Market Overview

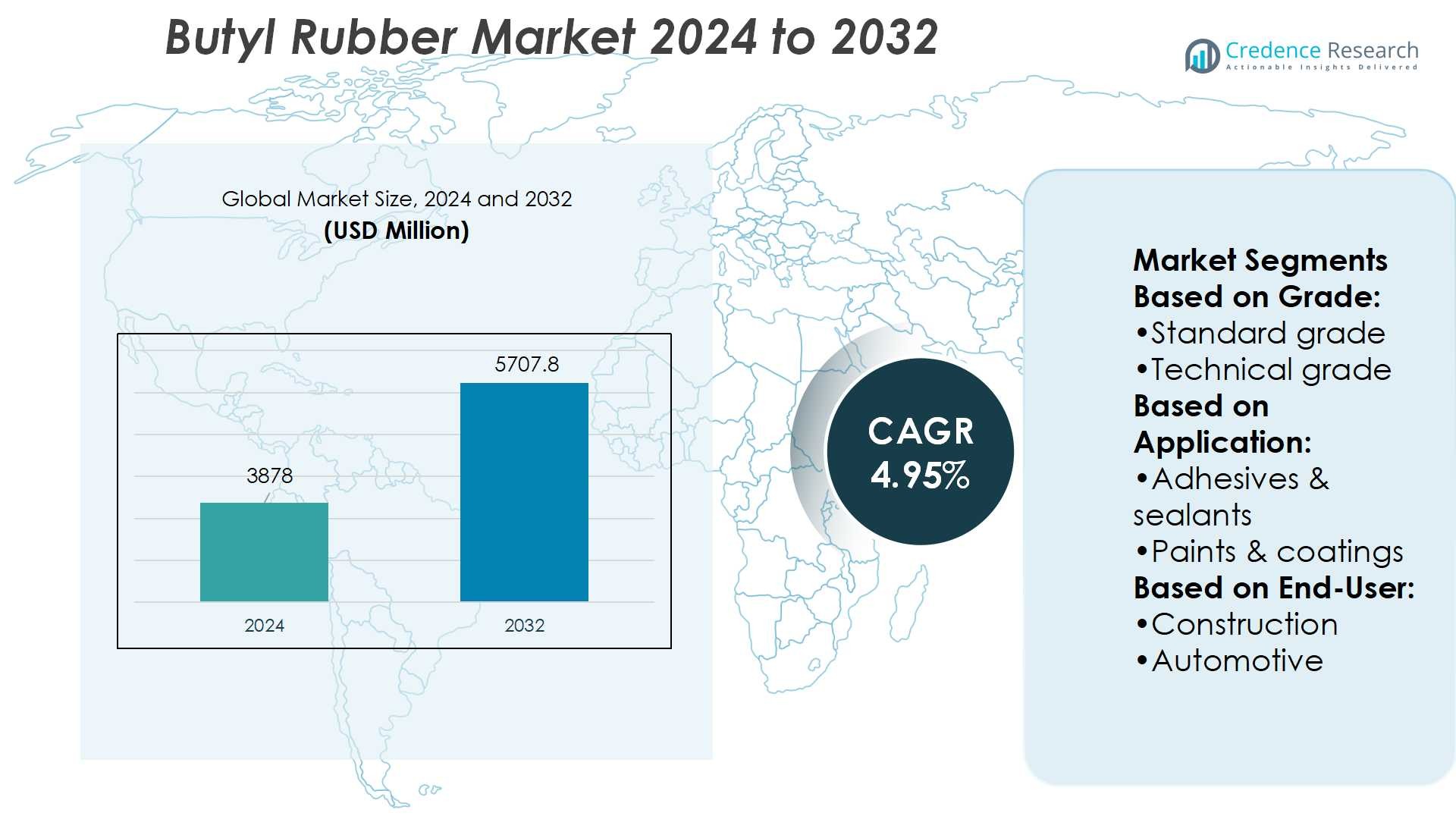

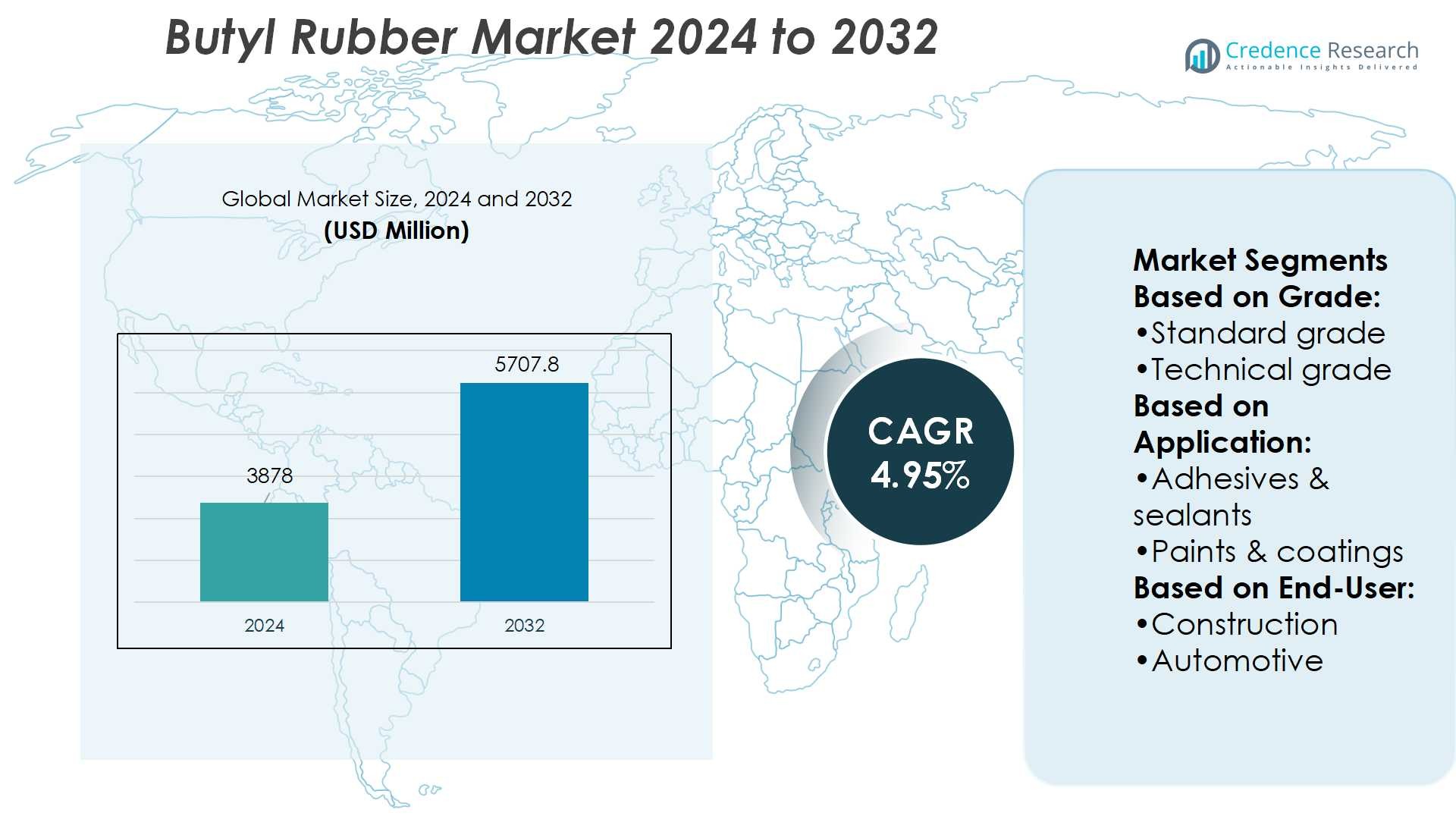

Butyl Rubber Market size was valued at USD 3878 million in 2024 and is anticipated to reach USD 5707.8 million by 2032, at a CAGR of 4.95% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Butyl Rubber Market Size 2024 |

USD 3878 Million |

| Butyl Rubber Market, CAGR |

4.95% |

| Butyl Rubber Market Size 2032 |

USD 5707.8 Million |

The Butyl Rubber Market is driven by rising demand in automotive, healthcare, and construction industries, supported by its superior air retention, chemical resistance, and durability. Expanding use in tire manufacturing, pharmaceutical packaging, and waterproofing solutions strengthens its position across diverse applications. Trends highlight the growing adoption of halogenated butyl grades for advanced performance, along with sustainable formulations aligning with global environmental standards. Increasing electric vehicle production, stricter fuel efficiency regulations, and healthcare innovation accelerate market expansion. Continuous research, recycling initiatives, and integration into eco-friendly solutions ensure that it adapts to evolving industry needs while sustaining long-term growth opportunities.

The Butyl Rubber Market shows strong geographical presence, with Asia Pacific holding the largest share, followed by North America and Europe, while Latin America and the Middle East & Africa record steady growth. Regional demand is shaped by automotive, healthcare, and construction industries. Key players influencing the market include Exxon Mobil Corporation, LANXESS, SIBUR Holding, Reliance Industries Limited, JSR Corporation, Kiran Rubber Industries, SABIC, Veolia, ARLANXEO, and The Goodyear Tire & Rubber Company, each driving innovation and competitive strategies globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Butyl Rubber Market was valued at USD 3878 million in 2024 and is projected to reach USD 5707.8 million by 2032, at a CAGR of 4.95%.

- Rising demand from automotive, healthcare, and construction industries drives strong adoption of butyl rubber.

- Expanding use in tire manufacturing, pharmaceutical packaging, and waterproofing solutions strengthens its market position.

- Growing adoption of halogenated butyl grades and sustainable formulations marks key market trends.

- Competition remains high with global players focusing on innovation, capacity expansion, and sustainable strategies.

- Volatility in raw material prices and regulatory pressures act as restraints for manufacturers.

- Asia Pacific leads the market share, followed by North America and Europe, while Latin America and the Middle East & Africa show steady growth across industrial and healthcare applications.

Market Drivers

Rising Demand from the Automotive Industry

The Butyl Rubber Market experiences strong growth due to its wide use in automotive applications. It plays a critical role in tire inner liners, sidewalls, and tubes because of excellent air retention and durability. Automakers prefer it to improve tire performance and extend lifespan under harsh road conditions. The demand for fuel-efficient and high-performance tires further strengthens its adoption. Rising vehicle production across emerging economies drives consumption at a rapid pace. It remains a vital material for manufacturers seeking durability and safety in tire design.

- For instance, the Dhirubhai Ambani Green Energy Giga Complex is home to a solar photovoltaic (PV) module factory with 10 GW annual capacity, expected to scale up in coming years.

Expanding Applications in Pharmaceutical and Healthcare Sectors

The Butyl Rubber Market gains traction from its significant role in pharmaceutical packaging and medical devices. It provides superior resistance to gases and moisture, making it ideal for stoppers, seals, and closures. Pharmaceutical companies rely on it to maintain drug stability and extend shelf life. Growing healthcare spending across developed and developing nations supports higher adoption levels. Demand for sterile and contamination-free packaging further accelerates growth. It positions itself as an essential solution for critical healthcare applications worldwide.

- For instance, Goodyear developed a demonstration tire composed of 70% sustainable material content, using bio-based carbon black alternatives, rice husk silica, and recycled polyester.

Increased Use in Construction and Industrial Applications

The Butyl Rubber Market also benefits from expanding construction and industrial usage. It serves as a key material for sealants, adhesives, and waterproofing membranes due to its chemical resistance and elasticity. Rapid urbanization and infrastructure growth in Asia Pacific and the Middle East create consistent demand. Industrial users adopt it for protective clothing, conveyor belts, and sealing materials. Its ability to withstand extreme weather and chemical exposure strengthens its role in diverse applications. It ensures long-term reliability for industrial and construction needs.

Rising Focus on Sustainable and Advanced Materials

The Butyl Rubber Market witnesses growth driven by innovation in sustainable and high-performance materials. Manufacturers invest in advanced formulations to meet environmental regulations and enhance recyclability. Focus on energy-efficient production and eco-friendly compounds aligns with global sustainability goals. It supports industries aiming to reduce carbon footprints and improve operational efficiency. Demand for next-generation materials in automotive, healthcare, and construction creates new opportunities. It reinforces its relevance by adapting to evolving performance and sustainability standards.

Market Trends

Growing Preference for Halogenated Butyl Rubber in Advanced Applications

The Butyl Rubber Market shows a clear trend toward halogenated grades, including chlorobutyl and bromobutyl. These variants deliver better chemical resistance, heat stability, and adhesion properties. Tire manufacturers increasingly adopt them to meet stricter performance and safety requirements. Pharmaceutical companies also favor halogenated types for closures and stoppers due to superior sealing. Demand growth is evident in automotive and healthcare sectors where performance is critical. It strengthens its position as a material of choice for advanced engineering needs.

- For instance, on an operated-basis the company reduced its greenhouse gas emissions intensity (Scope 1 + Scope 2) from 31.7 metric tons CO₂e per 100 metric tons of production in upstream operations in 2016, down to 20.4.

Rising Integration of Butyl Rubber in Green and Sustainable Solutions

The Butyl Rubber Market aligns with sustainability efforts through eco-friendly innovations. Producers are investing in recyclable formulations and energy-efficient production processes. Automotive firms prefer it in low-resistance tires to reduce emissions and improve fuel economy. Construction industries adopt butyl-based sealants that meet environmental compliance standards. Demand is growing for sustainable packaging and medical solutions built on butyl formulations. It adapts to global sustainability frameworks while supporting new product developments.

- For instance, SABIC’s TRUCIRCLE™ programme is set to process one million metric tons of circular materials annually by 2030, enabling materials that can be reused or recycled in multiple product lifecycles. The Cartagena polycarbonate plant will run on 100% renewable power cutting CO₂ emissions by about 70,000 metric tons per year.

Increasing Adoption in High-Performance Tire Manufacturing

The Butyl Rubber Market benefits from rising use in premium and high-performance tires. It improves air retention and extends tire life under extreme driving conditions. OEMs integrate it in tubeless tires and radial constructions to enhance reliability. Growth in electric vehicles also increases demand for advanced tire materials. Emerging economies report strong vehicle production, further driving market expansion. It plays a decisive role in supporting innovation in modern automotive manufacturing.

Expanding Role in Medical and Pharmaceutical Packaging

The Butyl Rubber Market records a growing trend in healthcare packaging solutions. Rising demand for sterile, airtight, and contamination-resistant materials drives its adoption in vial closures and stoppers. Pharmaceutical producers rely on its barrier properties to ensure drug stability. Increased global vaccination programs expand usage across critical applications. Growing investments in biotechnology and advanced drug delivery systems further support its role. It remains essential for ensuring safety and performance in pharmaceutical packaging.

Market Challenges Analysis

Volatility in Raw Material Prices and Supply Chain Constraints

The Butyl Rubber Market faces challenges from fluctuating prices of raw materials, especially isobutylene and isoprene. Dependence on petrochemical feedstocks exposes manufacturers to oil price volatility and supply disruptions. High input costs directly affect production margins and limit competitive pricing flexibility. Global supply chain disruptions intensify risks, creating shortages and delays in delivery. Industries such as automotive and pharmaceuticals face difficulties in securing consistent supply. It pressures producers to seek alternative sourcing strategies and explore cost-efficient production methods.

Environmental Regulations and Competition from Substitute Materials

The Butyl Rubber Market encounters pressure from strict environmental regulations on petrochemical-derived products. Manufacturers must comply with emission standards and waste management norms, which increase operational costs. Growing awareness of sustainable alternatives introduces competition from synthetic and bio-based elastomers. Industries experiment with silicone, thermoplastic elastomers, and natural rubber blends for certain applications. Rising focus on eco-friendly materials poses long-term substitution risks. It compels producers to innovate sustainable formulations and maintain relevance in evolving market conditions.

Market Opportunities

Expanding Demand in Healthcare and Pharmaceutical Packaging Applications

The Butyl Rubber Market presents strong opportunities in healthcare and pharmaceutical packaging. Its superior barrier properties make it ideal for stoppers, vial closures, and seals that protect drug stability. Rising global demand for vaccines and injectable drugs increases the need for high-quality butyl components. Biopharmaceutical advancements create new applications requiring contamination-free and airtight packaging. Growth in emerging markets with expanding healthcare infrastructure supports further adoption. It positions itself as a vital material in critical medical and pharmaceutical supply chains.

Growth Potential in Sustainable Tire and Construction Solutions

The Butyl Rubber Market gains opportunities from rising demand for sustainable tires and eco-friendly construction materials. Automotive manufacturers seek it for low rolling resistance tires that improve fuel efficiency and align with emission targets. Expanding electric vehicle adoption further strengthens demand for durable and high-performance tire materials. In the construction sector, butyl-based adhesives, sealants, and waterproofing solutions see increased use in energy-efficient infrastructure projects. Growing emphasis on green building standards drives adoption across global construction markets. It enables manufacturers to address both performance requirements and sustainability goals effectively.

Market Segmentation Analysis:

By Grade

The Butyl Rubber Market by grade is divided into standard grade, technical grade, chemical grade, and pharmaceutical grade. Standard grade holds wide use across general applications such as adhesives and coatings due to balanced performance and cost efficiency. Technical grade finds demand in specialized applications requiring high durability and resistance to chemicals. Chemical grade is essential for industrial uses, offering strong resistance against solvents and gases. Pharmaceutical grade records strong adoption for stoppers, seals, and medical packaging materials. It delivers superior purity and barrier properties, making it critical for healthcare applications.

- For instance, SIBUR’s standard grade butyl rubber has balanced performance and cost efficiency; for instance, the IMPRAMER R 1675 grade shows a Mooney viscosity ML1+8 at 125 °C value of 46-56 units, with unsaturation (isoprene content) between 1.4 and 1.8 mole %.

By Application

By application, the Butyl Rubber Market covers adhesives and sealants, paints and coatings, textiles, plastics, paper and paperboard, personal care products, and others. Adhesives and sealants represent a major share due to extensive use in construction and automotive. Paints and coatings benefit from its resistance to weathering and chemical exposure. The textile sector integrates butyl formulations for protective clothing and industrial fabrics. Plastics and paper applications use it for flexibility and improved barrier performance. Personal care products utilize it for its safe and stable characteristics, supporting cosmetics and hygiene formulations. It maintains relevance across a broad spectrum of end-use applications.

- For instance, the X_Butyl® CB 1240 (chlorobutyl rubber) grade has an ash content ≤ 0.5 wt % and volatile content ≤ 0.5 wt %, making it suitable for coatings with low impurity requirements.

By End User

In terms of end user, the Butyl Rubber Market is segmented into construction, automotive, packaging, and textile industries. Construction leads adoption for waterproofing membranes, sealants, and adhesives that ensure long-term structural reliability. Automotive records strong demand due to extensive use in tires, tubes, and inner liners. Packaging adopts it for pharmaceutical and food-grade closures that preserve product safety. Textile industries integrate it into industrial fabrics and protective gear. It remains a core material supporting durability, safety, and efficiency across these key end-use sectors.

Segments:

Based on Grade:

- Standard grade

- Technical grade

Based on Application:

- Adhesives & sealants

- Paints & coatings

Based on End-User:

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds a market share of 23% in the Butyl Rubber Market and demonstrates stable demand across multiple industries. The region benefits from well-established automotive manufacturing hubs in the United States and Canada, which continue to drive strong consumption of butyl rubber in tire production. Stringent fuel efficiency and safety regulations further support demand for high-performance tire components made from butyl rubber. The pharmaceutical industry in North America also adopts pharmaceutical-grade butyl rubber for drug closures, stoppers, and sterile packaging, expanding its application base. Construction projects in residential and commercial segments rely on butyl-based adhesives and sealants to enhance structural performance and durability. Leading producers in the region continue investing in advanced formulations to comply with environmental standards and extend product life cycles. It remains a key region where technological innovation and regulatory frameworks influence the growth trajectory.

Europe

Europe accounts for a market share of 21% in the Butyl Rubber Market, driven by its strong automotive and healthcare industries. Germany, France, and the United Kingdom serve as central hubs for premium and performance-oriented automotive production, creating significant demand for halogenated butyl rubber in tire manufacturing. The healthcare industry, particularly in Western Europe, uses pharmaceutical-grade butyl rubber for packaging and sterile applications, supported by strict regulations on quality and safety. The construction industry also utilizes butyl rubber for waterproofing membranes and adhesives, particularly in sustainable building projects. Rising emphasis on green technologies and carbon reduction targets drives further research into eco-friendly butyl rubber formulations. European chemical producers collaborate with automotive and healthcare players to optimize formulations for regulatory compliance and high performance. It sustains consistent demand by combining advanced industrial capacity with strict environmental standards.

Asia Pacific

Asia Pacific dominates the Butyl Rubber Market with the largest share of 38%, supported by rapid industrialization, urbanization, and strong automotive production. China, India, Japan, and South Korea act as key contributors, accounting for high consumption across tire manufacturing, pharmaceuticals, and construction applications. Expanding vehicle ownership in China and India continues to boost demand for tires incorporating butyl rubber inner liners. Healthcare advancements in Japan and India strengthen the need for pharmaceutical packaging, creating a steady market for pharmaceutical-grade butyl rubber. Construction activities across emerging cities in Asia Pacific adopt butyl rubber in adhesives and sealants for reliable performance under varying climatic conditions. The region also leads in research and development for cost-efficient production methods, increasing competitiveness at the global level. It emerges as the fastest-growing regional market with vast opportunities across multiple end-use industries.

Latin America

Latin America secures a market share of 10% in the Butyl Rubber Market, led by Brazil and Mexico as primary contributors. Growing automotive assembly operations in Brazil generate significant demand for tires, directly fueling butyl rubber consumption. Pharmaceutical packaging demand expands in Mexico, where drug production and exports continue to rise. Construction activities in Latin American cities also adopt butyl-based waterproofing and sealing materials for infrastructure projects. Economic diversification and government focus on industrial growth further support wider applications in manufacturing and packaging. Regional producers seek to strengthen supply chains and reduce dependence on imports by investing in local capacity. It represents an emerging market with untapped growth potential supported by industrial expansion.

Middle East and Africa

The Middle East and Africa collectively account for a market share of 8% in the Butyl Rubber Market, showing steady progress in industrial and infrastructure applications. Gulf countries such as Saudi Arabia and the UAE invest heavily in construction, driving demand for adhesives, sealants, and waterproofing membranes. South Africa and other parts of Africa witness growing automotive sector activity, expanding the need for butyl rubber in tire production. Pharmaceutical and healthcare packaging markets in the Middle East also adopt pharmaceutical-grade butyl rubber to meet rising demand for sterile medical supplies. Regional producers benefit from proximity to petrochemical feedstocks, which ensures steady availability of raw materials. Governments prioritize infrastructure modernization, creating strong demand in building materials and industrial uses. It continues to expand with rising investments in automotive, healthcare, and construction sectors across both developed and developing economies within the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Veolia

- Reliance Industries Limited

- The Goodyear Tire & Rubber Company

- Kiran Rubber Industries

- Exxon Mobil Corporation

- SABIC

- JSR Corporation

- SIBUR Holding

- ARLANXEO

- LANXESS

Competitive Analysis

The Butyl Rubber Market players including Exxon Mobil Corporation, LANXESS, SIBUR Holding, Reliance Industries Limited, JSR Corporation, Kiran Rubber Industries, SABIC, Veolia, ARLANXEO, and The Goodyear Tire & Rubber Company. The Butyl Rubber Market is highly competitive, driven by innovation, cost optimization, and sustainability initiatives. Companies focus on expanding production capacities and strengthening supply chains to meet rising demand from automotive, construction, and healthcare industries. Advancements in halogenated butyl rubber support adoption in high-performance tires and pharmaceutical packaging, reinforcing market growth. Sustainability plays a central role, with producers investing in eco-friendly manufacturing processes and recyclable formulations to align with global regulations. Strategic collaborations, research partnerships, and regional expansion remain key approaches to enhance market presence. The competitive landscape continues to evolve as manufacturers balance performance, compliance, and innovation to maintain leadership.

Recent Developments

- In March 2025, METEX NØØVISTA, a subsidiary of METABOLIC EXPLORER, and ALINOVA announced an agreement for the marketing of the first 100% bio-based butyric acid for animal nutrition in France.

- In July 2024, ARLANXEO announced that its Butyl plant in Singapore, EPDM plant in Geleen (The Netherlands), and EVM facility in Dormagen (Germany) had received ISCC PLUS certifications. This development is expected to help the company boost the production of sustainable synthetic rubber solutions under its ‘Eco’ label, with ARLANXEO currently producing Eco grades for X_Butyl, Keltan, Levamelt, and standard Levapren.

- In 2024 Formosa Synthetic Rubber Corporation, operated a plant in Ningbo, China, with an annual production capacity of 100,000 metric tons of butyl rubber. This facility primarily produces regular butyl rubber, which is widely used in tire manufacturing, medical closures, and sealants.

- In December 2023, SIBUR’s Nizhnekamskneftekhim announced that it had completed the upgradation of its halobutyl rubber (HBR) capacities, increasing them from 150 kilotons to 200 kilotons. This project saw the installation of six new production units and revamping 16 units.

Report Coverage

The research report offers an in-depth analysis based on Grade, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Butyl Rubber Market will expand with rising demand for high-performance automotive tires.

- Pharmaceutical packaging will remain a strong growth driver due to its superior barrier properties.

- Sustainable and eco-friendly butyl rubber formulations will gain wider adoption across industries.

- Electric vehicle production will create new opportunities for advanced tire applications.

- Construction projects will increase demand for adhesives, sealants, and waterproofing solutions.

- Research in halogenated butyl grades will strengthen their role in specialized applications.

- Emerging economies will witness strong consumption growth supported by industrial expansion.

- Strategic alliances and joint ventures will shape global market competition.

- Recycling initiatives and circular economy models will influence production practices.

- Continuous technological advancements will support diversified applications across end-use sectors.