Market Overview:

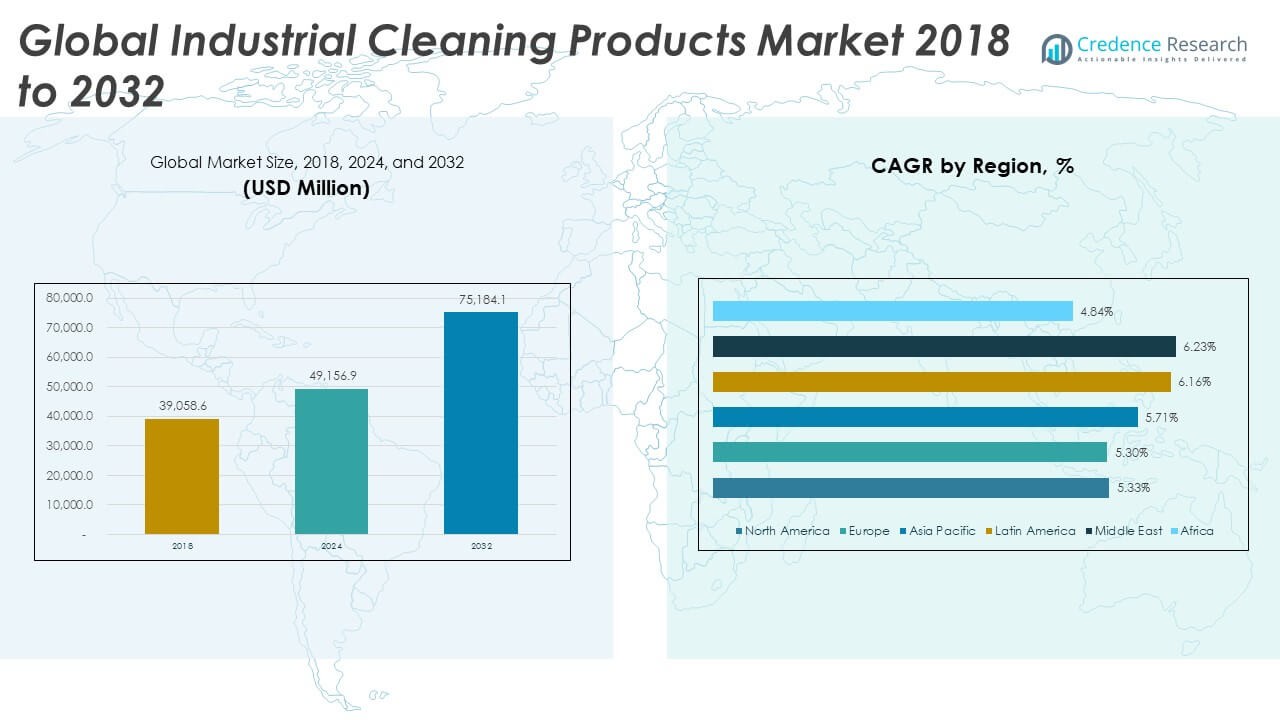

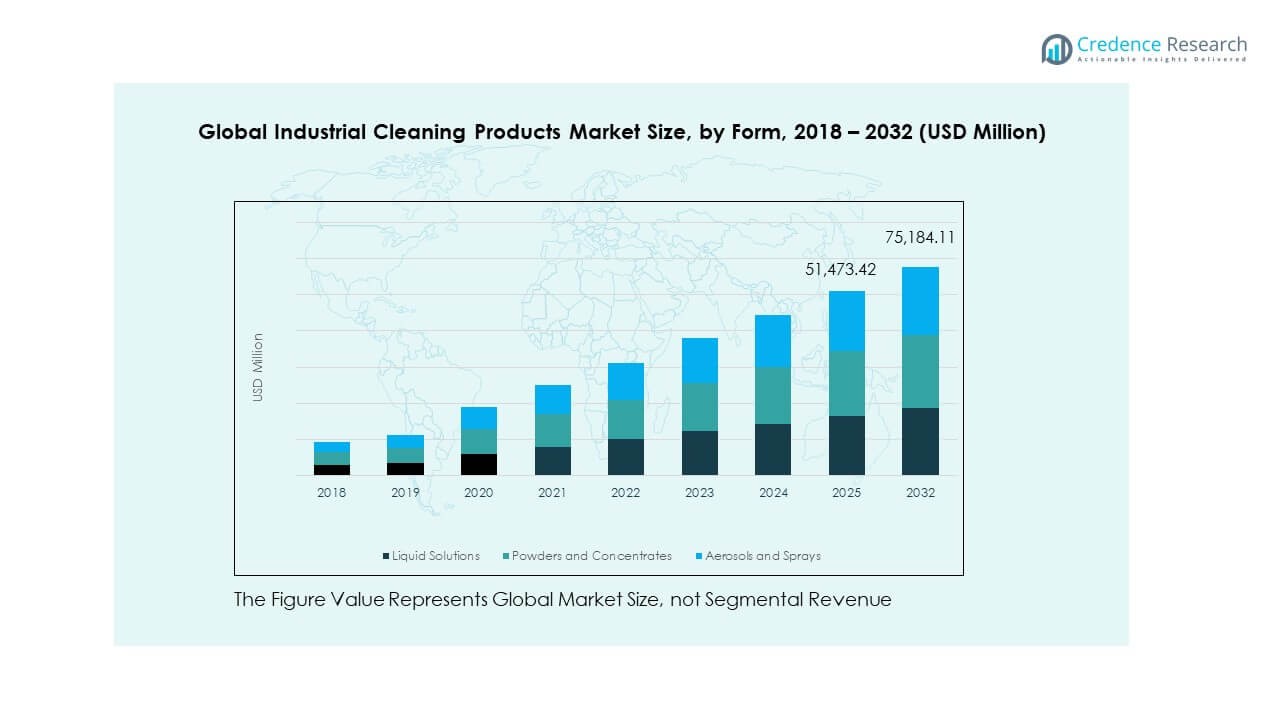

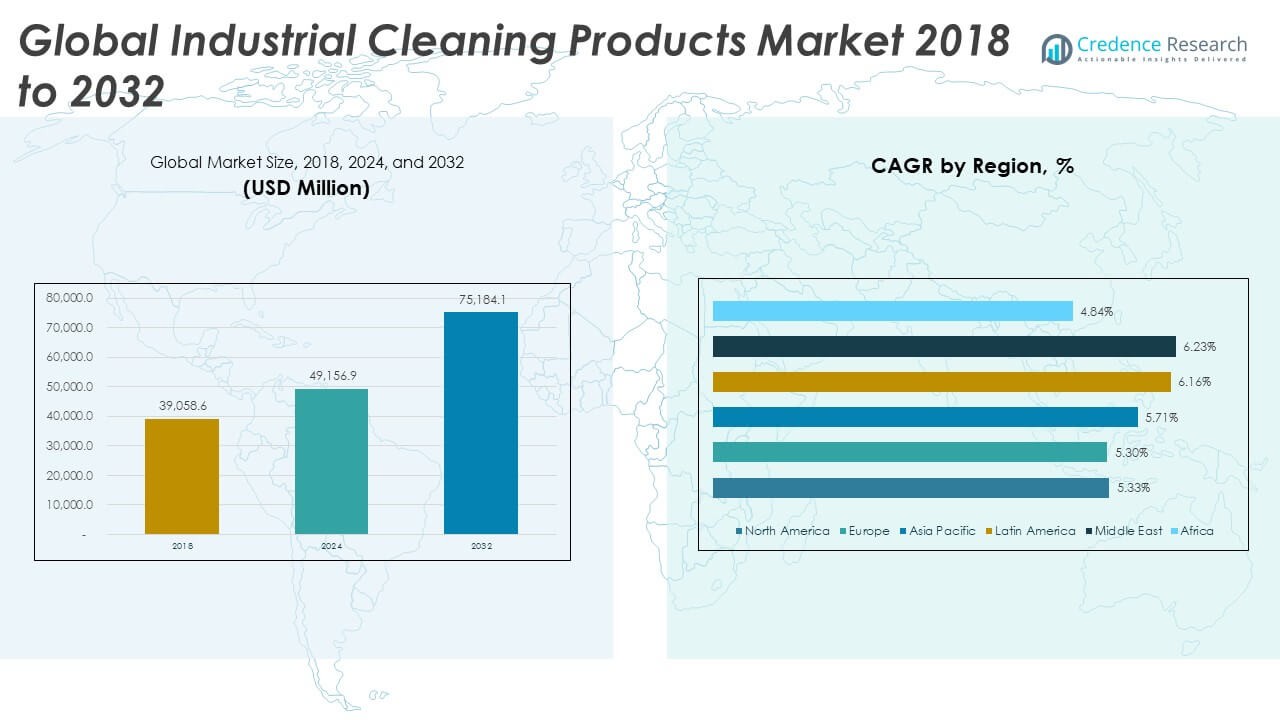

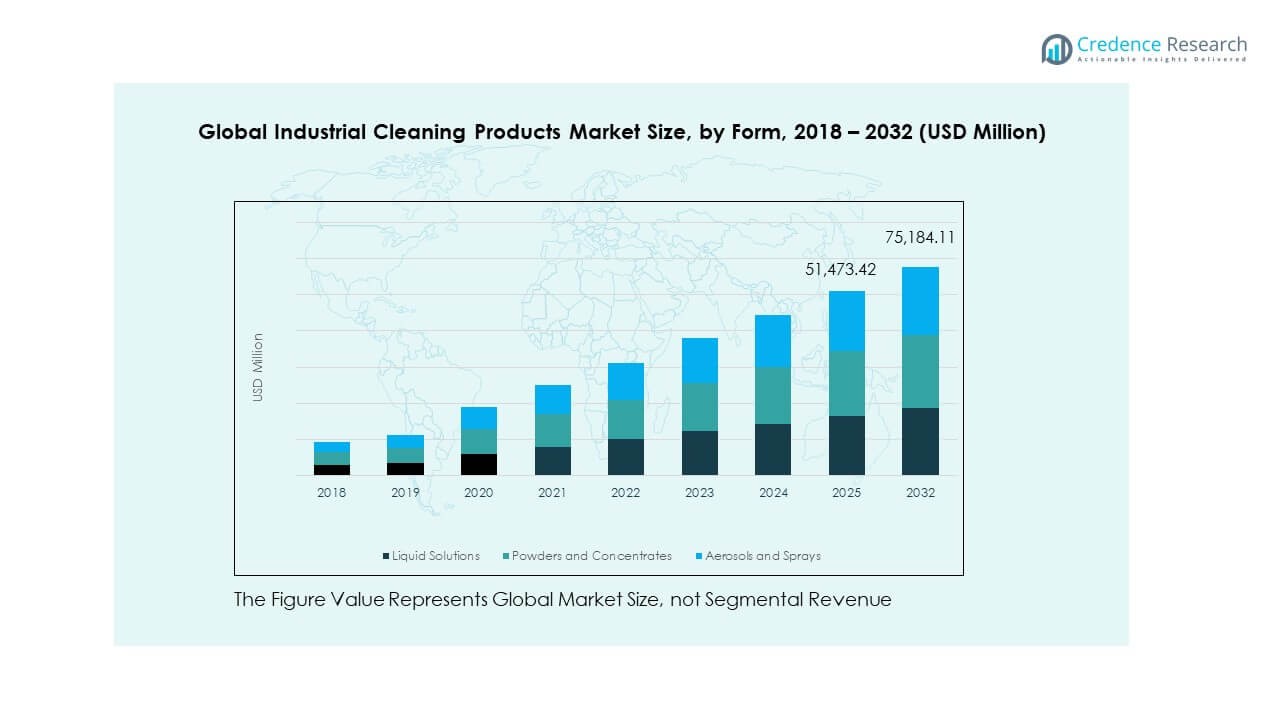

The Global Industrial Cleaning Products Market size was valued at USD 39,058.6 million in 2018 to USD 49,156.9 million in 2024 and is anticipated to reach USD 75,184.1 million by 2032, at a CAGR of 5.56% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial Cleaning Products Market Size 2024 |

USD 49,156.9 Million |

| Industrial Cleaning Products Market, CAGR |

5.56% |

| Industrial Cleaning Products Market Size 2032 |

USD 75,184.1 Million |

Rising industrialization and strict hygiene regulations drive the market growth. Companies invest in advanced cleaning solutions to maintain operational efficiency and comply with safety standards. Growing awareness about contamination control in healthcare, food processing, and manufacturing sectors fuels demand for high-performance products. Eco-friendly and biodegradable formulations attract industries aiming to meet sustainability goals. Automation and technological innovations in cleaning equipment enhance efficiency and reduce chemical consumption. Corporate focus on workplace safety and quality assurance reinforces continuous adoption. It supports long-term growth and innovation in industrial cleaning solutions.

Regionally, North America and Europe lead due to mature industrial infrastructure and stringent regulatory frameworks. Asia Pacific is an emerging market with rapid industrial expansion and urbanization driving adoption. Countries like China and India show strong demand in manufacturing and food processing industries. Latin America and the Middle East experience steady growth due to infrastructure development and industrial investments. Africa remains a smaller yet growing market with potential for industrial cleaning adoption in key sectors. The regional landscape reflects varied growth trajectories based on industrial maturity and regulatory enforcement.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Industrial Cleaning Products Market was valued at USD 39,058.6 million in 2018, USD 49,156.9 million in 2024, and is projected to reach USD 75,184.1 million by 2032, growing at a CAGR of 5.56% during the forecast period.

- North America (approximately 24%), Europe (27%), and Asia Pacific (33%) hold the top regional shares, driven by mature industrial bases, stringent hygiene regulations, and rapid industrialization respectively.

- Asia Pacific is the fastest-growing region with a 33% share, propelled by expanding manufacturing sectors, urbanization, and rising demand in food processing and healthcare industries.

- By form, liquid solutions dominate with an estimated 45% share due to ease of use and compatibility with automated cleaning systems, followed by powders and concentrates at around 35% for cost-efficiency and storage benefits.

- Aerosols and sprays capture roughly 20% of the market, catering to targeted and specialized industrial cleaning applications, reflecting the market’s diversification across product formats.

Market Drivers

Rising Demand For Enhanced Hygiene And Safety Standards Across Industrial Sectors

The Global Industrial Cleaning Products Market is driven by increasing demand for strict hygiene and safety compliance. It supports industrial facilities, food processing units, and healthcare centers in maintaining contamination-free environments. Companies invest in advanced cleaning chemicals and equipment to meet regulatory requirements. Enhanced awareness about occupational safety encourages frequent sanitation practices. Industries implement systematic cleaning protocols to reduce accidents and microbial risks. It ensures workplace efficiency while protecting employee health. The demand for certified and eco-friendly cleaning agents rises in parallel. Rising governmental inspections and certifications boost product consumption significantly.

Strict Regulatory Frameworks And Compliance Standards Driving Product Adoption

Government regulations and international standards enforce cleanliness protocols in manufacturing and service industries. The Global Industrial Cleaning Products Market benefits from mandatory adherence to safety and hygiene guidelines. Companies adopt chemical solutions that meet these compliance benchmarks. It helps in mitigating liability risks and maintaining production quality. Inspections and audits force continuous investment in cleaning technologies. Regulatory pressure stimulates innovation in biodegradable and low-toxicity products. Firms leverage compliance certifications to enhance market reputation. Continuous monitoring and quality assurance create a steady demand cycle. Legal frameworks accelerate adoption of specialized industrial cleaning solutions.

- For instance, Ecolab has documented support for life sciences companies in meeting FDA cleaning validation standards, with process validations that directly contributed to companies passing U.S. FDA inspections with reduced 483 observations, detailed in Ecolab’s regulatory trends and advisory publications.

Growing Industrial Production And Infrastructure Development Increasing Consumption

Rising industrialization and large-scale infrastructure projects fuel the need for industrial cleaning solutions. It ensures machinery longevity, operational efficiency, and environmental safety. The Global Industrial Cleaning Products Market benefits from expansion in manufacturing, oil and gas, and chemical sectors. Proper cleaning prevents equipment corrosion, contamination, and downtime. It enhances product quality in sensitive manufacturing processes. Emerging markets witness rapid infrastructure development, which escalates cleaning product utilization. Companies integrate cleaning regimes into maintenance schedules. Increasing construction and facility management activities drive recurring demand. Enhanced production efficiency encourages strategic investment in industrial cleaning technologies.

- For instance, Nilfisk’s industrial vacuum solutions employ certified HEPA filtration meeting OSHA and ISO dust control standards. Their published case studies demonstrate how scheduled deep-cleaning using these vacuums reduced machine downtime and improved compliance in manufacturing facilities, as reported in Nilfisk’s maintenance guides and news releases.

Technological Advancements And Eco-Friendly Product Innovation Stimulating Market Growth

Development of advanced cleaning technologies and sustainable chemicals expands market potential. It reduces chemical usage while maintaining high cleaning efficiency. The Global Industrial Cleaning Products Market sees growth from automation in cleaning equipment. Smart cleaning systems optimize resource consumption and improve productivity. Innovations in enzyme-based and biodegradable agents attract environmentally conscious industries. It supports compliance with green regulations and sustainability goals. Improved formulations offer multi-surface and multi-purpose solutions. Companies differentiate through performance and ecological benefits. Technology integration creates opportunities for premium product adoption across sectors.

Market Trends

Shift Toward Automation And Robotics In Industrial Cleaning Processes

The Global Industrial Cleaning Products Market observes a growing trend of automated cleaning systems. It reduces human labor and enhances precision in hygiene management. Industries implement robotics to clean large-scale machinery, production lines, and storage facilities. Automated systems ensure consistent results and reduce chemical waste. It integrates with IoT devices to monitor cleaning frequency and efficiency. Adoption increases in pharmaceuticals, food, and electronics sectors. Manufacturers invest in robotics to enhance operational safety. Emerging markets gradually adopt automated solutions to match global standards. Cost reduction and improved performance drive this trend.

Integration Of Sustainable And Biodegradable Cleaning Solutions

The market witnesses a strong focus on environmentally safe and biodegradable cleaning agents. It supports corporate sustainability initiatives and reduces ecological impact. The Global Industrial Cleaning Products Market includes enzyme-based, non-toxic, and phosphate-free chemicals. Industries adopt these solutions to comply with environmental regulations. It allows companies to maintain hygiene without compromising sustainability. Rising consumer and stakeholder awareness favors eco-friendly practices. Manufacturers develop high-efficiency products with low chemical residue. It promotes brand value and regulatory compliance. Sustainable trends encourage continuous R&D investment in industrial cleaning innovations.

Digital Platforms And Online Distribution Expanding Market Reach

The Global Industrial Cleaning Products Market experiences growth through e-commerce and digital sales channels. It enables suppliers to reach industrial clients directly with product information, certifications, and bulk orders. Online platforms allow businesses to compare specifications and pricing efficiently. It enhances customer convenience and reduces dependence on traditional distributors. Manufacturers leverage online marketing to educate clients about new products. Rapid delivery options and subscription models increase adoption rates. It also supports global expansion for niche product categories. Digital channels improve visibility for emerging manufacturers. Market penetration accelerates through online distribution networks.

- For instance, Reckitt Professional ran a targeted campaign for Lysol Big Bucket wipes in 2024, resulting in a 130% increase in total sales and a 582% sales increase at its primary retail partner, as documented in post-campaign analytics and media materials. The campaign leveraged digital channels and measurable conversion data, directly attributing these results to e-commerce and online marketing strategies for B2B industrial cleaning products.

Customized Solutions And Industry-Specific Cleaning Products Driving Adoption

The demand for tailored cleaning solutions grows across various industrial verticals. It addresses specific challenges in sectors such as healthcare, food processing, and automotive manufacturing. The Global Industrial Cleaning Products Market benefits from multi-functional and specialty chemical formulations. Companies require products for sterilization, degreasing, and surface protection. It improves efficiency while reducing equipment damage and downtime. Manufacturers invest in R&D to deliver industry-specific innovations. It enhances operational productivity and compliance adherence. Customized solutions create competitive differentiation in a crowded market. Increasing specialization drives higher-value product consumption.

- For instance, Solugen’s BioSol™ industrial cleaner received USDA Certified Biobased Product status in 2024, confirming a 98% biobased content verified through laboratory analysis and listed in the USDA certification directory. This achievement ensures BioSol™ meets rigorous national standards for renewable content and sustainability in industrial cleaning solutions.

Market Challenges Analysis

High Cost Of Advanced Industrial Cleaning Technologies Limiting Adoption In Certain Regions

The Global Industrial Cleaning Products Market faces challenges from the elevated cost of premium chemicals and automated equipment. It creates barriers for small and medium enterprises in developing regions. Companies require capital investment for training, installation, and maintenance of advanced systems. It can delay adoption despite clear efficiency benefits. High operational costs reduce affordability for frequent cleaning cycles. Some industries still rely on manual processes and conventional chemicals. It limits penetration in cost-sensitive markets. Price fluctuations of raw materials impact product pricing. Financial constraints slow growth in emerging industrial hubs.

Stringent Regulations And Chemical Safety Compliance Increasing Operational Complexity

The market encounters difficulties due to rigorous chemical safety regulations across regions. It necessitates compliance with international standards for storage, handling, and disposal. The Global Industrial Cleaning Products Market requires detailed documentation and frequent inspections. Companies must ensure personnel training to mitigate chemical hazards. It adds operational complexity and increases administrative overhead. Non-compliance risks legal penalties and reputational damage. Frequent updates to regulations demand continuous process adjustments. It restricts flexibility in adopting new cleaning formulations. Managing compliance across multiple jurisdictions challenges global expansion efforts.

Market Opportunities

Expansion In Emerging Industrial Markets Offering High Growth Potential

The Global Industrial Cleaning Products Market finds significant opportunities in Asia-Pacific, Latin America, and Middle East regions. It benefits from rapid industrialization, urbanization, and growing manufacturing bases. Emerging markets demand scalable and cost-effective cleaning solutions. Companies can introduce advanced, eco-friendly products to meet increasing hygiene standards. It allows penetration into previously under-served industrial sectors. Strategic partnerships with local distributors accelerate market entry. Rising infrastructure projects create recurring demand for industrial cleaning solutions. It encourages investment in localized manufacturing and product customization. Growing economies provide sustained growth potential.

Innovation In Eco-Friendly And Multi-Functional Cleaning Products Driving Market Expansion

The market gains opportunities through continuous innovation in sustainable and high-efficiency products. It caters to industries seeking reduced chemical usage without compromising performance. The Global Industrial Cleaning Products Market benefits from enzyme-based, biodegradable, and multi-purpose formulations. Manufacturers can differentiate through premium, environmentally safe solutions. It aligns with corporate sustainability objectives and global green regulations. Development of automation-compatible cleaning agents opens further growth avenues. Companies can target high-value industrial clients and specialized sectors. It encourages adoption of advanced cleaning systems. Technological advancements in formulation chemistry create long-term expansion prospects.

Market Segmentation Analysis:

The Global Industrial Cleaning Products Market is segmented to address diverse industrial needs and applications.

By Product Type, surface cleaners dominate due to their broad applicability across manufacturing, healthcare, and commercial facilities. Disinfectants and sanitizers maintain strong demand driven by hygiene regulations, while detergents and degreasers support heavy-duty cleaning in industrial operations. The “others” category captures niche chemicals for specialized requirements.

- For example, the 3M Neutral Quat Disinfectant Cleaner contains 660 ppm quat and is effective against SARS-CoV-2 in 1 minute.

By Form, liquid solutions lead the market because of ease of use and compatibility with automated systems. Powders and concentrates offer cost-efficiency and storage advantages, while aerosols and sprays cater to targeted applications.

By End User, manufacturing and engineering industries consume significant volumes for equipment and facility maintenance. Food and beverage processing plants demand strict sanitation solutions, and healthcare and laboratories require high-performance disinfectants. Transportation workshops, energy, mining, and utilities also rely on specialized formulations. Commercial buildings and institutions drive recurring demand for standardized cleaning.

- For example, Henkel’s LOCTITE Pulse IIoT solution enables 24/7 digital monitoring to predict and prevent leakages, substantially reducing unplanned maintenance costs. Case studies confirm that predictive monitoring can lower emergency outage expenses by up to tenfold compared to reactive maintenance.

By Sales Channel, direct industrial sales remain key for bulk orders, while online and e-commerce platforms expand accessibility for smaller buyers. Retail stores support localized distribution. It enables manufacturers to tailor offerings to each segment, ensuring coverage across industrial, commercial, and institutional applications while driving adoption and market growth.

Segmentation:

By Product Type

- Surface Cleaners

- Disinfectants and Sanitizers

- Detergents & Degreasers

- Others

By Form

- Liquid Solutions

- Powders and Concentrates

- Aerosols and Sprays

By End User

- Manufacturing & Engineering Industries

- Food & Beverage Processing Plants

- Healthcare & Laboratories

- Transportation & Automotive Workshops

- Energy, Mining & Utilities

- Commercial Buildings & Institutions

By Sales Channel

- Direct Industrial Sales

- Online / E-commerce Platforms

- Retail Stores

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Global Industrial Cleaning Products Market size was valued at USD 9,417.02 million in 2018 to USD 11,700.05 million in 2024 and is anticipated to reach USD 17,585.56 million by 2032, at a CAGR of 5.33% during the forecast period. North America holds a significant market share due to its mature industrial base and stringent regulatory frameworks. It sees high adoption of advanced cleaning technologies and eco-friendly chemical formulations. Industrial sectors such as pharmaceuticals, food processing, and automotive drive consistent demand. It benefits from well-established distribution networks and professional cleaning service providers. Companies invest in R&D to enhance product performance. Automation and robotics integration increases operational efficiency. It maintains leadership due to strong safety standards and sustainable practices.

Europe

The Europe Global Industrial Cleaning Products Market size was valued at USD 10,545.81 million in 2018 to USD 13,082.76 million in 2024 and is anticipated to reach USD 19,623.05 million by 2032, at a CAGR of 5.30% during the forecast period. Europe commands a large share of the global market due to advanced industrialization and strict hygiene regulations. It emphasizes compliance with environmental and safety standards in manufacturing and healthcare sectors. Demand for biodegradable and low-toxicity products continues to rise. It benefits from the presence of key international suppliers and strong R&D initiatives. Companies adopt smart cleaning systems to optimize resource use. It experiences steady growth driven by regulatory enforcement and industrial output. European markets focus on sustainability and high-efficiency cleaning solutions.

Asia Pacific

The Asia Pacific Global Industrial Cleaning Products Market size was valued at USD 12,760.43 million in 2018 to USD 16,200.71 million in 2024 and is anticipated to reach USD 25,066.38 million by 2032, at a CAGR of 5.71% during the forecast period. Asia Pacific dominates the market share due to rapid industrialization and urbanization in countries like China and India. It witnesses increasing demand in manufacturing, food processing, and healthcare industries. Expansion of industrial facilities and infrastructure projects drives growth. It leverages cost-efficient production and growing local manufacturing. The region invests in sustainable and automated cleaning solutions. It experiences rising adoption of eco-friendly formulations. Asia Pacific presents high growth potential with emerging industrial hubs.

Latin America

The Latin America Global Industrial Cleaning Products Market size was valued at USD 3,421.53 million in 2018 to USD 4,462.04 million in 2024 and is anticipated to reach USD 7,142.49 million by 2032, at a CAGR of 6.16% during the forecast period. Latin America is an emerging market with increasing industrial activity in Brazil, Mexico, and Argentina. It sees growing adoption of certified industrial cleaning products for manufacturing and food processing. It benefits from government initiatives promoting workplace safety and hygiene standards. Local manufacturers expand production to meet rising demand. It gradually incorporates automated and sustainable cleaning technologies. Multinational companies establish regional distribution networks. Latin America presents strong growth opportunities due to rising industrial output and urbanization.

Middle East

The Middle East Global Industrial Cleaning Products Market size was valued at USD 1,867.00 million in 2018 to USD 2,444.50 million in 2024 and is anticipated to reach USD 3,932.13 million by 2032, at a CAGR of 6.23% during the forecast period. The Middle East holds an emerging position due to expanding oil, gas, and manufacturing sectors. It sees increasing demand for industrial cleaning solutions in petrochemical plants and industrial facilities. Investments in infrastructure development drive product consumption. It benefits from multinational companies establishing regional operations. Compliance with safety and hygiene standards fuels adoption. It experiences rising use of eco-friendly and high-performance chemicals. Middle East markets focus on modernization and technological integration. Growth potential remains high due to industrial diversification and urban expansion.

Africa

The Africa Global Industrial Cleaning Products Market size was valued at USD 1,046.77 million in 2018 to USD 1,266.84 million in 2024 and is anticipated to reach USD 1,834.49 million by 2032, at a CAGR of 4.84% during the forecast period. Africa represents a smaller share of the market but shows steady growth due to expanding manufacturing and mining activities. It faces rising demand for effective cleaning solutions in industrial and healthcare sectors. It benefits from increasing foreign investment and infrastructure projects. Local companies adopt sustainable and cost-effective products. It gradually integrates automation in cleaning operations. Africa sees growth from urbanization and industrial expansion. It holds potential for multinational companies targeting emerging markets. Regulatory frameworks slowly improve, supporting market development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BASF SE

- Dow Inc.

- Clariant AG

- Evonik Industries AG

- Solvay SA

- Stepan Company

- Ecolab Inc.

- 3M

- Careclean

- Roots Multiclean Ltd.

- Other regional

Competitive Analysis:

The Global Industrial Cleaning Products Market features a fragmented competitive landscape with multiple global and regional players shaping industry dynamics. Leading companies such as Ecolab Inc., Diversey Holdings Ltd., 3M Company, BASF SE, and The Dow Chemical Company hold a combined market share of roughly 14.5%, highlighting the presence of numerous smaller competitors across regions. It drives companies to differentiate through product performance, regulatory compliance, and cost-efficiency. Key players invest in research and development to produce eco-friendly, multi-functional, and automation-compatible solutions for diverse industrial needs. Global firms pursue mergers, acquisitions, and strategic partnerships to expand their geographic reach and strengthen supply chains, enabling access to emerging markets where regional suppliers dominate due to cost advantages and established customer relationships. Leading companies emphasize branding, service bundles, and tailored offerings to retain industrial clients and long-term contracts. It leverages smart distribution networks and digital platforms to enhance operational efficiency and customer engagement. Regional and local players remain competitive by focusing on niche industrial sectors or customizing solutions for specific environments.

Recent Developments:

- In November 2025, Ecolab Inc. expanded its partnership with The Home Depot by launching the Ecolab® Scientific Clean™ product line in Canada, featuring nine new cleaning products targeted at both professional and consumer segments. This exclusive partnership aims to provide industry-grade cleaning solutions for commercial, industrial, and residential use and demonstrates Ecolab’s commitment to supporting healthier environments with science-based products.

- In October 2025, BASF and IFF announced a strategic collaboration aimed at driving next-generation enzyme and polymer innovation for industrial cleaning applications. The partnership is set to accelerate new product development, leveraging both companies’ expertise in sustainable ingredients and advanced chemical engineering to respond to the growing demand for eco-friendly and high-performance cleaning solutions in industrial environments.

- In July 2025, BASF SE strengthened its liquid enzyme portfolio for the laundry and cleaning industry by introducing innovative enzyme types lipase, cellulase, and amylase designed to enhance stain removal and fabric care in laundry formulations. This development reinforces BASF’s position as an innovation leader in sustainable industrial cleaning solutions.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Form, End User and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising industrialization in emerging economies will continue to drive demand for industrial cleaning solutions.

- Adoption of automated and robotic cleaning systems will enhance operational efficiency across sectors.

- Eco-friendly and biodegradable formulations will gain preference, supporting sustainability initiatives.

- Expansion in healthcare, food processing, and pharmaceutical industries will boost market penetration.

- Integration of digital platforms and e-commerce will improve accessibility and distribution efficiency.

- Technological innovation in multi-functional cleaning products will attract high-value industrial clients.

- Regulatory enforcement on hygiene and workplace safety will sustain consistent product adoption.

- Strategic mergers, acquisitions, and partnerships will strengthen regional and global market positions.

- Focus on energy-efficient and water-saving cleaning technologies will drive premium solution adoption.

- Emerging industrial hubs in Asia Pacific and Latin America will offer long-term growth potential.