Market Overview

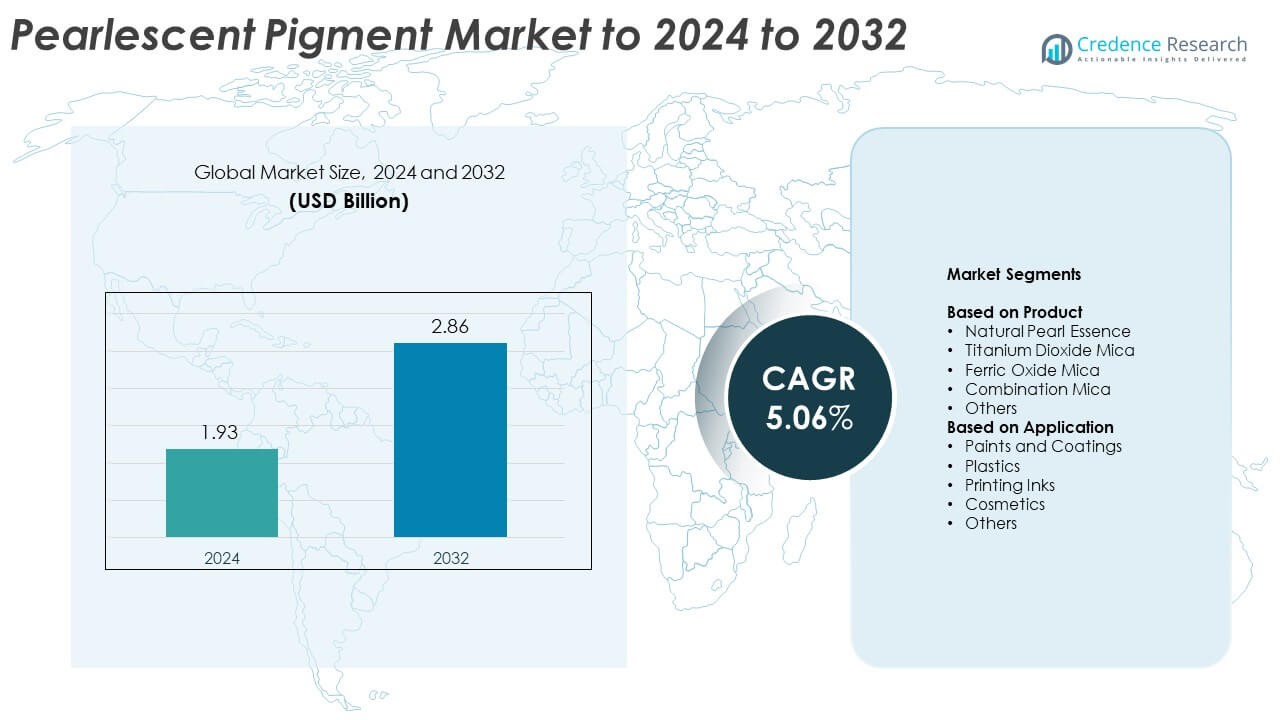

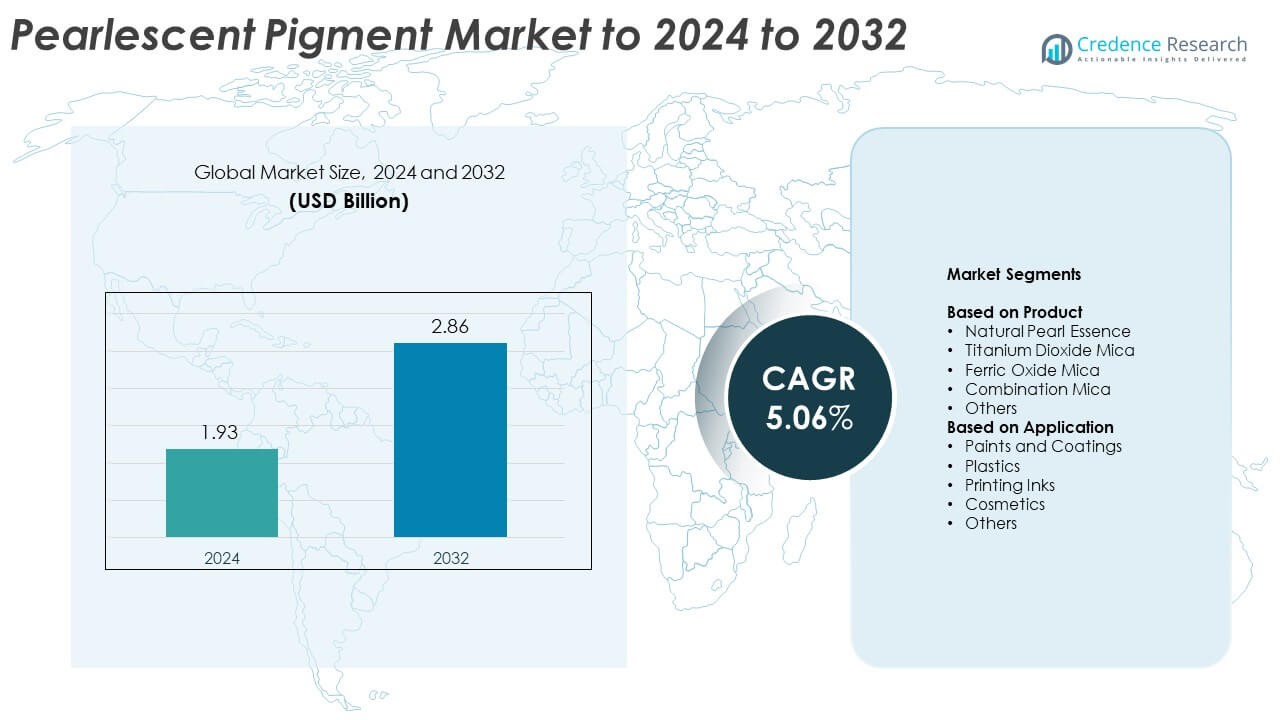

Pearlescent Pigment Market size was valued at USD 1.93 billion in 2024 and is anticipated to reach USD 2.86 billion by 2032, at a CAGR of 5.06% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pearlescent Pigment Market Size 2024 |

USD 1.93 Billion |

| Pearlescent Pigment Market, CAGR |

5.06% |

| Pearlescent Pigment Market Size 2032 |

USD 2.86 Billion |

The pearlescent pigment market is led by prominent players such as Merck KGaA, BASF SE, ECKART, Sudarshan Chemical Industries Limited, Altana AG, Kuncai Chemical, Brenntag SE, and Geotech International B.V. These companies dominate through technological innovation, product diversification, and a strong focus on sustainable and high-performance pigment formulations. Their strategic initiatives include expanding production capacities, enhancing distribution networks, and developing eco-friendly mica-based pigments to meet evolving global standards. Asia Pacific led the market in 2024 with a 33.4% share, supported by rapid industrialization, robust automotive production, and a growing cosmetics sector across China, India, Japan, and South Korea.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Pearlescent Pigment Market was valued at USD 1.93 billion in 2024 and is projected to reach USD 2.86 billion by 2032, growing at a CAGR of 5.06%.

- Growth is driven by rising demand in automotive coatings, cosmetics, and packaging applications, supported by advancements in surface treatment and color brilliance.

- Trends include the shift toward eco-friendly, mica-based pigments and the adoption of nanotechnology to improve durability, dispersion, and optical performance.

- The market is highly competitive, with key players focusing on R&D, sustainable innovation, and strategic collaborations to strengthen their global presence.

- Asia Pacific held 33.4% of the market share in 2024, followed by North America with 33.3%, while the titanium dioxide mica segment dominated with 46.5% share due to its superior optical and UV-resistant properties.

Market Segmentation Analysis:

By Product

The titanium dioxide mica segment dominated the pearlescent pigment market in 2024 with a 46.5% share. This dominance stems from its strong optical properties, high brightness, and stability across coatings, plastics, and cosmetic applications. Titanium dioxide-coated mica provides superior pearlescent effects with excellent UV and weather resistance, making it a preferred choice for automotive and decorative finishes. Natural pearl essence and ferric oxide mica segments also exhibit steady growth due to rising adoption in luxury packaging and color cosmetics, supported by increasing demand for premium visual appeal and environmentally safe alternatives.

- For instance, Sudarshan’s Sumica Bright Silver 41132WR lists a 10–40 µm particle range and heat stability below 250 °C.

By Application

The paints and coatings segment led the market in 2024 with a 39.8% share. Its leadership is attributed to growing use in automotive coatings, architectural finishes, and industrial paints to enhance surface gloss and aesthetic quality. Pearlescent pigments offer color-shifting effects and durability, making them popular in metallic automotive paints and decorative surfaces. The plastics segment follows, driven by expanding applications in consumer goods, packaging, and household products. Rising usage in printing inks and cosmetics further contributes to overall market expansion, reflecting a trend toward visually enhanced and durable products.

- For instance, BASF’s 2024 automotive report shows Japan’s white at 37% and EMEA achromatics near 80% share.

Key Growth Drivers

Rising Demand in Automotive and Industrial Coatings

The growing automotive sector is a major driver for the pearlescent pigment market. Manufacturers use these pigments in vehicle coatings to enhance surface gloss, depth, and color-shifting effects. Increasing consumer preference for premium finishes in passenger cars and commercial vehicles boosts demand. Industrial coatings also adopt pearlescent pigments to improve visual appeal and surface protection. Expanding infrastructure and refurbishment projects globally further support the adoption of high-performance coatings incorporating pearlescent pigments.

- For instance, Merck’s Iriodin testing uses 1% pigment in PMMA under xenon-arc weathering protocols.

Expanding Applications in Cosmetics and Personal Care

The cosmetics industry is witnessing strong adoption of pearlescent pigments due to their ability to deliver shimmer and luminous effects. These pigments are widely used in eye shadows, nail polishes, lipsticks, and skin care products to enhance visual texture and appeal. Rising consumer interest in beauty enhancement products and clean-label formulations encourages manufacturers to develop mica-based and biodegradable variants. The trend toward luxury and eco-conscious cosmetics continues to drive steady growth for pearlescent pigment suppliers globally.

- For instance, ECKART’s Prestige Ruby TDS reports 10–50 µm particle size and 43–56% TiO₂ content.

Technological Advancements in Pigment Formulations

Advancements in coating technologies and nanostructured pigment engineering are expanding the functional range of pearlescent pigments. New formulations offer improved dispersion, color intensity, and temperature resistance, catering to automotive, plastics, and printing applications. Enhanced synthesis methods allow precise control over layer thickness and refractive properties, enabling tailored effects from subtle sheen to high-gloss metallic finishes. These innovations help manufacturers meet evolving design demands and environmental regulations while maintaining high durability and optical performance.

Key Trends & Opportunities

Shift Toward Eco-Friendly and Sustainable Pigments

Manufacturers are increasingly focusing on sustainable production methods and eco-friendly raw materials. Mica-based and natural pearlescent pigments derived from renewable resources are gaining traction as alternatives to synthetic variants. Regulatory pressures on heavy metal-based pigments further accelerate this transition. Growing awareness of environmental impact and consumer preference for non-toxic, biodegradable materials presents opportunities for innovation in green pigment formulations. This trend aligns with global sustainability goals and enhances brand value among environmentally conscious consumers.

- For instance, Kuncai’s TiO₂-free pearlescents list 5–25 µm and 10–60 µm particle bands with pH 7.0–11.0.

Growing Demand for Functional and Aesthetic Customization

Industries are increasingly demanding pigments that offer both functional and aesthetic advantages. Pearlescent pigments now integrate UV stability, chemical resistance, and compatibility with multiple substrates while delivering unique optical effects. This customization trend benefits packaging, cosmetics, and high-end coatings, where visual differentiation drives product appeal. Advancements in pigment layering and dispersion technology enable the creation of dynamic, light-responsive finishes that support premium branding and innovative design possibilities across sectors.

- For instance, CQV’s Adamas grades specify 5–30 µm and 9–45 µm particle ranges for controlled effects.

Key Challenges

High Production Costs and Complex Manufacturing Process

The production of pearlescent pigments involves intricate coating, calcination, and layering processes that increase overall costs. Raw material sourcing, especially of high-purity mica, adds further expense. Manufacturers face challenges in balancing cost-efficiency with quality and performance standards. Smaller producers struggle to compete with large-scale manufacturers that benefit from economies of scale. These cost challenges can limit market penetration, particularly in price-sensitive applications such as low-end plastics and decorative coatings.

Regulatory Restrictions and Environmental Concerns

Stringent regulations regarding mining and use of mica, titanium dioxide, and synthetic colorants affect supply chains and production practices. Ethical sourcing of mica is under scrutiny due to labor and environmental concerns. Compliance with REACH and EPA standards for pigments also increases operational complexity and costs. These regulatory pressures push companies toward sustainable sourcing and alternative materials but require significant investment in R&D and process modifications, challenging profitability in the short term.

Regional Analysis

North America

North America held approximately 33.3% of the global pearlescent pigment market in 2024, driven by strong demand from automotive coatings, cosmetics, and packaging sectors. The region’s focus on vehicle customization and high-quality finishes supports wider pigment adoption in luxury cars and industrial coatings. Growing awareness of sustainable and non-toxic pigment options aligns with environmental regulations, encouraging manufacturers to develop eco-friendly formulations. The United States remains the leading market, supported by technological innovation and the presence of major players investing in R&D for high-performance, weather-resistant, and visually appealing pigment solutions.

Asia Pacific

Asia Pacific accounted for around 33.4% of the market in 2024, making it the largest regional contributor. Rapid industrialization, urban development, and expanding automotive production in China, India, and South Korea are major growth factors. Rising disposable incomes and changing consumer lifestyles are increasing the demand for luxury cosmetics, premium packaging, and decorative coatings using pearlescent pigments. Government support for domestic manufacturing and foreign investments in automotive and beauty industries enhance the market’s growth potential. The region’s continuous innovation in cost-effective pigment formulations also strengthens its leadership position globally.

Europe

Europe contributed about 13.5% of the global pearlescent pigment market in 2024, supported by advanced production technologies and strict environmental regulations. Countries such as Germany, France, and the United Kingdom are leading users of high-end automotive and cosmetic pigments. The region’s focus on circular economy principles and sustainable manufacturing practices drives the shift toward mica-based and biodegradable pigments. Growing demand for metallic and reflective finishes in architectural coatings further enhances market performance. European consumers’ preference for luxury and eco-certified cosmetic products also sustains steady demand for ethically sourced pearlescent pigments.

Latin America

Latin America represented over 5% of the global pearlescent pigment market in 2024, with notable growth from Brazil and Mexico. The region’s construction, automotive refinishing, and beauty sectors are expanding due to rising disposable incomes and urban development. Increased demand for decorative coatings and high-quality packaging products enhances pigment usage across industries. Local manufacturers are also investing in domestic production to reduce dependence on imports and strengthen regional supply chains. Economic recovery and evolving consumer trends toward premium and aesthetically appealing goods are expected to sustain steady market expansion through the forecast period.

Middle East & Africa

Middle East & Africa held roughly 2% of the pearlescent pigment market in 2024, showing gradual but steady progress. The region’s growth is supported by rising investments in infrastructure, architectural coatings, and luxury cosmetics in Gulf countries such as the UAE and Saudi Arabia. Expanding urban development and increasing consumer interest in premium finishes across construction and packaging applications are contributing to demand. Import-dependent supply chains and limited local manufacturing remain challenges, but growing government initiatives to promote industrial diversification are expected to create new opportunities for market penetration in the coming years.

Market Segmentations:

By Product

- Natural Pearl Essence

- Titanium Dioxide Mica

- Ferric Oxide Mica

- Combination Mica

- Others

By Application

- Paints and Coatings

- Plastics

- Printing Inks

- Cosmetics

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The pearlescent pigment market is characterized by strong competition among leading companies such as Merck KGaA, BASF SE, ECKART, Sudarshan Chemical Industries Limited, Altana AG, Kuncai Chemical, Brenntag SE, Geotech International B.V., Aal Chem, Pritty Pearlescent Pigments Co. Ltd., RIKA Technology Co. Ltd., Sinoparst Science and Technology Co. Ltd., Smarol Industry Co. Ltd., and L’Arca Srl. The market players compete through product innovation, advanced coating technologies, and expansion of global distribution networks. Many manufacturers are focusing on developing eco-friendly, non-toxic, and mica-based pigments to align with sustainability regulations and consumer preferences. Companies are investing in R&D to enhance pigment brilliance, durability, and compatibility with various substrates. Strategic partnerships, mergers, and capacity expansions are common approaches to strengthen supply chains and improve market reach. The rising demand from automotive, cosmetics, and packaging sectors continues to drive competition, with innovation in surface treatment and formulation efficiency remaining key differentiators.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Merck KGaA

- BASF SE

- ECKART

- Sudarshan Chemical Industries Limited

- Altana AG

- Kuncai Chemical

- Brenntag SE

- Geotech International B.V.

- Aal Chem

- Pritty Pearlescent Pigments Co. Ltd.

- RIKA Technology Co. Ltd.

- Sinoparst Science and Technology Co. Ltd.

- Smarol Industry Co. Ltd.

- L’Arca Srl

Recent Developments

- In 2024, BASF SE Introduced advanced effect pigments for automotive coatings, including new pearlescent shades that offer enhanced color flop and durability for modern vehicle designs.

- In 2024, ECKART launched SYNCRYSTAL Garnet, a carmine-free, red effect pigment for cosmetics that is made from synthetic fluorphlogopite. The pigment has a high chroma with a bluish undertone, is ideal for creating red and purple shades, and offers high pearlescence, brilliance, and a good skin feel

- In 2023, Kuncai Chemical launched the Kyntaline Purples product series, which is based on synthetic mica and offers intense, pure body colors and vibrant sparkle.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for pearlescent pigments will rise due to growing automotive and cosmetic applications.

- Manufacturers will focus on developing eco-friendly and mica-based pigment alternatives.

- Technological advancements will enhance color uniformity and light reflection properties.

- The cosmetics sector will continue adopting pearlescent pigments for premium visual effects.

- Asia Pacific will remain the leading market, driven by industrialization and urban growth.

- Increased use in packaging and printing inks will support steady market expansion.

- Sustainable mining practices will become a priority to meet global environmental standards.

- Integration of nanotechnology will improve pigment performance and surface brilliance.

- Rising demand for luxury goods will drive innovation in high-end effect pigments.

- Strategic collaborations among pigment producers will strengthen supply chains and market presence.