Market Overview:

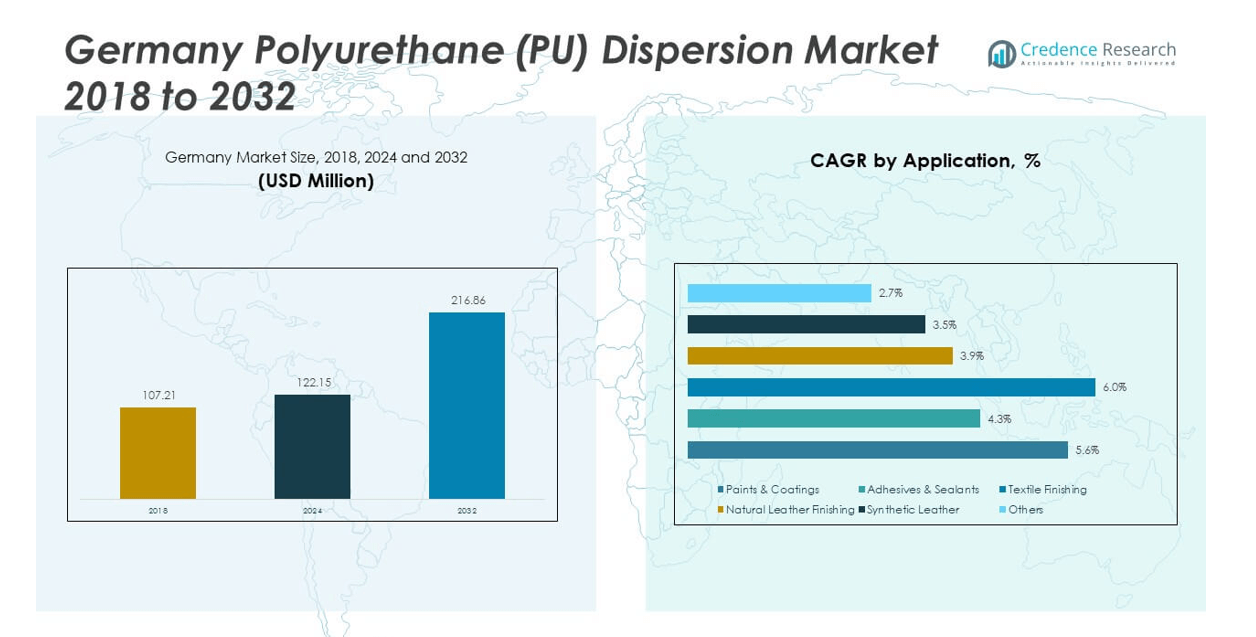

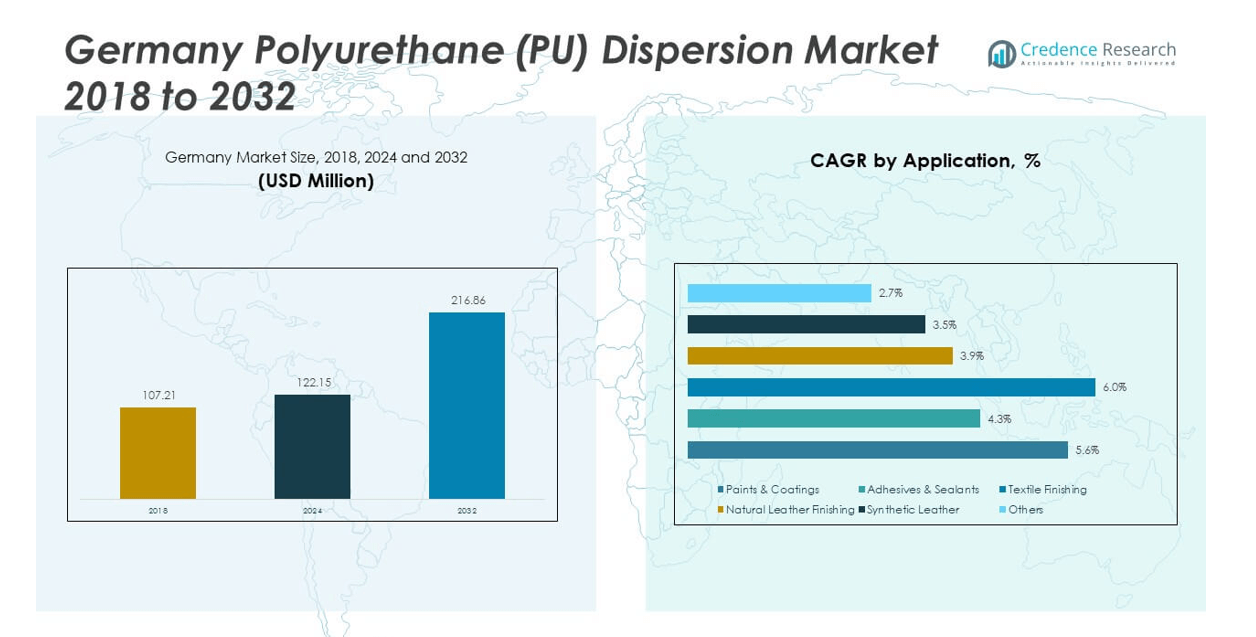

The Germany Polyurethane Dispersion Market size was valued at USD 107.21 million in 2018 to USD 122.15 million in 2024 and is anticipated to reach USD 216.86 million by 2032, at a CAGR of 7.44% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Polyurethane Dispersion Market Size 2024 |

USD 122.15 million |

| Germany Polyurethane Dispersion Market, CAGR |

7.44% |

| Germany Polyurethane Dispersion Market Size 2032 |

USD 216.86 million |

Growth in this market is driven by rising demand for eco-friendly and high-performance materials. Industries such as automotive, construction, textiles, and packaging adopt polyurethane dispersions for their superior properties including flexibility, abrasion resistance, and low emissions. Stringent EU environmental regulations push companies toward water-based solutions, replacing solvent-based alternatives. The trend toward sustainable manufacturing and consumer preference for green products further accelerates adoption. Continuous innovation in formulations with enhanced durability and chemical resistance strengthens their role across end-use industries. It positions dispersions as a preferred choice for both industrial and consumer applications.

Regionally, Western Germany leads the market due to its strong industrial infrastructure and concentration of automotive and chemical companies. Southern Germany also plays a vital role, supported by thriving textile and leather industries. Northern Germany demonstrates growing usage in marine, renewable energy, and construction applications, while Eastern Germany shows steady growth backed by government investments in industrial development. Each region contributes uniquely, with developed areas ensuring stability and emerging regions providing new growth avenues. This regional balance supports the sustained expansion of the Germany Polyurethane Dispersion Market across multiple applications and industries.

Market Insights:

- The Germany Polyurethane Dispersion Market size was valued at USD 107.21 million in 2018, reached USD 122.15 million in 2024, and is projected to attain USD 216.86 million by 2032, expanding at a CAGR of 7.44% during the forecast period.

- Western Germany led with 42% share in 2024, driven by its automotive and chemical industries, while Southern Germany held 31%, supported by textiles and leather, and Northern and Eastern Germany together accounted for 27%, benefiting from marine, construction, and SME-led activities.

- Northern Germany emerged as the fastest-growing region with 15% share in 2024, fueled by renewable energy, marine applications, and infrastructure investments that expand polyurethane dispersion adoption.

- By product type, water-based dispersions accounted for nearly 58% of the market in 2024, supported by strict EU regulations and demand for eco-friendly solutions.

- Solvent-based dispersions held around 42% share in 2024, maintaining importance in specialized applications requiring superior chemical resistance and durability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Environmental Regulations And Preference For Eco-Friendly Coatings:

The Germany Polyurethane Dispersion Market benefits from strict environmental rules that promote water-based solutions. Authorities restrict solvent-based coatings, pushing industries to adopt sustainable alternatives. It encourages companies to reformulate products that reduce emissions and improve workplace safety. The automotive sector adopts these dispersions for coating efficiency and durability. Textile and leather industries prefer them for flexibility and chemical resistance. It supports manufacturers aiming to align with sustainability targets. Strong government backing accelerates adoption in industrial and consumer applications. This alignment strengthens the overall market demand consistently.

- For instance, Bayer AG’s development of two-component waterborne polyurethane coatings cuts volatile organic compound (VOC) and hazardous air pollutant emissions by 50 to 90 percent, supporting regulatory compliance and sustainability targets in automotive and textile applications. BASF SE further supports environmental goals with its Phoenix platform offering waterborne systems that demonstrate excellent corrosion resistance and durability, as evidenced by their ASTM B-117 salt spray test showing no blistering and minimal rust after up to 1440 hours.

Growing Demand From Automotive And Packaging Industries:

Automotive manufacturers drive growth by using dispersions for coatings and adhesives. It ensures durability, abrasion resistance, and superior surface finish. Packaging companies adopt dispersions for protective and functional coatings. Food packaging benefits from safety and compliance with environmental norms. Lightweight and flexible packaging designs support wider use. German automotive hubs provide steady demand for high-performance materials. It helps suppliers expand their distribution networks and R&D activities. The sector’s strong export orientation adds more volume growth opportunities.

- For instance, Covestro AG completed a new production facility in 2024, advancing capabilities to supply high-performance waterborne polyurethane dispersions for automotive coatings with improved early and final hardness and chemical resistance features that meet industry demands.

Continuous Innovation In Formulation And Performance Enhancement:

Producers focus on developing advanced dispersions with superior qualities. These include fast drying, improved hardness, and excellent adhesion. It enables usage across diverse applications beyond coatings and adhesives. Demand from wood, textile, and construction segments increases innovation efforts. Formulations with better resistance to water and chemicals gain preference. Customized products support niche requirements across industries. R&D partnerships with academic institutions enhance performance breakthroughs. This innovation pipeline ensures long-term adoption across industrial sectors.

Adoption Across Textile And Leather Manufacturing Base In Germany:

The textile and leather industries adopt dispersions for flexible coatings. It delivers softness, abrasion resistance, and smooth finishing properties. Footwear and fashion brands integrate these materials into premium products. The leather export sector benefits from compliance with environmental regulations. Textile producers demand consistent quality for global buyers. It strengthens the role of dispersions in maintaining German manufacturing excellence. Eco-conscious consumers fuel demand for sustainable textiles. This driver ensures continuous adoption in domestic and international supply chains.

Market Trends:

Shifting Focus Toward Bio-Based And Renewable Raw Materials:

Manufacturers invest in bio-based dispersions to reduce fossil fuel reliance. The Germany Polyurethane Dispersion Market aligns with global sustainability goals. It supports companies in achieving green certifications and eco-labels. Consumer demand for renewable and safe products drives this trend. Bio-based feedstock improves brand reputation and attracts eco-conscious buyers. Suppliers explore agricultural and natural inputs for stable production. Collaboration with chemical innovators accelerates development cycles. This trend creates a premium product segment with strong growth potential.

- For instance, Bayer’s introduction of bio-based polyurethane dispersions with renewable content reaching up to 65 percent reduces CO2 emissions and enhances sustainability credentials in textiles and footwear production. Covestro also advances circular PUDs incorporating biobased or biocircular raw materials supported by ISCC PLUS certification, ensuring a steady supply of sustainable alternatives.

Rising Integration Of Polyurethane Dispersions In 3D Printing And Coatings:

The market explores advanced applications like 3D printing materials. It strengthens opportunities in additive manufacturing technologies. Coatings for electronics and flexible devices use dispersions for performance. This integration supports miniaturization and functional surface finishing. German industries adopt these solutions in electronics and medical sectors. Printing inks with dispersions enhance durability and eco-friendliness. It provides compatibility with digital printing platforms. The trend diversifies the application scope beyond traditional sectors.

- For instance, Alberdingk Boley GmbH offers polyurethane dispersions with high abrasion resistance (pendulum hardness of 105 s and elongation at break of 300%), improving durability in printing inks and coatings used in digital printing platforms. This technological advancement supports miniaturization and enhanced performance requirements beyond conventional uses.

Increased Focus On Circular Economy And Recycling Practices:

Producers invest in closed-loop systems to reduce waste. It aligns with EU policies promoting circular economy adoption. Dispersions support recyclable packaging and coatings solutions. The trend helps industries reduce disposal costs and improve sustainability reporting. Advanced recycling technologies enhance material recovery efficiency. German manufacturers lead innovation in industrial waste management. It encourages clients to prefer dispersions that support recyclability. This shift reinforces long-term demand from packaging and consumer goods sectors.

Collaboration And Strategic Partnerships Among Industry Players:

Companies form partnerships to expand capacity and market presence. It ensures reliable supply chains for high-demand sectors. Collaborations with research institutions accelerate product innovation. Joint ventures in Germany strengthen regional competitiveness. Global players partner with local firms to meet compliance standards. It expands distribution networks for polyurethane dispersions. Technology sharing creates advanced product lines with wider acceptance. This trend shapes a dynamic and competitive market landscape.

Market Challenges Analysis:

High Production Costs And Dependency On Raw Material Prices:

The Germany Polyurethane Dispersion Market faces challenges from volatile raw material prices. It impacts cost stability for manufacturers relying on petrochemical inputs. High R&D expenses add pressure to maintain profitability. Scaling bio-based alternatives remains costly and time intensive. This limits adoption in price-sensitive sectors. Manufacturers face difficulty in balancing quality, performance, and affordability. Currency fluctuations further affect import costs of specialty chemicals. These challenges reduce profit margins and hinder aggressive expansion strategies.

Regulatory Compliance And Technological Adaptation Barriers:

Strict EU regulations create compliance hurdles for smaller firms. It requires continuous investment in testing and certifications. Adapting advanced technologies demands skilled labor and infrastructure upgrades. Smaller players struggle to match innovation pace set by global leaders. Technological gaps affect competitiveness in export-oriented markets. Customer demand for eco-certifications increases operational complexities. Market entry barriers remain high for emerging manufacturers. These challenges slow down diversification into new applications and industries.

Market Opportunities:

Expanding Application In Renewable Energy And Advanced Manufacturing:

The Germany Polyurethane Dispersion Market gains opportunities in renewable energy. It supports coatings for wind turbines and solar panels. Advanced manufacturing sectors demand dispersions for durable and efficient products. It opens pathways into aerospace, electronics, and renewable technology. German innovation clusters promote adoption of such high-performance materials. Growing focus on decarbonization fuels long-term demand. This opportunity strengthens the strategic value of dispersions across industries.

Rising Export Potential And Growth In Niche Markets:

Germany’s export capacity creates opportunities for dispersions in global markets. It supports growth in specialty coatings and functional textiles. Niche sectors such as medical devices and electronics demand premium dispersions. Local producers gain advantage by offering eco-certified products. It expands their footprint in international supply chains. German reputation for quality enhances trust among global buyers. Export-driven growth strengthens the overall resilience of the industry. This opportunity fuels sustainable expansion for manufacturers.

Market Segmentation Analysis:

By Product Segment

The Germany Polyurethane Dispersion Market is divided into water-based and solvent-based dispersions. Water-based dispersions dominate due to strong demand from environmentally conscious industries. It offers lower emissions, excellent film-forming properties, and compliance with strict EU regulations. The growth of sustainable construction, automotive, and packaging sectors further strengthens adoption. Solvent-based dispersions continue to hold relevance in specialized applications that require superior resistance and durability. It finds use in areas where performance under extreme conditions is critical, though its share faces gradual decline due to regulatory pressure.

- For instance, Alberdingk Boley’s water-based dispersions such as ALBERDINGK® UC 84 provide good surface hardness, abrasion resistance, and gloss on wood and metal substrates, demonstrating solvent-free technology suited for sustainable applications. Meanwhile, solvent-based PU systems are seeing declines due to regulatory pressure.

By Application Segment

Paints and coatings represent a leading application area, driven by high demand for protective and decorative finishes across construction and automotive industries. It ensures durability, abrasion resistance, and smooth finishing. Adhesives and sealants form another significant segment, where dispersions provide strong bonding, flexibility, and chemical resistance. Textile finishing applications benefit from enhanced softness, washability, and wear performance, making it popular in apparel and technical textiles. Natural and synthetic leather finishing sectors also present strong adoption, supported by Germany’s robust fashion and footwear industries. These dispersions deliver flexibility, resistance, and eco-friendly performance that align with export requirements. Other applications such as wood finishing and specialty coatings contribute steady demand, expanding the overall market scope.

- For example, BASF SE’s waterborne coatings maintain gloss retention and humidity resistance over extended environmental exposure, crucial for automotive and industrial paint systems. Adhesives and sealants benefit from dispersions that deliver flexibility and chemical resistance, essential for durable bonds in automotive manufacturing. The textile and leather finishing sectors also show strong use, with Covestro’s (formerly Bayer MaterialScience) bio-based polyurethanes improving softness and washability in apparel while meeting high bonding specifications in footwear production.

Segmentation:

By Product Segment

- Water-based Dispersion

- Solvent-based Dispersion

By Application Segment

- Paints & Coatings

- Adhesives & Sealants

- Textile Finishing

- Natural Leather Finishing

- Synthetic Leather

- Others

Regional Analysis:

Western Germany – Leading Industrial Hub

Western Germany holds the largest share of the Germany Polyurethane Dispersion Market, accounting for nearly 42% in 2024. The dominance is supported by a strong base of automotive, chemical, and construction industries that demand high-performance coatings and adhesives. It benefits from advanced infrastructure, export-oriented manufacturing clusters, and established research centers. Western Germany also serves as the key hub for multinational corporations, driving both innovation and capacity expansion. Sustainability regulations further accelerate adoption of water-based dispersions in industrial applications. Strong consumer awareness of eco-friendly solutions reinforces the region’s leadership position across major end-use industries.

Southern Germany – Expanding Manufacturing Base

Southern Germany contributes around 31% of the market share, with a growing presence in textile finishing, footwear, and leather industries. The region benefits from specialized manufacturing units that integrate dispersions into high-value products for domestic and international markets. It demonstrates strong adoption in adhesives, driven by packaging and furniture production. It also acts as a hub for innovative fashion and automotive suppliers that emphasize sustainable materials. Universities and technical institutes in the region actively collaborate with industry players, supporting product innovation. Southern Germany continues to strengthen its market position by aligning industrial output with global environmental standards.

Northern And Eastern Germany – Emerging Growth Regions

Northern and Eastern Germany together account for nearly 27% of the Germany Polyurethane Dispersion Market. Northern Germany shows significant adoption in marine, construction, and renewable energy applications, driven by its coastal economy and infrastructure development. Eastern Germany represents a developing segment where government support and industrial investments are increasing usage of eco-friendly dispersions. Both regions benefit from the growth of SMEs focusing on niche applications in textiles and specialty coatings. It is also supported by rising export activity to Eastern Europe, enhancing market penetration. These regions are emerging growth engines that complement the strong industrial dominance of Western and Southern Germany.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BASF SE

- Covestro AG

- LANXESS AG

- Alberdingk Boley GmbH

- Bayer AG

- PCC SE

- Chemische Werke Kluthe GmbH

- Ardex GmbH

- Akemi GmbH

Competitive Analysis:

The Germany Polyurethane Dispersion Market features strong competition among global corporations and regional manufacturers. It is characterized by continuous product innovation, regulatory compliance, and sustainability-driven strategies. Leading players such as BASF SE, Covestro AG, LANXESS AG, and Alberdingk Boley GmbH invest heavily in R&D to expand eco-friendly product portfolios. Smaller firms focus on niche applications in textiles, leather finishing, and specialty coatings to maintain competitiveness. Strategic mergers, partnerships, and capacity expansions enhance market positioning. Intense rivalry encourages price optimization and supply chain efficiency. The market’s competitive nature ensures consistent innovation and performance improvements across product categories.

Recent Developments:

- LANXESS AG signed a contract in October 2024 to sell its Urethane Systems business, a segment dealing with polyurethane systems, to Japanese UBE Corporation and completed this sale in April 2025. This marked LANXESS’s exit from the last polymer business in its portfolio to focus on specialty chemicals.

- BASF SE announced in May 2024 an investment to expand its Ultramid and Ultradur capacities including the inauguration of a Polyurethane Technical Development Center to enhance market development and customer support. Additionally, in August 2025, BASF expanded its distribution agreement with Univar Solutions in North America to meet growing demand for high-performance polyurethane coatings, adhesives, and polymer systems.

Report Coverage:

The research report offers an in-depth analysis based on product and application segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising adoption of water-based dispersions will drive growth in eco-sensitive industries.

- Expansion in automotive coatings will continue to strengthen demand.

- Bio-based raw material development will create sustainable growth pathways.

- Strong textile and leather finishing industries will sustain market resilience.

- Increased collaboration between research institutes and manufacturers will accelerate innovation.

- Packaging applications will see higher adoption due to safety and environmental compliance.

- SMEs will capture niche opportunities in specialty coatings and adhesives.

- Regulatory frameworks will guide industry investments toward greener technologies.

- Export potential will rise as German producers expand into global markets.

- Continuous product diversification will secure long-term competitiveness in the market.