Market Overview

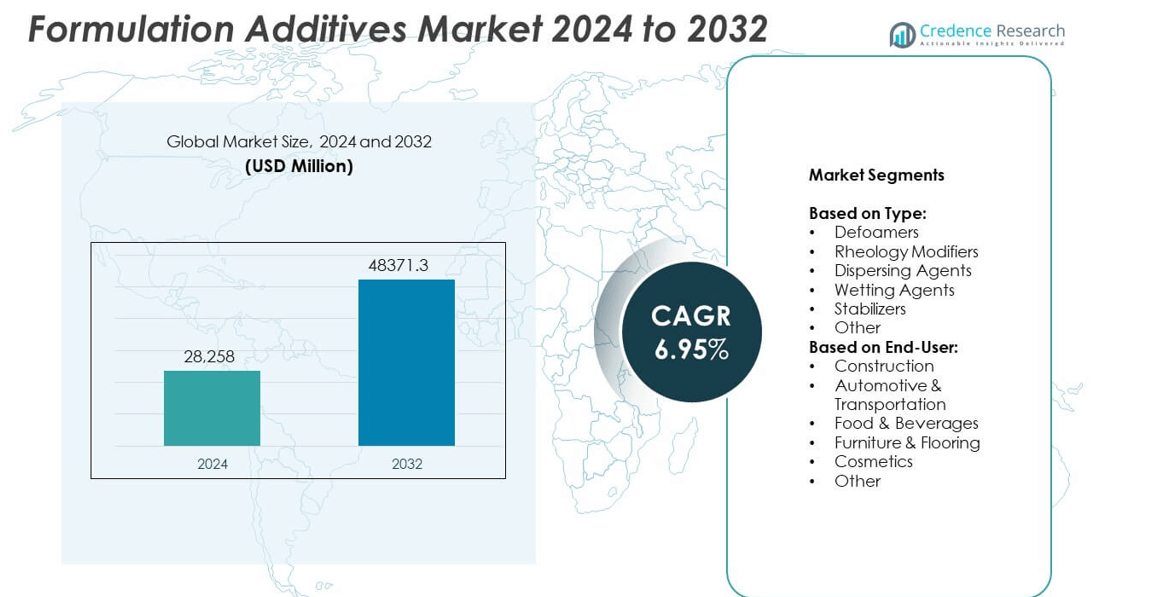

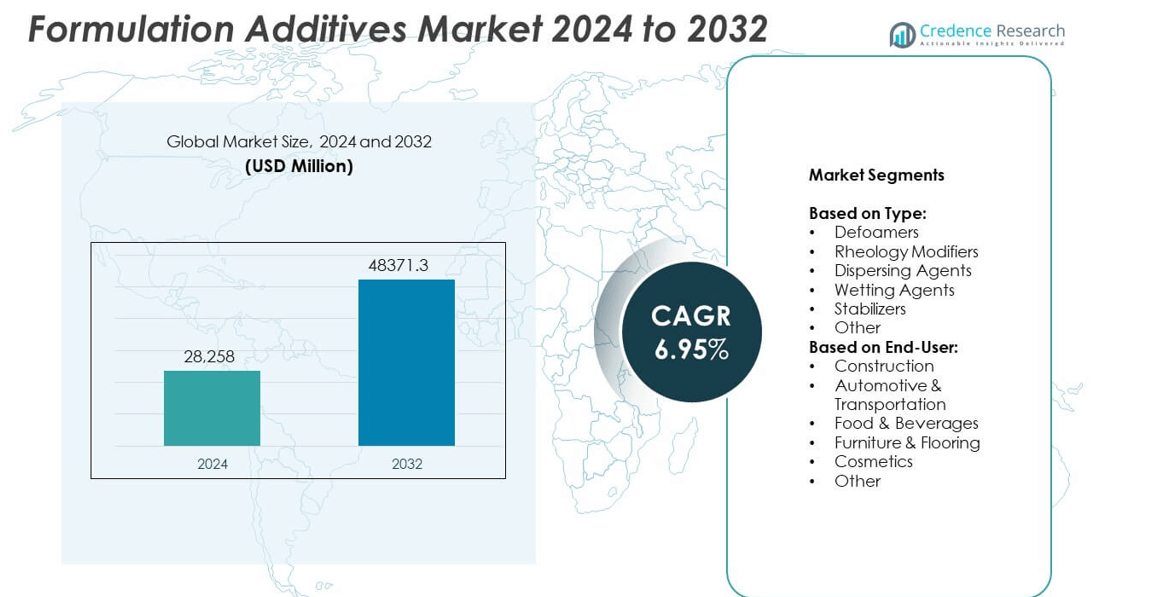

The formulation additives market size was valued at USD 28,258 million in 2024 and is expected to reach USD 48,371.3 million by 2032, growing at a CAGR of 6.95% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Formulation Additives Market Size 2024 |

USD 28,258 million |

| Formulation Additives Market, CAGR |

6.95% |

| Formulation Additives Market Size 2032 |

USD 48,371.3 million |

The formulation additives market grows with rising demand from construction, automotive, and packaging sectors. Manufacturers focus on enhancing performance, durability, and efficiency of coatings, adhesives, and sealants. Strict environmental regulations drive the shift toward low-VOC, waterborne, and bio-based solutions. Growing urbanization and infrastructure projects support consumption across emerging economies. Technological advances in nanomaterials and smart additives improve functionality and open new applications. Increasing focus on sustainability and process optimization strengthens innovation and drives market competitiveness globally.

North America leads the formulation additives market with strong demand from construction, automotive, and packaging sectors, followed by Europe driven by strict environmental regulations and sustainability goals. Asia-Pacific shows the fastest growth due to rapid industrialization and infrastructure development. Latin America and Middle East & Africa witness steady adoption supported by manufacturing expansion and urban projects. Key players include BASF SE, AkzoNobel, LANXESS AG, and Dow, focusing on innovation, eco-friendly solutions, and regional expansions to strengthen their market presence.

Market Insights

- The formulation additives market was valued at USD 28,258 million in 2024 and is projected to reach USD 48,371.3 million by 2032 at a CAGR of 6.95%.

- Rising demand from construction, automotive, and packaging industries drives market growth worldwide.

- Strong trend toward bio-based, waterborne, and low-VOC additives aligns with global sustainability goals.

- Competitive landscape features leading players focusing on R&D, product innovation, and strategic partnerships to gain market presence.

- Volatile raw material prices and strict regulatory compliance pose challenges to consistent profitability for manufacturers.

- North America and Europe maintain leadership with strong demand and strict environmental standards, while Asia-Pacific records fastest growth driven by infrastructure and manufacturing expansion.

- Continuous technological advancements, including nanotechnology and smart additives, create new opportunities in high-performance coatings, adhesives, and specialty applications

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand from Construction and Automotive Industries

Formulation additives market benefits from the steady expansion of construction and automotive sectors. Demand for high-performance coatings, adhesives, and sealants drives consumption. It enhances durability, chemical resistance, and surface appearance of end products. Automotive manufacturers use additives to improve scratch resistance and color stability. Construction applications require additives for concrete admixtures, protective coatings, and waterproofing. Growing urbanization and infrastructure development projects worldwide strengthen the market outlook. Rising renovation activities in developed economies also support product adoption.

- For instance, in a benchmark by Covestro, silane- and nano-modified 2K polyurethane (PU) clearcoats outperformed standard 2K coatings in wet scratch‒resistance tests after weathering.

Rising Focus on Sustainability and Low-VOC Solutions

Stricter environmental regulations fuel demand for eco-friendly formulation additives. Manufacturers shift toward low-VOC, water-based, and bio-based products to meet compliance standards. It reduces harmful emissions and aligns with global sustainability goals. Industries adopt greener solutions to address consumer preference for safer materials. Continuous innovation in biodegradable and renewable additives strengthens product portfolios. Global initiatives on carbon footprint reduction further encourage adoption. This trend creates opportunities for suppliers with advanced sustainable technologies.

- For instance, BYK has defoamers evaluated 24 hours after incorporation into paint; tests measure defoaming efficiency via reduction in entrained air after a defined stir and storage period

Increasing Use in Industrial Applications

Industrial sectors adopt formulation additives to enhance performance of paints, inks, and lubricants. It improves dispersion, flow, and stability of complex formulations. Demand grows in packaging, electronics, and energy industries for tailored solutions. Specialty additives support resistance to temperature extremes and harsh environments. Manufacturers use them to optimize production efficiency and reduce material waste. Expanding manufacturing activities in Asia-Pacific and other emerging regions accelerate consumption. Growing investment in industrial coatings contributes to steady market growth.

Technological Advancements and Product Innovation

Continuous R&D efforts lead to new high-performance additives with superior properties. It enables formulators to meet evolving performance requirements across applications. Companies invest in nanotechnology and advanced chemistry to enhance functionality. Smart additives with self-healing or anti-microbial features gain popularity. Innovation supports differentiation in a competitive market landscape. Collaboration between chemical producers and end-use industries accelerates product development. These advancements ensure the formulation additives market remains dynamic and future-ready.

Market Trends

Shift Toward Bio-Based and Eco-Friendly Additives

Formulation additives market witnesses strong momentum toward bio-based and eco-friendly solutions. Manufacturers focus on reducing dependence on petroleum-based raw materials. It supports global efforts to lower environmental impact and meet regulatory norms. Waterborne and solvent-free additives gain preference across industries. Development of biodegradable additives attracts industries seeking sustainable certifications. Government policies promoting green chemistry encourage faster adoption. This trend positions companies with eco-innovation at a competitive advantage.

- For instance, Ampacet introduced its ScratchShield PET 7000076-E additive that resists scuffs at load forces up to 100 N, and at forces under 25 N scuffs were virtually eliminated in bottle-to-bottle scuff tests.

Rising Integration of Smart and Functional Additives

Demand grows for additives that deliver multiple performance benefits in one formulation. It drives research into smart materials with self-cleaning, anti-microbial, or corrosion-resistant properties. Functional additives enable end-users to achieve superior durability and efficiency. Industries seek products that enhance processability and final product quality. Integration of nanotechnology creates opportunities for high-performance coatings and composites. Growth of high-tech applications fuels demand for advanced solutions. This shift strengthens the value proposition of premium additives.

- For instance, Axel Plastics Research Laboratories’ MoldWiz INT-35CPD additive used at 1-2% concentration showed no scratching at 10 N force, and significantly reduced scratch depth at forces up to 20 N in thermoplastic polyolefin (TPO) tests.

Digitalization and Process Optimization in Manufacturing

Producers adopt digital tools to improve additive formulation and application processes. It enhances precision, consistency, and reduces development time. Data-driven platforms allow quick customization for end-user requirements. Artificial intelligence supports predictive modeling for performance outcomes. Smart manufacturing reduces waste and improves energy efficiency. Digital twins and automation gain popularity among large-scale chemical producers. This digital trend reshapes the competitive landscape in formulation additives market.

Rising Demand from Emerging Economies

Emerging economies become major growth hubs for formulation additives demand. It is fueled by urban development, infrastructure expansion, and growing consumer goods sectors. Rising middle-class population increases consumption of high-quality coatings and plastics. Local production facilities expand to meet regional needs and lower costs. Trade liberalization policies support foreign investment in chemical manufacturing. Strong growth in Asia-Pacific drives higher production capacities. This regional momentum contributes significantly to global market expansion.

Market Challenges Analysis

Volatility in Raw Material Prices and Supply Chain Disruptions

Formulation additives market faces challenges due to fluctuating raw material prices. Dependence on petrochemical derivatives exposes manufacturers to cost instability. It affects profit margins and pricing strategies across industries. Global supply chain disruptions create delays in raw material availability. Rising transportation costs add further pressure on operating expenses. Manufacturers struggle to maintain consistent product quality under volatile conditions. Strategic sourcing and long-term supplier agreements become essential to manage risks.

Stringent Regulatory Compliance and High Development Costs

Compliance with evolving environmental and safety regulations creates significant hurdles. It demands constant reformulation to meet VOC and chemical safety standards. Regulatory approval processes extend time-to-market for new additives. High R&D costs impact small and mid-sized manufacturers’ competitiveness. Limited availability of skilled professionals slows innovation cycles. Companies face pressure to deliver sustainable solutions without compromising performance. These factors collectively challenge growth pace and profitability for market participants.

Market Opportunities

Expansion in High-Growth End-Use Industries

Formulation additives market has significant opportunities in rapidly growing industries such as automotive, construction, and packaging. Rising demand for high-performance coatings and lightweight materials fuels adoption. It supports product innovation focused on durability, weather resistance, and improved aesthetics. Growth in electric vehicles and infrastructure projects increases consumption of specialty additives. Packaging sector needs functional additives to improve barrier properties and shelf life. Emerging applications in renewable energy and electronics create new revenue streams. Companies with industry-specific solutions can capture strong market share.

Advancement in Sustainable and Smart Additive Technologies

Innovation in bio-based and waterborne formulations presents long-term growth potential. It allows manufacturers to meet strict environmental standards and consumer expectations. Smart additives with self-healing, anti-fouling, or conductive properties gain traction. Industries seek solutions that enhance performance while reducing resource consumption. Nanotechnology-enabled additives open opportunities in high-value applications like aerospace and medical devices. Strategic collaborations between chemical producers and research institutes accelerate development. This wave of innovation positions leading players to strengthen competitive advantage.

Market Segmentation Analysis:

By Type:

Formulation additives market is led by defoamers due to their widespread use in paints, coatings, and adhesives. It helps control foam formation and improves finish quality in industrial processes. Rheology modifiers hold significant share for enhancing viscosity and flow characteristics, supporting uniform application. Dispersing agents remain crucial for pigment stabilization in paints, inks, and plastics. Wetting agents see growing demand to improve surface tension and adhesion on diverse substrates. Stabilizers find increasing use in protecting formulations from heat, light, and oxidation damage. Other additives include specialty blends designed for niche performance requirements across industries.

- For instance, BYK’s product BYK-1740 is a bio-based, VOC-free defoamer with shelf life of 36 months, used in aqueous paint systems, adhesives, detergents etc

By End-User:

Construction sector dominates demand with large-scale use in concrete admixtures, protective coatings, and sealants. It drives adoption of additives that improve durability, water resistance, and workability of building materials. Automotive and transportation industries represent a fast-growing segment due to rising focus on corrosion resistance and aesthetic quality. Food and beverages sector relies on additives for packaging coatings and safety compliance. Furniture and flooring applications use additives to enhance scratch resistance, color retention, and product longevity. Cosmetics industry adopts formulation additives to improve texture, stability, and shelf life of personal care products. Other end-user segments include electronics, textiles, and energy sectors, which steadily expand consumption for specialized applications.

- For instance, Nanovea tested a PTFE coating using its Mechanical Tester: scratch tests used a 200 µm diamond stylus, rising load to ~8.5 N as critical load when the coating failed, with coefficient of friction (COF) of ~0.30 at that point.

Segments:

Based on Type:

- Defoamers

- Rheology Modifiers

- Dispersing Agents

- Wetting Agents

- Stabilizers

- Other

Based on End-User:

- Construction

- Automotive & Transportation

- Food & Beverages

- Furniture & Flooring

- Cosmetics

- Other

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a market share of 32% in the formulation additives market, supported by strong demand from construction, automotive, and packaging industries. The region benefits from large-scale infrastructure development, renovation projects, and growth in sustainable building materials. It drives higher adoption of defoamers, rheology modifiers, and dispersing agents to meet strict performance standards. Automotive manufacturers use additives to improve coatings, corrosion resistance, and energy efficiency of vehicles. Packaging producers integrate wetting agents and stabilizers to enhance shelf life and product safety. Regulatory frameworks such as EPA guidelines encourage the development of low-VOC and waterborne additives, boosting innovation in eco-friendly solutions. Growing focus on advanced manufacturing and adoption of digital technologies in production further strengthens the market position of North America.

Europe

Europe accounts for 27% of the global share, driven by stringent environmental regulations and strong industrial base. The region leads in adoption of bio-based and sustainable formulation additives due to compliance with REACH and EU Green Deal initiatives. It supports significant R&D investment to develop high-performance additives with minimal environmental impact. Automotive and transportation sectors create robust demand, particularly in Germany, France, and Italy, where premium coatings and adhesives are widely used. Construction sector emphasizes energy-efficient building materials, driving consumption of dispersing agents and rheology modifiers. Food and beverage packaging industries adopt additives to meet recyclability and safety standards. Europe’s commitment to circular economy principles continues to create opportunities for innovative additive solutions.

Asia-Pacific

Asia-Pacific dominates with a market share of 30%, emerging as the fastest-growing regional market. Rapid urbanization, industrial expansion, and rising disposable incomes fuel strong consumption of formulation additives across industries. China, India, and Southeast Asian countries lead demand with large-scale infrastructure and residential projects. Automotive production and exports from the region further increase the use of advanced coatings and adhesives. Packaging industry expands rapidly to serve growing e-commerce and FMCG sectors, driving demand for wetting agents and stabilizers. Local manufacturers invest in capacity expansion to meet domestic and export requirements. Supportive government policies for industrial development and foreign investment attract global producers to establish manufacturing bases in the region.

Latin America

Latin America contributes 6% of the global share, with steady growth led by Brazil and Mexico. The construction sector drives demand for admixtures and protective coatings in residential and commercial projects. Automotive assembly plants in the region create demand for coatings and performance additives. Food and beverage sector uses formulation additives to enhance packaging integrity and meet regulatory compliance. It also benefits from increased investment in manufacturing facilities to cater to rising consumer demand. Economic recovery and infrastructure projects under government initiatives support market expansion. Local producers focus on developing cost-effective additives to remain competitive.

Middle East & Africa

Middle East & Africa hold a market share of 5%, driven by construction and oil & gas sector development. Large infrastructure projects, including smart cities and industrial zones, support demand for high-performance additives. The region uses defoamers and dispersing agents to ensure quality in coatings and adhesives for extreme weather conditions. Growing adoption of advanced building technologies boosts requirement for rheology modifiers and stabilizers. Automotive and packaging sectors gradually increase consumption as manufacturing activity expands. It also sees rising interest in sustainable and waterborne solutions to align with global environmental standards. Strategic collaborations with global suppliers help bridge supply gaps and meet rising regional demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- AkzoNobel

- LANXESS AG

- Cabot Corporation

- Momentive

- BYK

- Dow

- Huntsman Corporation

- Arkema

- Honeywell International Inc.

- Cytec (Solvay)

- Evonik Industries

- Eastman Chemical Company

- Michelman

- MUNZING Corporation

Competitive Analysis

The leading players in the formulation additives market include BASF SE, AkzoNobel, LANXESS AG, Cabot Corporation, Momentive, BYK, Dow, Huntsman Corporation, Arkema, Honeywell International Inc., Cytec (Solvay), Evonik Industries, Eastman Chemical Company, Michelman, and MUNZING Corporation. These companies focus on expanding their product portfolios and enhancing performance through continuous R&D investments. They emphasize the development of low-VOC, waterborne, and bio-based additives to meet stringent environmental regulations and support sustainability goals. Strategic partnerships with end-use industries enable them to co-develop tailored solutions that address specific performance requirements in construction, automotive, packaging, and coatings applications. The competitive landscape is marked by capacity expansions and regional diversification to capture growth in emerging markets. Companies invest in advanced manufacturing technologies to improve process efficiency and ensure consistent quality. Innovation in nanotechnology-enabled and multifunctional additives strengthens differentiation in a competitive market. Global players also engage in mergers and acquisitions to expand geographic presence and product offerings. Focus on customer-centric solutions and digitalization in formulation processes helps leading manufacturers maintain a competitive edge. This approach allows them to meet the evolving demands of high-performance and sustainable products across diverse end-use sectors.

Recent Developments

- In 2025, Evonik Coating Additives, part of Evonik Industries AG, developed TEGO Wet 288, a substrate wetting formulation additive for waterborne and radiation-cured formulations, compliant with food contact regulations, suitable for food packaging applications.

- In 2025, AkzoNobel launched Sikkens Autowave Optima, a next-generation waterborne basecoat to boost bodyshop productivity and sustainability.

- In 2024, BASF SE introduced the RDY additives range to help formulators anticipate stricter performance and regulatory needs in coatings.

Report Coverage

The research report offers an in-depth analysis based on Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily with rising demand from construction and automotive sectors.

- Manufacturers will focus on developing bio-based and waterborne additives to meet regulations.

- Digital tools and AI-driven formulation technologies will improve efficiency and customization.

- Emerging economies will drive consumption with expanding infrastructure and manufacturing activity.

- Companies will invest in nanotechnology-enabled additives for high-performance and specialty applications.

- Sustainability will remain a key driver, pushing producers toward low-VOC and eco-friendly products.

- Collaboration between chemical producers and end-use industries will accelerate innovation.

- Packaging industry will increase use of additives to improve barrier properties and recyclability.

- R&D spending will rise to develop multifunctional additives that deliver superior performance.

- Global supply chain optimization will become a priority to reduce cost volatility and delays.