Market Overview:

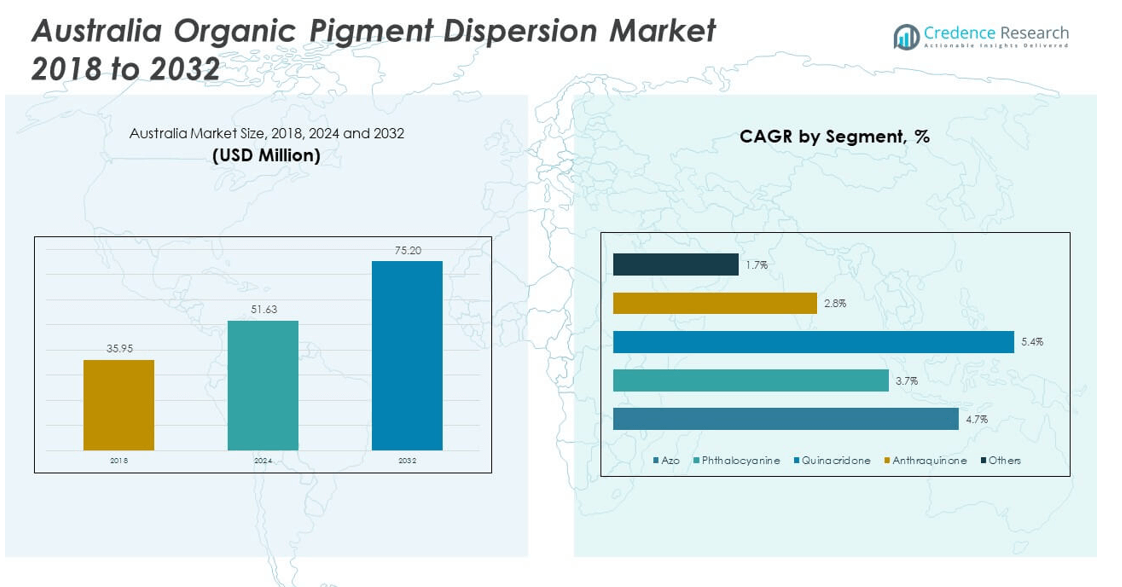

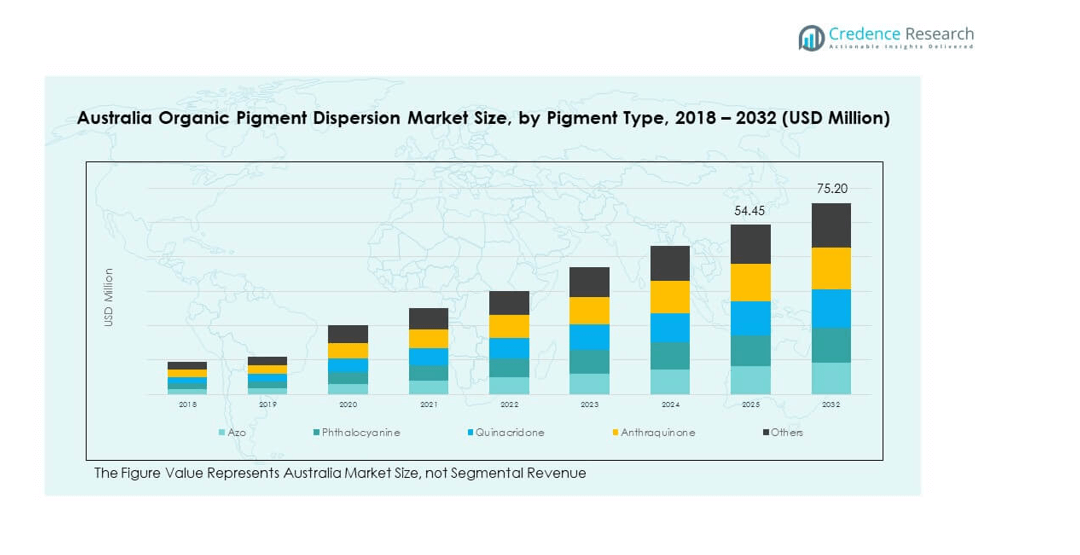

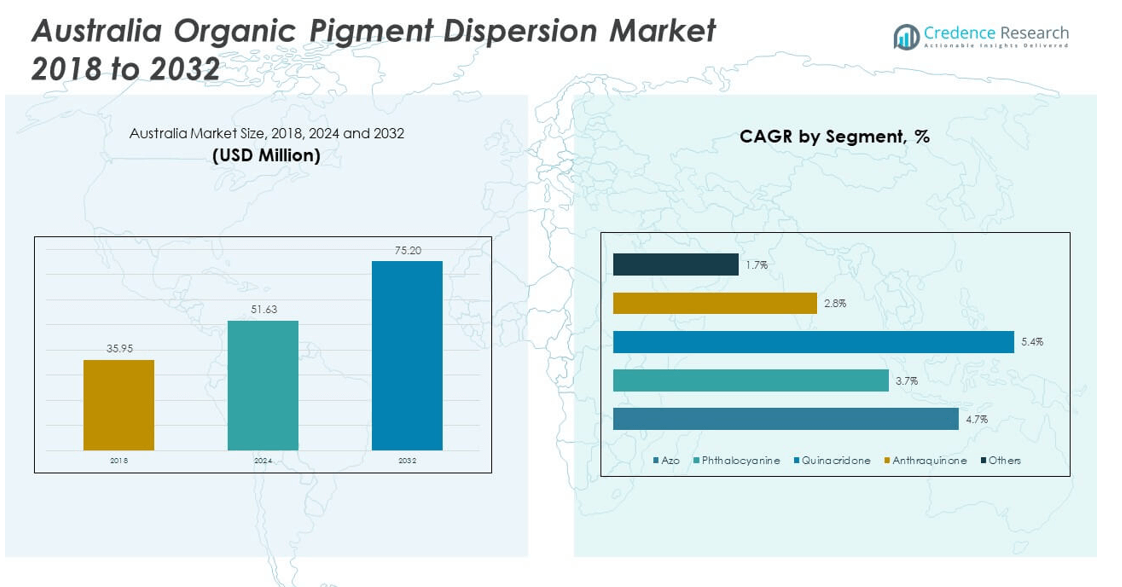

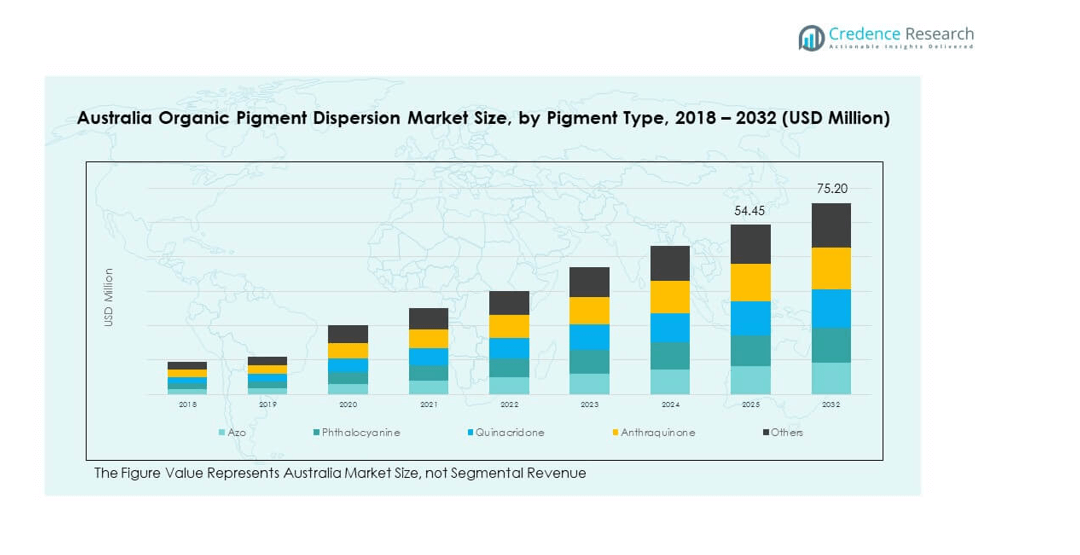

The Australia Organic Pigment Dispersion Market size was valued at USD 35.95 million in 2018 to USD 51.63 million in 2024 and is anticipated to reach USD 75.20 million by 2032, at a CAGR of 4.72% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Organic Pigment Dispersion Market Size 2024 |

USD 51.63 million |

| Australia Organic Pigment Dispersion Market, CAGR |

4.72% |

| Australia Organic Pigment Dispersion Market Size 2032 |

USD 75.20 million |

The market growth is driven by rising demand for sustainable and high-performance colorants across industries such as paints, coatings, textiles, and plastics. Increasing consumer preference for eco-friendly and non-toxic formulations supports greater adoption of organic pigment dispersions. Strong investments in research and development enhance pigment quality, durability, and dispersion properties, making them a preferred choice over inorganic alternatives. Furthermore, regulatory emphasis on reducing harmful emissions and promoting safe pigments strengthens the position of organic pigment dispersions in the Australian market.

Geographically, the Australia Organic Pigment Dispersion Market is led by Eastern and Southeastern Australia, holding 46% share due to strong industrial bases, urbanization, and construction-driven demand. Western Australia follows with 32% share, where mining activity and infrastructure projects create significant demand for coatings and packaging. Northern and Central Australia account for 22% share, showing the fastest growth as agriculture, textiles, and packaging industries expand alongside infrastructure projects. Environmental regulations and sustainability-focused policies further strengthen adoption across all subregions, supporting both established and emerging markets.

Market Insights

- The Australia Organic Pigment Dispersion Market was valued at USD 35.95 million in 2018, USD 51.63 million in 2024, and is projected to reach USD 75.20 million by 2032, growing at a CAGR of 4.72%.

- Eastern and Southeastern Australia led with 46% share due to strong industrial bases and high urbanization, followed by Western Australia at 32% supported by mining and construction, and Northern and Central Australia at 22% driven by agriculture and localized manufacturing.

- Northern and Central Australia represent the fastest-growing subregion with 22% share, supported by infrastructure expansion, packaging demand, and opportunities in neighboring Pacific export markets.

- Azo pigments accounted for the largest share of pigment type usage at 38%, driven by versatility and broad industrial application across coatings, inks, and plastics.

- Phthalocyanine pigments followed with a 27% share, supported by demand for high stability and weather resistance in paints and long-lasting outdoor applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Eco-Friendly and Sustainable Pigment Solutions Across Multiple Industries

The Australia Organic Pigment Dispersion Market expands with growing demand for eco-friendly color solutions in industries such as paints, coatings, plastics, and textiles. Regulatory pressure to minimize toxic materials encourages industries to replace inorganic pigments with safer alternatives. Companies focus on non-toxic, biodegradable dispersions to meet environmental standards and customer expectations. Growing urbanization and infrastructure projects further support consumption in construction paints and architectural coatings. The textile sector drives uptake due to consumer preference for sustainable fabrics. Packaging industries also shift to eco-based inks and dispersions to meet compliance requirements. Rising awareness about health hazards of synthetic pigments influences purchasing patterns. This demand growth strengthens the position of organic dispersions in manufacturing chains.

- For example, BASF’s AURASPERSE® II water-based organic pigment dispersions are confirmed to be free of APEOs, binding agents, and solvents. They deliver high batch-to-batch consistency with a tint strength tolerance of ±3% and are designed for applications in architectural, industrial coatings, and printing inks.

Technological Advancements Driving Improvements in Performance, Quality, and Application Scope

Continuous R&D improves pigment dispersion quality, enhancing brightness, stability, and durability across multiple applications. Companies invest in advanced production technologies to improve dispersion uniformity, ensuring consistency in end-use applications. The Australia Organic Pigment Dispersion Market benefits from innovations that expand pigment versatility. Advanced formulations allow usage in challenging conditions without color fading or loss of performance. Stronger resistance to UV radiation supports longer lifespans in outdoor products. Advancements in nano-dispersion methods also improve pigment integration into plastics and polymers. The adoption of new manufacturing processes reduces production costs, making pigments accessible to more industries. Such technological improvements expand application potential across both consumer and industrial markets.

Regulatory Policies Encouraging Safe and Sustainable Product Adoption in Australia

Government regulations emphasize lowering hazardous emissions and supporting safe material choices across industries. Policies targeting chemical safety and environmental health encourage manufacturers to adopt organic pigment dispersions over synthetic substitutes. The Australia Organic Pigment Dispersion Market responds to these policies with strong compliance-driven adoption. Companies align with standards that limit heavy metals and toxic compounds in finished products. Stricter import regulations also influence domestic manufacturers to innovate sustainable pigments. Export-oriented businesses benefit by aligning with global regulations, increasing competitiveness in international markets. Adoption in packaging and food-contact materials reflects this compliance-focused growth. Regulatory pressure provides long-term direction to pigment producers and users.

Growing Consumer Awareness and Preference for Health-Safe and Durable Pigments

Consumers increasingly choose products that prioritize safety, durability, and eco-friendly performance. Demand grows for paints, coatings, and textiles free from hazardous pigments, driving preference toward organic dispersions. The Australia Organic Pigment Dispersion Market experiences this consumer-driven push, particularly in premium product categories. Buyers value products with long-lasting color vibrancy and reduced health risks. Growing lifestyle awareness influences household paint choices and personal product selections. Consumer-driven sustainability also aligns with brand positioning strategies in packaging and fashion. Companies that promote organic pigments in marketing gain stronger loyalty and adoption. This awareness enhances long-term growth prospects by aligning consumer values with industrial adoption.

- For example, DIC Corporation offers organic pigment dispersions for display, plastics, and coatings markets, including brightness-optimized green pigments used in LCD color filters. The company supports Asia-Pacific customers through its broad pigment portfolio and regional supply network.

Market Trends

Integration of Smart Manufacturing Processes and Digital Tools in Pigment Production

Smart manufacturing practices streamline production processes and improve dispersion efficiency. Automation ensures consistent pigment quality, reducing wastage and production time. The Australia Organic Pigment Dispersion Market adapts digital monitoring tools for quality control. Predictive maintenance systems enhance equipment performance, reducing downtime in pigment facilities. Integration of AI supports optimization in formulation processes. Real-time data improves traceability, meeting regulatory and customer expectations. Adoption of smart processes also reduces energy usage, aligning with sustainability goals. Digital transformation creates opportunities for efficiency, cost reduction, and enhanced pigment competitiveness.

Emergence of Customization and Personalization in Pigment Dispersion Applications

Industries seek pigments tailored to specific functional and aesthetic requirements. Customization trends strengthen the Australia Organic Pigment Dispersion Market by enabling niche applications. Manufacturers offer specialized colors and effects to meet customer-specific needs. The demand for unique packaging, textiles, and consumer products drives tailored pigment development. Brands use customized pigments to differentiate their products in competitive markets. Niche applications such as luxury goods and high-end interiors benefit from unique pigment options. Personalized pigment formulations help brands align with evolving consumer identities. This trend emphasizes flexibility and creativity in pigment supply chains.

- For example, Avient’s ColorWorks™ team released ColorForward™ 2023, the 17th edition of its annual color trend forecasting guide. The guide includes a curated set of 20 colors and effects to help designers and brand owners in plastics and packaging make informed color decisions.

Growing Adoption of Organic Pigments in High-Performance End-Use Applications

High-performance industries require pigments that maintain durability under challenging conditions. The Australia Organic Pigment Dispersion Market benefits from increased adoption in automotive, aerospace, and construction applications. Pigments with enhanced UV and heat resistance meet long-term durability requirements. High-performance coatings demand stable dispersion solutions to withstand harsh environments. Industries value pigments that retain vibrancy under outdoor exposure. Construction projects incorporate organic dispersions into protective coatings for extended lifespans. Automotive paints integrate organic pigments for superior finish and reduced environmental impact. These applications highlight organic dispersions as premium solutions across advanced industries.

- For instance, Heubach Group’s Hostaperm Violet RL spec. 01 is a high-performance pigment designed for automotive and industrial coatings, featuring excellent fastness properties, including a heat stability of 160 °C and light fastness rated at 8 (full shade) on the Blue Wool Scale. These properties meet the needs of demanding applications such as outdoor automotive paints, where durability and color retention are essential.

Expansion of Export-Oriented Production Capacity in the Australian Market

Australian pigment producers expand facilities to capture export opportunities in global markets. The Australia Organic Pigment Dispersion Market gains traction with capacity expansion targeting Asia-Pacific and European buyers. Export growth is driven by compliance with international environmental standards. Producers invest in advanced manufacturing lines to meet global demand for safe pigments. Supply diversification enhances resilience against domestic demand fluctuations. Trade agreements open access to high-demand regions with strict sustainability requirements. Export-oriented expansion increases competitiveness of Australian manufacturers on global platforms. This trend strengthens the industry’s international footprint and long-term market potential.

Market Challenges Analysis

High Production Costs and Competitive Pressure from Low-Cost Substitutes

The Australia Organic Pigment Dispersion Market faces challenges due to high production costs linked with raw materials and specialized processes. Smaller manufacturers struggle to compete with cheaper inorganic substitutes widely available in the market. Price-sensitive industries often choose low-cost alternatives despite environmental drawbacks. High production expenses also limit scalability for mid-sized firms. Global competition from low-cost Asian suppliers further increases market pressure. Import reliance on certain raw materials exposes the industry to supply fluctuations. Companies need strategic cost management and process optimization to remain competitive. This cost challenge continues to influence profitability and adoption rates.

Regulatory Compliance Complexities and Technological Barriers for Small Producers

Smaller firms encounter difficulties in meeting strict compliance requirements for safety and environmental standards. Regulatory frameworks demand continuous monitoring and certifications, which increase operational costs. The Australia Organic Pigment Dispersion Market requires significant investments in advanced technology to maintain compliance. Small producers often lack capital for high-tech equipment and R&D. Limited technical expertise slows adoption of new dispersion methods. Delays in upgrading facilities reduce competitiveness in regulated sectors such as packaging and food-contact applications. Compliance burdens create entry barriers for new entrants. These challenges restrict participati

Market Opportunities

Growing Scope of Pigment Applications in Emerging Industrial Sectors

Expansion into emerging sectors such as renewable energy, bio-based materials, and advanced textiles creates new growth pathways. The Australia Organic Pigment Dispersion Market benefits from demand in eco-packaging and sustainable construction projects. Organic pigments with advanced properties enable usage in energy-efficient materials. Emerging applications such as smart textiles further strengthen market prospects. Manufacturers aligning products with these industries secure long-term growth. Companies expanding product lines into renewable-aligned applications gain stronger relevance. Opportunities in new sectors enhance diversification strategies across producers.

Potential for Strategic Collaborations and Export Expansion into High-Demand Regions

Collaboration between producers, research institutions, and end-use industries unlocks innovation opportunities. The Australia Organic Pigment Dispersion Market grows with joint ventures targeting advanced dispersion solutions. Export growth potential exists in Europe and Asia, where demand for safe pigments is high. Partnerships with global distributors increase visibility and market reach. Producers gain advantage by aligning with sustainability-focused international standards. Collaborative R&D accelerates breakthrough innovations and strengthens brand credibility. Strategic partnerships and export focus ensure resilience against domestic demand cycles. These factors create strong opportunities for long-term growth.

Market Segmentation Analysis

By pigment type, azo pigments dominate the Australia Organic Pigment Dispersion Market due to their versatility, cost efficiency, and widespread use in coatings, inks, and plastics. Phthalocyanine pigments follow with strong demand for their excellent stability and weather resistance, especially in outdoor paints and industrial coatings. Quinacridone pigments secure a niche share by offering high color strength and durability, which appeals to premium applications such as automotive coatings and decorative finishes. Anthraquinone pigments are valued for specialty applications requiring unique shades and performance features, while the others category includes niche pigments serving custom formulations and emerging uses. It reflects diverse adoption patterns across industries based on cost, performance, and application requirements.

- For example, Clariant is the only manufacturer of high-performance quinacridone pigments based on renewable, bio-succinic acid, as recognized by Myriant; their Pigment Red 122 and Pigment Violet 19 used worldwide including in Australia fulfill EcoTain® sustainability criteria, and the process enables CO₂ reductions compared to petrochemical benchmarks.

By application, paints and coatings represent the largest share of the Australia Organic Pigment Dispersion Market, driven by construction activity and infrastructure development. Printing inks hold significant demand due to expanding packaging needs and sustainability-driven ink formulations. Plastics and polymers use pigments to enhance product appeal, durability, and compliance with safety regulations. Textiles contribute steady growth through consumer preference for eco-friendly and durable colors in fabrics. Cosmetics form a smaller but high-value segment, leveraging non-toxic pigments for safer formulations. The others category includes applications in specialty products and evolving niche industries, highlighting broader potential for future adoption.

- For instance, Neon Cosmetics operates a GMP and ISO 22716:2007-certified facility in Melbourne, Australia, specializing in the manufacturing of color cosmetics for major brands and private labels. Neon provides custom-formulated pigment dispersions for a broad range of cosmetic products—including lipsticks, eye shadows, and nail polishes and ensures every production batch is validated through in-house R&D and quality assurance laboratories.

Segmentation

By Pigment Type

- Azo

- Phthalocyanine

- Quinacridone

- Anthraquinone

- Others

By Application

- Printing Inks

- Paints & Coatings

- Plastics & Polymers

- Textiles

- Cosmetics

- Others

Regional Analysis

Eastern and Southeastern Australia

Eastern and Southeastern Australia lead the Australia Organic Pigment Dispersion Market with a 46% share. This dominance comes from the strong presence of construction, textiles, and packaging industries in cities such as Sydney, Melbourne, and Brisbane. High urbanization drives consistent demand for paints, coatings, and consumer goods requiring organic dispersions. Advanced infrastructure projects and housing activity reinforce pigment consumption. Regulatory enforcement is stronger in this region, creating a favorable environment for eco-friendly pigments. The concentration of manufacturing hubs in Victoria and New South Wales also drives wider adoption across multiple end-use sectors.

Western Australia

Western Australia holds a 32% share of the Australia Organic Pigment Dispersion Market. Its mining-driven economy generates significant demand for industrial coatings and protective applications. Growth in Perth’s construction sector supports pigment usage in architectural paints and surface coatings. The packaging industry in this region increasingly incorporates organic pigments to meet sustainability goals. Export activity through Western Australia’s ports creates a gateway for pigment manufacturers targeting Asian markets. It benefits from stable industrial demand combined with emerging consumer interest in eco-friendly products. Strong distribution channels further support pigment supply in both regional and industrial zones.

Northern and Central Australia

Northern and Central Australia account for 22% of the Australia Organic Pigment Dispersion Market. Market activity is driven by construction growth in Darwin and Alice Springs and demand from agricultural packaging. The presence of smaller manufacturing clusters creates localized opportunities for organic dispersions. Demand for textiles and consumer goods is steadily expanding with population growth in regional centers. The harsher climate increases the need for pigments with high durability and UV resistance. Export opportunities into neighboring Pacific markets strengthen this region’s role within the industry. It shows gradual expansion supported by infrastructure projects and sustainable product adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Aron Universal

- All Colour Supplies

- Oxerra

- Advancion Sciences

- Aarbor Colorants Corporation

- Asharrison

- Tradechem

- Colorflo Dispersions Pty Ltd

Competitive Analysis

The Australia Organic Pigment Dispersion Market features a competitive landscape shaped by both multinational and domestic companies. Aron Universal, Oxerra, and Aarbor Colorants Corporation hold strong positions through established product portfolios and wide distribution networks. All Colour Supplies and Colorflo Dispersions Pty Ltd strengthen regional supply by focusing on customized solutions and client-specific formulations. Advancion Sciences and Tradechem emphasize technical expertise and R&D to expand into high-performance pigment segments. Asharrison leverages partnerships to enhance presence across printing inks and coatings. Competitive strategies include mergers, capacity expansions, and sustainable product innovations. It remains highly competitive, with firms balancing cost efficiency, compliance, and product differentiation to secure market share.

Recent Developments

- In July 2025, Sun Chemical, a wholly owned subsidiary of DIC Corporation, launched a new effect pigment called Chione Electric Amber SB90D, expanding its Chione Electric product line with a shimmering amber hue. This pigment is designed for vegan beauty products in cosmetics, skin, and sun care, offering enhanced chroma, UV stability, and non-staining properties.

- In November 2023, Heubach GmbH expanded its cooperation with TER Chemicals to include inorganic colored pigments, anti-corrosion pigments, and pigment preparations in Germany and Austria. This partnership aims to enhance product availability for coatings and related applications.

- In October 2024, Oxerra marked a significant milestone by completing the sale of Cathay Pigments & Chemicals Phils. Corp to WWRC. The company intensified its commitment to growth and sustainability in Australia by investing in advanced technologies, enhancing supply security, and integrating newly acquired sites into its global network.

Report Coverage

The research report offers an in-depth analysis based on Pigment Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Australia Organic Pigment Dispersion Market will expand steadily, supported by rising demand across coatings and packaging industries.

- Sustainability initiatives will drive adoption of eco-friendly pigments aligned with regulatory compliance requirements.

- Advanced R&D will improve pigment stability, UV resistance, and color vibrancy for industrial applications.

- Demand for customized pigment solutions will grow as brands target differentiation in packaging and textiles.

- Export opportunities will strengthen, with Australian producers meeting global standards for safe pigments.

- Construction activity and infrastructure upgrades will boost coatings consumption, increasing dispersion demand nationwide.

- Local manufacturers will focus on capacity expansion and automation to reduce production costs and enhance competitiveness.

- High-performance applications in automotive and aerospace will fuel premium pigment adoption across the market.

- Strategic collaborations between producers and research institutions will accelerate innovation and product diversification.

- Regional growth in Northern and Central areas will create new opportunities for localized pigment adoption.