Market Overview:

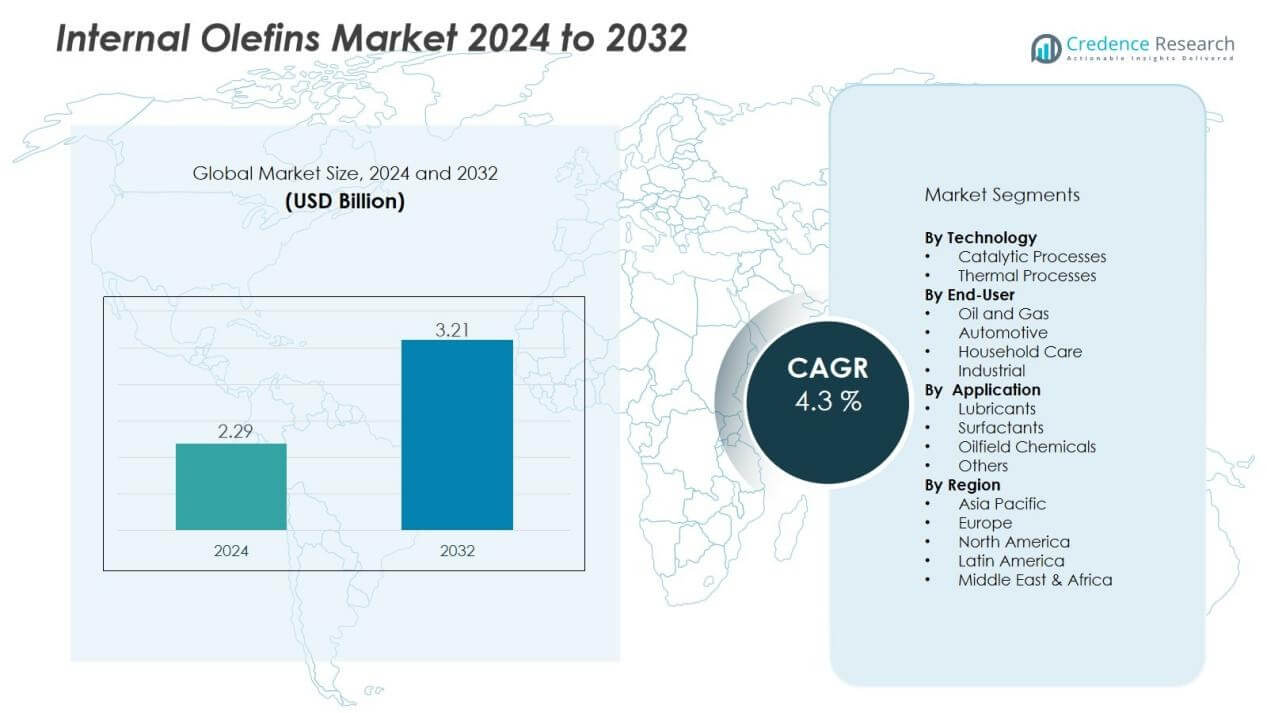

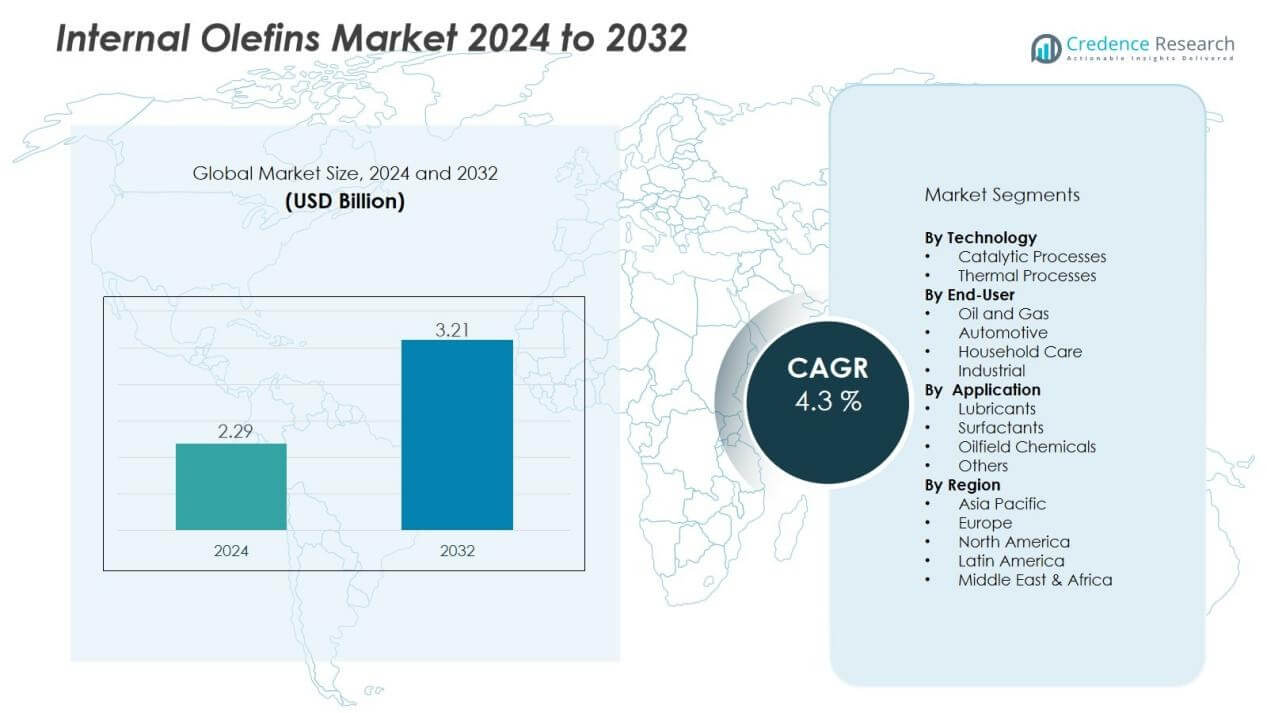

The internal olefins market size was valued at USD 2.29 billion in 2024 and is anticipated to reach USD 3.21 billion by 2032, at a CAGR of 4.3 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Internal Olefins Market Size 2024 |

USD 2.29 Billion |

| Internal Olefins Market, CAGR |

4.3% |

| Internal Olefins Market Size 2032 |

USD 3.21 Billion |

Key market drivers include the rising preference for biodegradable and environmentally friendly chemical alternatives, as internal olefins provide superior performance while aligning with sustainability goals. Their extensive use in synthetic lubricants, drilling fluids, and industrial cleaners further strengthens demand. Growing investments in oil and gas exploration, coupled with advancements in specialty chemical formulations, also contribute to market expansion.

Regionally, North America leads the internal olefins market due to significant oilfield activity and strong industrial adoption. Europe follows with high emphasis on eco-friendly chemicals and regulatory compliance, which supports the use of internal olefins in multiple applications. Asia-Pacific is projected to be the fastest-growing region, fueled by rapid industrialization, expanding automotive and construction sectors, and rising demand for performance-based chemicals in emerging economies such as China and India. Latin America and the Middle East & Africa present additional growth opportunities through increasing industrial and energy sector investments.

Market Insights:

- The internal olefins market was valued at USD 2.29 billion in 2024 and is expected to reach USD 3.21 billion by 2032, growing at a CAGR of 4.3%.

- Rising demand for eco-friendly and biodegradable chemicals is a major driver, with internal olefins widely used in surfactants, detergents, and lubricants.

- Oilfield applications continue to expand, as internal olefins provide thermal stability, lubricity, and biodegradability, supporting drilling fluids and offshore exploration.

- The automotive and industrial sectors drive growth through synthetic lubricants, where internal olefins enhance efficiency, durability, and long-term performance.

- Advancements in specialty chemical formulations, including industrial cleaners and niche performance chemicals, strengthen market adoption through improved catalytic processes and lower emissions.

- High production costs and dependency on crude oil-based feedstocks remain a challenge, with price volatility affecting producer margins and new entrants.

- North America holds 36% of the market and Europe 28%, supported by strong oilfield activity, sustainability regulations, and established chemical industries. Asia-Pacific holds 24% and is the fastest-growing region, while Latin America at 7% and Middle East & Africa at 5% offer emerging opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Eco-Friendly and Biodegradable Chemicals:

The internal olefins market is strongly driven by the global shift toward sustainable and biodegradable chemical solutions. It is widely adopted in surfactants, detergents, and lubricants that meet stringent environmental standards. Growing awareness of sustainability goals among industries and consumers supports adoption. Regulatory frameworks in developed economies further push companies to integrate eco-friendly raw materials into their processes. This trend positions internal olefins as a preferred choice for manufacturers seeking compliance and performance.

- For instance, Elevance Renewable Sciences and Wilmar International began commercial shipments of bio-based internal olefins from their newly commissioned metathesis-based biorefinery in Gresik, Indonesia, with a capacity of 180 000 metric tons per annum in 2025.

Expanding Use in Oilfield Applications:

Oilfield exploration and production remain a key driver for the internal olefins market. It is extensively used in drilling fluids due to its thermal stability, lubricity, and biodegradability. Rising global investments in oil and gas activities directly increase demand for internal olefins. Energy companies favor it for its ability to meet technical requirements while reducing environmental risks. Growth in offshore exploration strengthens this segment further.

Growth in Synthetic Lubricants Across Automotive and Industrial Sectors:

The automotive and industrial sectors contribute significantly to the expansion of the internal olefins market. It is a critical component in high-performance synthetic lubricants that enhance efficiency and extend machinery life. Rising demand for advanced lubricants in vehicles, aerospace, and heavy equipment supports consistent growth. Manufacturers are adopting internal olefins to meet evolving performance requirements while ensuring sustainability. This application continues to reinforce its position in global supply chains.

Advancements in Specialty Chemical Formulations:

Innovation in specialty chemical development is another strong driver for the internal olefins market. It enables improved formulations of industrial cleaners, surfactants, and niche performance chemicals. Producers are investing in advanced catalytic processes that boost yields and reduce emissions. Demand for high-value specialty applications creates opportunities for differentiated product offerings. These advancements help internal olefins expand their role beyond traditional uses, strengthening market penetration.

Market Trends:

Rising Focus on Sustainable and High-Performance Chemical Applications:

The internal olefins market is experiencing strong momentum due to the global shift toward sustainable chemical solutions. It is increasingly used in biodegradable lubricants, surfactants, and detergents that align with environmental regulations. Growing demand for synthetic lubricants in automotive and industrial sectors further supports adoption, given their superior thermal stability and efficiency. Rising oil and gas exploration has also expanded the use of internal olefins in drilling fluids and oilfield chemicals. Specialty chemical producers are investing in advanced formulations that enhance performance and extend application scope. These factors are shaping demand across diverse end-use industries, strengthening the market’s long-term growth trajectory.

- For Instance, Chevron Phillips Chemical completed an expansion of its low-viscosity polyalphaolefins (LV PAO) production unit in Beringen, Belgium, doubling its capacity to 120,000 metric tons per year.

Technological Advancements and Expanding Regional Adoption:

Innovation in production technologies is another key trend influencing the internal olefins market, with emphasis on improving yield, reducing costs, and ensuring consistent quality. It is benefiting from advancements in catalytic processes that enhance efficiency and minimize environmental impact. Regional adoption patterns are also evolving, with Asia-Pacific emerging as the fastest-growing region due to rapid industrialization, automotive expansion, and rising infrastructure investments. North America continues to lead in oilfield applications, while Europe drives demand through strict sustainability regulations and the shift toward eco-friendly chemicals. Emerging economies in Latin America and the Middle East & Africa are beginning to adopt internal olefins more widely, supported by growing industrial activities. These trends highlight both the technological progress and the expanding global footprint of internal olefins.

- For instance, the Shell Higher Olefin Process (SHOP) produces over 1 million tons of olefins annually using a nickel catalyst at 90–100°C and 100–110 bar pressure, advancing efficiency in ethylene oligomerization with selective catalytic reactions.

Market Challenges Analysis:

High Production Costs and Raw Material Dependency:

The internal olefins market faces significant challenges related to high production costs and dependency on petrochemical feedstocks. It relies heavily on raw materials derived from crude oil, making the market vulnerable to fluctuations in oil prices. Rising energy costs and volatility in crude supply chains increase uncertainty for producers. The capital-intensive nature of production facilities further restricts new entrants, limiting competitive flexibility. Producers are under constant pressure to balance operational efficiency with sustainability goals, which often requires additional investments. These cost pressures may slow expansion and restrict adoption in price-sensitive markets.

Regulatory Pressures and Competitive Alternatives:

Stringent environmental and safety regulations also pose hurdles for the internal olefins market, particularly in regions with tight chemical use policies. It must align with evolving standards on emissions, waste management, and biodegradability, which demand continuous adaptation. Compliance often increases costs and impacts profitability for smaller manufacturers. At the same time, the market faces competition from alternative synthetic and bio-based chemicals offering similar performance. Industries seeking cost-effective solutions may shift toward substitutes, reducing potential demand. These regulatory and competitive pressures challenge market players to innovate while maintaining affordability and compliance.

Market Opportunities:

Expanding Role in Sustainable and Specialty Chemical Applications:

The internal olefins market presents strong opportunities through its alignment with global sustainability goals. It is increasingly used in biodegradable surfactants, detergents, and lubricants that meet regulatory and environmental requirements. Growing demand for high-performance synthetic lubricants in automotive, aerospace, and industrial sectors supports long-term growth. Investments in oil and gas exploration also expand opportunities, with internal olefins widely applied in drilling fluids and oilfield chemicals. Rising awareness of eco-friendly formulations is pushing chemical producers to adopt internal olefins in product development. These opportunities highlight its potential to strengthen presence in both established and emerging industries.

Growth Potential Across Emerging Economies and Advanced Formulations:

Rapid industrialization in Asia-Pacific and the Middle East & Africa creates new opportunities for the internal olefins market. It benefits from expanding automotive, construction, and manufacturing sectors that demand advanced performance chemicals. Emerging economies with increasing infrastructure investments also provide a strong base for adoption. Producers focusing on advanced catalytic processes and customized formulations can capture niche demand in specialty applications. Expanding research in bio-based feedstocks further enhances future opportunities by reducing dependence on petroleum sources. These factors collectively position internal olefins as a critical growth enabler across global chemical and industrial value chains.

Market Segmentation Analysis:

By Technology:

The internal olefins market is segmented by technology into catalytic processes and thermal processes. Catalytic methods dominate due to higher efficiency, better selectivity, and reduced energy consumption. Thermal processes maintain relevance in specific applications where cost sensitivity plays a key role. Continuous innovation in catalysts is strengthening adoption, with producers focusing on lower emissions and improved yields. It is expected that catalytic technology will remain the preferred choice for sustainable and large-scale production.

- For instance, the Advanced Catalytic Olefins (ACO™) technology developed by Kellogg Brown & Root LLC (KBR) and SK Innovation produces 10-25% more olefins than traditional FCC processes while reducing energy consumption per unit of olefins by 7-10%.

By End-User:

End-user segmentation includes oil and gas, automotive, household care, and industrial sectors. Oil and gas lead demand due to widespread use of internal olefins in drilling fluids and oilfield chemicals. The automotive industry supports growth with rising consumption of synthetic lubricants that improve performance and durability. Household care drives steady adoption, driven by internal olefins used in detergents and cleaning agents. Industrial applications add further growth potential through demand in specialty chemicals. It is clear that diverse end-user needs continue to sustain market expansion.

- For Instance,Shell’s NEOFLO drilling fluid systems utilize a range of olefins, including internal olefins with carbon chain lengths of C13 to C14 (such as NEOFLO 3121) and C15 to C18 (such as NEOFLO 1-58).

By Application:

Application segmentation covers lubricants, surfactants, oilfield chemicals, and others. Lubricants represent the largest share, supported by increasing use in synthetic and high-performance fluids. Surfactants hold significant importance in household and industrial cleaning solutions. Oilfield chemicals continue to expand alongside global exploration activities. Other applications, including specialty formulations, are gaining traction in niche markets. It is evident that broad application diversity enhances the resilience of the internal olefins market across industries.

Segmentations:

By Technology

- Catalytic Processes

- Thermal Processes

By End-User

- Oil and Gas

- Automotive

- Household Care

- Industrial

By Application

- Lubricants

- Surfactants

- Oilfield Chemicals

- Others

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America and Europe:

North America holds a market share of 36% in the internal olefins market, driven by extensive oilfield applications and strong chemical industry capabilities. Europe accounts for 28% of the market, supported by strict environmental regulations and high demand for sustainable chemical alternatives. The United States leads in consumption due to robust oil and gas exploration and advanced specialty chemical manufacturing. In Europe, countries such as Germany, France, and the UK contribute significantly through adoption in detergents, lubricants, and industrial cleaning agents. Regulatory frameworks encouraging eco-friendly solutions further support growth in both regions. The strong presence of leading global manufacturers reinforces regional competitiveness and long-term demand stability.

Asia-Pacific:

Asia-Pacific represents 24% of the internal olefins market, making it the fastest-growing regional segment during the forecast period. China and India dominate demand, supported by expanding automotive, construction, and industrial sectors. Rising infrastructure investments and increasing adoption of specialty surfactants strengthen regional consumption. Japan and South Korea contribute through advancements in synthetic lubricants and high-performance chemical applications. Government initiatives promoting industrial expansion and sustainability further accelerate adoption. It is expected that the region will continue to expand rapidly, benefiting from large-scale industrialization and rising consumer demand for performance-driven products.

Latin America and Middle East & Africa:

Latin America holds a market share of 7%, while the Middle East & Africa account for 5% in the internal olefins market. Brazil and Mexico drive Latin American demand through their industrial sectors and rising adoption of oilfield chemicals. In the Middle East, Saudi Arabia and the UAE lead with expanding petrochemical industries and energy sector investments. Africa shows increasing opportunities through industrial growth and infrastructure development, particularly in South Africa. Rising demand for detergents, lubricants, and drilling fluids is supporting adoption across both regions. These markets present long-term potential as industrial activities and energy sector developments expand further.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Royal Dutch Shell

- INEOS Oligomers

- Elevance Renewable Sciences

- Sasol

- Chevron Phillips Chemical Company

- Schlumberger

- Halliburton

- Idemitsu Kosan

- Shrieve Chemical Company

- SABIC

- Infineum International

Competitive Analysis:

The internal olefins market is highly competitive with global players focusing on technology, efficiency, and sustainability. Key companies include Royal Dutch Shell, INEOS Oligomers, Elevance Renewable Sciences, Sasol, Chevron Phillips Chemical Company, Schlumberger, Halliburton, and Idemitsu Kosan. It is driven by strategic investments in production capacity, advanced catalytic processes, and expansion into high-growth regions. Companies strengthen their positions by developing eco-friendly solutions that align with regulatory requirements and customer demand. Partnerships with oilfield service providers and chemical manufacturers support market penetration, particularly in drilling fluids and specialty chemicals. Competitive pressure is also evident in the shift toward bio-based feedstocks, where leading firms invest in research to reduce reliance on petroleum sources. Strong regional presence, product innovation, and long-term contracts with end-users remain central strategies for sustaining growth and capturing market share.

Recent Developments:

- In September 2025, Shell signed a 10-year gas supply deal with Hungary’s MVM CEEnergy to provide 200 million cubic meters of natural gas annually, starting in January 2026.

- In May 2025, INEOS, together with Royal Wagenborg, launched the first European-built offshore CO2 carrier as part of their climate initiative.

Report Coverage:

The research report offers an in-depth analysis based on Technology,End-User, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Growing demand for biodegradable lubricants and surfactants will drive wider adoption across industries.

- Expansion in oilfield exploration and production will sustain the use of internal olefins in drilling fluids.

- Innovation in catalytic processes will improve efficiency, reduce emissions, and support cost-effective production.

- Rising adoption of synthetic lubricants in automotive and aerospace sectors will enhance market penetration.

- Asia-Pacific will emerge as a major growth hub, supported by industrialization and infrastructure development.

- Regulatory emphasis on eco-friendly chemicals will encourage broader usage in Europe and North America.

- Development of bio-based feedstocks will reduce dependency on petroleum sources and support sustainability.

- Growing investment in specialty chemical formulations will open opportunities for niche applications.

- Technological integration will enhance performance features, expanding product use in detergents and industrial cleaners.

- Global manufacturers will strengthen their regional presence through partnerships and capacity expansions to meet rising demand.