Market Overview:

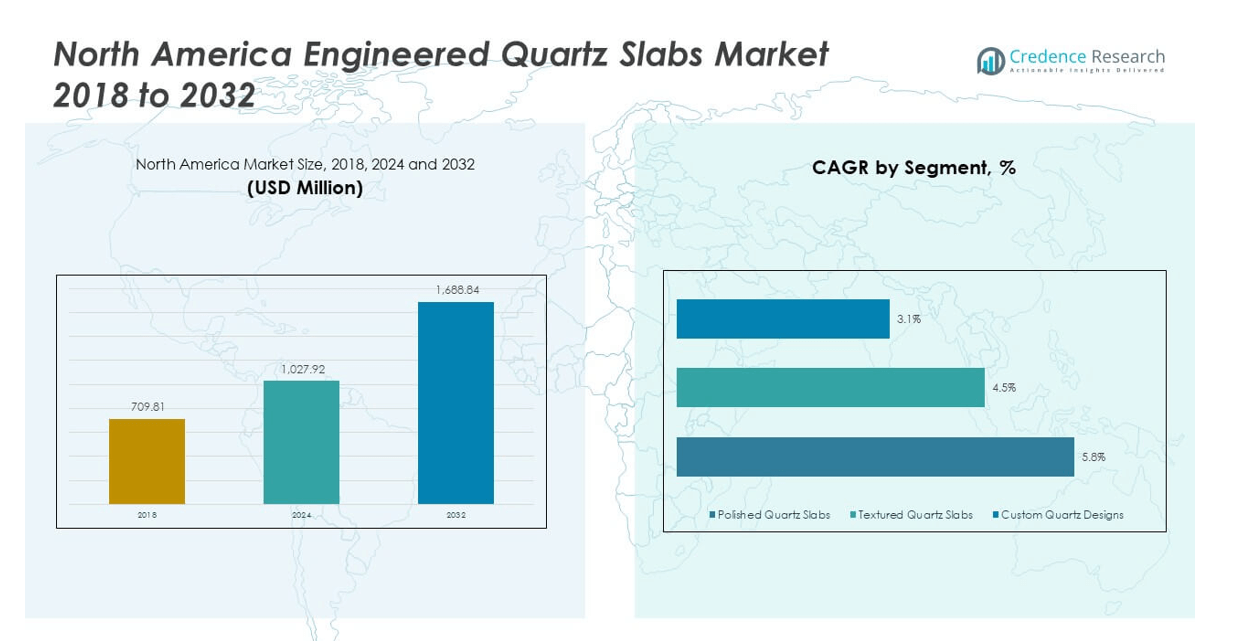

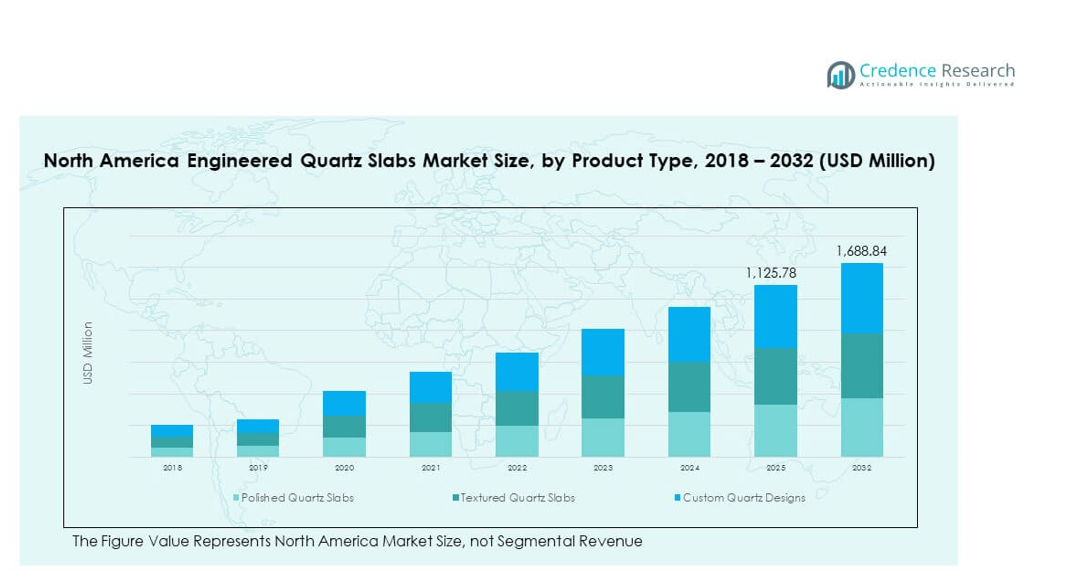

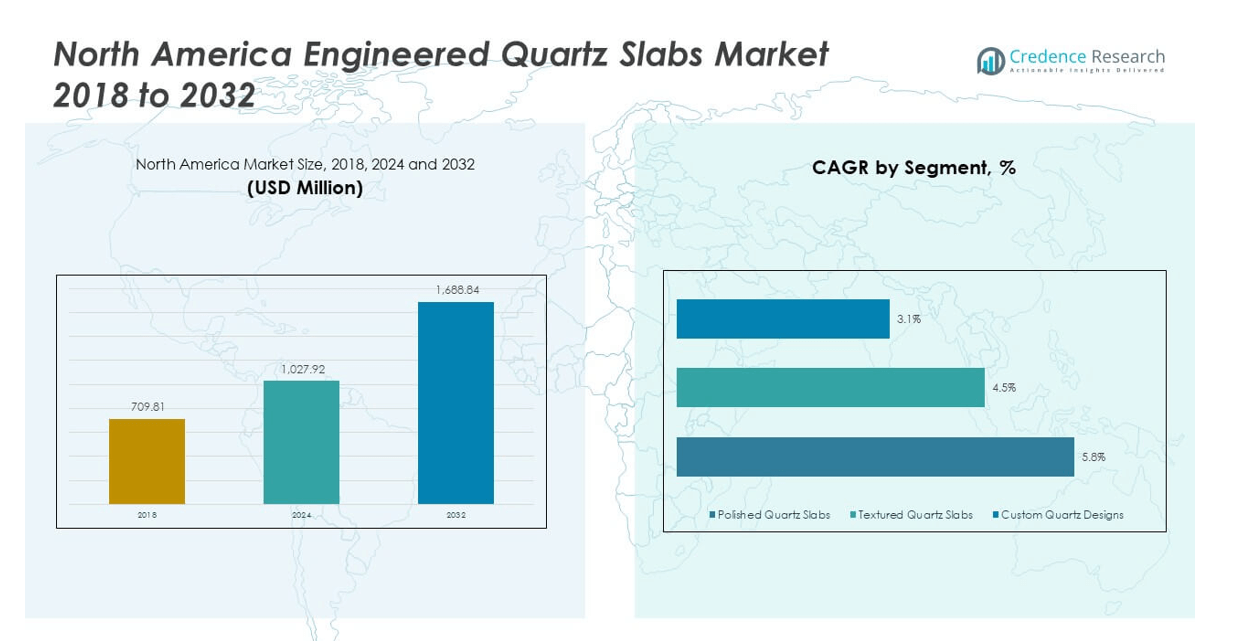

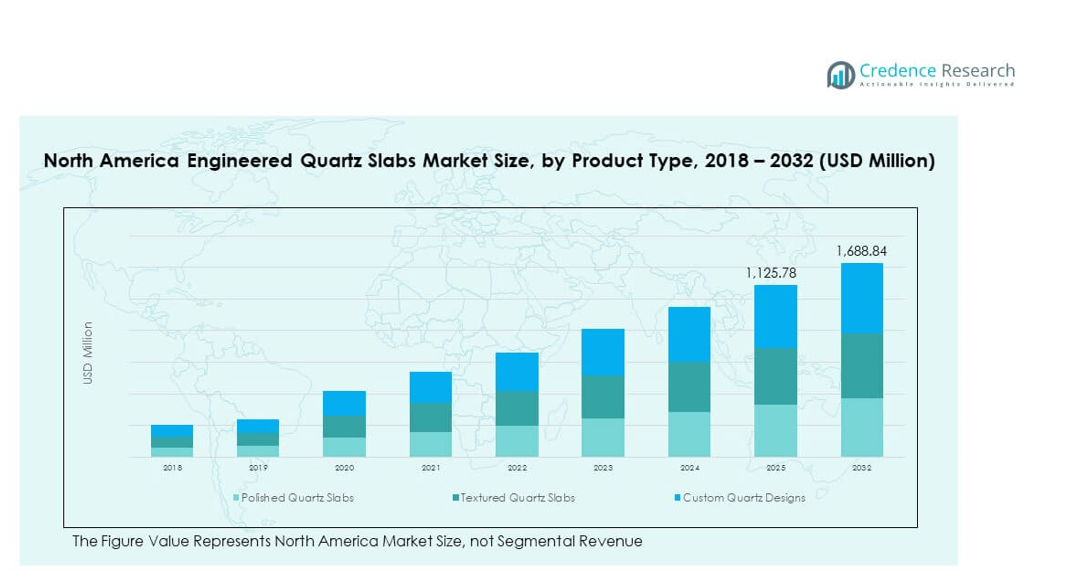

The North America Quartz Engineered Quartz Slabs Market size was valued at USD 709.81 million in 2018 to USD 1,027.92 million in 2024 and is anticipated to reach USD 1,688.84 million by 2032, at a CAGR of 6.00% during the forecast period. Rising demand for durable, non-porous, and low-maintenance surfaces has driven market growth across residential and commercial applications. The adoption of modern interior designs continues to enhance the use of quartz slabs in kitchens, bathrooms, and office spaces.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Quartz Engineered Quartz Slabs Market Size 2024 |

USD 1,027.92 million |

| North America Quartz Engineered Quartz Slabs Market, CAGR |

6.00% |

| North America Quartz Engineered Quartz Slabs Market Size 2032 |

USD 1,688.84 million |

The market is driven by consumer preference for premium aesthetics and enhanced durability in surface materials. Home renovation activities, coupled with growth in urban housing projects, have supported higher adoption of quartz slabs. Increased awareness of hygienic surfaces and stain resistance is strengthening the shift toward engineered quartz. Hospitality and retail sectors are also contributing to the demand, with developers focusing on stylish yet functional designs. Sustainability trends are further shaping material innovations and production methods.

Geographically, the U.S. dominates the North America Quartz Engineered Quartz Slabs Market due to strong construction activity, advanced design adoption, and higher consumer spending. Canada is emerging as a significant growth market, fueled by residential remodeling and increasing demand for upscale interiors. Mexico shows growing potential, supported by rising urbanization and expanding middle-class income. Each country benefits from distinct consumer behaviors and construction trends, creating opportunities for manufacturers to diversify offerings and strengthen regional supply chains.

Market Insights:

- The North America Quartz Engineered Quartz Slabs Market was USD 709.81 million in 2018, USD 1,027.92 million in 2024, and is projected to reach USD 1,688.84 million by 2032, at a CAGR of 6.00%.

- The U.S. leads with 65% share, supported by strong construction, advanced design adoption, and higher consumer spending.

- Canada holds 22% and is the fastest-growing region, driven by luxury remodeling, sustainability projects, and rising disposable incomes.

- Polished quartz slabs dominate with 64% share, benefiting from high usage in kitchens and bathrooms for their sleek aesthetics and stain resistance.

- Textured quartz slabs hold 23% share, while custom quartz designs account for 13%, reflecting demand for luxury finishes and personalized interiors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Aesthetic and Durable Surfaces

The North America Quartz Engineered Quartz Slabs Market is expanding due to growing preference for durable, stylish, and low-maintenance surfaces. Homeowners and developers are increasingly using quartz slabs for kitchens, bathrooms, and commercial interiors. It offers non-porous, stain-resistant, and hygienic qualities that make it superior to natural stone alternatives. Rising renovation projects and remodeling activities in urban housing further boost its usage. Hospitality and office construction also add to demand by prioritizing elegant yet practical designs. Shifts in consumer lifestyle toward premium finishes strengthen market adoption. Sustainability-driven innovations in engineered quartz production are also fueling growth.

- For instance, Caesarstone debuted its multi-material Porcelain Collection at the Kitchen & Bath Industry Show (KBIS) in January 2023, expanding its North American portfolio with over 100 colors and designs that emphasize both high durability and aesthetic appeal.

Growing Construction and Remodeling Activities

The construction sector in North America significantly supports the demand for quartz slabs. Residential and commercial property development continues to rise, creating strong opportunities for engineered quartz suppliers. It is favored for both new constructions and remodeling projects due to versatility and wide design availability. Increasing investment in luxury housing has heightened consumer spending on premium interior finishes. The popularity of modern and contemporary designs further positions quartz slabs as a preferred option. Government-backed housing projects also indirectly boost material demand. Enhanced distribution networks across major cities strengthen supply and consumer access.

- For instance, Cambria opened a new sales and distribution center and showroom in Houston, TX (13939 West Rd), which offers expanded capacity and a broad selection of quartz slab designs, directly supporting the surge in remodeling and residential upgrade projects in southern U.S. metro areas from 2022 onward.

Consumer Preference for Premium and Hygienic Materials

The market benefits from consumer preference for high-quality surfaces that combine luxury with function. Quartz slabs are valued for providing a clean, sleek appearance while maintaining long-term durability. It resists scratches, stains, and microbial growth, making it ideal for residential and commercial kitchens. Health-conscious consumers increasingly value non-porous materials, creating steady demand. Awareness of hygienic advantages drives preference over granite and marble in modern projects. The shift toward sustainable and eco-friendly construction solutions also supports this trend. Architects and designers favor quartz slabs for their blend of style, strength, and practicality.

Expanding Commercial Applications and Infrastructure Growth

Commercial applications are driving demand as businesses invest in durable interior finishes. Hotels, retail stores, and offices adopt quartz slabs for countertops, wall cladding, and flooring. It offers long-lasting performance with minimal maintenance, making it suitable for high-traffic environments. Rapid infrastructure development in urban areas further increases material use in projects. Retail expansion and hospitality upgrades are boosting demand for stylish surface solutions. Strong replacement demand in commercial properties sustains market momentum. The growing role of quartz slabs in institutional spaces like hospitals and schools broadens application scope.

Market Trends:

Integration of Sustainable Manufacturing Practices

The North America Quartz Engineered Quartz Slabs Market is witnessing a strong focus on sustainability. Manufacturers are incorporating recycled materials and adopting eco-friendly production techniques. It supports rising demand for green building materials in both residential and commercial projects. Consumers are increasingly favoring brands that emphasize reduced carbon footprint and responsible sourcing. Green certifications for construction are also driving adoption of sustainable quartz slabs. Government policies supporting environmentally friendly building materials strengthen this trend. Manufacturers are investing in advanced technologies to align with evolving sustainability goals.

- For instance, Cosentino launched HybriQ+ technology in its Silestone portfolio in 2021, utilizing 99% reused water, 100% renewable electric energy, and at least 20% recycled raw materials while reducing crystalline silica content to less than 50%, meeting stringent sustainability standards adopted in commercial building.

Expansion of Customization and Design Flexibility

Rising consumer demand for personalized designs is shaping quartz slab production. The market is seeing more colors, textures, and finishes tailored to diverse preferences. It allows homeowners and businesses to achieve unique interior aesthetics with engineered slabs. Architects and designers are leveraging customization for creative flexibility in projects. Luxury housing projects and commercial interiors prefer tailored solutions over mass-produced designs. Digital tools and advanced processing technologies are enhancing the ability to offer design variations. This trend creates differentiation for manufacturers and strengthens consumer appeal.

- For instance, Cambria introduced the Inverness Collection in 2021 and 2022, leveraging advanced digital processing and proprietary veining technology, such as textured “debossed” veins, to achieve intricate color variations and customizable slab aesthetics, appealing to luxury and bespoke interior projects.

Growing Penetration in E-Commerce Distribution

Digital platforms are playing a growing role in quartz slab distribution. Consumers increasingly explore online channels for selecting and comparing materials. It allows greater accessibility and expands reach beyond traditional specialty stores. Online platforms provide product visualization, customization tools, and pricing transparency. The rise of digital sales channels accelerates brand exposure in competitive markets. E-commerce also enables direct engagement with end-users, boosting brand loyalty. Manufacturers are investing in digital marketing and virtual showrooms to strengthen this trend.

Adoption of Technological Advancements in Production

The market is evolving through technological innovation in manufacturing processes. Automation, advanced cutting techniques, and digital printing enhance precision and design options. It helps manufacturers deliver high-quality slabs with consistent finishes at scale. Smart machinery reduces production costs while increasing efficiency. Integration of new technologies allows experimentation with unique patterns and natural stone-like appearances. Investment in R&D supports material improvements, such as heat resistance and extended durability. Technology adoption positions companies competitively in North America’s premium construction market.

Market Challenges Analysis:

High Competition and Price Pressures in the Market

The North America Quartz Engineered Quartz Slabs Market faces intense competition from both domestic and international players. Companies compete heavily on design, quality, and pricing to maintain market share. It leads to price pressures that affect margins, particularly for smaller firms. Natural stone alternatives like granite and marble still pose competition in certain consumer segments. Import-dependent suppliers face volatility in raw material costs and currency fluctuations. Shifting consumer preferences create challenges for consistent demand forecasting. Differentiating products while maintaining competitive prices remains a major obstacle for many manufacturers.

Supply Chain Issues and Rising Raw Material Costs

Another significant challenge lies in supply chain disruptions and cost fluctuations. Quartz slabs rely on steady access to raw materials like quartz crystals and resins. It becomes difficult when global supply chains face delays or trade restrictions. Rising energy costs and labor shortages in manufacturing hubs further elevate production expenses. Transportation and distribution challenges across North America add complexity for suppliers. Environmental regulations on mining and production also increase compliance costs. Manufacturers are under pressure to balance sustainability with affordability. Addressing these issues requires strategic sourcing and investment in resilient supply networks.

Market Opportunities:

Rising Scope in Residential and Commercial Renovation Projects

The North America Quartz Engineered Quartz Slabs Market offers opportunities through the growing demand for renovations. Increasing housing upgrades and remodeling projects drive quartz slab installations in kitchens and bathrooms. It benefits from consumer inclination toward premium interiors and stylish finishes. Developers and builders are also prioritizing quartz for its long-lasting performance and design appeal. The rise of luxury apartments and high-end commercial properties further expands opportunity. Strong urban growth trends continue to encourage quartz slab adoption. The demand for both functional and aesthetic surfaces supports sustained market potential.

Expansion Potential Through Product Innovation and Distribution Networks

Product innovation and improved supply channels create another opportunity for market growth. Manufacturers investing in new textures, eco-friendly materials, and digital design integration can gain competitive advantage. It enhances brand recognition and appeals to diverse consumer segments across North America. Expanding distribution networks, both offline and online, strengthens market penetration. Partnerships with construction firms and retail chains increase accessibility for end-users. Growth in digital sales channels opens new ways to reach customers directly. A blend of innovation and distribution expansion positions the market for strong future gains.

Market Segmentation Analysis:

Product Type

The North America Quartz Engineered Quartz Slabs Market is segmented into polished slabs, textured slabs, and custom designs. Polished slabs dominate due to their wide usage in kitchens and bathrooms, offering a sleek look and stain resistance. Textured slabs are growing in demand for luxury interiors, especially in high-end residential and commercial projects where tactile finishes add design depth. Custom quartz designs represent a niche but fast-rising category, driven by consumer demand for unique patterns and color variations. The ability to customize creates strong differentiation for premium projects and luxury housing developments.

- For instance, LX Hausys (formerly Hanwha Surfaces) launched the Viatera Masterpiece Collection in September 2022, offering large-format quartz slabs (up to 63″ x 130″) with dramatic veining and both polished and matte finishes, specifically targeted at premium kitchen and luxury design segments.

Application

Residential construction represents the leading segment, accounting for more than half of the market share in 2024. Homeowners prefer quartz for kitchen countertops, bathroom vanities, and flooring due to its durability and hygienic benefits. Remodeling activities in urban housing continue to boost this segment. Commercial construction follows, supported by adoption in hospitality, retail, and office interiors where both performance and aesthetics are key. Kitchen and bathroom design remain strong demand centers, with increasing use of engineered quartz in modern, stylish upgrades. Interior design applications are expanding as architects integrate quartz for wall cladding, flooring, and decorative surfaces.

- For instance, in mid-2023, MSI Surfaces expanded its Q Premium Natural Quartz Collection by introducing 15 new colors designed specifically for both residential kitchens and high-traffic commercial interiors, thereby enabling architects and designers to meet evolving client demands in both home and hospitality sectors.

Segmentation:

By Product Type

- Polished Quartz Slabs

- Textured Quartz Slabs

- Custom Quartz Designs

By Application

- Residential Construction

- Commercial Construction

- Kitchen & Bathroom Design

- Interior Design

- Others

By Region

- United States

- Canada

- Mexico

Regional Analysis:

United States

The U.S. dominates the North America Quartz Engineered Quartz Slabs Market with 65% share. Strong residential remodeling, luxury housing projects, and commercial property developments drive demand. Premium interior design preferences and high consumer spending support continued expansion. The country also benefits from advanced manufacturing capabilities and widespread distribution channels.

Canada

Canada holds 22% of the market, representing the fastest-growing region. Demand is fueled by upscale residential remodeling, luxury apartments, and sustainability-driven projects. Rising disposable incomes and preference for hygienic, durable surfaces are reshaping consumer adoption. The market benefits from growing collaboration between developers and quartz suppliers to meet design flexibility needs.

Mexico

Mexico accounts for 13% of the market, supported by urbanization and growing middle-class income. Demand is concentrated in residential upgrades and new housing construction. Commercial projects, including retail and hospitality, are adding momentum. Increased awareness of premium finishes and expanding supply networks are strengthening growth prospects.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Cambria

- Caesarstone

- MSI Surfaces (Q Premium Quartz)

- Silestone (Cosentino)

- HanStone Quartz

- Wilsonart Quartz

- Viatera (LG Hausys)

- PentalQuartz

- Corian Quartz (DuPont)

- Imperial Vanities

Competitive Analysis:

The North America Quartz Engineered Quartz Slabs Market is highly competitive, with leading global and regional manufacturers focusing on product innovation, design variety, and distribution strength. Companies such as Cambria, Caesarstone, and Cosentino dominate with strong brand presence and wide product portfolios. It faces intense competition from natural stone substitutes like granite and marble, but quartz maintains an edge due to superior durability and hygiene. Manufacturers are leveraging sustainability, digital sales channels, and custom design options to differentiate offerings. Strategic mergers, partnerships, and regional expansions remain critical to strengthening market positions.

Recent Developments:

- In April 2025, MSI Surfaces (Q Premium Quartz) introduced eight new Q Premium Natural Quartz colors at KBIS 2025 in Las Vegas, extending its portfolio for North American consumers and highlighting fresh designs influenced by contemporary interior trends. MSI also enhanced distribution partnerships in 2025 with a continued focus on dealer accessibility and new product launches.

- In February and March 2025, Viatera (LG Hausys) unveiled six new American-made VIATERA quartz colors, developed at its Adairsville, Georgia facility, featuring the new Taj Duna and Cloud Ridge colors—showcasing advanced low-silica NeoQ technology and enhanced natural pattern detail; this extended the VIATERA Suprema and Quartzite collections for North American kitchens and baths.

- In August 2024, Wilsonart announced the acquisition of Octopus Products, a Toronto-based decorative interior surfacing brand, integrating it into the Laminart portfolio to boost product selection and interior design options across North America.

- HanStone Quartz, part of Hyundai L&C Canada, launched a luxury large-format porcelain slab collection in 2025, expanding its core North American quartz portfolio and providing higher-functional surfaces to designers and homeowners interested in both quartz and porcelain.

Report Coverage:

The research report offers an in-depth analysis based on product type, application, and region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing demand for premium, non-porous surfaces in residential and commercial spaces.

- Rising adoption in luxury housing and upscale remodeling projects.

- Expanding hospitality and retail construction to drive commercial usage.

- Increasing focus on eco-friendly quartz slab production.

- Digital platforms to strengthen distribution and consumer engagement.

- Customization and design flexibility shaping competitive differentiation.

- Technological innovations improving durability and production efficiency.

- Canada to remain the fastest-growing market within the region.

- Strategic partnerships and acquisitions to enhance regional reach.

- Long-term growth supported by sustainability trends and consumer lifestyle shifts.