Market Overview

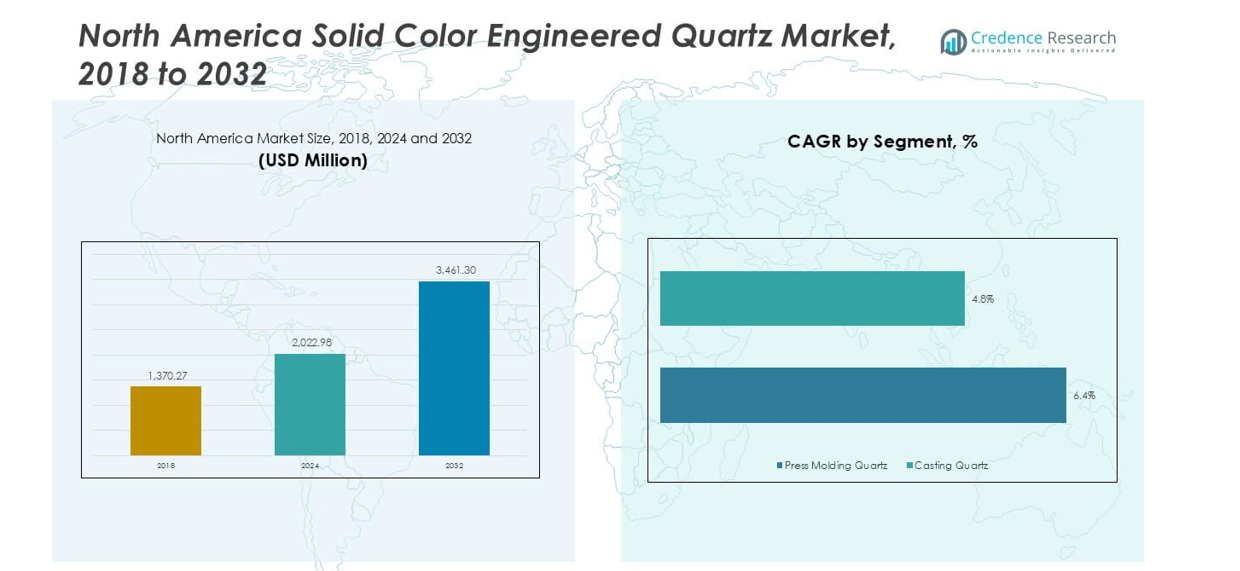

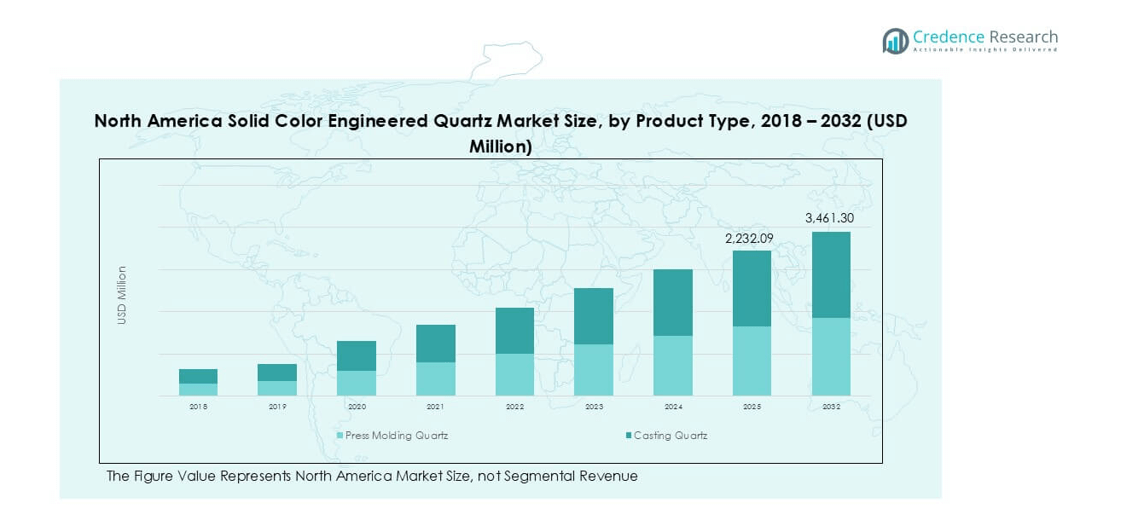

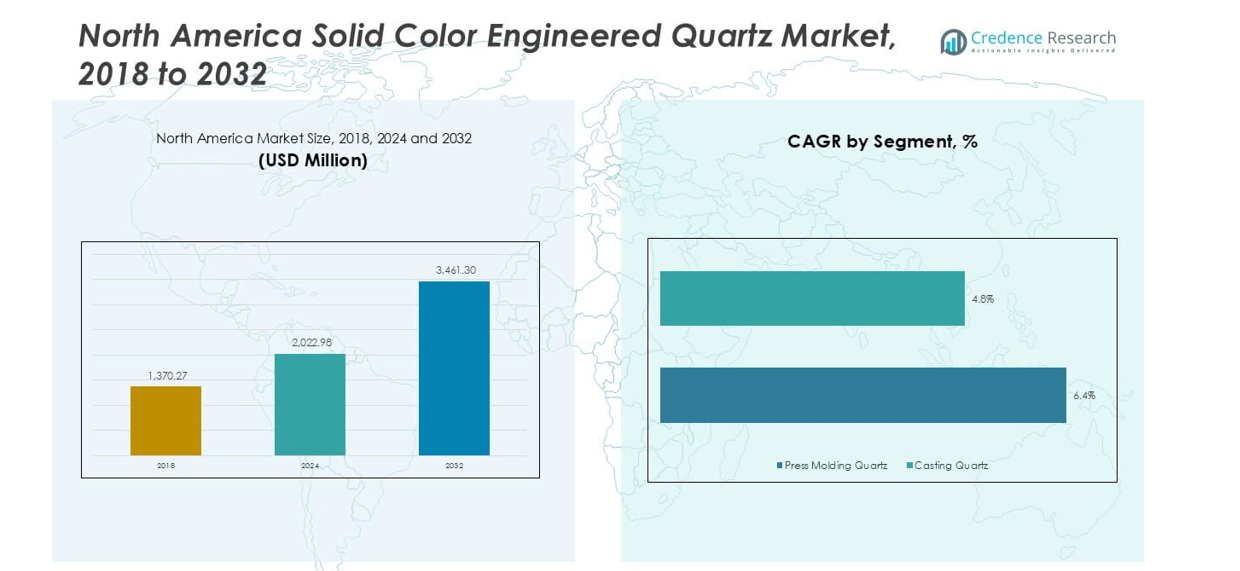

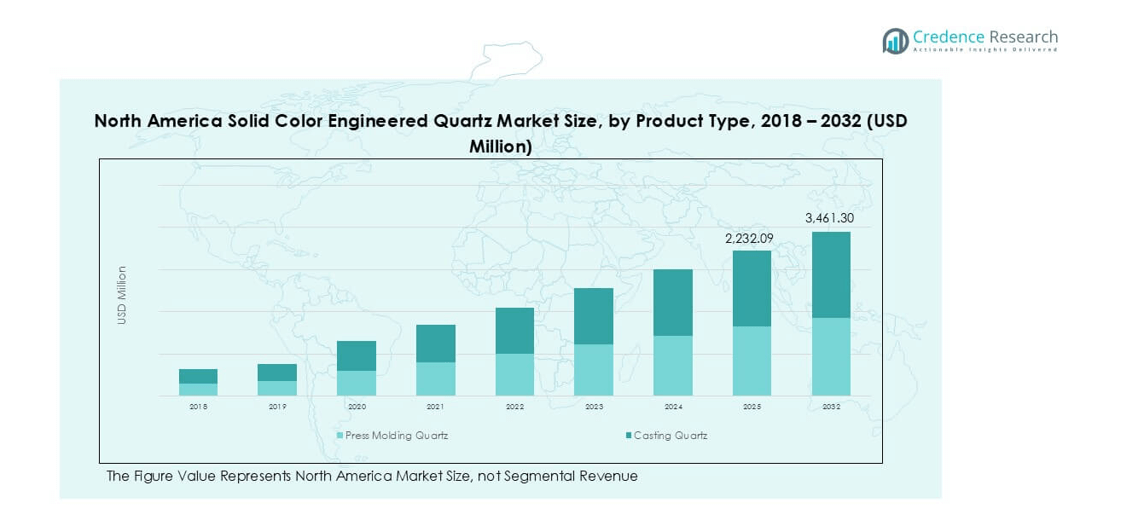

North America Solid Color Engineered Quartz market size was valued at USD 1,370.27 million in 2018, growing to USD 2,022.98 million in 2024, and is anticipated to reach USD 3,461.30 million by 2032, at a CAGR of 6.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Solid Color Engineered Quartz Market Size 2024 |

USD 2,022.98 million |

| North America Solid Color Engineered Quartz Market, CAGR |

6.5% |

| North America Solid Color Engineered Quartz Market Size 2032 |

3,461.30 million million |

The North America solid color engineered quartz market is led by major players including Cambria, Caesarstone, Silestone by Cosentino, HanStone Quartz, MSI Surfaces, Wilsonart Quartz, Vicostone, Daltile, Meta Surfaces, and LX Hausys Viatera. These companies dominate through strong distribution channels, advanced product portfolios, and brand-driven consumer loyalty. Cambria and Caesarstone hold a significant edge in premium residential applications, while MSI Surfaces and Daltile lead in cost-competitive segments. Regionally, the United States accounted for over 70% of the market share in 2024, driven by robust residential remodeling and commercial construction projects. Canada followed with 18%, supported by sustainable building trends, while Mexico held 12%, fueled by growing urbanization and mid-range residential demand. Together, these players and regions define the market’s competitive and geographic stronghold.

Market Insights

- The North America solid color engineered quartz market was valued at USD 1,370.27 million in 2018, grew to USD 2,022.98 million in 2024, and is projected to reach USD 3,461.30 million by 2032, at a CAGR of 6.5%.

- Rising demand for premium home renovations and durable, low-maintenance surfaces drives adoption, with countertops leading the application segment at 55% share in 2024.

- Key trends include the shift toward sustainable, eco-friendly quartz with recycled inputs and the rising popularity of customizable designs in solid colors, matte finishes, and stone-like textures.

- Competitive dynamics feature major players like Cambria, Caesarstone, Silestone by Cosentino, and MSI Surfaces, who strengthen market positions through advanced production, design innovations, and strong builder partnerships.

- Regionally, the United States dominates with 70% share, followed by Canada at 18% and Mexico at 12%, reflecting strong demand across both residential and commercial applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Press molding quartz dominated the North America solid color engineered quartz market in 2024, holding over 60% share. Its dominance stems from higher density, durability, and superior resistance to scratches compared to casting quartz. The technology’s ability to replicate natural stone aesthetics with consistent quality makes it the preferred option for premium applications. Strong adoption in residential and commercial interiors, coupled with advanced molding techniques, continues to drive growth. Casting quartz maintains presence in cost-sensitive projects but lags due to lower mechanical strength and limited design versatility.

- For instance, Caesarstone reported that casting-based specialty quartz accounted for less than 20% of its 2023 U.S. shipments, highlighting its niche appeal.

By Application

Countertops accounted for the largest share of over 55% in 2024, making them the leading application segment. The surge in kitchen and bathroom remodeling, particularly in urban households, has driven the demand for solid color engineered quartz. Consumers prefer quartz countertops for their stain resistance, minimal maintenance, and wide color palette. The rising influence of contemporary home design trends and the shift toward sustainable, non-porous surfaces strengthen market traction. Flooring and wall applications are gaining visibility, yet countertops remain the prime growth engine for manufacturers across the region.

- For instance, in 2023, Home Depot and Lowe’s both sold a significant number of quartz countertops, reflecting strong remodeling activity in the North American market.

By End User

The residential segment led the market with more than 65% share in 2024. Homeowners increasingly adopt engineered quartz for kitchen and bathroom surfaces, reflecting preferences for durability, modern aesthetics, and hygienic properties. Rising single-family housing projects, combined with the growing trend of premium renovations, support strong uptake. Builders and interior designers also favor quartz due to its consistent quality and availability in diverse finishes. While the commercial sector is expanding in retail, hospitality, and office spaces, residential installations remain the primary driver of overall market growth in North America.

Key Growth Drivers

Rising Demand for Premium Home Renovations

The North America solid color engineered quartz market is significantly driven by increasing investment in premium home renovations. Homeowners are prioritizing durable, low-maintenance, and aesthetically appealing materials for kitchens and bathrooms, where quartz countertops dominate. The material’s resistance to stains, scratches, and microbial growth makes it a preferred substitute for natural stones like granite or marble. Growth in single-family housing, combined with high consumer spending on luxury remodeling, continues to fuel adoption. Renovation activity in urban and suburban regions, supported by design-focused marketing from manufacturers, amplifies this trend.

- For instance, Cambria, a leading quartz surface manufacturer, operates a 1-million-square-foot slab manufacturing facility in Le Sueur, Minnesota.

Expanding Commercial Real Estate Development

Commercial infrastructure development across retail, hospitality, and office spaces strongly supports quartz demand. Developers and architects increasingly prefer engineered quartz for countertops, wall panels, and flooring, thanks to its uniform design, durability, and long lifecycle performance. The growing emphasis on modern, sleek aesthetics in hotels, restaurants, and corporate interiors enhances the role of quartz in project specifications. Additionally, the material’s compliance with sustainability certifications aligns with eco-conscious building codes. The surge in mixed-use developments and luxury commercial spaces is further creating strong opportunities for quartz producers across North America.

- For instance, MSI Surfaces, a prominent distributor, operates a state-of-the-art production facility in Latta, South Carolina, producing quartz countertops using Bretonstone technology.

Advancements in Manufacturing and Design Innovation

Technological innovations in quartz manufacturing act as a major growth catalyst. Press molding techniques and resin enhancements allow producers to deliver higher density, more durable slabs with improved scratch and heat resistance. Continuous improvements in design versatility, including matte, glossy, and stone-like finishes, expand customer choices. Automated production lines also reduce costs and ensure consistent quality, strengthening competitiveness against natural stone. Additionally, manufacturers are incorporating eco-friendly binders and recycled quartz to meet sustainability standards. These advancements not only address performance requirements but also support increasing consumer preference for modern, sustainable, and customizable interior solutions.

Key Trends & Opportunities

Growing Popularity of Sustainable and Eco-Friendly Materials

A notable trend in the North America market is the rising focus on sustainable quartz surfaces. Consumers and builders alike are prioritizing eco-conscious materials, prompting manufacturers to adopt recycled quartz and low-VOC resins. Engineered quartz producers are highlighting green certifications such as LEED compliance to appeal to environmentally aware buyers. This trend is also reinforced by government-driven sustainability programs and green building codes. The opportunity lies in companies that can balance premium performance with eco-friendly innovation, as demand for sustainable interior solutions will continue to expand across both residential and commercial projects.

- For instance, MSI’s Elite Quartz manufacturing facility in Latta, South Carolina, covers 360,000 square feet and has created over 150 new jobs.

Expansion of Customized Design Solutions

Another key opportunity arises from growing demand for personalized, design-driven quartz surfaces. Consumers increasingly favor custom color palettes, patterns, and textures that match modern interior design trends. Digital printing and advanced molding techniques enable manufacturers to replicate marble, concrete, and other natural looks while ensuring durability. The rising popularity of minimalist and contemporary home styles also drives demand for sleek, solid-color quartz slabs. This trend creates strong opportunities for producers that invest in design flexibility, enabling them to serve both residential homeowners seeking unique kitchens and commercial developers prioritizing brand-specific aesthetics.

Key Challenges

High Cost Compared to Alternative Materials

One of the primary challenges for the solid color engineered quartz market is its higher cost compared to substitutes such as laminates, tiles, and even some natural stones. While quartz offers superior durability and aesthetics, its premium pricing limits adoption in price-sensitive markets and mid-range residential projects. Builders working on budget housing often select cost-effective materials, constraining quartz penetration. To overcome this challenge, manufacturers must improve production efficiency, explore competitive pricing models, or offer entry-level quartz lines to capture a wider consumer base without compromising quality.

Environmental Concerns and Regulatory Scrutiny

Although quartz is promoted as a sustainable material, the use of resins and energy-intensive manufacturing processes creates environmental challenges. Dust emissions during fabrication also raise occupational health concerns, prompting stricter workplace regulations. Increasing regulatory scrutiny on material safety and environmental compliance can raise production costs for manufacturers. Moreover, consumers seeking fully natural or low-impact materials may shift to alternatives like recycled ceramics or bamboo composites. To address this challenge, industry players are investing in greener technologies, recycled inputs, and safer production methods to maintain compliance and retain consumer trust.

Regional Analysis

United States

The United States dominated the North America solid color engineered quartz market in 2024, accounting for over 70% share. Strong demand is fueled by the country’s thriving residential remodeling sector, particularly in kitchen and bathroom upgrades. Rising consumer preference for durable, non-porous, and aesthetically versatile surfaces positions quartz as the top choice over granite and laminate. Large-scale adoption in commercial real estate, including hotels, restaurants, and office interiors, adds momentum. The availability of advanced manufacturing facilities and a wide range of product designs ensures continued U.S. leadership, supported by high per-capita spending on premium home improvement projects.

Canada

Canada held nearly 18% share of the North America solid color engineered quartz market in 2024. Market growth is supported by increasing investments in residential construction and renovation, particularly in urban centers such as Toronto and Vancouver. Canadian consumers are adopting quartz countertops due to their durability and easy maintenance, aligning with modern lifestyle trends. Government programs encouraging sustainable building materials also support wider adoption. While natural stone remains a competitor, quartz is gaining preference in premium housing and retail projects. The country’s rising demand for eco-friendly and customizable surfaces continues to create opportunities for manufacturers.

Mexico

Mexico accounted for approximately 12% share of the North America solid color engineered quartz market in 2024. The market is growing steadily, driven by urbanization, rising middle-class incomes, and expanding residential construction. Demand is particularly strong in new housing developments where affordable yet durable surfacing materials are in high demand. Although cost sensitivity has slowed penetration in lower-end projects, quartz adoption is increasing in premium households and modern commercial spaces. Local distributors and imports are expanding availability across key cities. With growing investments in infrastructure and hospitality projects, Mexico is emerging as an important growth hub in the region.

]

Market Segmentations:

By Product Type

- Press Molding Quartz

- Casting Quartz

By Application

- Flooring

- Walls

- Countertops

- Door Jambs

- Others

By End User

By Geography

Competitive Landscape

The North America solid color engineered quartz market is highly competitive, with a mix of established global brands and regional manufacturers driving innovation and market share. Leading companies such as Cambria, Caesarstone, Silestone by Cosentino, HanStone Quartz, and MSI Surfaces dominate through strong brand presence, extensive distribution networks, and advanced manufacturing capabilities. These players compete on product quality, design variety, and sustainability credentials, with growing focus on eco-friendly resins and recycled quartz. Smaller players like Meta Surfaces and Wilsonart Quartz target niche markets with customized solutions and cost-effective offerings. The competitive landscape is further shaped by continuous product launches, marketing campaigns emphasizing durability and aesthetics, and partnerships with builders and designers to strengthen project-based sales. Mergers, acquisitions, and expansion of manufacturing facilities are common strategies adopted to secure long-term growth. With rising demand for personalized, durable, and sustainable surfaces, competition is intensifying across both residential and commercial segments in North America.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cambria

- Caesarstone

- HanStone Quartz

- MSI Surfaces

- Silestone by Cosentino

- Meta Surfaces

- Wilsonart Quartz

- Vicostone

- Daltile

- LX Hausys Viatera

Recent Developments

- In July 2025, Caesarstone launched ICON™, a revolutionary crystalline silica-free solid surface (less than 1% silica) with approximately 80% recycled content, prioritizing both safety for fabricators and sustainability for consumers.

- In July 2025, Vicostone launched 10 new quartz colors for the fall season, focusing on inspirations from natural elements and aesthetics.

- In May 2025, RAK Ceramics commissioned its new next-generation slab production facility using Continua+ PCR 2180 technology, marking a significant technological leap in large-format engineered quartz and ceramic surfaces.

- In May 2024, WK Stone partnered with Eight Homes to offer Quantum Zero, a recycled surface as a safe alternative to high-silica engineered stone.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily due to strong demand in residential remodeling projects.

- Countertops will remain the leading application supported by design-focused consumer preferences.

- Press molding quartz will continue to dominate product type due to durability and quality.

- Sustainable and recycled quartz surfaces will gain wider adoption among eco-conscious buyers.

- Commercial real estate projects will drive demand for durable and aesthetic interior solutions.

- United States will maintain leadership, supported by high consumer spending on premium interiors.

- Canada will grow steadily with emphasis on sustainable building materials and green certifications.

- Mexico will emerge as a growth hub with rising urbanization and middle-class housing demand.

- Competition will intensify as global brands and regional players invest in innovation and design.

- Technological advancements in manufacturing will reduce costs and expand customization opportunities for buyers.