Market Overview:

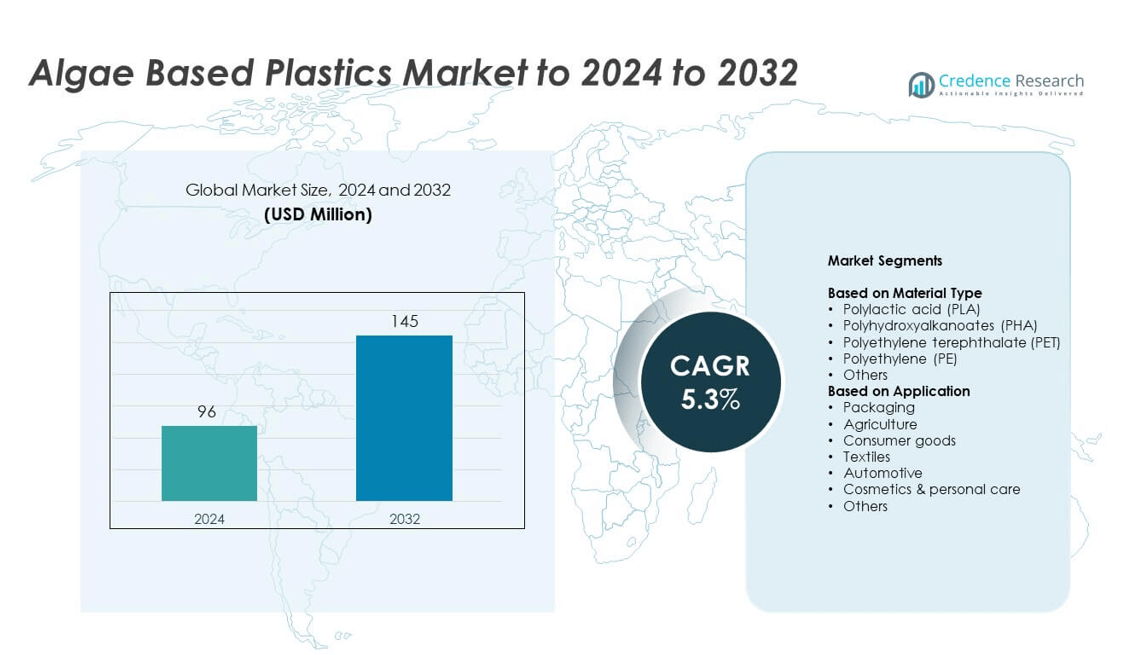

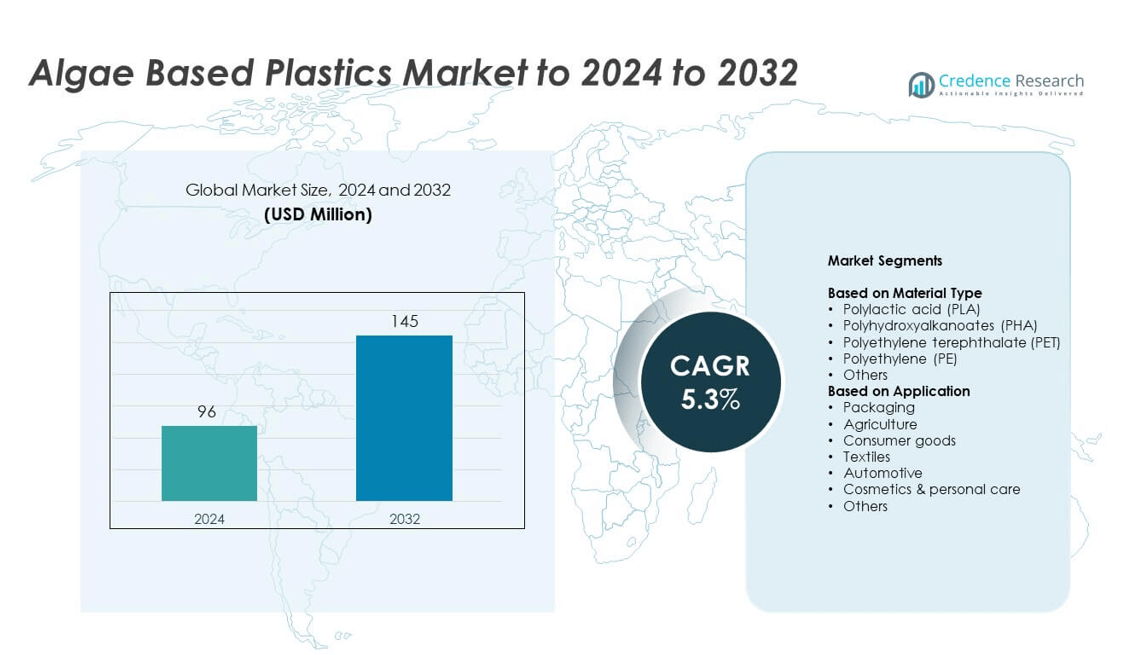

Algae Based Plastics Market size was valued at USD 96 million in 2024 and is anticipated to reach USD 145 million by 2032, at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Algae Based Plastics Market Size 2024 |

USD 96 million |

| Algae Based Plastics Market, CAGR |

5.3% |

| Algae Based Plastics Market Size 2032 |

USD 145 million |

The algae-based plastics market features prominent players such as Algix LLC, FLEXSEA, Eranova, ALGBIO, Sway Innovation Co., Notpla Limited, Lifeasible, PT Seaweedtama Biopac Indonesia, BZEOS, BLOM, Evoware, and Checkerspot. These companies focus on developing biodegradable and renewable polymers through advanced algae cultivation and polymerization technologies. Strategic collaborations and investments in scalable bioprocessing are enhancing global supply capabilities. North America led the market with a 37.8% share in 2024, driven by strong R&D initiatives and sustainability regulations, followed by Europe with 31.4%, supported by circular economy programs and corporate commitments to eco-friendly materials.

Market Insights

- The algae-based plastics market was valued at USD 96 million in 2024 and is projected to reach USD 145 million by 2032, growing at a CAGR of 5.3% during the forecast period.

- Rising demand for biodegradable and renewable materials across packaging and consumer goods sectors is driving market expansion globally.

- Trends include advancements in algae cultivation, polymer extraction, and growing use of algae-based resins in high-performance packaging and textiles.

- The competitive landscape is shaped by players investing in scalable production, cost reduction, and material performance improvement to meet sustainability goals.

- North America led with a 37.8% share in 2024, followed by Europe with 31.4%, while the packaging segment dominated applications with 46.7% share, supported by strict environmental regulations and strong corporate sustainability commitments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material Type

The polyhydroxyalkanoates (PHA) segment led the algae-based plastics market with a 39.2% share in 2024. PHA’s full biodegradability and compatibility with marine environments make it the most preferred bio-plastic derived from algae. Its demand is rising in sustainable packaging and disposable product manufacturing as global regulations tighten on single-use plastics. Companies are investing in cost-efficient fermentation and extraction technologies to enhance yield and purity. The growing preference for compostable materials and reduced carbon footprint further supports PHA’s dominance across packaging, agriculture, and consumer goods applications.

- For instance, Danimer Scientific’s Winchester, Kentucky plant was a retrofitted facility that began commercial operation with an annual capacity of approximately 9,000 to 10,000 tons of PHA.

By Application

The packaging segment dominated the market with a 46.7% share in 2024. Algae-based plastics are increasingly adopted for food containers, films, and flexible packaging due to their biodegradability and lightweight nature. Regulatory pressures on petroleum-based plastics, combined with brand commitments toward sustainable packaging, drive large-scale adoption. Firms are focusing on bio-resin formulations that provide strength, heat resistance, and moisture control for extended shelf life. Growing e-commerce activity and consumer awareness of eco-friendly packaging solutions further strengthen this segment’s leadership in the market.

- For instance, Notpla replaced 4.4 million single-use plastic units in 2023 with seaweed-based packaging used by partners across Europe.

Key Growth Drivers

Rising Demand for Sustainable Alternatives

Growing environmental concerns and strict regulations on single-use plastics are boosting demand for algae-based plastics. These bioplastics offer full biodegradability and lower carbon emissions, aligning with global sustainability targets. Industries such as packaging and consumer goods are rapidly shifting to algae-derived materials to meet eco-label certifications and reduce dependence on fossil-based polymers. This transition is supported by policy incentives and rising consumer preference for eco-friendly products, reinforcing algae-based plastics as a credible alternative to petroleum-derived materials.

- For instance, Kaneka’s PHBH earned “OK Biodegradable MARINE,” which requires ≥90% biodegradation in 30 °C seawater within six months.

Advancements in Biopolymer Production Technologies

Ongoing innovation in biopolymer extraction and processing technologies enhances yield and cost efficiency in algae-based plastic production. Companies are adopting photobioreactors and optimized fermentation techniques to scale production while maintaining material strength and flexibility. Such technological improvements are making algae-derived polymers more commercially viable for large-scale applications, including packaging and textiles. The shift toward automation and continuous cultivation further supports reduced production costs and improved product consistency, driving market expansion across multiple industries.

- For instance, CJ BIO commissioned a 5,000 t/yr amorphous-PHA facility in Pasuruan, Indonesia, and began production in 2022.

Corporate Sustainability Initiatives and Circular Economy Goals

Major corporations are increasingly investing in bio-based materials to achieve carbon neutrality and circular economy objectives. Algae-based plastics provide a sustainable raw material that supports recyclability and biodegradability without compromising performance. Global brands in consumer goods and packaging are integrating algae-based polymers to replace traditional plastics, driven by internal ESG goals. This widespread corporate adoption is accelerating commercialization, enhancing investor confidence, and fostering partnerships for industrial-scale bioplastic production.

Key Trends & Opportunities

Integration in High-Performance Packaging Solutions

Algae-based plastics are increasingly used in advanced packaging applications due to their superior barrier properties and biodegradability. Manufacturers are developing blends that maintain durability and resistance to moisture, heat, and UV light. The growing focus on sustainable food packaging and e-commerce delivery solutions presents a major opportunity. Continuous improvements in algae resin formulations are expanding use across flexible and rigid packaging, positioning algae-based plastics as a viable alternative to conventional materials in global supply chains.

- For instance, Handtmann’s ConProSachet system produces seaweed-based sachets by co-extrusion technology. Other related Handtmann systems for products in alginate casings (like sausage-shaped items or soup add-ins) can achieve speeds of up to 300 portions per minute (e.g., KVLSH 162 model) for single-lane operations, or up to 3,000 portions per minute for cocktail products in a multi-forming line (KLSH 153 model).

Expansion Across Non-Packaging Industries

The versatility of algae-based plastics is opening new avenues in automotive, textiles, and cosmetics sectors. These bioplastics are being tested for lightweight components, biodegradable fabrics, and eco-friendly cosmetic packaging. Advancements in algae polymer blends enhance thermal stability and elasticity, making them suitable for durable applications. Rising consumer awareness and industrial collaborations are promoting algae-based material integration beyond packaging, strengthening long-term growth potential across multiple verticals.

- For instance, Nature Coatings’ BioBlack Beauty pigments achieved 100% biobased certification from the USDA’s BioPreferred Program.

Key Challenges

High Production Costs and Limited Scalability

Despite environmental benefits, algae-based plastic production remains expensive compared to petroleum-based polymers. Cultivation, extraction, and polymerization processes require significant capital investment and technical precision. Limited industrial-scale infrastructure also restricts output capacity. While ongoing R&D aims to reduce costs, price competitiveness remains a major barrier to adoption. Achieving cost parity through technological optimization and government incentives is crucial for wider commercial use in mainstream plastic manufacturing.

Regulatory and Standardization Barriers

The absence of unified global standards for bioplastics certification poses challenges for producers and buyers. Different biodegradability testing norms across regions create inconsistencies in product labeling and market approval. Regulatory complexities slow product launches and limit cross-border trade opportunities. Establishing harmonized policies for bio-based materials and biodegradability criteria is essential to enhance consumer trust and encourage broader adoption of algae-based plastics in both developed and emerging markets.

Regional Analysis

North America

North America held a 37.8% share of the algae-based plastics market in 2024. Strong regulatory frameworks supporting bioplastics adoption, coupled with growing corporate sustainability commitments, drive regional demand. The United States leads due to investments in algae cultivation and polymer processing facilities. Rising awareness of carbon footprint reduction and biodegradable packaging is strengthening adoption across food and beverage and consumer goods sectors. Technological advancements in bioengineering and collaboration between startups and major packaging manufacturers are further accelerating commercialization of algae-based polymers in North America.

Europe

Europe accounted for a 31.4% share in 2024, driven by stringent environmental policies and circular economy initiatives. The European Union’s ban on single-use plastics and incentives for renewable material usage promote algae-based plastics adoption. Countries such as Germany, France, and the Netherlands are at the forefront, investing heavily in bio-based polymer R&D. Packaging, automotive, and personal care sectors are increasingly integrating algae-derived plastics to meet sustainability targets. Collaborative projects between academia and industry are enhancing production scalability and reinforcing Europe’s leadership in bio-innovation and sustainable material deployment.

Asia-Pacific

Asia-Pacific captured a 23.9% share of the market in 2024, supported by growing industrialization and government focus on reducing plastic waste. Japan, China, and South Korea are leading regional production through technological advancements in microalgae cultivation. Expanding packaging and textile industries in emerging economies such as India and Indonesia also contribute to rising demand. Increasing investment in green manufacturing infrastructure and favorable regulatory support enhance regional competitiveness. The growing presence of local bioplastic producers and sustainable consumer preferences are establishing Asia-Pacific as a high-potential growth hub for algae-based plastics.

Latin America

Latin America represented a 4.2% share in 2024, with rising interest in sustainable materials within Brazil, Chile, and Mexico. The region’s expanding agricultural and packaging industries are adopting bio-based solutions to align with global export standards. Government initiatives encouraging bioeconomy development are stimulating investment in algae-based production facilities. Despite slower commercialization than developed regions, growing awareness and partnerships with European bioplastic companies are strengthening local production capacity. Continued innovation in low-cost algae cultivation could further expand Latin America’s role in the global bio-based plastics landscape.

Middle East & Africa

The Middle East & Africa held a 2.7% market share in 2024, supported by emerging sustainability goals and growing diversification of material industries. Nations such as the UAE and South Africa are investing in green technology to reduce dependence on fossil-based products. Limited production infrastructure remains a constraint, yet increasing interest from packaging and consumer goods sectors offers growth prospects. Research collaborations with international firms and focus on renewable resource utilization are expected to expand algae-based plastic adoption in the coming years across this developing region.

Market Segmentations:

By Material Type

- Polylactic acid (PLA)

- Polyhydroxyalkanoates (PHA)

- Polyethylene terephthalate (PET)

- Polyethylene (PE)

- Others

By Application

- Packaging

- Agriculture

- Consumer goods

- Textiles

- Automotive

- Cosmetics & personal care

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The algae-based plastics market is characterized by active participation from key players such as Algix LLC, FLEXSEA, Eranova, ALGBIO, Sway Innovation Co., Notpla Limited, Lifeasible, PT Seaweedtama Biopac Indonesia, BZEOS, BLOM, Evoware, and Checkerspot. The competitive environment emphasizes innovation in bio-polymer synthesis, sustainable resin development, and low-cost algae cultivation systems. Companies are focusing on scaling production capacity, optimizing bioprocess efficiency, and enhancing polymer strength and flexibility for diverse end-use applications. Strategic collaborations with packaging, textile, and consumer goods industries are accelerating commercialization efforts. Increasing partnerships with research institutions support continuous product innovation and performance improvement. The market also witnesses rising investments in biorefinery technologies and closed-loop systems to achieve zero-waste production models. Competition is intensifying as emerging players enter the space with advanced eco-designs and cost-effective bioplastic solutions, contributing to a rapidly evolving landscape that prioritizes performance, biodegradability, and environmental compliance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Algix LLC

- FLEXSEA

- Eranova

- ALGBIO

- Sway Innovation Co.

- Notpla Limited

- Lifeasible

- PT Seaweedtama Biopac Indonesia

- BZEOS

- BLOM

- Evoware

- Checkerspot

Recent Developments

- In 2024, French biotech startup Eranova and Somater, a packaging manufacturer, collaborated to develop ALGX, a 100% bio-based polymer material for packaging derived from green algae harvested from the Étang de Berre lagoon in France.

- In 2024, Notpla and Duni Group launched the “Alga” product line, which features plastic-free food packaging made from cardboard coated with a renewable seaweed-based material

- In 2022, Checkerspot launched a “Pollinator Kit,” which is a direct-to-designer kit that allows companies to experiment with new algae-based plastic materials aimed at replacing traditional polyurethane resin, a fossil fuel-derived substance found in many home goods.

Report Coverage

The research report offers an in-depth analysis based on Material Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for biodegradable and renewable plastics will continue to rise across global packaging industries.

- Advancements in algae cultivation and polymer extraction will improve cost efficiency and scalability.

- Corporate sustainability targets will drive greater adoption of algae-based polymers in consumer goods.

- Governments will expand incentives and regulations supporting bio-based material development.

- Integration of algae-based plastics in automotive and textile sectors will broaden market applications.

- Collaboration between biotechnology firms and packaging manufacturers will accelerate material innovation.

- Research into algae strain optimization will enhance polymer yield and performance characteristics.

- Expansion of bioplastic production facilities in Asia-Pacific will boost regional competitiveness.

- Improved compostability standards will strengthen consumer trust and regulatory acceptance.

- Continued investment in circular economy initiatives will support long-term market growth and stability.