Market Overview:

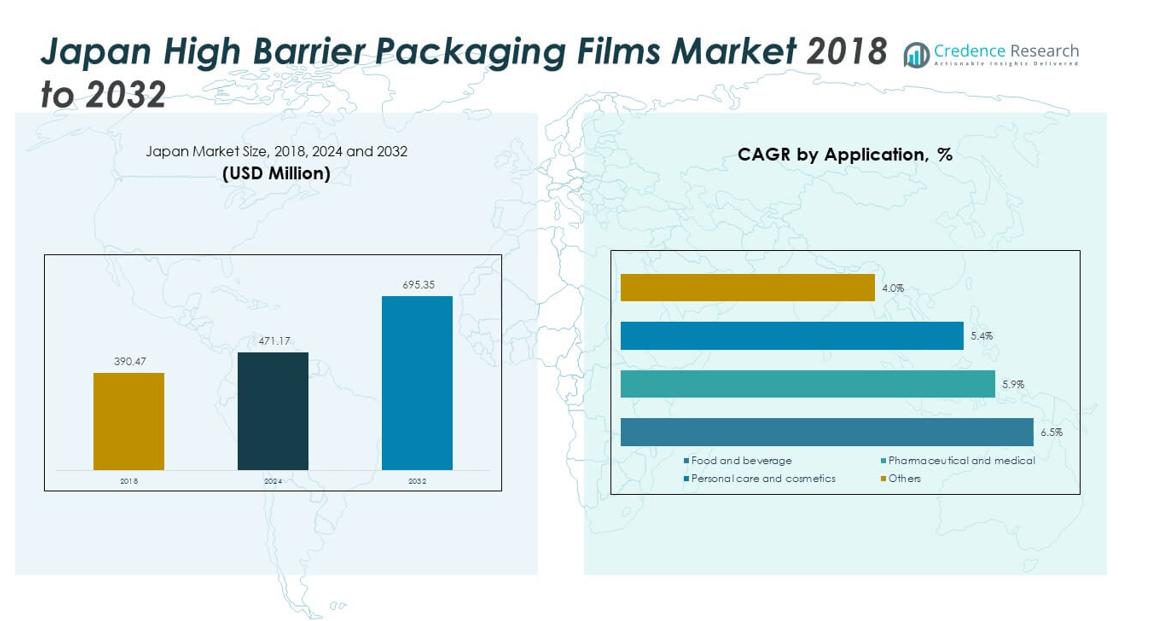

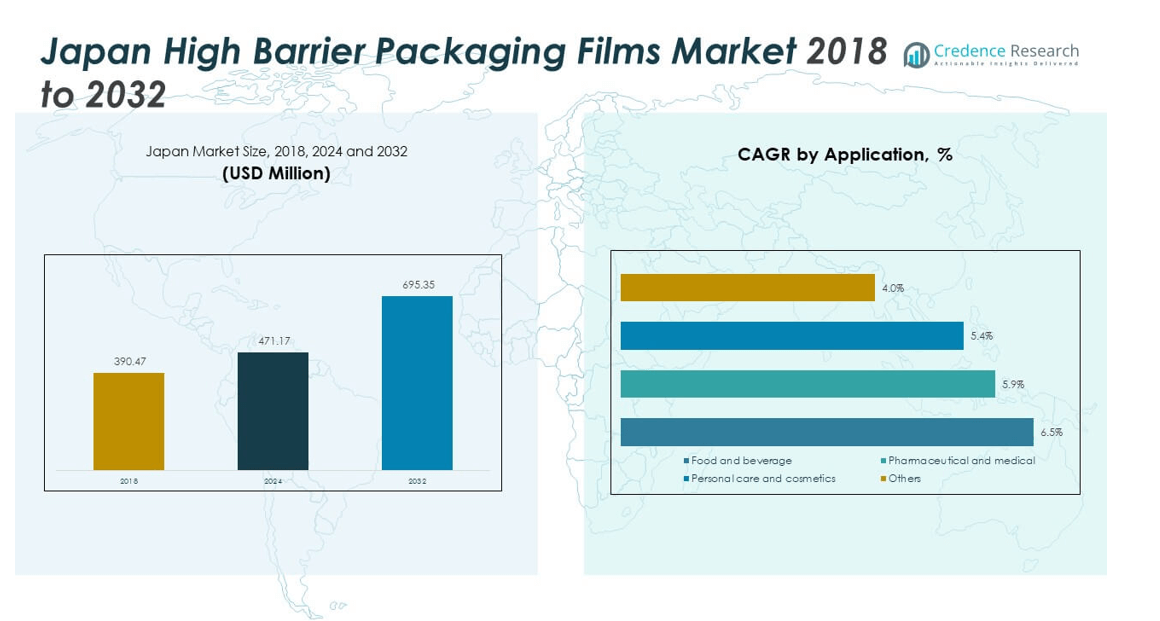

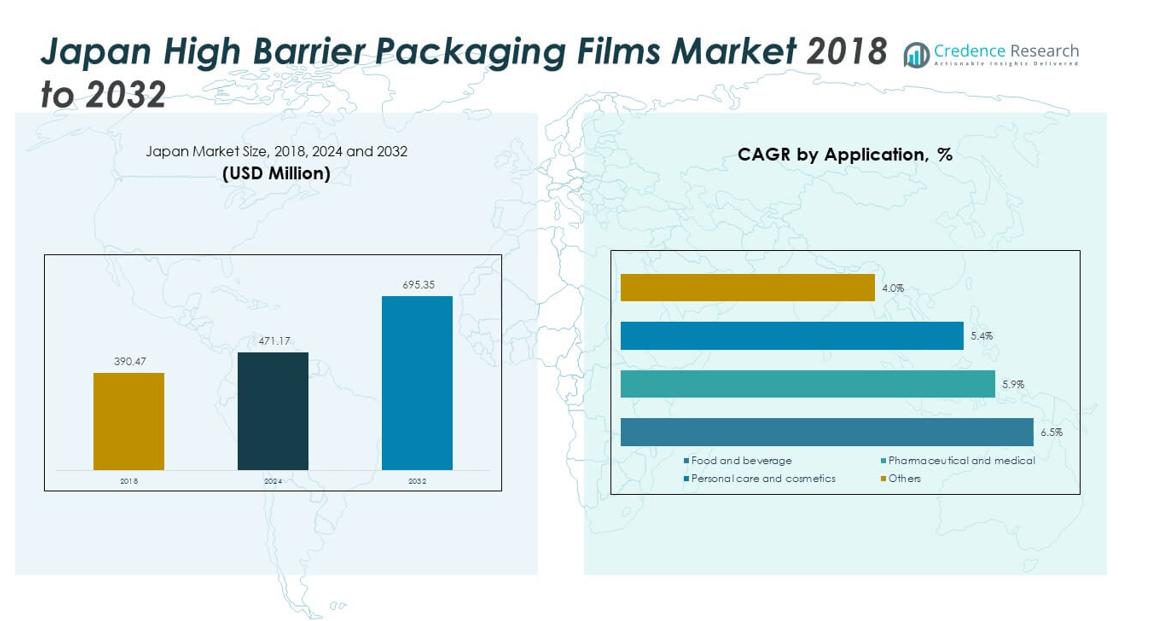

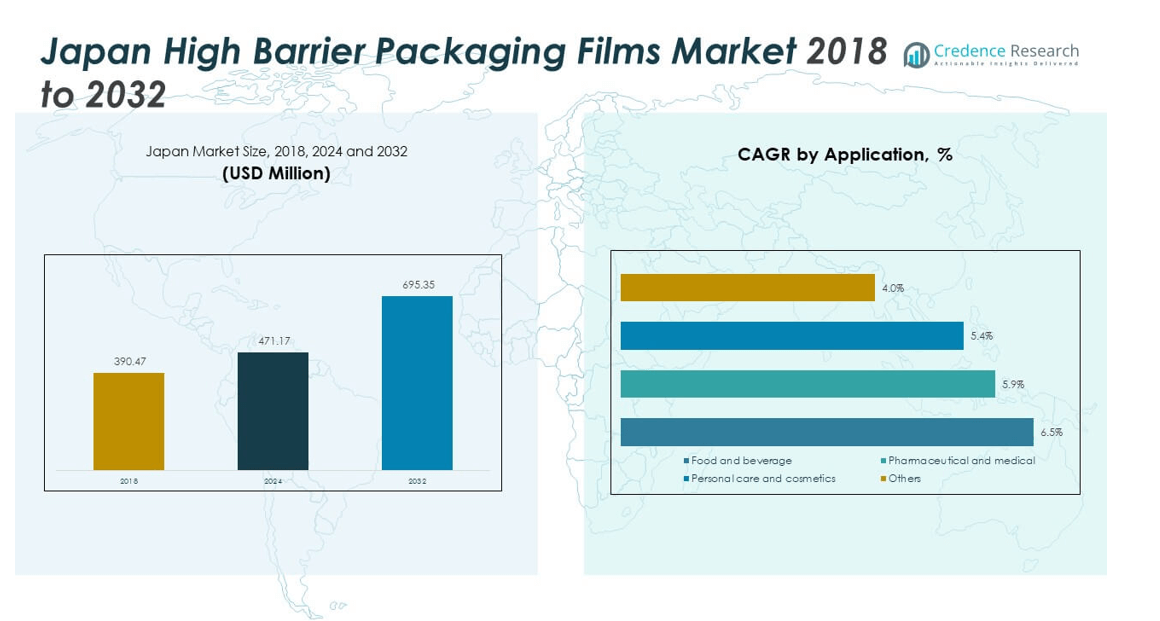

The Japan High Barrier Packaging Films Market size was valued at USD 390.47 million in 2018 to USD 471.17 million in 2024 and is anticipated to reach USD 695.35 million by 2032, at a CAGR of 4.99% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan High Barrier Packaging Films Market Size 2024 |

USD 471.17 million |

| Japan High Barrier Packaging Films Market, CAGR |

4.99% |

| Japan High Barrier Packaging Films Market Size 2032 |

USD 695.35 million |

Rising demand for packaged food, beverages, and pharmaceuticals drives steady growth in this market. Increasing urbanization and changing lifestyles create higher consumption of ready-to-eat and convenience products. Consumers demand extended shelf life and superior protection from oxygen, moisture, and contaminants, boosting adoption of high barrier films. Advancements in film technologies, including multilayer structures and eco-friendly materials, strengthen product performance while supporting sustainability goals. Japan’s strong pharmaceutical sector also contributes by requiring advanced barrier solutions to preserve drug quality.

Japan leads the regional market due to its established food, beverage, and healthcare industries. Neighboring Asian countries, including China and South Korea, are emerging as key markets driven by rapid industrialization and increasing packaged product consumption. Demand is expanding in Southeast Asia where rising disposable incomes and changing consumer preferences encourage adoption of advanced packaging solutions. Developed Western regions maintain strong positions with advanced technologies and established regulatory frameworks, while Asia-Pacific continues to show faster growth due to expanding consumer bases and evolving industry requirements.

Market Insights:

- The Japan High Barrier Packaging Films Market was valued at USD 390.47 million in 2018, reached USD 471.17 million in 2024, and is projected to reach USD 695.35 million by 2032, growing at a CAGR of 4.99%.

- Kanto and Kansai regions hold the largest share at 42%, supported by dense populations, robust retail distribution, and leading pharmaceutical hubs. Chubu and Kyushu follow with 35% share, driven by strong manufacturing clusters and packaging demand in automotive and healthcare. Hokkaido, Tohoku, and Shikoku account for 23%, supported by agricultural exports and food processing expansion.

- The fastest-growing region is Asia-Pacific excluding Japan, with a 33% share, fueled by rising disposable incomes, urbanization, and expansion in food and pharmaceutical packaging needs.

- Bags & pouches dominate the segmental share with 34%, representing the largest portion of demand due to flexibility and convenience in food packaging.

- Labels and wraps together account for nearly 41% share, driven by strong retail adoption, brand visibility requirements, and increasing use in processed food and beverage products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Packaged and Ready-to-Eat Foods in Urban Households

The growing urban population in Japan is fueling strong demand for convenient packaged food options. Busy lifestyles and a preference for quick meal solutions encourage adoption of packaged products requiring advanced protection. High barrier packaging films provide extended shelf life and protection against oxygen and moisture. Consumers value freshness and safety, making these films a critical component in food distribution. Retailers and food brands rely on these materials to maintain product quality across long supply chains. The Japan High Barrier Packaging Films Market benefits from this consistent demand in both domestic and export sectors. It continues to adapt as food manufacturers emphasize safe, longer-lasting packaging solutions. This driver ensures stable growth across diverse food segments, including snacks, ready meals, and frozen products.

- For instance, Toyo Seikan Co., Ltd. received the 2023 Packaging Engineering Award for developing an ultra-lightweight aluminum beverage can technology, achieving a reduction in can weight by up to 13.3% compared to prior models, which enables the lightest aluminum cans in Japan as of March 2024 and contributes to improved transport efficiency and reduced environmental impact.

Expanding Pharmaceutical Industry Driving Higher Packaging Standards

Japan’s advanced pharmaceutical sector is another significant driver for high barrier films. The industry demands packaging that ensures product stability, extends shelf life, and maintains efficacy. High barrier films safeguard sensitive formulations against oxygen, light, and contaminants. Pharmaceutical companies require compliance with strict global regulatory standards, increasing reliance on specialized films. Rising exports of Japanese pharmaceuticals amplify the need for durable and protective packaging solutions. The Japan High Barrier Packaging Films Market meets these requirements with innovations in multilayer and high-performance film technologies. It also helps firms reduce risks of contamination or product recalls. Strong alignment between packaging suppliers and pharmaceutical firms supports steady growth.

- For instance, Mitsubishi Chemical offers multilayer co-extruded films under the DIAMIRON™ brand, designed for pharmaceutical packaging and recognized for maintaining integrity and barrier protection of pharmaceutical supplies in compliance with industry regulations in Japan.

Strong Retail and E-Commerce Expansion Boosting Packaging Consumption

The retail and e-commerce landscape in Japan has experienced significant growth. Consumer preferences for online shopping increase the demand for secure and durable packaging. High barrier films play a central role in protecting perishable items during transportation. Logistics firms and retailers rely on these materials to reduce damage and preserve freshness. Growing online grocery services amplify this requirement further. Packaging must ensure safety, hygiene, and shelf stability across long distances. The Japan High Barrier Packaging Films Market gains traction as retailers invest in reliable packaging formats. It provides opportunities for companies to innovate in protective solutions for digital commerce.

Innovation in Sustainable and Eco-Friendly Barrier Film Materials

Sustainability concerns in Japan drive demand for eco-friendly packaging materials. Consumers and regulators push companies to reduce plastic waste and adopt recyclable solutions. High barrier films are evolving with bio-based and recyclable materials that meet these requirements. Companies integrate advanced multilayer designs that balance performance with environmental responsibility. The Japan High Barrier Packaging Films Market responds to these demands with strong R&D investments. Manufacturers innovate to reduce carbon footprints while ensuring packaging durability. This creates opportunities for firms to differentiate themselves in a competitive environment. Sustainable product development enhances market positioning and customer trust across industries.

Market Trends:

Adoption of Advanced Multilayer Film Structures for Enhanced Protection

The adoption of multilayer film technologies is a key trend shaping the market. These films combine different materials to provide stronger resistance against oxygen, light, and moisture. Food and pharmaceutical industries prefer multilayer options for their superior performance. It allows longer shelf life and improved product safety across diverse applications. The Japan High Barrier Packaging Films Market reflects this trend as manufacturers expand R&D to develop advanced structures. Multilayer films also support lightweight packaging, reducing overall material use. This innovation balances protection with sustainability. Companies gain a competitive edge by offering advanced and adaptable packaging formats.

- For instance, in March 2024, Toppan Inc. announced the launch of GL-SP, a new BOPP-based high-barrier film for sustainable packaging that combines high oxygen and water vapor resistance with reduced material consumption, delivered through an end-to-end process that enhances quality control.

Integration of Smart Packaging Features to Improve Consumer Safety

Smart packaging technologies are becoming more prominent in Japan. Features such as freshness indicators, QR codes, and anti-counterfeit labels enhance consumer trust. High barrier films integrate with these innovations to improve product transparency and traceability. Food and pharmaceutical firms use smart features to comply with safety regulations. The Japan High Barrier Packaging Films Market adapts to this need by supporting digital labeling. It strengthens consumer engagement and builds brand loyalty. Adoption of these technologies is expanding in premium product categories. It reflects the growing demand for value-added packaging solutions. This trend aligns with Japan’s technology-driven consumer base.

- For instance, Dai Nippon Printing Co., Ltd. in July 2025 developed a vacuum metalized high barrier PP film suitable for mono-material packaging, delivering nearly double the barrier performance against oxygen and water vapor compared to their previous generation films, supporting enhanced product safety and shelf life in food and pharmaceutical applications.

Shift Toward Lightweight and Flexible Packaging Formats

Japanese manufacturers are adopting flexible packaging formats to reduce costs and enhance convenience. Lightweight packaging reduces shipping expenses and environmental impacts. High barrier films ensure durability and protection despite thinner material use. Consumers favor easy-to-handle formats like pouches and resealable packs. The Japan High Barrier Packaging Films Market leverages this trend by supporting innovation in flexible materials. It helps meet the growing demand for portable and on-the-go products. Flexible formats also benefit e-commerce deliveries by improving storage efficiency. This shift drives adoption across food, beverage, and healthcare sectors. Firms view it as a strategy to balance cost, sustainability, and performance.

Rising Use of Bio-Based Materials in Barrier Film Development

Environmental awareness is pushing Japanese firms to explore bio-based packaging solutions. Materials derived from renewable resources such as corn starch and cellulose gain attention. High barrier films produced from bio-based inputs appeal to eco-conscious consumers. The Japan High Barrier Packaging Films Market incorporates these innovations into mainstream adoption. Companies seek to align with government sustainability goals and circular economy practices. Bio-based films reduce dependency on petroleum-based plastics. They also support recycling initiatives, reducing landfill waste. This trend opens growth opportunities in both domestic and export markets. It reinforces the focus on sustainability as a central competitive factor.

Market Challenges Analysis:

High Production Costs and Complex Manufacturing Processes

The high cost of raw materials and advanced production technologies creates a major challenge. High barrier films often require multilayer structures, specialized resins, and coating techniques. These increase manufacturing expenses and limit small firms’ participation. The Japan High Barrier Packaging Films Market faces pressure from buyers demanding affordable solutions. Manufacturers must balance performance, cost, and sustainability expectations. High initial investment in machinery and R&D further complicates market entry. It restricts expansion for new companies while favoring established players. This cost barrier slows innovation adoption among small-scale producers. Price sensitivity among food and retail sectors intensifies the challenge.

Stringent Environmental Regulations and Recycling Limitations

Japan enforces strict environmental policies, placing pressure on packaging producers. Recycling high barrier films is complex due to multilayer compositions. Limited infrastructure for advanced recycling restricts adoption of sustainable solutions. The Japan High Barrier Packaging Films Market struggles to align with eco-friendly mandates while maintaining performance. Companies face penalties or reputational risks if they fail to comply. Developing recyclable or biodegradable alternatives requires significant investment. Consumer awareness about plastic waste amplifies these challenges. Balancing sustainability with product safety creates ongoing tension for packaging firms. This challenge will remain central as regulations continue to evolve.

Market Opportunities:

Expansion of Eco-Friendly Packaging Solutions in Response to Sustainability Goals

Japan’s commitment to sustainability creates strong opportunities for eco-friendly packaging. High barrier films made from recyclable and bio-based materials align with national policies. Companies invest in sustainable innovations to meet consumer and regulatory demands. The Japan High Barrier Packaging Films Market benefits from these initiatives as industries shift toward greener options. It opens prospects for firms that can deliver performance with reduced environmental impact. Eco-focused product lines also help brands build stronger consumer loyalty. This opportunity supports long-term competitiveness in global markets.

Growth Potential in E-Commerce and International Export Markets

The rapid growth of e-commerce expands the need for protective packaging. High barrier films ensure safe transport of perishable goods to consumers. The Japan High Barrier Packaging Films Market gains from this growth through innovation in protective solutions. International demand for Japanese food and pharmaceuticals strengthens export potential. Companies leveraging advanced packaging can expand their reach to global markets. Emerging economies also create new avenues for expansion. The rising popularity of Japanese brands abroad adds to this momentum. Export-driven growth combined with domestic e-commerce ensures a strong outlook.

Market Segmentation Analysis:

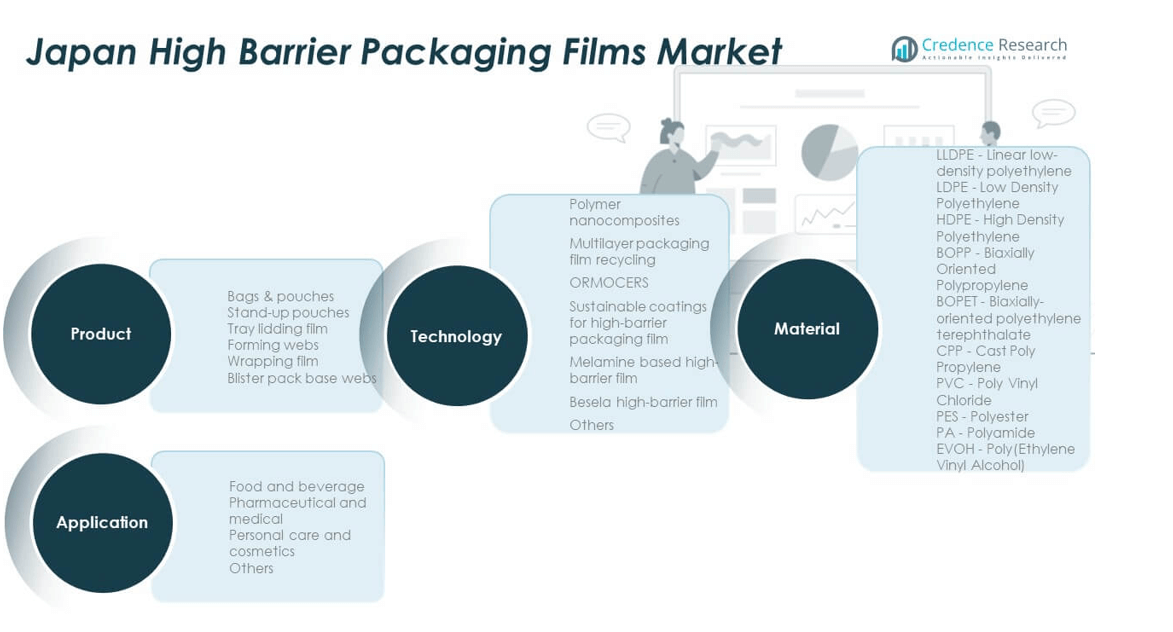

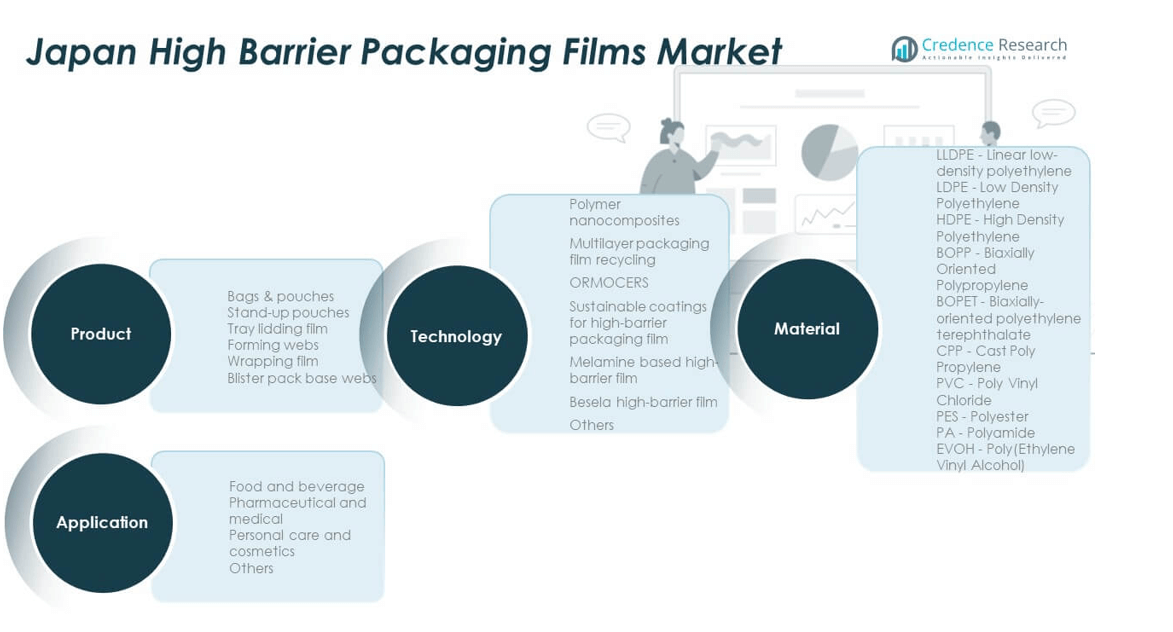

By Product Segment

Bags and pouches dominate usage due to their flexibility, lightweight design, and extended shelf-life benefits. Stand-up pouches are gaining preference in retail packaging for snacks, beverages, and convenience foods. Tray lidding films support fresh food packaging by ensuring strong sealability and visibility. Forming webs are favored in meat and cheese packaging, ensuring durability and barrier protection. Wrapping films remain important for bakery and confectionery applications. Blister pack base webs continue to expand in pharmaceutical packaging where product integrity is critical. The Japan High Barrier Packaging Films Market shows steady innovation across all formats.

By Application Segment

Food and beverage leads the market, supported by Japan’s demand for ready-to-eat and processed foods. Pharmaceutical and medical applications require strict compliance and advanced barrier solutions, driving significant adoption. Personal care and cosmetics use grows as brands emphasize premium packaging and extended shelf life. Other sectors, including industrial and household goods, contribute niche demand. Each segment values safety, durability, and sustainability. Companies develop targeted packaging to meet unique performance requirements. The market benefits from strong cross-industry dependence on barrier technologies.

- For instance, Kuraray’s PLANTIC EP, launched in 2023, is a repulpable, plant-based high-barrier granulate demonstrated for use in flexible pouches and cartons with gas and aroma barrier performance, certified repulpable and recyclable by Western Michigan University, and used by brands seeking eco-friendly packaging for foods, cosmetics, and other perishable goods.

By Technology Segment

Polymer nanocomposites are advancing with superior strength and gas barrier performance. Multilayer packaging film recycling is gaining traction under Japan’s circular economy goals. ORMOCERS offer advanced coatings that enhance product protection. Sustainable coatings support reduced plastic use and improved recyclability. Melamine-based and Besela high-barrier films address specialized packaging needs. The Japan High Barrier Packaging Films Market adopts these technologies to balance performance with environmental responsibility. Companies leverage R&D to expand functionality while reducing waste.

By Material Segment

LLDPE, LDPE, and HDPE are widely used for flexibility, durability, and cost-effectiveness. BOPP and BOPET dominate where clarity, strength, and high barrier performance are essential. CPP supports versatile food packaging formats. PVC and PES remain relevant in specialty applications requiring strength and chemical resistance. EVOH stands out for its superior oxygen barrier properties, making it indispensable in food and pharmaceutical packaging. The Japan High Barrier Packaging Films Market integrates diverse materials to meet application-specific demands. It ensures protection, shelf life extension, and sustainability improvements across industries.

Segmentation:

- By Product Segment

- Bags & Pouches

- Stand-up Pouches

- Tray Lidding Film

- Forming Webs

- Wrapping Film

- Blister Pack Base Webs

- By Application Segment

- Food and Beverage

- Pharmaceutical and Medical

- Personal Care and Cosmetics

- Others

- By Technology Segment

- Polymer Nanocomposites

- Multilayer Packaging Film Recycling

- ORMOCERS

- Sustainable Coatings for High-Barrier Packaging Film

- Melamine Based High-Barrier Film

- Besela High-Barrier Film

- Others

- By Material Segment

- LLDPE – Linear Low-Density Polyethylene

- LDPE – Low Density Polyethylene

- HDPE – High Density Polyethylene

- BOPP – Biaxially Oriented Polypropylene

- BOPET – Biaxially-Oriented Polyethylene Terephthalate

- CPP – Cast Polypropylene

- PVC – Poly Vinyl Chloride

- PES – Polyester

- EVOH – Poly(Ethylene Vinyl Alcohol)

Regional Analysis:

Concentration in Urban and Industrial Hubs

The Japan High Barrier Packaging Films Market shows its highest concentration in major urban and industrial regions, including Kanto and Kansai. These areas together contribute nearly 42% of the national share, supported by dense populations, strong retail networks, and established food processing facilities. Demand for ready-to-eat meals and processed food packaging remains strong in metropolitan centers such as Tokyo and Osaka. The pharmaceutical and medical sectors clustered in these regions also drive packaging innovation. It benefits from well-developed supply chains, advanced logistics, and continuous investment in high barrier technologies. This concentration ensures sustained dominance in both domestic demand and exports.

Growth Momentum in Regional Manufacturing Clusters

Chubu and Kyushu regions hold close to 35% of the national share, driven by strong manufacturing bases and expanding packaging needs in automotive, healthcare, and consumer goods. Local companies in these regions focus on producing flexible and sustainable packaging solutions that align with environmental policies. The presence of major chemical and polymer producers supports cost-effective raw material supply. It helps packaging converters adopt advanced materials like EVOH and BOPET for high-performance films. Demand from mid-sized cities in these regions is increasing, supported by rising consumer awareness of food safety and quality. This momentum highlights regional diversity in driving overall market expansion.

Emerging Opportunities in Secondary and Rural Markets

Hokkaido, Tohoku, and Shikoku collectively account for nearly 23% of the national share, representing emerging demand zones. Growth is supported by increasing investment in food processing plants, dairy industries, and agricultural exports. These regions are adopting high barrier packaging films to extend product shelf life and maintain freshness during long-distance transportation. It reflects the need for durable packaging in cold-chain logistics and regional exports. Rising consumer expectations in rural and semi-urban areas are encouraging retailers to stock more packaged goods. Government initiatives promoting regional industrial development also support adoption. These opportunities ensure that secondary markets will play a growing role in national market dynamics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Sealed Air Corporation

- Amcor plc

- Berry Global

- Toray Industries, Inc.

- Mitsubishi Chemical Group

- Toyobo Co., Ltd.

- Toppan Printing Co., Ltd. (now Toppan Holdings)

- Dai Nippon Printing Co., Ltd. (DNP)

- UBE Industries, Ltd.

- Kuraray Co., Ltd.

- Fujifilm Specialty Materials

Competitive Analysis:

The Japan High Barrier Packaging Films Market is highly competitive with strong participation from domestic and international companies. Leading players such as Toray Industries, Mitsubishi Chemical Group, Toyobo, Toppan Holdings, and Dai Nippon Printing dominate with advanced R&D capabilities and wide product portfolios. Global firms like Amcor and Sealed Air enhance competition through investments in sustainable and high-performance packaging. It benefits from innovation in multilayer films, eco-friendly materials, and technologies that meet strict safety standards. Companies compete by focusing on partnerships, capacity expansion, and customized solutions for food and pharmaceutical sectors. The market landscape favors firms that can balance sustainability, cost-efficiency, and product performance while addressing evolving consumer and regulatory demands.

Recent Developments:

- In September 2025, Freshr Sustainable Technologies Inc. and Mitsubishi Chemical Group announced a joint development agreement to launch advanced active packaging solutions targeting reduced food waste, leveraging FreshrPack™ shelf-extension technology for Japanese protein supply chains.

- In August 2025, Mitsubishi Chemical Group approved the sale of its subsidiary J-Film Corporation to Marunouchi Capital Fund III, marking a strategic acquisition focused on growing packaging materials and film-processing technologies for advanced food and healthcare sectors in Japan.

- In July 2025, Dai Nippon Printing Co., Ltd. developed a new vacuum metalized high barrier polypropylene (PP) film optimized for mono-material packaging, doubling previous generation barrier performance and supporting Japanese brands in meeting elevated food and pharma safety requirements.

- In June 2025, Toyobo Co., Ltd. signed a joint development agreement with DMC Biotechnologies Inc. to create and commercialize key sustainable compounds for use as raw materials in high-barrier packaging films, accelerating Toyobo’s commitment to eco-friendly innovation for Japan’s food and healthcare industries.

Report Coverage:

The research report offers an in-depth analysis based on product, application, technology, and material segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing demand for packaged and ready-to-eat foods will increase reliance on advanced barrier films.

- Expansion of pharmaceutical manufacturing will strengthen adoption of protective packaging solutions.

- Rising e-commerce penetration will boost demand for durable and safe packaging formats.

- Development of sustainable and recyclable barrier films will shape future innovations.

- Partnerships between Japanese firms and global players will enhance technology transfer.

- Adoption of polymer nanocomposites and advanced coatings will improve film performance.

- Strong R&D investments will fuel product differentiation in competitive markets.

- Expansion in regional manufacturing clusters will diversify supply capabilities.

- Stricter environmental regulations will accelerate adoption of bio-based alternatives.

- Continuous focus on cost reduction and operational efficiency will define long-term strategies.