and testing protocols to maintain quality benchmarks.

Market Opportunities

Growing Demand for Sustainable Packaging Solutions Across Consumer Goods and E-Commerce

Sustainability goals in packaging open new growth areas for natural fiber composites. The Natural Fiber Reinforced Plastics market finds strong potential in replacing traditional plastic films, trays, and containers. It offers compostable and lightweight solutions with sufficient strength for retail and logistics. Brands explore bio-based packaging to enhance product image and comply with environmental regulations. The rise in online shopping and eco-conscious buyers supports scalable demand. Partnerships between packaging suppliers and FMCG companies drive fast commercialization of fiber-based formats.

Increased Investments in Green Building and Infrastructure Projects

Government policies supporting low-carbon construction create new use cases for bio-composites. The Natural Fiber Reinforced Plastics market gains traction in insulation panels, façade elements, and interior structures. It aligns with green building certifications like LEED and BREEAM that prioritize sustainable material use. Builders and architects prefer these materials to reduce emissions and improve indoor air quality. Rising urban housing and infrastructure expansion in Asia and Latin America fuel interest in cost-effective, renewable composites. Public procurement policies favoring eco-friendly products amplify commercial visibility.

Market Segmentation Analysis:

By Fiber Type:

Cellulose fibers hold a major share due to their wide availability, low cost, and strong mechanical properties. Cellulose fibers offer good compatibility with thermoplastics and are widely used in automotive and consumer goods. Lignin fibers are gaining attention for their thermal stability and potential in structural applications. Starch fibers are preferred in biodegradable products, especially in packaging. Protein fibers show limited use due to processing challenges but offer value in niche segments. The Natural Fiber Reinforced Plastics market benefits from growing interest in other natural fibers such as hemp and kenaf, which offer higher tensile strength and lightweight benefits.

- For instance, “A 2020 review on PLA composites reinforced with flax and jute fibers noted that properties vary based on fiber content, surface treatment, and processing temperature. In one study involving jute fiber and PLA, the flexural strength was found to increase by 116% compared to plain PLA at an optimal fiber loading of 15%.

By Application:

The automotive segment dominates due to strict fuel efficiency standards and weight reduction goals. Car makers use natural fiber composites in door panels, dashboards, and trims. Construction ranks second with demand for insulation boards, panels, and structural reinforcements. Packaging is growing rapidly due to rising demand for compostable and lightweight solutions. The consumer products segment uses bio-composites in furniture, electronics casings, and household items for both function and eco-branding. Aerospace and defense applications remain niche but are expected to grow with advancements in hybrid composites. It helps expand the role of natural fibers in structural and semi-structural parts.

- For instance, Saint-Gobain India produces a range of insulation and construction products, including gypsum plasterboards and mineral wool insulation (Glass wool and Stone wool) through its Rockinsul and Twigainsul brands. These products are used in green buildings across India to improve thermal comfort, energy efficiency, and fire safety. Research indicates that coir fiber composites can exhibit low thermal conductivity, with some experimental results showing values as low as 0.040 W/mK

By Matrix Type:

Thermoplastic polymers hold the largest share due to their recyclability and ease of processing. These include polypropylene and polyethylene blends widely used in automotive and construction. Thermosetting polymers offer better dimensional stability and chemical resistance but lack recyclability, limiting long-term adoption. Biodegradable polymers show strong growth, especially in packaging and single-use products. It aligns with government bans on non-degradable plastics. Other matrix types, including bio-resins and elastomers, support specialized applications where high flexibility or durability is needed.

Segments:

Based on Fiber Type:

- Cellulose Fibers

- Lignin Fibers

- Starch Fibers

- Protein Fibers

- Other Natural Fibers

Based on Application:

- Automotive

- Construction

- Packaging

- Consumer Products

- Aerospace Defense

- Other Applications

Based on Matrix Type:

- Thermoplastic Polymers

- Thermosetting Polymers

- Biodegradable Polymers

- Other Matrices

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a 31.2% share of the global Natural Fiber Reinforced Plastics market. The region leads in adoption across automotive, construction, and consumer goods industries. Major automakers such as Ford and General Motors have incorporated natural fiber composites in vehicle interiors to reduce weight and meet fuel efficiency targets. Construction firms use these materials in insulation, decking, and wall panels to meet green building certifications. The packaging sector also shows high traction, with bio-composite trays and containers replacing traditional plastics. Growth is supported by strong government focus on sustainability, combined with consumer preference for eco-friendly products. Companies in the U.S. and Canada are investing in R&D to develop durable hybrid composites that offer better water resistance and strength for outdoor applications.

Europe

Europe accounts for 28.5% of the Natural Fiber Reinforced Plastics market. The region’s leadership in environmental regulations and circular economy strategies drives adoption across multiple sectors. Automotive manufacturers like BMW, Mercedes-Benz, and Peugeot have integrated flax, jute, and hemp-based composites into interior panels, seat backs, and dashboards. Regulatory frameworks such as the EU Green Deal and extended producer responsibility mandates support widespread adoption in construction and packaging. Consumer brands in Germany, France, and the Netherlands increasingly use natural fiber plastics in electronics casings, kitchenware, and furniture to boost their sustainability profiles. Research institutions and industrial clusters across the region focus on enhancing composite durability, recyclability, and compatibility with biodegradable matrices.

Asia Pacific

Asia Pacific holds a 25.4% share of the global market and represents the fastest-growing region. Demand is driven by rapid industrialization, urban housing projects, and automotive expansion in China, India, Japan, and Southeast Asia. The region benefits from an abundant supply of natural fibers such as coir, bamboo, jute, and hemp, making raw materials cost-effective and locally sourced. Automotive suppliers integrate these materials into door trims and insulation parts to meet emissions targets and reduce raw material imports. Packaging companies in China and India replace petroleum-based films with starch or bagasse composites for food and retail packaging. Rising awareness of environmental impact and strong government support for biodegradable materials contribute to high growth potential across all sectors.

Latin America

Latin America contributes 8.1% to the Natural Fiber Reinforced Plastics market. Countries such as Brazil, Mexico, and Argentina show increasing interest in sustainable alternatives to conventional plastic. The construction industry adopts natural fiber composites in roofing, wall claddings, and formwork boards for both residential and commercial projects. Local automakers experiment with jute and sisal fibers in vehicle interiors to reduce production costs and comply with green targets. Consumer goods manufacturers shift toward sustainable designs using bio-composites in furniture and home decor. Government initiatives promoting bio-economy and agricultural diversification further encourage fiber-based plastic production across the region.

Middle East & Africa

The Middle East & Africa region holds a 6.8% market share. Market expansion remains moderate due to limited industrial infrastructure and awareness. However, countries such as South Africa, UAE, and Saudi Arabia are making early moves toward sustainable construction and waste reduction. It supports demand for natural fiber composites in insulation materials and interior applications. Agriculture-rich nations in Africa explore the use of sisal and kenaf fibers for biodegradable packaging and low-cost housing components. International partnerships and government-led projects focused on rural development and material innovation help create a foundation for long-term market presence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Victrex plc

- Toray Advanced Materials Korea Inc.

- LyondellBasell Industries Holdings B.V.

- Teijin Limited

- Formosa Plastics Corporation

- Aditya Birla Group

- Solvay SA

- Hexcel Corporation

- DuPont de Nemours, Inc.

- SGL Carbon SE

- SABIC

- Owens Corning

- Saint-Gobain SA

- Mitsubishi Chemical Advanced Materials

Competitive Analysis

The Natural Fiber Reinforced Plastics market features strong competition among global and regional players such as Victrex plc, Toray Advanced Materials Korea Inc., LyondellBasell Industries Holdings B.V., Teijin Limited, Formosa Plastics Corporation, Aditya Birla Group, Solvay SA, Hexcel Corporation, DuPont de Nemours, Inc., SGL Carbon SE, SABIC, Owens Corning, Saint-Gobain SA, and Mitsubishi Chemical Advanced Materials. These companies compete on product innovation, processing technology, raw material integration, and end-use customization. Leading players invest in R&D to enhance mechanical performance, moisture resistance, and compatibility with biodegradable matrices. Several firms focus on automotive and construction sectors, where demand for lightweight, high-strength, and sustainable composites remains high. Some players expand their market presence through regional production hubs and raw fiber sourcing partnerships. Suppliers offer both thermoplastic and thermosetting composite solutions tailored to client requirements across transportation, packaging, and consumer goods. Key companies leverage patented formulations, supply chain integration, and strategic mergers to maintain competitive advantages. Emerging players focus on cost-effective bio-composites for mass-market adoption in Asia and Latin America. Overall, competition drives innovation, regulatory compliance, and product differentiation in this fast-growing market.

Recent Developments

- In February 2025, Polyplastics launched a new eco-friendly composite, PLASTRON® RA627P. The composite combines polypropylene (PP) resin with long cellulose fibers, offering low density, high rigidity, high impact strength, and excellent damping properties.

- In 2024, Toray Advanced Materials Korea Inc. unveiled plans to enhance product quality, boost productivity, and cut costs through process engineering for its carbon fiber and prepreg product lines

- In 2024, Solvay made significant progress in reducing emissions from its soda ash plants by ceasing coal use at its Green River, Wyoming, facility and converting its Rheinberg, Germany, plant to run primarily on renewable energy. The company is continuing this effort with a project to eliminate coal at its Dombasle, France, plant by the end of 2025.

Report Coverage

The research report offers an in-depth analysis based on Fiber Type, Application, Matrix Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow due to strong demand from the automotive, construction, and packaging sectors.

- Lightweight and renewable materials will replace conventional plastics in more end-use applications.

- Manufacturers will invest in hybrid composites to improve durability and expand product lifespan.

- Advancements in surface treatment will improve bonding between fibers and polymer matrices.

- Bio-based resins will see greater adoption in both consumer and industrial composite products.

- Regulatory support for sustainable materials will drive market expansion across all major regions.

- Asia Pacific will emerge as the fastest-growing region due to abundant raw materials and rising demand.

- Global companies will expand partnerships with local suppliers to ensure consistent fiber quality.

- New applications in electronics, marine, and aerospace will offer additional revenue streams.

- R&D efforts will focus on standardizing quality, improving water resistance, and lowering production costs.