Market Overview:

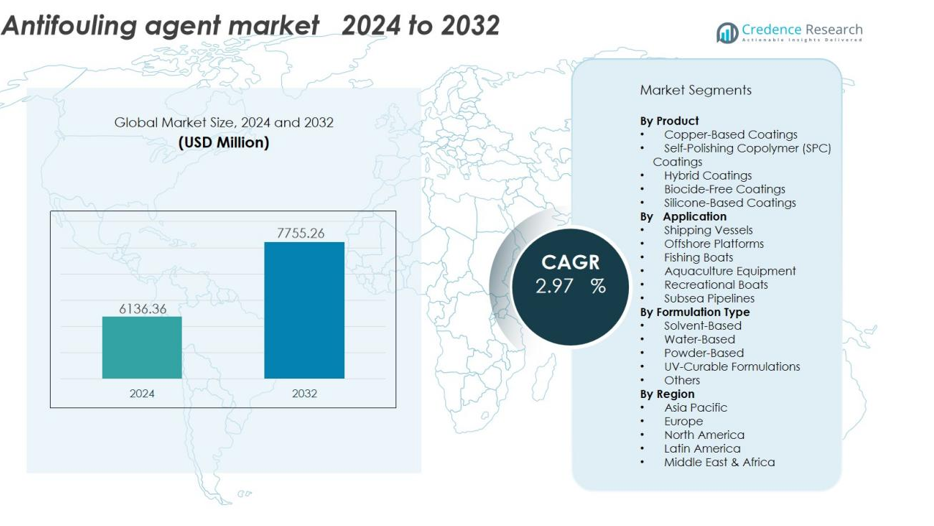

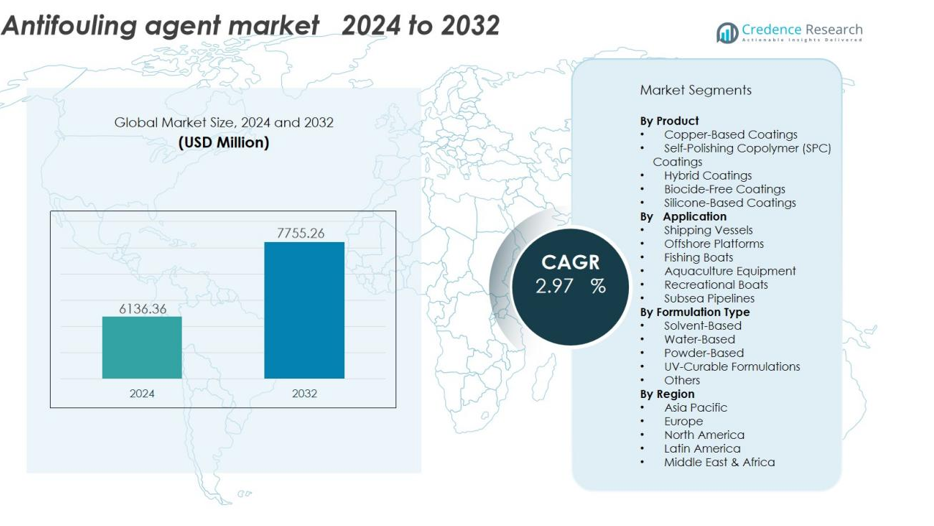

The Antifouling agent market size was valued at USD 6136.36 million in 2024 and is anticipated to reach USD 7755.26 million by 2032, at a CAGR of 2.97 during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Antifouling agent market Size 2024 |

USD 6136.36 million |

| Antifouling agent market, CAGR |

2.97% |

| Antifouling agent market Size 2032 |

USD 7755.26 million |

Market expansion is mainly driven by rising shipping and maritime activities, coupled with growing environmental awareness. As global trade increases, vessel owners are adopting antifouling coatings to prevent biofouling, reduce fuel consumption, and enhance hull performance. Additionally, stricter regulations are pushing the adoption of eco-friendly, biocide-free formulations and boosting innovation across the marine coatings industry.

Asia Pacific leads the market due to its expanding shipbuilding industry, aquaculture sector, and port infrastructure. North America and Europe represent mature markets with strong regulatory oversight and established players, ensuring steady but moderate growth. Meanwhile, the Middle East & Africa and Latin America offer emerging opportunities supported by increasing maritime trade activities, offshore oil exploration, and gradual implementation of environmental standards.

Market Insights:

- The Antifouling Agent Market size was valued at USD 6,136.36 million in 2024 and is projected to reach USD 7,755.26 million by 2032, growing at a CAGR of 2.97% during the forecast period.

- Asia Pacific holds 45% share, driven by its strong shipbuilding industries, expanding aquaculture, and major port infrastructure in China, Japan, and South Korea.

- Europe accounts for 25% share due to strict environmental regulations, advanced marine technology, and growing adoption of biocide-free coatings across Norway, Germany, and the United Kingdom.

- North America captures 18% share, supported by strong offshore oil exploration, naval defense investments, and increased use of high-performance coatings in the United States and Canada.

- Copper-based coatings dominate the product segment with 38% share, while the shipping vessel application segment leads with 42% share, supported by expanding global maritime trade and demand for efficient vessel maintenance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Global Maritime Trade and Fleet Expansion

The Antifouling Agent Market is expanding due to strong growth in global shipping and marine trade. Increasing vessel traffic in international waters raises demand for coatings that prevent biofouling and maintain fuel efficiency. It helps reduce drag and operating costs for shipping companies, improving overall fleet performance. The rapid rise in commercial shipping activities across Asia and Europe continues to boost product consumption in ship maintenance and dry-docking operations.

- For Instance, Nippon Paint Marine has a long-standing relationship with China COSCO Shipping, which has applied Nippon Paint Marine’s advanced antifouling coatings, such as the FASTAR series, to the hulls of many of its vessels over the years.

Growing Environmental Regulations and Sustainability Initiatives

Stringent environmental standards are driving the shift toward eco-friendly antifouling agents. Governments are enforcing restrictions on harmful biocides, prompting manufacturers to develop non-toxic, silicone-based, and nanotechnology-driven coatings. It encourages innovation in sustainable solutions that meet both regulatory and performance requirements. The industry’s movement toward green technology is reshaping long-term growth strategies across the marine coatings ecosystem.

- For Instance, AkzoNobel’s Intercept 8500 LPP is a biocidal self-polishing copolymer (SPC) coating launched in 2016, not a silicone-based coating launched in 2024. The coating is highlighted for demonstrating significant fuel savings and CO2 emission reductions through superior hull performance, rather than a specific percentage reduction in biocide emissions.

Technological Advancements in Coating Formulations

Continuous research in nanotechnology and polymer science is improving product performance and durability. Advanced coatings offer extended protection against marine organisms and lower maintenance frequency, reducing operational downtime. It supports vessel operators in achieving long-term efficiency and environmental compliance. Growing collaboration between coating manufacturers and marine research institutions is accelerating product innovation and commercialization.

Expansion of Offshore Oil, Gas, and Renewable Energy Projects

Increasing offshore exploration and wind energy projects are creating new growth opportunities. Offshore structures such as rigs, platforms, and turbines require robust protection from corrosion and biofouling. It strengthens demand for high-performance coatings designed for harsh marine conditions. The steady rise in ocean-based industrial development continues to support the global antifouling agent market.

Market Trends:

Adoption of Eco-Friendly and Biocide-Free Coatings Driven by Environmental Concerns

The Antifouling Agent Market is witnessing a clear transition toward sustainable and biocide-free solutions. Growing awareness of the ecological impact of toxic coatings has accelerated the shift to silicone-based and fouling-release technologies. It helps reduce the leaching of harmful substances into marine ecosystems, aligning with international maritime environmental goals. Manufacturers are introducing advanced polymer-based coatings that rely on surface smoothness to prevent organism attachment rather than chemical toxicity. The International Maritime Organization’s (IMO) stricter emission and waste regulations are reinforcing this trend across shipyards and port authorities. It is also encouraging strategic partnerships between coating producers and marine research institutes to create safer, long-lasting, and compliant products. The ongoing emphasis on green innovation is reshaping the competitive landscape toward sustainable growth.

- For instance, paint manufacturer Jotun has developed a range of advanced antifouling coatings designed to optimize hull performance, which helps vessels comply with various environmental regulations, including the IMO’s MEPC.331(76) directive.

Integration of Nanotechnology and Smart Surface Technologies to Enhance Efficiency

Rapid technological advancement is driving the development of nanostructured and smart antifouling coatings with improved efficiency. These coatings offer enhanced resistance against microbial adhesion, improved hydrophobicity, and longer service life. It supports vessel operators in reducing maintenance cycles and optimizing fuel performance. Nanomaterials such as graphene, titanium dioxide, and silica are gaining traction for their superior protective properties and cost-effectiveness. The rise in demand for real-time hull performance monitoring is pushing manufacturers to integrate smart sensors with coating systems. It enables predictive maintenance and better operational planning for marine assets. The convergence of nanotechnology and smart coating technology is setting a new standard for performance and sustainability in the global antifouling agent market.

- For instance, Nippon Paint Marine reports that its nanodomain structured hydrolysis antifouling paint, FASTAR, has been applied on over 1,000 vessels since its 2021 launch.

Market Challenges Analysis:

Stringent Regulatory Standards and Compliance Limitations Affecting Product Adoption

The Antifouling Agent Market faces growing challenges from evolving environmental and safety regulations. Government restrictions on harmful biocides and heavy metals have limited the use of traditional formulations. It compels manufacturers to reformulate products, which increases development costs and approval timelines. Compliance with regional and international maritime standards often requires multiple testing phases, delaying product commercialization. Smaller manufacturers struggle to meet these evolving standards, which limits competition and innovation in some regions. The cost of meeting new regulatory demands continues to pressure profit margins and delay market entry for next-generation coatings.

High Cost of Advanced Coatings and Limited Awareness in Developing Regions

The adoption of advanced antifouling coatings remains constrained by their high production and application costs. It poses a barrier for small vessel owners and operators with limited maintenance budgets. Many developing countries lack awareness and access to modern, eco-friendly technologies, creating a reliance on conventional coatings. The absence of skilled applicators and maintenance infrastructure further slows adoption. Rising raw material prices and complex manufacturing processes also restrict scalability. The gap between sustainable technology development and end-user affordability continues to challenge the global antifouling agent market’s growth potential.

Market Opportunities:

Rising Demand for Eco-Friendly and Long-Lasting Coating Solutions

The Antifouling Agent Market presents strong opportunities in the development of sustainable coating technologies. Growing global emphasis on marine ecosystem protection is increasing demand for non-toxic, biocide-free products. It opens prospects for silicone-based and nanotechnology-driven coatings that reduce environmental impact while maintaining high performance. Manufacturers investing in green chemistry and advanced polymers are expected to capture significant market share. Expanding shipbuilding and repair activities in Asia Pacific further strengthen the need for long-lasting coatings with low maintenance costs. The move toward sustainability is shaping new commercial pathways for companies focused on clean technology innovation.

Emerging Opportunities in Offshore Energy and Defense Sectors

Expanding offshore oil, gas, and renewable energy installations are creating new revenue streams for coating manufacturers. These structures require durable antifouling protection to withstand harsh marine conditions. It enhances opportunities for high-performance coatings tailored for offshore wind turbines, oil platforms, and naval vessels. Governments are also investing in naval modernization and maritime defense programs, boosting product demand. The combination of energy transition projects and defense infrastructure upgrades is expected to expand the global market base. The Antifouling Agent Market is well positioned to benefit from this growing industrial and defense-focused demand.

Market Segmentation Analysis:

By Product

The Antifouling Agent Market is segmented into copper-based, self-polishing, hybrid, and biocide-free coatings. Copper-based coatings hold a dominant share due to their strong protection against marine organisms and proven reliability in commercial vessels. It continues to be the preferred option for large ships and offshore platforms that demand durable hull protection. Hybrid and self-polishing coatings are gaining traction due to improved performance and reduced maintenance intervals. The growing demand for biocide-free products reflects a global shift toward sustainable solutions and stricter environmental regulations.

- For instance, Coppercoat’s epoxy resin coating, impregnated with 2 kilograms of 99% pure copper per litre, has exhibited continuous fouling protection for over 10 sailing seasons, making it one of the most potent copper-based antifouling products available.

By Application

Key application areas include shipping vessels, offshore structures, fishing boats, aquaculture equipment, and recreational boats. The shipping segment leads due to high consumption in cargo carriers, tankers, and container ships. It benefits from rising global trade and the need to minimize fuel consumption through smoother hull surfaces. Offshore structures represent another critical application, driven by increased oil exploration and wind farm development. Demand from aquaculture facilities and leisure boats is expanding due to growing awareness of biofouling prevention and operational efficiency.

- For instance, Nippon Paint Marine’s FASTAR coating system, applied to over 1,000 vessels since its 2021 launch, demonstrates fuel consumption and emissions reductions of up to 8%, while simultaneously reducing drydocking time through faster drying at 50% reduced thickness compared to alternative solutions.

By Formulation Type

Based on formulation, the market is divided into solvent-based, water-based, and others. Solvent-based coatings dominate due to their superior adhesion and long-lasting properties. It remains the standard in commercial marine maintenance, while water-based formulations are gaining preference for their lower environmental impact and safety profile. The trend toward eco-friendly formulations continues to drive innovation in coating technologies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segmentations:

By Product:

- Copper-Based Coatings

- Self-Polishing Copolymer (SPC) Coatings

- Hybrid Coatings

- Biocide-Free Coatings

- Silicone-Based Coatings

By Application:

- Shipping Vessels

- Offshore Platforms

- Fishing Boats

- Aquaculture Equipment

- Recreational Boats

- Subsea Pipelines

By Formulation Type:

- Solvent-Based

- Water-Based

- Powder-Based

- UV-Curable Formulations

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Dominance of Asia Pacific Driven by Expanding Maritime and Shipbuilding Activities

Asia Pacific holds 45% market share in the global Antifouling Agent Market, making it the leading regional contributor. Strong shipbuilding industries in China, Japan, and South Korea, combined with growing offshore energy projects, drive substantial demand. It benefits from large-scale marine trade routes, rapid port expansion, and rising government investments in naval infrastructure. The region’s focus on reducing operational costs and complying with environmental standards has accelerated the shift toward eco-friendly coatings. India and Southeast Asian countries are emerging as fast-growing markets due to expanding fishing and aquaculture sectors. Continuous research and local production capacity enhancements further strengthen the region’s market position.

Steady Growth in Europe Supported by Stringent Environmental Regulations

Europe accounts for 25% market share, supported by strict environmental compliance and advanced marine technology. Countries such as Norway, the United Kingdom, and Germany lead in adopting sustainable antifouling coatings. It gains traction through the region’s commitment to reducing marine pollution and promoting biocide-free alternatives. The presence of major coating manufacturers and consistent investments in R&D reinforce regional competitiveness. The European Union’s maritime decarbonization policies are encouraging ship operators to adopt energy-efficient coatings. Growth in yacht maintenance and offshore wind projects also contributes to the expanding demand.

Rising Adoption in North America with Strong Focus on Offshore Operations

North America captures 18% market share, driven by a well-established marine maintenance and offshore exploration industry. The United States leads with rising demand from naval defense, commercial shipping, and oil platforms. It benefits from technological advancements in coating formulations and increased investment in renewable marine energy. Canada shows promising growth due to expanding port modernization programs and Arctic shipping activities. Manufacturers are investing in environmentally safe and high-performance solutions tailored for regional climatic conditions. The region continues to evolve as a critical market for innovative antifouling technologies with strong long-term potential.

Key Player Analysis:

Competitive Analysis:

The Antifouling Agent Market is highly competitive, with global and regional players focusing on product innovation and environmental compliance. Key companies include Akzo Nobel N.V., Jotun, Hempel A/S, PPG Industries, The Sherwin-Williams Company, and Gruppo Boero. It is characterized by continuous investments in sustainable, biocide-free, and advanced polymer-based coatings. Leading manufacturers emphasize R&D collaborations to develop long-lasting, low-maintenance products that meet international maritime standards. Strategic initiatives such as mergers, acquisitions, and distribution partnerships help these companies strengthen market presence. Innovation in nanotechnology, hybrid coatings, and silicone-based formulations is reshaping competition by improving performance and durability. The shift toward eco-friendly technologies and the rise in regulatory pressure continue to define the market’s competitive dynamics.

Recent Developments:

- In October 2025, AkzoNobel became the exclusive supplier for a solar absorbing wall technology, launching an innovative coating that harnesses energy from sunlight partly invisible to the human eye.

- In August 2025, Jotun Malaysia partnered with ZUS Coffee to present the 2025 Nuances Colour Collection, unveiling 30 new shades designed to combine color innovation and customer comfort.

Report Coverage:

The research report offers an in-depth analysis based on Product, Application, Formulation Type and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The Antifouling Agent Market is projected to witness consistent expansion driven by sustainability and innovation.

- Eco-friendly and biocide-free coatings will dominate future demand as regulations tighten globally.

- Nanotechnology and smart surface materials will redefine product efficiency and extend service life.

- Rising shipbuilding and port development in Asia Pacific will continue to fuel large-scale adoption.

- Marine renewable energy and offshore wind projects will create long-term coating application opportunities.

- Collaborations between manufacturers and research institutions will accelerate next-generation coating advancements.

- Digital monitoring tools and sensor-integrated coatings will enhance predictive maintenance in vessel operations.

- Strategic mergers and acquisitions will shape market consolidation among top-tier coating suppliers.

- The defense and naval sectors will strengthen their role as consistent demand drivers for high-performance coatings.

- Continuous innovation focused on durability, energy savings, and sustainability will define the future direction of the global antifouling agent market.