Market Overview:

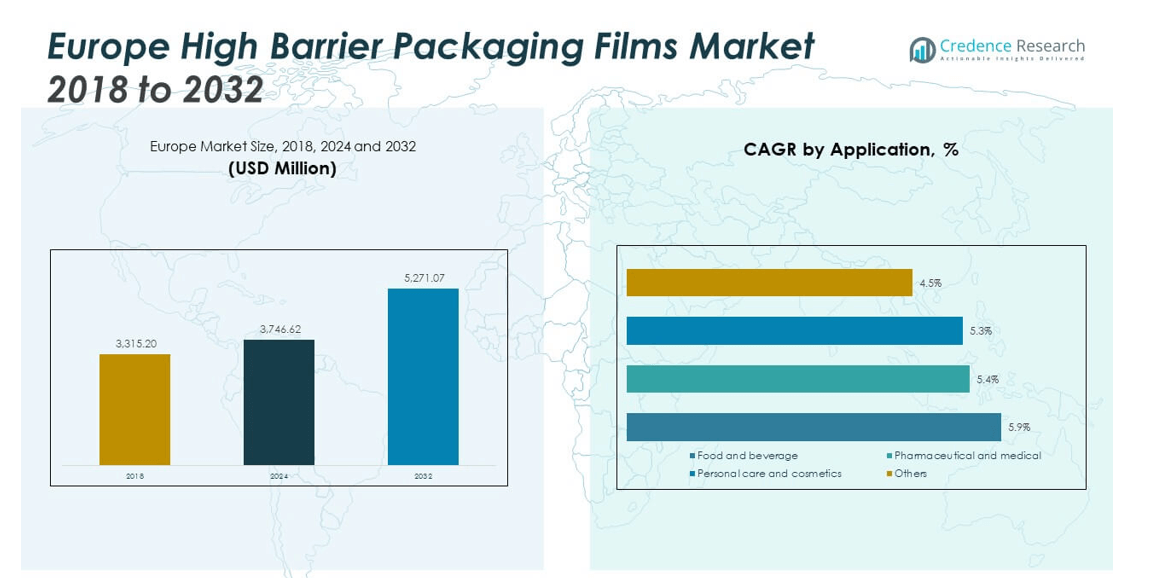

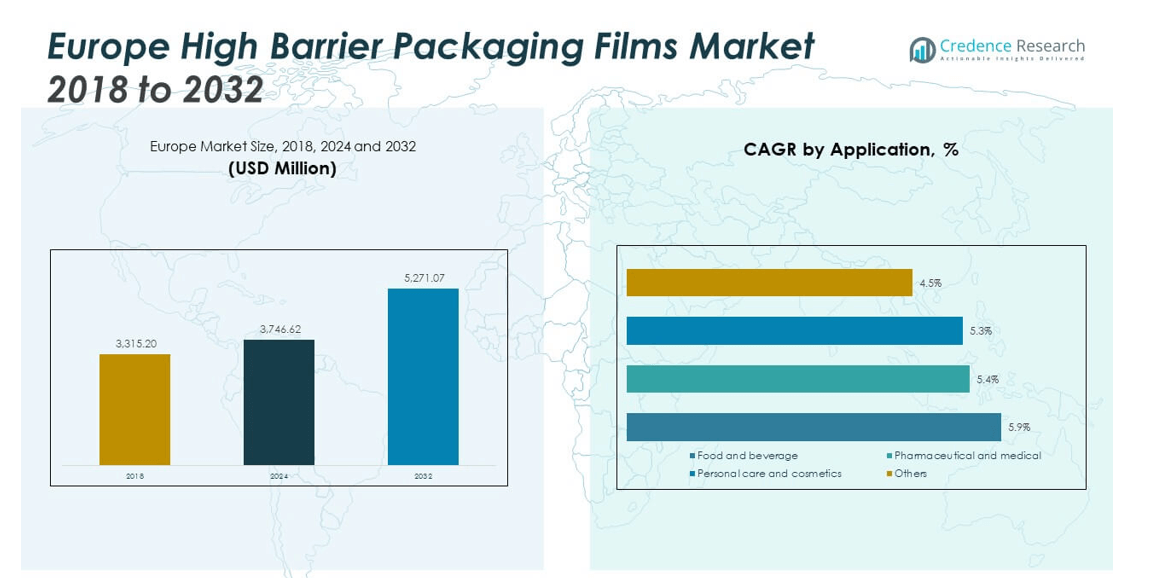

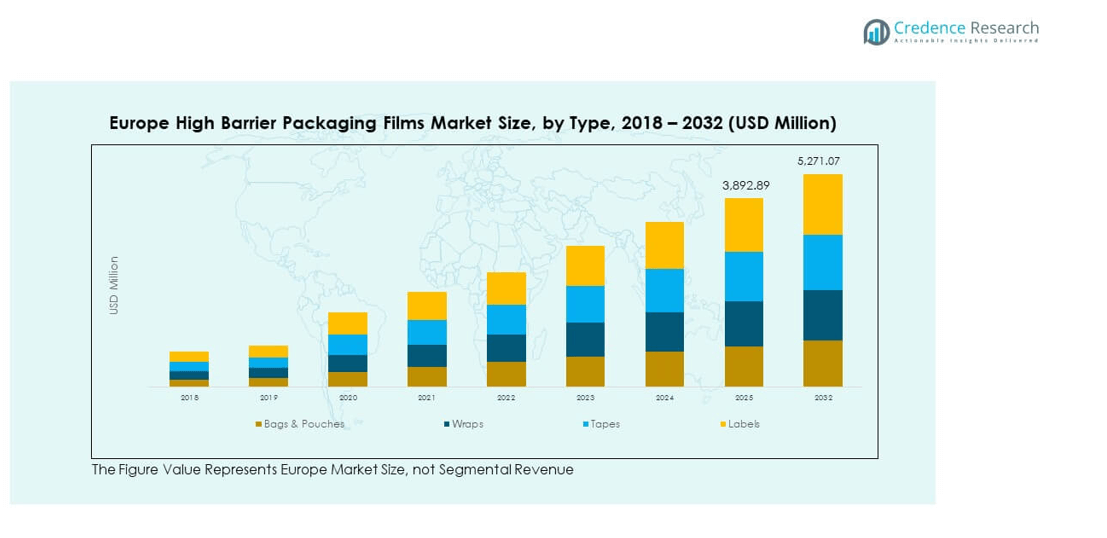

The Europe High Barrier Packaging Films Market size was valued at USD 3,315.20 million in 2018 to USD 3,746.62 million in 2024 and is anticipated to reach USD 5,271.07 million by 2032, at a CAGR of 4.37% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe High Barrier Packaging Films Market Size 2025 |

USD 3,746.62 million |

| Europe High Barrier Packaging Films Market, CAGR |

4.37% |

| Europe High Barrier Packaging Films Market Size 2032 |

USD 5,271.07 million |

Growth in the Europe High Barrier Packaging Films Market is driven by rising demand for packaged food, increasing preference for extended shelf life, and stricter regulatory standards for food safety. Manufacturers are adopting advanced film technologies to provide strong protection against oxygen, moisture, and contaminants. Sustainability goals are also encouraging the use of recyclable barrier films, aligning with consumer and government expectations for eco-friendly packaging solutions. Expansion in e-commerce and convenience-driven consumption further fuels market adoption across multiple industries.

Within Europe, Western countries such as Germany, France, and the United Kingdom dominate due to their advanced food processing industries, high packaging innovation, and strong sustainability regulations. Southern and Eastern European markets are emerging, supported by growing retail penetration and increased consumer spending. Countries in these regions are witnessing rising adoption of packaged goods and processed food products, creating opportunities for high barrier packaging solutions. The market outlook reflects both established leadership in Western Europe and expanding potential in emerging parts of the region.

Market Insights:

- The Europe High Barrier Packaging Films Market was valued at USD 3,315.20 million in 2018, reached USD 3,746.62 million in 2024, and is projected to hit USD 5,271.07 million by 2032, expanding at a CAGR of 4.37%.

- Western Europe led the market with a 41% share in 2024, driven by advanced food industries, strong sustainability regulations, and packaging innovation.

- Southern Europe accounted for 26% in 2024, supported by food and beverage consumption, while Eastern and Northern Europe together held 33%, benefitting from retail expansion and sustainability initiatives.

- Eastern Europe emerged as the fastest-growing region within its 33% share, fueled by urbanization, retail penetration, and rising demand for packaged food and medical packaging.

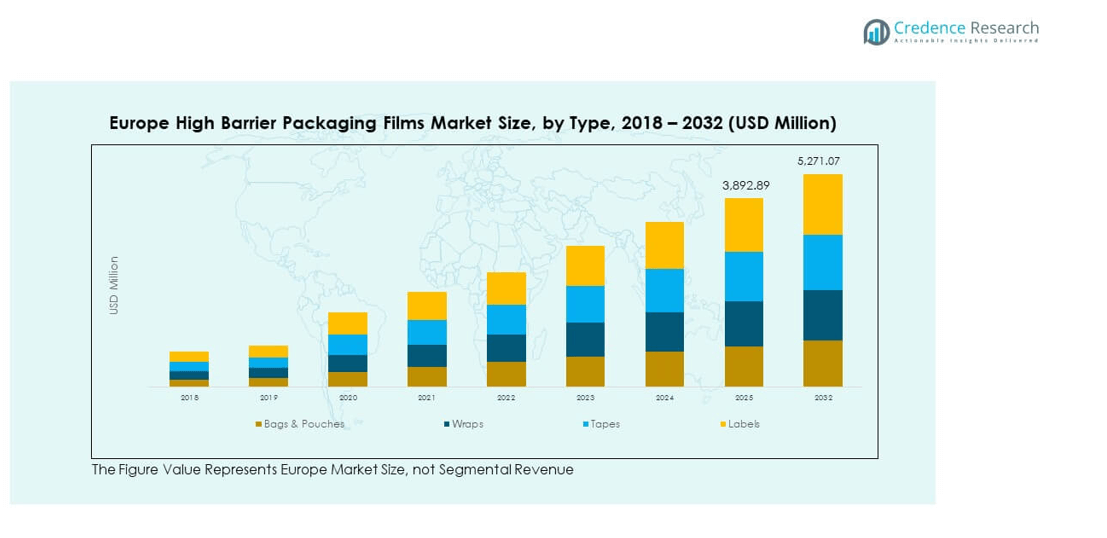

- By product distribution, bags & pouches accounted for 34%, followed by wraps at 28% in 2024. Labels and tapes represented smaller but steadily growing shares, showing diversification across packaging needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Packaged and Processed Food

The Europe High Barrier Packaging Films Market benefits from strong consumer demand for packaged food and beverages. It is supported by busy lifestyles, urbanization, and growing preference for convenience-based products. High barrier films extend shelf life by preventing spoilage and preserving taste. Retailers prioritize packaging solutions that enhance product safety and reduce food wastage. Food manufacturers adopt advanced multilayer films to meet strict European safety standards. Consumers prefer packaging that offers both convenience and protection. These factors collectively drive significant adoption across diverse food categories.

- For instance, Amcor’s AmLite Recyclable high barrier packaging doubled the shelf life of Popcorn Shed’s premium popcorn, increasing it from 6 months to 12 months for products distributed globally, as validated by export contract requirements and customer reports.

Stringent Food Safety and Quality Regulations

Food safety standards across Europe strengthen the requirement for barrier packaging. The Europe High Barrier Packaging Films Market addresses strict EU guidelines for protecting against contamination. Regulatory bodies mandate effective packaging to maintain freshness and prevent exposure to oxygen or moisture. Manufacturers invest in innovation to comply with safety benchmarks. Pharmaceutical and healthcare industries also demand high barrier films for safe product storage. It ensures that sensitive goods remain protected during transit and storage. Compliance with these frameworks drives continuous product development and adoption.

- For instance, Huhtamaki’s Omnilock™ Ultra PAPER, which won the Prime Awards Packaging MEA 2025, offers a fully recyclable, heat-sealable barrier solution that replaces traditional multi-layer laminates and is designed for superior product protection and compliance with modern food safety standards.

Sustainability Initiatives and Eco-Friendly Packaging

Sustainability remains a major driver in the regional market. The Europe High Barrier Packaging Films Market experiences pressure from policies promoting recyclability and reduced plastic waste. Consumers increasingly demand environmentally responsible packaging options. Producers focus on developing bio-based, recyclable, or compostable high barrier films. Retailers prefer packaging that aligns with sustainability goals. Government regulations further encourage the use of circular economy practices. Companies innovate to balance barrier performance with eco-friendly material choices. This trend pushes suppliers to create solutions that meet both performance and environmental needs.

Expansion of E-Commerce and Convenience Retailing

E-commerce growth boosts the need for protective and durable packaging films. The Europe High Barrier Packaging Films Market leverages this expansion by offering solutions tailored for transit safety. Products shipped through online platforms require packaging that ensures freshness and integrity. Rising popularity of ready-to-eat and convenience meals further expands film demand. Packaging films offer protection from moisture and oxygen during distribution. Retail chains focus on shelf-ready packaging for customer convenience. The dual growth of e-commerce and modern retail channels strengthens consistent adoption of high barrier packaging films.

Market Trends:

Adoption of Advanced Multilayer Film Technologies

The Europe High Barrier Packaging Films Market is witnessing rapid innovation in multilayer film structures. Producers are using nanotechnology and specialty coatings to improve oxygen and moisture resistance. These films offer superior durability while maintaining lightweight features. Food and pharmaceutical industries favor such technology for extended shelf stability. Advanced films also help maintain product appeal through transparency and design flexibility. Manufacturers use new technologies to lower costs and boost performance. Adoption of these multilayer films is becoming a defining trend in the regional market.

- For instance, Sealed Air’s CRYOVAC brand OptiDure Bags utilize a chlorine-free EVOH barrier and a multi-resin structure, reducing packaging material weight by over 50% and enabling carbon footprint reduction of up to 39% compared to standard bags, as reported by Sealed Air’s product data and sustainability reports.

Growing Focus on Smart and Functional Packaging

Smart packaging technologies are gaining prominence in the Europe High Barrier Packaging Films Market. Brands are integrating features such as freshness indicators and QR codes for consumer engagement. Functional barrier films support both product safety and customer convenience. Retailers adopt intelligent labelling to improve supply chain traceability. Smart packaging aligns with Europe’s push toward digital transformation in consumer goods. Producers invest in combining barrier protection with value-added features. This trend enhances product appeal and builds stronger trust among consumers.

- For instance, Huhtamaki’s Adtone cups integrate heat-sensitive labels and QR codes, achieving consumer digital interaction click-through rates between 14% and over 30% in actual customer campaigns, demonstrating the effectiveness of smart packaging for brand engagement in Europe.

Expansion of Premium and Specialty Product Segments

Premiumization in food, beverage, and healthcare industries influences packaging innovation. The Europe High Barrier Packaging Films Market supports premium goods requiring high-quality preservation. Specialty films provide strong protection for organic, gourmet, and sensitive products. Rising consumer spending encourages demand for packaging that communicates quality. Luxury and artisanal brands adopt advanced films for differentiation. Pharmaceutical companies also prefer superior barrier films for high-value medications. This expansion strengthens opportunities for suppliers focusing on niche and premium applications.

Shift Toward Regionalized and Custom Packaging Solutions

Localized packaging solutions are becoming important across Europe. The Europe High Barrier Packaging Films Market adapts to regional preferences and sustainability needs. Suppliers design films tailored for country-specific regulations and consumer expectations. Customization supports brand identity and strengthens retailer partnerships. Regional players emphasize recyclable or biodegradable solutions aligned with local policies. This trend drives competition between global firms and regional innovators. Custom and localized packaging strategies help brands build stronger connections with diverse European markets.

Market Challenges Analysis:

High Costs of Production and Material Sourcing

The Europe High Barrier Packaging Films Market faces challenges linked to high production and raw material costs. Advanced multilayer and sustainable films require complex processes. Volatility in raw material prices, especially polymers, raises overall expenses. Producers struggle to balance affordability with quality performance. Smaller companies face difficulties competing with larger firms that benefit from economies of scale. Rising energy costs across Europe further pressure manufacturing margins. Companies must optimize resources while maintaining compliance with strict EU regulations. This challenge limits market penetration for cost-sensitive applications.

Regulatory Complexity and Recycling Infrastructure Gaps

Compliance with diverse and evolving regulations remains a challenge for market participants. The Europe High Barrier Packaging Films Market operates under strict frameworks regarding recyclability and environmental impact. Many countries lack uniform recycling infrastructure, complicating circular economy goals. Complex multilayer films are often difficult to recycle effectively. Producers face pressure to innovate while ensuring affordability and availability. Misalignment between consumer expectations and infrastructure readiness creates hurdles. Governments continue to update policies, requiring constant adaptation. These challenges create barriers for smooth and cost-efficient market expansion.

Market Opportunities:

Innovation in Sustainable High Barrier Film Solutions

The Europe High Barrier Packaging Films Market offers opportunities through eco-friendly material innovations. Producers are focusing on recyclable and bio-based films that maintain high barrier performance. Demand is growing from retailers and brands seeking sustainable alternatives. Investments in advanced compostable solutions enhance long-term opportunities. Consumer preference for green packaging strengthens product acceptance. Companies that balance cost efficiency with sustainability gain competitive advantages. It positions them as leaders in Europe’s evolving packaging landscape.

Rising Demand Across Healthcare and Specialty Food Sectors

Opportunities are emerging from healthcare and specialty food applications. The Europe High Barrier Packaging Films Market benefits from strong demand in pharmaceutical packaging. Sensitive drugs and medical devices require reliable protection. Specialty food sectors such as organic and gourmet products also seek advanced solutions. Retailers focus on enhancing consumer trust through safe and protective films. Growth in these sectors supports innovation and premium product offerings. Companies that address these industries with tailored solutions can expand market presence. It highlights significant long-term growth potential.

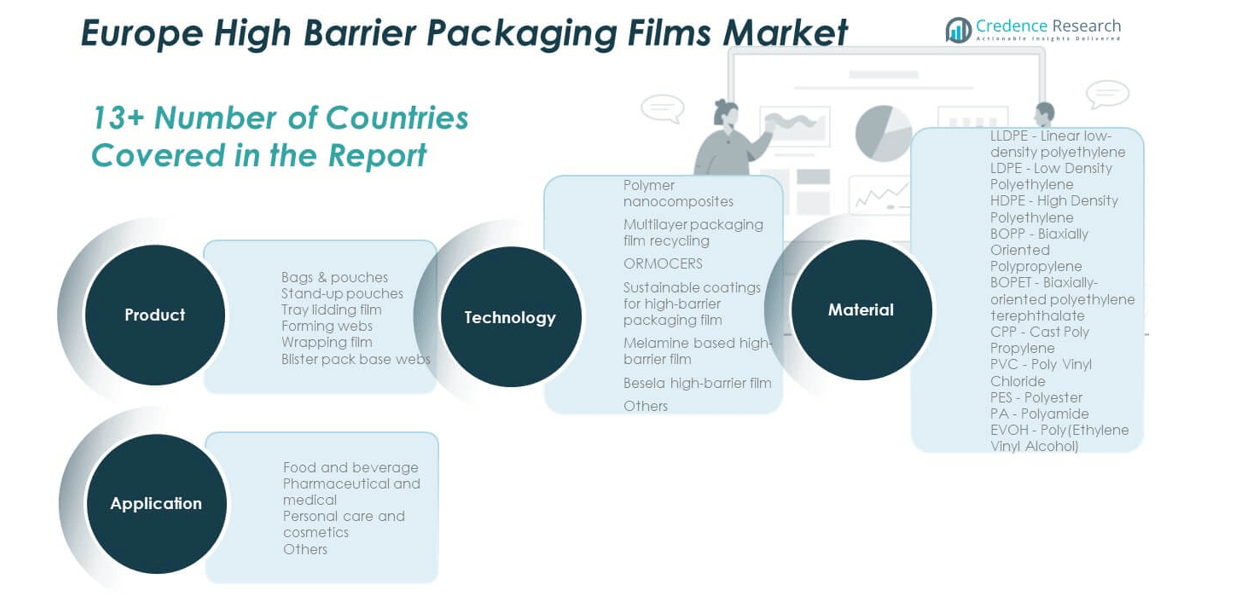

Market Segmentation Analysis:

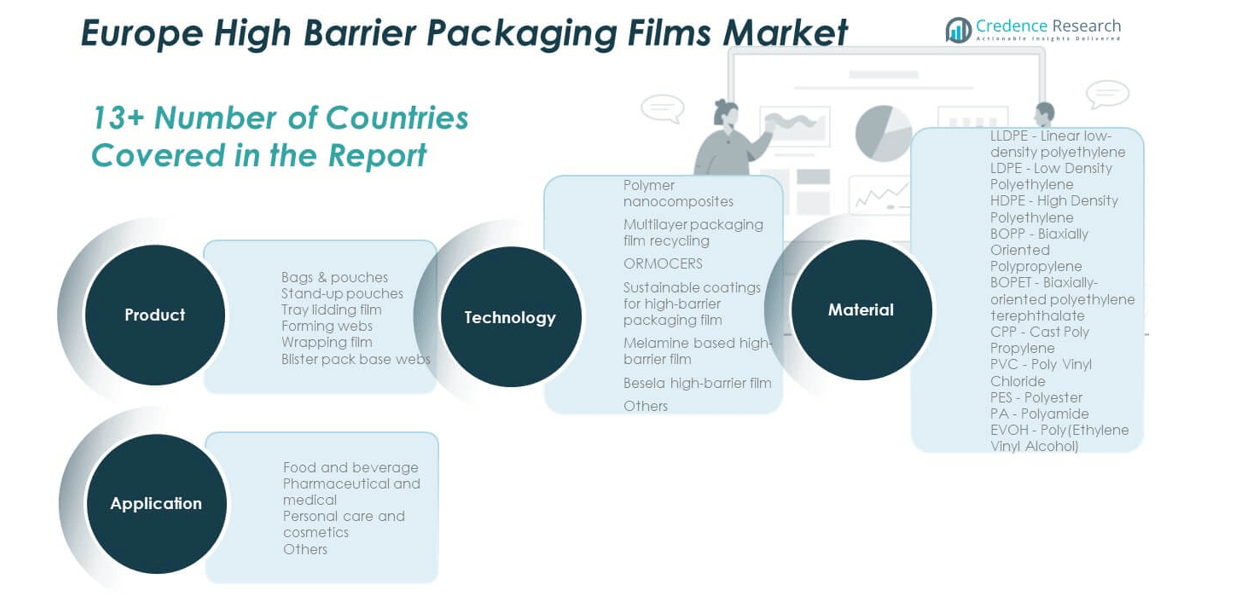

By Product

The Europe High Barrier Packaging Films Market is segmented into bags & pouches, stand-up pouches, tray lidding film, forming webs, wrapping film, and blister pack base webs. Bags & pouches hold strong demand due to their lightweight, flexible, and versatile design. Stand-up pouches are gaining traction in retail for shelf visibility and convenience. Tray lidding films dominate ready-to-eat meals, while forming webs support vacuum packaging. Wrapping films secure perishable products, and blister pack base webs remain essential for pharmaceutical packaging.

- For instance, Huhtamaki’s smooth molded fiber lids and dairy solutions are produced at the Alf, Germany site, which reached a capacity of up to 3.5 billion fiber products annually in 2022, marking Europe’s first such large-scale site for plastic replacement in packaging.

By Application

Food and beverage is the leading application segment in the Europe High Barrier Packaging Films Market, driven by demand for extended shelf life and food safety. Pharmaceutical and medical packaging follows closely, requiring protection against moisture, oxygen, and contamination. Personal care and cosmetics contribute steady growth through premium packaging. Other applications, including industrial uses, expand adoption across niche markets.

- For instance, Sealed Air’s CRYOVAC FlexPrep™ portion pouches achieve up to 98% yield for food packaging, significantly reducing food waste and supporting compliance in leading food and beverage applications across Europe.

By Technology

The market incorporates polymer nanocomposites, multilayer packaging film recycling, ORMOCERS, sustainable coatings, melamine-based high-barrier films, Besela films, and others. Polymer nanocomposites deliver superior strength and barrier efficiency. Recycling-focused multilayer technologies gain momentum from EU sustainability mandates. Advanced ORMOCERS and eco-friendly coatings enhance innovation, while specialty films like Besela address high-performance niches.

By Material

Materials in the market include LLDPE, LDPE, HDPE, BOPP, BOPET, CPP, PVC, PES, and EVOH. LLDPE and LDPE dominate flexible packaging. BOPP and BOPET deliver clarity and strength for food applications. EVOH provides strong oxygen barriers, while CPP, PES, and PVC support specialized packaging needs. It demonstrates material diversity tailored to industry requirements.

Segmentation:

By Product

- Bags & Pouches

- Stand-up Pouches

- Tray Lidding Film

- Forming Webs

- Wrapping Film

- Blister Pack Base Webs

By Application

- Food and Beverage

- Pharmaceutical and Medical

- Personal Care and Cosmetics

- Others

By Technology

- Polymer Nanocomposites

- Multilayer Packaging Film Recycling

- ORMOCERS

- Sustainable Coatings for High-Barrier Packaging Film

- Melamine-Based High-Barrier Film

- Besela High-Barrier Film

- Others

By Material

- LLDPE (Linear Low-Density Polyethylene)

- LDPE (Low-Density Polyethylene)

- HDPE (High-Density Polyethylene)

- BOPP (Biaxially Oriented Polypropylene)

- BOPET (Biaxially-Oriented Polyethylene Terephthalate)

- CPP (Cast Polypropylene)

- PVC (Poly Vinyl Chloride)

- PES (Polyester)

- EVOH (Poly(Ethylene Vinyl Alcohol))

By Country (Regional Analysis)

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Regional Analysis:

Western Europe

Western Europe dominates the Europe High Barrier Packaging Films Market with a market share of 41%. Germany, France, and the United Kingdom drive this leadership through strong food processing industries and advanced packaging innovation. Strict regulatory frameworks and high consumer awareness encourage adoption of sustainable and recyclable barrier films. Retailers and brands in these countries prioritize packaging that offers both product safety and environmental compliance. Pharmaceutical and healthcare packaging also supports steady growth in the region. It benefits from established infrastructure and consistent demand for premium and specialty packaging solutions.

Southern Europe

Southern Europe holds a 26% share of the Europe High Barrier Packaging Films Market, led by Italy and Spain. The region benefits from a strong food and beverage sector that relies on advanced barrier films for product preservation. Expanding retail networks and rising disposable incomes support steady adoption of high-quality packaging. Demand for convenience-driven formats such as stand-up pouches and tray lidding films is increasing. Pharmaceutical packaging contributes to growth, supported by regional production hubs. It reflects balanced expansion driven by food safety priorities and consumer expectations for modern packaging.

Eastern and Northern Europe

Eastern and Northern Europe together account for 33% of the Europe High Barrier Packaging Films Market. Eastern Europe is emerging with rapid growth, supported by retail penetration and expanding urban populations. Rising adoption of packaged food and growing medical needs drive demand in countries like Poland and Russia. Northern Europe, led by Scandinavian nations, emphasizes eco-friendly packaging aligned with strong environmental policies. Adoption of recyclable and bio-based materials is higher in these markets. It highlights strong opportunities for suppliers targeting sustainability and localized innovations across both regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Europe High Barrier Packaging Films Market is highly competitive, with global and regional players striving to strengthen their positions. It is characterized by a mix of multinational corporations such as Amcor, Sealed Air, and Bemis alongside European innovators like Taghleef Industries, Jindal Poly Films, and Krehalon. Companies focus on sustainability-driven innovations, including recyclable and bio-based film solutions, to meet EU regulations and consumer expectations. Strategic mergers, product launches, and regional expansions are common to maintain market presence. It reflects intense rivalry with firms competing on technology, cost efficiency, and brand relationships across food, pharmaceutical, and personal care industries.

Recent Developments:

- In September 2025, Amcor Limited entered into a strategic partnership with GreenDot Packaging Solutions to promote the development of recyclable high-barrier packaging films for the European market, enhancing Amcor’s sustainability commitment and expanding their premium film portfolio.

- In November 2024, Jindal Poly Films Europe launched ultra-high barrier metallized films and Alox transparent barrier films designed to replace aluminum foil and provide enhanced protection, visibility, and recyclability for European flexible packaging—alongside new mono-PE recyclable structures under the Ethy-Lyte trademark platform.

- In May 2025, Taghleef Industries showcased its EXTENDO® Enhanced Barrier Films and innovative biobased, biodegradable, and recycled-content PP films at Ipack-Ima 2025 in Milan, Italy—these launches are designed to address new regulatory requirements and extend shelf life while supporting food waste reduction in Europe.

Report Coverage:

The research report offers an in-depth analysis based on product, application, technology, and material segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing demand for recyclable and bio-based films will reshape product development strategies.

- Food and beverage applications will remain the dominant revenue driver in the region.

- Pharmaceutical packaging will grow steadily, supported by stricter safety requirements.

- Premium and specialty packaging formats will see higher adoption in retail chains.

- Western Europe will continue to lead due to advanced industries and strong regulations.

- Southern Europe will expand steadily with rising consumption of packaged goods.

- Eastern Europe will emerge as a key growth hub supported by retail expansion.

- Investments in advanced multilayer and nanocomposite technologies will accelerate.

- Digital and smart packaging integration will enhance product traceability and appeal.

- Companies prioritizing sustainability and compliance will hold stronger competitive advantages.